Key Insights

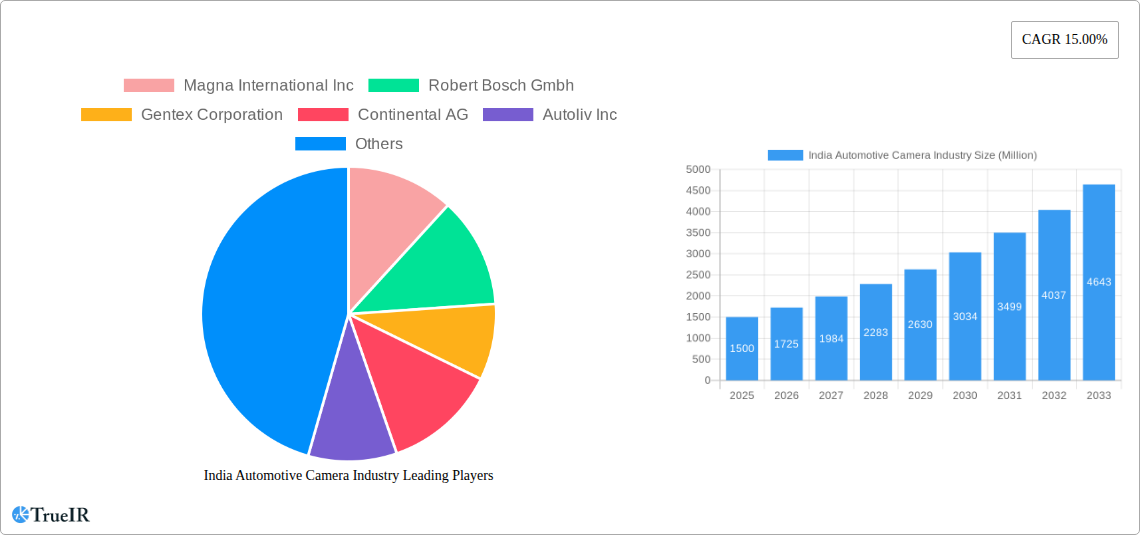

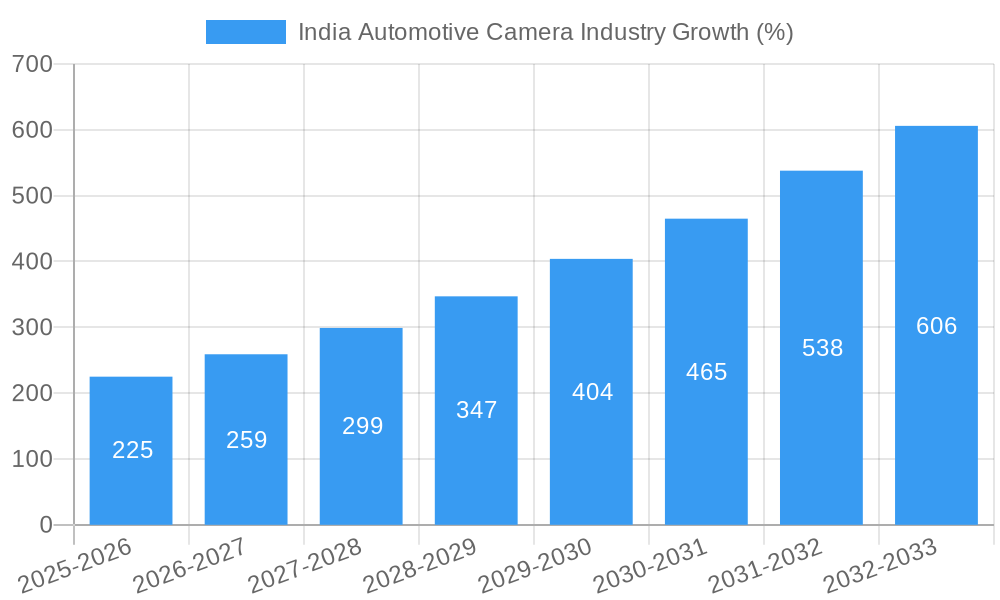

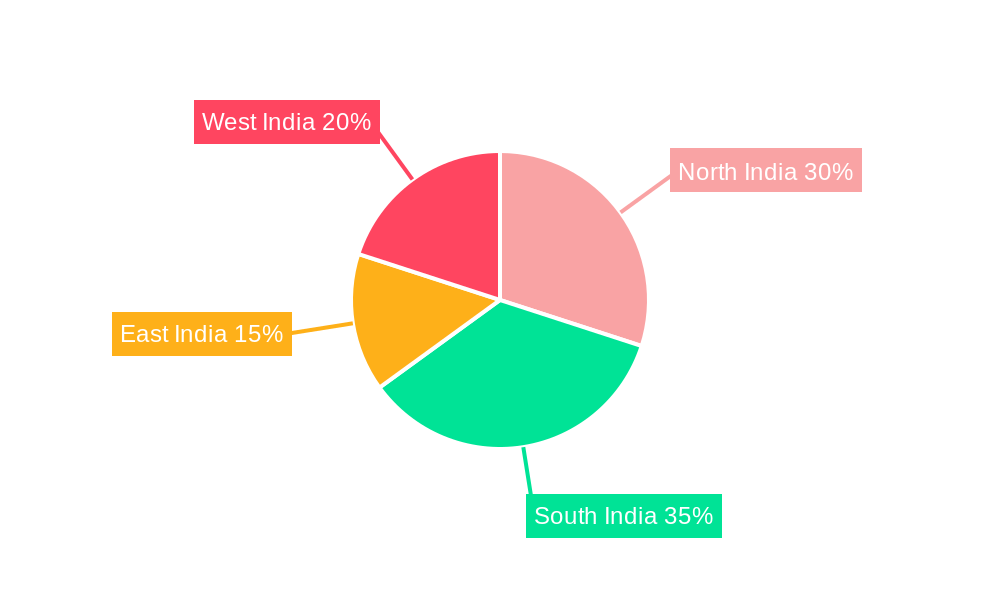

The Indian automotive camera market, valued at approximately ₹1500 crore (estimated based on a global market size and India's automotive sector contribution) in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 15% from 2025 to 2033. This surge is primarily driven by the increasing adoption of Advanced Driver-Assistance Systems (ADAS) in passenger and commercial vehicles, aligning with global trends toward enhanced road safety and autonomous driving capabilities. Government regulations promoting safety features and the rising demand for technologically advanced vehicles further fuel market expansion. The passenger vehicle segment currently dominates market share, but the commercial vehicle segment is anticipated to witness significant growth fueled by fleet management and safety requirements. Within camera types, sensing cameras are gaining traction due to their ability to provide more comprehensive environmental data for ADAS functionalities. While the market faces challenges such as initial high costs associated with ADAS integration and technological complexities, the long-term benefits and increasing affordability are overcoming these hurdles. Regional variations exist, with Southern and Western India showing potentially faster growth rates due to higher vehicle production and adoption of new technologies.

The key players in this dynamic market, including Magna International Inc, Robert Bosch GmbH, Gentex Corporation, Continental AG, Autoliv Inc, Valeo SA, Hella KGaA Hueck & Co, Garmin Ltd, and Panasonic Corporation, are strategically investing in R&D and partnerships to maintain their competitive edge. The market segmentation, encompassing vehicle type (passenger and commercial vehicles), camera type (viewing and sensing), and application (ADAS and parking), provides valuable insights into specific market niches and growth trajectories. The forecast period (2025-2033) promises further expansion driven by technological advancements, evolving consumer preferences, and favorable government policies. The historical period (2019-2024) data reveals a steady incline setting the stage for the accelerated growth predicted in the forecast period. This growth is supported by a burgeoning middle class with increased purchasing power and the government's "Make in India" initiative, encouraging domestic manufacturing.

India Automotive Camera Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides an in-depth analysis of the burgeoning India automotive camera industry, offering invaluable insights for stakeholders seeking to navigate this rapidly evolving market. From market size and segmentation to key players and future trends, this report delivers a comprehensive overview of the landscape between 2019 and 2033. The report leverages extensive data analysis and expert insights to provide a clear understanding of opportunities and challenges, empowering informed decision-making.

India Automotive Camera Industry Market Structure & Competitive Landscape

The Indian automotive camera market exhibits a moderately concentrated structure, with key players like Magna International Inc, Robert Bosch GmbH, and Continental AG holding significant market share. The market is characterized by intense competition driven by technological advancements in ADAS (Advanced Driver-Assistance Systems) and increasing demand for safety features. Regulatory pressures, particularly concerning vehicle safety standards, are shaping industry dynamics. Product substitution is minimal, with cameras increasingly becoming integral to vehicle functionalities. The passenger vehicle segment dominates the market, while the commercial vehicle segment is expected to witness significant growth driven by increasing adoption of safety technologies. M&A activity has been moderate, with a focus on strategic partnerships and technological collaborations. The concentration ratio (CR4) for 2025 is estimated at 45%, reflecting a moderate level of market concentration. Further consolidation is anticipated during the forecast period (2025-2033), with an expected increase in M&A activity driven by the need for technological advancements and global expansion. Over the historical period (2019-2024), M&A volume averaged approximately xx Million USD annually.

India Automotive Camera Industry Market Trends & Opportunities

The Indian automotive camera market is experiencing robust growth, driven by factors such as rising vehicle production, increasing adoption of advanced driver-assistance systems (ADAS), and stringent government regulations mandating safety features. The market size is projected to reach xx Million USD by 2025 and xx Million USD by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Technological advancements, such as the integration of AI and machine learning in camera systems, are enhancing functionalities and driving market expansion. Consumer preferences are shifting towards vehicles with advanced safety and convenience features, further fueling demand. Competitive dynamics are characterized by intense rivalry among established players and emerging entrants, leading to continuous product innovation and pricing pressures. Market penetration rate for ADAS-equipped vehicles is currently at xx% and is projected to reach xx% by 2033. The increasing affordability of automotive cameras and rising consumer awareness are also key growth catalysts.

Dominant Markets & Segments in India Automotive Camera Industry

Dominant Vehicle Type: The passenger vehicle segment accounts for the largest share of the automotive camera market, driven by high vehicle sales and increasing preference for safety features.

Dominant Camera Type: Sensing cameras are witnessing faster growth compared to viewing cameras, primarily due to their applications in ADAS functionalities.

Dominant Application: The ADAS segment is the fastest-growing application segment, driven by government regulations and rising consumer demand for advanced safety features. Parking assistance cameras also contribute significantly to the market.

The Southern and Western regions of India are leading in market growth, fueled by robust automotive manufacturing hubs and a higher concentration of technologically advanced vehicles. Key growth drivers include supportive government policies promoting vehicle safety, expanding automotive manufacturing capabilities, and increasing disposable incomes.

India Automotive Camera Industry Product Analysis

The Indian automotive camera market showcases a diverse range of products, including single-lens cameras, multi-lens cameras, and surround-view systems. Technological advancements focus on enhancing image quality, expanding functionalities through AI and machine learning integration, and improving cost-effectiveness. Competition is driven by product differentiation through features like higher resolution, wider field of view, and improved night vision capabilities. Products are tailored to meet diverse application needs, from basic parking assistance to advanced driver assistance systems. The market shows a strong preference for high-resolution cameras with night vision capabilities, particularly in higher-end vehicles.

Key Drivers, Barriers & Challenges in India Automotive Camera Industry

Key Drivers:

- Rising vehicle production and sales.

- Government regulations mandating safety features.

- Growing demand for advanced driver assistance systems (ADAS).

- Increasing consumer awareness regarding vehicle safety.

Challenges:

- High initial investment costs associated with ADAS technologies can hinder adoption, especially in the lower segments.

- Supply chain disruptions due to global geopolitical events and resource constraints affect production and pricing.

- Intense competition among established and emerging players creates pricing pressure.

Growth Drivers in the India Automotive Camera Industry Market

The Indian automotive camera market is propelled by technological advancements, economic growth, and supportive government policies. Technological innovation, particularly in AI and machine learning, is enhancing camera functionalities and driving adoption. Rising disposable incomes and increasing vehicle ownership are boosting demand. Government regulations promoting vehicle safety and the development of automotive manufacturing hubs are crucial enablers.

Challenges Impacting India Automotive Camera Industry Growth

The Indian automotive camera market faces challenges such as high initial costs, supply chain complexities, and regulatory hurdles. The high cost of advanced cameras and associated technology can limit adoption. Global supply chain disruptions, raw material shortages, and geopolitical events create uncertainty. Complex regulatory frameworks and standardization challenges add to the industry's complexities.

Key Players Shaping the India Automotive Camera Industry Market

- Magna International Inc

- Robert Bosch GmbH

- Gentex Corporation

- Continental AG

- Autoliv Inc

- Valeo SA

- Hella KGaA Hueck & Co

- Garmin Ltd

- Panasonic Corporation

Significant India Automotive Camera Industry Industry Milestones

- 2020: Introduction of stricter safety regulations by the Indian government, mandating the use of rearview cameras in new vehicles.

- 2022: Launch of several new ADAS-equipped vehicles by major automotive manufacturers.

- 2023: Several key players announced significant investments in R&D for advanced camera technologies, focusing on AI-powered solutions.

Future Outlook for India Automotive Camera Industry Market

The future of the India automotive camera market is exceptionally promising. Continued growth is anticipated, driven by increasing vehicle production, rising demand for advanced safety features, and ongoing technological advancements. The market presents lucrative opportunities for players to capitalize on the expanding ADAS segment and the growing adoption of connected car technologies. Strategic collaborations and investments in R&D will play a pivotal role in shaping market dynamics and driving innovation.

India Automotive Camera Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Vehicle

- 1.2. Commercial Vehicle

-

2. Type

- 2.1. Viewing Camera

- 2.2. Sensing Camera

-

3. Application

- 3.1. Advanced Driver Assistance Systems

- 3.2. Parking

India Automotive Camera Industry Segmentation By Geography

- 1. India

India Automotive Camera Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surge in Awareness About the Benefits of Leasing; Shift in Trends Towards Rental

- 3.3. Market Restrains

- 3.3.1. Labor Shortage may obstruct the market growth; The economic downturn in the equipment leasing sector will impede market expansion

- 3.4. Market Trends

- 3.4.1. Sensing Camera to Witness the Fastest Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Automotive Camera Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Vehicle

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Viewing Camera

- 5.2.2. Sensing Camera

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Advanced Driver Assistance Systems

- 5.3.2. Parking

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North India India Automotive Camera Industry Analysis, Insights and Forecast, 2019-2031

- 7. South India India Automotive Camera Industry Analysis, Insights and Forecast, 2019-2031

- 8. East India India Automotive Camera Industry Analysis, Insights and Forecast, 2019-2031

- 9. West India India Automotive Camera Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Magna International Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Robert Bosch Gmbh

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Gentex Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Continental AG

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Autoliv Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Valeo SA

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Hella KGaA Hueck & Co

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Garmin Lt

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Panasonic Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Magna International Inc

List of Figures

- Figure 1: India Automotive Camera Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Automotive Camera Industry Share (%) by Company 2024

List of Tables

- Table 1: India Automotive Camera Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Automotive Camera Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: India Automotive Camera Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: India Automotive Camera Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: India Automotive Camera Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: India Automotive Camera Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: North India India Automotive Camera Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South India India Automotive Camera Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: East India India Automotive Camera Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: West India India Automotive Camera Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India Automotive Camera Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 12: India Automotive Camera Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 13: India Automotive Camera Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 14: India Automotive Camera Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Automotive Camera Industry?

The projected CAGR is approximately 15.00%.

2. Which companies are prominent players in the India Automotive Camera Industry?

Key companies in the market include Magna International Inc, Robert Bosch Gmbh, Gentex Corporation, Continental AG, Autoliv Inc, Valeo SA, Hella KGaA Hueck & Co, Garmin Lt, Panasonic Corporation.

3. What are the main segments of the India Automotive Camera Industry?

The market segments include Vehicle Type, Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Surge in Awareness About the Benefits of Leasing; Shift in Trends Towards Rental.

6. What are the notable trends driving market growth?

Sensing Camera to Witness the Fastest Growth.

7. Are there any restraints impacting market growth?

Labor Shortage may obstruct the market growth; The economic downturn in the equipment leasing sector will impede market expansion.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Automotive Camera Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Automotive Camera Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Automotive Camera Industry?

To stay informed about further developments, trends, and reports in the India Automotive Camera Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence