Key Insights

The Singapore Luxury Residential Real Estate Market is projected for substantial growth, anticipating a market size of $15.8 billion by 2024, with a compound annual growth rate (CAGR) of 4.8%. This expansion is propelled by an influx of high-net-worth individuals, robust investor confidence in Singapore's economic stability, and a rising demand for premium, exclusive living experiences. Key growth factors include the emphasis on modern amenities, sustainable designs, and integrated community living. Emerging trends such as smart home integration, demand for larger residences, and green building principles are actively reshaping the luxury development landscape. Prime locations and exclusive waterfront or park-facing properties remain highly sought after by discerning buyers.

Singapore Luxury Residential Real Estate Market Market Size (In Billion)

While the market exhibits strong growth, potential restraints include land scarcity in prime areas, which can lead to price appreciation, and stringent regulatory policies that may impact foreign investment. Nonetheless, Singapore's status as a global financial hub and a secure haven for wealth management continues to underpin consistent demand. The market is segmented into Apartments & Condominiums and Villas & Landed Houses, both demonstrating healthy activity. Leading developers are actively contributing to market innovation with bespoke projects designed to meet the sophisticated needs of affluent buyers.

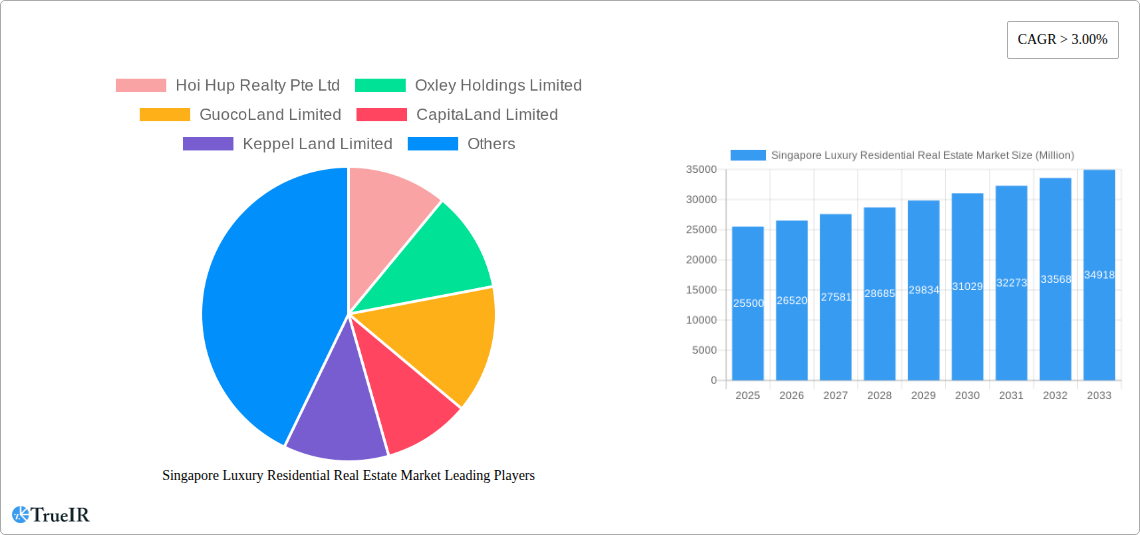

Singapore Luxury Residential Real Estate Market Company Market Share

This comprehensive report offers in-depth analysis of the Singapore Luxury Residential Real Estate Market, covering its structure, key trends, competitive environment, and future projections. Utilizing extensive data from 2019-2024, a base year of 2024, and a forecast period through 2033, this report is an indispensable resource for investors, developers, and stakeholders. We meticulously examine critical market segments, including Apartments & Condominiums and Villas & Landed Houses, as well as industry developments influencing this exclusive sector.

Singapore Luxury Residential Real Estate Market Market Structure & Competitive Landscape

The Singapore luxury residential real estate market exhibits a moderate level of market concentration, with a few dominant players holding significant market share. However, the presence of agile and niche developers contributes to a dynamic competitive environment. Innovation drivers are primarily fueled by evolving consumer preferences for smart home technology, sustainable living, and exclusive amenities. Regulatory impacts, such as property cooling measures and foreign ownership restrictions, play a crucial role in shaping market dynamics, influencing demand and pricing. Product substitutes, while limited in the ultra-luxury segment, can include high-end serviced apartments or fractional ownership schemes. End-user segmentation reveals a strong demand from high-net-worth individuals (HNWIs), expatriates, and discerning local buyers seeking premium living experiences. Mergers and acquisitions (M&A) trends, while less frequent in the ultra-luxury niche compared to mass-market segments, are indicative of strategic consolidation and expansion efforts. For instance, recent M&A activity in the broader Singaporean property sector has seen transaction volumes averaging between 500 Million and 1.5 Billion, demonstrating underlying investor confidence. Concentration ratios for the top three developers in prime luxury segments are estimated to be around 35%-45%, highlighting a competitive yet somewhat consolidated landscape.

Singapore Luxury Residential Real Estate Market Market Trends & Opportunities

The Singapore luxury residential real estate market is projected for sustained growth, with a robust Compound Annual Growth Rate (CAGR) estimated at 5.5% from 2025 to 2033. This expansion is underpinned by a confluence of economic resilience, strong foreign direct investment, and an insatiable appetite for premium properties. Market size is anticipated to grow from an estimated 25 Billion in 2025 to over 38 Billion by 2033. Technological shifts are profoundly influencing the sector, with a significant uptake in smart home integration, advanced security systems, and AI-driven property management solutions. Developers are increasingly incorporating sustainable design principles and green building certifications, appealing to environmentally conscious buyers. Consumer preferences are evolving towards larger, more bespoke living spaces, with a focus on wellness amenities, integrated workspaces, and access to green spaces. The demand for exclusive, low-density housing remains high, particularly for landed properties and penthouses in prime districts. Competitive dynamics are characterized by a blend of established conglomerates and boutique developers, each vying for market share through unique offerings and strategic partnerships. Market penetration rates for integrated smart home features are estimated to be around 60% in new luxury developments by 2028, a significant increase from current levels. The ongoing urban transformation projects and the continuous development of world-class infrastructure further enhance Singapore's allure as a global hub, attracting international buyers and bolstering demand for high-value residential assets. The city-state's stable political climate and reputation as a safe haven for capital also contribute significantly to its attractiveness for luxury real estate investment, creating a fertile ground for sustained market expansion and lucrative opportunities.

Dominant Markets & Segments in Singapore Luxury Residential Real Estate Market

Within the Singapore Luxury Residential Real Estate Market, the Apartments and Condominiums segment consistently demonstrates dominant market performance, driven by its accessibility, modern amenities, and the inherent desirability of vertical living in a land-scarce nation. Prime districts such as District 9 (Orchard), District 10 (Tanglin/Newton), and District 11 (Novena) continue to be epicenters of luxury apartment and condominium developments, commanding premium prices and attracting a global clientele. Key growth drivers for this segment include:

- Infrastructure Development: Continuous investment in Singapore's world-class public transportation network, including new MRT lines and integrated transport hubs, enhances the connectivity and desirability of residential areas. Projects like the North-South Corridor will further improve accessibility.

- Urban Planning & Liveability: Government initiatives focused on creating green and sustainable urban environments, such as the Master Plan's emphasis on park connectors and waterfront living, significantly boost the appeal of urban apartments and condominiums.

- Economic Hub Status: Singapore's position as a global financial and business hub attracts a high concentration of expatriates and multinational corporations, creating sustained demand for high-quality, conveniently located residential properties.

- Policy Support for Homeownership: While regulated, policies that support long-term resident homeownership, coupled with the perception of real estate as a stable asset class, continue to drive demand.

- Technological Integration: The increasing adoption of smart home technologies and sustainable building practices in new developments aligns with the preferences of modern luxury buyers.

While Villas and Landed Houses represent a smaller, albeit highly exclusive, segment of the market, their dominance is characterized by their rarity and premium pricing. Areas such as Sentosa Cove, Nassim Road, and certain enclaves within Bukit Timah offer unparalleled privacy and spacious living. The growth drivers for this segment are less about mass appeal and more about exclusivity, legacy, and bespoke luxury. Key factors include:

- Scarcity and Exclusivity: The limited supply of prime landed properties in Singapore inherently drives up their value and desirability among ultra-high-net-worth individuals seeking unique assets.

- Privacy and Space: Landed properties offer a level of privacy and expansive living that is unparalleled in apartment living, catering to a discerning buyer segment.

- Investment as Legacy Assets: Many luxury landed properties are acquired as generational assets, emphasizing long-term value appreciation and inheritance.

- Foreign Buyer Interest in Prime Enclaves: While subject to regulations, the appeal of owning a landed property in Singapore's most prestigious addresses remains a significant draw for international wealth.

The Apartments and Condominiums segment, however, will continue to dominate in terms of transaction volume and overall market size due to its broader appeal to a wider range of luxury buyers, including both local and international individuals seeking prime urban residences with excellent amenities and connectivity. The forecast period anticipates continued strong performance in both segments, with apartments and condominiums leading in overall market value and transaction numbers, while landed properties will remain the pinnacle of exclusivity and value appreciation.

Singapore Luxury Residential Real Estate Market Product Analysis

The Singapore luxury residential real estate market is characterized by a relentless pursuit of exclusivity, innovation, and unparalleled lifestyle offerings. Product innovations are increasingly focused on integrating cutting-edge smart home technology, sustainable building materials, and bespoke interior finishes, catering to the sophisticated demands of affluent buyers. Competitive advantages are derived from the meticulous design, prime locations, and comprehensive amenity packages, which often include private infinity pools, sky gardens, personalized concierge services, and integrated wellness facilities. Technological advancements are not merely about convenience but also about enhancing security, energy efficiency, and overall living experience. Market fit is achieved by meticulously aligning these premium products with the evolving preferences of high-net-worth individuals seeking not just a residence, but a statement of prestige and a sanctuary of comfort.

Key Drivers, Barriers & Challenges in Singapore Luxury Residential Real Estate Market

Key Drivers: The Singapore luxury residential real estate market is propelled by a robust economy, a stable political climate, and its status as a global financial hub. High net worth individuals, both local and international, are drawn by the city-state's reputation as a safe haven for capital and its world-class infrastructure. The increasing influx of expatriates and the sustained demand for premium living experiences are significant growth catalysts. Technological advancements in smart home integration and sustainable construction further enhance property appeal.

Barriers & Challenges: Significant barriers include stringent government regulations, such as Additional Buyer's Stamp Duty (ABSD), which can dampen foreign investment and speculative buying. The finite land supply naturally restricts the availability of prime luxury properties, leading to high acquisition costs. Supply chain disruptions and rising construction material costs can impact project timelines and profitability. Intense competition among developers, coupled with evolving buyer expectations for increasingly sophisticated amenities, presents ongoing challenges.

Growth Drivers in the Singapore Luxury Residential Real Estate Market Market

Key growth drivers in the Singapore luxury residential real estate market include the continuous influx of high-net-worth individuals and expatriates attracted by Singapore's robust economy and stable environment. The city-state's status as a global financial and business hub, coupled with its reputation as a safe haven for capital, significantly fuels demand for premium properties. Furthermore, ongoing infrastructure development and urban renewal projects enhance the desirability of prime locations. Technological innovations, such as smart home integration and sustainable building practices, are increasingly becoming standard expectations, driving demand for modern, amenity-rich residences.

Challenges Impacting Singapore Luxury Residential Real Estate Market Growth

Challenges impacting Singapore luxury residential real estate market growth are primarily rooted in regulatory complexities, including significant property cooling measures like the Additional Buyer's Stamp Duty (ABSD), which can increase the cost of acquisition for foreign buyers. The inherent scarcity of land in Singapore limits the supply of prime luxury properties, driving up prices and creating an exclusive market. Supply chain issues and fluctuations in construction material costs can also pose challenges to project development and profitability. Moreover, increasingly discerning buyer expectations for hyper-personalized amenities and unique lifestyle offerings require developers to constantly innovate and invest heavily to remain competitive.

Key Players Shaping the Singapore Luxury Residential Real Estate Market Market

- Hoi Hup Realty Pte Ltd

- Oxley Holdings Limited

- GuocoLand Limited

- CapitaLand Limited

- Keppel Land Limited

- MCC Land Limited

- Bukit Sembawang Estates Limited

- City Developments Limited

- MCL Land

- Allgreen Properties Limited

Significant Singapore Luxury Residential Real Estate Market Industry Milestones

- 2021: Launch of luxury developments like Les Maisons, emphasizing exclusive landed living and private ownership.

- 2022: Increased focus on sustainable and green building certifications in new luxury projects, aligning with global environmental trends.

- 2023: Introduction of smart home technology as a standard feature in a majority of new luxury condominium launches, enhancing convenience and security.

- 2024 (Ongoing): Continued strong demand for prime districts, with record prices achieved for ultra-luxury apartments and penthouses in sought-after addresses.

Future Outlook for Singapore Luxury Residential Real Estate Market Market

The future outlook for the Singapore luxury residential real estate market remains exceptionally strong, driven by sustained economic growth, a stable political environment, and the city-state's appeal as a global financial and lifestyle destination. Key growth catalysts include the continued influx of high-net-worth individuals and expatriates, coupled with the intrinsic demand for premium, well-appointed residences. Developers are expected to further innovate in areas of smart technology, sustainability, and exclusive lifestyle amenities, catering to an increasingly sophisticated buyer base. Strategic opportunities lie in niche developments that offer unparalleled privacy, bespoke designs, and integrated wellness features, ensuring robust market performance and attractive investment returns in the forecast period.

Singapore Luxury Residential Real Estate Market Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Villas and Landed Houses

Singapore Luxury Residential Real Estate Market Segmentation By Geography

- 1. Singapore

Singapore Luxury Residential Real Estate Market Regional Market Share

Geographic Coverage of Singapore Luxury Residential Real Estate Market

Singapore Luxury Residential Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid urbanization; Government initiatives

- 3.3. Market Restrains

- 3.3.1. High property prices; Regulatory challenges

- 3.4. Market Trends

- 3.4.1. UHNWI in Asia Driving the Demand for Luxury Properties

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Villas and Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hoi Hup Realty Pte Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Oxley Holdings Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GuocoLand Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CapitaLand Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Keppel Land Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 MCC Land Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bukit Sembawang Estates Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 City Developments Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 MCL Land

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Allgreen Properties Limited**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Hoi Hup Realty Pte Ltd

List of Figures

- Figure 1: Singapore Luxury Residential Real Estate Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Singapore Luxury Residential Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: Singapore Luxury Residential Real Estate Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Singapore Luxury Residential Real Estate Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Singapore Luxury Residential Real Estate Market Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Singapore Luxury Residential Real Estate Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Luxury Residential Real Estate Market?

The projected CAGR is approximately 4.8%.

2. Which companies are prominent players in the Singapore Luxury Residential Real Estate Market?

Key companies in the market include Hoi Hup Realty Pte Ltd, Oxley Holdings Limited, GuocoLand Limited, CapitaLand Limited, Keppel Land Limited, MCC Land Limited, Bukit Sembawang Estates Limited, City Developments Limited, MCL Land, Allgreen Properties Limited**List Not Exhaustive.

3. What are the main segments of the Singapore Luxury Residential Real Estate Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Rapid urbanization; Government initiatives.

6. What are the notable trends driving market growth?

UHNWI in Asia Driving the Demand for Luxury Properties.

7. Are there any restraints impacting market growth?

High property prices; Regulatory challenges.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Luxury Residential Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Luxury Residential Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Luxury Residential Real Estate Market?

To stay informed about further developments, trends, and reports in the Singapore Luxury Residential Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence