Key Insights

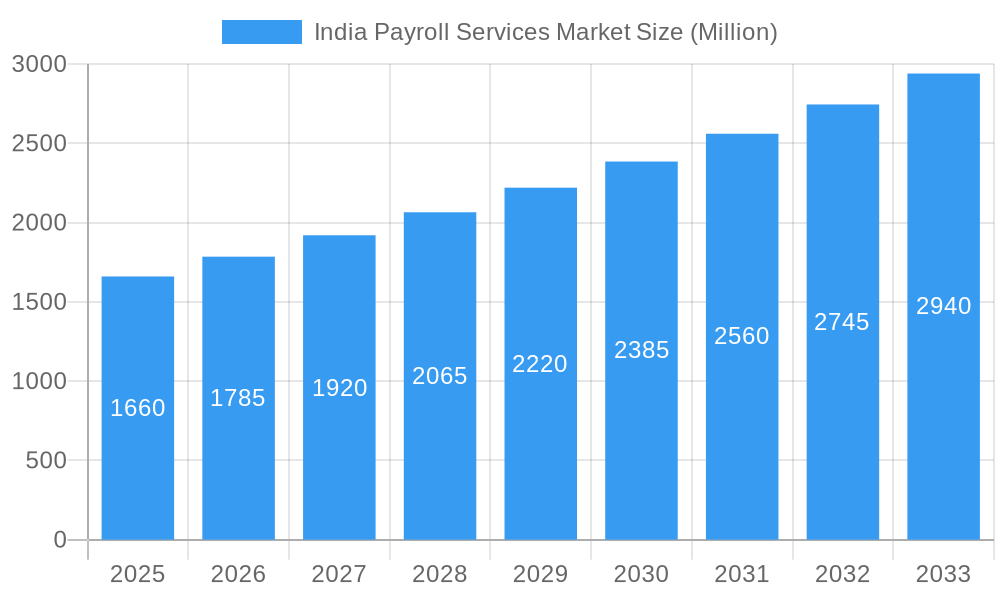

The Indian payroll services market is poised for robust expansion, projected to reach a valuation of $1.66 billion, driven by a compelling compound annual growth rate (CAGR) of 7.49%. This dynamic growth is primarily fueled by the increasing adoption of cloud-based payroll solutions, the growing complexity of labor laws and compliance requirements, and the rising trend of outsourcing non-core business functions by Indian enterprises. Small and medium-sized enterprises (SMEs) are increasingly leveraging payroll services to streamline operations, reduce costs, and ensure compliance, while large enterprises are focusing on sophisticated, integrated payroll systems for greater efficiency and strategic workforce management. The IT and Telecommunication sector, along with BFSI, are leading the charge in adopting these services, owing to their high volume of employees and stringent regulatory landscapes.

India Payroll Services Market Market Size (In Billion)

The market's upward trajectory is further supported by the continuous innovation in payroll technology, offering features such as automated tax calculations, direct deposit, employee self-service portals, and advanced analytics. While the market is largely driven by positive growth factors, certain restraints, such as concerns over data security and the initial investment costs for advanced systems, may slightly temper its pace. However, the overarching benefits of enhanced accuracy, reduced administrative burden, and improved employee satisfaction are compelling businesses to overcome these challenges. Key players are actively innovating and expanding their offerings to cater to the diverse needs of various industry segments and organizational sizes across India, ensuring sustained market development and a highly competitive landscape.

India Payroll Services Market Company Market Share

Unlock strategic insights into the burgeoning India Payroll Services Market with this in-depth report. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this comprehensive analysis delves into market dynamics, key players, and future trajectories. Driven by increasing digital adoption, evolving labor laws, and the growing demand for specialized HR solutions, the Indian payroll services sector is poised for significant expansion. This report provides essential data and expert analysis for businesses seeking to navigate and capitalize on this dynamic market.

India Payroll Services Market Market Structure & Competitive Landscape

The India Payroll Services Market is characterized by a moderate to high degree of fragmentation, with a blend of global behemoths and agile domestic players vying for market share. Innovation is a key differentiator, with companies continuously investing in advanced technologies such as cloud computing, AI, and automation to enhance service delivery, improve data security, and offer seamless user experiences. Regulatory frameworks surrounding labor, taxation, and data privacy play a crucial role in shaping the market, demanding constant adaptation from service providers. Product substitutes, including in-house payroll management software and manual processing, are gradually diminishing as the efficiency and compliance benefits of professional outsourcing become more apparent. End-user segmentation is diverse, spanning critical sectors like BFSI, IT & Telecommunication, Consumer & Industrial Products, Healthcare, and the Public Sector, each with unique payroll requirements. Mergers and acquisitions (M&A) are an active trend, with larger players acquiring smaller, niche providers to expand their service portfolios and geographical reach. The concentration ratio is projected to be around 35-40% among the top 5 players by 2025, indicating a competitive yet consolidating landscape.

- Market Concentration: Moderate to high, with a growing influence of larger, integrated service providers.

- Innovation Drivers: Cloud-based solutions, AI-powered automation, real-time analytics, and enhanced data security protocols.

- Regulatory Impacts: Evolving tax reforms (e.g., GST), labor law amendments, and data protection regulations necessitate robust compliance frameworks.

- Product Substitutes: In-house payroll systems, manual processing, and basic accounting software.

- End-User Segmentation: BFSI, IT & Telecommunication, Consumer & Industrial Products, Public Sector, Healthcare, and others.

- M&A Trends: Consolidation through strategic acquisitions to gain market share and expand service offerings.

India Payroll Services Market Market Trends & Opportunities

The India Payroll Services Market is experiencing robust growth, projected to reach an estimated value of XX Billion USD by 2025, with a Compound Annual Growth Rate (CAGR) of approximately 12-15% during the forecast period (2025–2033). This expansion is fueled by several compelling trends. Firstly, the increasing complexity of India's labor laws and tax regulations, including the Goods and Services Tax (GST), necessitates specialized expertise that many businesses, particularly Small and Medium-Sized Enterprises (SMEs), find challenging to manage internally. This creates a significant demand for fully outsourced and hybrid payroll solutions. Secondly, the rapid digitalization across industries is driving the adoption of cloud-based payroll platforms, offering enhanced accessibility, scalability, and real-time data processing capabilities. Companies like ADP and SAP are at the forefront of this digital transformation, with their recent advancements in generative AI for payroll validation and cloud-based solutions respectively, significantly impacting operational efficiency and strategic focus for HR professionals.

Furthermore, the growing IT and Telecommunication sector, along with the BFSI and Consumer and Industrial Products industries, are major contributors to market growth due to their large employee bases and stringent compliance requirements. The expanding gig economy and the rise of contract workers also present unique payroll processing challenges, opening up opportunities for service providers offering flexible and compliant solutions. The government's focus on Ease of Doing Business and Digital India initiatives further encourages formalization and outsourcing of payroll functions. Opportunities abound for providers who can offer integrated HR solutions, advanced analytics for workforce management, and robust cybersecurity measures to protect sensitive employee data. The market penetration rate for professional payroll services is expected to climb from an estimated XX% in 2024 to over XX% by 2033, signifying substantial untapped potential. The increasing adoption of advanced technologies is not merely about task automation; it's about empowering HR departments to transition from transactional processing to strategic workforce planning and employee engagement. The competitive landscape is intensifying, with companies like Infosys Limited, Quikchex, Paysquare, and ZingHR innovating to offer tailored solutions for various business sizes and industry verticals.

Dominant Markets & Segments in India Payroll Services Market

The India Payroll Services Market exhibits clear dominance across specific segments, driven by distinct growth catalysts and evolving business needs.

Dominant Segments by Type:

- Hybrid Payroll Services: This segment is experiencing significant traction as businesses seek a balance between in-house control and external expertise. Hybrid models allow organizations to retain certain payroll functions while outsourcing others, offering flexibility and cost-effectiveness. Key growth drivers include:

- The need for specialized compliance management for complex tax laws.

- Desire to leverage advanced payroll technology without complete relinquishment of internal oversight.

- Cost-efficiency compared to fully outsourced models for certain operational scales.

- Fully Outsourced Payroll Services: This segment continues to be a strong contender, particularly for Small and Medium-Sized Enterprises (SMEs) that lack the internal resources or expertise to manage payroll effectively. The increasing complexity of Indian labor laws and the desire for businesses to focus on core competencies are significant drivers.

Dominant Segments by Organization Size:

- Small and Medium-Sized Enterprises (SMEs): This segment represents a vast and rapidly growing opportunity. SMEs often lack dedicated HR departments and struggle with the intricacies of payroll compliance. Professional payroll services offer them an affordable and efficient solution, enabling them to scale without significant overhead. The "Startup India" initiative and government support for SMEs are further fueling their growth and, consequently, the demand for payroll outsourcing.

- Large Enterprises: While large enterprises often have in-house payroll departments, they are increasingly opting for outsourced or hybrid solutions to gain access to advanced technologies, improve efficiency, and ensure global compliance. The sheer volume of employees and the complexity of operations in these organizations make specialized payroll providers an attractive proposition.

Dominant Segments by End-User:

- IT and Telecommunication: This sector consistently leads in the adoption of payroll services due to its rapid growth, dynamic workforce, and global operational presence. Companies in this industry often deal with complex compensation structures, international assignments, and a high demand for efficient and accurate payroll processing to attract and retain talent.

- BFSI (Banking, Financial Services, and Insurance): The BFSI sector is heavily regulated and places a premium on data security and compliance. Outsourcing payroll allows these institutions to adhere to stringent regulations and leverage advanced technology for secure and accurate processing of sensitive employee data.

- Consumer and Industrial Products: This broad sector, encompassing manufacturing and retail, is also a significant market. As these industries scale and expand, the need for streamlined payroll operations to manage a large and often distributed workforce becomes paramount.

The dominance of these segments is further propelled by government policies promoting formalization of employment, digital India initiatives, and a general shift towards specialized outsourcing for non-core business functions. The demand for cloud-based solutions, real-time reporting, and integration with other HR systems are key trends that influence the preference for dominant service providers in these segments.

India Payroll Services Market Product Analysis

The India Payroll Services Market is witnessing a surge in product innovation, driven by the need for greater efficiency, accuracy, and compliance. Cloud-based platforms are now standard, offering seamless access and real-time data management. Key advancements include the integration of Artificial Intelligence (AI) and Machine Learning (ML) for automated validation, anomaly detection, and predictive analytics, as demonstrated by ADP's recent enhancements. Solutions are increasingly offering end-to-end functionalities, from employee onboarding and time tracking to statutory compliance and tax filings. The focus is on delivering a user-friendly experience for both employers and employees, with self-service portals and mobile accessibility becoming crucial. Competitive advantages are being built on robust security features, seamless integration with other HRIS and ERP systems (like SAP S/4HANA Cloud, as highlighted by Alight Inc.'s partnership), and customizable reporting capabilities tailored to specific industry needs.

Key Drivers, Barriers & Challenges in India Payroll Services Market

Key Drivers:

- Increasing Complexity of Regulations: Evolving labor laws and tax reforms (e.g., GST) necessitate specialized expertise.

- Digital Transformation: Growing adoption of cloud-based solutions and automation for enhanced efficiency.

- Focus on Core Competencies: Businesses are increasingly outsourcing non-core functions like payroll to concentrate on strategic initiatives.

- Growth of SMEs: The expanding SME sector requires cost-effective and compliant payroll solutions.

- Demand for Data Security and Compliance: Stringent requirements drive the need for professional, secure payroll processing.

Barriers & Challenges:

- Data Security Concerns: Ensuring the confidentiality and integrity of sensitive employee data is paramount.

- Integration with Existing Systems: Challenges in seamlessly integrating new payroll solutions with legacy HR and finance systems.

- Skilled Workforce Shortage: A lack of adequately trained professionals for complex payroll management.

- Cost Sensitivity: While seeking efficiency, some smaller businesses remain price-sensitive to outsourcing costs.

- Resistance to Change: In-house teams may exhibit resistance to adopting new outsourcing models.

Growth Drivers in the India Payroll Services Market Market

The India Payroll Services Market is propelled by significant growth drivers. Technologically, the widespread adoption of cloud computing and the integration of AI are revolutionizing payroll processing, making it more efficient and intelligent. Economic factors, such as the increasing formalization of the economy and the sustained growth of sectors like IT and BFSI, are expanding the potential client base. Regulatory drivers, including the continuous evolution of tax laws and labor compliances, compel businesses to seek expert assistance. Furthermore, the government's push for digital initiatives and ease of doing business creates a favorable environment for payroll service providers. The increasing trend of remote work and hybrid work models also necessitates flexible and accessible payroll solutions, acting as another key growth catalyst.

Challenges Impacting India Payroll Services Market Growth

Several challenges are impacting the growth trajectory of the India Payroll Services Market. Regulatory complexities, while a driver, also present challenges due to the frequent changes and the need for constant updates and adaptation by service providers. Supply chain issues are less of a direct concern for services but can indirectly impact client businesses, affecting their ability to pay for services. Competitive pressures are intensifying as more players enter the market, leading to price wars and the need for continuous innovation and differentiation. Data security and privacy remain a significant concern, requiring substantial investment in robust security infrastructure and protocols to prevent breaches. Additionally, the availability of a skilled workforce capable of handling complex payroll and compliance matters can be a constraint.

Key Players Shaping the India Payroll Services Market Market

- ADP

- SAP

- Oracle

- Infosys Limited

- Quikchex

- Paysquare

- ZingHR

- Excelity Global

- Hinduja Global Solutions

- Osourc

Significant India Payroll Services Market Industry Milestones

- March 2024: Alight Inc. enhanced its partnership with SAP, integrating its Worklife platform with SAP S/4HANA Cloud to deliver a cutting-edge, cloud-based payroll solution that boosts efficiency and security.

- February 2024: ADP enhanced its HR tools by incorporating generative AI, focusing on streamlining payroll validation and automating mundane tasks to empower HR professionals for strategic endeavors.

Future Outlook for India Payroll Services Market Market

The future outlook for the India Payroll Services Market is exceptionally bright, driven by sustained economic growth, increasing regulatory complexities, and the accelerating pace of digital transformation. Strategic opportunities lie in the further development of AI-powered analytics for workforce insights, enhanced cybersecurity measures to build client trust, and the expansion of services catering to the burgeoning gig economy and remote workforces. The market is expected to witness continued consolidation, with larger players acquiring niche providers to offer comprehensive, end-to-end HR solutions. The increasing demand for specialized services in sectors like Healthcare and the Public Sector will also open new avenues for growth. Companies that can effectively leverage technology, maintain stringent compliance, and offer a superior customer experience will be best positioned to capitalize on the market's immense potential in the coming years.

India Payroll Services Market Segmentation

-

1. Type

- 1.1. Hybrid

- 1.2. Fully Outsourced

-

2. Organization Size

- 2.1. Small and Medium-Sized Enterprises

- 2.2. Large Enterprises

-

3. End-User

- 3.1. BFSI

- 3.2. Consumer and Industrial Products

- 3.3. IT and Telecommunication

- 3.4. Public Sector

- 3.5. Healthcare

- 3.6. Other End Users

India Payroll Services Market Segmentation By Geography

- 1. India

India Payroll Services Market Regional Market Share

Geographic Coverage of India Payroll Services Market

India Payroll Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.49% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Increasing Number of SMEs is Driving the Demand for Scalable Payroll Solutions; Continuous Technological Advancements and Increasing Cloud Services are Driving the Landscape

- 3.3. Market Restrains

- 3.3.1. The Increasing Number of SMEs is Driving the Demand for Scalable Payroll Solutions; Continuous Technological Advancements and Increasing Cloud Services are Driving the Landscape

- 3.4. Market Trends

- 3.4.1. Technological Advancements and Cloud Services Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Payroll Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hybrid

- 5.1.2. Fully Outsourced

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. Small and Medium-Sized Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. BFSI

- 5.3.2. Consumer and Industrial Products

- 5.3.3. IT and Telecommunication

- 5.3.4. Public Sector

- 5.3.5. Healthcare

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ADP

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SAP

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Oracle

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Infosys Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Quikchex

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Paysquare

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ZingHR

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Excelity Global

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hinduja Global Solutions

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Osourc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ADP

List of Figures

- Figure 1: India Payroll Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Payroll Services Market Share (%) by Company 2025

List of Tables

- Table 1: India Payroll Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: India Payroll Services Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: India Payroll Services Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 4: India Payroll Services Market Volume Billion Forecast, by Organization Size 2020 & 2033

- Table 5: India Payroll Services Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: India Payroll Services Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 7: India Payroll Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: India Payroll Services Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: India Payroll Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: India Payroll Services Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: India Payroll Services Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 12: India Payroll Services Market Volume Billion Forecast, by Organization Size 2020 & 2033

- Table 13: India Payroll Services Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 14: India Payroll Services Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 15: India Payroll Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: India Payroll Services Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Payroll Services Market?

The projected CAGR is approximately 7.49%.

2. Which companies are prominent players in the India Payroll Services Market?

Key companies in the market include ADP, SAP, Oracle, Infosys Limited, Quikchex, Paysquare, ZingHR, Excelity Global, Hinduja Global Solutions, Osourc.

3. What are the main segments of the India Payroll Services Market?

The market segments include Type, Organization Size, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.66 Million as of 2022.

5. What are some drivers contributing to market growth?

The Increasing Number of SMEs is Driving the Demand for Scalable Payroll Solutions; Continuous Technological Advancements and Increasing Cloud Services are Driving the Landscape.

6. What are the notable trends driving market growth?

Technological Advancements and Cloud Services Driving the Market.

7. Are there any restraints impacting market growth?

The Increasing Number of SMEs is Driving the Demand for Scalable Payroll Solutions; Continuous Technological Advancements and Increasing Cloud Services are Driving the Landscape.

8. Can you provide examples of recent developments in the market?

March 2024: Alight Inc., a prominent provider of cloud-based human capital and technology services, enhanced its partnership with SAP. Through this collaboration, Alight's Worklife platform will harness the power of SAP S/4HANA Cloud, introducing a cutting-edge, cloud-based payroll solution. This innovative system not only boosts payroll efficiency and performance but also fortifies security measures for handling sensitive employee and organizational data.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Payroll Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Payroll Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Payroll Services Market?

To stay informed about further developments, trends, and reports in the India Payroll Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence