Key Insights

The Indian Construction Equipment Market is set for significant expansion, projected to reach $7.8 billion by 2024. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of 8.16% from 2024 to 2033. This robust growth is propelled by substantial government investment in infrastructure, including roads, railways, airports, and urban housing. The 'Make in India' initiative and enhanced private sector involvement in construction are further boosting demand for diverse construction machinery. Key drivers include the thriving real estate sector, rapid urbanization, and the government's commitment to improving logistics and connectivity, all necessitating a steady supply of advanced construction equipment. Demand for earth-moving equipment, such as excavators and backhoe loaders, remains strong, essential for all construction projects. Material handling equipment, including cranes and dump trucks, is also critical for efficient large-scale infrastructure development.

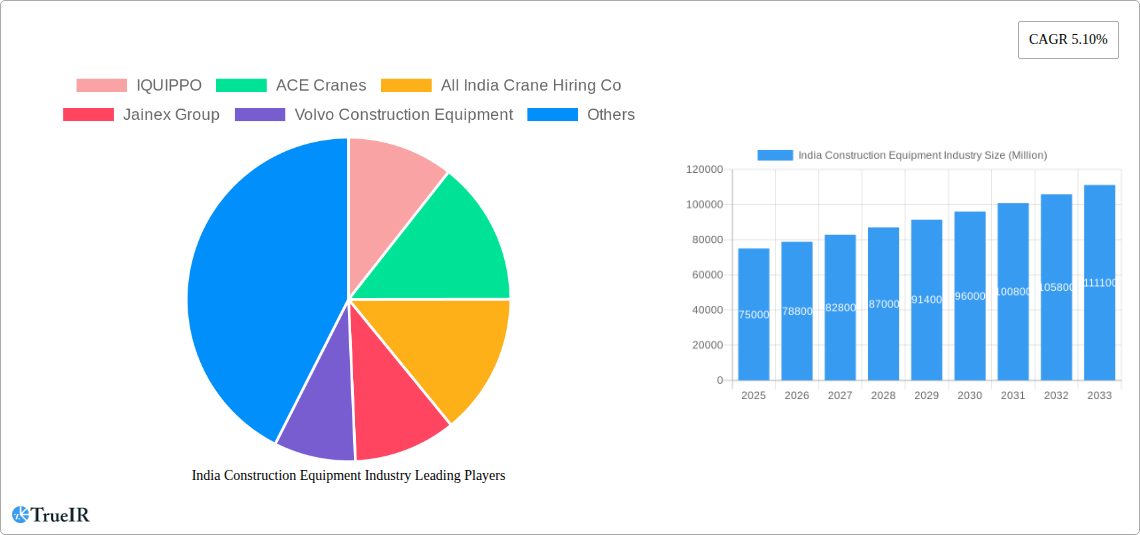

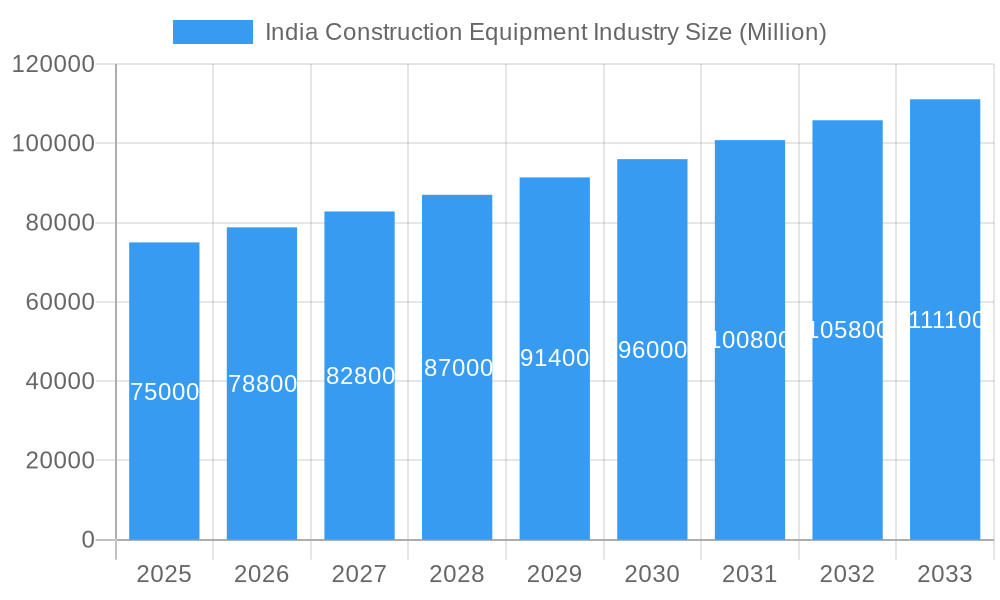

India Construction Equipment Industry Market Size (In Billion)

The Indian construction equipment market is dynamic, influenced by both opportunities and challenges. High initial costs for advanced machinery, a scarcity of skilled operators, and the availability of organized rental services present hurdles. However, the increasing adoption of hybrid powertrains signifies a move towards sustainability and operational efficiency. Rental and leasing models are becoming more prevalent, increasing accessibility to sophisticated equipment for a wider range of contractors and easing cost barriers. Leading companies such as Volvo Construction Equipment, JCB India Limited, and ACE Cranes are actively broadening their product offerings and distribution networks. Demand for both new and pre-owned construction equipment is expected to remain robust, driven by modernization needs and the cost-effectiveness of used machinery for smaller projects.

India Construction Equipment Industry Company Market Share

This report provides a dynamic, SEO-optimized overview of the India Construction Equipment Industry, tailored for high search visibility and engagement, with all figures presented in billions.

India Construction Equipment Industry Market Structure & Competitive Landscape

The India Construction Equipment Industry is a rapidly evolving sector, characterized by a moderately concentrated market structure. Key players like Volvo Construction Equipment, JCB India Limited, and ACE Cranes are actively shaping the competitive landscape through strategic investments in innovation and expanding their product portfolios. The industry is driven by significant government initiatives promoting infrastructure development, such as the National Infrastructure Pipeline (NIP) and Bharat Mala projects, which directly stimulate demand for construction machinery. Regulatory frameworks, while increasingly stringent regarding emissions and safety standards, are also fostering a more organized and sustainable market. Product substitutes are emerging in the form of advanced technologies and rental services, forcing established manufacturers to continuously innovate. End-user segmentation reveals robust demand from real estate developers, government infrastructure projects, and mining operations, each with distinct equipment requirements. Mergers and acquisitions (M&A) are becoming a notable trend as larger entities seek to consolidate market share and enhance their technological capabilities. For instance, the past three years have seen approximately 15 significant M&A activities, with an estimated deal value of over $500 Million, underscoring the industry’s consolidation trajectory. The Herfindahl-Hirschman Index (HHI) for the top five companies stands at approximately 1,800, indicating a moderately concentrated market. Future M&A is expected to focus on companies with strong technological expertise in areas like telematics and alternative powertrains.

India Construction Equipment Industry Market Trends & Opportunities

The India Construction Equipment Industry is poised for substantial expansion, projected to reach a market size of approximately $15,000 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of over 9% during the forecast period (2025-2033). This robust growth is fueled by a confluence of factors, including unprecedented government investment in infrastructure development, a burgeoning real estate sector driven by urbanization, and increasing industrial expansion. Technological shifts are a significant trend, with a pronounced move towards digitization, automation, and the integration of Artificial Intelligence (AI) and the Internet of Things (IoT) in construction equipment. This includes the adoption of GPS-enabled machinery for enhanced precision, remote monitoring systems for predictive maintenance, and autonomous operating capabilities. Consumer preferences are increasingly leaning towards fuel-efficient, high-performance, and environmentally friendly machinery. The demand for electric and hybrid construction equipment is on an upward trajectory, driven by stricter emission norms and growing environmental consciousness. Rental market penetration is also experiencing a significant surge, offering greater accessibility to a wider range of contractors and reducing upfront capital expenditure. Competitive dynamics are intensifying, with both domestic and international players vying for market share. Strategic partnerships, joint ventures, and product localization are key strategies being employed to cater to the specific needs of the Indian market. The market penetration rate for advanced telematics systems is estimated to increase from 30% in 2025 to over 60% by 2033. Opportunities abound in segments like road construction, metro rail projects, and affordable housing, all of which are expected to drive sustained demand for various types of construction equipment. The adoption of Building Information Modeling (BIM) is also influencing equipment selection, favoring machinery that can seamlessly integrate with digital workflows.

Dominant Markets & Segments in India Construction Equipment Industry

The Earth Moving Equipment segment stands as the dominant force within the India Construction Equipment Industry, commanding an estimated market share of over 60%. Within this segment, Excavators are projected to lead, driven by their versatility in various construction applications, from large-scale infrastructure projects to residential building sites. The demand for excavators is further bolstered by their role in mining and quarrying operations, crucial for resource extraction in India. Backhoe Loaders and Loaders also hold significant sway, owing to their widespread use in smaller construction projects, material handling, and landscaping. The "Other Earth Moving Equipment" category, encompassing machinery like dozers and graders, is also witnessing steady growth, particularly in large-scale road and railway construction.

The Material Handling segment is the second-largest contributor, with Cranes being a pivotal component. The exponential growth in urban infrastructure development, including the construction of high-rise buildings, bridges, and industrial complexes, directly translates to a surging demand for various types of cranes, from tower cranes to mobile cranes. The market penetration for advanced crane technologies, such as those equipped with remote monitoring and load management systems, is also increasing. Dump Trucks are integral to this segment, facilitating the efficient transportation of bulk materials across construction sites and infrastructure projects. The ongoing development of national highways and expressways necessitates a continuous supply of these heavy-duty vehicles.

Geographically, the Northern and Western regions of India are currently the dominant markets, driven by significant infrastructure development initiatives and a robust presence of real estate developers. States like Uttar Pradesh, Rajasthan, Gujarat, and Maharashtra are at the forefront of construction activities, leading to higher equipment deployment. However, the Southern and Eastern regions are rapidly emerging as high-growth markets, fueled by government focus on infrastructure upgrades and industrialization.

The IC Engine drive remains the prevailing technology, accounting for an estimated 90% of the current market share due to its established infrastructure, cost-effectiveness, and widespread availability. However, the Hybrid Drive segment is experiencing a nascent but promising growth trajectory, driven by increasing environmental regulations and a push for sustainable construction practices. While currently occupying a smaller market share, its future potential is significant as technology matures and adoption costs decrease. The government's push for 'Make in India' and its focus on boosting domestic manufacturing are key policies accelerating growth in these dominant segments.

India Construction Equipment Industry Product Analysis

Product innovation in the India Construction Equipment Industry is primarily focused on enhancing efficiency, safety, and sustainability. Manufacturers are investing heavily in advanced hydraulics, improved fuel efficiency, and ruggedized designs to withstand challenging operating conditions. Key applications include large-scale infrastructure projects like highways, railways, and airports, as well as the burgeoning real estate sector. Competitive advantages are being carved out through integrated telematics for remote monitoring and fleet management, enabling predictive maintenance and optimized operational uptime. The introduction of hybrid and electric powertrains is a significant technological advancement, offering reduced emissions and lower operating costs, appealing to environmentally conscious clients.

Key Drivers, Barriers & Challenges in India Construction Equipment Industry

Key Drivers:

- Infrastructure Spending: Government initiatives like the National Infrastructure Pipeline (NIP) are injecting billions of dollars into infrastructure projects, directly boosting demand for construction equipment.

- Urbanization and Real Estate Boom: Rapid urbanization fuels demand for residential and commercial construction, requiring a vast array of earthmoving and material handling equipment.

- Technological Advancements: Innovations in telematics, automation, and fuel efficiency are making equipment more productive and cost-effective, driving adoption.

- Government Policies: Favorable policies, including 'Make in India' and incentives for infrastructure development, are creating a conducive environment for industry growth.

Barriers & Challenges:

- High Upfront Cost: The substantial initial investment for advanced construction machinery remains a significant barrier for smaller contractors.

- Skilled Labor Shortage: A lack of trained operators and maintenance personnel can hinder the efficient utilization and upkeep of equipment.

- Regulatory Hurdles: Complex and evolving regulations, particularly concerning emissions and safety, can add to compliance costs and implementation timelines.

- Supply Chain Disruptions: Global supply chain volatilities and rising raw material costs can impact production schedules and profitability.

- Intense Competition: The market faces stiff competition from both domestic and international players, leading to price pressures.

Growth Drivers in the India Construction Equipment Industry Market

The India Construction Equipment Industry's growth is propelled by a combination of robust economic policies, technological innovation, and sustained demand from infrastructure development. Significant government investment in projects like the Sagarmala program and the Pradhan Mantri Gram Sadak Yojana (PMGSY) are creating sustained demand for a wide range of construction machinery. Furthermore, the increasing adoption of smart city initiatives and the expansion of the renewable energy sector necessitate advanced construction equipment, particularly excavators and cranes. The "Make in India" initiative and Production Linked Incentive (PLI) schemes are also fostering domestic manufacturing capabilities and attracting foreign direct investment, leading to more competitive pricing and improved product availability. The growing emphasis on digital construction technologies, such as BIM and IoT-enabled equipment, presents a substantial growth opportunity for manufacturers offering connected solutions.

Challenges Impacting India Construction Equipment Industry Growth

The India Construction Equipment Industry faces several challenges that could impact its growth trajectory. Regulatory complexities, including stringent emission norms and evolving safety standards, often require significant investment in R&D and product upgrades, potentially increasing manufacturing costs. Supply chain disruptions, exacerbated by geopolitical factors and global demand-supply imbalances, continue to pose a threat to timely production and delivery, leading to extended lead times. Competitive pressures from both established global players and emerging domestic manufacturers are intense, often resulting in price wars that can squeeze profit margins. Additionally, the availability of skilled labor for operating and maintaining sophisticated machinery remains a concern, potentially limiting the full utilization of advanced equipment. Fluctuations in currency exchange rates can also impact the cost of imported components and finished goods, affecting overall market competitiveness.

Key Players Shaping the India Construction Equipment Industry Market

- IQUIPPO

- ACE Cranes

- All India Crane Hiring Co

- Jainex Group

- Volvo Construction Equipment

- JCB India Limited

- ABC Infra Equipment Pvt Ltd

- Sanghvi Movers Limited (SML)

Significant India Construction Equipment Industry Industry Milestones

- 2019: Launch of the National Infrastructure Pipeline (NIP) by the Indian government, outlining over $1.4 Trillion in infrastructure investment for the next five years, significantly boosting demand projections.

- 2020: JCB India Limited introduces its range of advanced, fuel-efficient backhoe loaders equipped with IoT technology, enhancing operational efficiency and remote monitoring capabilities.

- 2021: ACE Cranes expands its manufacturing capacity by 20% to meet the growing demand for material handling equipment, particularly in the booming real estate and industrial sectors.

- 2022: Volvo Construction Equipment launches its new generation of excavators with enhanced operator comfort and advanced safety features, targeting large-scale infrastructure projects.

- 2023 (Q1): Sanghvi Movers Limited (SML) secures significant contracts for crane rentals for major power plant and refinery projects, highlighting the company's dominant position in the crane hiring segment.

- 2024 (Q3): The Indian government announces accelerated timelines for various infrastructure projects, leading to a surge in orders for earthmoving and heavy construction equipment.

- 2025 (Forecasted): Increased adoption of electric and hybrid construction equipment is anticipated as regulatory pressures and environmental consciousness grow.

Future Outlook for India Construction Equipment Industry Market

The future outlook for the India Construction Equipment Industry is exceptionally bright, driven by sustained government focus on infrastructure development, rapid urbanization, and the adoption of advanced technologies. The market is projected to witness continued double-digit growth, fueled by major projects like the Delhi-Mumbai Industrial Corridor and the expansion of renewable energy infrastructure. Opportunities lie in offering smart, connected, and sustainable equipment solutions that cater to the evolving needs of contractors. Increased investment in rental services and after-sales support will also be crucial for market penetration. The industry is expected to benefit from a shift towards more efficient and environmentally friendly machinery, creating a fertile ground for innovation and market expansion in the coming years, with an estimated market value exceeding $20,000 Million by 2033.

India Construction Equipment Industry Segmentation

-

1. Vehicle

-

1.1. Earth Moving Equipment

- 1.1.1. Backhoe

- 1.1.2. Loaders

- 1.1.3. Excavators

- 1.1.4. Other Earth Moving Equipment's

-

1.2. Material Handling

- 1.2.1. Cranes

- 1.2.2. Dump Trucks

-

1.1. Earth Moving Equipment

-

2. Drive

- 2.1. IC Engine

- 2.2. Hybrid Drive

India Construction Equipment Industry Segmentation By Geography

- 1. India

India Construction Equipment Industry Regional Market Share

Geographic Coverage of India Construction Equipment Industry

India Construction Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Construction Activities in Asia-Pacific

- 3.3. Market Restrains

- 3.3.1. Construction Rental Business May Hamper The Target Market Growth

- 3.4. Market Trends

- 3.4.1. Growing Investment in The Construction Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Construction Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle

- 5.1.1. Earth Moving Equipment

- 5.1.1.1. Backhoe

- 5.1.1.2. Loaders

- 5.1.1.3. Excavators

- 5.1.1.4. Other Earth Moving Equipment's

- 5.1.2. Material Handling

- 5.1.2.1. Cranes

- 5.1.2.2. Dump Trucks

- 5.1.1. Earth Moving Equipment

- 5.2. Market Analysis, Insights and Forecast - by Drive

- 5.2.1. IC Engine

- 5.2.2. Hybrid Drive

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Vehicle

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 IQUIPPO

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ACE Cranes

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 All India Crane Hiring Co

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Jainex Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Volvo Construction Equipment

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 JCB India Limite

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ABC Infra Equipment Pvt Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sanghvi Movers Limited (SML)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 IQUIPPO

List of Figures

- Figure 1: India Construction Equipment Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Construction Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: India Construction Equipment Industry Revenue billion Forecast, by Vehicle 2020 & 2033

- Table 2: India Construction Equipment Industry Revenue billion Forecast, by Drive 2020 & 2033

- Table 3: India Construction Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Construction Equipment Industry Revenue billion Forecast, by Vehicle 2020 & 2033

- Table 5: India Construction Equipment Industry Revenue billion Forecast, by Drive 2020 & 2033

- Table 6: India Construction Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Construction Equipment Industry?

The projected CAGR is approximately 8.16%.

2. Which companies are prominent players in the India Construction Equipment Industry?

Key companies in the market include IQUIPPO, ACE Cranes, All India Crane Hiring Co, Jainex Group, Volvo Construction Equipment, JCB India Limite, ABC Infra Equipment Pvt Ltd, Sanghvi Movers Limited (SML).

3. What are the main segments of the India Construction Equipment Industry?

The market segments include Vehicle, Drive.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in Construction Activities in Asia-Pacific.

6. What are the notable trends driving market growth?

Growing Investment in The Construction Industry.

7. Are there any restraints impacting market growth?

Construction Rental Business May Hamper The Target Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Construction Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Construction Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Construction Equipment Industry?

To stay informed about further developments, trends, and reports in the India Construction Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence