Key Insights

The European Electric Vehicle (EV) market is experiencing substantial growth, propelled by stringent emission regulations, heightened consumer environmental consciousness, and supportive government incentives. The market is projected to reach 538933.3 million by 2024, with a compound annual growth rate (CAGR) of 32.5% from the base year 2024. Key growth drivers include the expanding charging infrastructure, addressing range anxiety, and technological advancements in battery life and charging speeds. Rising fossil fuel costs, coupled with government subsidies, are enhancing EV cost-competitiveness. The market is segmented by vehicle type (passenger, commercial), fuel category (BEV, FCEV, HEV, PHEV), and country, with Germany, France, and the UK leading adoption. Major automotive manufacturers are heavily investing in EV R&D, contributing to a diverse product offering.

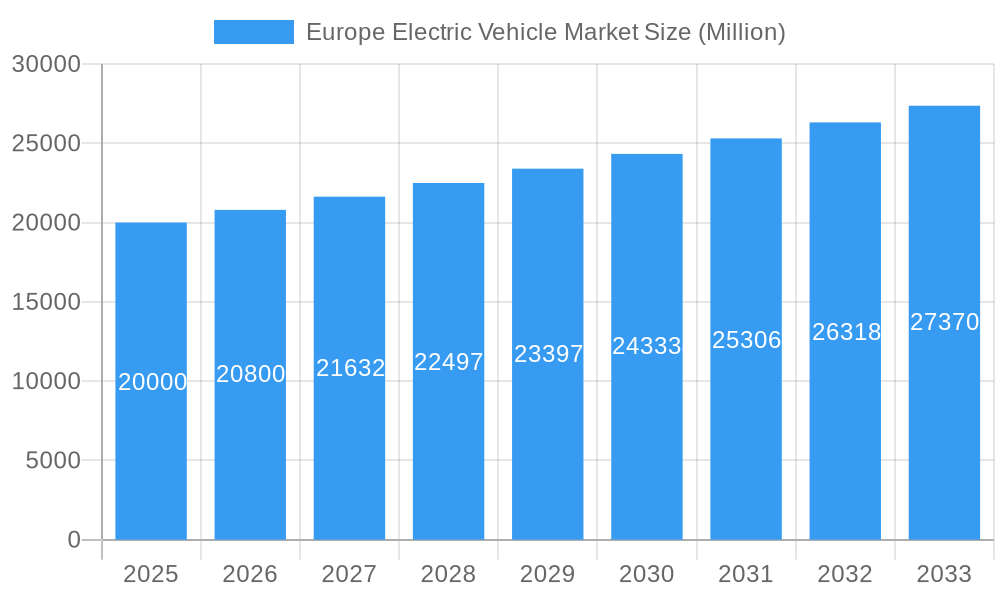

Europe Electric Vehicle Market Market Size (In Billion)

The forecast period of 2025-2033 anticipates continued expansion in the European EV market, despite challenges such as the initial purchase price and uneven charging infrastructure availability. Sustained investment in infrastructure, battery technology advancements, and ongoing government support will be crucial for navigating these hurdles. The overall outlook for the European EV market remains highly positive, indicating significant growth potential over the coming decade.

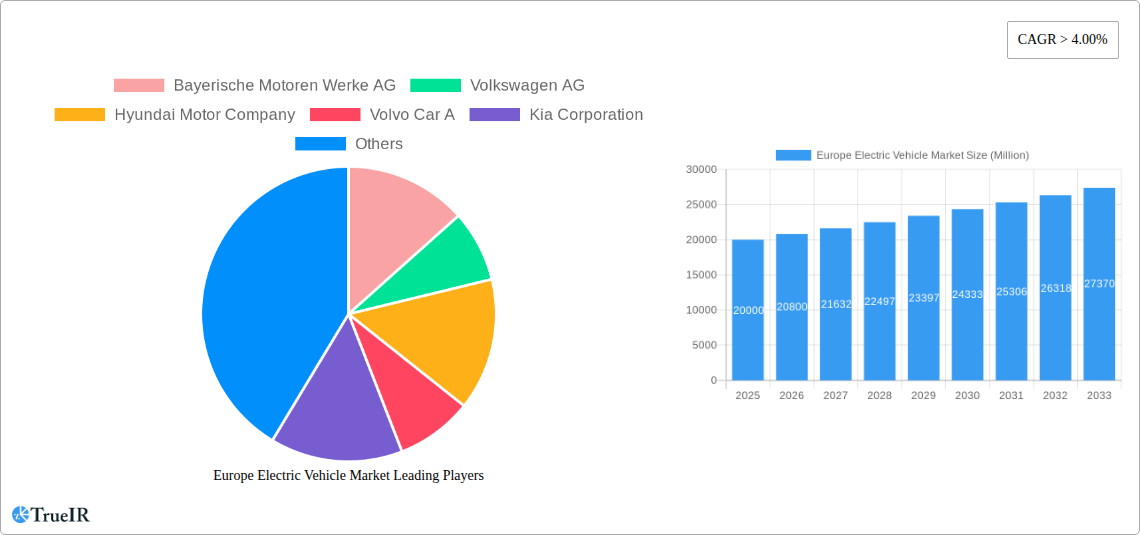

Europe Electric Vehicle Market Company Market Share

Europe Electric Vehicle Market: A Comprehensive Report (2019-2033)

This dynamic report offers an in-depth analysis of the burgeoning Europe Electric Vehicle (EV) market, providing crucial insights for investors, manufacturers, and industry stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market trends, competitive dynamics, and future growth potential. Expect detailed segmentation across vehicle types, fuel categories, and key European countries, supported by robust quantitative data and expert analysis.

Europe Electric Vehicle Market Market Structure & Competitive Landscape

The European EV market exhibits a complex structure, influenced by intense competition, rapid technological advancements, and evolving regulatory landscapes. Market concentration is moderate, with several major players commanding significant shares, but a growing number of smaller, niche players are also emerging. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately concentrated market. Key innovation drivers include battery technology improvements, advancements in charging infrastructure, and the development of autonomous driving capabilities. Stringent emission regulations across Europe are driving demand for EVs, while the availability of internal combustion engine (ICE) vehicles serves as a primary product substitute. The end-user segment is diverse, encompassing private consumers, commercial fleets, and public transportation entities. Mergers and acquisitions (M&A) activity has been significant, with xx Million in deals recorded in 2024, primarily focused on securing battery supply chains and expanding market reach.

- Market Concentration: Moderate, with a projected HHI of xx in 2025.

- Innovation Drivers: Battery technology, charging infrastructure, autonomous driving.

- Regulatory Impacts: Stringent emission standards are a key driver of EV adoption.

- Product Substitutes: Internal combustion engine (ICE) vehicles.

- End-User Segmentation: Private consumers, commercial fleets, public transport.

- M&A Trends: Significant activity in 2024, totaling xx Million, focused on battery supply chains and market expansion.

Europe Electric Vehicle Market Market Trends & Opportunities

The European EV market is experiencing substantial growth, driven by increasing environmental concerns, government incentives, and falling battery costs. The market size is projected to reach xx Million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological shifts, such as the development of solid-state batteries and improvements in fast-charging technology, are further accelerating market expansion. Consumer preferences are shifting towards EVs, driven by factors such as lower running costs and improved performance. Competitive dynamics are characterized by intense rivalry among established automakers and new entrants, leading to continuous product innovation and price competition. Market penetration rates are expected to increase significantly, reaching xx% by 2033, from the current level of xx%.

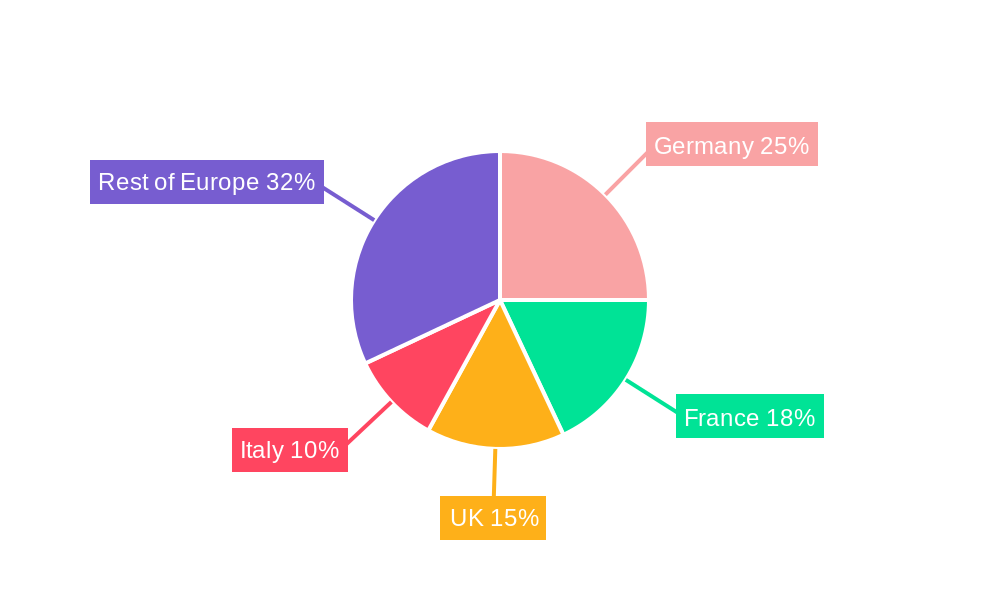

Dominant Markets & Segments in Europe Electric Vehicle Market

The German EV market currently holds the largest share in Europe, followed by France and the UK. However, Norway demonstrates exceptionally high per capita EV adoption rates, indicating significant growth potential in other Nordic countries. Within the segments:

- Fuel Category: Battery Electric Vehicles (BEVs) are the dominant segment, holding the largest market share, followed by Plug-in Hybrid Electric Vehicles (PHEVs). Fuel cell electric vehicles (FCEVs) and Hybrid Electric Vehicles (HEVs) are still niche markets in Europe.

- Vehicle Type: Passenger vehicles currently account for the lion's share of the market. Commercial vehicle electrification is growing rapidly but lags behind passenger vehicles.

- Country: Germany, France, and the UK are the leading markets, but Norway shows the highest penetration rate. The Rest-of-Europe segment displays diverse growth patterns.

Key Growth Drivers:

- Government Incentives: Subsidies, tax breaks, and emission regulations are driving demand.

- Charging Infrastructure Development: Expansion of public charging networks is crucial for wider adoption.

- Technological Advancements: Battery improvements, range extension, and faster charging are key factors.

Europe Electric Vehicle Market Product Analysis

The European EV market displays a wide range of product offerings, from compact city cars to luxury SUVs. Technological advancements are continuously improving battery performance, range, and charging speed. Key competitive advantages include innovative designs, advanced driver-assistance systems, and superior connectivity features. The market is witnessing a growing trend towards the integration of smart technologies and the development of purpose-built EV platforms.

Key Drivers, Barriers & Challenges in Europe Electric Vehicle Market

Key Drivers:

- Environmental Regulations: Stringent emission standards are pushing the transition to EVs.

- Government Incentives: Financial support schemes significantly boost demand.

- Technological Advancements: Battery improvements and increased range extend market appeal.

Challenges:

- Supply Chain Disruptions: Component shortages, particularly batteries, can impact production and availability. This resulted in a xx% reduction in production in Q3 2024.

- Charging Infrastructure Gaps: Insufficient charging infrastructure limits EV adoption in certain regions.

- High Initial Purchase Prices: The higher cost of EVs compared to ICE vehicles remains a significant barrier for some consumers.

Growth Drivers in the Europe Electric Vehicle Market Market

Government policies promoting EV adoption, including tax incentives and emission regulations, are crucial drivers. Technological advancements, like improved battery technology and charging infrastructure, are also key. Increasing consumer awareness of environmental benefits and falling battery prices further contribute to market expansion.

Challenges Impacting Europe Electric Vehicle Market Growth

High upfront costs, limited charging infrastructure in certain areas, and range anxiety remain significant barriers. Supply chain vulnerabilities, particularly concerning battery materials, could hinder production. Competition from established automakers and new entrants also presents a challenge.

Key Players Shaping the Europe Electric Vehicle Market Market

Significant Europe Electric Vehicle Market Industry Milestones

- November 2023: Tesla acquired US-based start-up SiILion battery (Battery manufacturer) to enhance its battery production capabilities. This significantly strengthens Tesla's vertical integration and could lead to more competitive pricing and higher production volumes.

- November 2023: Volkswagen launched the new Nivus in Argentina, expanding its presence in South America. While not directly impacting the European market, it shows continued investment in new models and technology.

- November 2023: Tesla opened a new Supercharger station between the Bay Area and Los Angeles. Although not in Europe, this highlights Tesla's focus on expanding its charging infrastructure, setting a benchmark for others to follow.

Future Outlook for Europe Electric Vehicle Market Market

The European EV market is poised for continued robust growth, driven by supportive government policies, technological innovation, and rising consumer demand. Strategic opportunities abound for companies that can effectively navigate supply chain challenges, invest in advanced battery technologies, and expand charging infrastructure. The market's potential is immense, with significant growth projected across various segments and countries.

Europe Electric Vehicle Market Segmentation

-

1. Vehicle Type

- 1.1. Commercial Vehicles

-

1.2. Passenger Vehicles

- 1.2.1. Hatchback

- 1.2.2. Multi-purpose Vehicle

- 1.2.3. Sedan

- 1.2.4. Sports Utility Vehicle

- 1.3. Two-Wheelers

-

2. Fuel Category

- 2.1. BEV

- 2.2. FCEV

- 2.3. HEV

- 2.4. PHEV

Europe Electric Vehicle Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Electric Vehicle Market Regional Market Share

Geographic Coverage of Europe Electric Vehicle Market

Europe Electric Vehicle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 32.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Used Car Financing To Continue Solving Consumer Challenges In Indonesia

- 3.3. Market Restrains

- 3.3.1. Trust And Transparency In Used Car Remained A Key Challenge For Consumers

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Electric Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Commercial Vehicles

- 5.1.2. Passenger Vehicles

- 5.1.2.1. Hatchback

- 5.1.2.2. Multi-purpose Vehicle

- 5.1.2.3. Sedan

- 5.1.2.4. Sports Utility Vehicle

- 5.1.3. Two-Wheelers

- 5.2. Market Analysis, Insights and Forecast - by Fuel Category

- 5.2.1. BEV

- 5.2.2. FCEV

- 5.2.3. HEV

- 5.2.4. PHEV

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bayerische Motoren Werke AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Volkswagen AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hyundai Motor Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Volvo Car A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kia Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tesla Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mercedes-Benz

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Groupe Renault

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Audi AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Toyota Motor Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Bayerische Motoren Werke AG

List of Figures

- Figure 1: Europe Electric Vehicle Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Electric Vehicle Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Electric Vehicle Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Europe Electric Vehicle Market Revenue million Forecast, by Fuel Category 2020 & 2033

- Table 3: Europe Electric Vehicle Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Europe Electric Vehicle Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 5: Europe Electric Vehicle Market Revenue million Forecast, by Fuel Category 2020 & 2033

- Table 6: Europe Electric Vehicle Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Electric Vehicle Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Electric Vehicle Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Electric Vehicle Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Electric Vehicle Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Electric Vehicle Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Electric Vehicle Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Electric Vehicle Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Electric Vehicle Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Electric Vehicle Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Electric Vehicle Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Electric Vehicle Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Electric Vehicle Market?

The projected CAGR is approximately 32.5%.

2. Which companies are prominent players in the Europe Electric Vehicle Market?

Key companies in the market include Bayerische Motoren Werke AG, Volkswagen AG, Hyundai Motor Company, Volvo Car A, Kia Corporation, Tesla Inc, Mercedes-Benz, Groupe Renault, Audi AG, Toyota Motor Corporation.

3. What are the main segments of the Europe Electric Vehicle Market?

The market segments include Vehicle Type, Fuel Category.

4. Can you provide details about the market size?

The market size is estimated to be USD 538933.3 million as of 2022.

5. What are some drivers contributing to market growth?

Used Car Financing To Continue Solving Consumer Challenges In Indonesia.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Trust And Transparency In Used Car Remained A Key Challenge For Consumers.

8. Can you provide examples of recent developments in the market?

November 2023: Tesla has acquired US-based start-up SiILion battery (Battery manufacturer) to excel the battery production in US.November 2023: In Argentina, Volkswagen debuted the brand-new Nivus. Both the Comfortline and Highline models of the VW Nivus will be offered in Argentina. They both come equipped with a 1.0-liter TSi three-cylinder engine that generates 116 horsepower and 200 Nm of torque and is coupled to a six-speed automated transmission.November 2023: Tesla opened its single-point electric vehicle super-charging station between the Bay Area and Los Angeles areas in the US.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Electric Vehicle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Electric Vehicle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Electric Vehicle Market?

To stay informed about further developments, trends, and reports in the Europe Electric Vehicle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence