Key Insights

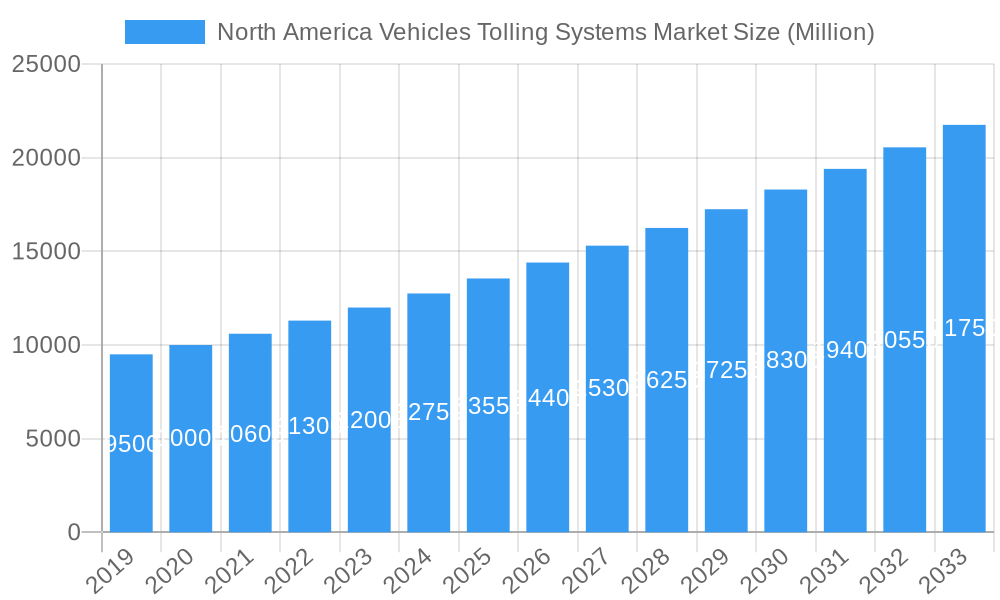

The North America Vehicles Tolling Systems Market is projected to reach a significant valuation, driven by a Compound Annual Growth Rate (CAGR) of 8.3%. The market size was valued at 10334.9 million in the base year of 2025 and is anticipated to experience substantial expansion. This growth is fueled by the increasing demand for sophisticated traffic management solutions to alleviate congestion and optimize revenue for infrastructure development. The widespread adoption of Electronic Toll Collection (ETC) systems, propelled by advancements in RFID and DSRC technologies, is a key growth factor. These systems enhance driver convenience, reduce vehicle idling, and streamline operations, contributing to a more efficient transportation network. Government initiatives focused on modernizing infrastructure and advancing smart city concepts are further accelerating the deployment of advanced tolling technologies across bridges, roads, and tunnels. The emphasis on contactless payments and real-time data analytics is also shaping market dynamics toward a more integrated and intelligent tolling approach.

North America Vehicles Tolling Systems Market Market Size (In Billion)

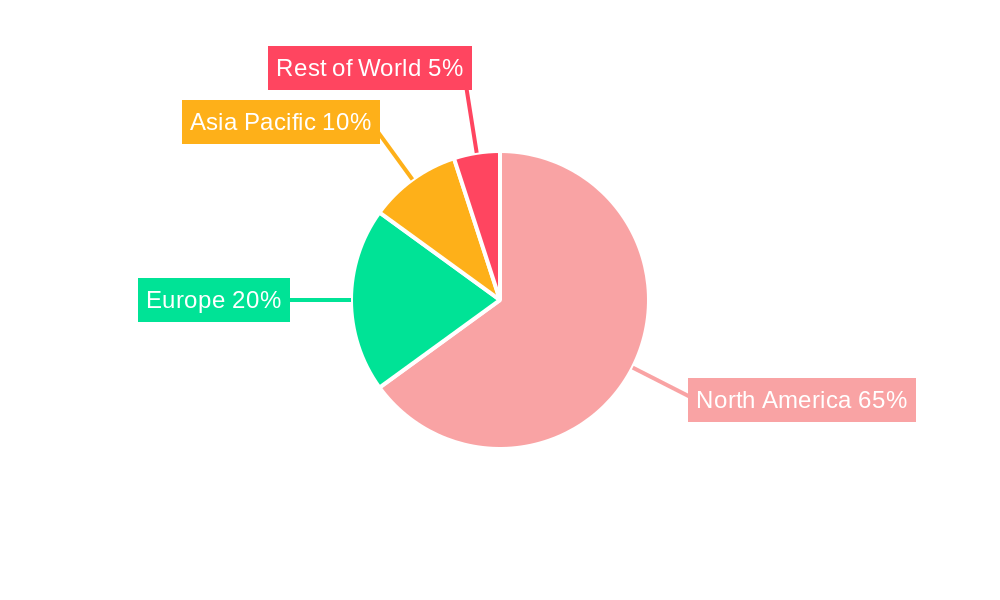

The market is segmented by toll collection method, with Electronic Toll Collection leading due to its superior speed and efficiency. Barrier Toll Collection methods are gradually being replaced by advanced, non-stop solutions. These systems are applied to critical infrastructure including bridges, major roadways, and tunnels, all vital for the seamless movement of goods and people across North America. Geographically, North America, with the United States and Canada at the forefront, represents a primary market, benefiting from extensive highway networks and a strong propensity for technological integration. Leading industry players are actively investing in innovation and strategic alliances to secure market positions. Potential challenges include the significant initial investment required for some advanced systems and the necessity for robust cybersecurity protocols to safeguard transaction data. Nevertheless, the overarching trend towards smart mobility and sustainable transportation infrastructure indicates a highly promising outlook for the North America Vehicles Tolling Systems Market.

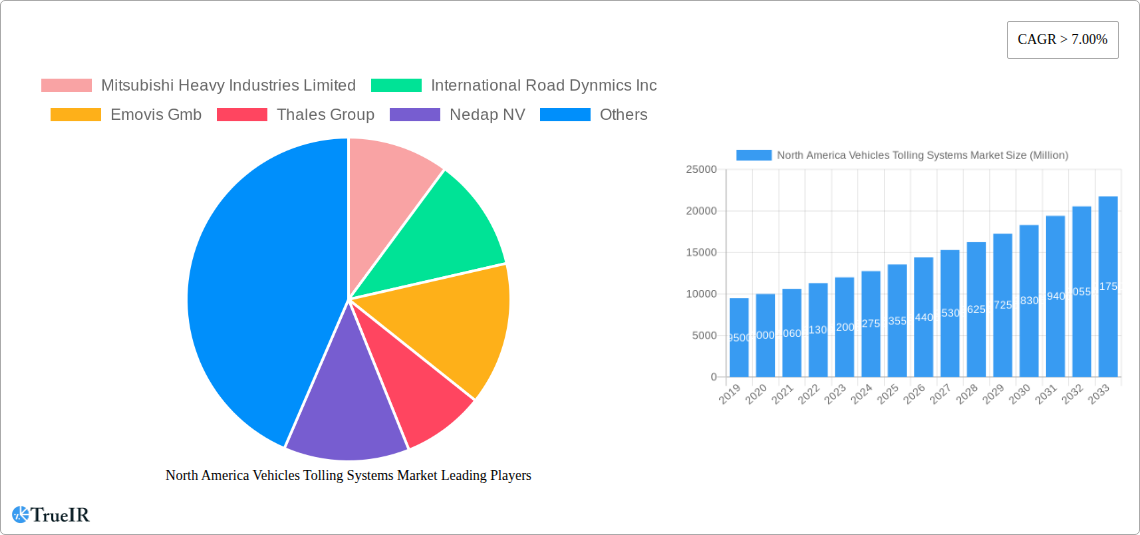

North America Vehicles Tolling Systems Market Company Market Share

This comprehensive report offers an in-depth analysis of the North America Vehicles Tolling Systems Market, covering market size, key trends, growth drivers, competitive landscape, and future projections for Electronic Toll Collection (ETC), Barrier Toll Collection, and Entry/Exit Toll Collection systems across bridges, roads, and tunnels in the United States, Canada, and the Rest of North America. The analysis spans from 2019 to 2033, with the base year set at 2025 and the forecast period from 2025 to 2033.

North America Vehicles Tolling Systems Market Market Structure & Competitive Landscape

The North America Vehicles Tolling Systems Market exhibits a moderately concentrated structure, characterized by the presence of both established global players and emerging regional specialists. Innovation drivers are primarily fueled by advancements in sensor technology, AI-powered data analytics, and seamless payment integration, aiming to enhance efficiency and user experience. Regulatory impacts, such as government mandates for open road tolling and data privacy, significantly shape market dynamics. Product substitutes, while limited in core functionality, include integrated payment solutions within connected vehicles and alternative transportation modes that could reduce toll road usage. End-user segmentation is broadly defined by government transportation agencies and private toll road operators, each with distinct procurement processes and performance requirements. Merger and acquisition (M&A) trends indicate strategic consolidation, with an estimated XX M&A transactions in the historical period (2019-2024) aimed at expanding service portfolios and geographical reach. For instance, the acquisition of smaller technology providers by larger players seeking to bolster their IoT and cloud capabilities is a recurring theme. The market is characterized by a strong focus on reliability, security, and interoperability to ensure smooth traffic flow and revenue collection.

North America Vehicles Tolling Systems Market Market Trends & Opportunities

The North America Vehicles Tolling Systems Market is poised for robust growth, with an estimated market size of USD XX Billion in the base year 2025, projected to reach USD XX Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period. This expansion is largely driven by an increasing demand for efficient traffic management solutions and the continuous expansion of toll infrastructure across the continent. Technological shifts are at the forefront of market evolution, with a significant move towards advanced Electronic Toll Collection (ETC) systems. This includes the widespread adoption of Radio-Frequency Identification (RFID) and Dedicated Short-Range Communications (DSRC) technologies, alongside the burgeoning integration of Global Navigation Satellite Systems (GNSS) and license plate recognition (LPR) systems. These advancements are facilitating seamless, non-stop tolling, thereby reducing congestion and improving travel times.

Consumer preferences are increasingly tilting towards convenience and speed. Drivers are seeking tolling solutions that minimize stops and offer integrated payment options, thereby reducing friction and enhancing their overall travel experience. This has led to a growing demand for mobile payment solutions and interoperable tolling systems that allow users to travel across different tolling authorities without the need for multiple transponders or accounts.

The competitive landscape is dynamic, with key players investing heavily in research and development to offer more sophisticated and integrated solutions. The increasing adoption of smart city initiatives and the development of connected and autonomous vehicles are opening up new avenues for innovative tolling solutions. Opportunities exist in developing data analytics platforms that can provide valuable insights into traffic patterns, enabling better infrastructure planning and operational efficiency for toll operators. Furthermore, the growing emphasis on sustainability is creating opportunities for tolling systems that can support congestion pricing and incentivize the use of public transportation or electric vehicles. The market is also witnessing a trend towards managed services, where operators can outsource the complex management and maintenance of their tolling systems to specialized providers.

Dominant Markets & Segments in North America Vehicles Tolling Systems Market

The United States of America currently holds the dominant position within the North America Vehicles Tolling Systems Market, driven by its extensive toll road network, significant urban congestion, and proactive adoption of advanced tolling technologies. Within the United States, the Roads application type represents the largest segment, accounting for approximately XX% of the market share in 2025. This is attributed to the vast expanse of highway systems and express lanes that rely heavily on tolling for revenue generation and traffic management.

Among the toll collection types, Electronic Toll Collection (ETC) is the undisputed leader, projected to capture over XX% of the market by 2033. This dominance is propelled by its inherent efficiency, ability to facilitate non-stop travel, and the significant reduction in operational costs compared to manual toll collection. Key growth drivers for ETC include government mandates pushing for greater automation, the widespread availability of transponder technology, and the increasing adoption of ANPR (Automatic Number Plate Recognition) systems. The ongoing development of smart city infrastructure and the integration of ETC with connected vehicle technologies further solidify its leading position.

Canada demonstrates a steady growth trajectory, with its Roads segment also being a primary revenue generator, albeit on a smaller scale than the US. The adoption of ETC in Canada is accelerating, driven by cross-border travel and the increasing implementation of provincial tolling initiatives. The Rest of North America, while currently a smaller segment, presents significant untapped potential, particularly in countries actively investing in modernizing their transportation infrastructure and exploring tolling as a viable revenue source.

The Bridges and Tunnels application types, while smaller segments than roads, are crucial for urban mobility and are increasingly adopting advanced tolling solutions. For instance, major bridge projects and urban tunnel constructions in metropolitan areas often incorporate ETC to manage traffic flow and collect tolls efficiently. The Barrier Toll Collection and Entry/Exit Toll Collection types, while historically significant, are gradually being supplemented and in some cases replaced by ETC due to efficiency and environmental benefits. However, they remain relevant in certain legacy systems and specific operational contexts. The overall market's expansion is intrinsically linked to infrastructure development, public-private partnerships in transportation, and the continuous pursuit of intelligent transportation systems (ITS) across the region.

North America Vehicles Tolling Systems Market Product Analysis

Product innovations in the North America Vehicles Tolling Systems Market are largely focused on enhancing the accuracy, speed, and user-friendliness of toll collection. Advanced ETC systems now integrate multiple technologies like RFID, GNSS, and AI-powered image recognition for seamless vehicle identification and payment processing. These systems offer improved accuracy in tag reading and license plate recognition, reducing errors and disputes. The trend towards interoperability allows for a single transponder or account to be used across multiple tolling authorities, significantly benefiting frequent travelers. Furthermore, the integration of mobile applications provides real-time transaction history, account management, and payment flexibility, increasing customer satisfaction. Competitive advantages lie in the development of robust, secure, and scalable systems that can handle high traffic volumes while ensuring data privacy and compliance with evolving regulations.

Key Drivers, Barriers & Challenges in North America Vehicles Tolling Systems Market

Key Drivers:

- Infrastructure Development & Modernization: Significant investments in new toll roads, bridges, and tunnels, coupled with the upgrade of existing infrastructure, directly fuels the demand for tolling systems.

- Traffic Congestion Management: Growing urban populations and increased vehicle ownership lead to severe traffic congestion, making tolling a critical tool for managing traffic flow and incentivizing alternative transportation.

- Technological Advancements: The continuous evolution of ETC technologies, including RFID, ANPR, and connected vehicle integration, offers more efficient and cost-effective tolling solutions.

- Government Initiatives & Funding: Supportive government policies, public-private partnerships, and dedicated funding for transportation infrastructure projects are significant catalysts for market growth.

Key Barriers & Challenges:

- High Initial Investment Costs: The implementation of advanced tolling systems requires substantial upfront capital expenditure, which can be a barrier for some municipalities and private operators.

- Public Acceptance & Political Opposition: Concerns regarding fairness, privacy, and the potential for increased costs can lead to public resistance and political challenges in implementing new tolling projects.

- Interoperability & Standardization Issues: While improving, the lack of complete standardization across different tolling agencies can still create complexity for users and system integrators.

- Cybersecurity Threats: The increasing reliance on digital systems makes tolling infrastructure vulnerable to cyberattacks, necessitating robust security measures and ongoing vigilance.

Growth Drivers in the North America Vehicles Tolling Systems Market Market

The North America Vehicles Tolling Systems Market is propelled by several key growth drivers. Technological advancements, particularly in Electronic Toll Collection (ETC), are revolutionizing the sector. Innovations in RFID, ANPR (Automatic Number Plate Recognition), and the integration with connected vehicle technologies are leading to more efficient, faster, and user-friendly tolling experiences. Economic factors, such as the ongoing need for infrastructure funding and the management of traffic congestion, are driving the adoption of tolling as a sustainable revenue generation model. Furthermore, supportive government policies and initiatives aimed at modernizing transportation infrastructure and promoting smart city development create a favorable environment for market expansion. The increasing trend of public-private partnerships (PPPs) in developing and managing toll roads also plays a significant role.

Challenges Impacting North America Vehicles Tolling Systems Market Growth

Several challenges impact the growth of the North America Vehicles Tolling Systems Market. The regulatory complexities surrounding tolling policies, data privacy, and interoperability across different jurisdictions can create hurdles for widespread adoption and seamless operation. Supply chain issues, particularly concerning the availability of specialized electronic components and sensors, can lead to project delays and increased costs. Competitive pressures from established players and the need for continuous innovation to stay ahead also present a challenge, requiring significant R&D investment. Furthermore, the initial high capital investment required for deploying advanced tolling infrastructure can be a deterrent for some entities. Public perception and resistance to new tolling systems, often fueled by concerns about cost and privacy, also pose a significant challenge that needs careful management through transparent communication and fair implementation strategies.

Key Players Shaping the North America Vehicles Tolling Systems Market Market

- Mitsubishi Heavy Industries Limited

- International Road Dynamics Inc

- Emovis Gmb

- Thales Group

- Nedap NV

- TansCore Atlantic LLC

- Cintra

- Magnetic Autocontrol GmbH

Significant North America Vehicles Tolling Systems Market Industry Milestones

- 2019: Increased deployment of AI-powered video analytics for more accurate license plate recognition.

- 2020: Growing emphasis on contactless payment solutions and mobile app integration for toll payments.

- 2021: Expansion of interoperable tolling networks across multiple US states, simplifying cross-state travel.

- 2022: Advancements in blockchain technology explored for secure and transparent toll transaction management.

- 2023: Significant investments in cloud-based tolling solutions to enhance scalability and data analytics capabilities.

- 2024: Increased adoption of GNSS-based tolling systems as an alternative or supplement to traditional methods.

Future Outlook for North America Vehicles Tolling Systems Market Market

The future outlook for the North America Vehicles Tolling Systems Market is exceptionally promising, driven by ongoing technological advancements and the persistent need for efficient traffic management. The integration of tolling systems with the broader ecosystem of connected and autonomous vehicles will unlock new opportunities for dynamic pricing, personalized user experiences, and enhanced data analytics. We anticipate a continued shift towards fully automated, contactless tolling solutions, with a decline in traditional barrier systems. Strategic partnerships between technology providers, infrastructure developers, and government agencies will be crucial for overcoming implementation hurdles and driving innovation. The market is poised for substantial growth, fueled by the development of smarter, more sustainable, and user-centric transportation networks across the continent.

North America Vehicles Tolling Systems Market Segmentation

-

1. Toll Collection Type

- 1.1. Barrier Toll Collection

- 1.2. Entry/ExiT Toll Collection

- 1.3. Electronic Toll Collection

-

2. Application Type

- 2.1. Bridges

- 2.2. Roads

- 2.3. Tunnels

-

3. Geography

-

3.1. North America

- 3.1.1. United States Of America

- 3.1.2. Canada

- 3.1.3. Rest of North America

-

3.1. North America

North America Vehicles Tolling Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States Of America

- 1.2. Canada

- 1.3. Rest of North America

North America Vehicles Tolling Systems Market Regional Market Share

Geographic Coverage of North America Vehicles Tolling Systems Market

North America Vehicles Tolling Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives to Promote Sales of Electric Vehicle

- 3.3. Market Restrains

- 3.3.1. High Initial Investment for Installing Electric Vehicle Charging Infrastructure

- 3.4. Market Trends

- 3.4.1. Electronic Toll Collection is Expected to Witness the Highest Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Vehicles Tolling Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Toll Collection Type

- 5.1.1. Barrier Toll Collection

- 5.1.2. Entry/ExiT Toll Collection

- 5.1.3. Electronic Toll Collection

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Bridges

- 5.2.2. Roads

- 5.2.3. Tunnels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. North America

- 5.3.1.1. United States Of America

- 5.3.1.2. Canada

- 5.3.1.3. Rest of North America

- 5.3.1. North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Toll Collection Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mitsubishi Heavy Industries Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 International Road Dynmics Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Emovis Gmb

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Thales Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nedap NV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TansCore Atlantic LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cintra

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Magnetic Autocontrol GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Mitsubishi Heavy Industries Limited

List of Figures

- Figure 1: North America Vehicles Tolling Systems Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North America Vehicles Tolling Systems Market Share (%) by Company 2025

List of Tables

- Table 1: North America Vehicles Tolling Systems Market Revenue million Forecast, by Toll Collection Type 2020 & 2033

- Table 2: North America Vehicles Tolling Systems Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 3: North America Vehicles Tolling Systems Market Revenue million Forecast, by Geography 2020 & 2033

- Table 4: North America Vehicles Tolling Systems Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: North America Vehicles Tolling Systems Market Revenue million Forecast, by Toll Collection Type 2020 & 2033

- Table 6: North America Vehicles Tolling Systems Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 7: North America Vehicles Tolling Systems Market Revenue million Forecast, by Geography 2020 & 2033

- Table 8: North America Vehicles Tolling Systems Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States Of America North America Vehicles Tolling Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Vehicles Tolling Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America North America Vehicles Tolling Systems Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Vehicles Tolling Systems Market?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the North America Vehicles Tolling Systems Market?

Key companies in the market include Mitsubishi Heavy Industries Limited, International Road Dynmics Inc, Emovis Gmb, Thales Group, Nedap NV, TansCore Atlantic LLC, Cintra, Magnetic Autocontrol GmbH.

3. What are the main segments of the North America Vehicles Tolling Systems Market?

The market segments include Toll Collection Type, Application Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 10334.9 million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives to Promote Sales of Electric Vehicle.

6. What are the notable trends driving market growth?

Electronic Toll Collection is Expected to Witness the Highest Growth Rate.

7. Are there any restraints impacting market growth?

High Initial Investment for Installing Electric Vehicle Charging Infrastructure.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Vehicles Tolling Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Vehicles Tolling Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Vehicles Tolling Systems Market?

To stay informed about further developments, trends, and reports in the North America Vehicles Tolling Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence