Key Insights

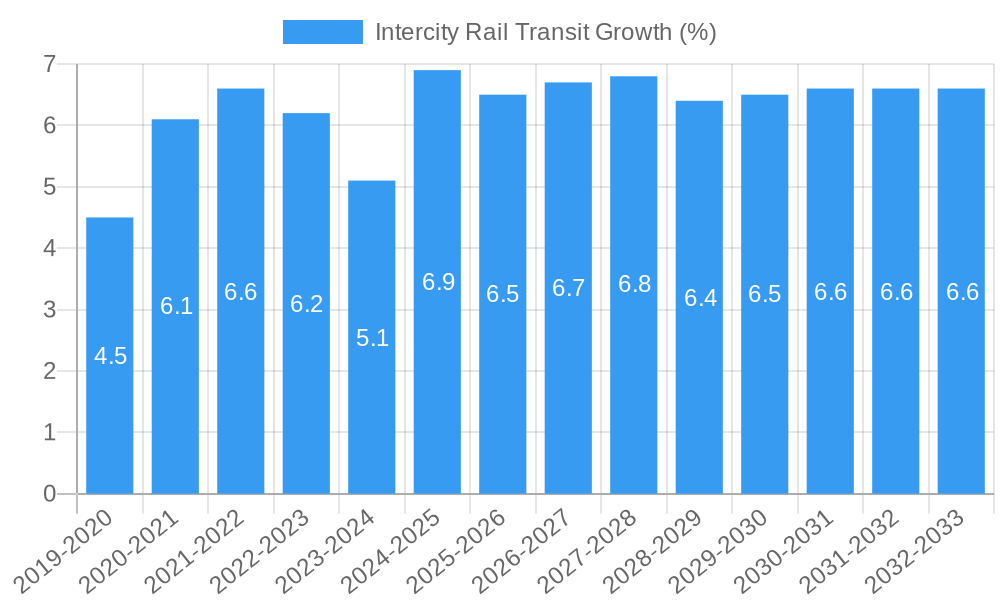

The Intercity Rail Transit market is poised for significant expansion, driven by escalating demand for efficient, sustainable, and high-speed transportation solutions. With an estimated market size of approximately $150 billion in 2025, the sector is projected to grow at a Compound Annual Growth Rate (CAGR) of around 6.5% through 2033, reaching an estimated $250 billion by the forecast period's end. This robust growth is primarily fueled by increasing urbanization, a burgeoning need to decongest road networks, and government investments in modernizing railway infrastructure. The expansion of high-speed rail networks and the development of advanced signaling and communication systems are key enablers of this market's upward trajectory. Furthermore, the growing emphasis on eco-friendly transportation alternatives to combat climate change positions intercity rail as a highly attractive option, further bolstering its market potential.

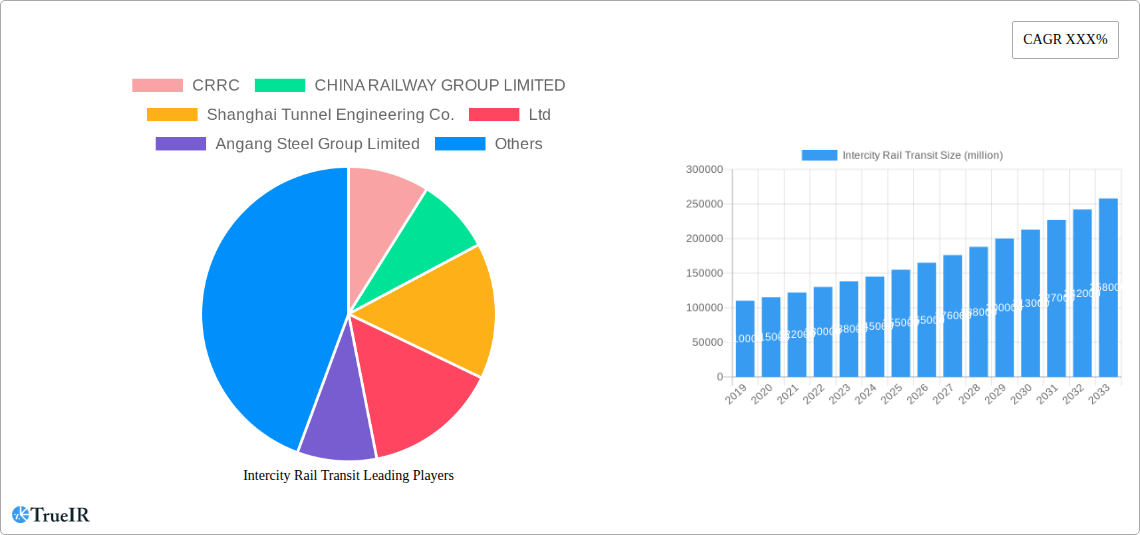

The market is segmented by application into Intercity Railway and Intercity Subway, with Intercity Railway currently dominating due to its extensive reach and capacity for longer-distance travel. Future growth in the Intercity Subway segment is expected to accelerate as more metropolitan areas invest in expanding their underground rail networks to connect suburban hubs. Key market drivers include technological advancements in train manufacturing, such as the development of lighter, more energy-efficient trains and intelligent transit systems. However, the market faces certain restraints, including the substantial capital investment required for infrastructure development and the lengthy project execution timelines. Nonetheless, strategic partnerships among key players like CRRC, CHINA RAILWAY GROUP LIMITED, and Shanghai Tunnel Engineering Co.,Ltd, coupled with ongoing innovation across various train models (Model A, B, C), are expected to propel the market forward, creating new opportunities for growth and efficiency across global regions.

Unlocking the Future of Urban Mobility: A Comprehensive Intercity Rail Transit Market Report

This in-depth report, "Intercity Rail Transit Market: Global Opportunities, Trends, and Forecasts (2019–2033)", offers a definitive analysis of the rapidly evolving intercity rail transit landscape. With a study period spanning 2019–2033, a base and estimated year of 2025, and a crucial forecast period of 2025–2033, this report leverages extensive historical data from 2019–2024 to provide unparalleled foresight into market dynamics. We delve into the core components of intercity rail, examining critical segments like Intercity Railway and Intercity Subway, and analyzing the impact of various product types including Model A, Model B, and Model C. This report is essential for stakeholders seeking to understand market concentration, innovation drivers, regulatory impacts, and the competitive ecosystem, all while identifying lucrative growth opportunities and navigating inherent challenges.

Intercity Rail Transit Market Structure & Competitive Landscape

The intercity rail transit market exhibits a moderately consolidated structure, driven by significant capital investments and technological sophistication. Key players like CRRC, CHINA RAILWAY GROUP LIMITED, and Shanghai Tunnel Engineering Co.,Ltd dominate a substantial portion of the market share, reflecting high concentration ratios in major infrastructure projects. Innovation drivers are primarily centered on enhancing passenger experience, improving energy efficiency, and increasing operational speeds. Regulatory frameworks play a pivotal role, with government subsidies and stringent safety standards shaping market entry and product development. Product substitutes, such as advanced bus networks and emerging autonomous vehicle solutions, present a growing challenge, necessitating continuous innovation in rail technology. End-user segmentation reveals a strong demand from urban commuters, business travelers, and tourists, with regional transportation authorities and private operators forming the primary customer base. Mergers and acquisitions (M&A) trends are evident, with larger conglomerates acquiring specialized technology firms to expand their capabilities and market reach, contributing to an estimated M&A volume of over XX million annually in recent years.

- Key Innovators: Focus on high-speed rail technology, smart signaling systems, and sustainable energy solutions.

- Regulatory Influence: Government procurement, environmental regulations, and safety certifications are critical market determinants.

- Competitive Dynamics: Intense competition based on technological prowess, cost-effectiveness, and project delivery timelines.

- M&A Activity: Strategic acquisitions aimed at consolidating market share and acquiring advanced intellectual property.

Intercity Rail Transit Market Trends & Opportunities

The global intercity rail transit market is experiencing robust growth, projected to reach an estimated market size exceeding XX million by 2033. This expansion is fueled by a confluence of factors, including increasing urbanization, a growing need for sustainable transportation alternatives, and significant government investments in infrastructure development. The market size growth is projected to exhibit a compound annual growth rate (CAGR) of approximately XX% during the forecast period, driven by the continuous expansion of high-speed rail networks and the integration of smart technologies. Technological shifts are paramount, with advancements in magnetic levitation (maglev) technology, digital signaling, and predictive maintenance revolutionizing operational efficiency and passenger safety. Consumer preferences are increasingly leaning towards faster, more comfortable, and environmentally friendly travel options, making intercity rail an attractive choice for a growing segment of the population. The market penetration rate for modern intercity rail systems is steadily increasing, particularly in emerging economies and densely populated regions. Competitive dynamics are characterized by a race for technological superiority and cost optimization, with established players leveraging their extensive experience and emerging players focusing on niche innovations. Opportunities abound in upgrading existing infrastructure, developing advanced rolling stock, and implementing intelligent transportation systems that enhance connectivity and reduce travel times between major urban centers. The growing emphasis on decarbonization and reducing carbon footprints further amplifies the demand for electric-powered intercity rail solutions. The market is also witnessing a trend towards integrated mobility platforms, where intercity rail forms a crucial backbone for multimodal transportation networks, offering seamless journeys from origin to destination. The development of smart stations, incorporating advanced passenger information systems, retail amenities, and efficient crowd management, is another significant trend enhancing the overall travel experience and driving demand for modern intercity rail transit. The increasing disposable income in many regions is also contributing to a rise in leisure travel, further boosting the demand for convenient and efficient intercity transportation.

Dominant Markets & Segments in Intercity Rail Transit

The Intercity Railway segment currently represents the dominant application within the broader intercity rail transit market, accounting for an estimated XX% of the total market value in 2025. This dominance is primarily driven by large-scale national and international infrastructure projects focused on connecting major economic hubs and facilitating high-speed travel over considerable distances. Within the Intercity Railway application, Model A type trains, characterized by their high-speed capabilities and advanced passenger amenities, command the largest market share, estimated at XX%. Key growth drivers for this segment include substantial government investment in high-speed rail expansion, particularly in Asia and Europe, and favorable government policies promoting the development of efficient and sustainable transportation networks. For instance, the ongoing expansion of high-speed rail corridors in China, with projected investments of over XX million in infrastructure development, significantly bolsters this segment's growth.

The Intercity Subway application, while currently smaller in market share, is experiencing rapid growth, driven by the need for efficient intra-city and inter-city connectivity within expanding metropolitan areas. The market share for Intercity Subway is projected to grow from an estimated XX% in 2025 to XX% by 2033. Within the Intercity Subway segment, Model B and Model C types, often designed for higher passenger capacity and frequent stops, are gaining traction, with their combined market share estimated at XX%. Growth drivers for this segment include increasing urbanization rates, the need to alleviate traffic congestion in major cities, and the development of integrated public transportation systems. For example, the ambitious urban development plans in India, involving the construction of extensive metro networks connecting suburban areas to city centers, are a major catalyst.

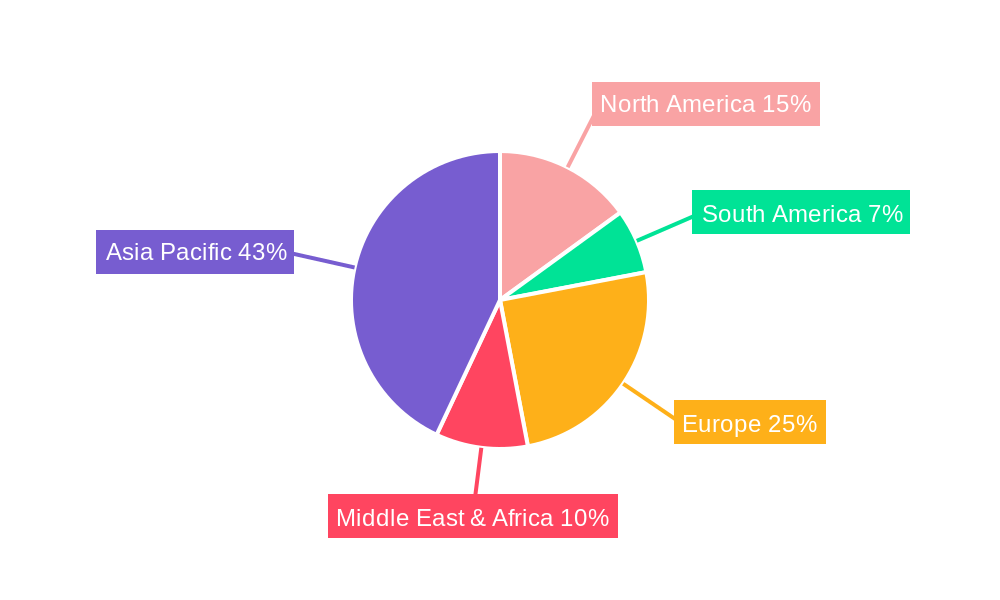

Geographically, Asia-Pacific stands out as the dominant region, driven by massive investments in high-speed rail infrastructure and a rapidly expanding urban population. China, in particular, is a global leader, with its extensive high-speed rail network and ongoing technological advancements in rolling stock. Europe also represents a significant market, with established high-speed rail networks and a strong focus on sustainability and modernization.

- Leading Region: Asia-Pacific, driven by China's extensive high-speed rail development.

- Dominant Application: Intercity Railway, fueled by national infrastructure projects and high-speed connectivity demands.

- Key Segment Growth Drivers:

- Intercity Railway: Government investment, technological innovation in high-speed trains, cross-border connectivity initiatives.

- Intercity Subway: Urbanization, traffic congestion mitigation, integrated transit system development, population growth.

- Dominant Type Models:

- Model A (Intercity Railway): High-speed capabilities, premium passenger amenities, longer operational ranges.

- Model B & C (Intercity Subway): High passenger capacity, frequent stop operations, optimized for urban transit.

Intercity Rail Transit Product Analysis

Innovations in intercity rail transit are rapidly transforming passenger travel, with a focus on enhanced speed, efficiency, and passenger comfort. High-speed trains, often classified under Model A, are at the forefront, featuring aerodynamic designs and advanced propulsion systems to achieve speeds exceeding XX km/h. These models offer superior competitive advantages through reduced travel times, significant capacity for both passengers and cargo, and improved energy efficiency. Model B and C variants, designed for intercity subway applications, are characterized by their modular construction, enabling flexible configurations for varying passenger loads and route demands. Their competitive advantages lie in their adaptability to urban environments, frequent stop operations, and integration with existing transit networks. Technological advancements include the widespread adoption of digital signaling systems, lightweight composite materials, and predictive maintenance technologies, all contributing to enhanced safety and operational reliability.

Key Drivers, Barriers & Challenges in Intercity Rail Transit

The intercity rail transit market is propelled by a strong combination of technological advancements, economic imperatives, and supportive government policies. The increasing demand for sustainable and eco-friendly transportation solutions is a primary driver, aligning with global decarbonization efforts. Significant investments in smart city initiatives and the expansion of urban infrastructure further fuel the need for efficient intercity connectivity. Technological innovation in high-speed rail, autonomous operations, and digital integration plays a crucial role in enhancing efficiency and passenger experience.

However, the market faces notable challenges and restraints. The substantial capital investment required for infrastructure development and rolling stock procurement poses a significant financial barrier. Regulatory complexities and lengthy approval processes can impede project timelines. Supply chain disruptions, particularly for specialized components, can impact manufacturing and delivery schedules, with potential cost overruns estimated at XX million for major projects. Intense competition from other modes of transport, including aviation and emerging high-speed road networks, also presents a challenge.

Growth Drivers:

- Technological Advancements: High-speed rail, maglev, digital signaling, autonomous systems.

- Economic Factors: Urbanization, economic growth, demand for efficient freight transport.

- Policy Support: Government investment, sustainability mandates, infrastructure development plans.

Barriers and Restraints:

- High Capital Expenditure: Significant upfront investment for infrastructure and rolling stock.

- Regulatory Hurdles: Complex permitting processes and varying national standards.

- Supply Chain Volatility: Potential disruptions and price fluctuations for critical components.

- Competition: Robust competition from air travel and advanced road-based transportation.

Growth Drivers in the Intercity Rail Transit Market

The intercity rail transit market is experiencing significant growth, driven by several key factors. Technologically, advancements in high-speed rail, such as the development of lighter materials and more efficient propulsion systems, are enabling faster and more sustainable journeys. Economically, the increasing urbanization and the need for efficient connectivity between major cities are creating substantial demand for rail infrastructure. Governments worldwide are recognizing the strategic importance of intercity rail, leading to supportive policies and substantial investments in new lines and modernization projects. Examples include the XX million allocated for high-speed rail expansion in North America and the European Union's commitment to developing trans-European transport networks. The growing awareness of environmental issues is also a major catalyst, with intercity rail offering a significantly lower carbon footprint per passenger-mile compared to other modes of transport.

Challenges Impacting Intercity Rail Transit Growth

Despite its growth potential, the intercity rail transit market faces several significant challenges. The immense capital required for constructing new lines and upgrading existing infrastructure is a substantial barrier, often requiring public-private partnerships or extensive government funding. Regulatory complexities, including varying safety standards and environmental impact assessments across different jurisdictions, can lead to project delays and increased costs, estimated to add XX million to project budgets on average. Supply chain issues, particularly concerning specialized electronic components and high-grade steel, can disrupt production timelines and inflate material costs, impacting the overall affordability of projects. Furthermore, competition from other transportation modes, such as the airline industry and increasingly sophisticated long-haul bus services, necessitates continuous innovation and service improvement to maintain market share. The operational costs associated with maintaining extensive rail networks and rolling stock also present an ongoing challenge.

Key Players Shaping the Intercity Rail Transit Market

- CRRC

- CHINA RAILWAY GROUP LIMITED

- Shanghai Tunnel Engineering Co.,Ltd

- Angang Steel Group Limited

- JSTI GROUP

- Jinxi Axle Company Limited

- Guangdong Huatie Tongda High-Speed Railway Equipment Corporation

Significant Intercity Rail Transit Industry Milestones

- 2019: Launch of the first fully autonomous high-speed train prototype by CRRC, demonstrating future operational capabilities.

- 2020: Significant government investment announcements for high-speed rail expansion in several Asian countries, totaling over XX million.

- 2021: Development of new lightweight composite materials for rolling stock, promising improved energy efficiency and reduced maintenance costs.

- 2022: Increased focus on digital signaling and train control systems, leading to enhanced safety and operational capacity.

- 2023: Major mergers and acquisitions within the supply chain, consolidating key manufacturers of rail components.

- 2024: Advancements in battery-electric and hydrogen-powered rail technologies gaining momentum for greener transit solutions.

Future Outlook for Intercity Rail Transit Market

The future outlook for the intercity rail transit market is exceptionally bright, driven by a convergence of robust growth catalysts. Strategic opportunities lie in the continued expansion of high-speed rail networks, the integration of advanced digital technologies for enhanced operational efficiency, and the development of sustainable propulsion systems like hydrogen and battery-electric trains. The increasing demand for seamless multimodal transportation solutions, where intercity rail serves as a vital connector, presents significant market potential. Governments' commitment to sustainable development and urban connectivity will continue to fuel investment, ensuring the market's upward trajectory. The market is poised for sustained growth, with an estimated market size projected to exceed XX million by 2033, driven by technological innovation and increasing global adoption of efficient, eco-friendly rail transit.

Intercity Rail Transit Segmentation

-

1. Application

- 1.1. Intercity Railway

- 1.2. Intercity Subway

-

2. Type

- 2.1. Model A

- 2.2. Model B

- 2.3. Model C

Intercity Rail Transit Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Intercity Rail Transit REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Intercity Rail Transit Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Intercity Railway

- 5.1.2. Intercity Subway

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Model A

- 5.2.2. Model B

- 5.2.3. Model C

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Intercity Rail Transit Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Intercity Railway

- 6.1.2. Intercity Subway

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Model A

- 6.2.2. Model B

- 6.2.3. Model C

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Intercity Rail Transit Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Intercity Railway

- 7.1.2. Intercity Subway

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Model A

- 7.2.2. Model B

- 7.2.3. Model C

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Intercity Rail Transit Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Intercity Railway

- 8.1.2. Intercity Subway

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Model A

- 8.2.2. Model B

- 8.2.3. Model C

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Intercity Rail Transit Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Intercity Railway

- 9.1.2. Intercity Subway

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Model A

- 9.2.2. Model B

- 9.2.3. Model C

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Intercity Rail Transit Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Intercity Railway

- 10.1.2. Intercity Subway

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Model A

- 10.2.2. Model B

- 10.2.3. Model C

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 CRRC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CHINA RAILWAY GROUP LIMITED

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Shanghai Tunnel Engineering Co.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Angang Steel Group Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 JSTI GROUP

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Jinxi Axle Company Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Guangdong Huatie Tongda High-Speed Railway Equipment Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 CRRC

List of Figures

- Figure 1: Global Intercity Rail Transit Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Intercity Rail Transit Revenue (million), by Application 2024 & 2032

- Figure 3: North America Intercity Rail Transit Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Intercity Rail Transit Revenue (million), by Type 2024 & 2032

- Figure 5: North America Intercity Rail Transit Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Intercity Rail Transit Revenue (million), by Country 2024 & 2032

- Figure 7: North America Intercity Rail Transit Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Intercity Rail Transit Revenue (million), by Application 2024 & 2032

- Figure 9: South America Intercity Rail Transit Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Intercity Rail Transit Revenue (million), by Type 2024 & 2032

- Figure 11: South America Intercity Rail Transit Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Intercity Rail Transit Revenue (million), by Country 2024 & 2032

- Figure 13: South America Intercity Rail Transit Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Intercity Rail Transit Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Intercity Rail Transit Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Intercity Rail Transit Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Intercity Rail Transit Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Intercity Rail Transit Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Intercity Rail Transit Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Intercity Rail Transit Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Intercity Rail Transit Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Intercity Rail Transit Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Intercity Rail Transit Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Intercity Rail Transit Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Intercity Rail Transit Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Intercity Rail Transit Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Intercity Rail Transit Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Intercity Rail Transit Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Intercity Rail Transit Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Intercity Rail Transit Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Intercity Rail Transit Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Intercity Rail Transit Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Intercity Rail Transit Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Intercity Rail Transit Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Intercity Rail Transit Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Intercity Rail Transit Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Intercity Rail Transit Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Intercity Rail Transit Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Intercity Rail Transit Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Intercity Rail Transit Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Intercity Rail Transit Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Intercity Rail Transit Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Intercity Rail Transit Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Intercity Rail Transit Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Intercity Rail Transit Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Intercity Rail Transit Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Intercity Rail Transit Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Intercity Rail Transit Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Intercity Rail Transit Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Intercity Rail Transit Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Intercity Rail Transit Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Intercity Rail Transit Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Intercity Rail Transit Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Intercity Rail Transit Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Intercity Rail Transit Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Intercity Rail Transit Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Intercity Rail Transit Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Intercity Rail Transit Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Intercity Rail Transit Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Intercity Rail Transit Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Intercity Rail Transit Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Intercity Rail Transit Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Intercity Rail Transit Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Intercity Rail Transit Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Intercity Rail Transit Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Intercity Rail Transit Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Intercity Rail Transit Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Intercity Rail Transit Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Intercity Rail Transit Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Intercity Rail Transit Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Intercity Rail Transit Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Intercity Rail Transit Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Intercity Rail Transit Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Intercity Rail Transit Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Intercity Rail Transit Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Intercity Rail Transit Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Intercity Rail Transit Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Intercity Rail Transit Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Intercity Rail Transit?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Intercity Rail Transit?

Key companies in the market include CRRC, CHINA RAILWAY GROUP LIMITED, Shanghai Tunnel Engineering Co., Ltd, Angang Steel Group Limited, JSTI GROUP, Jinxi Axle Company Limited, Guangdong Huatie Tongda High-Speed Railway Equipment Corporation.

3. What are the main segments of the Intercity Rail Transit?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Intercity Rail Transit," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Intercity Rail Transit report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Intercity Rail Transit?

To stay informed about further developments, trends, and reports in the Intercity Rail Transit, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence