Key Insights

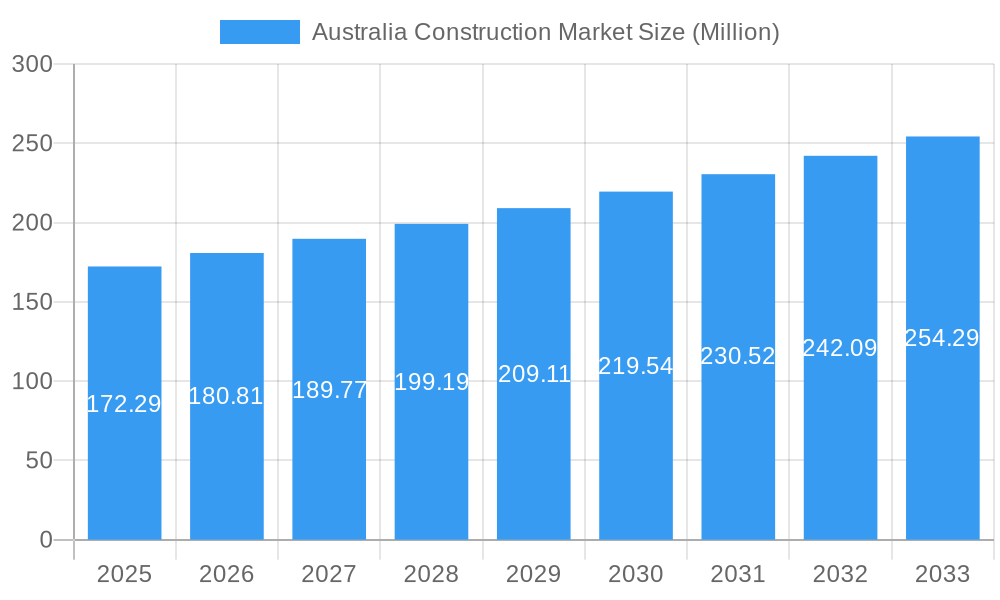

The Australian construction market is projected for robust growth, currently valued at approximately $172.29 million and expected to expand at a Compound Annual Growth Rate (CAGR) of 5.00% through 2033. This expansion is fueled by a confluence of significant drivers, including substantial government investment in infrastructure projects such as roads, railways, and public transport networks. Additionally, a sustained demand for residential housing, driven by population growth and urbanization, particularly in key metropolitan areas, is a major contributor. The commercial sector is also experiencing a resurgence, with increased development in office spaces, retail complexes, and hospitality venues. Furthermore, the energy and utilities sector is undergoing a transformation with significant investments in renewable energy infrastructure and upgrades to existing utility networks, all contributing to the market's upward trajectory.

Australia Construction Market Market Size (In Million)

Key trends shaping the Australian construction landscape include a growing emphasis on sustainable building practices and green construction technologies, driven by environmental regulations and increasing client demand for eco-friendly solutions. The adoption of advanced technologies like Building Information Modeling (BIM), artificial intelligence, and prefabrication is enhancing efficiency, reducing costs, and improving project outcomes. However, the market also faces certain restraints. Labor shortages, particularly for skilled trades, remain a persistent challenge, potentially impacting project timelines and costs. Fluctuations in material prices and supply chain disruptions, exacerbated by global economic factors, can also pose significant hurdles. Despite these challenges, the Australian construction market is poised for sustained expansion, supported by strong governmental support, increasing private sector investment, and an evolving technological landscape.

Australia Construction Market Company Market Share

Australia Construction Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a dynamic and SEO-optimized analysis of the Australian construction market, leveraging high-volume keywords to enhance search rankings and deliver critical insights for industry stakeholders. Covering the historical period of 2019-2024 and projecting growth through 2033, this report offers a detailed examination of market structure, trends, opportunities, dominant segments, product innovations, key drivers, challenges, and the competitive landscape. With a base year of 2025 and an estimated year also of 2025, this analysis is crucial for understanding current dynamics and future trajectory.

Australia Construction Market Market Structure & Competitive Landscape

The Australian construction market exhibits a moderately concentrated structure, with a few dominant players holding significant market share, particularly in large-scale infrastructure and commercial projects. Key players like Cimic Group Limited, Lendlease Corporation Limited, and John Holland Group often vie for major contracts, influencing overall market dynamics and innovation. The concentration ratio for the top 3 companies in the infrastructure segment is estimated at 65% for 2025. Regulatory impacts, including stringent building codes, environmental regulations, and planning approvals, play a crucial role in shaping market entry and operational strategies for all participants. Innovation drivers are primarily focused on sustainable building practices, digital construction technologies (BIM, AI), and modular construction, aiming to address labor shortages and improve project efficiency. Product substitutes, while limited in core construction materials, emerge in the form of alternative building methods and materials that offer enhanced sustainability or cost-effectiveness. End-user segmentation reveals strong demand from infrastructure and residential sectors, driven by government investment and population growth respectively. Mergers & Acquisitions (M&A) trends are evident, with larger entities consolidating their market position and acquiring specialized firms to expand capabilities. For instance, M&A volumes in the construction sector are projected to reach approximately $1,500 Million in 2025.

- Market Concentration: Moderately concentrated, with a few major players dominating large projects.

- Innovation Drivers: Sustainability, Digital Construction (BIM, AI), Modular Construction.

- Regulatory Impacts: Building codes, environmental standards, planning approvals.

- Product Substitutes: Alternative building methods, sustainable materials.

- End-User Segmentation: Infrastructure, Residential, Commercial, Industrial, Energy & Utilities.

- M&A Trends: Consolidation of market share, acquisition of specialized firms.

Australia Construction Market Market Trends & Opportunities

The Australian construction market is experiencing robust growth, propelled by significant government investment in infrastructure, a resilient housing market, and an increasing focus on sustainable development. The market size is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 5.8% between 2025 and 2033. Technological shifts are profoundly impacting the industry, with the adoption of Building Information Modeling (BIM), artificial intelligence (AI) for project management and design optimization, and advanced robotics for construction tasks becoming increasingly prevalent. These advancements are crucial for enhancing productivity, reducing costs, and mitigating labor shortages, a persistent challenge within the Australian construction workforce. Consumer preferences are leaning towards energy-efficient, sustainable, and smart homes, driving demand for green building materials and technologies. The competitive landscape is characterized by a mix of large multinational corporations and agile local players, each striving to differentiate through innovation, specialization, and client relationships. Opportunities abound in the development of renewable energy infrastructure, the upgrading of existing urban and regional infrastructure, and the provision of specialized construction services for the burgeoning healthcare and education sectors. The market penetration rate for sustainable building practices is expected to reach over 70% by 2033.

The market size for the Australian construction industry is estimated to be $250,000 Million in 2025, with a projected growth to $400,000 Million by 2033. This expansion is fueled by a combination of public and private sector investment. The increasing demand for affordable housing, coupled with government initiatives to boost homeownership, continues to drive the residential construction sector. Simultaneously, the commercial and industrial sectors are witnessing a resurgence, driven by e-commerce growth, warehousing needs, and investment in manufacturing facilities. The infrastructure segment remains a cornerstone of the market, with ongoing projects in transportation, water, and energy, supported by significant federal and state government funding. The energy and utilities sector is also a key growth area, with a strong focus on renewable energy projects such as solar farms and wind turbine installations.

Technological advancements are revolutionizing how projects are designed, managed, and executed. Drones are increasingly used for site surveying and progress monitoring, while advanced analytics and AI are being employed to predict project risks and optimize resource allocation. Prefabrication and modular construction are gaining traction, offering faster build times and improved quality control, especially in remote or challenging locations. This trend is a direct response to labor shortages and rising labor costs.

Consumer preferences are evolving, with a growing emphasis on environmental sustainability and occupant well-being. This translates into a demand for green building materials, energy-efficient designs, and smart home technologies. Developers and builders who can incorporate these features into their projects are likely to gain a competitive edge. The competitive dynamics are intensifying, with companies investing heavily in R&D to develop innovative solutions and enhance their service offerings. Strategic partnerships and collaborations are also becoming more common as companies seek to leverage each other's expertise and resources.

Dominant Markets & Segments in Australia Construction Market

The Infrastructure segment stands out as a dominant force within the Australian construction market, consistently attracting substantial investment and driving economic development. This dominance is underpinned by significant government commitment to upgrading and expanding the nation's transport networks, energy grids, and essential utilities. Federal and state governments are prioritizing projects such as high-speed rail corridors, urban transit systems, renewable energy infrastructure (including wind and solar farms), and water management systems. For instance, the National Infrastructure Plan outlines a pipeline of projects valued at over $200,000 Million for the next decade.

- Infrastructure: This sector is the leading segment, driven by substantial government investment in transportation, energy, and utilities. Key growth drivers include national infrastructure upgrade programs, a focus on renewable energy projects, and the development of smart city initiatives. Government policies and funding are paramount to its continued expansion. The estimated market share for infrastructure in 2025 is 35%.

- Residential: The residential sector remains a vital component, supported by population growth and ongoing demand for housing, particularly in urban centers. Government incentives for first-home buyers and affordable housing initiatives contribute to its stability. However, rising material costs and labor shortages can pose challenges. This segment accounts for an estimated 30% of the market share in 2025.

- Commercial: The commercial segment is experiencing growth, fueled by demand for office spaces, retail developments, and hospitality projects, especially in recovering urban areas. E-commerce growth also drives demand for logistics and warehousing facilities.

- Industrial: The industrial sector is benefiting from investment in manufacturing, mining support infrastructure, and specialized facilities. The push for domestic manufacturing and resource development contributes to its expansion.

- Energy and Utilities: This segment is witnessing significant expansion due to the global transition to renewable energy sources. The construction of solar power plants, wind farms, battery storage facilities, and upgrades to electricity grids are key growth areas.

The growth in infrastructure is further stimulated by projects aimed at enhancing national resilience, such as flood mitigation and climate adaptation measures. The implementation of advanced technologies, including smart grid systems and intelligent transport solutions, also necessitates new construction and upgrades. Furthermore, the ongoing development of critical services like healthcare facilities and educational institutions, which fall under the broader umbrella of infrastructure and public works, continues to sustain robust activity. The market dominance of infrastructure is a testament to its role in shaping Australia's economic future and its capacity to absorb significant capital investment.

Australia Construction Market Product Analysis

The Australian construction market is characterized by a growing emphasis on technologically advanced and sustainable building products. Innovations are driven by the need for enhanced performance, reduced environmental impact, and improved construction efficiency. This includes the development and adoption of high-performance insulation materials, energy-efficient glazing, smart building management systems, and advanced concrete formulations that offer greater strength and durability. The application of these products spans all construction segments, from energy-efficient homes and eco-friendly commercial buildings to resilient infrastructure and industrial facilities. The competitive advantage lies with companies that can offer integrated solutions that combine innovative materials with smart technologies and sustainable design principles, meeting the evolving demands of environmentally conscious clients and stringent regulatory frameworks.

Key Drivers, Barriers & Challenges in Australia Construction Market

The Australian construction market is propelled by several key drivers, including significant government investment in national infrastructure projects, a consistent demand for housing driven by population growth, and an increasing focus on sustainable and green building initiatives. Technological advancements such as BIM and AI are also driving efficiency and innovation.

Key challenges impacting the market include persistent labor shortages, which are exacerbated by an aging workforce and skilled migration limitations. Supply chain disruptions, including the volatility of material prices and availability, also pose significant restraints. Regulatory complexities, such as lengthy approval processes and evolving environmental standards, can lead to project delays and increased costs. Competitive pressures from both domestic and international firms can also impact profit margins.

Growth Drivers in the Australia Construction Market Market

The primary growth drivers in the Australian construction market are multifaceted. Government expenditure on infrastructure development (estimated at $40,000 Million annually for the forecast period) remains a significant catalyst, encompassing transport, energy, and utilities. A resilient housing market, fueled by population growth and urbanization, continues to sustain residential construction activity. The escalating demand for sustainable building practices and renewable energy infrastructure is another major driver, aligning with national climate targets. Technological adoption, including digitalization and automation, enhances productivity and project delivery. Furthermore, policies supporting affordable housing and urban renewal projects are expected to contribute to sustained growth.

Challenges Impacting Australia Construction Market Growth

Several critical challenges are impacting the growth of the Australian construction market. Persistent labor shortages across various trades are a significant constraint, leading to increased labor costs and project delays. Supply chain vulnerabilities, including the global volatility of construction material prices and limited availability, directly affect project budgets and timelines. Regulatory hurdles and lengthy approval processes can impede project commencement and execution, adding to overall project duration and cost. Furthermore, intense competition among market players, coupled with rising operational costs, puts pressure on profit margins. The increasing frequency of extreme weather events also presents challenges related to project resilience and insurance costs.

Key Players Shaping the Australia Construction Market Market

- John Holland Group

- Hutchinson Builders

- Lendlease Corporation Limited

- Cimic Group Limited

- Adco Constructions

- Laing O'Rourke

- CPB Contractors

- Ugl Limited

- Fulton Hogan

- Thiess Pty Ltd

Significant Australia Construction Market Industry Milestones

- May 2023: New office of the Indonesia-Australia partnership for Infrastructure (KIAT) was opened by the Australian ambassador to Indonesia, Penny Williams (PSM), and minister of public works and housing of the Republic of Indonesia, Basuki Hidayat. (Impact: Strengthened international collaboration in infrastructure development, potentially opening new avenues for Australian firms.)

- July 2022: Laing O'Rourke entered into a strategic partnership with Robotics Australia Group. This partnership is anticipated to explore how current and emerging robotics technologies can address key challenges in the construction sector, including productivity, labor shortages, and safety. (Impact: Signifies a commitment to technological advancement and addressing critical industry pain points.)

- April 2022: Thiess, a CIMIC Group company, entered into a business cooperation agreement to provide mine design and engineering services to Tata Steel. As part of the deal, Thiess is expected to work with Tata Steel to provide competitive integrated business solutions to the global mining industry. (Impact: Demonstrates expansion into international services and diversification of revenue streams for major players.)

Future Outlook for Australia Construction Market Market

The future outlook for the Australian construction market remains positive, driven by ongoing infrastructure investment and a steady demand for housing. The increasing adoption of innovative technologies like AI, robotics, and sustainable materials will be crucial for overcoming challenges such as labor shortages and supply chain disruptions. Strategic opportunities lie in the continued development of renewable energy projects, smart city initiatives, and the retrofitting of existing buildings to enhance energy efficiency. Furthermore, government policies focused on urban renewal, affordable housing, and climate resilience are expected to sustain market activity. Companies that can adapt to evolving client demands for sustainability, digital integration, and efficient project delivery will be well-positioned for success. The market is anticipated to witness continued growth, albeit with a focus on smarter, greener, and more resilient construction practices.

Australia Construction Market Segmentation

-

1. Sector

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

- 1.4. Infrastructure

- 1.5. Energy and Utilities

Australia Construction Market Segmentation By Geography

- 1. Australia

Australia Construction Market Regional Market Share

Geographic Coverage of Australia Construction Market

Australia Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives is driving the market; Increase In Residential Sector

- 3.3. Market Restrains

- 3.3.1. Supply chain issues and rising material costs; Rising labor costs and labor shortages

- 3.4. Market Trends

- 3.4.1. Increase in Non-Residential and Infrastructure Construction

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.1.4. Infrastructure

- 5.1.5. Energy and Utilities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 John Holland Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hutchinson Builders

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lendlease Corporation Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cimic Group Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Adco Constructions

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Laing O'rourke

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CPB Contractors

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ugl Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Fulton Hogan

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Thiess Pty Ltd**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 John Holland Group

List of Figures

- Figure 1: Australia Construction Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Construction Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Construction Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 2: Australia Construction Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Australia Construction Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 4: Australia Construction Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Construction Market?

The projected CAGR is approximately 5.00%.

2. Which companies are prominent players in the Australia Construction Market?

Key companies in the market include John Holland Group, Hutchinson Builders, Lendlease Corporation Limited, Cimic Group Limited, Adco Constructions, Laing O'rourke, CPB Contractors, Ugl Limited, Fulton Hogan, Thiess Pty Ltd**List Not Exhaustive.

3. What are the main segments of the Australia Construction Market?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 172.29 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives is driving the market; Increase In Residential Sector.

6. What are the notable trends driving market growth?

Increase in Non-Residential and Infrastructure Construction.

7. Are there any restraints impacting market growth?

Supply chain issues and rising material costs; Rising labor costs and labor shortages.

8. Can you provide examples of recent developments in the market?

May 2023: New office of the Indonesia-Australia partnership for Infrastructure (KIAT) was opened by the Australian ambassador to Indonesia, Penny Williams (PSM), and minister of public works and housing of the Republic of Indonesia, Basuki Hidayat.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Construction Market?

To stay informed about further developments, trends, and reports in the Australia Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence