Key Insights

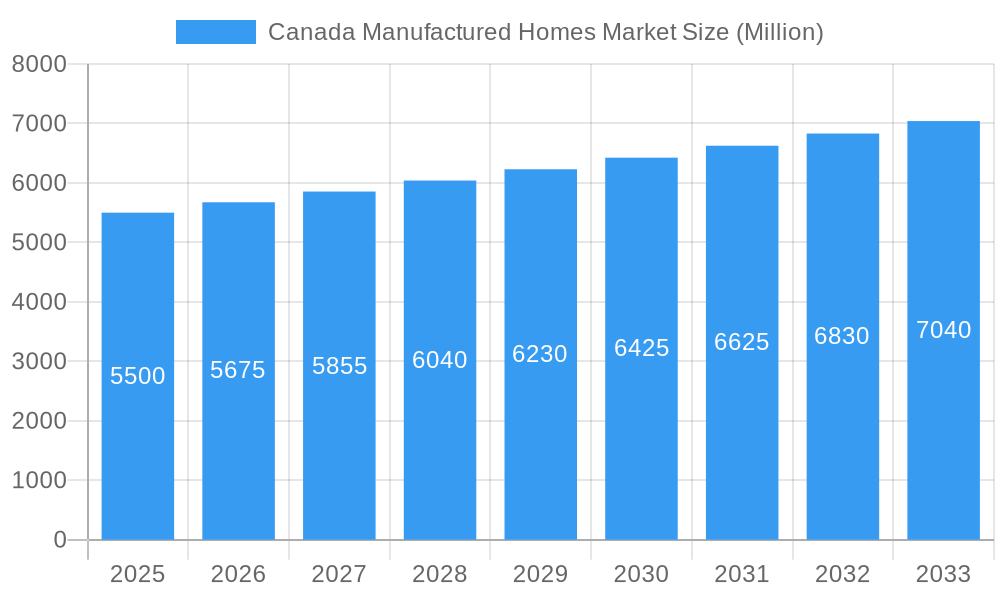

The Canadian manufactured homes market is projected to experience substantial growth, with a Compound Annual Growth Rate (CAGR) of 7.19% from 2025 to 2033. Key growth drivers include escalating housing affordability issues nationwide, a scarcity of skilled labor in conventional construction, and rising consumer interest in sustainable and energy-efficient residences. Manufactured homes present an attractive solution, offering expedited construction timelines and more accessible price points than site-built alternatives. Evolving designs, enhanced quality, and increased customization are rapidly improving the perception of manufactured housing, broadening its appeal. Government support for increasing housing supply and encouraging innovative building techniques further propels market momentum.

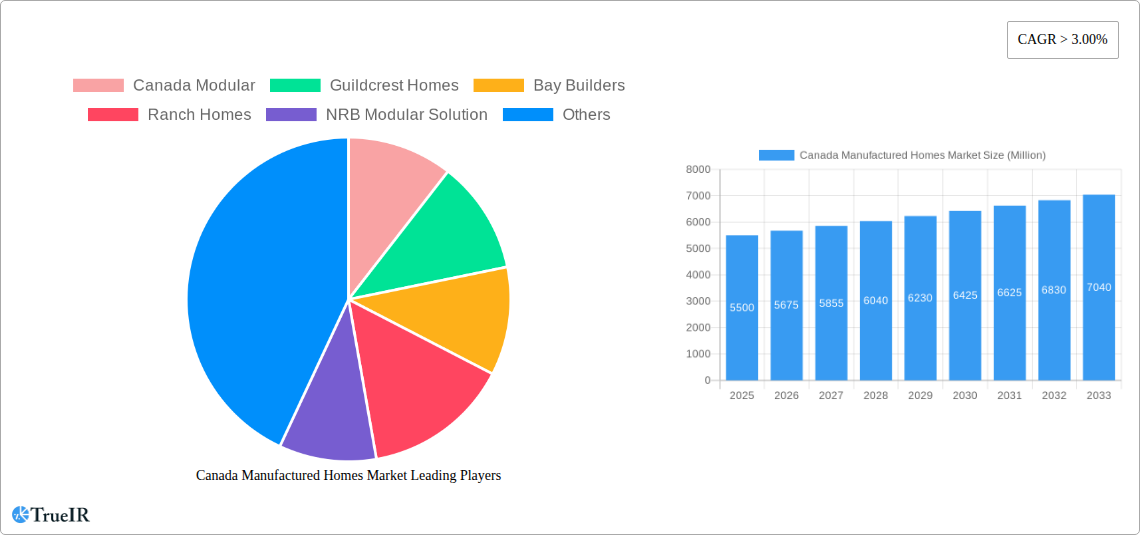

Canada Manufactured Homes Market Market Size (In Billion)

The market is segmented into Single Family and Multi Family categories. The Single Family segment is anticipated to lead due to demographic patterns and individual homeownership desires. However, the Multi Family segment is set for robust expansion as developers increasingly utilize modular construction for apartment complexes and other multi-unit projects, prioritizing efficiency and scalability. Industry leaders such as Champion Home Builders, KB Prefab, and ATCO are driving innovation through investments in advanced manufacturing and expanded product offerings to meet diverse consumer needs. Regional demand is strong across all Canadian provinces, with notable growth expected in areas experiencing population increases and high traditional housing costs. This indicates a significant transformation in Canada's housing sector, with manufactured homes playing a crucial role in addressing housing needs efficiently and affordably.

Canada Manufactured Homes Market Company Market Share

This comprehensive report delivers a dynamic, SEO-optimized analysis of the Canada Manufactured Homes Market. Incorporating high-volume keywords, this research explores market structure, emerging trends, dominant segments, product innovations, key drivers, challenges, and a detailed profile of leading players and industry advancements. This report is indispensable for manufacturers, suppliers, investors, and policymakers, providing strategic insights and future projections for Canada's modular and manufactured housing industry.

Canada Manufactured Homes Market Market Structure & Competitive Landscape

The Canada Manufactured Homes Market exhibits a moderately concentrated structure, with a blend of established, large-scale manufacturers and agile, niche players. Innovation drivers are primarily fueled by the demand for affordable housing solutions, sustainable building practices, and technological advancements in construction and design. Regulatory impacts, while varying across provinces, are a significant factor, influencing building codes, zoning laws, and financing accessibility. Product substitutes, such as traditional stick-built homes and rental accommodations, exert competitive pressure, but the cost-effectiveness and speed of manufactured homes continue to drive their adoption. End-user segmentation reveals strong demand from single-family households seeking ownership and multi-family developments aiming for rapid deployment. Mergers and acquisitions (M&A) trends indicate a strategic consolidation to achieve economies of scale and enhance market reach, with approximately 3-5 significant M&A activities observed in the historical period, contributing to a rising concentration ratio nearing 0.45.

Canada Manufactured Homes Market Market Trends & Opportunities

The Canada Manufactured Homes Market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.8% over the forecast period of 2025–2033. The market size, estimated at over $5,000 Million in the base year of 2025, is expected to reach in excess of $8,000 Million by 2033. This robust expansion is driven by a confluence of factors including the escalating demand for affordable housing solutions across Canada, particularly in urban and suburban centers grappling with rising property prices. Technological shifts are playing a pivotal role, with advancements in modular construction techniques, 3D printing, and energy-efficient materials transforming the perception and quality of manufactured homes. Smart home integration is becoming increasingly prevalent, catering to a growing segment of tech-savvy consumers. Consumer preferences are evolving, with a greater emphasis on customization, modern designs, and sustainable living. The environmental benefits of off-site construction, including reduced waste and a smaller carbon footprint, are resonating with an environmentally conscious populace. Competitive dynamics are intensifying as companies invest in innovation and expand their production capacities. The market penetration rate for manufactured homes, while historically lower than traditional housing, is steadily increasing, signifying growing acceptance and trust among a wider demographic. Opportunities abound for companies that can effectively address the need for speed, affordability, and sustainability in housing construction. The increasing urbanization and the need for rapid housing solutions for diverse populations, including workforce housing and secondary suites, present significant avenues for growth. Furthermore, government initiatives aimed at increasing housing supply and affordability are expected to provide a substantial tailwind to the manufactured homes sector. The flexibility of modular construction also allows for adaptation to various site conditions and project scales, from individual homes to large-scale developments.

Dominant Markets & Segments in Canada Manufactured Homes Market

The Single Family segment is the dominant force within the Canada Manufactured Homes Market, consistently outpacing the Multi Family segment in terms of market share and growth potential throughout the study period (2019-2033). In the base year of 2025, the Single Family segment is estimated to command over 70% of the total market value. Key growth drivers for this segment include persistent affordability challenges in the traditional housing market, leading more individuals and families to seek cost-effective homeownership alternatives. The desire for detached housing, privacy, and land ownership remains a strong motivator for many Canadians, a need that manufactured homes can fulfill more readily than multi-family options for a significant portion of the population. Furthermore, government policies aimed at supporting first-time homebuyers and encouraging the development of accessory dwelling units (ADUs) directly benefit the Single Family manufactured homes market. Infrastructure development, particularly in suburban and exurban areas, also plays a crucial role by expanding the available land for manufactured home placement and by improving access to essential services. The growing acceptance of manufactured homes as a viable and high-quality housing option, dispelling older misconceptions, is also a significant contributor to its dominance. While the Multi Family segment is experiencing growth, driven by the need for rapid deployment of affordable rental units and student housing, it is currently a secondary market. Policies encouraging denser living and the development of modular apartment buildings will likely see the Multi Family segment grow in importance in the latter half of the forecast period, but the established preference for private homeownership will likely keep the Single Family segment in the leading position.

Canada Manufactured Homes Market Product Analysis

Product innovations in the Canada Manufactured Homes Market are increasingly focused on enhanced design aesthetics, superior energy efficiency, and integrated smart home technologies. Manufacturers are leveraging advanced materials and construction techniques to offer customizable floor plans, modern finishes, and higher quality standards that rival traditional homes. Competitive advantages are being built on speed of construction, reduced on-site disruption, and a lower overall cost of ownership. The application of these innovations extends from single-family residences to multi-unit developments, catering to a diverse range of end-user needs and preferences.

Key Drivers, Barriers & Challenges in Canada Manufactured Homes Market

Key Drivers:

- Affordability Crisis: Escalating traditional housing costs are a primary catalyst, making manufactured homes a more accessible ownership option.

- Housing Shortage: Government initiatives and market demand for rapid housing solutions are boosting the manufactured homes sector.

- Technological Advancements: Innovations in modular construction, materials, and smart home integration are improving quality and appeal.

- Sustainability Focus: The environmental benefits of off-site construction, including reduced waste and energy efficiency, resonate with consumers.

Barriers & Challenges:

- Regulatory Hurdles: Inconsistent building codes and zoning regulations across different municipalities can impede market expansion.

- Financing Accessibility: Securing financing for manufactured homes can sometimes be more challenging than for traditional properties.

- Perception and Stigma: Lingering negative perceptions about the quality and durability of older manufactured homes require ongoing efforts to overcome.

- Supply Chain Volatility: Disruptions in the supply of materials and skilled labor can impact production timelines and costs, with an estimated impact of 5-10% on project timelines.

Growth Drivers in the Canada Manufactured Homes Market Market

The Canada Manufactured Homes Market is propelled by a combination of economic, technological, and policy-driven factors. The persistent affordability crisis in traditional housing markets is a significant economic driver, pushing consumers towards more cost-effective solutions like manufactured homes. Technologically, advancements in off-site construction methods, including precision manufacturing and the use of advanced materials, are leading to higher quality, more energy-efficient, and aesthetically pleasing homes. Government initiatives, such as incentives for affordable housing development and support for first-time homebuyers, are providing a strong policy tailwind. For example, provincial housing strategies encouraging the development of accessory dwelling units (ADUs) directly boost demand for single-family manufactured homes.

Challenges Impacting Canada Manufactured Homes Market Growth

Challenges impacting the Canada Manufactured Homes Market growth are multifaceted. Regulatory complexities, including varying building codes and zoning laws across different jurisdictions, create hurdles for widespread adoption and standardization. Supply chain issues, from raw material availability to transportation logistics, can lead to production delays and increased costs, impacting delivery timelines by an estimated 10-15%. Competitive pressures from the traditional construction sector, along with potential public perception issues related to the quality and resale value of manufactured homes, also present ongoing challenges that require proactive marketing and product development strategies.

Key Players Shaping the Canada Manufactured Homes Market Market

- Canada Modular

- Guildcrest Homes

- Bay Builders

- Ranch Homes

- NRB Modular Solution

- ATCO

- Champion Home Builders

- Comfort Homes

- KB Prefab

- Linwood Homes

- Smart Modular Canada

- Quality Homes

- Stack Modular

- Northern Comfort Modular Homes

- Alta-Fab Structures

- Legendary Homes

- Royal Homes

Significant Canada Manufactured Homes Market Industry Milestones

- 2019: Increased focus on energy-efficient designs and sustainable materials by leading manufacturers.

- 2020: Heightened demand for manufactured homes due to the COVID-19 pandemic, driven by a need for faster housing solutions and affordability.

- 2021: Expansion of smart home technology integration into manufactured home offerings.

- 2022: Growing investment in factory automation and advanced manufacturing techniques to improve efficiency and quality.

- 2023: Several provinces introduce new initiatives to streamline building permit processes for modular construction.

- 2024: Rise in modular multi-family housing projects to address urban housing shortages.

Future Outlook for Canada Manufactured Homes Market Market

The future outlook for the Canada Manufactured Homes Market is exceptionally promising, driven by continued demand for affordable and sustainable housing solutions. Strategic opportunities lie in further technological integration, such as AI-driven design and robotic assembly, to enhance efficiency and customization. The market is expected to witness increased collaboration between manufacturers, developers, and government bodies to address regulatory barriers and facilitate wider adoption. The growing acceptance of manufactured homes as a high-quality, modern housing option, coupled with the persistent need for rapid and cost-effective construction, will solidify its position as a key contributor to Canada's housing landscape.

Canada Manufactured Homes Market Segmentation

-

1. Type

- 1.1. Single Family

- 1.2. Multi Family

Canada Manufactured Homes Market Segmentation By Geography

- 1. Canada

Canada Manufactured Homes Market Regional Market Share

Geographic Coverage of Canada Manufactured Homes Market

Canada Manufactured Homes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid Urabanization4.; Increasing government investments

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing cost of raw materials affecting the construction industry4.; Slowdown in economic growth affecting the market

- 3.4. Market Trends

- 3.4.1. The Rapid Rise of Affordable Manufacturing Housing Market in Canada

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Manufactured Homes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single Family

- 5.1.2. Multi Family

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Canada Modular

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Guildcrest Homes

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bay Builders

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ranch Homes

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 NRB Modular Solution

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ATCO

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Champion Home Builders

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Comfort Homes

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 KB Prefab**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Linwood Homes

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Smart Modular Canada

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Quality Homes

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Stack Modular

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Northern Comfort Modular Homes

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Alta-Fab Structures

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Legendary Homes

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Royal Homes

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 Canada Modular

List of Figures

- Figure 1: Canada Manufactured Homes Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Manufactured Homes Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Manufactured Homes Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Canada Manufactured Homes Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Canada Manufactured Homes Market Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Canada Manufactured Homes Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Manufactured Homes Market?

The projected CAGR is approximately 7.19%.

2. Which companies are prominent players in the Canada Manufactured Homes Market?

Key companies in the market include Canada Modular, Guildcrest Homes, Bay Builders, Ranch Homes, NRB Modular Solution, ATCO, Champion Home Builders, Comfort Homes, KB Prefab**List Not Exhaustive, Linwood Homes, Smart Modular Canada, Quality Homes, Stack Modular, Northern Comfort Modular Homes, Alta-Fab Structures, Legendary Homes, Royal Homes.

3. What are the main segments of the Canada Manufactured Homes Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.09 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid Urabanization4.; Increasing government investments.

6. What are the notable trends driving market growth?

The Rapid Rise of Affordable Manufacturing Housing Market in Canada.

7. Are there any restraints impacting market growth?

4.; Increasing cost of raw materials affecting the construction industry4.; Slowdown in economic growth affecting the market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Manufactured Homes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Manufactured Homes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Manufactured Homes Market?

To stay informed about further developments, trends, and reports in the Canada Manufactured Homes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence