Key Insights

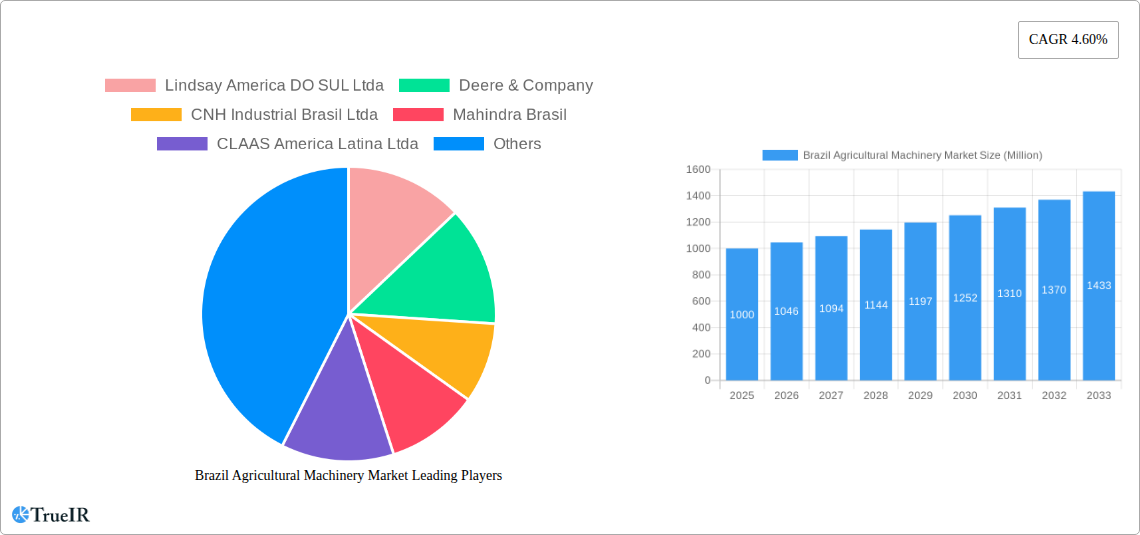

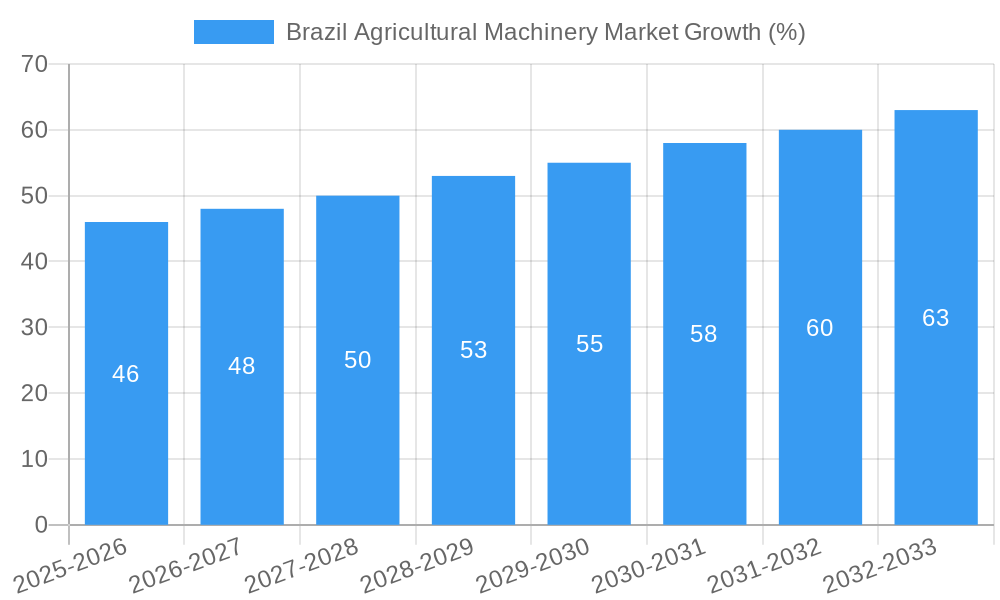

The Brazilian agricultural machinery market, valued at approximately $X million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.60% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, Brazil's significant agricultural sector, a global powerhouse in commodities like soybeans, sugarcane, and coffee, necessitates continuous modernization and efficiency improvements in farming practices. The increasing adoption of precision agriculture techniques, driven by technological advancements in GPS-guided machinery and data analytics, further stimulates demand. Government initiatives promoting agricultural modernization and infrastructure development also contribute positively to market growth. Furthermore, the expanding cultivated land area and rising farmer incomes are creating a favorable environment for increased investment in advanced agricultural machinery. However, market growth faces challenges such as economic volatility, fluctuations in commodity prices, and the potential impact of climate change on agricultural yields. Segmentation analysis reveals that high-horsepower tractors (above 130 HP) and advanced harvesting machinery (combine harvesters and forage harvesters) are likely to witness the fastest growth, reflecting the trend towards larger-scale farming operations and the need for higher productivity.

The market's competitive landscape is characterized by a mix of international and domestic players. Key companies like Deere & Company, CNH Industrial Brasil Ltda, Mahindra Brasil, and AGCO do Brasil compete fiercely, offering a diverse range of machinery to cater to varied agricultural needs. Future market success hinges on companies' ability to adapt to evolving technological advancements, offer financing options, and provide robust after-sales services to farmers. Considering the historical period (2019-2024) and the provided CAGR, specific segments like planting and irrigation machinery are anticipated to experience significant growth, driven by the increasing adoption of water-efficient irrigation techniques and precision planting technologies to maximize crop yields and resource utilization. The market's future trajectory will be significantly influenced by broader macroeconomic factors, agricultural policies, and technological innovations impacting farming practices across Brazil.

Brazil Agricultural Machinery Market: A Comprehensive Report (2019-2033)

This dynamic report provides a comprehensive analysis of the Brazil agricultural machinery market, offering invaluable insights for industry stakeholders, investors, and researchers. Covering the period from 2019 to 2033, with a focus on 2025, this report leverages robust data and expert analysis to illuminate market trends, opportunities, and challenges. The Brazilian agricultural machinery market, valued at xx Million in 2024, is poised for significant growth, driven by technological advancements and government initiatives. This report dissects this vibrant market, segmenting it by key machinery types and exploring the competitive landscape dominated by major players like Deere & Company, CNH Industrial Brasil Ltda, and AGCO do Brasil.

Brazil Agricultural Machinery Market Market Structure & Competitive Landscape

The Brazilian agricultural machinery market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a competitive yet consolidated landscape. Innovation plays a crucial role, driven by the need for increased efficiency and productivity in agriculture. Government regulations, particularly those concerning safety and environmental standards, significantly impact market dynamics. Substitute products, such as older, second-hand machinery, present a competitive challenge, while the emergence of precision agriculture technologies introduces new market segments.

End-user segmentation primarily focuses on large-scale commercial farms and smaller family-run operations, each with distinct machinery needs. Mergers and acquisitions (M&A) activity has been moderate in recent years, with xx M&A deals recorded between 2019 and 2024, primarily driven by consolidation efforts and expansion into new market segments. Future M&A activity is predicted to increase due to the potential for synergy and growth within the market. The key aspects of market structure are:

- Market Concentration: Moderately concentrated, with an estimated HHI of xx in 2024.

- Innovation Drivers: Demand for higher efficiency, precision agriculture, and automation.

- Regulatory Impacts: Stringent safety and environmental standards influence product design and market access.

- Product Substitutes: Used machinery presents a competitive threat to new equipment sales.

- End-User Segmentation: Large commercial farms and smaller family-run operations.

- M&A Trends: Moderate activity (xx deals between 2019-2024) with potential for increased future activity.

Brazil Agricultural Machinery Market Market Trends & Opportunities

The Brazilian agricultural machinery market exhibits substantial growth potential, with an estimated Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, driven by several key factors. Rising agricultural output, fueled by increasing global demand for food and biofuels, necessitates the adoption of advanced machinery. Technological advancements, such as precision farming technologies, automation, and data analytics, are enhancing efficiency and productivity. Consumer preferences are shifting towards technologically advanced, fuel-efficient, and easy-to-operate machinery. This is leading to increased demand for higher horsepower tractors and advanced planting and harvesting equipment. Intense competition among major players is stimulating innovation and price competitiveness. However, factors such as fluctuations in commodity prices, economic instability, and access to credit can impact market growth.

The market penetration of advanced technologies like GPS-guided tractors and automated harvesters remains relatively low, presenting significant opportunities for future expansion. The increasing adoption of precision agriculture practices is expected to further drive market growth. The government's initiatives to support agricultural modernization and improve infrastructure are creating a favorable environment for market expansion. This growth is also expected to be fueled by increasing investments from major players. The market size is expected to reach xx Million by 2033.

Dominant Markets & Segments in Brazil Agricultural Machinery Market

The Brazilian agricultural machinery market is geographically diverse, with significant demand across various regions. However, the key growth drivers are concentrated in specific segments and regions.

Leading Segments:

- Tractors: The tractor segment dominates the market, particularly in the 81-130 HP and Above 130 HP categories. The demand for higher horsepower tractors is fueled by the expansion of large-scale farms and the need for increased efficiency in land cultivation.

- Planting Machinery: This segment is also witnessing robust growth due to the focus on improving planting precision and yield optimization.

- Harvesting Machinery: Demand for advanced combine harvesters and forage harvesters is increasing due to the rising production of grains and forage crops.

Key Growth Drivers (by segment):

- Infrastructure Development: Improved transportation networks and storage facilities are facilitating the distribution and use of agricultural machinery.

- Government Policies: Government subsidies and incentives aimed at promoting agricultural modernization are stimulating market growth.

- Technological Advancements: Precision agriculture technologies, automation, and data analytics are significantly improving efficiency and productivity.

- Favorable Climate: Brazil's climate is conducive to a wide range of agricultural crops, enhancing overall agricultural output and stimulating demand for machinery.

The states of Mato Grosso, Paraná, and Goiás are among the most dominant regions, owing to their significant agricultural production and favorable infrastructure.

Brazil Agricultural Machinery Market Product Analysis

The Brazilian agricultural machinery market is characterized by a diverse range of products, reflecting the varying needs of different agricultural operations. Technological advancements are evident in the incorporation of precision agriculture technologies, automation features, and improved engine efficiency across various machinery types. This leads to increased productivity, reduced operating costs, and improved crop yields. The market is witnessing a growing demand for technologically advanced products that meet stringent safety and environmental standards. Competition is primarily based on price, quality, features, and after-sales services, leading to continuous product innovation and differentiation.

Key Drivers, Barriers & Challenges in Brazil Agricultural Machinery Market

Key Drivers:

Technological advancements, including precision agriculture and automation, are increasing efficiency and yield. Government support through subsidies and infrastructure development is fueling market growth. The expanding agricultural sector, driven by global food demand and biofuel production, creates a substantial need for advanced machinery.

Challenges & Restraints:

Fluctuations in commodity prices can significantly impact demand. High import duties and tariffs can increase the cost of imported machinery, affecting affordability and competitiveness. Access to credit and financing can be a challenge for many farmers, especially smaller operations. The current geopolitical climate may also result in supply chain disruptions and material scarcity.

Growth Drivers in the Brazil Agricultural Machinery Market Market

The growth of the Brazilian agricultural machinery market is primarily driven by the increasing demand for efficient and technologically advanced machinery to enhance productivity and optimize yields. Government initiatives, such as subsidies and infrastructure development, play a crucial role in boosting market growth. The rising global demand for food and biofuels is a significant driver, stimulating agricultural expansion and the need for more sophisticated machinery.

Challenges Impacting Brazil Agricultural Machinery Market Growth

The primary challenges include price volatility of agricultural commodities, which directly affects farmer investment capacity. Economic uncertainties and fluctuating currency exchange rates can impact machinery imports and investment decisions. Access to credit remains a significant barrier for some farmers, especially smaller producers, hindering their ability to acquire new machinery.

Key Players Shaping the Brazil Agricultural Machinery Market Market

- Lindsay America DO SUL Ltda

- Deere & Company

- CNH Industrial Brasil Ltda

- Mahindra Brasil

- CLAAS America Latina Ltda

- Kubota Tractor Corp

- AGCO do Brasil

Significant Brazil Agricultural Machinery Market Industry Milestones

- August 2023: New Holland Agriculture (CNH Industrial) launched the TL5 Acessível tractor, designed for farmers with lower limb motor disabilities.

- September 2022: Marcher Brasil introduced the OUTGRAIN211 grain extractor, improving silo bag grain removal efficiency.

- July 2022: Mahindra & Mahindra inaugurated an assembly plant in Brazil, expanding its manufacturing presence.

Future Outlook for Brazil Agricultural Machinery Market Market

The Brazilian agricultural machinery market is expected to experience sustained growth, driven by technological advancements, government support, and the expanding agricultural sector. The increasing adoption of precision agriculture techniques, automation, and data analytics will further drive market expansion. Strategic investments in research and development, along with collaborations between manufacturers and agricultural institutions, will be crucial in shaping the future of the market. The market holds significant potential for growth in the coming years, with opportunities for both established and emerging players.

Brazil Agricultural Machinery Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Brazil Agricultural Machinery Market Segmentation By Geography

- 1. Brazil

Brazil Agricultural Machinery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Brazilian Farm Structure and Consolidation of Smaller Farms; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. High Cost of Equipment and Price Sensitivity; Data Privacy Concerns

- 3.4. Market Trends

- 3.4.1. Brazilian Farm Structure and Consolidation of Smaller Farms

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Agricultural Machinery Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Lindsay America DO SUL Ltda

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Deere & Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CNH Industrial Brasil Ltda

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mahindra Brasil

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CLAAS America Latina Ltda

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kubota Tractor Corp

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AGCO do Brasil

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Lindsay America DO SUL Ltda

List of Figures

- Figure 1: Brazil Agricultural Machinery Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Agricultural Machinery Market Share (%) by Company 2024

List of Tables

- Table 1: Brazil Agricultural Machinery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Agricultural Machinery Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Brazil Agricultural Machinery Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Brazil Agricultural Machinery Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Brazil Agricultural Machinery Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Brazil Agricultural Machinery Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Brazil Agricultural Machinery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Brazil Agricultural Machinery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Brazil Agricultural Machinery Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 10: Brazil Agricultural Machinery Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 11: Brazil Agricultural Machinery Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 12: Brazil Agricultural Machinery Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 13: Brazil Agricultural Machinery Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 14: Brazil Agricultural Machinery Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Agricultural Machinery Market?

The projected CAGR is approximately 4.60%.

2. Which companies are prominent players in the Brazil Agricultural Machinery Market?

Key companies in the market include Lindsay America DO SUL Ltda, Deere & Company, CNH Industrial Brasil Ltda, Mahindra Brasil, CLAAS America Latina Ltda, Kubota Tractor Corp, AGCO do Brasil.

3. What are the main segments of the Brazil Agricultural Machinery Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Brazilian Farm Structure and Consolidation of Smaller Farms; Technological Advancements.

6. What are the notable trends driving market growth?

Brazilian Farm Structure and Consolidation of Smaller Farms.

7. Are there any restraints impacting market growth?

High Cost of Equipment and Price Sensitivity; Data Privacy Concerns.

8. Can you provide examples of recent developments in the market?

August 2023: New Holland Agriculture, a brand under CNH Industrial, introduced one of the world's pioneering and cost-effective farm tractors created by an automobile manufacturer. The TL5 Acessível model tractor was manufactured at the Curitiba (PR) facility in Brazil. This tractor has been specifically engineered to cater to individuals with lower limb motor disabilities, enabling them to independently engage in agricultural activities. This breakthrough by the company promises to break down barriers that have long hindered many farmers from accessing tractor-operating stations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Agricultural Machinery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Agricultural Machinery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Agricultural Machinery Market?

To stay informed about further developments, trends, and reports in the Brazil Agricultural Machinery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence