Key Insights

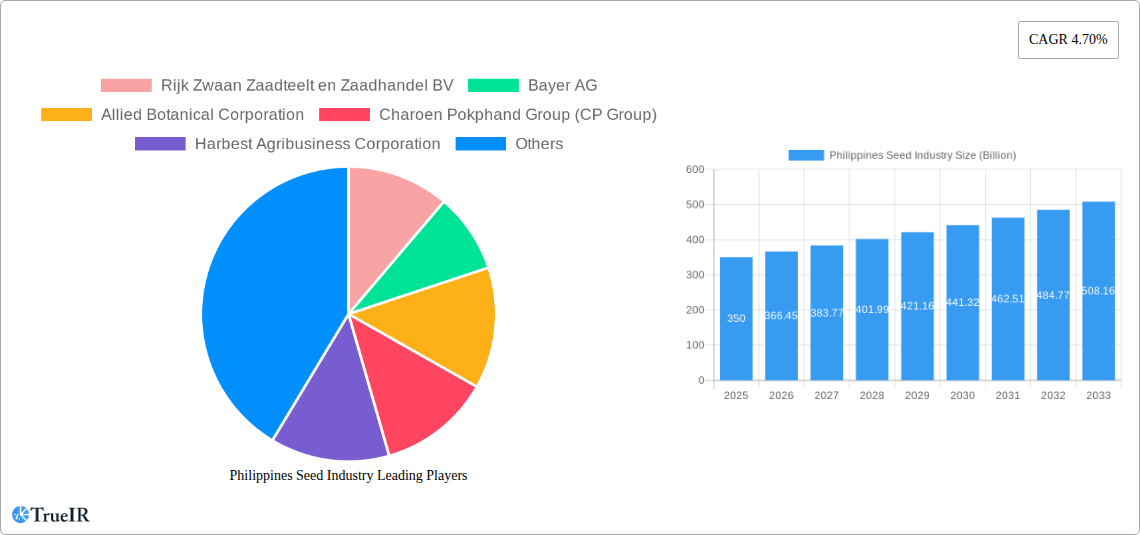

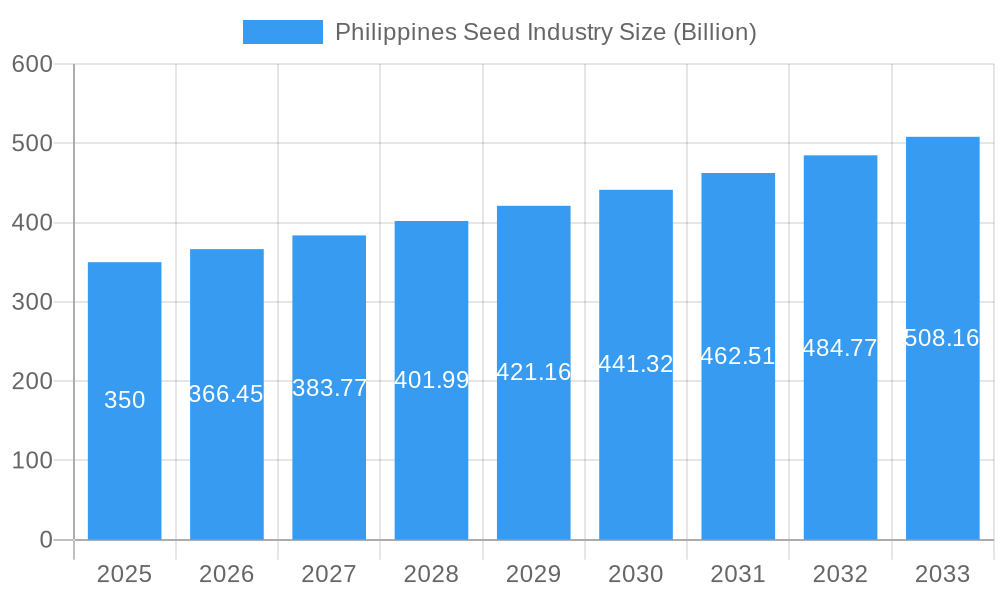

The Philippine seed industry is poised for significant expansion, driven by a robust CAGR of 4.70%, projecting a market value of approximately USD 350 million by 2025, considering a hypothetical base market size from which the CAGR is applied. This growth is underpinned by a confluence of factors, most notably the increasing adoption of high-yielding and disease-resistant seed varieties by Filipino farmers. Government initiatives aimed at modernizing agriculture, coupled with a growing emphasis on food security and export potential, are further fueling demand for premium seeds. The rising disposable income and a greater awareness of advanced farming techniques are also encouraging farmers to invest in quality seeds, thereby improving crop productivity and overall farm profitability. Key segments like production analysis, consumption patterns, and import/export dynamics are crucial for understanding the market's trajectory, with innovations in biotechnology and precision agriculture expected to shape future trends.

Philippines Seed Industry Market Size (In Million)

The industry, however, faces certain restraints, including the persistent challenges of climate change, which necessitates the development of resilient seed varieties, and fluctuating input costs for seed production. Regulatory hurdles and the need for greater farmer education on the benefits of improved seed technologies also present areas for focused development. Major players like Syngenta, Bayer AG, and East-West Seed are actively investing in research and development to cater to the evolving needs of the Philippine agricultural landscape, focusing on segments such as hybrid rice, corn, and vegetables. The Philippines' strategic location and its strong agricultural base present a fertile ground for growth, with the potential to become a regional hub for seed innovation and distribution. The ongoing focus on sustainable agricultural practices will also influence the types of seeds that gain prominence, with an increased demand for organic and drought-tolerant varieties expected.

Philippines Seed Industry Company Market Share

Philippines Seed Industry Market Structure & Competitive Landscape

The Philippines seed industry exhibits a moderately concentrated market structure, with key global players alongside established domestic entities. Innovation drivers are primarily focused on developing high-yielding, disease-resistant, and climate-resilient seed varieties tailored to the Philippine agricultural landscape. Regulatory impacts, while evolving, aim to standardize seed quality and promote farmer access to improved germplasm. Product substitutes, such as traditional seed saving practices, are gradually being displaced by certified hybrid and improved varieties. End-user segmentation primarily revolves around major crop types like rice, corn, and vegetables, with distinct requirements for each. Mergers and acquisitions (M&A) trends, though not extensively documented with specific transaction volumes in billions for the Philippines alone, are indicative of global consolidation efforts by major seed corporations seeking to expand their regional footprint and product portfolios. For instance, global M&A activities by companies like Syngenta and Corteva underscore a broader trend of market consolidation to enhance R&D capabilities and market reach. The industry is characterized by a blend of multinational corporations with significant R&D investment and strong distribution networks, and local companies that possess deep understanding of regional farming conditions and farmer relationships.

Philippines Seed Industry Market Trends & Opportunities

The Philippines seed industry is poised for robust growth, driven by a confluence of factors including increasing demand for food security, a growing population, and government initiatives promoting agricultural modernization. The market size is projected to expand at a compound annual growth rate (CAGR) of approximately 6.5% from 2025 to 2033, reaching an estimated value exceeding X Billion by 2033. Technological shifts are a dominant trend, with a growing emphasis on biotechnology, gene editing, and digital agriculture solutions to enhance crop productivity and resilience. Consumers, increasingly aware of food quality and safety, are driving demand for seeds that produce healthier and more nutritious crops. Competitive dynamics are intensifying, with established multinational corporations competing against agile local players, creating a vibrant ecosystem of innovation. Opportunities abound for companies focusing on drought-tolerant and flood-resistant seed varieties, crucial for mitigating the impact of climate change on Philippine agriculture. The adoption of precision agriculture techniques and smart farming solutions presents another significant avenue for growth, enabling farmers to optimize resource utilization and maximize yields. Furthermore, the expanding middle class and rising disposable incomes are contributing to an increased demand for diverse and high-quality produce, thereby stimulating the market for a wider range of vegetable and fruit seeds. The government's continued support for agricultural research and development, coupled with favorable trade policies, is expected to further bolster market expansion. The push towards sustainable agriculture practices is also creating opportunities for companies offering eco-friendly seed solutions and integrated pest management strategies.

Dominant Markets & Segments in Philippines Seed Industry

Production Analysis: The production of seeds in the Philippines is significantly influenced by climatic conditions, farmer adoption rates of improved varieties, and the presence of seed production facilities. Key regions contributing to seed production often align with major agricultural belts. Factors driving production include government support for local seed multiplication programs, the availability of skilled labor, and access to advanced breeding technologies. The dominance in production is often held by companies with robust R&D capabilities and established seed multiplication networks.

Consumption Analysis: Consumption patterns are predominantly shaped by staple crop requirements, with rice and corn accounting for the largest share of the seed market. The vegetable seed segment is also experiencing substantial growth due to rising consumer demand for diverse and nutritious produce. Key growth drivers for consumption include:

- Increasing Food Demand: A growing population necessitates higher agricultural output, driving demand for high-yielding seeds.

- Government Support Programs: Initiatives promoting the adoption of certified seeds for key crops directly influence consumption.

- Farmer Education and Extension Services: Improved awareness and knowledge among farmers about the benefits of improved seed varieties boost consumption.

- Climate Change Adaptation: Demand for seeds that can withstand adverse weather conditions like typhoons and droughts is rising.

Import Market Analysis (Value & Volume): The Philippines is a net importer of certain high-value seed types, particularly for specialized vegetable hybrids and advanced corn varieties. The import market is driven by the need to access germplasm that offers superior traits not yet fully developed or widely available domestically. Value is often higher for seeds with advanced breeding technologies and specific disease resistances.

Export Market Analysis (Value & Volume): While the Philippines is primarily a consumer and producer of seeds for its domestic market, there are emerging opportunities for exporting specific varieties, especially to neighboring Southeast Asian countries. Factors enabling export growth include:

- Competitive Pricing: Potential for cost-effective production of certain seed types.

- Niche Crop Varieties: Exporting unique or climate-adapted varieties suitable for regional agricultural practices.

- Quality Standards: Meeting international quality standards to gain market access.

Price Trend Analysis: Price trends in the Philippines seed industry are influenced by a multitude of factors, including:

- Input Costs: Cost of R&D, hybrid development, production, and certification.

- Supply and Demand Dynamics: Availability of specific seed varieties versus the demand from farmers.

- Technological Advancement: Adoption of advanced breeding technologies can sometimes lead to higher initial prices for superior traits.

- Government Subsidies and Support: Policies can influence the final price paid by farmers.

- Market Competition: Intense competition can lead to price adjustments and promotions.

The market dominance in these segments is often held by companies that effectively balance local needs with global technological advancements, ensuring a steady supply of high-quality seeds that cater to the diverse agricultural landscape of the Philippines.

Philippines Seed Industry Product Analysis

Product innovation in the Philippines seed industry is characterized by a focus on developing seeds with enhanced yield potential, improved disease and pest resistance, and greater tolerance to environmental stresses such as drought and salinity. Companies are actively investing in breeding programs that leverage both conventional methods and cutting-edge biotechnologies, including gene editing, to introduce traits that align with the evolving needs of Filipino farmers and the changing climate. The competitive advantage lies in offering seed varieties that demonstrate superior performance under local agro-climatic conditions, provide better economic returns to farmers, and contribute to food security and sustainability. Applications range from staple crops like rice and corn to a burgeoning demand for high-value vegetables and fruits, driven by changing consumer preferences and the export market.

Key Drivers, Barriers & Challenges in Philippines Seed Industry

Key Drivers:

- Growing Population and Food Demand: A fundamental driver necessitating increased agricultural productivity.

- Government Support and Policies: Initiatives aimed at modernizing agriculture and enhancing food security are crucial.

- Technological Advancements: Innovations in breeding and biotechnology are leading to higher-yielding and resilient seeds.

- Climate Change Adaptation: The increasing need for seeds tolerant to extreme weather conditions.

- Farmer Adoption of Improved Varieties: Growing awareness and economic incentives encouraging farmers to use certified seeds.

Barriers & Challenges:

- Supply Chain Disruptions: Issues related to logistics, storage, and timely distribution of seeds, especially in remote areas.

- Regulatory Hurdles: Navigating complex seed regulations and certification processes can be time-consuming and costly.

- Climate Change Impacts: Unpredictable weather patterns can affect seed production and farmer income, leading to reduced investment.

- Farmer Access to Credit and Resources: Limited access to capital can hinder farmers from purchasing improved seed varieties.

- Competition from Informal Seed Systems: Traditional seed saving and informal markets can pose a challenge to the formal seed industry.

- Intellectual Property Protection: Ensuring adequate protection for proprietary seed technologies remains a concern.

Growth Drivers in the Philippines Seed Industry Market

The Philippines seed industry's growth is propelled by a confluence of strategic factors. Technological advancements, particularly in areas like hybrid breeding and genetic modification, are yielding seed varieties with enhanced resilience to pests, diseases, and climate variability, such as drought and salinity tolerance. Economic factors, including the government's sustained focus on agricultural modernization and food security, coupled with rising domestic demand for diverse food products, create a fertile ground for expansion. Regulatory support, with policies aimed at streamlining seed registration and promoting local seed production, further bolsters growth. For example, government-backed research institutions and agricultural programs encourage the adoption of high-performing seeds, directly translating into market expansion and improved farmer livelihoods.

Challenges Impacting Philippines Seed Industry Growth

Several significant challenges impede the seamless growth of the Philippines seed industry. Regulatory complexities surrounding seed importation, registration, and intellectual property rights can create bottlenecks and increase operational costs for companies. Supply chain inefficiencies, particularly in reaching remote agricultural regions, lead to delayed access for farmers and potential spoilage. Intense competitive pressures, both from established multinational corporations and local players, necessitate continuous innovation and strategic pricing. Furthermore, climate change impacts, such as unpredictable weather patterns and increased frequency of natural disasters, create uncertainty in seed production and farmer purchasing power, alongside farmer access to credit and agricultural extension services which directly impacts their ability to invest in modern seed technologies.

Key Players Shaping the Philippines Seed Industry Market

- Rijk Zwaan Zaadteelt en Zaadhandel BV

- Bayer AG

- Allied Botanical Corporation

- Charoen Pokphand Group (CP Group)

- Harbest Agribusiness Corporation

- SeedWorks International Pvt Ltd

- DCM Shriram Ltd (Bioseed)

- East-West Seed

- Syngenta Grou

- Corteva Agriscience

Significant Philippines Seed Industry Industry Milestones

- April 2023: Syngenta Seeds and Ginkgo Bioworks collaborated to develop new traits for the next generation of seed technology to produce healthier and more resilient crops.

- April 2023: Syngenta acquired a vegetable seed-producing company in Brazil, Feltrin Seeds, which serves customers in over 40 countries. The acquisition is estimated to spread the product portfolio of Syngenta in all vegetable-producing countries in the world.

- March 2023: Corteva Agriscience introduced gene-editing technology for added protection to corn hybrids, which helps in providing resistance to multiple diseases.

Future Outlook for Philippines Seed Industry Market

The future outlook for the Philippines seed industry is highly promising, driven by a sustained demand for increased agricultural productivity and enhanced food security. Strategic opportunities lie in the development and commercialization of climate-resilient seed varieties, catering to the growing threat of extreme weather events. The ongoing adoption of advanced biotechnologies and digital farming solutions will further shape the market, offering greater precision and efficiency. Companies that can effectively navigate regulatory landscapes, strengthen their distribution networks to reach underserved regions, and align their product portfolios with evolving consumer preferences for nutritious and sustainably produced food will be well-positioned for significant growth. The increasing focus on crop diversification and the potential for export of niche varieties to neighboring markets also present considerable market potential.

Philippines Seed Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Philippines Seed Industry Segmentation By Geography

- 1. Philippines

Philippines Seed Industry Regional Market Share

Geographic Coverage of Philippines Seed Industry

Philippines Seed Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Philippines Seed Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Philippines

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Rijk Zwaan Zaadteelt en Zaadhandel BV

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bayer AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Allied Botanical Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Charoen Pokphand Group (CP Group)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Harbest Agribusiness Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SeedWorks International Pvt Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DCM Shriram Ltd (Bioseed)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 East-West Seed

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Syngenta Grou

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Corteva Agriscience

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Rijk Zwaan Zaadteelt en Zaadhandel BV

List of Figures

- Figure 1: Philippines Seed Industry Revenue Breakdown (Billion, %) by Product 2025 & 2033

- Figure 2: Philippines Seed Industry Share (%) by Company 2025

List of Tables

- Table 1: Philippines Seed Industry Revenue Billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Philippines Seed Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 3: Philippines Seed Industry Revenue Billion Forecast, by Consumption Analysis 2020 & 2033

- Table 4: Philippines Seed Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 5: Philippines Seed Industry Revenue Billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: Philippines Seed Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: Philippines Seed Industry Revenue Billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: Philippines Seed Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: Philippines Seed Industry Revenue Billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: Philippines Seed Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: Philippines Seed Industry Revenue Billion Forecast, by Region 2020 & 2033

- Table 12: Philippines Seed Industry Volume Kiloton Forecast, by Region 2020 & 2033

- Table 13: Philippines Seed Industry Revenue Billion Forecast, by Production Analysis 2020 & 2033

- Table 14: Philippines Seed Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 15: Philippines Seed Industry Revenue Billion Forecast, by Consumption Analysis 2020 & 2033

- Table 16: Philippines Seed Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 17: Philippines Seed Industry Revenue Billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: Philippines Seed Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Philippines Seed Industry Revenue Billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Philippines Seed Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: Philippines Seed Industry Revenue Billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: Philippines Seed Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: Philippines Seed Industry Revenue Billion Forecast, by Country 2020 & 2033

- Table 24: Philippines Seed Industry Volume Kiloton Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Philippines Seed Industry?

The projected CAGR is approximately 4.70%.

2. Which companies are prominent players in the Philippines Seed Industry?

Key companies in the market include Rijk Zwaan Zaadteelt en Zaadhandel BV, Bayer AG, Allied Botanical Corporation, Charoen Pokphand Group (CP Group), Harbest Agribusiness Corporation, SeedWorks International Pvt Ltd, DCM Shriram Ltd (Bioseed), East-West Seed, Syngenta Grou, Corteva Agriscience.

3. What are the main segments of the Philippines Seed Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX Billion as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

April 2023: Syngenta Seeds and Ginkgo Bioworks collaborated to develop new traits for the next generation of seed technology to produce healthier and more resilient crops.April 2023: Syngenta acquired a vegetable seed-producing company in Brazil, Feltrin Seeds, which serves customers in over 40 countries. The acquisition is estimated to spread the product portfolio of Syngenta in all vegetable-producing countries in the world.March 2023: Corteva Agriscience introduced gene-editing technology for added protection to corn hybrids, which helps in providing resistance to multiple diseases.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Billion and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Philippines Seed Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Philippines Seed Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Philippines Seed Industry?

To stay informed about further developments, trends, and reports in the Philippines Seed Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence