Key Insights

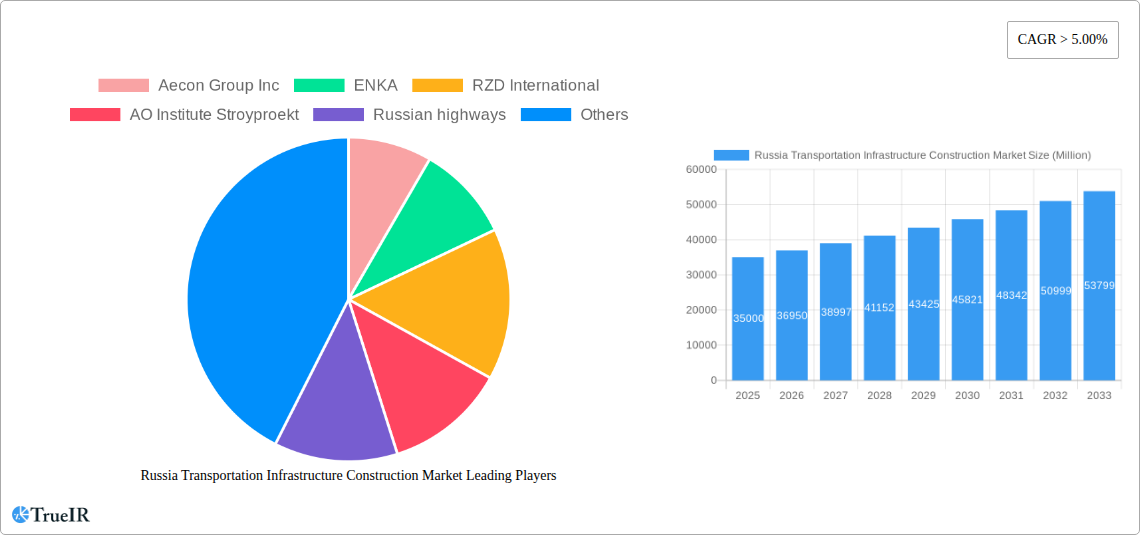

The Russian transportation infrastructure construction market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 5.00% from 2025 to 2033. This dynamic market, estimated to be valued in the tens of billions of USD, is propelled by a confluence of strategic initiatives aimed at modernizing and expanding the nation's extensive transport network. Key drivers include significant government investment in large-scale projects, the ongoing need to upgrade aging infrastructure, and the increasing demand for efficient logistics to support both domestic commerce and international trade routes. The development of new high-speed rail lines, the expansion and modernization of major airports and seaports, and the construction of vital new roadways are central to this growth trajectory. Furthermore, the focus on improving connectivity to remote regions and enhancing multimodal transportation hubs will continue to fuel demand for construction services.

Russia Transportation Infrastructure Construction Market Market Size (In Billion)

The market's expansion is further influenced by evolving transportation trends, such as the increasing adoption of digital technologies in infrastructure management and the growing emphasis on sustainable construction practices. While the market benefits from substantial investment and clear development objectives, it also faces certain restraints. These include the potential impact of geopolitical factors, fluctuations in material costs, and the complexity of large-scale project execution in diverse geographical conditions. Nonetheless, the strategic importance of a well-developed transportation network for Russia's economic competitiveness and regional integration underscores the continued strength and resilience of this sector. Key market players, including established construction giants and specialized engineering firms, are actively engaged in securing a share of this burgeoning market, contributing to its overall expansion and innovation.

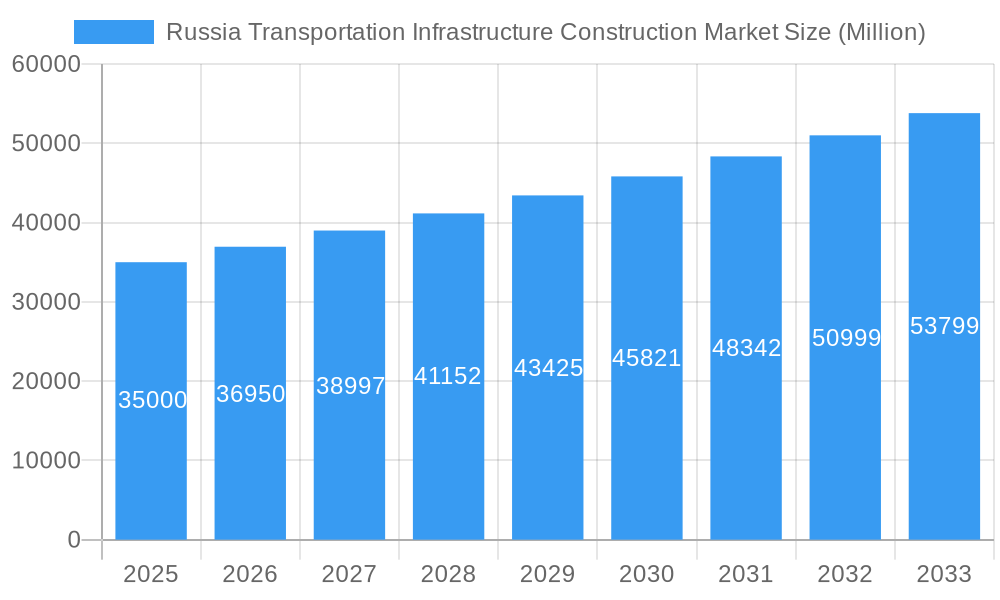

Russia Transportation Infrastructure Construction Market Company Market Share

Russia Transportation Infrastructure Construction Market: A Comprehensive Analysis & Forecast (2019-2033)

Report Description:

Dive into the dynamic Russia Transportation Infrastructure Construction Market with this in-depth report, meticulously crafted for industry stakeholders seeking actionable intelligence. This analysis offers a panoramic view of the sector's evolution from 2019 to 2033, with a sharp focus on the base year of 2025 and a comprehensive forecast for 2025-2033. Uncover critical insights into market size, growth trends, dominant segments, technological innovations, and the competitive landscape, driven by high-volume keywords vital for SEO success and industry engagement. This report is your definitive guide to understanding and capitalizing on the burgeoning opportunities within Russia's transportation infrastructure development.

Russia Transportation Infrastructure Construction Market Market Structure & Competitive Landscape

The Russia Transportation Infrastructure Construction Market exhibits a moderately concentrated structure, with key players investing heavily in large-scale projects. Innovation drivers are primarily focused on the adoption of advanced construction technologies, sustainable building materials, and digital project management solutions aimed at increasing efficiency and reducing project timelines. Regulatory impacts are significant, with government policies and funding allocations heavily influencing project commencements and completion rates. The Russian government's commitment to modernizing its transportation network, including major initiatives like the Northern Sea Route development and extensive highway network expansion, acts as a pivotal catalyst. Product substitutes are limited in core infrastructure construction, but advancements in pre-fabricated components and modular construction techniques are offering potential alternatives for certain project types. End-user segmentation is diverse, encompassing government entities, state-owned enterprises, and private logistics and industrial companies. Mergers and Acquisitions (M&A) trends are observed as larger entities seek to consolidate market share and acquire specialized expertise. For instance, during the historical period, M&A activity in the construction sector was estimated to be in the range of 500 Million to 1 Billion, reflecting a consolidation trend. Concentration ratios for the top 5 players in specific infrastructure segments are estimated to be between 45% and 60%, indicating significant market control.

Russia Transportation Infrastructure Construction Market Market Trends & Opportunities

The Russia Transportation Infrastructure Construction Market is poised for substantial growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period of 2025-2033. This expansion is fueled by a confluence of factors, including the government's ambitious national projects aimed at enhancing connectivity and facilitating trade, coupled with the increasing demand for efficient logistics and transportation solutions driven by economic development. Technological shifts are a significant trend, with a growing adoption of Building Information Modeling (BIM), drone technology for surveying and inspection, and advanced materials such as high-performance concrete and durable asphalt mixes. These innovations are not only improving construction quality and speed but also contributing to the long-term sustainability of infrastructure assets. Consumer preferences, in this context referring to the needs of end-users like freight forwarders, commuters, and industrial sectors, are increasingly leaning towards integrated transportation networks, faster transit times, and reduced transportation costs. This translates into a greater demand for modernized railway lines, expanded highway networks, and improved port and airport facilities. Competitive dynamics are intensifying, with both domestic giants and international firms vying for lucrative projects. The market is characterized by strategic partnerships and joint ventures, especially in the execution of mega-projects. For example, the development of new high-speed rail corridors or the expansion of Arctic port infrastructure presents significant opportunities for specialized engineering and construction firms. The ongoing focus on digital transformation within the construction sector is also creating opportunities for companies offering integrated software solutions for project planning, execution, and maintenance. Furthermore, the demand for green infrastructure solutions, including the construction of electric vehicle charging stations along highways and the development of energy-efficient transport hubs, is on the rise, presenting a niche yet growing market segment. The market penetration rate for advanced construction technologies is estimated to be increasing by 5-7% annually, indicating a swift adoption curve.

Dominant Markets & Segments in Russia Transportation Infrastructure Construction Market

Within the Russia Transportation Infrastructure Construction Market, the Roadways segment consistently emerges as a dominant force, driven by extensive government investment in highway expansion and modernization projects across the nation. The Moscow region, along with its surrounding Federal Subjects, and St. Petersburg stand out as key cities experiencing the highest levels of infrastructure development, due to their economic significance and dense population centers. Kazan is also a rapidly developing hub, particularly in relation to its role in logistics and transit routes.

Roadways Dominance: The sheer scale of the Russian landmass necessitates a robust and well-maintained road network for internal connectivity and trade. The government's national highway development programs, aimed at improving interregional links and facilitating the movement of goods, are primary growth drivers. These initiatives are supported by substantial budgetary allocations, ensuring a consistent pipeline of projects. The demand for new construction, as well as the rehabilitation and widening of existing roads, is perpetual. For instance, the ongoing construction of the M-12 Vostok highway, connecting Moscow to Kazan and extending further east, exemplifies the scale of roadway development. The market size for roadway construction in the base year 2025 is estimated to be around 25,000 Million.

Railways Growth: The Railways segment holds significant strategic importance for Russia, given its vast railway network and its role in international freight transit, particularly along the Trans-Siberian Railway and towards Europe and Asia. Investments in high-speed rail projects, modernization of existing lines to handle increased freight volumes, and the development of new freight corridors are key growth drivers. The electrification of railway lines and the adoption of advanced signaling systems are also crucial trends. The estimated market size for railway construction in 2025 is around 15,000 Million.

Airports & Ports Expansion: While currently smaller in absolute market size compared to roadways and railways, the Airports and Ports and Inland Waterways segments are experiencing robust growth driven by increasing air travel demand and the strategic imperative to develop Arctic shipping routes and modernize existing port infrastructure. The development of new airport terminals, runway extensions, and cargo handling facilities is ongoing. Similarly, investments in port modernization, dredging, and the construction of new terminals, especially in the Arctic and Far East regions, are crucial for boosting international trade. The market size for airports in 2025 is estimated at 5,000 Million, while ports and inland waterways are valued at approximately 4,000 Million.

The dominance of these segments is underpinned by government policies prioritizing infrastructure as a tool for economic growth, national security, and regional development. The cities of Moscow and St. Petersburg, as major economic and transportation hubs, naturally attract the lion's share of investment in all segments, followed by strategically important cities like Kazan, which serves as a key node in the east-west corridor.

Russia Transportation Infrastructure Construction Market Product Analysis

The Russia Transportation Infrastructure Construction Market is characterized by a focus on durable, high-capacity infrastructure solutions. Innovations in materials science are leading to the adoption of self-healing concrete, advanced asphalt formulations for extended road life, and corrosion-resistant steel for bridges and port structures. Digitization plays a crucial role, with the implementation of BIM across all project phases, from design to maintenance, enhancing precision and reducing waste. Advanced surveying technologies, including LiDAR and photogrammetry, ensure accurate site analysis and progress monitoring. The competitive advantage lies in the ability to deliver large-scale, complex projects on time and within budget, leveraging efficient logistics and project management. The application of these products ranges from constructing multi-lane federal highways and high-speed railway lines to developing deep-water port terminals and modern airport facilities.

Key Drivers, Barriers & Challenges in Russia Transportation Infrastructure Construction Market

Key Drivers:

- Government Investment & National Projects: Significant state funding allocated to infrastructure modernization, including programs like the Federal Highway Agency's plans and the Northern Sea Route initiative.

- Economic Growth & Trade Facilitation: The need to support expanding domestic and international trade by improving connectivity and reducing logistics costs.

- Technological Advancement: Adoption of BIM, advanced materials, and digital construction tools for increased efficiency and sustainability.

- Urbanization & Population Growth: Demand for enhanced public transportation systems and improved road networks in major cities.

Barriers & Challenges:

- Geopolitical Sanctions & Economic Volatility: Impact on access to international financing, technology, and certain materials, potentially leading to increased project costs and delays.

- Supply Chain Disruptions: Issues related to the availability and timely delivery of specialized equipment and raw materials.

- Regulatory Complexities & Bureaucracy: Navigating intricate permitting processes and environmental regulations can prolong project timelines.

- Labor Shortages & Skill Gaps: A need for skilled labor in specialized construction areas, particularly with the adoption of new technologies. The estimated impact of these challenges on project timelines can be an increase of 10-20%.

Growth Drivers in the Russia Transportation Infrastructure Construction Market Market

The Russia Transportation Infrastructure Construction Market is propelled by several key growth drivers. Government initiatives remain paramount, with substantial budgetary allocations to national projects focused on enhancing connectivity and modernizing aging infrastructure. The economic imperative to facilitate trade, both domestically and internationally, is a significant factor, demanding more efficient and robust transportation networks. Technological advancements in construction methods, such as the widespread adoption of BIM, pre-fabricated components, and advanced materials, are increasing project efficiency and sustainability, thereby driving growth. Furthermore, the strategic development of Arctic routes and the modernization of ports are opening new avenues for international trade and stimulating related infrastructure investments. The increasing demand for comfortable and efficient passenger and freight movement in major urban centers also contributes to the sustained demand for infrastructure upgrades.

Challenges Impacting Russia Transportation Infrastructure Construction Market Growth

Despite the promising outlook, several challenges impact Russia Transportation Infrastructure Construction Market growth. Geopolitical factors and international sanctions present a considerable restraint, affecting access to certain technologies, equipment, and potentially international financing. Supply chain vulnerabilities, particularly concerning imported specialized components and materials, can lead to delays and increased costs. Regulatory complexities and bureaucratic hurdles associated with land acquisition, environmental permits, and project approvals can significantly slow down project execution. Furthermore, a persistent shortage of skilled labor in specialized construction trades, coupled with the need for training in new technologies, poses a challenge to project delivery timelines and quality. Competitive pressures among domestic firms and the potential for cost overruns in large-scale projects also require careful management. The estimated impact of these challenges on project costs can be an increase of up to 15%.

Key Players Shaping the Russia Transportation Infrastructure Construction Market Market

- Aecon Group Inc

- ENKA

- RZD International

- AO Institute Stroyproekt

- Russian highways

- Mosproekt-

- AVTOBAN

- Seaway 7

- MOSTOTREST

- Transstroy

Significant Russia Transportation Infrastructure Construction Market Industry Milestones

- 2021: Launch of the M-12 Vostok highway construction project, connecting Moscow to Kazan, a significant undertaking in roadway expansion.

- 2022: Increased government focus and investment in the development of the Northern Sea Route infrastructure, including port upgrades and navigational aids.

- 2023: Continued expansion and modernization efforts at major airports like Sheremetyevo and Pulkovo, focusing on capacity enhancement and passenger services.

- 2023: Significant investments by Russian Railways in the electrification and modernization of key freight corridors to improve efficiency and capacity.

- Ongoing (2019-2024): Consistent allocation of federal funds towards regional road network improvements and the repair of existing infrastructure across various regions.

Future Outlook for Russia Transportation Infrastructure Construction Market Market

The future outlook for the Russia Transportation Infrastructure Construction Market is overwhelmingly positive, driven by sustained government commitment and strategic economic imperatives. The ongoing emphasis on expanding and modernizing road and rail networks, particularly for freight movement and interregional connectivity, will continue to be a primary growth catalyst. The strategic importance of the Arctic region and the Northern Sea Route will spur significant investments in port infrastructure and related logistical capabilities. Furthermore, the drive towards adopting digital technologies and sustainable construction practices will shape future projects, leading to more efficient and environmentally conscious infrastructure development. The market is expected to witness a steady increase in project value, with opportunities for both large-scale national projects and specialized regional developments.

Russia Transportation Infrastructure Construction Market Segmentation

-

1. Mode

- 1.1. Roadways

- 1.2. Railways

- 1.3. Airports

- 1.4. Ports and Inland Waterways

-

2. Key Cities

- 2.1. Moscow

- 2.2. St. Petersburg

- 2.3. Kazan

Russia Transportation Infrastructure Construction Market Segmentation By Geography

- 1. Russia

Russia Transportation Infrastructure Construction Market Regional Market Share

Geographic Coverage of Russia Transportation Infrastructure Construction Market

Russia Transportation Infrastructure Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid Urbanization is driving the market4.; Government Initiatives Actively promoting the Construction Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Limited Infrastructure4.; Shortage of Skilled Labours

- 3.4. Market Trends

- 3.4.1. Increasing Large-Scale Infrastructure Projects

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Transportation Infrastructure Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 5.1.1. Roadways

- 5.1.2. Railways

- 5.1.3. Airports

- 5.1.4. Ports and Inland Waterways

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Moscow

- 5.2.2. St. Petersburg

- 5.2.3. Kazan

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Aecon Group Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ENKA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 RZD International

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AO Institute Stroyproekt

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Russian highways

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mosproekt-

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AVTOBAN

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Seaway 7**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 MOSTOTREST

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Transstroy

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Aecon Group Inc

List of Figures

- Figure 1: Russia Transportation Infrastructure Construction Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Russia Transportation Infrastructure Construction Market Share (%) by Company 2025

List of Tables

- Table 1: Russia Transportation Infrastructure Construction Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 2: Russia Transportation Infrastructure Construction Market Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 3: Russia Transportation Infrastructure Construction Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Russia Transportation Infrastructure Construction Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 5: Russia Transportation Infrastructure Construction Market Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 6: Russia Transportation Infrastructure Construction Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Transportation Infrastructure Construction Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Russia Transportation Infrastructure Construction Market?

Key companies in the market include Aecon Group Inc, ENKA, RZD International, AO Institute Stroyproekt, Russian highways, Mosproekt-, AVTOBAN, Seaway 7**List Not Exhaustive, MOSTOTREST, Transstroy.

3. What are the main segments of the Russia Transportation Infrastructure Construction Market?

The market segments include Mode, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid Urbanization is driving the market4.; Government Initiatives Actively promoting the Construction Activities.

6. What are the notable trends driving market growth?

Increasing Large-Scale Infrastructure Projects.

7. Are there any restraints impacting market growth?

4.; Limited Infrastructure4.; Shortage of Skilled Labours.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Transportation Infrastructure Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Transportation Infrastructure Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Transportation Infrastructure Construction Market?

To stay informed about further developments, trends, and reports in the Russia Transportation Infrastructure Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence