Key Insights

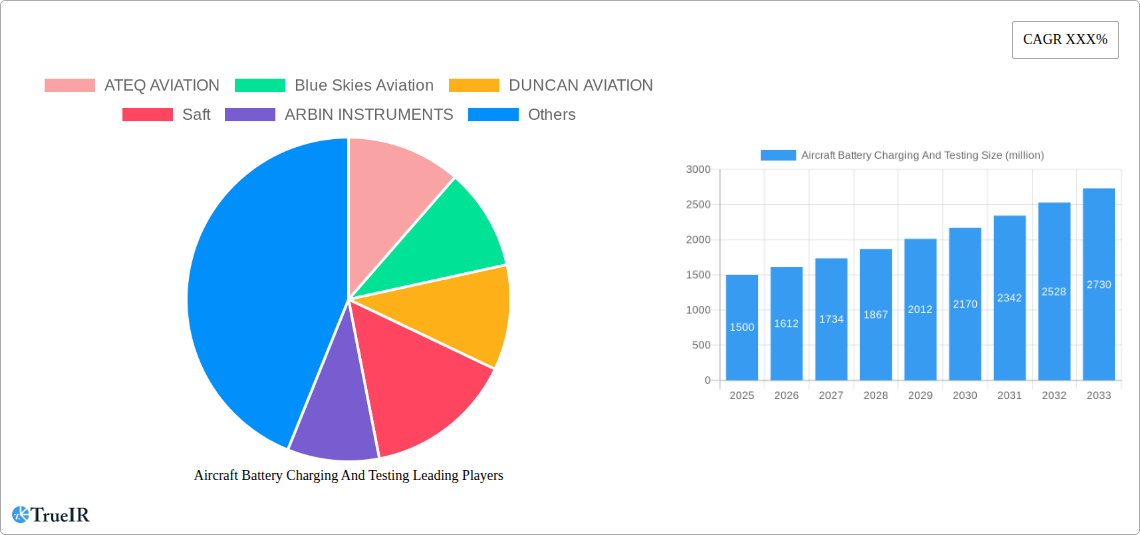

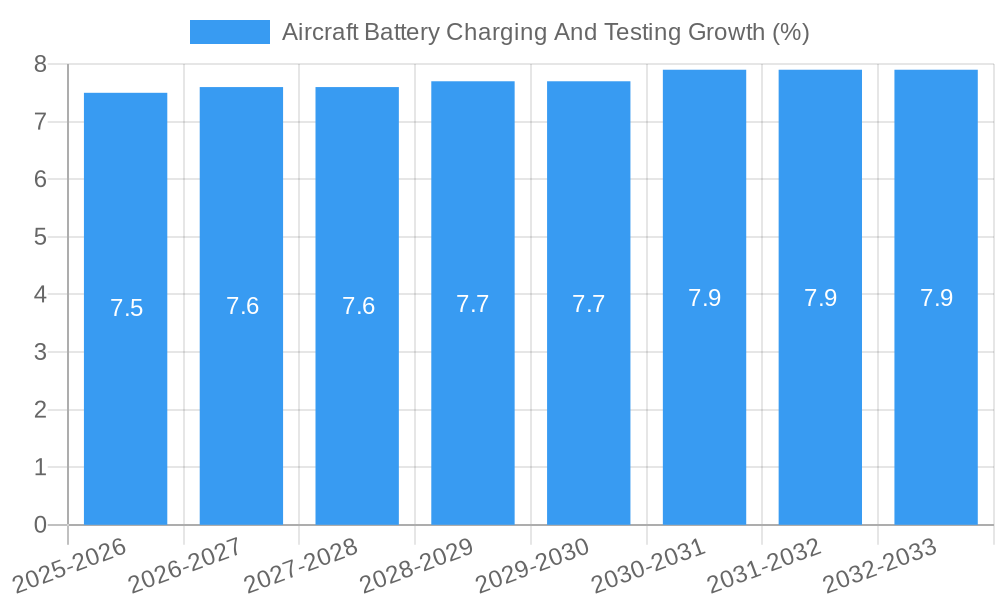

The global Aircraft Battery Charging and Testing market is poised for significant expansion, projected to reach a substantial market size of approximately $1.5 billion by 2025. This growth trajectory is further underscored by an estimated Compound Annual Growth Rate (CAGR) of around 7.5% expected throughout the forecast period of 2025-2033. This robust expansion is primarily fueled by the escalating demand for commercial aviation, driven by increasing passenger and cargo volumes worldwide, necessitating a larger fleet and, consequently, more battery maintenance services. The ongoing modernization of aircraft fleets, incorporating advanced battery technologies and stricter safety regulations, also plays a pivotal role in bolstering the market. Furthermore, the burgeoning growth in private aviation, catering to the affluent and corporate sectors, contributes to the sustained demand for reliable battery charging and testing solutions.

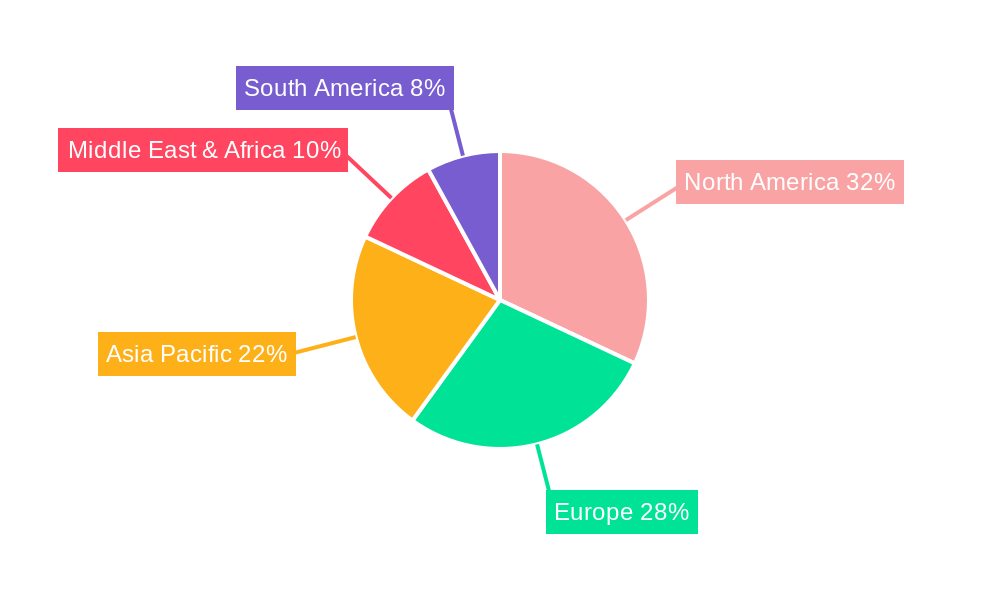

Key trends shaping this dynamic market include the increasing adoption of advanced diagnostic tools and automation in battery testing, leading to enhanced efficiency and accuracy. The development of lighter, more durable, and higher-performance battery chemistries for aircraft is also a significant driver, requiring specialized charging and testing equipment. However, the market faces certain restraints, such as the high initial cost of advanced testing equipment and the stringent certification processes for new technologies, which can impede rapid adoption. The market is segmented by application into Commercial Aircraft and Private Aircraft, with Capacity Test and Charge Acceptance Test being the primary testing types. Geographically, North America is anticipated to lead the market due to the presence of major aviation hubs and established MRO (Maintenance, Repair, and Overhaul) facilities. The Asia Pacific region is expected to exhibit the fastest growth, driven by rapid expansion in air travel and increasing investments in aviation infrastructure within countries like China and India.

This in-depth report provides a dynamic, SEO-optimized analysis of the global Aircraft Battery Charging And Testing market, covering historical trends, current market dynamics, and future projections from 2019 to 2033. Leveraging high-volume keywords such as "aircraft battery charger," "aircraft battery tester," "aviation battery maintenance," and "MRO services," this report is designed to enhance search rankings and engage a broad spectrum of industry audiences, from aviation manufacturers and MRO providers to battery suppliers and regulatory bodies. The study encompasses a market size projected to reach over $XXX million by 2025, with a significant CAGR predicted for the forecast period.

Aircraft Battery Charging And Testing Market Structure & Competitive Landscape

The Aircraft Battery Charging And Testing market exhibits a moderately concentrated structure, driven by a blend of established aviation giants and specialized MRO (Maintenance, Repair, and Overhaul) service providers. Innovation is primarily fueled by the relentless pursuit of enhanced battery lifespan, faster charging cycles, and improved diagnostic accuracy, with an estimated investment of over $XX million annually in R&D. Regulatory impacts from aviation authorities like the FAA and EASA significantly shape product development and testing protocols, demanding adherence to stringent safety and performance standards. Product substitutes, while limited in the core battery technology, emerge in the form of alternative testing methodologies and data analytics platforms. End-user segmentation clearly delineates demand between Commercial Aircraft and Private Aircraft segments, each with unique operational requirements and testing frequencies. Mergers and Acquisitions (M&A) activity, totaling approximately XX deals with an aggregate value exceeding $XXX million over the historical period, indicate a trend towards consolidation and the integration of advanced testing technologies. Key players like The Boeing Company and GS Yuasa Corporation are actively involved in shaping this landscape, alongside specialized providers such as ATEQ AVIATION and ARBIN INSTRUMENTS.

Aircraft Battery Charging And Testing Market Trends & Opportunities

The global Aircraft Battery Charging And Testing market is poised for significant expansion, with an estimated market size projected to surpass $XXX million in 2025. This growth is underpinned by a confluence of escalating aviation activity, stringent safety mandates, and rapid technological advancements. The increasing volume of global air travel, particularly in the commercial aviation sector, directly correlates with a higher demand for efficient and reliable aircraft battery maintenance solutions. As fleets expand and aircraft utilization intensifies, the need for robust charging and testing equipment to ensure optimal battery performance and longevity becomes paramount. The market penetration rate for advanced battery testing equipment, such as automated diagnostic systems and impedance testers, is steadily increasing, reflecting a proactive approach by airlines and MRO providers to minimize downtime and prevent in-flight battery failures.

Technological shifts are a primary catalyst for market evolution. The transition towards more advanced battery chemistries, including Lithium-ion, necessitates specialized charging and testing protocols that differ significantly from traditional Nickel-Cadmium or Lead-Acid batteries. Manufacturers are responding by developing intelligent charging systems that optimize charge acceptance rates and sophisticated testing equipment capable of accurately assessing the health and capacity of these next-generation power sources. Furthermore, the integration of data analytics and artificial intelligence (AI) into battery management systems is creating new opportunities for predictive maintenance, allowing operators to identify potential battery issues before they manifest as critical failures. This shift towards data-driven maintenance not only enhances safety but also contributes to operational cost savings.

Consumer preferences, represented by the operational needs of aircraft operators, are increasingly leaning towards solutions that offer faster turnaround times, higher accuracy, and comprehensive diagnostic capabilities. Airlines are seeking equipment that can perform a full suite of tests, including capacity tests and charge acceptance tests, with minimal disruption to flight schedules. The emphasis is on minimizing Total Cost of Ownership (TCO) for battery systems, which directly translates to the efficiency and reliability of the charging and testing infrastructure. This growing demand for end-to-end solutions presents a substantial opportunity for companies that can offer integrated hardware and software platforms. The competitive dynamics within the market are intensifying, with players differentiating themselves through innovation, strategic partnerships, and the ability to cater to the specific needs of diverse aviation segments, from large commercial carriers to private jet operators. The average Compound Annual Growth Rate (CAGR) for the market is predicted to be around xx% between 2025 and 2033, indicating a robust and sustained growth trajectory.

Dominant Markets & Segments in Aircraft Battery Charging And Testing

The Commercial Aircraft segment emerges as the dominant force within the Aircraft Battery Charging And Testing market, driven by the sheer volume of aircraft operations and the stringent regulatory oversight governing commercial aviation. With a global fleet numbering in the tens of millions, these aircraft undergo regular maintenance cycles, creating a consistent and substantial demand for charging and testing equipment. Key growth drivers in this segment include the continuous expansion of global air travel, necessitating the maintenance of larger and more complex fleets. Infrastructure development plays a crucial role, as major airlines and MRO hubs invest in state-of-the-art battery maintenance facilities. Furthermore, evolving regulatory policies and a heightened focus on passenger safety mandate rigorous testing protocols, ensuring that batteries perform optimally under all flight conditions.

The Capacity Test segment also holds significant sway, as accurately assessing a battery's remaining useful life and its ability to deliver power is fundamental to flight safety and operational efficiency. Airlines rely heavily on capacity tests to determine battery replacement schedules, preventing unexpected failures and associated operational disruptions. The demand for precise and reliable capacity testing solutions is consistently high across all aviation segments.

In terms of regional dominance, North America and Europe currently lead the market, owing to their well-established aviation industries, advanced MRO infrastructure, and proactive regulatory frameworks. However, the Asia-Pacific region is exhibiting the fastest growth rate, fueled by the rapid expansion of its airline industry and increasing investments in aviation manufacturing and MRO capabilities. Policies promoting the modernization of aviation infrastructure and the adoption of advanced maintenance technologies are further accelerating growth in this dynamic region. The Private Aircraft segment, while smaller in volume compared to commercial aviation, represents a significant niche market. Owners and operators of private jets often demand high-performance, customized solutions that prioritize rapid turnaround times and advanced diagnostic features to minimize downtime for their premium clientele.

Aircraft Battery Charging And Testing Product Analysis

Product innovations in Aircraft Battery Charging And Testing are primarily focused on enhancing diagnostic accuracy, optimizing charging efficiency, and extending battery lifespan. Advanced solutions are incorporating features such as intelligent algorithms for real-time monitoring, automated testing sequences, and cloud-based data management for comprehensive trend analysis. These technological advancements offer significant competitive advantages by reducing maintenance costs, improving operational reliability, and ensuring compliance with evolving aviation standards. The market is witnessing a shift towards integrated systems that combine charging and comprehensive testing capabilities within a single unit, streamlining MRO processes and reducing equipment footprint.

Key Drivers, Barriers & Challenges in Aircraft Battery Charging And Testing

Key Drivers: The Aircraft Battery Charging And Testing market is propelled by several key drivers. Technological advancements in battery chemistries, leading to higher energy density and longer lifecycles, necessitate specialized charging and testing equipment. The increasing global air traffic directly fuels demand for regular battery maintenance and diagnostics. Stringent aviation safety regulations mandate rigorous testing to prevent in-flight failures, acting as a significant market accelerant. Furthermore, the growing emphasis on reducing operational costs through efficient battery management and predictive maintenance strategies drives the adoption of advanced charging and testing solutions.

Key Barriers & Challenges: Despite the growth, several challenges impact the market. The high initial investment cost for sophisticated testing equipment can be a barrier for smaller MRO providers and airlines. Evolving battery technologies require continuous adaptation and investment in new testing methodologies, creating a challenge for equipment manufacturers. Supply chain disruptions, particularly for specialized electronic components, can affect production and lead times. Regulatory complexities and the need for continuous certification of testing equipment add to operational costs and time. Competitive pressures from established players and emerging technologies also present a challenge.

Growth Drivers in the Aircraft Battery Charging And Testing Market

The growth drivers in the Aircraft Battery Charging And Testing market are multifaceted. Technologically, the continuous evolution of battery chemistries, including the widespread adoption of Lithium-ion batteries, demands innovative charging and testing solutions. Economically, the increasing global air passenger traffic directly translates into a higher number of aircraft requiring maintenance, thereby boosting the demand for charging and testing services. Regulatory factors, such as enhanced safety mandates from aviation authorities like the FAA and EASA, continuously push for more sophisticated and reliable battery testing protocols. Furthermore, a growing focus on operational efficiency and cost reduction by airlines is driving the adoption of predictive maintenance strategies enabled by advanced diagnostic tools.

Challenges Impacting Aircraft Battery Charging And Testing Growth

Several challenges impact the growth of the Aircraft Battery Charging And Testing market. The significant capital expenditure required for acquiring cutting-edge charging and testing equipment can be a considerable barrier, particularly for smaller MRO providers and regional airlines. The rapid pace of technological advancement in battery technology necessitates ongoing investment in research and development for testing equipment manufacturers, creating a challenge to stay ahead of the curve. Supply chain vulnerabilities, especially concerning the availability of specialized electronic components, can lead to production delays and increased costs. Navigating complex and evolving regulatory landscapes across different regions requires continuous adaptation and can lead to extended certification timelines for new products. Intense competitive pressures within the market also necessitate strategic differentiation and continuous innovation to maintain market share.

Key Players Shaping the Aircraft Battery Charging And Testing Market

- ATEQ AVIATION

- Blue Skies Aviation

- DUNCAN AVIATION

- Saft

- ARBIN INSTRUMENTS

- Concorde Battery Corporation

- Enersys

- The Boeing Company

- GS Yuasa Corporation

- Securaplane Technologies

Significant Aircraft Battery Charging And Testing Industry Milestones

- 2019: Increased adoption of Li-ion battery technology in commercial aircraft, driving demand for specialized testing equipment.

- 2020: Emergence of AI-powered diagnostic tools for predictive battery maintenance.

- 2021: Stringent regulatory updates from EASA and FAA emphasizing battery health monitoring.

- 2022: Significant M&A activity as larger players acquire specialized testing technology firms.

- 2023: Development of faster charging solutions to reduce aircraft turnaround times.

- 2024: Increased focus on sustainable battery disposal and recycling in MRO processes.

Future Outlook for Aircraft Battery Charging And Testing Market

- 2019: Increased adoption of Li-ion battery technology in commercial aircraft, driving demand for specialized testing equipment.

- 2020: Emergence of AI-powered diagnostic tools for predictive battery maintenance.

- 2021: Stringent regulatory updates from EASA and FAA emphasizing battery health monitoring.

- 2022: Significant M&A activity as larger players acquire specialized testing technology firms.

- 2023: Development of faster charging solutions to reduce aircraft turnaround times.

- 2024: Increased focus on sustainable battery disposal and recycling in MRO processes.

Future Outlook for Aircraft Battery Charging And Testing Market

The future outlook for the Aircraft Battery Charging And Testing market is exceptionally positive, driven by continued growth in global aviation and an unwavering commitment to safety and operational efficiency. Strategic opportunities lie in the development of integrated, smart charging and testing systems that leverage IoT and AI for real-time data analysis and predictive maintenance. The increasing adoption of advanced battery chemistries will further propel demand for specialized testing solutions. The market potential is substantial, with an anticipated surge in demand for retrofitting older aircraft with advanced battery management systems and the continuous development of next-generation charging infrastructure. Early adoption of emerging technologies and a focus on providing comprehensive, end-to-end solutions will be crucial for players aiming to capitalize on this expanding market.

Aircraft Battery Charging And Testing Segmentation

-

1. Application

- 1.1. Commercial Aircraft

- 1.2. Private Aircraft

-

2. Type

- 2.1. Capacity Test

- 2.2. Charge Acceptance Test

Aircraft Battery Charging And Testing Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Aircraft Battery Charging And Testing REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aircraft Battery Charging And Testing Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial Aircraft

- 5.1.2. Private Aircraft

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Capacity Test

- 5.2.2. Charge Acceptance Test

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Aircraft Battery Charging And Testing Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial Aircraft

- 6.1.2. Private Aircraft

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Capacity Test

- 6.2.2. Charge Acceptance Test

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Aircraft Battery Charging And Testing Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial Aircraft

- 7.1.2. Private Aircraft

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Capacity Test

- 7.2.2. Charge Acceptance Test

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Aircraft Battery Charging And Testing Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial Aircraft

- 8.1.2. Private Aircraft

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Capacity Test

- 8.2.2. Charge Acceptance Test

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Aircraft Battery Charging And Testing Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commercial Aircraft

- 9.1.2. Private Aircraft

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Capacity Test

- 9.2.2. Charge Acceptance Test

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Aircraft Battery Charging And Testing Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Commercial Aircraft

- 10.1.2. Private Aircraft

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Capacity Test

- 10.2.2. Charge Acceptance Test

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 ATEQ AVIATION

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Blue Skies Aviation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DUNCAN AVIATION

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Saft

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ARBIN INSTRUMENTS

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Concorde Battery Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Enersys

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 The Boeing Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 GS Yuasa Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Securaplane Technologies

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 ATEQ AVIATION

List of Figures

- Figure 1: Global Aircraft Battery Charging And Testing Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Aircraft Battery Charging And Testing Revenue (million), by Application 2024 & 2032

- Figure 3: North America Aircraft Battery Charging And Testing Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Aircraft Battery Charging And Testing Revenue (million), by Type 2024 & 2032

- Figure 5: North America Aircraft Battery Charging And Testing Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Aircraft Battery Charging And Testing Revenue (million), by Country 2024 & 2032

- Figure 7: North America Aircraft Battery Charging And Testing Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Aircraft Battery Charging And Testing Revenue (million), by Application 2024 & 2032

- Figure 9: South America Aircraft Battery Charging And Testing Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Aircraft Battery Charging And Testing Revenue (million), by Type 2024 & 2032

- Figure 11: South America Aircraft Battery Charging And Testing Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Aircraft Battery Charging And Testing Revenue (million), by Country 2024 & 2032

- Figure 13: South America Aircraft Battery Charging And Testing Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Aircraft Battery Charging And Testing Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Aircraft Battery Charging And Testing Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Aircraft Battery Charging And Testing Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Aircraft Battery Charging And Testing Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Aircraft Battery Charging And Testing Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Aircraft Battery Charging And Testing Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Aircraft Battery Charging And Testing Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Aircraft Battery Charging And Testing Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Aircraft Battery Charging And Testing Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Aircraft Battery Charging And Testing Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Aircraft Battery Charging And Testing Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Aircraft Battery Charging And Testing Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Aircraft Battery Charging And Testing Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Aircraft Battery Charging And Testing Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Aircraft Battery Charging And Testing Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Aircraft Battery Charging And Testing Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Aircraft Battery Charging And Testing Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Aircraft Battery Charging And Testing Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Aircraft Battery Charging And Testing Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Aircraft Battery Charging And Testing Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Aircraft Battery Charging And Testing Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Aircraft Battery Charging And Testing Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Aircraft Battery Charging And Testing Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Aircraft Battery Charging And Testing Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Aircraft Battery Charging And Testing Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Aircraft Battery Charging And Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Aircraft Battery Charging And Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Aircraft Battery Charging And Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Aircraft Battery Charging And Testing Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Aircraft Battery Charging And Testing Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Aircraft Battery Charging And Testing Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Aircraft Battery Charging And Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Aircraft Battery Charging And Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Aircraft Battery Charging And Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Aircraft Battery Charging And Testing Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Aircraft Battery Charging And Testing Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Aircraft Battery Charging And Testing Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Aircraft Battery Charging And Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Aircraft Battery Charging And Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Aircraft Battery Charging And Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Aircraft Battery Charging And Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Aircraft Battery Charging And Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Aircraft Battery Charging And Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Aircraft Battery Charging And Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Aircraft Battery Charging And Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Aircraft Battery Charging And Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Aircraft Battery Charging And Testing Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Aircraft Battery Charging And Testing Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Aircraft Battery Charging And Testing Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Aircraft Battery Charging And Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Aircraft Battery Charging And Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Aircraft Battery Charging And Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Aircraft Battery Charging And Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Aircraft Battery Charging And Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Aircraft Battery Charging And Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Aircraft Battery Charging And Testing Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Aircraft Battery Charging And Testing Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Aircraft Battery Charging And Testing Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Aircraft Battery Charging And Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Aircraft Battery Charging And Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Aircraft Battery Charging And Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Aircraft Battery Charging And Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Aircraft Battery Charging And Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Aircraft Battery Charging And Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Aircraft Battery Charging And Testing Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aircraft Battery Charging And Testing?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Aircraft Battery Charging And Testing?

Key companies in the market include ATEQ AVIATION, Blue Skies Aviation, DUNCAN AVIATION, Saft, ARBIN INSTRUMENTS, Concorde Battery Corporation, Enersys, The Boeing Company, GS Yuasa Corporation, Securaplane Technologies.

3. What are the main segments of the Aircraft Battery Charging And Testing?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aircraft Battery Charging And Testing," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aircraft Battery Charging And Testing report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aircraft Battery Charging And Testing?

To stay informed about further developments, trends, and reports in the Aircraft Battery Charging And Testing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence