Key Insights

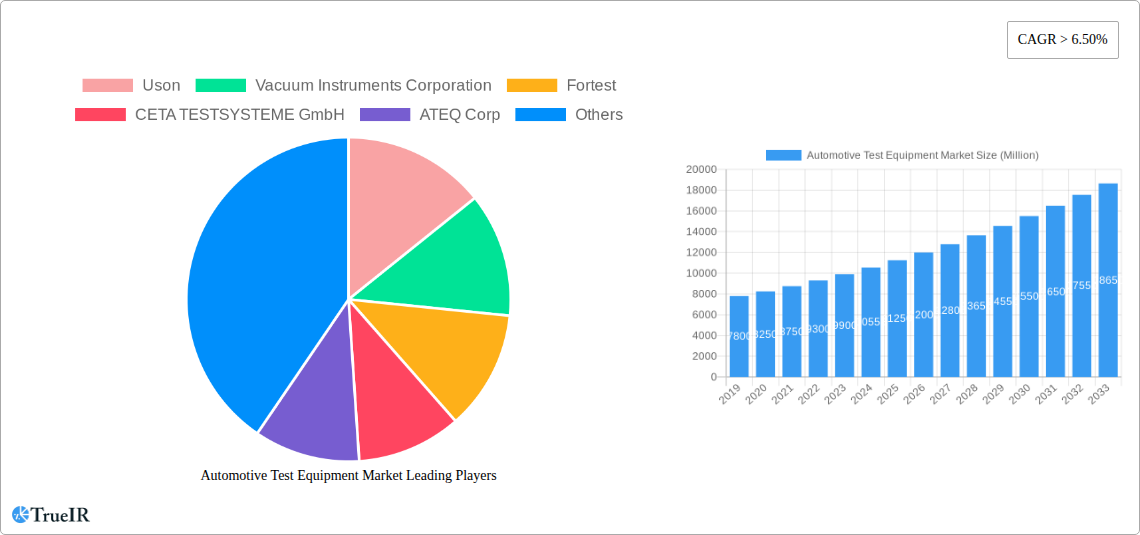

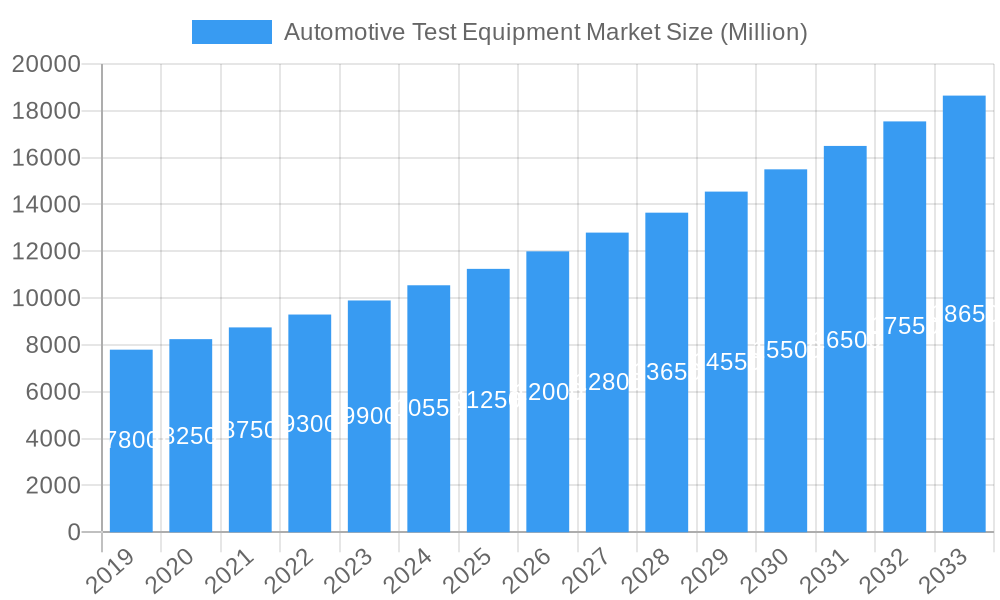

The global Automotive Test Equipment Market is poised for significant expansion, projected to surpass a market size of approximately $15 billion by 2033, driven by a Compound Annual Growth Rate (CAGR) exceeding 6.50%. This robust growth is underpinned by the relentless evolution of the automotive industry, particularly the escalating demand for sophisticated testing solutions to meet stringent safety regulations, the increasing complexity of vehicle electronics, and the rapid adoption of advanced driver-assistance systems (ADAS) and electric vehicle (EV) technologies. Manufacturers are investing heavily in ensuring the reliability, performance, and safety of these intricate systems, thereby fueling the demand for a wide array of specialized automotive test equipment. Furthermore, the growing emphasis on quality control throughout the vehicle lifecycle, from component manufacturing to final assembly and in-field diagnostics, is a critical factor propelling market expansion. The integration of Industry 4.0 principles and smart manufacturing technologies within automotive production lines further necessitates advanced testing and validation processes.

Automotive Test Equipment Market Market Size (In Billion)

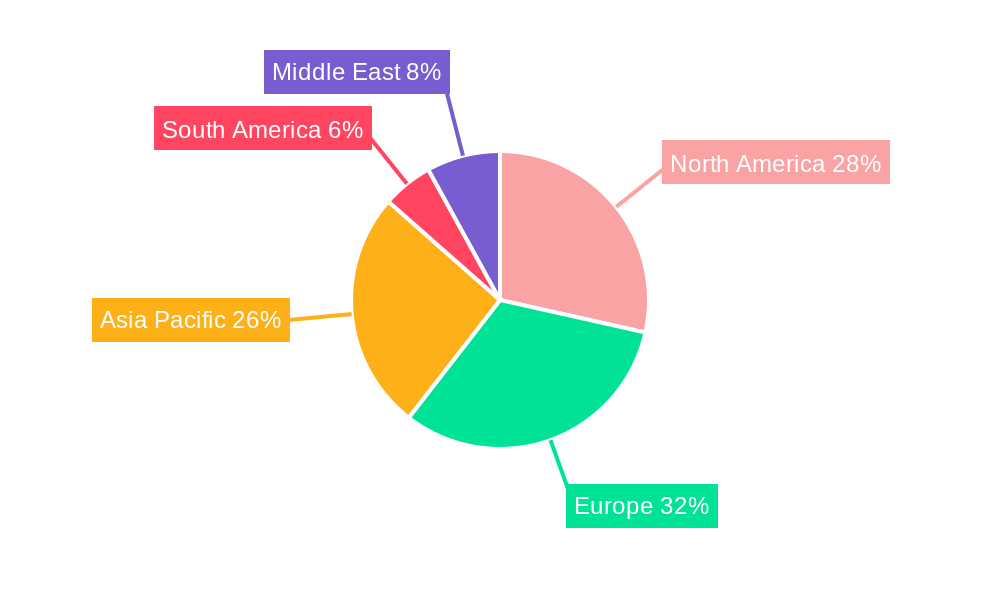

The market is segmented across key end-user applications, with HVAC/R, Automotive & Transportation, Medical & Pharmaceutical, Packaging, and Industrial sectors representing major consumers. Within the Automotive & Transportation segment, the relentless pursuit of electric mobility and autonomous driving technologies is creating substantial opportunities for specialized test equipment. This includes solutions for battery testing, powertrain diagnostics, sensor calibration, and communication network validation. Emerging economies, particularly in the Asia Pacific region, are expected to witness the fastest growth due to burgeoning automotive production hubs and increasing regulatory compliances. Major players such as ATEQ Corp, INFICON, and Pfeiffer Vacuum GmbH are actively innovating and expanding their product portfolios to cater to these evolving market demands, focusing on developing more efficient, accurate, and integrated testing solutions. Challenges such as high initial investment costs for advanced equipment and the need for skilled personnel to operate and maintain them are present, but the overwhelming benefits of enhanced product quality and regulatory adherence are expected to mitigate these concerns.

Automotive Test Equipment Market Company Market Share

Gain unparalleled insights into the Automotive Test Equipment Market with this in-depth report. Spanning a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025, this analysis dissects critical market dynamics, from burgeoning growth drivers and opportunities to significant challenges and competitive landscapes. We leverage high-volume keywords to ensure optimal search visibility for industry professionals seeking to understand the global automotive testing solutions, vehicle diagnostic equipment, and automotive manufacturing test systems landscape. This report provides actionable intelligence for stakeholders in automotive electronics testing, EV battery testing equipment, and ADAS calibration tools.

Automotive Test Equipment Market Market Structure & Competitive Landscape

The Automotive Test Equipment Market exhibits a moderately concentrated structure, with a significant presence of both established global players and specialized niche providers. Innovation drivers are primarily propelled by the rapid evolution of automotive technologies, including electrification, autonomous driving, and advanced driver-assistance systems (ADAS), necessitating sophisticated automotive diagnostic tools and vehicle inspection equipment. Regulatory impacts are also substantial, with increasing emission standards and safety mandates driving demand for precise automotive emissions testing equipment and automotive safety testing solutions. Product substitutes, while present in some basic testing functionalities, are generally outpaced by the specialized and integrated solutions offered by leading manufacturers. End-user segmentation reveals a dominant Automotive & Transportation sector, closely followed by the growing HVAC/R and Industrial segments, each with unique testing requirements for their respective components and systems. Mergers and acquisitions (M&A) trends are on the rise as companies seek to consolidate their market position, expand their product portfolios, and acquire advanced technological capabilities in areas like automotive software testing and automotive sensor testing. The report details M&A volumes and concentration ratios to illustrate these strategic moves.

Automotive Test Equipment Market Market Trends & Opportunities

The Automotive Test Equipment Market is experiencing robust growth, projected to reach $XX Million by 2033, with a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). This expansion is fueled by a confluence of technological shifts, evolving consumer preferences, and intensifying competitive dynamics. The burgeoning electric vehicle (EV) revolution is a paramount trend, driving unprecedented demand for specialized EV battery testing equipment, electric powertrain testing solutions, and charging infrastructure testing tools. The increasing complexity of automotive electronics, including advanced infotainment systems, connectivity features, and ADAS, necessitates sophisticated automotive electronics testing equipment and ECU (Electronic Control Unit) testing solutions. Furthermore, stringent global regulations regarding vehicle emissions and safety are compelling manufacturers to invest heavily in advanced automotive emissions testing equipment, automotive crash test equipment, and automotive safety testing solutions.

Consumer preferences are also playing a pivotal role. The demand for safer, more fuel-efficient, and feature-rich vehicles translates directly into a need for higher quality and more reliable components, thereby increasing the reliance on comprehensive automotive component testing and automotive reliability testing. The competitive landscape is characterized by a blend of global giants and agile innovators, constantly pushing the boundaries of automotive diagnostic technology and automotive performance testing. Opportunities abound in emerging markets, particularly in regions experiencing rapid automotive industry growth. The integration of AI and machine learning into test equipment is another significant trend, enabling predictive maintenance, faster defect detection, and more efficient testing processes for automotive manufacturing automation and automotive quality control. The market penetration rates for advanced diagnostic and testing solutions are expected to climb as the industry embraces digitalization and Industry 4.0 principles, impacting the demand for automotive cybersecurity testing and automotive connectivity testing.

Dominant Markets & Segments in Automotive Test Equipment Market

The Automotive & Transportation segment stands as the undisputed dominant force within the Automotive Test Equipment Market, driven by the sheer volume of vehicle production and the continuous innovation within the sector. This dominance is further amplified by the global shift towards electric vehicles, necessitating a comprehensive suite of EV testing equipment, battery management system (BMS) testers, and electric motor testing solutions. Key growth drivers within this segment include:

- Global Vehicle Production Growth: Despite regional fluctuations, the overall trajectory of vehicle production, particularly in emerging economies, directly correlates with the demand for automotive test equipment.

- Electrification Mandates: Government incentives and regulations worldwide are accelerating the adoption of EVs, creating a substantial market for specialized EV testing solutions.

- ADAS and Autonomous Driving Development: The relentless pursuit of enhanced safety and convenience features, powered by ADAS and autonomous driving technologies, requires extensive validation and testing, driving demand for ADAS calibration equipment and automotive sensor testing systems.

- Stringent Safety and Emission Standards: Continual updates and tightening of global safety and emissions regulations necessitate sophisticated automotive emissions testing equipment and vehicle safety testing equipment.

The HVAC/R segment also presents a significant market share, driven by the demand for reliable climate control systems in vehicles and industrial applications. Testing for leakage, performance, and efficiency of HVAC/R components is critical, leading to a consistent demand for specialized HVAC/R test equipment. The Industrial segment, encompassing a broad range of manufacturing and engineering applications, also contributes substantially, requiring robust industrial automation testing and component reliability testing.

While the Medical & Pharmaceutical and Packaging segments are smaller in comparison, they represent niche growth areas. The stringent quality and safety requirements in the medical device and pharmaceutical industries drive demand for highly precise and validated testing solutions. Similarly, the packaging sector requires specialized equipment for ensuring product integrity and safety during transit, influencing the demand for certain types of material testing equipment. The Others segment encompasses a variety of specialized applications that contribute to the overall market diversification.

Automotive Test Equipment Market Product Analysis

The Automotive Test Equipment Market is characterized by continuous product innovation, focusing on enhanced accuracy, speed, and integration. Key product advancements include the development of sophisticated automotive diagnostic tools with advanced software capabilities for faster troubleshooting and data analysis. The rise of electric and hybrid vehicles has spurred the creation of specialized EV battery testing equipment capable of assessing performance, lifespan, and safety under various conditions, alongside electric powertrain testing solutions. Furthermore, the growing complexity of vehicle electronics has led to the development of advanced automotive electronics testing equipment, including ECU testers and CAN bus analyzers, ensuring the reliable functioning of critical systems. Competitive advantages are increasingly derived from the integration of AI and machine learning for predictive diagnostics and automated testing procedures, alongside wireless connectivity for remote monitoring and data management, enhancing the overall efficiency of automotive manufacturing automation and quality control.

Key Drivers, Barriers & Challenges in Automotive Test Equipment Market

Key Drivers: The Automotive Test Equipment Market is propelled by several powerful forces. The rapid adoption of electric vehicles (EVs) is a primary driver, necessitating specialized EV battery testing equipment and powertrain testing solutions. Technological advancements in automotive electronics, including ADAS and autonomous driving systems, demand sophisticated automotive electronics testing equipment and sensor validation tools. Stringent global regulations for emissions and safety are continuously pushing the need for advanced automotive emissions testing equipment and vehicle safety testing solutions. The increasing complexity of vehicle components and systems also drives the demand for comprehensive automotive component testing and reliability testing. Furthermore, the pursuit of enhanced fuel efficiency and performance fuels investment in cutting-edge automotive performance testing equipment.

Barriers & Challenges: Despite the strong growth trajectory, the market faces several challenges. The high cost of advanced automotive diagnostic tools and specialized testing equipment can be a barrier for smaller manufacturers. Evolving industry standards and the rapid pace of technological change require continuous investment in research and development, posing a challenge for maintaining competitiveness. Supply chain disruptions, as witnessed in recent years, can impact the availability of components and lead times for manufacturing automotive test equipment. The skilled workforce required to operate and maintain sophisticated automotive testing solutions is also a growing concern. Moreover, navigating complex and varying regulatory landscapes across different regions can create hurdles for global market penetration. Competitive pressures from both established players and emerging innovators can also lead to price erosion and margin pressures.

Growth Drivers in the Automotive Test Equipment Market Market

The Automotive Test Equipment Market is experiencing substantial growth driven by several key factors. The accelerating global transition to electric vehicles (EVs) is a paramount catalyst, spurring significant investment in EV battery testing equipment, charging system testers, and electric powertrain diagnostic tools. Advancements in automotive electronics, including the proliferation of ADAS and the development of autonomous driving technologies, necessitate sophisticated automotive electronics testing equipment, sensor calibration tools, and LiDAR testing solutions. Furthermore, increasingly stringent global regulations for vehicle emissions and safety standards mandate the use of advanced automotive emissions testing equipment and comprehensive vehicle safety testing solutions. The growing complexity of vehicle architectures and the demand for enhanced vehicle performance and fuel efficiency also contribute to the need for more precise and integrated automotive performance testing and component validation equipment.

Challenges Impacting Automotive Test Equipment Market Growth

Several factors present significant challenges to the growth of the Automotive Test Equipment Market. The substantial capital investment required for cutting-edge automotive diagnostic equipment and advanced automotive testing solutions can be a deterrent for some market participants, particularly smaller enterprises. The rapid pace of technological evolution in the automotive industry necessitates continuous and costly updates to test equipment, posing a challenge for maintaining relevancy and competitiveness. Supply chain volatility and potential shortages of critical components can disrupt manufacturing processes and impact delivery timelines for automotive manufacturing test systems. Furthermore, a shortage of skilled technicians and engineers capable of operating and maintaining highly sophisticated automotive testing machinery represents a significant hurdle. Navigating the fragmented and evolving global regulatory landscape, with differing standards and compliance requirements, adds complexity to market expansion. Intense competition from both established global players and agile new entrants can lead to price pressures and impact profitability for manufacturers of automotive inspection equipment.

Key Players Shaping the Automotive Test Equipment Market Market

- Uson

- Vacuum Instruments Corporation

- Fortest

- CETA TESTSYSTEME GmbH

- ATEQ Corp

- CTS Cincinnati

- InterTech Development Company

- LACO Technologies

- INFICON

- TASI Group

- Pfeiffer Vacuum GmbH

- Cosmo Instruments Co ltd

- TQC Automation & Test Solutions

- GMJ Systems & Automations Pvt Ltd

Significant Automotive Test Equipment Market Industry Milestones

- Oct 2020: Vacuum Instruments Corporation and ATEQ Corp. North America entered into a strategic partnership. This collaboration aimed to leverage their combined expertise, offering the world's most extensive range of leak-testing products and top-tier leak-testing technology specialists. The partnership focused on key applications like electric vehicle batteries and fuel cells, promising comprehensive and reliable solutions.

- Feb 2022: ATEQ Corp., a prominent manufacturer of leak and flow testers, formed a strategic business partnership with North Central Manufacturing Solutions, a provider of manufacturing solutions for the Upper Midwest. This alliance was designed to enhance ATEQ's local customer service capabilities in that region, expanding their reach and support infrastructure.

Future Outlook for Automotive Test Equipment Market Market

The future outlook for the Automotive Test Equipment Market is exceptionally promising, driven by ongoing technological advancements and the industry's transformative shifts. The continued expansion of the electric vehicle (EV) market will be a primary growth catalyst, fueling demand for sophisticated EV battery testing equipment, charging system diagnostics, and electric powertrain validation tools. The relentless progress in autonomous driving and advanced driver-assistance systems (ADAS) will necessitate further innovation in automotive sensor calibration, LiDAR testing, and ADAS testing solutions. Opportunities also lie in the integration of artificial intelligence (AI) and machine learning into testing processes, enabling predictive maintenance, enhanced fault detection, and more efficient automotive quality control. The increasing focus on vehicle cybersecurity will also drive the demand for specialized automotive cybersecurity testing equipment. Emerging economies and evolving regulatory landscapes worldwide will present further avenues for market expansion, ensuring sustained growth for automotive diagnostic and testing solutions.

Automotive Test Equipment Market Segmentation

-

1. End-user

- 1.1. HVAC/R

- 1.2. Automotive & Transportation

- 1.3. Medical & Pharmaceutical

- 1.4. Packaging

- 1.5. Industrial

- 1.6. Others

Automotive Test Equipment Market Segmentation By Geography

-

1. North America

- 1.1. US

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

-

5. Middle East

- 5.1. UAE

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East

Automotive Test Equipment Market Regional Market Share

Geographic Coverage of Automotive Test Equipment Market

Automotive Test Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Demand from Oil and Gas Industry Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user

- 5.1.1. HVAC/R

- 5.1.2. Automotive & Transportation

- 5.1.3. Medical & Pharmaceutical

- 5.1.4. Packaging

- 5.1.5. Industrial

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by End-user

- 6. North America Automotive Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user

- 6.1.1. HVAC/R

- 6.1.2. Automotive & Transportation

- 6.1.3. Medical & Pharmaceutical

- 6.1.4. Packaging

- 6.1.5. Industrial

- 6.1.6. Others

- 6.1. Market Analysis, Insights and Forecast - by End-user

- 7. Europe Automotive Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user

- 7.1.1. HVAC/R

- 7.1.2. Automotive & Transportation

- 7.1.3. Medical & Pharmaceutical

- 7.1.4. Packaging

- 7.1.5. Industrial

- 7.1.6. Others

- 7.1. Market Analysis, Insights and Forecast - by End-user

- 8. Asia Pacific Automotive Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user

- 8.1.1. HVAC/R

- 8.1.2. Automotive & Transportation

- 8.1.3. Medical & Pharmaceutical

- 8.1.4. Packaging

- 8.1.5. Industrial

- 8.1.6. Others

- 8.1. Market Analysis, Insights and Forecast - by End-user

- 9. South America Automotive Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user

- 9.1.1. HVAC/R

- 9.1.2. Automotive & Transportation

- 9.1.3. Medical & Pharmaceutical

- 9.1.4. Packaging

- 9.1.5. Industrial

- 9.1.6. Others

- 9.1. Market Analysis, Insights and Forecast - by End-user

- 10. Middle East Automotive Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user

- 10.1.1. HVAC/R

- 10.1.2. Automotive & Transportation

- 10.1.3. Medical & Pharmaceutical

- 10.1.4. Packaging

- 10.1.5. Industrial

- 10.1.6. Others

- 10.1. Market Analysis, Insights and Forecast - by End-user

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Uson

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Vacuum Instruments Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fortest

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CETA TESTSYSTEME GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ATEQ Corp

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CTS Cincinnati

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 InterTech Development Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 LACO Technologies

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 INFICON

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TASI Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Pfeiffer Vacuum GmbH

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Cosmo Instruments Co ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 TQC Automation & Test Solutions

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 GMJ Systems & Automations Pvt Ltd**List Not Exhaustive

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Uson

List of Figures

- Figure 1: Global Automotive Test Equipment Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Automotive Test Equipment Market Revenue (undefined), by End-user 2025 & 2033

- Figure 3: North America Automotive Test Equipment Market Revenue Share (%), by End-user 2025 & 2033

- Figure 4: North America Automotive Test Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America Automotive Test Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Automotive Test Equipment Market Revenue (undefined), by End-user 2025 & 2033

- Figure 7: Europe Automotive Test Equipment Market Revenue Share (%), by End-user 2025 & 2033

- Figure 8: Europe Automotive Test Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: Europe Automotive Test Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Automotive Test Equipment Market Revenue (undefined), by End-user 2025 & 2033

- Figure 11: Asia Pacific Automotive Test Equipment Market Revenue Share (%), by End-user 2025 & 2033

- Figure 12: Asia Pacific Automotive Test Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia Pacific Automotive Test Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Automotive Test Equipment Market Revenue (undefined), by End-user 2025 & 2033

- Figure 15: South America Automotive Test Equipment Market Revenue Share (%), by End-user 2025 & 2033

- Figure 16: South America Automotive Test Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: South America Automotive Test Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East Automotive Test Equipment Market Revenue (undefined), by End-user 2025 & 2033

- Figure 19: Middle East Automotive Test Equipment Market Revenue Share (%), by End-user 2025 & 2033

- Figure 20: Middle East Automotive Test Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 21: Middle East Automotive Test Equipment Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Test Equipment Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 2: Global Automotive Test Equipment Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Automotive Test Equipment Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 4: Global Automotive Test Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: US Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Canada Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Mexico Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Rest of North America Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Global Automotive Test Equipment Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 10: Global Automotive Test Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: Germany Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: UK Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: France Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Russia Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Spain Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Global Automotive Test Equipment Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 18: Global Automotive Test Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: India Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: China Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Japan Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Global Automotive Test Equipment Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 24: Global Automotive Test Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: Brazil Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Argentina Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Global Automotive Test Equipment Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 28: Global Automotive Test Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: UAE Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Saudi Arabia Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East Automotive Test Equipment Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Test Equipment Market?

The projected CAGR is approximately 4.3%.

2. Which companies are prominent players in the Automotive Test Equipment Market?

Key companies in the market include Uson, Vacuum Instruments Corporation, Fortest, CETA TESTSYSTEME GmbH, ATEQ Corp, CTS Cincinnati, InterTech Development Company, LACO Technologies, INFICON, TASI Group, Pfeiffer Vacuum GmbH, Cosmo Instruments Co ltd, TQC Automation & Test Solutions, GMJ Systems & Automations Pvt Ltd**List Not Exhaustive.

3. What are the main segments of the Automotive Test Equipment Market?

The market segments include End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Demand from Oil and Gas Industry Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

Oct 2020 - Vacuum Instruments Corporation and ATEQ Corp. North America entered into a strategic partnership. The partnership offers the world's largest leak-testing product range and the best experts in leak-testing technologies. ATEQ and VIC combine experiences with key applications, like electric vehicle batteries and fuel cells, in order to provide comprehensive and reliable solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Test Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Test Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Test Equipment Market?

To stay informed about further developments, trends, and reports in the Automotive Test Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence