Key Insights

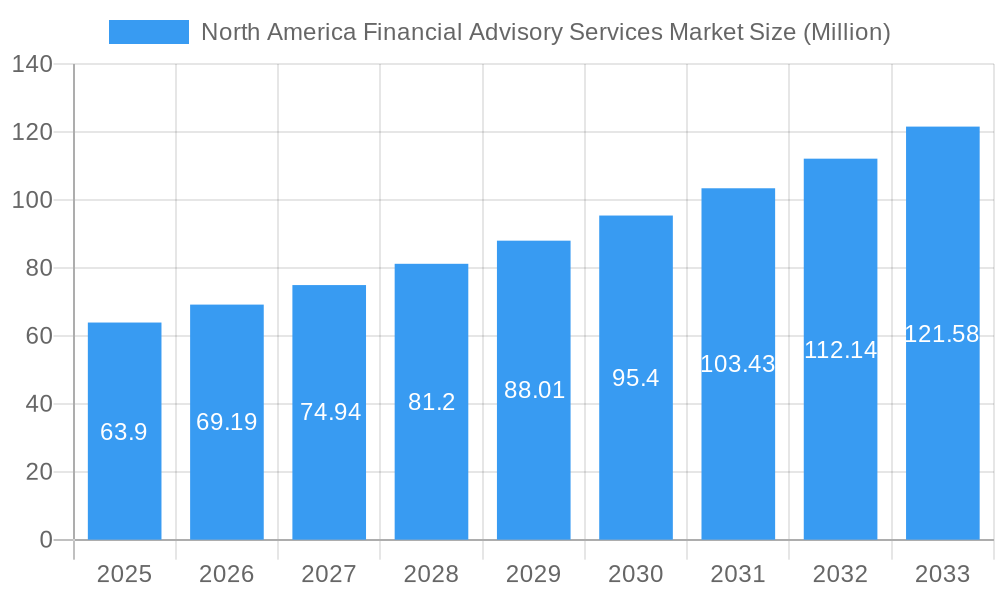

The North America Financial Advisory Services Market is poised for substantial growth, projected to reach a significant size of approximately USD 63.90 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8.12% expected to propel it through 2033. This expansion is primarily fueled by an increasing demand for sophisticated financial planning, risk management, and strategic guidance across diverse organizational sizes, from large enterprises to small and medium-sized businesses. The BFSI, IT & Telecom, and Manufacturing sectors are leading the charge, leveraging financial advisory services to navigate complex regulatory landscapes, optimize capital allocation, and drive innovation. Emerging trends such as the digital transformation of financial services, the rise of FinTech, and a growing emphasis on Environmental, Social, and Governance (ESG) investing are further shaping market dynamics, necessitating specialized expertise.

North America Financial Advisory Services Market Market Size (In Million)

Despite the positive outlook, the market faces certain restraints. The intense competition among established players and emerging FinTech startups, coupled with the ongoing need for talent acquisition and retention of skilled financial professionals, present ongoing challenges. Regulatory complexities and data privacy concerns also require careful management. Nevertheless, the overarching drivers—including the need for strategic financial decision-making, cross-border transactions, and the demand for specialized tax and accounting advisory services—remain strong. Corporate finance and transaction services are particularly in demand as companies seek to optimize their financial structures and capitalize on growth opportunities. The market's structure, encompassing various service types and industry verticals, indicates a highly segmented yet interconnected ecosystem driven by evolving economic conditions and business imperatives in North America.

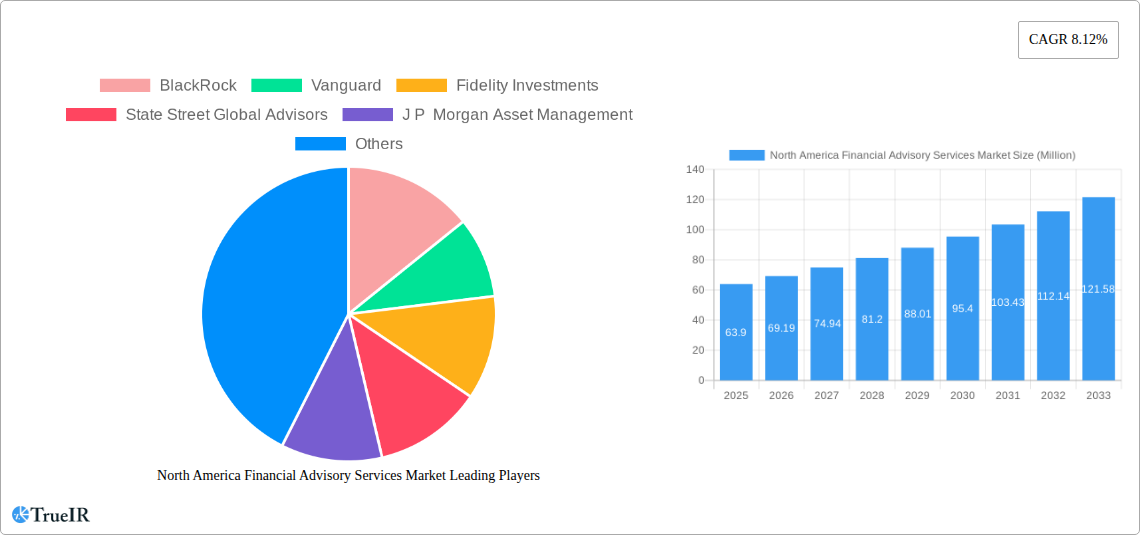

North America Financial Advisory Services Market Company Market Share

This in-depth report provides a definitive analysis of the North America Financial Advisory Services Market, offering critical insights for strategic decision-making. Covering the historical period of 2019-2024 and projecting growth through 2033, this research delves into market dynamics, key players, emerging trends, and future opportunities. With a base year of 2025, the report leverages high-volume SEO keywords to ensure maximum discoverability for industry professionals seeking comprehensive market intelligence. This report is designed for immediate use without requiring further modification.

North America Financial Advisory Services Market Market Structure & Competitive Landscape

The North America Financial Advisory Services Market exhibits a moderately concentrated structure, characterized by the significant presence of both established global giants and specialized boutique firms. Innovation drivers are primarily fueled by technological advancements in AI, machine learning, and data analytics, enabling more sophisticated risk assessment, fraud detection, and personalized financial strategies. Regulatory impacts, while presenting compliance challenges, also foster a demand for expert advisory services, particularly in areas like cross-border taxation and evolving ESG (Environmental, Social, and Governance) mandates. Product substitutes, though limited in the core advisory functions, can arise from in-house capabilities or simpler software solutions for smaller enterprises. The end-user segmentation is diverse, spanning large enterprises to small and medium-sized enterprises (SMEs), each with unique needs for corporate finance, accounting, tax, transaction, and risk management services. Mergers and acquisitions (M&A) are a significant trend, driven by the pursuit of enhanced capabilities, expanded client bases, and market consolidation. For instance, recent M&A activity indicates a strategic push to integrate technology and specialized expertise. The market is projected to see an increase in consolidation as firms seek scale and competitive advantage. Key players are actively engaged in acquiring smaller, agile companies with niche expertise or innovative technologies. Industry concentration ratios suggest that the top 5 players hold approximately 40% of the market share, with significant growth potential for those focusing on specialized segments like fintech advisory and sustainable finance.

North America Financial Advisory Services Market Market Trends & Opportunities

The North America Financial Advisory Services Market is poised for robust expansion, driven by a confluence of accelerating economic recovery, increasing regulatory complexity, and a burgeoning demand for specialized financial guidance. The market size is projected to reach an estimated USD 350,000 Million by 2025, with a projected Compound Annual Growth Rate (CAGR) of 7.5% during the forecast period of 2025–2033. This impressive growth trajectory is underpinned by several transformative trends. Technological shifts are at the forefront, with the integration of artificial intelligence (AI), machine learning (ML), and big data analytics revolutionizing how advisory services are delivered. These technologies are enabling real-time financial insights, predictive modeling for risk management, and hyper-personalized client experiences. Firms are leveraging AI-powered platforms for automated due diligence, fraud detection, and algorithmic trading strategies, thereby enhancing efficiency and accuracy. Consumer preferences are increasingly shifting towards digital-first, agile, and value-driven advisory solutions. Clients, both corporate and individual, expect seamless digital interactions, transparent fee structures, and tailored advice that addresses their evolving financial goals, including sustainability and impact investing. The competitive dynamics are intensifying, with a discernible bifurcation between large, full-service advisory firms and niche specialists. Companies are strategically investing in digital transformation and talent acquisition to stay ahead. The rise of FinTech has also spurred demand for specialized advisory services related to blockchain, cryptocurrencies, and digital asset management. Furthermore, the growing emphasis on Environmental, Social, and Governance (ESG) principles is creating a significant new frontier for financial advisory, with companies seeking guidance on sustainable investments, reporting, and compliance. This presents a substantial opportunity for advisory firms to develop expertise in ESG strategy and implementation. The increasing globalization of businesses necessitates cross-border financial advisory, focusing on international taxation, regulatory compliance, and global investment strategies. The market penetration rates for specialized services like cybersecurity risk assessment and data privacy consulting are rapidly increasing. The ongoing digital transformation across industries is directly translating into a higher demand for IT and Telecom financial advisory, particularly in areas of cloud migration, cybersecurity, and digital infrastructure investments. Opportunities also lie in supporting the burgeoning startup ecosystem with venture capital advisory, funding strategies, and scaling guidance. The need for robust financial planning and restructuring in response to economic uncertainties and supply chain disruptions is creating sustained demand for corporate finance and transaction services. The healthcare sector, with its complex regulatory environment and increasing M&A activity, represents another fertile ground for specialized financial advisory. The retail and e-commerce sector's rapid evolution, driven by digitalization and changing consumer behaviors, requires sophisticated financial strategies for inventory management, online payment systems, and market expansion. The public sector, facing fiscal pressures and a need for efficient resource allocation, is also increasingly seeking expert financial advisory to optimize operations and manage public funds effectively.

Dominant Markets & Segments in North America Financial Advisory Services Market

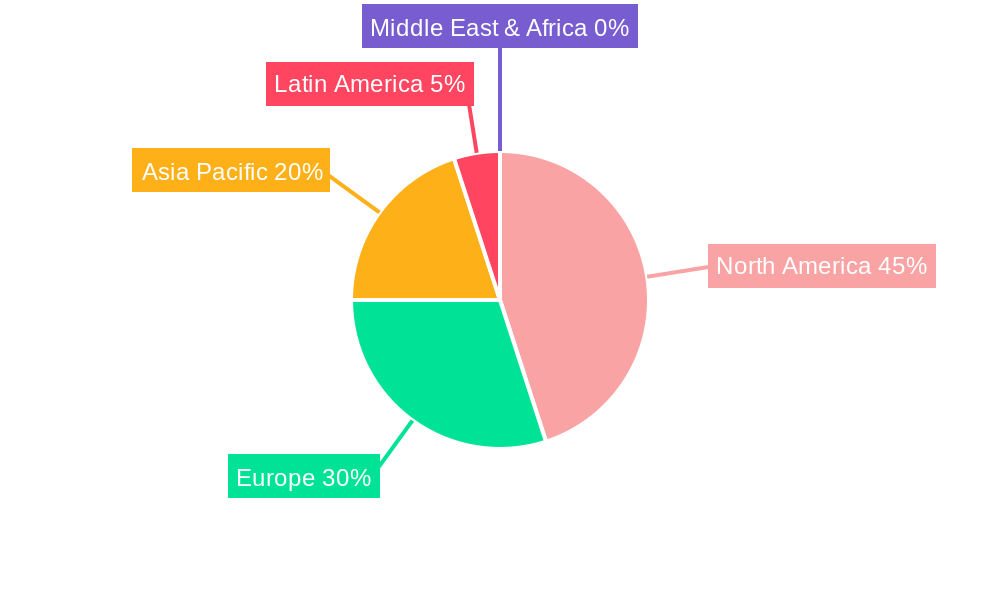

The North America Financial Advisory Services Market is characterized by distinct dominant regions and segments, each exhibiting unique growth drivers and market penetration.

Dominant Region: The United States unequivocally leads the North American market, accounting for over 70% of the total market revenue. This dominance is attributed to its large and sophisticated economy, a robust financial services sector, a highly developed regulatory framework, and a substantial presence of large enterprises and high-growth startups. Canada follows, contributing a significant but smaller share, with its own growing financial advisory needs driven by its natural resources sector and increasing focus on innovation.

Dominant Segments by Type:

- Corporate Finance: This segment consistently holds the largest market share, driven by the constant need for mergers and acquisitions (M&A), capital raising, financial restructuring, and strategic planning by businesses across all sectors. The complexity of global financial markets and the pursuit of strategic growth initiatives fuel this demand.

- Transaction Services: Closely following Corporate Finance, Transaction Services are critical for due diligence, valuation, and post-merger integration. The high volume of M&A activities in sectors like technology and healthcare directly boosts the demand for these services.

- Risk Management: As regulatory scrutiny intensifies and economic volatility persists, businesses are increasingly investing in robust risk management frameworks. This includes financial risk, operational risk, and cybersecurity risk, making this a rapidly growing segment.

- Tax Advisory: The ever-changing tax landscapes, both domestically and internationally, necessitate expert tax advisory services for compliance, optimization, and strategic planning. The growth of cross-border transactions and evolving tax legislations contribute significantly to this segment.

- Accounting Advisory: While often integrated with other services, specialized accounting advisory for complex financial reporting standards, forensic accounting, and internal control assessments remains crucial, especially for publicly traded companies and those undergoing significant financial transformations.

Dominant Segments by Organization Size:

- Large Enterprises: These organizations are the primary consumers of comprehensive financial advisory services, requiring sophisticated solutions for complex financial challenges, global operations, and strategic decision-making. Their substantial financial resources allow for significant investment in advisory partnerships.

- Small & Medium-Sized Enterprises (SMEs): While individually smaller in spend, the sheer volume of SMEs in North America represents a significant and growing market. They increasingly seek scalable and cost-effective advisory services for startup funding, operational efficiency, and digital transformation.

Dominant Segments by Industry Vertical:

- BFSI (Banking, Financial Services, and Insurance): This sector is the largest consumer of financial advisory services, driven by its inherent complexity, stringent regulations, and constant need for risk management, compliance, and strategic innovation. M&A activity within BFSI is also a significant driver.

- IT And Telecom: The rapid pace of technological change, digital transformation initiatives, and substantial M&A activity in this sector create a continuous demand for specialized financial advisory services, including funding for R&D, cybersecurity advisory, and digital infrastructure investment.

- Healthcare: This industry is experiencing significant growth in M&A, regulatory changes, and the adoption of new technologies, all of which require expert financial advisory for strategic planning, compliance, and operational efficiency.

- Manufacturing: As the sector navigates supply chain disruptions, automation, and global market shifts, there is a growing need for financial advisory in areas of operational efficiency, investment in new technologies, and international trade finance.

North America Financial Advisory Services Market Product Analysis

The North America Financial Advisory Services Market is witnessing a significant surge in product innovation, driven by technological advancements and evolving client needs. Firms are increasingly offering digitally-enabled advisory solutions, leveraging AI and machine learning for predictive analytics, automated reporting, and enhanced risk assessment. Applications span across corporate finance, transaction services, and tax advisory, providing clients with real-time insights and more efficient decision-making processes. Competitive advantages are increasingly derived from the ability to offer integrated, end-to-end solutions that combine deep industry expertise with cutting-edge technology, ensuring a personalized and value-driven client experience. The focus is on delivering actionable intelligence that directly translates into improved financial performance and strategic advantage.

Key Drivers, Barriers & Challenges in North America Financial Advisory Services Market

Key Drivers:

- Technological Advancements: The widespread adoption of AI, ML, and big data analytics is transforming advisory services, enabling more sophisticated insights and efficient delivery.

- Regulatory Evolution: Increasingly complex domestic and international regulations, particularly in areas of ESG, data privacy, and cross-border finance, drive demand for expert guidance.

- Economic Volatility and Uncertainty: Global economic shifts, supply chain disruptions, and inflation necessitate strategic financial planning, risk mitigation, and restructuring services.

- Mergers & Acquisitions Activity: A consistently active M&A landscape fuels the demand for transaction services, due diligence, and post-merger integration advisory.

- Digital Transformation: Across all industries, the push for digital transformation requires specialized financial advisory for investment, implementation, and risk management.

Barriers & Challenges:

- Intense Competition: The market is characterized by a high degree of competition from established players, boutique firms, and in-house capabilities, leading to pricing pressures.

- Talent Acquisition and Retention: A shortage of skilled professionals with both financial expertise and technological acumen poses a significant challenge for service providers.

- Data Security and Privacy Concerns: Handling sensitive client financial data necessitates robust cybersecurity measures and compliance with evolving data privacy regulations, which can be costly.

- Economic Downturns: While volatility can drive demand for certain services, severe economic downturns can lead to reduced corporate spending on advisory services.

- Adapting to Rapid Technological Change: Keeping pace with the rapid evolution of technology and integrating new tools effectively requires continuous investment and training.

Growth Drivers in the North America Financial Advisory Services Market Market

The North America Financial Advisory Services Market is experiencing significant growth fueled by several key factors. Technological innovation, particularly the integration of Artificial Intelligence (AI) and Machine Learning (ML), is revolutionizing service delivery, enabling predictive analytics, automated processes, and personalized client experiences. Economic resilience and the ongoing pursuit of strategic growth by businesses across various sectors are driving demand for corporate finance, M&A advisory, and capital raising services. Furthermore, the ever-evolving regulatory landscape, encompassing areas like ESG compliance, data privacy, and international tax laws, necessitates specialized expert guidance, thereby boosting the demand for tax and risk management advisory services. The increasing emphasis on sustainable finance and impact investing presents a substantial opportunity for advisory firms to develop niche expertise and cater to a growing client base focused on responsible investment strategies. The robust activity in the Mergers & Acquisitions (M&A) market also continues to be a significant growth catalyst, demanding comprehensive transaction advisory services.

Challenges Impacting North America Financial Advisory Services Market Growth

Despite the robust growth, the North America Financial Advisory Services Market faces several significant challenges. The intense competitive landscape, characterized by the presence of both large global firms and agile niche specialists, can lead to pricing pressures and market fragmentation. A persistent challenge is the acquisition and retention of top talent; the demand for professionals with a blend of financial acumen and technological proficiency often outstrips supply. Cybersecurity and data privacy concerns are paramount, as firms handle highly sensitive client financial information, requiring substantial investments in robust security infrastructure and compliance with stringent regulations. Economic downturns, while sometimes spurring demand for restructuring, can also lead to a general reduction in corporate discretionary spending on advisory services. Finally, the rapid pace of technological change demands continuous investment in new tools and training, posing a challenge for firms to remain agile and innovative.

Key Players Shaping the North America Financial Advisory Services Market Market

The North America Financial Advisory Services Market is shaped by a diverse array of prominent organizations, each contributing to market dynamics through their specialized offerings and strategic initiatives. These include global financial powerhouses, renowned consulting firms, and leading asset managers.

- BlackRock

- Vanguard

- Fidelity Investments

- State Street Global Advisors

- J P Morgan Asset Management

- Boston Consulting Group

- Ernst & Young Global Limited

- Bain & Company

- PWC

- Deloitte

Significant North America Financial Advisory Services Market Industry Milestones

- February 2023: Deloitte bolstered its start-up and scale-up capabilities by acquiring 27 pilots, a Germany-based incubator, a venture capitalist, and a matchmaker. With 27 pilots as part of its portfolio, Deloitte can better serve its base of start-ups and scale-ups with a full range of services, from incubation and growth to technology, infrastructure, and venture capital solutions.

- January 2023: Fidelity Investments acquired Shoobx, a provider of automated equity management operations and financing software for private companies. The financial terms of the deal were not disclosed.

Future Outlook for North America Financial Advisory Services Market Market

The future outlook for the North America Financial Advisory Services Market remains exceptionally strong, driven by continued economic recovery, increasing regulatory complexity, and an accelerating pace of digital transformation across industries. Strategic opportunities abound for firms that can adeptly integrate advanced technologies like AI and blockchain to offer enhanced predictive analytics, automated compliance, and personalized financial strategies. The growing emphasis on Environmental, Social, and Governance (ESG) factors presents a significant growth catalyst, as businesses increasingly seek guidance on sustainable investments, reporting, and ethical operations. The market potential is further amplified by the sustained activity in mergers and acquisitions, cross-border transactions, and the ongoing need for sophisticated risk management and financial restructuring services. Advisory firms that invest in specialized expertise, cultivate digital capabilities, and demonstrate agility in navigating evolving market demands are well-positioned for substantial growth and market leadership in the coming years.

North America Financial Advisory Services Market Segmentation

-

1. Type

- 1.1. Corporate Finance

- 1.2. Accounting Advisory

- 1.3. Tax Advisory

- 1.4. Transaction Services

- 1.5. Risk Management

- 1.6. Others

-

2. Organization Size

- 2.1. Large Enterprises

- 2.2. Small & Medium-Sized Enterprises

-

3. Industry Vertical

- 3.1. BFSI

- 3.2. IT And Telecom

- 3.3. Manufacturing

- 3.4. Retail And E-Commerce

- 3.5. Public Sector

- 3.6. Healthcare

- 3.7. Others

North America Financial Advisory Services Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Financial Advisory Services Market Regional Market Share

Geographic Coverage of North America Financial Advisory Services Market

North America Financial Advisory Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Use of Robot Advisory Services is Growing in North America.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Financial Advisory Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Corporate Finance

- 5.1.2. Accounting Advisory

- 5.1.3. Tax Advisory

- 5.1.4. Transaction Services

- 5.1.5. Risk Management

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. Large Enterprises

- 5.2.2. Small & Medium-Sized Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. BFSI

- 5.3.2. IT And Telecom

- 5.3.3. Manufacturing

- 5.3.4. Retail And E-Commerce

- 5.3.5. Public Sector

- 5.3.6. Healthcare

- 5.3.7. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BlackRock

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vanguard

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fidelity Investments

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 State Street Global Advisors

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 J P Morgan Asset Management

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Boston Consulting Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ernst & Young Global Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bain & Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PWC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Deloitte**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 BlackRock

List of Figures

- Figure 1: North America Financial Advisory Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Financial Advisory Services Market Share (%) by Company 2025

List of Tables

- Table 1: North America Financial Advisory Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: North America Financial Advisory Services Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: North America Financial Advisory Services Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 4: North America Financial Advisory Services Market Volume Billion Forecast, by Organization Size 2020 & 2033

- Table 5: North America Financial Advisory Services Market Revenue Million Forecast, by Industry Vertical 2020 & 2033

- Table 6: North America Financial Advisory Services Market Volume Billion Forecast, by Industry Vertical 2020 & 2033

- Table 7: North America Financial Advisory Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: North America Financial Advisory Services Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: North America Financial Advisory Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: North America Financial Advisory Services Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: North America Financial Advisory Services Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 12: North America Financial Advisory Services Market Volume Billion Forecast, by Organization Size 2020 & 2033

- Table 13: North America Financial Advisory Services Market Revenue Million Forecast, by Industry Vertical 2020 & 2033

- Table 14: North America Financial Advisory Services Market Volume Billion Forecast, by Industry Vertical 2020 & 2033

- Table 15: North America Financial Advisory Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: North America Financial Advisory Services Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United States North America Financial Advisory Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States North America Financial Advisory Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Canada North America Financial Advisory Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada North America Financial Advisory Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Mexico North America Financial Advisory Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico North America Financial Advisory Services Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Financial Advisory Services Market?

The projected CAGR is approximately 8.12%.

2. Which companies are prominent players in the North America Financial Advisory Services Market?

Key companies in the market include BlackRock, Vanguard, Fidelity Investments, State Street Global Advisors, J P Morgan Asset Management, Boston Consulting Group, Ernst & Young Global Limited, Bain & Company, PWC, Deloitte**List Not Exhaustive.

3. What are the main segments of the North America Financial Advisory Services Market?

The market segments include Type, Organization Size, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 63.90 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Use of Robot Advisory Services is Growing in North America..

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Deloitte boosted its start-up and scale-up capabilities by acquiring 27 pilots, a Germany-based incubator, a venture capitalist, and a matchmaker. With 27 pilots as part of its portfolio, Deloitte can better serve its base of start-ups and scale-ups with a full range of services, from incubation and growth to technology, infrastructure, and venture capital solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Financial Advisory Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Financial Advisory Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Financial Advisory Services Market?

To stay informed about further developments, trends, and reports in the North America Financial Advisory Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence