Key Insights

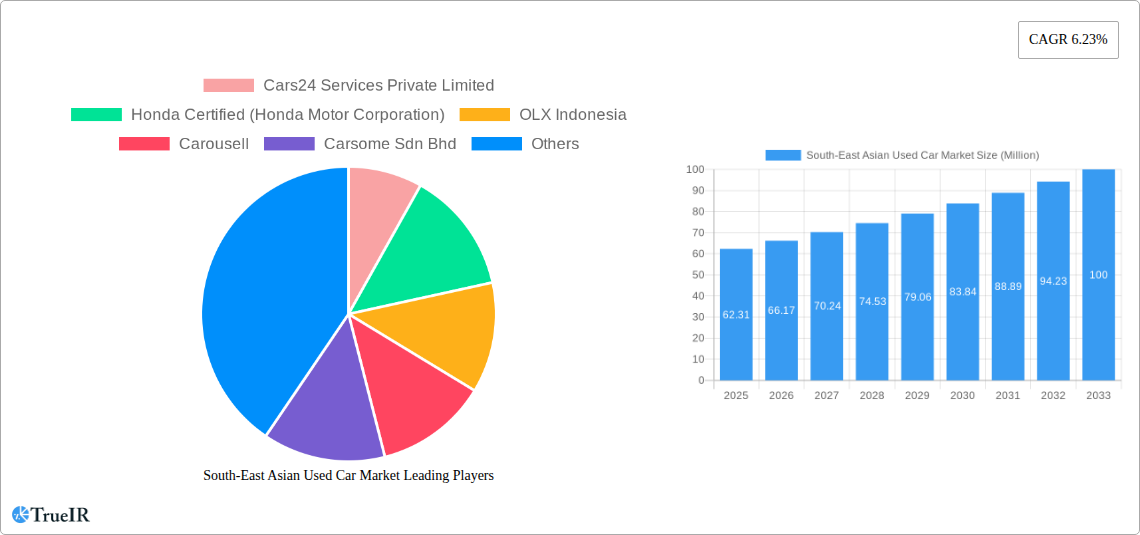

The South-East Asian used car market is poised for significant expansion, projected to reach a market size of USD 62.31 million with a robust Compound Annual Growth Rate (CAGR) of 6.23% between 2025 and 2033. This growth is primarily propelled by increasing disposable incomes and a burgeoning middle class across key South-East Asian nations such as Indonesia, Thailand, and the Philippines. Consumers are increasingly opting for pre-owned vehicles as a more affordable entry point into car ownership, especially for popular segments like SUVs and Sedans. The shift towards online sales channels, facilitated by platforms like Carsome and Carro, is democratizing the used car market, offering greater transparency and convenience. Furthermore, the availability of organized vendors and diverse financing options, including captive financing and NBFCs, is building consumer confidence and stimulating demand. The market is also benefiting from a growing acceptance of certified pre-owned programs offered by major manufacturers like Toyota and Honda, assuring buyers of quality and reliability in the used car segment.

South-East Asian Used Car Market Market Size (In Million)

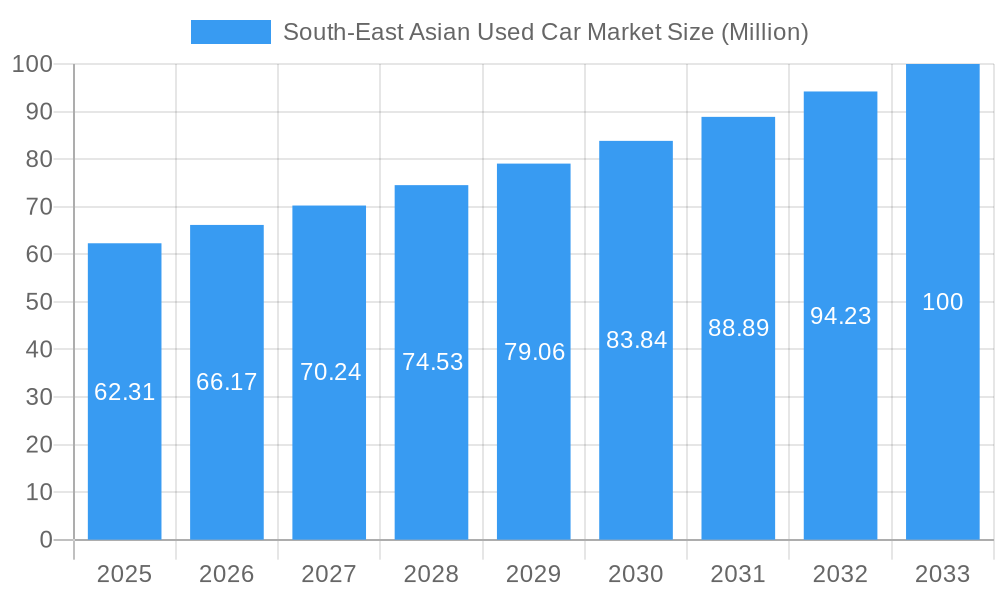

The market's dynamism is further underscored by evolving consumer preferences and technological advancements. While gasoline and diesel vehicles continue to dominate the fuel type segment, there's a nascent but growing interest in electric and other alternative fuel vehicles within the used car space, reflecting a broader trend towards sustainability. The penetration of organized players is expected to rise, gradually shifting market share from unorganized vendors as consumers prioritize trust and standardized processes. The prevalence of outright purchases remains strong, but financed purchases are gaining traction, driven by accessible credit facilities. Key players like Cars24, OLX Indonesia, and Carousell are actively shaping the market landscape through innovative business models, digital transformation, and strategic expansions across the region, catering to a diverse range of vehicle types and purchase motivations within the South-East Asian automotive ecosystem.

South-East Asian Used Car Market Company Market Share

South-East Asian Used Car Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a dynamic and SEO-optimized analysis of the South-East Asian Used Car Market. Leveraging high-volume keywords such as "used cars Southeast Asia," "pre-owned vehicles ASEAN," "online car sales Asia," and "used car market growth," this report is designed to engage industry professionals, investors, and stakeholders by offering clear insights and actionable intelligence. Covering a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025, this report delves into the market structure, trends, dominant segments, product analysis, key drivers, challenges, and future outlook of this rapidly evolving sector.

South-East Asian Used Car Market Market Structure & Competitive Landscape

The South-East Asian used car market is characterized by a moderately concentrated structure, with a blend of established organized players and a significant number of unorganized vendors. Innovation drivers are primarily technological advancements in online platforms, digital inspection tools, and financing solutions, aiming to enhance transparency and customer trust. Regulatory impacts vary across countries, with some nations implementing stricter inspection standards and import/export regulations for pre-owned vehicles, while others foster growth through supportive policies for digitalization and consumer protection. Product substitutes, such as new car financing schemes and ride-sharing services, exert a degree of influence, but the cost-effectiveness and accessibility of used cars ensure their continued relevance. End-user segmentation is diverse, encompassing first-time buyers, budget-conscious consumers, and those seeking specific vehicle models no longer available new. Mergers and Acquisitions (M&A) trends are on the rise as larger platforms seek to consolidate market share and expand their geographical reach. For instance, recent M&A activities are estimated to have added approximately 20% to market consolidation, while new entrants are continuously assessed based on their innovative business models and funding rounds, with Series A funding rounds like Moladin's $42 Million in January 2022 highlighting significant investment interest. Concentration ratios are estimated to be around 0.65 for the top five organized players, indicating room for further consolidation.

South-East Asian Used Car Market Market Trends & Opportunities

The South-East Asian used car market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. This expansion is fueled by a confluence of factors including a burgeoning middle class, increasing disposable incomes, and a persistent demand for affordable personal mobility solutions. The market size is projected to reach over $50 Billion by 2033, up from an estimated $25 Billion in 2025. Technological shifts are central to this growth, with the rise of online marketplaces and digital inspection technologies revolutionizing the way used cars are bought and sold. These platforms are enhancing transparency, providing detailed vehicle history reports, and offering convenient home delivery services, thereby building consumer confidence. Consumer preferences are increasingly leaning towards value for money, with a growing willingness to purchase pre-owned vehicles that offer a significant cost saving compared to new models. The competitive dynamics are intensifying, marked by aggressive expansion strategies of online platforms, strategic partnerships, and investments in brand building. For example, the entry into the luxury used car segment by platforms like Spinnymax in Vietnam in April 2022 signifies a move towards catering to a wider spectrum of consumer needs and aspirations. Opportunities abound in developing integrated ecosystems that offer end-to-end solutions, including financing, insurance, warranty, and after-sales services. Furthermore, the increasing adoption of electric vehicles (EVs) is creating a nascent but growing market for used EVs, presenting a future opportunity for specialized dealers and remarketing services. The penetration rate of organized online platforms is expected to climb from approximately 25% in 2025 to over 50% by 2033, demonstrating a clear shift in consumer behavior and preference.

Dominant Markets & Segments in South-East Asian Used Car Market

The South-East Asian used car market exhibits distinct dominance across various geographical regions and product segments. The largest market is consistently Indonesia, driven by its large population and substantial demand for affordable transportation. Following closely are Thailand and Vietnam, each presenting unique growth trajectories influenced by their economic development and automotive policies. Within the Vehicle Type segmentation, Sports Utility Vehicles (SUVs) and Multi-Purpose Utility Vehicles (MPVs) are experiencing remarkable growth, reflecting consumer preferences for larger, more versatile vehicles suitable for family use and diverse terrains. Hatchbacks and Sedans remain significant, catering to urban commuters and budget-conscious buyers. Regarding Fuel Type, Gasoline remains the dominant fuel, accounting for an estimated 75% of the market share in 2025. However, the market for Diesel continues to hold a substantial position, particularly in commercial applications, while Electric and Other Fuel Types (LPG, CNG, etc.) represent emerging segments with considerable long-term growth potential, driven by environmental concerns and government incentives. The Sales Channel is witnessing a significant shift towards Online platforms, which are projected to capture over 50% of the market by 2033, eclipsing traditional Offline channels. This shift is propelled by enhanced convenience, wider selection, and competitive pricing offered by digital marketplaces. The Vendor Type is bifurcating, with Organized players gaining prominence due to their structured operations, quality assurance, and financing options, while the Unorganized sector continues to cater to a specific segment of price-sensitive buyers. The Purchase Method is evenly split, with Financed Purchases accounting for a slight majority, driven by attractive financing schemes from captive financiers, banks, and Non-banking Financial Corporations (NBFCs). Outright Purchases remain a strong alternative for consumers with immediate liquidity. Key growth drivers include government initiatives to promote digital economy adoption, infrastructure development supporting logistics and delivery networks, and evolving consumer trust in online transactions. For example, favorable policies promoting vehicle inspections and certifications in markets like Malaysia are bolstering the organized sector's growth.

South-East Asian Used Car Market Product Analysis

Product innovation in the South-East Asian used car market is primarily focused on enhancing the customer experience and building trust. Companies are investing in digital inspection tools that provide detailed, unbiased reports on vehicle condition, including mileage verification and accident history. Applications range from AI-powered vehicle valuation to virtual showrooms and online financing portals, streamlining the purchase process. Competitive advantages are derived from transparency, convenience, and the availability of certified pre-owned vehicles that offer extended warranties and peace of mind. These advancements are crucial in bridging the trust gap often associated with the used car market, making pre-owned vehicles a more attractive and reliable option for consumers.

Key Drivers, Barriers & Challenges in South-East Asian Used Car Market

The South-East Asian used car market is propelled by several key drivers. Technologically driven convenience, such as online platforms and digital inspections, significantly enhances accessibility and transparency. Economic factors, including the increasing affordability of personal transportation and a growing middle class, fuel demand. Favorable government policies, aimed at promoting digital adoption and consumer protection, also contribute positively. For instance, digital payment infrastructure development across the region supports online transactions.

However, significant barriers and challenges exist. Regulatory complexities and inconsistencies across different countries can hinder cross-border trade and create operational hurdles. Supply chain issues, including the availability of quality used vehicles and efficient logistics for delivery and remarketing, remain a concern. Competitive pressures from new car manufacturers offering attractive financing and the informal sector's price advantage also pose challenges. The estimated impact of unorganized sector competition on organized players' market share is around 15-20%.

Growth Drivers in the South-East Asian Used Car Market Market

Key growth drivers in the South-East Asian used car market include the rapid digital transformation of retail, leading to the proliferation of online used car platforms that offer unparalleled convenience and transparency. Economic factors, such as the rising disposable incomes of the burgeoning middle class and the inherent cost savings of purchasing pre-owned vehicles, are significant demand catalysts. Furthermore, evolving consumer preferences towards value-for-money mobility solutions, coupled with supportive government policies promoting digital economy growth and vehicle import/export regulations, are creating a conducive environment for market expansion. The increasing adoption of ride-sharing services also indirectly contributes to the supply of well-maintained used vehicles entering the market.

Challenges Impacting South-East Asian Used Car Market Growth

Challenges impacting the South-East Asian used car market growth include the inherent complexities and varying regulations across different countries, which can impede seamless cross-border transactions and create operational hurdles for pan-regional players. Persistent supply chain issues, ranging from ensuring a consistent supply of quality pre-owned vehicles to establishing efficient logistics for inspection, refurbishment, and delivery, continue to pose a significant restraint. Intense competition, not only from other online platforms but also from traditional brick-and-mortar dealerships and new car manufacturers offering attractive financing deals, puts pressure on margins. Moreover, building and maintaining consumer trust in the quality and authenticity of used vehicles remains a critical challenge, particularly in markets where transparency has historically been low.

Key Players Shaping the South-East Asian Used Car Market Market

- Cars24 Services Private Limited

- Honda Certified (Honda Motor Corporation)

- OLX Indonesia

- Carousell

- Carsome Sdn Bhd

- PT Moladin Digita

- Toyota Trust (Toyota Motor Corporation)

- Nissan Intelligent Mobility (Nissan Motor Corporation)

- ICar Asia Limited

- Carro (Trusty Cars Pte Ltd)

Significant South-East Asian Used Car Market Industry Milestones

- April 2022: Spinny, a used car buying and selling platform, entered the luxury car used vehicle segment under the Spinnymax brand in the Vietnamese market. The platform will operate at a national scale and offers over 500 cars from various brands, including Mercedes-Benz, BMW, Audi, Jaguar, and Land Rover, with an all-India delivery service through 250 cities.

- January 2022: Moladin, an Indonesian used car platform, raised USD 42 million in Series A funding headed by Sequoia Capital India and Northstar Group.

Future Outlook for South-East Asian Used Car Market Market

The future outlook for the South-East Asian used car market is exceptionally promising, projected for sustained growth driven by an increasing digital penetration and a young, aspirational demographic seeking affordable mobility. Strategic opportunities lie in the further integration of advanced technologies, such as AI for vehicle diagnostics and blockchain for transparent vehicle history, which will enhance trust and efficiency. The growing demand for electric vehicles (EVs) will also carve out a significant niche in the used car market, requiring specialized remarketing and certification processes. Continued investment in seamless online-to-offline integrated experiences, coupled with robust financing and after-sales support, will be crucial for players aiming to capture market share. The market is expected to witness further consolidation and strategic partnerships, leading to a more organized and customer-centric ecosystem by 2033.

South-East Asian Used Car Market Segmentation

-

1. Vehicle Type

- 1.1. Hatchback

- 1.2. Sedan

- 1.3. Sports Utility Vehicle (SUV)

- 1.4. Multi-Purpose Utility Vehicle (MPV)

-

2. Fuel Type

- 2.1. Gasoline

- 2.2. Diesel

- 2.3. Electric

- 2.4. Other Fuel Types (LPG, CNG, Etc.)

-

3. Sales Channel

- 3.1. Online

- 3.2. Offline

-

4. Vendor Type

- 4.1. Organized

- 4.2. Unorganized

-

5. Purchase Method

- 5.1. Outright Purchase

-

5.2. Financed Purchase

- 5.2.1. Captive Financing

- 5.2.2. Bank Financing

- 5.2.3. Non-banking Financial Corporations (NBFC)

South-East Asian Used Car Market Segmentation By Geography

-

1. South East Asia

- 1.1. Indonesia

- 1.2. Malaysia

- 1.3. Singapore

- 1.4. Thailand

- 1.5. Vietnam

- 1.6. Philippines

- 1.7. Myanmar

- 1.8. Cambodia

- 1.9. Laos

South-East Asian Used Car Market Regional Market Share

Geographic Coverage of South-East Asian Used Car Market

South-East Asian Used Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Distribution Channels; Others

- 3.3. Market Restrains

- 3.3.1. Lack Of Trust And Transparency; Others

- 3.4. Market Trends

- 3.4.1. Strengthening of Digital Platforms is Driving the Online Booking Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South-East Asian Used Car Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchback

- 5.1.2. Sedan

- 5.1.3. Sports Utility Vehicle (SUV)

- 5.1.4. Multi-Purpose Utility Vehicle (MPV)

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Gasoline

- 5.2.2. Diesel

- 5.2.3. Electric

- 5.2.4. Other Fuel Types (LPG, CNG, Etc.)

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Vendor Type

- 5.4.1. Organized

- 5.4.2. Unorganized

- 5.5. Market Analysis, Insights and Forecast - by Purchase Method

- 5.5.1. Outright Purchase

- 5.5.2. Financed Purchase

- 5.5.2.1. Captive Financing

- 5.5.2.2. Bank Financing

- 5.5.2.3. Non-banking Financial Corporations (NBFC)

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South East Asia

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cars24 Services Private Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Honda Certified (Honda Motor Corporation)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 OLX Indonesia

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Carousell

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Carsome Sdn Bhd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PT Moladin Digita

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Toyota Trust (Toyota Motor Corporation)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nissan Intelligent Mobility (Nissan Motor Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ICar Asia Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Carro (Trusty Cars Pte Ltd)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Cars24 Services Private Limited

List of Figures

- Figure 1: South-East Asian Used Car Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South-East Asian Used Car Market Share (%) by Company 2025

List of Tables

- Table 1: South-East Asian Used Car Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: South-East Asian Used Car Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 3: South-East Asian Used Car Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 4: South-East Asian Used Car Market Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 5: South-East Asian Used Car Market Revenue Million Forecast, by Purchase Method 2020 & 2033

- Table 6: South-East Asian Used Car Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: South-East Asian Used Car Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 8: South-East Asian Used Car Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 9: South-East Asian Used Car Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 10: South-East Asian Used Car Market Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 11: South-East Asian Used Car Market Revenue Million Forecast, by Purchase Method 2020 & 2033

- Table 12: South-East Asian Used Car Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Indonesia South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Malaysia South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Singapore South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Thailand South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Vietnam South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Philippines South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Myanmar South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Cambodia South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Laos South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South-East Asian Used Car Market?

The projected CAGR is approximately 6.23%.

2. Which companies are prominent players in the South-East Asian Used Car Market?

Key companies in the market include Cars24 Services Private Limited, Honda Certified (Honda Motor Corporation), OLX Indonesia, Carousell, Carsome Sdn Bhd, PT Moladin Digita, Toyota Trust (Toyota Motor Corporation), Nissan Intelligent Mobility (Nissan Motor Corporation, ICar Asia Limited, Carro (Trusty Cars Pte Ltd).

3. What are the main segments of the South-East Asian Used Car Market?

The market segments include Vehicle Type, Fuel Type, Sales Channel, Vendor Type, Purchase Method.

4. Can you provide details about the market size?

The market size is estimated to be USD 62.31 Million as of 2022.

5. What are some drivers contributing to market growth?

Expanding Distribution Channels; Others.

6. What are the notable trends driving market growth?

Strengthening of Digital Platforms is Driving the Online Booking Segment.

7. Are there any restraints impacting market growth?

Lack Of Trust And Transparency; Others.

8. Can you provide examples of recent developments in the market?

April 2022: Spinny, a used car buying and selling platform, entered the luxury car used vehicle segment under the Spinnymax brand in the Vietnamese market. The platform will operate at a national scale and offers over 500 cars from various brands, including Mercedes-Benz, BMW, Audi, Jaguar, and Land Rover, with an all-India delivery service through 250 cities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South-East Asian Used Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South-East Asian Used Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South-East Asian Used Car Market?

To stay informed about further developments, trends, and reports in the South-East Asian Used Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence