Key Insights

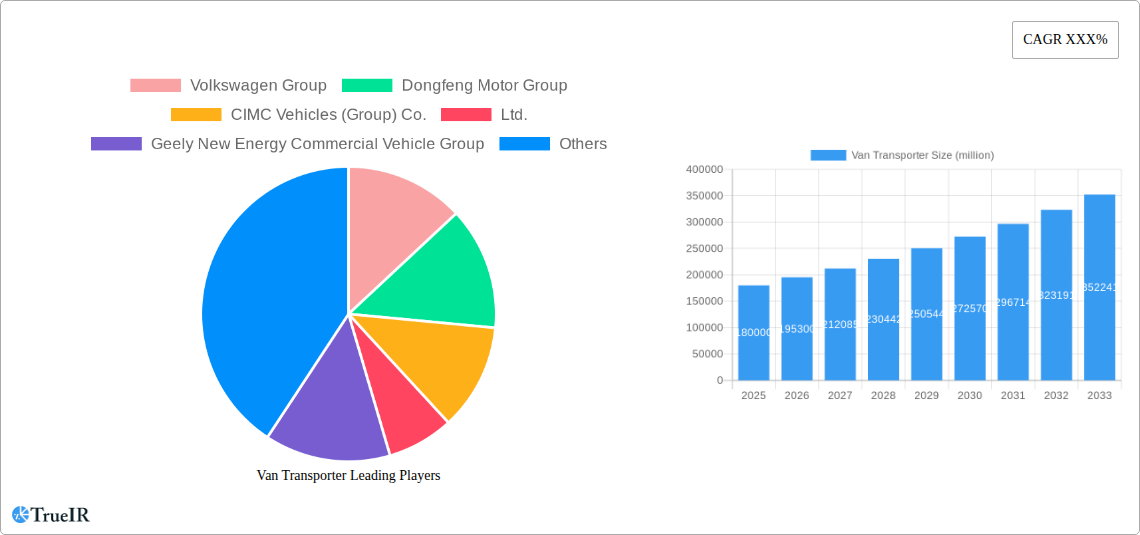

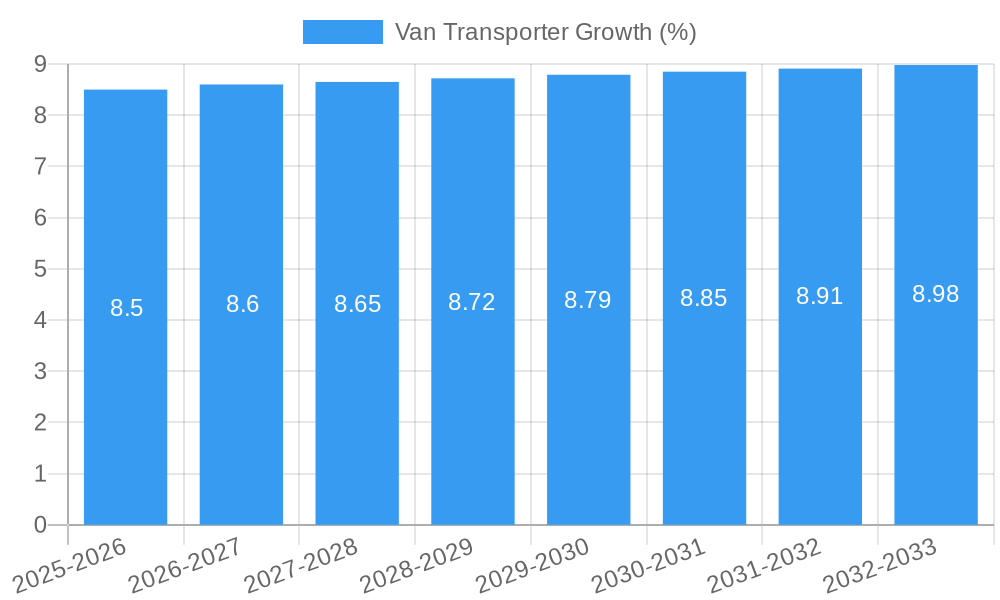

The Van Transporter market is experiencing robust growth, projected to reach a substantial market size of $180,000 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 8.5% extending through 2033. This expansion is primarily fueled by the escalating demand in Cold Chain Logistics, driven by the global need for efficient and temperature-controlled transport of perishable goods, pharmaceuticals, and specialized chemicals. The burgeoning e-commerce sector also significantly contributes, necessitating rapid and reliable delivery solutions for last-mile distribution, thus boosting the demand for both small and medium-sized vans and their larger, heavy-duty counterparts. Postal services are also undergoing a transformation, embracing fleet modernization with specialized van transporters to enhance operational efficiency and expand service reach.

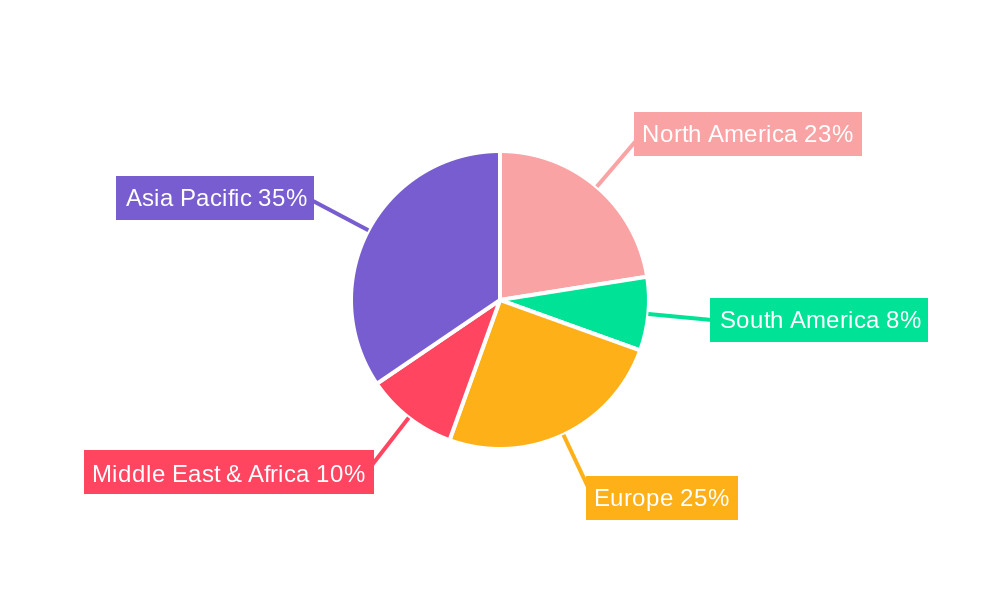

While the market demonstrates strong upward momentum, certain restraints could temper its pace. Increasing stringent emission regulations across major economies pose a challenge, encouraging a shift towards electric and alternative fuel powertrains, which require significant upfront investment and infrastructure development. Furthermore, fluctuations in raw material prices, particularly for steel and advanced battery components, can impact manufacturing costs and subsequently influence vehicle pricing, potentially affecting affordability for smaller businesses. Despite these hurdles, the market is characterized by continuous innovation, with a strong focus on enhancing vehicle payload capacity, fuel efficiency, and the integration of advanced telematics and tracking systems to optimize fleet management. The Asia Pacific region, led by China, is expected to dominate the market due to its vast manufacturing capabilities and significant domestic demand, while North America and Europe are witnessing a strong uptake in advanced and eco-friendly van transporter solutions.

This comprehensive report, spanning 2019-2033 with a base and estimated year of 2025, offers a deep dive into the global Van Transporter market. Leveraging high-volume SEO keywords, it delivers actionable insights for industry stakeholders seeking to capitalize on emerging trends and navigate complex market dynamics. The report analyzes market size, segmentation, competitive landscape, and future projections, providing a robust foundation for strategic decision-making.

Van Transporter Market Structure & Competitive Landscape

The global van transporter market exhibits a moderate to high level of concentration, with leading players like Volkswagen Group, Dongfeng Motor Group, and CIMC Vehicles (Group) Co.,Ltd. commanding significant market share, estimated at approximately 60% for the top five entities. Innovation remains a key driver, with significant investments in electric vehicle (EV) technology and advanced telematics. Regulatory impacts, such as evolving emissions standards and urban access restrictions, are reshaping product development and market entry strategies. Product substitutes, including smaller trucks and dedicated cargo bikes for last-mile delivery, present a growing challenge, particularly in urban environments. End-user segmentation reveals strong demand from Cold Chain Logistics, Postal Services, and Material Transportation sectors. Mergers and acquisitions (M&A) activity is a notable trend, with an estimated 15-20 significant M&A deals occurring annually over the historical period (2019-2024), aimed at consolidating market presence and expanding product portfolios. The competitive landscape is characterized by a blend of established global manufacturers and rapidly growing regional players, particularly from China.

Van Transporter Market Trends & Opportunities

The van transporter market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.5% from 2025 to 2033, reaching an estimated market size of over $250 billion by the end of the forecast period. This expansion is fueled by a confluence of powerful trends. E-commerce proliferation continues to be a primary catalyst, driving unprecedented demand for last-mile delivery solutions and necessitating a larger fleet of efficient and specialized van transporters. Technological advancements are revolutionizing the sector; the increasing adoption of electric vans is a significant shift, driven by environmental regulations, lower operating costs, and growing corporate sustainability commitments. Battery technology improvements, coupled with expanding charging infrastructure, are making electric vans increasingly viable for a wider range of applications. The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) into van operations presents a major opportunity for enhancing efficiency, optimizing routes, and improving vehicle maintenance through predictive analytics. Autonomous driving technology, while still in its nascent stages for commercial applications, holds long-term transformative potential. Consumer preferences are evolving towards more sustainable, efficient, and connected logistics solutions. Businesses are prioritizing vans that offer lower total cost of ownership, reduced emissions, and enhanced cargo security. Competitive dynamics are intensifying, with manufacturers focusing on diversifying their product offerings to include a wider range of electric and hybrid models, as well as specialized vehicles for niche applications like Cold Chain Logistics. The rise of van-sharing platforms and integrated logistics services also creates new opportunities for fleet operators and manufacturers alike. Market penetration rates for electric vans are expected to climb from an estimated 8% in 2025 to over 35% by 2033, signifying a profound shift in powertrain preferences. The growing emphasis on last-mile delivery efficiency, coupled with government incentives for green transportation, are critical factors underpinning this growth trajectory.

Dominant Markets & Segments in Van Transporter

Asia-Pacific, particularly China, is emerging as the dominant region in the van transporter market, driven by its massive manufacturing base, rapidly expanding e-commerce sector, and supportive government policies aimed at modernizing logistics infrastructure. The country is projected to account for over 35% of the global market share by 2025. Within this region, China's domestic manufacturers like Dongfeng Motor Group, Geely New Energy Commercial Vehicle Group, and Wuling Motors are leading the charge.

Key Growth Drivers in Dominant Markets:

- Infrastructure Development: Significant investments in road networks, urban logistics hubs, and charging infrastructure are facilitating the widespread adoption of van transporters.

- E-commerce Boom: The insatiable demand for online retail and same-day delivery services necessitates a robust fleet of efficient vans.

- Government Support: Favorable policies, including subsidies for electric vehicles and incentives for logistics modernization, are spurring market growth.

Dominant Segments:

Application:

- Cold Chain Logistics: This segment is experiencing rapid growth due to increasing demand for temperature-sensitive goods, including pharmaceuticals and perishable foods. The need for reliable and specialized refrigerated vans is paramount.

- Postal Services: With the continuous growth of e-commerce and parcel delivery, postal services require efficient and high-volume van transporters for their daily operations.

- Material Transportation: This broad category encompasses a wide range of goods and materials, with a consistent demand for versatile and robust van transporters across various industries.

Type:

- Small and Medium-sized Vans: These vans are pivotal for urban logistics, last-mile delivery, and services requiring agility and maneuverability in congested city centers. Their fuel efficiency and lower operating costs make them highly attractive.

- Heavy-duty Vans: While smaller vans dominate urban landscapes, heavy-duty vans are crucial for longer-haul transportation, larger cargo volumes, and specialized industrial applications, particularly in regions with less stringent urban access regulations. The market for heavy-duty electric vans is also showing promising growth.

The market dominance in Asia-Pacific is further bolstered by the presence of a vast domestic consumer base and a competitive manufacturing ecosystem that drives innovation and cost-effectiveness. Emerging markets in Southeast Asia are also exhibiting significant growth potential.

Van Transporter Product Analysis

The van transporter market is characterized by a surge in product innovation focused on electrification, increased cargo capacity, and advanced telematics. Manufacturers are introducing lightweight materials and aerodynamic designs to enhance fuel efficiency and battery range in electric vans. Smart cargo management systems and integrated navigation with real-time traffic updates are becoming standard features, improving operational efficiency for logistics providers. The competitive advantage lies in offering a diverse range of specialized vans tailored for specific applications, from temperature-controlled units for cold chain logistics to modular designs for adaptable material transportation.

Key Drivers, Barriers & Challenges in Van Transporter

The van transporter market is propelled by several key drivers including the exponential growth of e-commerce, demanding efficient last-mile delivery solutions. Technological advancements, particularly the rapid development and adoption of electric vehicle (EV) technology, are a significant growth catalyst. Supportive government regulations and incentives for green transportation further bolster this trend.

Conversely, the market faces substantial challenges and restraints. High upfront costs for electric vans and the need for extensive charging infrastructure remain a barrier. Supply chain disruptions, particularly for critical components like semiconductor chips, continue to impact production volumes and lead times. Regulatory complexities across different regions regarding emissions, vehicle dimensions, and operational permits add another layer of difficulty. Intense competition among numerous manufacturers, both established and emerging, also pressures profit margins.

Growth Drivers in the Van Transporter Market

The van transporter market's growth is primarily fueled by the relentless expansion of e-commerce, necessitating more efficient and wider-reaching logistics networks. Technological innovation, especially the accelerating development and widespread adoption of electric vehicle (EV) powertrains, is a critical growth engine. Governments globally are implementing supportive policies, including subsidies for EV purchases and investments in charging infrastructure, further incentivizing the shift towards cleaner transportation solutions. The increasing focus on sustainability and reducing carbon footprints across industries also drives demand for greener logistics options.

Challenges Impacting Van Transporter Growth

Despite robust growth prospects, the van transporter market confronts significant challenges. The high initial purchase price of electric vans and the ongoing development of adequate charging infrastructure in many areas represent a considerable barrier to widespread adoption. Supply chain vulnerabilities, such as shortages of raw materials and electronic components, can lead to production delays and increased costs. Navigating diverse and sometimes complex regulatory landscapes across different countries and cities adds operational hurdles. Furthermore, intense competition from both established automakers and new entrants puts pressure on pricing and profitability, requiring continuous innovation and efficiency improvements.

Key Players Shaping the Van Transporter Market

- Volkswagen Group

- Dongfeng Motor Group

- CIMC Vehicles (Group) Co.,Ltd.

- Geely New Energy Commercial Vehicle Group

- Wuling Motors

- BAIC Group

- Shandong Kaima Automobile Manufacturing Co.,Ltd.

- Shenyang Brilliance Jinbei Automobile Co.,Ltd.

- China FAW Group

- Yuejin Automobile Group Co.,Ltd.

- Anhui Jianghuai Automobile Co.,Ltd.

- China National Heavy Duty Truck Group Co.,Ltd.

- Yutong Bus

- Xiamen Jinlong Travel Vehicle Co.,Ltd.

- Zhangjiagang Jiangnan Automobile Manufacturing Co.,Ltd.

- Fujian Wuyi Automobile Manufacturing Co.,Ltd.

- Jiangling Motors Group Corporation

- Hubei Danjiang Special Automobile Co.,Ltd.

- Liuzhou Yanlong Automobile Co.,Ltd.

- China Changan Automobile Group Co.,Ltd.

Significant Van Transporter Industry Milestones

- 2019: Launch of several new electric van models by major automakers, signaling a commitment to electrification.

- 2020: Increased focus on last-mile delivery solutions due to the surge in e-commerce.

- 2021: Significant supply chain disruptions due to semiconductor shortages impact production volumes globally.

- 2022: Government incentives for electric commercial vehicles are strengthened in key markets like Europe and China.

- 2023: Major investments announced in advanced battery technology and charging infrastructure development.

- Early 2024: Introduction of advanced autonomous driving features in select premium van transporter models.

- Mid 2024: Growing emphasis on sustainable materials and circular economy principles in van manufacturing.

Future Outlook for Van Transporter Market

The future outlook for the van transporter market is exceptionally bright, characterized by sustained growth and transformative innovation. The ongoing expansion of e-commerce will continue to be a primary demand driver, while the accelerating adoption of electric vehicles promises to reshape the powertrain landscape, offering significant environmental benefits and potentially lower operating costs. Strategic opportunities lie in developing specialized electric vans for niche applications like cold chain logistics and urban micro-mobility. Manufacturers that prioritize intelligent features, enhanced connectivity, and robust charging solutions will be well-positioned to capture market share. The market is expected to witness further consolidation through M&A as companies seek to expand their technological capabilities and geographic reach. The increasing global commitment to decarbonization will further accelerate the transition to zero-emission vans, presenting a vast growth potential for forward-thinking industry players.

Van Transporter Segmentation

-

1. Application

- 1.1. Cold Chain Logistics

- 1.2. Postal Services

- 1.3. Material Transportation

- 1.4. Other

-

2. Type

- 2.1. Small and Medium-sized Vans

- 2.2. Heavy-duty Vans

Van Transporter Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Van Transporter REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Van Transporter Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Cold Chain Logistics

- 5.1.2. Postal Services

- 5.1.3. Material Transportation

- 5.1.4. Other

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Small and Medium-sized Vans

- 5.2.2. Heavy-duty Vans

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Van Transporter Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Cold Chain Logistics

- 6.1.2. Postal Services

- 6.1.3. Material Transportation

- 6.1.4. Other

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Small and Medium-sized Vans

- 6.2.2. Heavy-duty Vans

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Van Transporter Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Cold Chain Logistics

- 7.1.2. Postal Services

- 7.1.3. Material Transportation

- 7.1.4. Other

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Small and Medium-sized Vans

- 7.2.2. Heavy-duty Vans

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Van Transporter Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Cold Chain Logistics

- 8.1.2. Postal Services

- 8.1.3. Material Transportation

- 8.1.4. Other

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Small and Medium-sized Vans

- 8.2.2. Heavy-duty Vans

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Van Transporter Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Cold Chain Logistics

- 9.1.2. Postal Services

- 9.1.3. Material Transportation

- 9.1.4. Other

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Small and Medium-sized Vans

- 9.2.2. Heavy-duty Vans

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Van Transporter Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Cold Chain Logistics

- 10.1.2. Postal Services

- 10.1.3. Material Transportation

- 10.1.4. Other

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Small and Medium-sized Vans

- 10.2.2. Heavy-duty Vans

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Volkswagen Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dongfeng Motor Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CIMC Vehicles (Group) Co.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ltd.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Geely New Energy Commercial Vehicle Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Wuling Motors

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BAIC Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Shandong Kaima Automobile Manufacturing Co.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ltd.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Shenyang Brilliance Jinbei Automobile Co.

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Ltd.

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 China FAW Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Yuejin Automobile Group Co.

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Ltd.

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Anhui Jianghuai Automobile Co.

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Ltd.

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 China National Heavy Duty Truck Group Co.

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Ltd.

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Yutong Bus

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Xiamen Jinlong Travel Vehicle Co.

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Ltd.

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Zhangjiagang Jiangnan Automobile Manufacturing Co.

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Ltd.

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Fujian Wuyi Automobile Manufacturing Co.

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Ltd.

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Jiangling Motors Group Corporation

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 Hubei Danjiang Special Automobile Co.

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.28 Ltd.

- 11.2.28.1. Overview

- 11.2.28.2. Products

- 11.2.28.3. SWOT Analysis

- 11.2.28.4. Recent Developments

- 11.2.28.5. Financials (Based on Availability)

- 11.2.29 Liuzhou Yanlong Automobile Co.

- 11.2.29.1. Overview

- 11.2.29.2. Products

- 11.2.29.3. SWOT Analysis

- 11.2.29.4. Recent Developments

- 11.2.29.5. Financials (Based on Availability)

- 11.2.30 Ltd.

- 11.2.30.1. Overview

- 11.2.30.2. Products

- 11.2.30.3. SWOT Analysis

- 11.2.30.4. Recent Developments

- 11.2.30.5. Financials (Based on Availability)

- 11.2.31 China Changan Automobile Group Co.

- 11.2.31.1. Overview

- 11.2.31.2. Products

- 11.2.31.3. SWOT Analysis

- 11.2.31.4. Recent Developments

- 11.2.31.5. Financials (Based on Availability)

- 11.2.32 Ltd.

- 11.2.32.1. Overview

- 11.2.32.2. Products

- 11.2.32.3. SWOT Analysis

- 11.2.32.4. Recent Developments

- 11.2.32.5. Financials (Based on Availability)

- 11.2.1 Volkswagen Group

List of Figures

- Figure 1: Global Van Transporter Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Van Transporter Revenue (million), by Application 2024 & 2032

- Figure 3: North America Van Transporter Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Van Transporter Revenue (million), by Type 2024 & 2032

- Figure 5: North America Van Transporter Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Van Transporter Revenue (million), by Country 2024 & 2032

- Figure 7: North America Van Transporter Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Van Transporter Revenue (million), by Application 2024 & 2032

- Figure 9: South America Van Transporter Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Van Transporter Revenue (million), by Type 2024 & 2032

- Figure 11: South America Van Transporter Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Van Transporter Revenue (million), by Country 2024 & 2032

- Figure 13: South America Van Transporter Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Van Transporter Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Van Transporter Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Van Transporter Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Van Transporter Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Van Transporter Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Van Transporter Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Van Transporter Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Van Transporter Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Van Transporter Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Van Transporter Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Van Transporter Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Van Transporter Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Van Transporter Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Van Transporter Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Van Transporter Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Van Transporter Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Van Transporter Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Van Transporter Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Van Transporter Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Van Transporter Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Van Transporter Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Van Transporter Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Van Transporter Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Van Transporter Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Van Transporter Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Van Transporter Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Van Transporter Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Van Transporter Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Van Transporter Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Van Transporter Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Van Transporter Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Van Transporter Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Van Transporter Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Van Transporter Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Van Transporter Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Van Transporter Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Van Transporter Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Van Transporter Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Van Transporter Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Van Transporter Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Van Transporter Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Van Transporter Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Van Transporter Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Van Transporter Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Van Transporter Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Van Transporter Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Van Transporter Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Van Transporter Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Van Transporter Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Van Transporter Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Van Transporter Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Van Transporter Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Van Transporter Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Van Transporter Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Van Transporter Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Van Transporter Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Van Transporter Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Van Transporter Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Van Transporter Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Van Transporter Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Van Transporter Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Van Transporter Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Van Transporter Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Van Transporter Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Van Transporter Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Van Transporter?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Van Transporter?

Key companies in the market include Volkswagen Group, Dongfeng Motor Group, CIMC Vehicles (Group) Co., Ltd., Geely New Energy Commercial Vehicle Group, Wuling Motors, BAIC Group, Shandong Kaima Automobile Manufacturing Co., Ltd., Shenyang Brilliance Jinbei Automobile Co., Ltd., China FAW Group, Yuejin Automobile Group Co., Ltd., Anhui Jianghuai Automobile Co., Ltd., China National Heavy Duty Truck Group Co., Ltd., Yutong Bus, Xiamen Jinlong Travel Vehicle Co., Ltd., Zhangjiagang Jiangnan Automobile Manufacturing Co., Ltd., Fujian Wuyi Automobile Manufacturing Co., Ltd., Jiangling Motors Group Corporation, Hubei Danjiang Special Automobile Co., Ltd., Liuzhou Yanlong Automobile Co., Ltd., China Changan Automobile Group Co., Ltd..

3. What are the main segments of the Van Transporter?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Van Transporter," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Van Transporter report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Van Transporter?

To stay informed about further developments, trends, and reports in the Van Transporter, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence