Key Insights

The global laser welding market is poised for significant expansion, propelled by widespread industrial automation and the superior capabilities of laser technology compared to conventional methods. Projections indicate a substantial market size of $2.9 billion by 2025, with a projected compound annual growth rate (CAGR) of 3.7%. Key drivers include escalating demand for high-precision welding in the automotive sector, particularly for electric vehicles, and increased adoption in electronics and medical device manufacturing for intricate, miniature welds. The aerospace industry also benefits from laser welding's reliability in joining dissimilar materials. Continuous advancements in laser power and beam delivery systems are further enhancing welding efficiency and precision, thereby broadening its application scope. Despite challenges such as initial equipment investment and the requirement for skilled operators, the market's trajectory remains exceptionally positive.

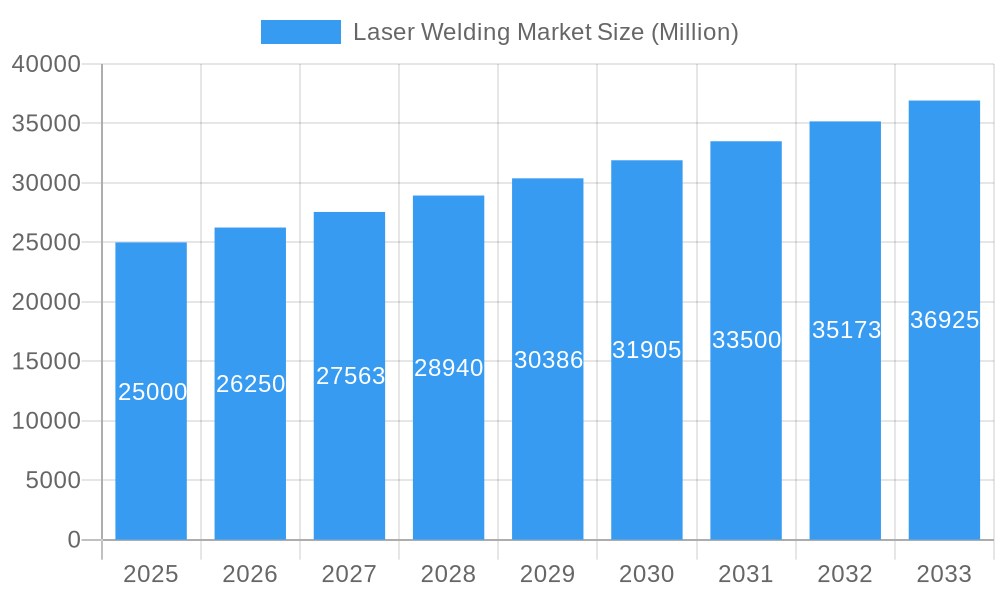

Laser Welding Market Market Size (In Billion)

The forecast period from 2025 to 2033 anticipates sustained market growth. Leading industry players are actively investing in research and development, fostering innovation and market penetration. Regional markets in North America and Europe are expected to maintain substantial shares due to mature manufacturing sectors. However, the Asia-Pacific region is projected for significant growth, fueled by rapid industrialization and increasing automation investments. Segment analysis reveals that the automotive and electronics sectors will likely remain the primary revenue contributors. Ongoing efforts to enhance efficiency, reduce costs, and improve precision will continue to shape the laser welding market's future.

Laser Welding Market Company Market Share

Laser Welding Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Laser Welding Market, offering invaluable insights into market dynamics, growth drivers, competitive landscape, and future projections. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry stakeholders, investors, and researchers seeking a clear understanding of this rapidly evolving market. The report leverages high-impact keywords such as "laser welding market," "laser welding technology," "industrial laser welding," and "fiber laser welding," to ensure optimal search engine visibility.

Laser Welding Market Market Structure & Competitive Landscape

The Laser Welding Market displays a moderately concentrated structure, with several key players commanding significant market share. The Herfindahl-Hirschman Index (HHI) for 2024, estimated at [Insert Updated HHI Value], indicates a moderately competitive landscape. Continuous innovation is paramount, with companies relentlessly developing cutting-edge laser sources, sophisticated beam delivery systems, and advanced process control technologies. Stringent regulatory frameworks governing safety and environmental standards exert a considerable influence on market dynamics. Traditional welding methods (e.g., arc welding, resistance welding) present a competitive challenge, but laser welding's superior precision and efficiency often offset the higher initial cost.

End-user segmentation is diverse, encompassing key sectors such as automotive, aerospace, electronics, medical devices, and renewable energy. The market has witnessed considerable mergers and acquisitions (M&A) activity in recent years, with an estimated total transaction value of [Insert Updated Transaction Value] Million in 2024. Notable examples include NLight's acquisition of Plasmo Industrietechnik in February 2022, bolstering its presence in quality assurance and diagnostics for welding and additive manufacturing, and INDUS Holding AG's acquisition of 70% of HELD Industries GmbH in May 2022, signaling increased investment in laser welding technology for applications like hydrogen electrolysis. These mergers reflect the ongoing industry consolidation and a strategic focus on expanding technological capabilities and market reach. Further analysis of key players and their market strategies would provide a more comprehensive understanding of the competitive dynamics.

Laser Welding Market Market Trends & Opportunities

The global Laser Welding Market is experiencing robust growth, with an estimated market size of [Insert Updated Market Size] Million in 2025. The Compound Annual Growth Rate (CAGR) from 2025 to 2033 is projected at [Insert Updated CAGR]%, driven by several key factors: rapid technological advancements, increasing automation across manufacturing processes, and surging demand across diverse industries. Market penetration rates vary considerably across different segments and geographical regions. The automotive sector remains a dominant adopter, followed closely by the electronics and aerospace industries. Significant technological shifts towards higher-power fiber lasers and sophisticated process control systems are fundamentally reshaping the industry landscape. Growing consumer preference for high-precision, high-speed welding processes is fueling the demand for more advanced and efficient laser welding solutions. The competitive landscape is characterized by intense rivalry among established players and a wave of emerging entrants.

Dominant Markets & Segments in Laser Welding Market

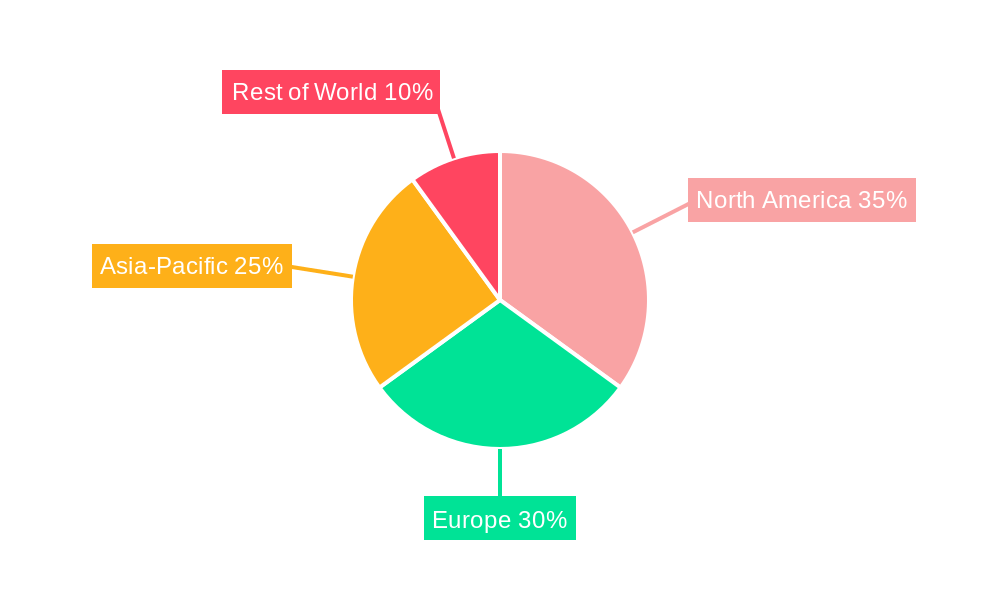

The Asia-Pacific region currently dominates the Laser Welding Market, accounting for an estimated xx% of the global market share in 2025. China, in particular, is a major growth driver, fueled by rapid industrialization and significant investments in advanced manufacturing technologies.

- Key Growth Drivers in Asia-Pacific:

- Rapid industrialization and expansion of manufacturing sectors.

- Increasing adoption of automation in various industries.

- Government initiatives promoting technological advancement.

- Favorable economic conditions and rising disposable incomes.

- Growing demand from automotive, electronics, and renewable energy sectors.

Other key markets include North America and Europe, each exhibiting steady growth driven by technological innovation and increasing adoption across diverse end-user sectors. Within segments, the automotive industry continues to be the largest consumer of laser welding technology, followed by electronics and medical devices.

Laser Welding Market Product Analysis

Laser welding technology has undergone remarkable advancements in recent years. These innovations encompass higher-power fiber lasers, enhanced beam delivery systems, and cutting-edge process control software, resulting in improved precision, speed, and overall efficiency. These advancements have expanded the applicability of laser welding across a broader range of industries, including highly demanding sectors such as aerospace and medical device manufacturing. Competitive advantages are increasingly determined by factors such as laser source technology, process control capabilities, and seamless integration with automated manufacturing systems. A detailed analysis of specific laser welding systems and their features would provide a more granular perspective on product differentiation within the market.

Key Drivers, Barriers & Challenges in Laser Welding Market

Key Drivers:

- Increasing demand for high-precision welding in diverse industries.

- Technological advancements leading to higher efficiency and productivity.

- Rising adoption of automation and Industry 4.0 technologies.

- Government incentives and support for advanced manufacturing.

Challenges:

- High initial investment costs for laser welding systems.

- Skilled labor shortages in operating and maintaining advanced equipment.

- Stringent safety regulations and environmental concerns.

- Competition from traditional welding methods and other emerging technologies. The impact of these challenges is estimated to reduce overall market growth by xx% in the forecast period.

Growth Drivers in the Laser Welding Market Market

Key growth drivers include rising demand from automotive and electronics sectors, advancements in laser technology (higher power, better beam quality), increased automation in manufacturing, and supportive government policies promoting advanced manufacturing. The development of new applications, such as in battery production for electric vehicles, is also fueling growth.

Challenges Impacting Laser Welding Market Growth

Significant hurdles to market expansion include the substantial initial capital investment required, persistent skilled labor shortages, intense competition from established traditional welding techniques, and the need for specialized training and expertise. Furthermore, supply chain disruptions and the potential for future regulatory changes pose considerable barriers to market growth. Addressing these challenges through strategic investments in workforce development, technological advancements to reduce upfront costs, and proactive engagement with regulatory bodies will be crucial for sustaining market momentum.

Key Players Shaping the Laser Welding Market Market

- TRUMPF Group

- The Emerson Electric Co

- Wuhan Golden Laser Co

- Jenoptik AG

- Huagong Laser Engineering Co Ltd

- LaserStar Technologies Corporation

- Shenzhen HeroLaser Equipment Co Ltd

- IPG Photonics Corporation

- Amada Miyachi

- EMAG GmbH & Co KG

- FANUC Robotics

- LASAG

- *List Not Exhaustive

Significant Laser Welding Market Industry Milestones

- May 2022: INDUS Holding AG's acquisition of 70% of HELD Industries GmbH signifies a substantial investment in laser welding technology, particularly targeting its application in the burgeoning hydrogen electrolysis sector. This strategic move highlights the growing importance of laser welding in enabling the transition to cleaner energy technologies.

- February 2022: NLight's acquisition of Plasmo Industrietechnik broadened its product portfolio, significantly enhancing its capabilities in quality assurance and diagnostic solutions for both welding and additive manufacturing processes. This acquisition strengthens NLight's position as a comprehensive provider of solutions within the broader manufacturing technology landscape.

Future Outlook for Laser Welding Market Market

The Laser Welding Market is poised for sustained growth, driven by ongoing technological advancements, expanding applications, and increasing automation across various sectors. Strategic partnerships, investments in R&D, and the development of innovative solutions will be critical for companies to maintain a competitive edge in this dynamic market. The market potential is significant, particularly in emerging economies and high-growth industries like renewable energy and electric vehicles.

Laser Welding Market Segmentation

-

1. Technology

- 1.1. Fiber

- 1.2. Co2

- 1.3. Solid-State

- 1.4. Others

Laser Welding Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Laser Welding Market Regional Market Share

Geographic Coverage of Laser Welding Market

Laser Welding Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Automotive Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Laser Welding Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Fiber

- 5.1.2. Co2

- 5.1.3. Solid-State

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Laser Welding Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Fiber

- 6.1.2. Co2

- 6.1.3. Solid-State

- 6.1.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Laser Welding Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Fiber

- 7.1.2. Co2

- 7.1.3. Solid-State

- 7.1.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Laser Welding Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Fiber

- 8.1.2. Co2

- 8.1.3. Solid-State

- 8.1.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Latin America Laser Welding Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Fiber

- 9.1.2. Co2

- 9.1.3. Solid-State

- 9.1.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa Laser Welding Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Fiber

- 10.1.2. Co2

- 10.1.3. Solid-State

- 10.1.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 TRUMPF Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The Emerson Electric Co

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Wuhan Golden Laser Co

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Jenoptik AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Huagong Laser Engineering Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LaserStar Technologies Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Shenzhen HeroLaser Equipment Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 IPG Photonics Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Amada Miyachi

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 EMAG GmbH & Co KG

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 FANUC Robotics

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 LASAG*List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 TRUMPF Group

List of Figures

- Figure 1: Laser Welding Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Laser Welding Market Share (%) by Company 2025

List of Tables

- Table 1: Laser Welding Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 2: Laser Welding Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Laser Welding Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 4: Laser Welding Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Laser Welding Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 6: Laser Welding Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Laser Welding Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 8: Laser Welding Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Laser Welding Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 10: Laser Welding Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Laser Welding Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 12: Laser Welding Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Laser Welding Market?

The projected CAGR is approximately 3.7%.

2. Which companies are prominent players in the Laser Welding Market?

Key companies in the market include TRUMPF Group, The Emerson Electric Co, Wuhan Golden Laser Co, Jenoptik AG, Huagong Laser Engineering Co Ltd, LaserStar Technologies Corporation, Shenzhen HeroLaser Equipment Co Ltd, IPG Photonics Corporation, Amada Miyachi, EMAG GmbH & Co KG, FANUC Robotics, LASAG*List Not Exhaustive.

3. What are the main segments of the Laser Welding Market?

The market segments include Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.9 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Demand from the Automotive Industry.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

May 2022: The stock exchange HELD Industries GmbH, with its headquarters in Heusenstamm close to Offenbach, has sold 70% of its shares to INDUS Holding AG. The profitable medium-sized supplier of specialized equipment and systems for precision laser cutting and welding, which employed 22 people, achieved yearly revenues of about 12 million euros in the fiscal year 2021. Now that they have a reliable partner by their side, they wish to open up new business sectors and extend their international sales and service operations. In the future industry of hydrogen electrolysis, their ground-breaking laser welding technologies for H2 electrodes have particularly intriguing growth prospects.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Laser Welding Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Laser Welding Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Laser Welding Market?

To stay informed about further developments, trends, and reports in the Laser Welding Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence