Key Insights

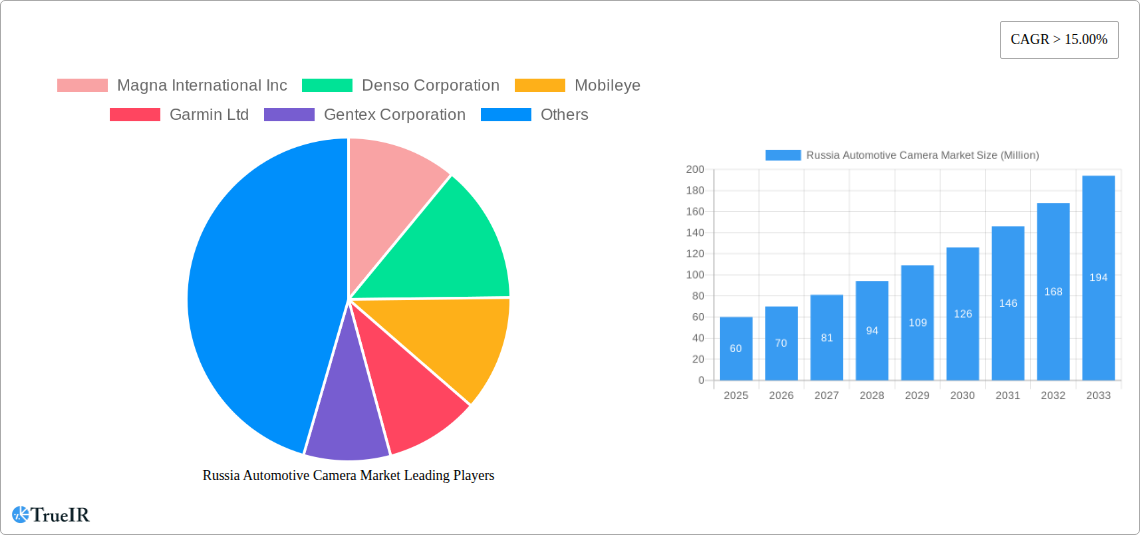

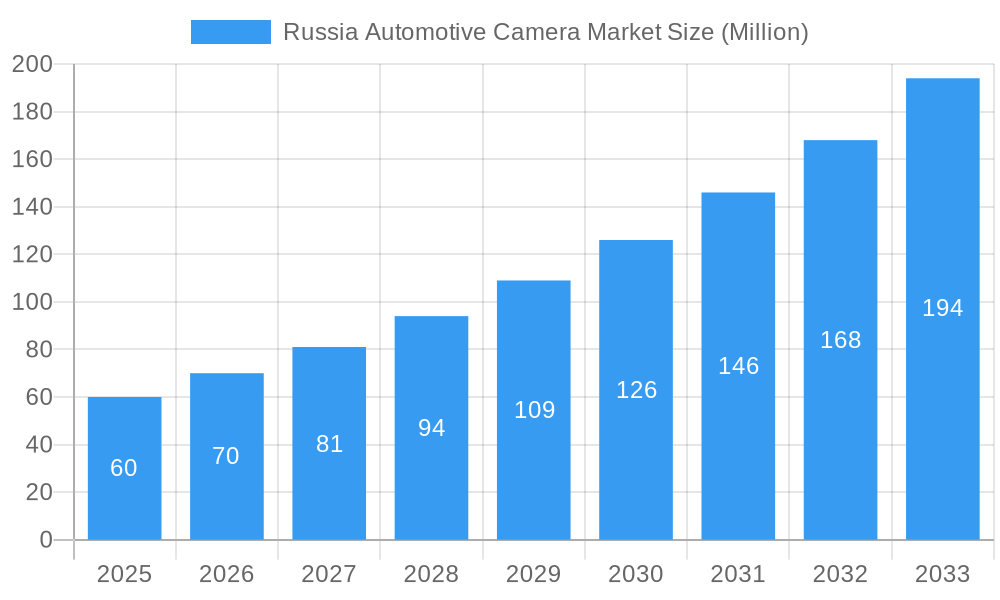

The Russia automotive camera market, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 15% from 2019-2033, presents a significant growth opportunity. Driven by increasing adoption of Advanced Driver-Assistance Systems (ADAS) features like lane departure warnings, automatic emergency braking, and adaptive cruise control, coupled with stringent government regulations promoting road safety, the market is poised for substantial expansion. The rising demand for parking assistance systems in both passenger cars and commercial vehicles further fuels this growth. Segmentation reveals a strong preference for viewing cameras, likely due to their cost-effectiveness and widespread use in existing vehicle models. However, sensing cameras are projected to gain significant market share over the forecast period (2025-2033) due to their crucial role in advanced ADAS functionalities. While the specific market size for 2025 is not provided, based on a 15%+ CAGR and considering global market trends, a reasonable estimation for the Russia automotive camera market size in 2025 would be in the range of 50-75 million USD. This estimation accounts for the relatively smaller size of the Russian automotive market compared to global leaders like the US or China, yet acknowledges the increasing penetration of technologically advanced features within the Russian automotive sector.

Russia Automotive Camera Market Market Size (In Million)

Market restraints include economic fluctuations impacting consumer spending on vehicles and technological advancements, the potential for supply chain disruptions could also influence growth. Major players such as Magna International, Denso, Mobileye, and Bosch are well-positioned to capitalize on this growth, leveraging their technological expertise and established distribution networks. The market's future trajectory will depend on continued technological innovation, government support for ADAS adoption, and overall economic stability within Russia. The segment of passenger cars is likely to dominate due to higher sales volume, followed by commercial vehicles experiencing growth driven by increasing safety standards within the commercial transportation sector. This makes it a lucrative market for both established players and emerging technology providers.

Russia Automotive Camera Market Company Market Share

Russia Automotive Camera Market Report: 2019-2033

This comprehensive report delivers an in-depth analysis of the burgeoning Russia automotive camera market, projecting robust growth from 2025 to 2033. It provides crucial insights for industry stakeholders, investors, and strategic decision-makers seeking to navigate this dynamic sector. The report leverages extensive market research, incorporating historical data (2019-2024), a base year of 2025, and a detailed forecast spanning 2025-2033. Key segments analyzed include viewing cameras, sensing cameras, ADAS applications, parking systems, passenger cars, and commercial vehicles. Leading players like Magna International Inc, Denso Corporation, and Mobileye are profiled, highlighting their competitive strategies and market influence. This report is essential for understanding the current market landscape, identifying lucrative opportunities, and formulating effective growth strategies within the Russia automotive camera market.

Russia Automotive Camera Market Market Structure & Competitive Landscape

The Russia automotive camera market exhibits a moderately concentrated structure, with a few major global players holding significant market share alongside several regional players. The market's concentration ratio (CR4) is estimated at xx% in 2025, indicating a presence of both established and emerging competitors. Innovation, particularly in advanced driver-assistance systems (ADAS), is a key driver, leading to product differentiation and shaping competitive dynamics. Stringent government regulations concerning vehicle safety and emission standards significantly influence the market, impacting adoption rates and technological advancements. Substitute products, such as radar and lidar systems, present competitive challenges, although camera-based systems maintain a cost and technological advantage in many applications. End-user segmentation is primarily driven by passenger car and commercial vehicle manufacturers, with the former holding the larger share currently. The market has witnessed a moderate level of mergers and acquisitions (M&A) activity in recent years, with xx M&A deals recorded between 2019 and 2024, primarily focused on technology integration and expansion into new segments. This activity is expected to intensify during the forecast period, driven by the pursuit of scale and technological capabilities.

- Market Concentration: CR4 estimated at xx% in 2025.

- Innovation Drivers: ADAS advancements, sensor fusion technologies.

- Regulatory Impacts: Stringent safety and emission standards.

- Product Substitutes: Radar, LiDAR systems.

- End-User Segmentation: Passenger cars (xx Million units in 2025), Commercial vehicles (xx Million units in 2025).

- M&A Trends: xx M&A deals between 2019 and 2024.

Russia Automotive Camera Market Market Trends & Opportunities

The Russia automotive camera market is projected to experience significant growth during the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is fueled by several factors, including the increasing adoption of ADAS features in new vehicles, a rising demand for enhanced vehicle safety, and government regulations promoting advanced safety technologies. Technological advancements, particularly in camera sensor technology, image processing, and artificial intelligence (AI), are driving innovation and improving the functionality and performance of automotive cameras. Consumer preferences are shifting towards vehicles equipped with advanced safety and driver-assistance features, boosting market demand. The competitive landscape is dynamic, with both established and emerging players vying for market share. This competition is pushing down prices, improving product quality, and driving innovation across the board. Market penetration of automotive cameras in new vehicles is steadily rising, with estimates exceeding xx% by 2033. The shift toward electric and autonomous vehicles further accelerates the growth, demanding higher-quality and more sophisticated camera systems. Opportunities exist in developing advanced camera functionalities, integrating cameras with other sensor technologies, and focusing on cost-effective solutions for broader market adoption.

Dominant Markets & Segments in Russia Automotive Camera Market

The passenger car segment dominates the Russia automotive camera market in terms of volume, accounting for approximately xx% of total market revenue in 2025. The ADAS application segment is experiencing the fastest growth due to increasing government regulations and consumer demand for advanced safety features. Geographically, the major cities and densely populated regions of Russia show higher adoption rates for automotive camera systems, largely due to improved infrastructure and higher vehicle ownership.

- Key Growth Drivers for Passenger Cars: Increasing vehicle production, rising disposable incomes, and government support for the automotive industry.

- Key Growth Drivers for ADAS Applications: Stringent safety regulations, consumer preference for safety features, and advancements in AI and machine learning.

- Key Growth Drivers for Urban Areas: Higher vehicle density, better road infrastructure, and increased awareness of safety technologies.

The sensing camera segment is expected to outpace the viewing camera segment in terms of growth, primarily driven by the rising demand for advanced driver-assistance systems.

Russia Automotive Camera Market Product Analysis

Automotive cameras are evolving rapidly, with improvements in image resolution, low-light performance, and wider field-of-view. The integration of advanced features such as object recognition, lane departure warning, and adaptive cruise control is enhancing their functionality and appeal. Key competitive advantages lie in superior image quality, robust processing capabilities, and cost-effectiveness. The market is witnessing a shift towards higher-resolution cameras, incorporating features like night vision and 360-degree surround view. These advancements enable greater precision in ADAS and parking applications.

Key Drivers, Barriers & Challenges in Russia Automotive Camera Market

Key Drivers: Technological advancements in sensor technology and image processing are driving innovation, reducing costs, and enhancing performance. Government regulations mandating advanced safety features are accelerating adoption rates. Rising consumer demand for improved safety and convenience features in vehicles fuels market growth.

Key Challenges: Supply chain disruptions caused by geopolitical factors can impact component availability and production timelines. High import tariffs and import restrictions could increase costs and limit market access. Intense competition from global players and regional competitors creates pricing pressure and necessitates continuous innovation.

Growth Drivers in the Russia Automotive Camera Market Market

Technological advancements, particularly in image processing and sensor fusion, are key growth drivers. Stringent government regulations and safety standards are pushing adoption of advanced camera systems. Increased consumer demand for safety and convenience features in vehicles is boosting market growth. The rising popularity of ADAS and autonomous driving technologies creates significant opportunities for camera system manufacturers.

Challenges Impacting Russia Automotive Camera Market Growth

The impact of geopolitical instability on supply chain resilience presents a major challenge. Import tariffs and logistical difficulties pose significant hurdles for foreign suppliers. Intense price competition from both established and emerging players puts pressure on profit margins.

Key Players Shaping the Russia Automotive Camera Market Market

Significant Russia Automotive Camera Market Industry Milestones

- 2020: Introduction of stricter safety regulations related to ADAS features in new vehicles.

- 2021: Launch of a new high-resolution automotive camera by a major player, enhancing image quality and functionality.

- 2022: Significant investment by a foreign company in a local Russian automotive camera manufacturer.

- 2023: Several partnerships formed between automotive camera manufacturers and software companies to develop advanced AI-powered features.

Future Outlook for Russia Automotive Camera Market Market

The Russia automotive camera market is poised for substantial growth, driven by technological advancements, supportive government policies, and evolving consumer preferences. Strategic partnerships, investments in R&D, and expansion into new applications will be crucial for players aiming to secure market leadership. Opportunities exist in the development of integrated sensor systems and the adoption of AI-powered features. The increasing penetration of ADAS and autonomous driving technologies will propel market expansion in the years to come. This report projects a market size of xx Million USD by 2033, reflecting robust growth and significant market potential.

Russia Automotive Camera Market Segmentation

-

1. Type

- 1.1. Viewing Camera

- 1.2. Sensing Camera

-

2. Application

- 2.1. ADAS

- 2.2. Parking

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicles

Russia Automotive Camera Market Segmentation By Geography

- 1. Russia

Russia Automotive Camera Market Regional Market Share

Geographic Coverage of Russia Automotive Camera Market

Russia Automotive Camera Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 15.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surge in Trend of Yacht Tourism

- 3.3. Market Restrains

- 3.3.1. Higher Rentals During Peak Season

- 3.4. Market Trends

- 3.4.1. Sensing Camera to Experience a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Automotive Camera Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Viewing Camera

- 5.1.2. Sensing Camera

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. ADAS

- 5.2.2. Parking

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Magna International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Denso Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mobileye

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Garmin Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Gentex Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Valeo S

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Continental AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Autoliv Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Robert Bosch GmbH

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hella KGaA Hueck & Co

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Panasonic Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 ZF Friedrichshafen AG

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Magna International Inc

List of Figures

- Figure 1: Russia Automotive Camera Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Russia Automotive Camera Market Share (%) by Company 2025

List of Tables

- Table 1: Russia Automotive Camera Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Russia Automotive Camera Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Russia Automotive Camera Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 4: Russia Automotive Camera Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Russia Automotive Camera Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Russia Automotive Camera Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Russia Automotive Camera Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 8: Russia Automotive Camera Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Automotive Camera Market?

The projected CAGR is approximately > 15.00%.

2. Which companies are prominent players in the Russia Automotive Camera Market?

Key companies in the market include Magna International Inc, Denso Corporation, Mobileye, Garmin Ltd, Gentex Corporation, Valeo S, Continental AG, Autoliv Inc, Robert Bosch GmbH, Hella KGaA Hueck & Co, Panasonic Corporation, ZF Friedrichshafen AG.

3. What are the main segments of the Russia Automotive Camera Market?

The market segments include Type, Application, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Surge in Trend of Yacht Tourism.

6. What are the notable trends driving market growth?

Sensing Camera to Experience a Significant Growth.

7. Are there any restraints impacting market growth?

Higher Rentals During Peak Season.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Automotive Camera Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Automotive Camera Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Automotive Camera Market?

To stay informed about further developments, trends, and reports in the Russia Automotive Camera Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence