Key Insights

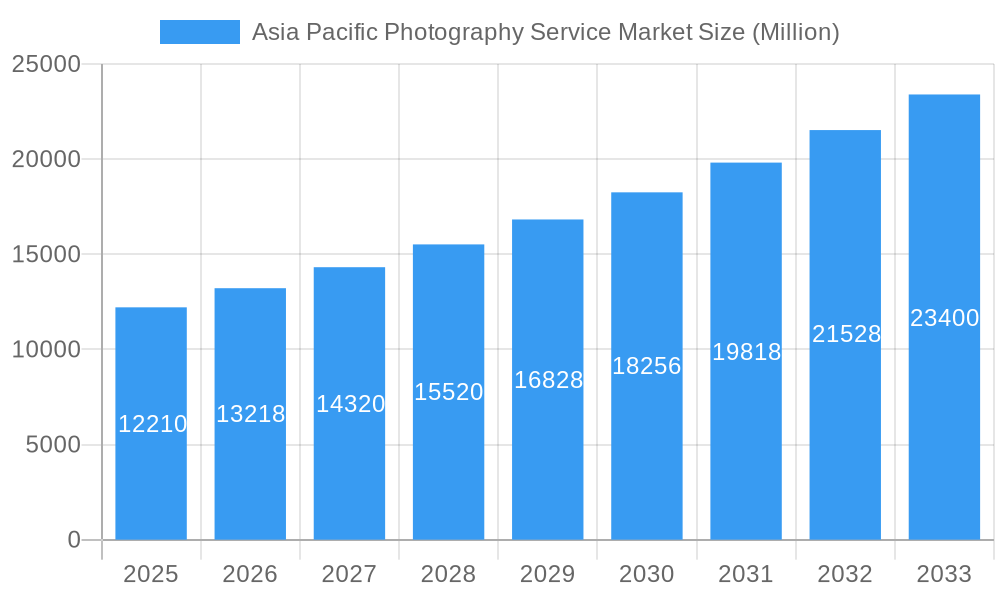

The Asia Pacific photography services market, valued at $12.21 billion in 2025, is poised for robust growth, exhibiting a compound annual growth rate (CAGR) of 8.13% from 2025 to 2033. This expansion is fueled by several key drivers. The rising popularity of social media and visual content marketing necessitates high-quality photography across various sectors, from businesses promoting their brands to individuals documenting their lives. Furthermore, technological advancements, such as improved camera technology and sophisticated editing software, are making professional-grade photography more accessible and affordable. The increasing disposable incomes in several Asian countries, coupled with a growing middle class with a penchant for capturing life's milestones, further boosts demand. While the market faces certain restraints such as intense competition and the fluctuating price of equipment, the overall trajectory remains positive. The market is segmented by service type (e.g., commercial, event, portrait, etc.), customer demographics, and geographic regions within the Asia-Pacific area. Key players like Educreate Films, Filmapia India, and Vortic Designs are vying for market share through strategic partnerships, technological innovation, and brand building initiatives. The historical period (2019-2024) shows consistent growth, laying the foundation for the projected expansion during the forecast period (2025-2033).

Asia Pacific Photography Service Market Market Size (In Billion)

The market's strong growth is particularly noticeable in regions experiencing rapid economic development and urbanization. Increased tourism and the rise of e-commerce also contribute significantly. The market's segmentation allows for targeted marketing strategies, catering to specific customer needs and preferences. Companies are investing in creative marketing campaigns and leveraging digital platforms to reach wider audiences. The continuous evolution of photography techniques and styles ensures the market's dynamism. Moreover, the increasing integration of artificial intelligence and virtual reality technologies within photography is expected to present lucrative new avenues for growth. The long-term outlook for the Asia Pacific photography services market remains highly promising due to the continuing confluence of technological progress, economic growth, and shifting consumer preferences towards visual storytelling.

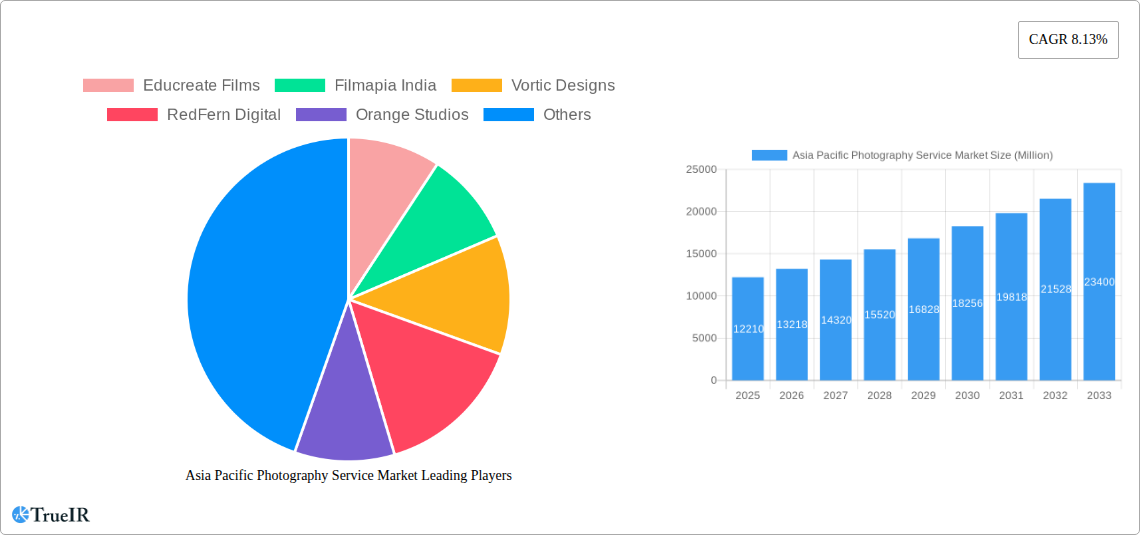

Asia Pacific Photography Service Market Company Market Share

Asia Pacific Photography Service Market: A Comprehensive Report (2019-2033)

This dynamic report provides a comprehensive analysis of the Asia Pacific photography service market, offering invaluable insights for businesses, investors, and stakeholders. Leveraging extensive research and data analysis spanning the period 2019-2033 (Base Year: 2025, Forecast Period: 2025-2033), this report unveils the market's structure, trends, opportunities, and challenges. The study encompasses detailed market sizing, segmentation, and competitive analysis, with a focus on key drivers and growth projections. Expect a deep dive into technological advancements, consumer preferences, and the competitive dynamics shaping this vibrant industry. The estimated market size in 2025 is projected at xx Million, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period.

Asia Pacific Photography Service Market Market Structure & Competitive Landscape

The Asia Pacific photography service market is characterized by a moderately fragmented structure, with an estimated Herfindahl-Hirschman Index (HHI) of **[Insert HHI Value Here]** in 2025. While a few prominent players command a substantial market share, a multitude of smaller enterprises contribute significantly to the overall market volume. Innovation serves as a primary catalyst for growth and competitive differentiation, particularly in emerging areas such as drone photography, AI-driven image enhancement, and immersive virtual reality photography. Navigating regulatory frameworks concerning data privacy and intellectual property rights is crucial, as these significantly influence operational costs and the barriers to market entry. The market faces a challenge from product substitution, predominantly from more economical alternatives like amateur photography services and readily available stock imagery. The market is strategically segmented based on service type (e.g., event photography, portrait photography, product photography), end-user demographics (e.g., corporate clients, individual consumers), and specific geographic locations. Merger and acquisition (M&A) activity within the industry has been moderate, with approximately **[Insert M&A Number Here]** M&A deals recorded between 2019 and 2024. This trend indicates a gradual consolidation, as larger entities aim to broaden their service portfolios and extend their geographical reach.

- Market Concentration: HHI of **[Insert HHI Value Here]** in 2025.

- Innovation Drivers: Advanced drone photography, sophisticated AI-powered image enhancement, immersive VR photography.

- Regulatory Impacts: Stringent data privacy regulations, evolving intellectual property rights.

- Product Substitutes: Accessible amateur photography services, extensive stock photography libraries.

- End-User Segmentation: Key segments include corporate clients and individual consumers.

- M&A Trends: Approximately **[Insert M&A Number Here]** M&A deals recorded between 2019 and 2024.

Asia Pacific Photography Service Market Market Trends & Opportunities

The Asia Pacific photography service market is experiencing a period of robust expansion, propelled by a confluence of dynamic factors. The steady increase in disposable incomes, especially within the rapidly developing economies of the region, is significantly bolstering the demand for professional photography services across a diverse range of sectors. Technological advancements, including the widespread availability of high-resolution cameras and advanced editing software, are not only lowering the threshold for new business ventures but also elevating the overall quality of services offered. Consumer preferences are demonstrably shifting towards highly personalized and unique photographic experiences, thereby fostering lucrative opportunities for niche service providers and specialized photographers. The competitive arena is notably dynamic, with established market leaders strategically investing in cutting-edge technology and expanding their service offerings to fortify their market positions. Concurrently, smaller enterprises are focusing on delivering innovative services and implementing targeted marketing strategies to capture specific market segments. The current market penetration rate for professional photography services in the Asia Pacific region is estimated at **[Insert Penetration Rate Here]**%, indicating substantial untapped potential in nascent markets. The market size is projected to reach **[Insert Market Size Here]** Million by 2033.

Dominant Markets & Segments in Asia Pacific Photography Service Market

Japan and China stand out as the principal markets within the Asia Pacific region, collectively accounting for an estimated **[Insert Percentage Here]**% of the total market value in 2025. The robust economic growth, substantial disposable incomes, and sophisticated infrastructure prevalent in these nations have significantly stimulated the demand for professional photography services. Among the various service types, the event photography segment commands the largest market share, driven by a consistently high volume of corporate events, weddings, and other celebratory occasions.

- Key Growth Drivers in Japan: High disposable incomes, advanced infrastructure, a strong and active corporate sector.

- Key Growth Drivers in China: Rapid economic expansion, a burgeoning middle class, and an escalating demand for personalized photography solutions.

- Key Growth Drivers in Event Photography Segment: Sustained high demand for professional photographic coverage at corporate functions, weddings, and diverse celebratory gatherings.

Asia Pacific Photography Service Market Product Analysis

Significant advancements in camera technology, image processing software, and drone technology are driving product innovation. New applications are emerging, including 360-degree photography, virtual reality photography, and AI-powered image enhancement. This leads to enhanced service offerings, increased efficiency, and improved customer satisfaction. The competitive advantages lie in the ability to leverage cutting-edge technology, offer customized services, and build strong brand reputations based on quality and reliability.

Key Drivers, Barriers & Challenges in Asia Pacific Photography Service Market

Key Drivers:

- Accelerated economic growth observed across numerous Asia-Pacific countries.

- A notable increase in disposable incomes and enhanced consumer spending power.

- Growing demand for high-quality visual content across a broad spectrum of industries.

- Pervasive technological advancements, particularly in sophisticated camera technology and user-friendly editing software.

Challenges:

- Intensified competition stemming from both established industry giants and agile new entrants.

- Susceptibility to fluctuations in economic conditions, which can impact consumer discretionary spending.

- Navigating complex regulatory landscapes related to data privacy and intellectual property rights. This results in an estimated annual market loss of **[Insert Annual Loss Here]** Million due to compliance costs.

- Vulnerability to supply chain disruptions caused by global events, impacting the availability of essential equipment and materials.

Growth Drivers in the Asia Pacific Photography Service Market Market

The Asia Pacific photography services market is fueled by rapid economic growth, rising disposable incomes, and increasing demand for visual content across various sectors. Technological advancements in camera technology, drone photography, and AI-based image processing are improving service quality and efficiency. Government initiatives promoting tourism and cultural events also boost demand for professional photography services.

Challenges Impacting Asia Pacific Photography Service Market Growth

Intense competition, economic fluctuations, and regulatory complexities pose significant challenges. Supply chain disruptions, particularly in sourcing specialized equipment, impact operations and costs. Maintaining compliance with data privacy regulations and intellectual property rights adds to operational burdens and financial strain.

Key Players Shaping the Asia Pacific Photography Service Market Market

- Educreate Films

- Filmapia India

- Vortic Designs

- RedFern Digital

- Orange Studios

- First Light Films

- Rimagine Graphic Design (Shanghai) Co Ltd

- Royal Creative Team

- Ricoh Co Ltd

- Panasonic Holdings Corp

Significant Asia Pacific Photography Service Market Industry Milestones

- 2020: Increased adoption of drone photography for real estate and tourism.

- 2021: Launch of several AI-powered photo editing platforms.

- 2022: Several mergers and acquisitions consolidating market share among larger players.

- 2023: Significant investments in virtual reality photography technologies.

Future Outlook for Asia Pacific Photography Service Market Market

The Asia Pacific photography service market is strategically positioned for sustained and significant growth, propelled by relentless technological innovation, escalating consumer demand, and increasing investments within the sector. Promising strategic opportunities lie in expanding into specialized niche segments, embracing and integrating advanced technologies, and cultivating a strong focus on delivering highly personalized customer experiences. The market's inherent potential for expansion is substantial, with numerous untapped markets and emerging trends poised to drive future growth trajectories.

Asia Pacific Photography Service Market Segmentation

-

1. Type Outlook

- 1.1. Shooting Service

- 1.2. After Sales Service

-

2. Application

- 2.1. Consumer

- 2.2. Commercial

Asia Pacific Photography Service Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

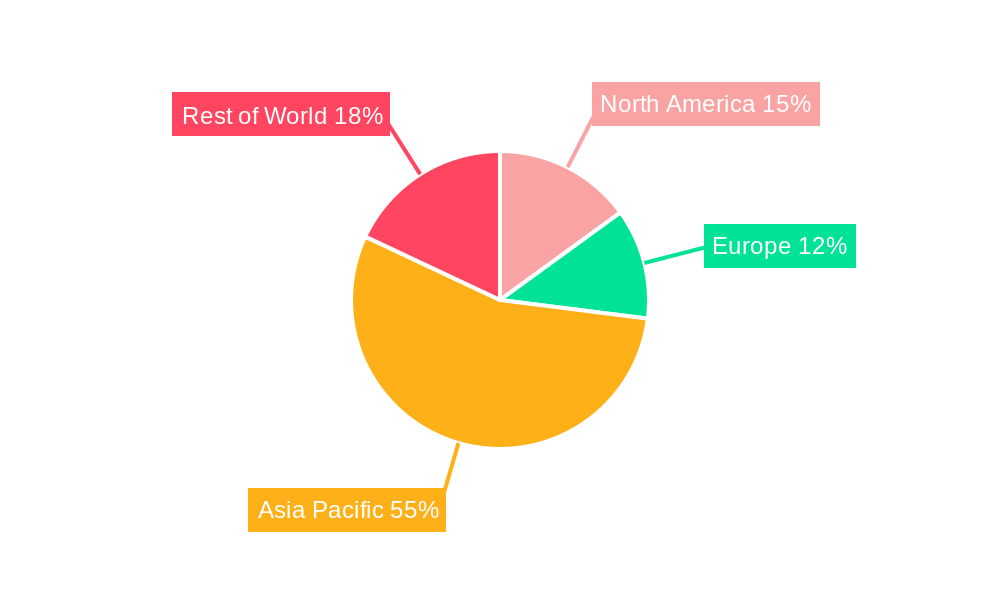

Asia Pacific Photography Service Market Regional Market Share

Geographic Coverage of Asia Pacific Photography Service Market

Asia Pacific Photography Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Impact of Social Media Users in Asia Pacific

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Photography Service Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type Outlook

- 5.1.1. Shooting Service

- 5.1.2. After Sales Service

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Consumer

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type Outlook

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Educreate Films

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Filmapia India

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Vortic Designs

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 RedFern Digital

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Orange Studios

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 First Light Films

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rimagine Graphic Design (Shanghai) Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Royal Creative Team

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ricoh Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Panasonic Holdings Corp**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Educreate Films

List of Figures

- Figure 1: Asia Pacific Photography Service Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Photography Service Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Photography Service Market Revenue Million Forecast, by Type Outlook 2020 & 2033

- Table 2: Asia Pacific Photography Service Market Volume Billion Forecast, by Type Outlook 2020 & 2033

- Table 3: Asia Pacific Photography Service Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Asia Pacific Photography Service Market Volume Billion Forecast, by Application 2020 & 2033

- Table 5: Asia Pacific Photography Service Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Asia Pacific Photography Service Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Asia Pacific Photography Service Market Revenue Million Forecast, by Type Outlook 2020 & 2033

- Table 8: Asia Pacific Photography Service Market Volume Billion Forecast, by Type Outlook 2020 & 2033

- Table 9: Asia Pacific Photography Service Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Asia Pacific Photography Service Market Volume Billion Forecast, by Application 2020 & 2033

- Table 11: Asia Pacific Photography Service Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Asia Pacific Photography Service Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: China Asia Pacific Photography Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: China Asia Pacific Photography Service Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Japan Asia Pacific Photography Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Japan Asia Pacific Photography Service Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: South Korea Asia Pacific Photography Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: South Korea Asia Pacific Photography Service Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: India Asia Pacific Photography Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: India Asia Pacific Photography Service Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Australia Asia Pacific Photography Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Australia Asia Pacific Photography Service Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: New Zealand Asia Pacific Photography Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: New Zealand Asia Pacific Photography Service Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Indonesia Asia Pacific Photography Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Indonesia Asia Pacific Photography Service Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Malaysia Asia Pacific Photography Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Malaysia Asia Pacific Photography Service Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Singapore Asia Pacific Photography Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Singapore Asia Pacific Photography Service Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Thailand Asia Pacific Photography Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Thailand Asia Pacific Photography Service Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Vietnam Asia Pacific Photography Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Vietnam Asia Pacific Photography Service Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Philippines Asia Pacific Photography Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Philippines Asia Pacific Photography Service Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Photography Service Market?

The projected CAGR is approximately 8.13%.

2. Which companies are prominent players in the Asia Pacific Photography Service Market?

Key companies in the market include Educreate Films, Filmapia India, Vortic Designs, RedFern Digital, Orange Studios, First Light Films, Rimagine Graphic Design (Shanghai) Co Ltd, Royal Creative Team, Ricoh Co Ltd, Panasonic Holdings Corp**List Not Exhaustive.

3. What are the main segments of the Asia Pacific Photography Service Market?

The market segments include Type Outlook, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.21 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Impact of Social Media Users in Asia Pacific.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Photography Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Photography Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Photography Service Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Photography Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence