Key Insights

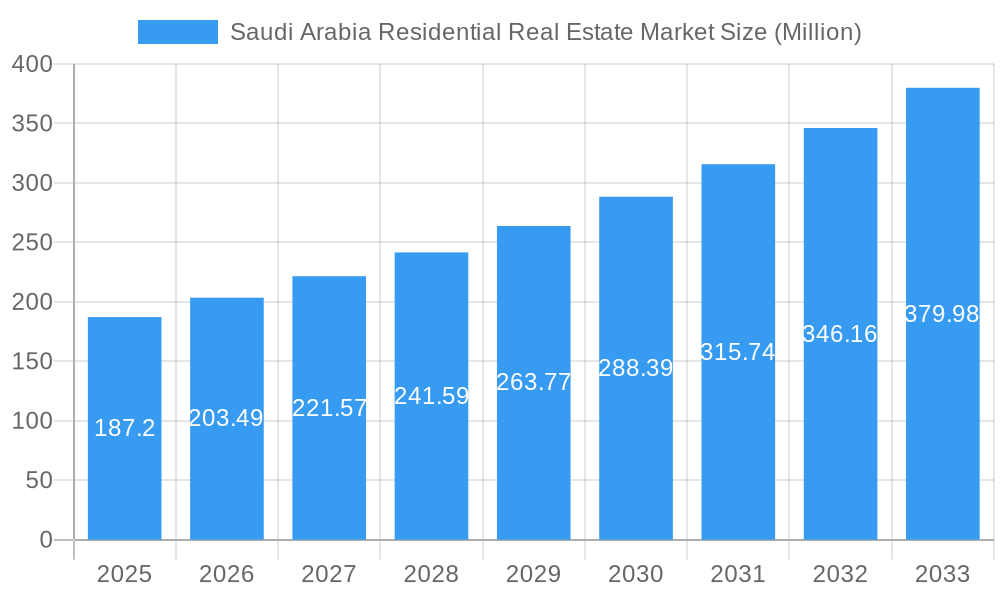

The Saudi Arabian residential real estate market is poised for significant expansion, projected to reach a substantial market size of $187.20 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8.77% anticipated between 2025 and 2033. This growth is underpinned by several powerful drivers, including the Saudi Vision 2030 initiatives that aim to increase homeownership rates and stimulate urban development, particularly in key cities like Riyadh, Jeddah, and Dammam. The increasing disposable incomes and a burgeoning young population are fueling demand for diverse housing options, from modern condominiums and apartments to spacious villas and landed houses. Furthermore, government support for the construction sector, coupled with significant foreign and local investment, is creating a dynamic environment for real estate developers. The market is witnessing a surge in large-scale master-planned communities and a focus on smart city technologies, enhancing the appeal and value of residential properties.

Saudi Arabia Residential Real Estate Market Market Size (In Million)

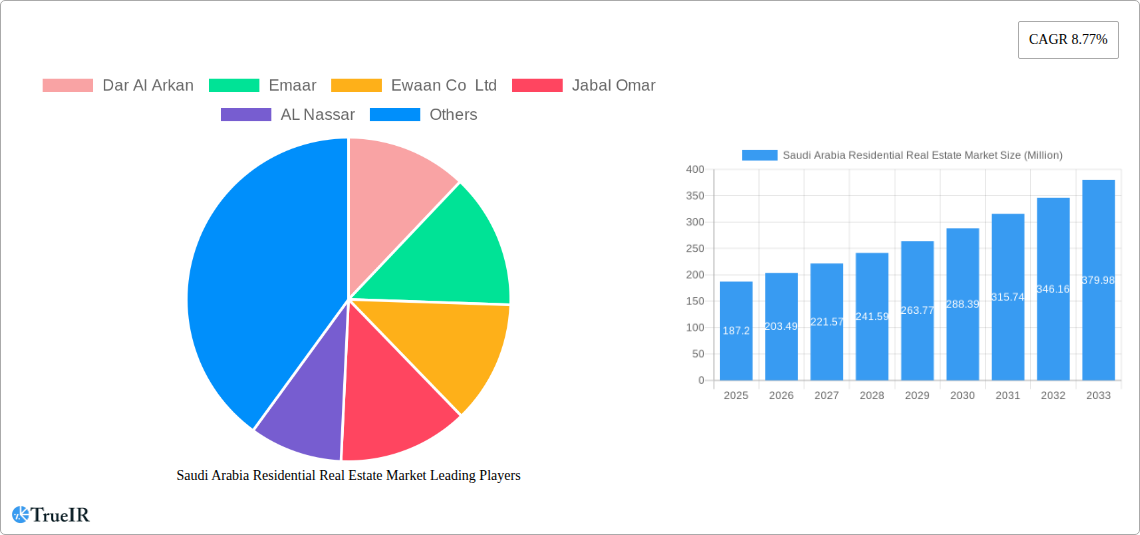

While the market benefits from strong demand and governmental impetus, certain restraints need careful consideration. The availability and cost of land, especially in prime urban locations, can pose a challenge to development and affordability. Moreover, fluctuations in construction material prices and labor costs can impact project timelines and profitability for developers such as Dar Al Arkan, Emaar, and Jabal Omar. However, the prevailing trends, such as the rise of affordable housing projects, sustainable construction practices, and the integration of smart home technologies, are actively addressing these challenges and shaping the future landscape of the Saudi residential real estate. The continued diversification of housing typologies, catering to a wider spectrum of buyer preferences, and the strategic development of infrastructure in emerging areas will be crucial for sustaining this upward trajectory. The presence of major developers like Ewaan Co Ltd, AL Nassar, and Jenan Real Estate Company indicates a competitive yet collaborative ecosystem focused on meeting the evolving housing needs of Saudi Arabia.

Saudi Arabia Residential Real Estate Market Company Market Share

Saudi Arabia Residential Real Estate Market Report: Trends, Opportunities & Future Outlook 2019-2033

This comprehensive report provides an in-depth analysis of the Saudi Arabia residential real estate market, covering the study period of 2019–2033. With a base year of 2025 and a forecast period extending to 2033, this report delves into market dynamics, key players, and future growth prospects. Leveraging high-volume keywords like "Saudi Arabia real estate," "residential property," "Saudi housing market," and "MENA real estate," this SEO-optimized report is designed to engage industry professionals, investors, and stakeholders seeking actionable insights into one of the region's most dynamic markets.

Saudi Arabia Residential Real Estate Market Market Structure & Competitive Landscape

The Saudi Arabia residential real estate market exhibits a moderately concentrated structure, with a few dominant developers controlling a significant share of the Saudi housing market developments. Innovation drivers include Vision 2030 initiatives, particularly those focused on increasing homeownership and developing integrated communities. Regulatory impacts are substantial, with government policies aimed at stimulating demand and supply of affordable housing playing a crucial role. Product substitutes are limited within the core residential segments, but the emergence of serviced apartments and co-living spaces offers alternative living solutions. End-user segmentation is driven by income levels, family size, and lifestyle preferences. Merger and acquisition (M&A) trends are expected to accelerate as larger players consolidate their market positions and smaller developers seek strategic partnerships to navigate evolving market demands. Recent M&A activity in the MENA real estate sector indicates a growing appetite for scale and diversification. The Saudi real estate investment landscape is increasingly attractive due to these structural shifts.

- Market Concentration: Dominated by a few large developers, with ongoing consolidation expected.

- Innovation Drivers: Vision 2030, smart city development, sustainable construction.

- Regulatory Impacts: Government incentives for homeownership, relaxed foreign ownership rules.

- Product Substitutes: Serviced apartments, co-living spaces, build-to-rent models.

- End-User Segmentation: First-time homebuyers, upgraders, expatriates, investors.

- M&A Trends: Increasing consolidation, joint ventures, and strategic alliances.

Saudi Arabia Residential Real Estate Market Market Trends & Opportunities

The Saudi Arabia residential real estate market is poised for significant growth, driven by robust economic diversification and ambitious government housing programs. The Saudi real estate market value is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 8-10% during the forecast period. Technological shifts, including the adoption of proptech for property management, virtual tours, and AI-driven market analysis, are transforming the sector. Consumer preferences are increasingly leaning towards modern amenities, community living, and sustainable designs. The demand for apartments in Saudi Arabia and villas in Saudi Arabia continues to rise, fueled by population growth and urbanization. Competitive dynamics are intensifying, with both local and international developers vying for market share. Opportunities abound in affordable housing projects, luxury segment developments, and integrated communities that offer a holistic living experience. The Saudi housing crisis mitigation efforts are creating substantial demand. The real estate Saudi Arabia landscape is becoming more sophisticated, with a focus on user experience and community building. This dynamic environment presents attractive investment opportunities within the Saudi property market. The increasing number of Saudi real estate projects signifies a period of sustained development and economic activity.

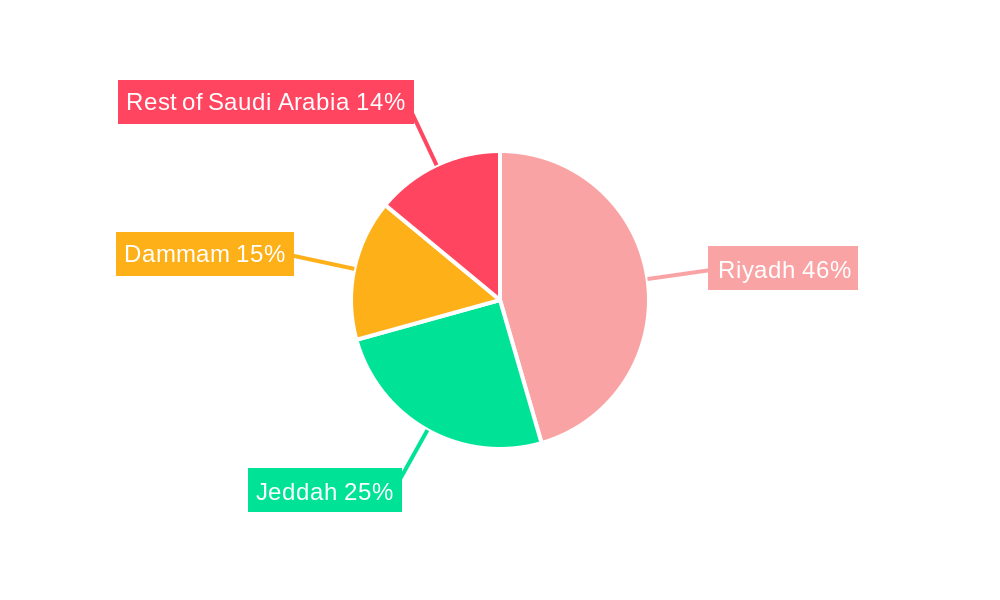

Dominant Markets & Segments in Saudi Arabia Residential Real Estate Market

Riyadh, the capital city, currently dominates the Saudi Arabia residential real estate market, driven by its status as the economic and administrative hub, significant population, and ongoing mega-projects. Jeddah, a major port city and commercial center, follows closely, with strong demand for apartments in Jeddah and villas in Jeddah. Dammam, the industrial heartland of the Eastern Province, also presents a robust market, particularly for workforce housing and family-oriented developments. The "Rest of Saudi Arabia" segment, encompassing emerging cities and towns, is experiencing rapid growth spurred by decentralization policies and the development of new economic zones. Within property types, the demand for both condominiums and apartments in Saudi Arabia and villas and landed houses in Saudi Arabia remains high. The government's focus on increasing homeownership under Vision 2030 is a key growth driver, particularly for mid-market segments. Infrastructure development, including new transportation networks and urban regeneration projects, further boosts market attractiveness in these key cities. The Saudi real estate developers are actively responding to these diverse demands across different urban and regional landscapes.

- Key Cities Dominance:

- Riyadh: Economic hub, government initiatives, high population density.

- Jeddah: Commercial significance, tourism, port-related activities.

- Dammam: Industrial activity, expatriate population, Eastern Province growth.

- Rest of Saudi Arabia: Emerging economic zones, decentralization efforts, increasing urbanization.

- Segment Growth Drivers:

- Infrastructure Development: New metro lines, road networks, and public amenities.

- Government Policies: Homeownership programs, mortgage incentives, affordable housing initiatives.

- Population Growth & Urbanization: Increasing demand for diverse housing options.

- Economic Diversification: Creation of new job opportunities in various cities.

- Developer Investment: Significant capital deployment in large-scale projects.

Saudi Arabia Residential Real Estate Market Product Analysis

The Saudi Arabia residential real estate market is witnessing a surge in product innovation, moving beyond traditional housing units. Developers are increasingly incorporating smart home technologies, energy-efficient designs, and sustainable building materials to meet evolving consumer demands and environmental regulations. Applications range from luxury penthouses with panoramic city views to affordable family homes designed for modern living. Competitive advantages are being carved out through superior construction quality, unique architectural designs, and the provision of extensive lifestyle amenities such as community centers, green spaces, and recreational facilities. The focus is on creating integrated communities that offer convenience, comfort, and a high quality of life, aligning with the aspirations of the Saudi population.

Key Drivers, Barriers & Challenges in Saudi Arabia Residential Real Estate Market

The Saudi Arabia residential real estate market is propelled by several key drivers, including the ambitious Vision 2030, which aims to significantly increase homeownership rates, and substantial government investment in infrastructure and urban development. Economic diversification strategies are creating new employment opportunities, leading to increased demand for housing. Technological advancements in construction and property management are enhancing efficiency and offering innovative living solutions. The market also benefits from a young and growing population with increasing disposable incomes.

However, the market faces notable barriers and challenges. Fluctuations in global oil prices can impact economic sentiment and investment appetite. Regulatory complexities and lengthy approval processes can sometimes hinder project timelines. Supply chain disruptions and rising construction material costs pose a significant threat to project profitability. Intense competition among developers can lead to price wars and pressure on profit margins. Furthermore, ensuring the affordability of housing for a broad segment of the population remains a persistent challenge.

Growth Drivers in the Saudi Arabia Residential Real Estate Market Market

Several key drivers are fueling growth in the Saudi Arabia residential real estate market. The Saudi government's Vision 2030 initiative, with its target of increasing homeownership to 70% by 2030, is a primary catalyst. This is supported by significant public and private sector investment in infrastructure projects and the development of new cities and economic hubs, creating demand for housing. Economic diversification beyond oil is generating job growth and attracting a skilled workforce, further boosting the need for residential properties. Technological adoption, including proptech and innovative construction methods, is improving efficiency and creating more attractive living spaces. The young demographic profile of Saudi Arabia also represents a sustained demand for housing for years to come.

Challenges Impacting Saudi Arabia Residential Real Estate Market Growth

Despite strong growth potential, the Saudi Arabia residential real estate market faces several challenges. Navigating regulatory complexities and obtaining necessary permits can be time-consuming and pose a barrier to faster development. Supply chain disruptions and the volatility of construction material prices can impact project costs and timelines. Intense competition among numerous developers can lead to market saturation in certain segments, putting pressure on pricing and profitability. Furthermore, ensuring that new housing developments are genuinely affordable for a wide range of income brackets remains a critical challenge, with a significant portion of the population seeking accessible housing solutions. Economic uncertainties, though diminishing, can still influence buyer confidence and investment decisions.

Key Players Shaping the Saudi Arabia Residential Real Estate Market Market

- Dar Al Arkan

- Emaar

- Ewaan Co Ltd

- Jabal Omar

- AL Nassar

- Jenan Real Estate Company

- Abdul Latif Jamal

- Sedco Development

- Alfirah United Company for Real Estate

- Al Sedan

- Rafal

Significant Saudi Arabia Residential Real Estate Market Industry Milestones

- September 2023: Emaar Properties explores potential development of residential communities in Saudi Arabia, with initial plans for a 4,000-unit housing project.

- June 2023: NEOM's residential communities expansion, the first phase of its ambitious accommodation plans, is finalized with contracts awarded to investors. This landmark social infrastructure project is valued at over SAR 21 billion (USD 5.60 billion) and involves leading Saudi companies like Alfanar Global Development (AGL), AARMAL real estate investment company (AREIC), NESMA Holding Co. (NSC), and Tamasuk (through partners Amlal Al Arab i Alabi Group Company (AALG) and SAMCO).

Future Outlook for Saudi Arabia Residential Real Estate Market Market

The future outlook for the Saudi Arabia residential real estate market is exceptionally positive, driven by ongoing government support, economic diversification, and a young, growing population. Vision 2030 initiatives will continue to be the primary growth catalyst, fostering an environment conducive to both local and international investment. Emerging opportunities lie in the development of integrated smart cities, sustainable communities, and affordable housing solutions. The increasing adoption of proptech and innovative construction methods will enhance market efficiency and product offerings. Strategic partnerships and foreign direct investment are expected to play a crucial role in developing large-scale projects. The market is poised for sustained growth, offering attractive returns for investors and developers committed to meeting the evolving housing needs of the Kingdom.

Saudi Arabia Residential Real Estate Market Segmentation

-

1. Type

- 1.1. Condominiums and Apartments

- 1.2. Villas and Landed Houses

-

2. Key Cities

- 2.1. Riyadh

- 2.2. Jeddah

- 2.3. Dammam

- 2.4. Rest of Saudi Arabia

Saudi Arabia Residential Real Estate Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Residential Real Estate Market Regional Market Share

Geographic Coverage of Saudi Arabia Residential Real Estate Market

Saudi Arabia Residential Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.77% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growth in Commercial Activities and Increased Competition4.; Increasing Demand for Affordable Housing Units

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Housing Spaces and Mortgage Regulation can Create Challenges

- 3.4. Market Trends

- 3.4.1. The Real Estate Market in Saudi Arabia is On The Rise In Line With Vision 2030.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Condominiums and Apartments

- 5.1.2. Villas and Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Riyadh

- 5.2.2. Jeddah

- 5.2.3. Dammam

- 5.2.4. Rest of Saudi Arabia

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dar Al Arkan

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Emaar

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ewaan Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Jabal Omar

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AL Nassar

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jenan Real Estate Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Abdul Latif Jamal

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sedco Development

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Alfirah United Company for Real Estate

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Al Sedan

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Rafal

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Dar Al Arkan

List of Figures

- Figure 1: Saudi Arabia Residential Real Estate Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Residential Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Residential Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Saudi Arabia Residential Real Estate Market Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 3: Saudi Arabia Residential Real Estate Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Saudi Arabia Residential Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Saudi Arabia Residential Real Estate Market Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 6: Saudi Arabia Residential Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Residential Real Estate Market?

The projected CAGR is approximately 8.77%.

2. Which companies are prominent players in the Saudi Arabia Residential Real Estate Market?

Key companies in the market include Dar Al Arkan, Emaar, Ewaan Co Ltd, Jabal Omar, AL Nassar, Jenan Real Estate Company, Abdul Latif Jamal, Sedco Development, Alfirah United Company for Real Estate, Al Sedan, Rafal.

3. What are the main segments of the Saudi Arabia Residential Real Estate Market?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 187.20 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growth in Commercial Activities and Increased Competition4.; Increasing Demand for Affordable Housing Units.

6. What are the notable trends driving market growth?

The Real Estate Market in Saudi Arabia is On The Rise In Line With Vision 2030..

7. Are there any restraints impacting market growth?

4.; Lack of Housing Spaces and Mortgage Regulation can Create Challenges.

8. Can you provide examples of recent developments in the market?

September 2023: Emaar Properties has the potential to develop residential communities in the Kingdom of Saudi Arabia. Emaar could begin construction of a 4,000-unit housing project.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Residential Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Residential Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Residential Real Estate Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Residential Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence