Key Insights

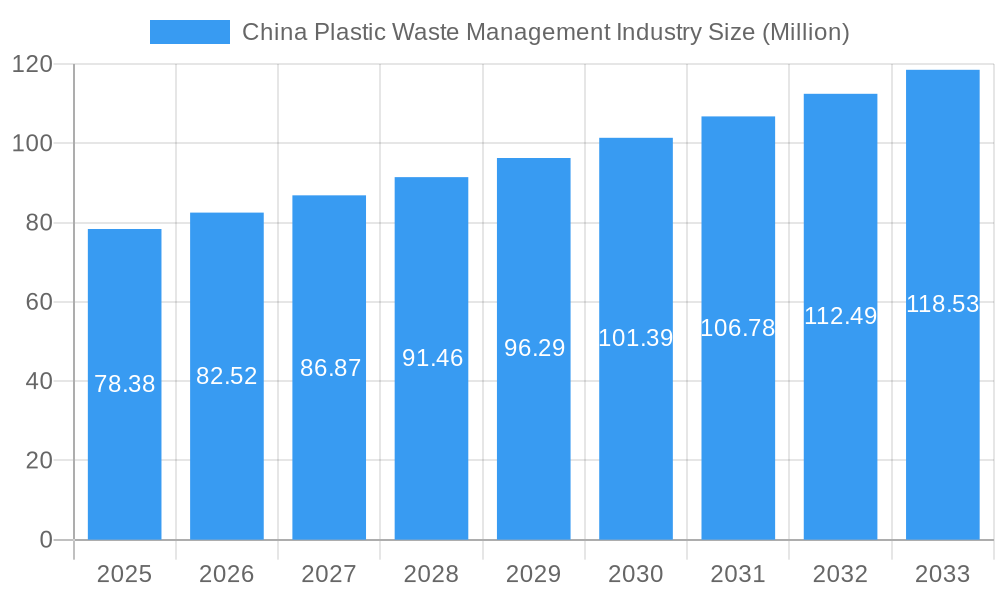

The China Plastic Waste Management Industry is poised for robust expansion, projected to reach an estimated market size of USD 78.38 million in 2025. This growth is underpinned by a Compound Annual Growth Rate (CAGR) of 5.25%, signaling sustained and healthy development over the forecast period of 2025-2033. The industry's evolution is being significantly propelled by increasing awareness of environmental pollution and the growing imperative for sustainable waste management practices. Key drivers include stringent government regulations aimed at reducing plastic pollution, coupled with advancements in recycling technologies that enhance efficiency and broaden the scope of recoverable materials. The escalating volume of plastic waste generated from industrial activities, municipal solid waste, and burgeoning sectors like e-waste and packaging further fuels the demand for sophisticated management solutions. China's commitment to a circular economy and its ambitious environmental targets are instrumental in shaping this market, encouraging greater investment in innovative waste-to-energy solutions and advanced recycling infrastructure.

China Plastic Waste Management Industry Market Size (In Million)

The market landscape is characterized by a diverse range of waste types, with industrial waste, municipal solid waste, and plastic waste forming the largest segments. Emerging categories like e-waste and bio-medical waste also present growing challenges and opportunities. Leading disposal methods include landfill, incineration, and increasingly, dismantling and recycling, reflecting a global shift towards resource recovery. The ownership structure of the industry is dynamic, with a significant presence of private players and public-private partnerships (PPPs) alongside public sector involvement, fostering competition and innovation. Companies like China Everbright International Limited, Sembcorp Industries Ltd, and Veolia Environnement S.A. are at the forefront, driving technological adoption and service provision. As China continues to emphasize green development, the plastic waste management sector is expected to attract substantial investment, leading to the development of more efficient collection, processing, and valorization systems, ultimately contributing to a cleaner environment and a more sustainable future.

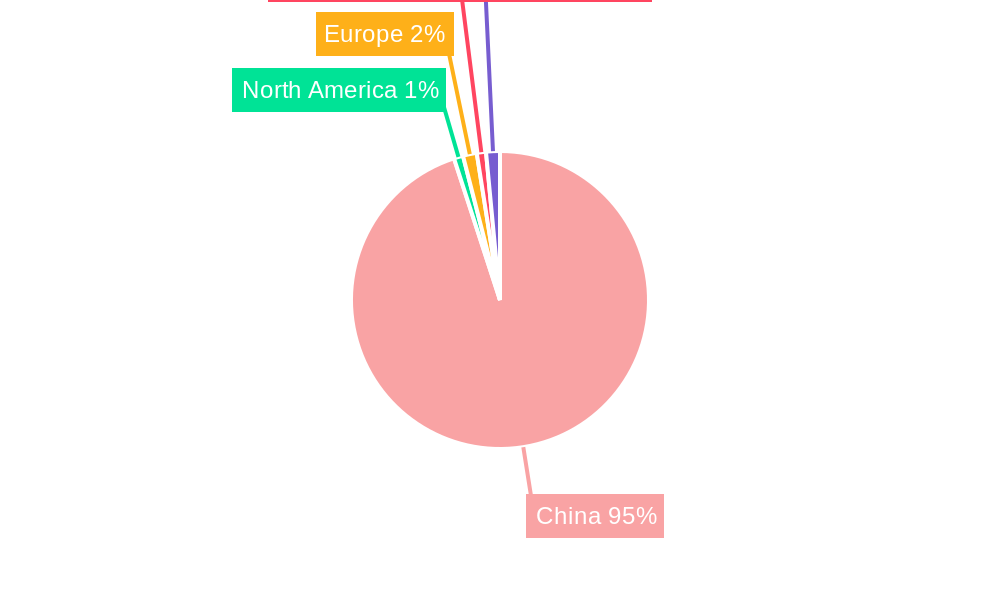

China Plastic Waste Management Industry Company Market Share

China Plastic Waste Management Industry: Market Analysis and Future Projections (2019-2033)

This comprehensive report provides an in-depth analysis of the dynamic China Plastic Waste Management Industry. Covering the historical period from 2019 to 2024, the base year of 2025, and extending to a detailed forecast period from 2025 to 2033, this study offers critical insights into market structure, trends, opportunities, and key players. Leveraging high-volume search terms such as "China plastic recycling," "municipal solid waste management China," "hazardous waste disposal China," and "e-waste recycling China," this report is meticulously crafted for industry professionals, investors, and policymakers seeking to understand the evolving landscape and capitalize on emerging opportunities in one of the world's largest waste management markets.

China Plastic Waste Management Industry Market Structure & Competitive Landscape

The China plastic waste management industry exhibits a moderate to high degree of market concentration, with a significant portion of market share held by a few large, integrated players, alongside a fragmented landscape of smaller, specialized service providers. Innovation drivers are primarily centered around advanced sorting technologies, chemical recycling processes, and the development of cost-effective waste-to-energy solutions. Regulatory impacts are profound, with government policies, such as the Extended Producer Responsibility (EPR) scheme and stringent environmental protection laws, shaping operational standards and market entry barriers. Product substitutes are limited for certain plastic waste streams, but advancements in biodegradable plastics and alternative materials pose a long-term challenge. End-user segmentation reveals substantial demand from manufacturing sectors requiring recycled plastics, alongside critical needs for municipal solid waste (MSW) and hazardous waste management. Mergers and acquisitions (M&A) trends indicate a consolidation phase, driven by the pursuit of economies of scale, technological integration, and expanded service offerings. M&A volumes in the last three years have reached an estimated xx Million, with key transactions focused on acquiring advanced recycling facilities and expanding geographical reach. Concentration ratios for the top five players are estimated to be above xx%.

China Plastic Waste Management Industry Market Trends & Opportunities

The China Plastic Waste Management Industry is experiencing robust growth, projected to reach an estimated market size of xx Million by 2033, demonstrating a compound annual growth rate (CAGR) of approximately xx% during the forecast period (2025-2033). This expansion is fueled by a confluence of factors including escalating plastic consumption, increasing environmental awareness, and proactive government initiatives aimed at curbing pollution and promoting a circular economy. Technological shifts are paramount, with significant investment flowing into automated sorting systems, advanced chemical recycling technologies capable of breaking down mixed plastics, and more efficient waste-to-energy (WtE) plants. These innovations are not only improving the recovery rates of valuable materials but also addressing the challenges posed by complex and contaminated plastic waste streams.

Consumer preferences are gradually evolving, with a growing demand for products made from recycled content and a greater willingness to participate in source segregation programs. This societal shift puts pressure on waste management companies to develop more sophisticated collection and processing infrastructure. Competitive dynamics are intensifying, characterized by strategic partnerships, vertical integration, and a race to adopt cutting-edge technologies. Companies are increasingly focusing on developing end-to-end waste management solutions, from collection and transportation to advanced processing and the sale of recycled materials.

Opportunities abound in several key areas. The burgeoning e-waste sector presents a significant, albeit complex, segment with high potential for precious metal recovery and responsible disposal of hazardous components. Similarly, the industrial waste segment offers scope for tailored solutions and specialized recycling processes. Furthermore, the development of advanced facilities for treating biomedical waste, driven by increased healthcare spending and public health concerns, represents a critical growth area. The push for a circular economy also creates opportunities for businesses that can effectively reintegrate recycled plastics back into the manufacturing supply chain, thereby reducing reliance on virgin materials. The market penetration rate for advanced recycling technologies is expected to grow from xx% in 2025 to xx% by 2033, indicating a strong adoption trend.

Dominant Markets & Segments in China Plastic Waste Management Industry

Within the China Plastic Waste Management Industry, Municipal Solid Waste (MSW) and Plastic Waste segments are projected to dominate the market in terms of volume and value throughout the forecast period (2025–2033). The sheer quantity of daily waste generated by urban populations, coupled with increasing government mandates for recycling and waste reduction, propels the MSW segment's dominance. The Plastic Waste segment, a critical sub-component of MSW, benefits from intensive policy focus on plastic pollution reduction, promoting advanced recycling technologies, and the growing demand for recycled plastic resins in various manufacturing industries.

Incineration as a disposal method is expected to witness significant growth, driven by the need for volume reduction and energy recovery from non-recyclable waste streams, especially within the MSW segment. While Recycling remains a cornerstone of sustainable waste management, its dominance is intrinsically linked to the effectiveness of collection and sorting, particularly for diverse plastic waste types.

Geographically, Eastern China, with its high population density, robust industrial base, and advanced infrastructure, is the leading region for waste management services. Provinces like Guangdong, Jiangsu, and Zhejiang are at the forefront of adopting new technologies and implementing stringent environmental regulations.

Key Growth Drivers in Dominant Segments:

Municipal Solid Waste (MSW):

- Infrastructure Development: Continued investment in modern waste collection, transfer stations, and advanced sorting facilities.

- Policy Support: Stringent regulations on waste segregation, landfill diversion targets, and incentives for waste-to-energy projects.

- Urbanization: Ongoing migration to urban centers increases the volume of MSW generation.

- Public Awareness: Growing public engagement in waste reduction and recycling initiatives.

Plastic Waste:

- Circular Economy Initiatives: Government push for a circular economy model emphasizing plastic reuse and recycling.

- Technological Advancements: Innovations in chemical recycling for mixed and complex plastics, increasing recyclability.

- Demand for Recycled Content: Growing pressure from downstream industries and consumers for products made with recycled plastics.

- Extended Producer Responsibility (EPR): Policies holding producers accountable for the end-of-life management of their products, including plastic packaging.

Incineration (Disposal Method):

- Energy Recovery: Government support and incentives for waste-to-energy (WtE) plants, contributing to renewable energy targets.

- Landfill Space Scarcity: Limited availability and rising costs of landfill space, driving the need for alternative disposal methods.

- Volume Reduction: Incineration effectively reduces the volume of waste requiring disposal.

Recycling (Disposal Method):

- Material Value: The inherent value of recovered plastics, metals, and other materials provides an economic incentive for recycling.

- Environmental Mandates: Strict regulations on waste diversion from landfills and incineration.

- Technological Improvements: Enhanced sorting and processing technologies making a wider range of materials recyclable.

While Hazardous Waste and Bio-medical Waste represent smaller but critically important segments, their growth is driven by specialized regulatory frameworks and the increasing focus on public health and environmental safety. E-waste is a rapidly growing segment with significant potential, driven by the accelerated pace of technological obsolescence and increasing consumer electronics adoption, though it presents unique challenges in terms of collection and dismantling for safe material recovery. Ownership types are diverse, with Public entities dominating infrastructure development, Private companies leading in operational efficiency and technological innovation, and Public-Private Partnerships (PPPs) playing an increasingly vital role in large-scale projects, leveraging the strengths of both sectors.

China Plastic Waste Management Industry Product Analysis

Innovations in the China Plastic Waste Management Industry are predominantly focused on enhancing the efficiency and scope of plastic waste processing. Advanced sorting technologies, including optical sorters and AI-powered robotics, are revolutionizing the separation of various plastic types, significantly improving the quality of recycled output. Chemical recycling technologies, such as pyrolysis and depolymerization, are gaining traction, enabling the breakdown of mixed and difficult-to-recycle plastics into their constituent monomers or feedstock, thereby creating a more closed-loop system. Applications for recycled plastics are expanding beyond traditional uses, with increasing integration into high-value products, construction materials, and even textiles. The competitive advantage lies in companies that can demonstrate cost-effectiveness, superior purity of recycled materials, and adherence to stringent environmental standards, meeting the growing demand from both domestic and international markets for sustainable inputs.

Key Drivers, Barriers & Challenges in China Plastic Waste Management Industry

Key Drivers:

- Government Policies and Regulations: Strict environmental protection laws, waste reduction targets, and incentives for recycling and waste-to-energy projects are powerful catalysts. The "dual carbon" goals further accelerate the adoption of circular economy principles.

- Technological Advancements: Innovations in sorting, recycling, and waste-to-energy technologies are making waste management more efficient and economically viable.

- Growing Environmental Awareness: Increasing public concern over plastic pollution and resource depletion is driving demand for sustainable waste management solutions.

- Economic Growth and Urbanization: Rapid economic development and increasing urban populations lead to higher waste generation, creating a sustained demand for management services.

- Circular Economy Imperatives: The global and national push towards a circular economy necessitates robust waste management infrastructure to recover and reuse materials.

Barriers & Challenges:

- Regulatory Complexity and Enforcement: Navigating a complex web of local and national regulations can be challenging, and inconsistent enforcement can hinder consistent operational standards.

- Infrastructure Gaps: While improving, there remain significant gaps in collection, sorting, and advanced processing infrastructure, particularly in rural areas.

- Cost of Advanced Technologies: The initial investment for state-of-the-art recycling and waste-to-energy technologies can be substantial.

- Contaminated Waste Streams: The presence of food waste, hazardous materials, and mixed plastics in waste streams complicates sorting and recycling processes.

- Market Volatility for Recycled Materials: Fluctuations in the price of virgin plastics can impact the economic competitiveness of recycled materials. Supply chain issues for specialized equipment and raw materials also pose a challenge.

Growth Drivers in the China Plastic Waste Management Industry Market

The China Plastic Waste Management Industry is propelled by a synergistic interplay of policy directives, technological innovation, and evolving societal priorities. Foremost among these is the robust government commitment to environmental protection and the ambitious "dual carbon" targets, which mandate significant reductions in emissions and resource consumption. This translates into favorable policies for waste-to-energy (WtE) plants and stringent regulations promoting recycling and the circular economy, such as the expansion of Extended Producer Responsibility (EPR) schemes. Technological advancements are another critical driver, with ongoing investments in automated sorting systems, advanced chemical recycling techniques capable of handling complex plastic waste, and more efficient incineration technologies that enhance energy recovery. The burgeoning domestic demand for recycled plastic content, driven by both consumer preference for sustainable products and industrial requirements, further fuels growth. Economic expansion and continued urbanization ensure a consistent and growing volume of waste requiring professional management.

Challenges Impacting China Plastic Waste Management Industry Growth

Despite its robust growth trajectory, the China Plastic Waste Management Industry faces several significant challenges. The inherent complexity of regulatory frameworks, with varying interpretations and enforcement across different regions, can create operational hurdles for companies. Supply chain issues, particularly concerning the consistent availability of high-quality feedstock for recycling and the procurement of specialized equipment, can also impact efficiency. Competitive pressures, especially from established state-owned enterprises and an increasing number of private players, necessitate continuous innovation and cost optimization. Furthermore, the financial viability of certain recycling processes can be jeopardized by volatile global commodity prices for virgin plastics, making it difficult to compete solely on cost. Public participation in waste segregation, while improving, remains a challenge in some areas, leading to the contamination of recyclable streams and increased processing costs.

Key Players Shaping the China Plastic Waste Management Industry Market

- China Everbright International Limited

- Sembcorp Industries Ltd

- Veolia Environnement S A

- Capital Environmental Holdings Ltd (CEHL)

- HydroThane

Significant China Plastic Waste Management Industry Industry Milestones

- 2021: Launch of the "Plastic Pollution Control Action Plan (2021-2025)" by the State Council, setting ambitious targets for plastic waste reduction and management.

- 2022: Increased investment in advanced chemical recycling technologies, with several pilot projects demonstrating the feasibility of breaking down mixed plastics.

- 2023 (Early): Expansion of Extended Producer Responsibility (EPR) schemes to cover a wider range of plastic products, placing greater accountability on manufacturers.

- 2023 (Mid): Significant growth in waste-to-energy (WtE) plant capacity, with a focus on improving energy efficiency and emission controls.

- 2024 (Ongoing): Focus on developing domestic supply chains for recycled plastic pellets and flakes, meeting the increasing demand from manufacturing sectors.

Future Outlook for China Plastic Waste Management Industry Market

The future outlook for the China Plastic Waste Management Industry is exceptionally positive, driven by continued policy support, accelerating technological adoption, and a deepening commitment to sustainability. The market is expected to witness sustained growth, with a particular emphasis on advanced recycling technologies like chemical recycling to tackle complex plastic waste streams and enhance circularity. Waste-to-energy (WtE) solutions will remain a crucial component for managing non-recyclable waste and contributing to renewable energy targets. Strategic opportunities lie in the development of integrated waste management solutions, including digital tracking and smart waste collection systems, as well as in specialized segments like e-waste and hazardous waste. The increasing demand for recycled materials will foster innovation in product development and secure the economic viability of recycling operations, positioning China as a global leader in sustainable waste management.

China Plastic Waste Management Industry Segmentation

-

1. Waste type

- 1.1. Industrial waste

- 1.2. Municipal solid waste

- 1.3. Hazardous waste

- 1.4. E-waste

- 1.5. Plastic waste

- 1.6. Bio-medical waste

-

2. Disposal methods

- 2.1. Landfill

- 2.2. Incineration

- 2.3. Dismantling

- 2.4. Recycling

-

3. Type of ownership

- 3.1. Public

- 3.2. Private

- 3.3. Public - Private Patnership

China Plastic Waste Management Industry Segmentation By Geography

- 1. China

China Plastic Waste Management Industry Regional Market Share

Geographic Coverage of China Plastic Waste Management Industry

China Plastic Waste Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Spotlight on the China e-waste generation and its effective management

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Plastic Waste Management Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 5.1.1. Industrial waste

- 5.1.2. Municipal solid waste

- 5.1.3. Hazardous waste

- 5.1.4. E-waste

- 5.1.5. Plastic waste

- 5.1.6. Bio-medical waste

- 5.2. Market Analysis, Insights and Forecast - by Disposal methods

- 5.2.1. Landfill

- 5.2.2. Incineration

- 5.2.3. Dismantling

- 5.2.4. Recycling

- 5.3. Market Analysis, Insights and Forecast - by Type of ownership

- 5.3.1. Public

- 5.3.2. Private

- 5.3.3. Public - Private Patnership

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 China Everbright International Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sembcorp Industries Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Veolia Environnement S A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Capital Environmental Holdings Ltd (CEHL)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 HydroThane**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 China Everbright International Limited

List of Figures

- Figure 1: China Plastic Waste Management Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Plastic Waste Management Industry Share (%) by Company 2025

List of Tables

- Table 1: China Plastic Waste Management Industry Revenue Million Forecast, by Waste type 2020 & 2033

- Table 2: China Plastic Waste Management Industry Volume Billion Forecast, by Waste type 2020 & 2033

- Table 3: China Plastic Waste Management Industry Revenue Million Forecast, by Disposal methods 2020 & 2033

- Table 4: China Plastic Waste Management Industry Volume Billion Forecast, by Disposal methods 2020 & 2033

- Table 5: China Plastic Waste Management Industry Revenue Million Forecast, by Type of ownership 2020 & 2033

- Table 6: China Plastic Waste Management Industry Volume Billion Forecast, by Type of ownership 2020 & 2033

- Table 7: China Plastic Waste Management Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: China Plastic Waste Management Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 9: China Plastic Waste Management Industry Revenue Million Forecast, by Waste type 2020 & 2033

- Table 10: China Plastic Waste Management Industry Volume Billion Forecast, by Waste type 2020 & 2033

- Table 11: China Plastic Waste Management Industry Revenue Million Forecast, by Disposal methods 2020 & 2033

- Table 12: China Plastic Waste Management Industry Volume Billion Forecast, by Disposal methods 2020 & 2033

- Table 13: China Plastic Waste Management Industry Revenue Million Forecast, by Type of ownership 2020 & 2033

- Table 14: China Plastic Waste Management Industry Volume Billion Forecast, by Type of ownership 2020 & 2033

- Table 15: China Plastic Waste Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: China Plastic Waste Management Industry Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Plastic Waste Management Industry?

The projected CAGR is approximately 5.25%.

2. Which companies are prominent players in the China Plastic Waste Management Industry?

Key companies in the market include China Everbright International Limited, Sembcorp Industries Ltd, Veolia Environnement S A, Capital Environmental Holdings Ltd (CEHL), HydroThane**List Not Exhaustive.

3. What are the main segments of the China Plastic Waste Management Industry?

The market segments include Waste type, Disposal methods, Type of ownership.

4. Can you provide details about the market size?

The market size is estimated to be USD 78.38 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Spotlight on the China e-waste generation and its effective management.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Plastic Waste Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Plastic Waste Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Plastic Waste Management Industry?

To stay informed about further developments, trends, and reports in the China Plastic Waste Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence