Key Insights

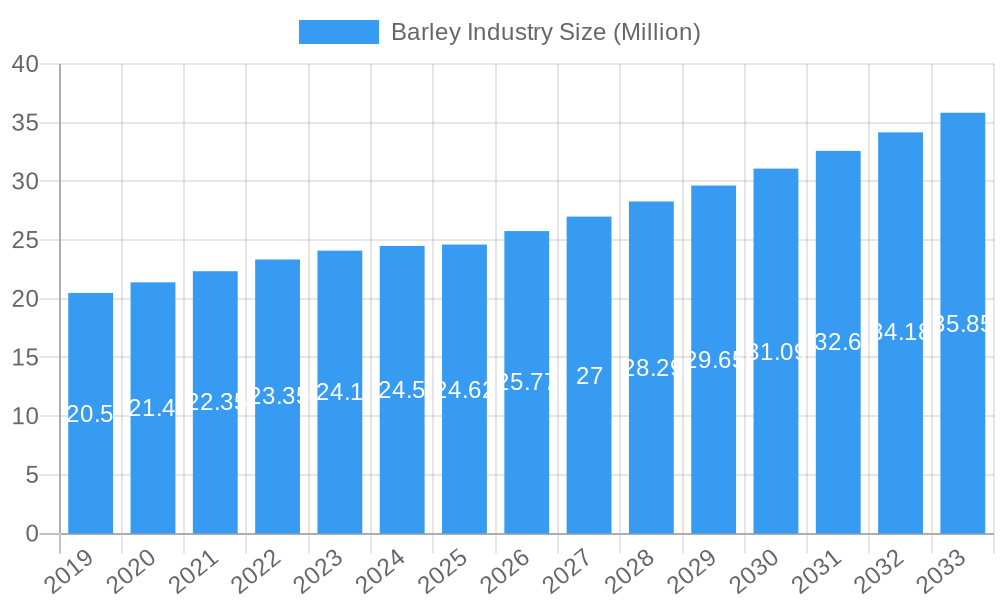

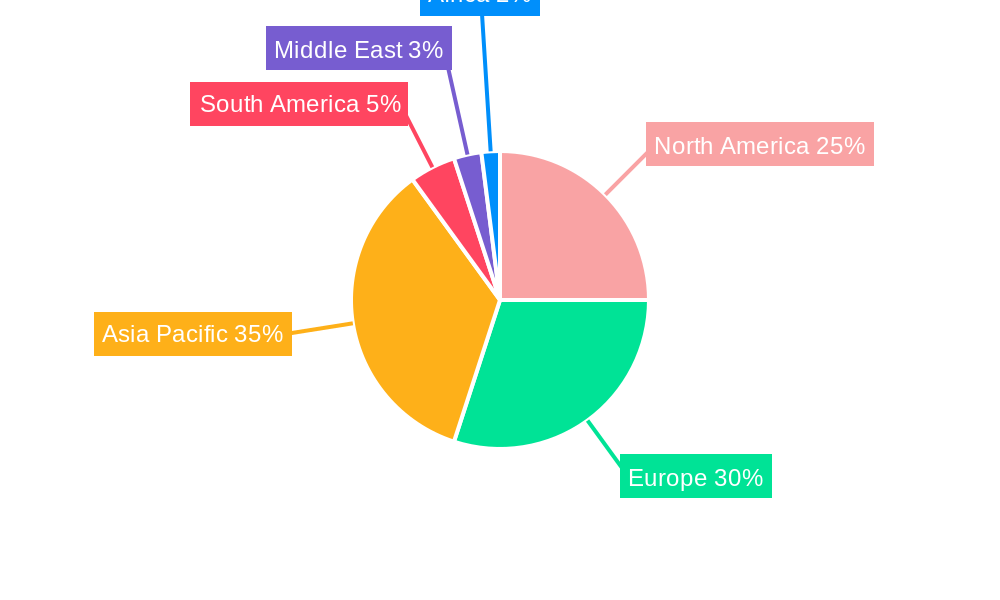

The global barley market is poised for steady growth, projected to reach an estimated market size of $24.62 million by 2025, with a compound annual growth rate (CAGR) of 4.73% expected to propel it further through 2033. This upward trajectory is underpinned by a confluence of robust demand drivers. A significant contributor is the burgeoning global beer industry, which relies heavily on barley for malting. Furthermore, the increasing adoption of barley in animal feed, driven by its nutritional value and cost-effectiveness compared to other grains, is a key growth factor. The health and wellness trend is also influencing consumption, with barley's inclusion in a variety of food products due to its perceived health benefits, such as its high fiber content and potential to lower cholesterol. Emerging economies, particularly in the Asia Pacific region, are witnessing accelerated demand for barley, fueled by population growth and rising disposable incomes, leading to increased consumption of beer and processed foods.

Barley Industry Market Size (In Million)

However, the market is not without its challenges. Supply chain disruptions, influenced by geopolitical factors and extreme weather events affecting crop yields, can lead to price volatility and impact availability. Furthermore, stringent regulations concerning agricultural practices and import/export policies in certain regions can create hurdles for market expansion. The presence of established major players such as Malteurop, Rahr Malting, Soufflet Group, Cargill, and Boortmalt signifies a competitive landscape, with innovation in malting technologies and product diversification being crucial for sustained market leadership. Key regions like North America, with the United States as a significant consumer and producer, and Europe, with Germany being a prominent market, are expected to continue their substantial contributions, while the Asia Pacific, led by China, is anticipated to be a major growth engine.

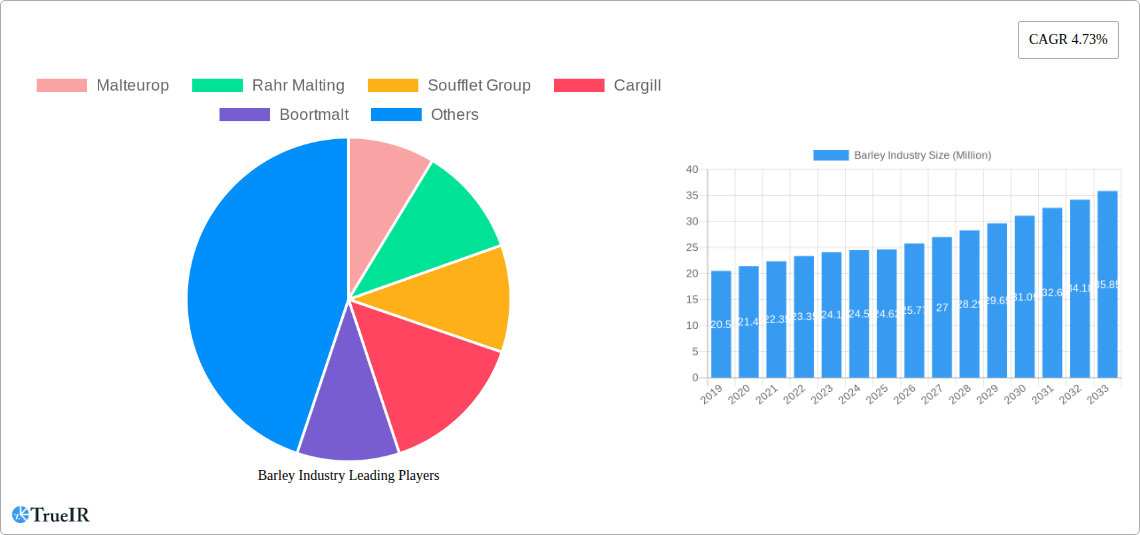

Barley Industry Company Market Share

Here is a dynamic, SEO-optimized report description for the Barley Industry, incorporating your specifications:

Barley Industry Market Structure & Competitive Landscape

The global barley industry exhibits a moderately concentrated market structure, with a handful of dominant players like Malteurop, Rahr Malting, Soufflet Group, Cargill, and Boortmalt accounting for a significant portion of production and market share. Innovation is a key driver, propelled by advancements in seed genetics, cultivation techniques, and processing technologies aimed at enhancing yield, disease resistance, and nutritional profiles. Regulatory frameworks, particularly concerning agricultural subsidies, trade policies, and food safety standards, profoundly influence market dynamics and competitive advantages. Product substitutes, such as other feed grains and malting ingredients, exert pressure, necessitating continuous improvement and differentiation in barley offerings. End-user segmentation spans malting and brewing, animal feed, and food and industrial applications, each with distinct demands and growth trajectories. Mergers and acquisitions (M&A) are strategic tools employed by leading companies to expand geographical reach, secure supply chains, and integrate value-added capabilities. The volume of M&A activities is projected to remain robust, reflecting a consolidation trend aimed at achieving economies of scale and enhancing global competitiveness. Quantitative analysis indicates a Herfindahl-Hirschman Index (HHI) in the moderate range, suggesting a balance between market leadership and the presence of smaller, specialized players.

Barley Industry Market Trends & Opportunities

The global barley market is poised for substantial growth, projected to reach xx Million by 2033, expanding at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025–2033. This growth is fueled by a confluence of evolving consumer preferences, technological advancements, and strategic industry developments. A significant trend is the increasing demand for higher-quality barley for malting and brewing, driven by the expanding craft beer industry and a global surge in premium beverage consumption. Simultaneously, the animal feed sector continues to be a robust consumer of barley, supported by the rising global demand for meat and dairy products, necessitating efficient and cost-effective feed solutions. Technological shifts are revolutionizing barley cultivation, with an emphasis on climate-resilient varieties and precision agriculture techniques. Initiatives like the one undertaken by Intergrain in April 2021, in collaboration with Australian universities, highlight the focus on improving barley yield stability against climate variability. This pursuit of innovative breeding solutions will be crucial in ensuring consistent supply and meeting the growing demand for productive crops. Consumer preferences are also leaning towards healthier food options, creating opportunities for barley in the human food sector, including breakfast cereals, baked goods, and functional food ingredients, due to its rich fiber content and nutritional benefits. The competitive landscape is characterized by intense R&D efforts, strategic alliances, and a focus on sustainable farming practices. Market penetration rates are expected to increase across emerging economies as agricultural infrastructure improves and consumer awareness of barley's versatility grows. The industry's ability to adapt to these trends, embrace innovation, and address sustainability concerns will be paramount in capitalizing on the significant market opportunities that lie ahead.

Dominant Markets & Segments in Barley Industry

The global barley industry's dominance is shaped by a complex interplay of production capabilities, consumption patterns, and trade flows.

Production Analysis:

- Dominant Region: Europe, particularly countries like Germany, France, and Russia, consistently leads in barley production volume, driven by favorable agricultural conditions and robust government support.

- Key Growth Drivers:

- Favorable Climate and Soil Conditions: Extensive arable land and suitable climatic zones in major producing countries facilitate large-scale cultivation.

- Government Subsidies and Agricultural Policies: The European Commission's Common Agricultural Policy (CAP), aiming for sustainable agriculture, plays a crucial role in supporting European farmers and maintaining production levels.

- Technological Advancements in Cultivation: Adoption of improved farming techniques and high-yield seed varieties contributes to increased output.

Consumption Analysis:

- Dominant Segment: The animal feed sector represents the largest consumer of barley globally, accounting for approximately xx% of total consumption.

- Key Growth Drivers:

- Rising Global Meat and Dairy Demand: An increasing global population and rising disposable incomes in emerging economies drive demand for animal protein, consequently boosting the need for feed grains like barley.

- Cost-Effectiveness as Feed Ingredient: Barley offers a nutritious and economically viable alternative to other feed grains, making it a preferred choice for livestock producers.

- Growth in the Brewing and Malting Industry: The expanding global beverage market, particularly craft beers and spirits, fuels demand for malting-grade barley.

Import Market Analysis (Value & Volume):

- Dominant Region: Asia, particularly China and Japan, are significant importers of barley, driven by their large populations and substantial demand from both feed and malting industries.

- Key Growth Drivers:

- Domestic Production Shortfalls: Many importing nations have insufficient domestic production to meet their consumption needs.

- Demand for Specific Barley Varieties: Importers often seek specialized barley types for brewing or specific feed formulations.

- Trade Agreements and Tariffs: Favorable trade policies and lower import duties can stimulate import volumes. The import market value is estimated at xx Million in 2025.

Export Market Analysis (Value & Volume):

- Dominant Exporter: Australia, the European Union (especially France and Germany), and Russia are leading barley exporters, leveraging their substantial production capacities and competitive pricing.

- Key Growth Drivers:

- Exportable Surpluses: Countries with strong domestic production often generate significant exportable surpluses.

- Global Demand Centers: Proximity to or strong trade ties with major importing regions is a significant advantage.

- Quality and Price Competitiveness: Offering high-quality barley at competitive prices is crucial for export market success. The export market value is projected to reach xx Million by 2033.

Price Trend Analysis:

- Key Influences: Global supply and demand dynamics, weather patterns impacting crop yields, input costs (fertilizers, fuel), currency fluctuations, and government agricultural policies significantly influence barley price trends. Prices are anticipated to exhibit xx% volatility between 2025 and 2033.

- Overall Trend: While subject to fluctuations, a general upward trend in barley prices is expected, driven by increasing global demand and the rising cost of agricultural inputs.

Barley Industry Product Analysis

The barley industry is characterized by a continuous drive for product innovation, focusing on enhancing existing varieties and developing novel applications. Key advancements include the breeding of barley with improved nutritional profiles for both human and animal consumption, such as higher protein or fiber content. For malting, research focuses on optimizing enzyme content and extract yield, directly impacting the efficiency and quality of brewing and distilling processes. In the food sector, barley flour and flakes are gaining traction as healthy ingredients in baked goods and cereals. Competitive advantages are derived from superior seed genetics that offer enhanced disease resistance, drought tolerance, and yield stability, particularly relevant in the face of climate variability as highlighted by initiatives like Intergrain's university collaborations.

Key Drivers, Barriers & Challenges in Barley Industry

Key Drivers:

- Growing Global Demand: Increasing consumption from the animal feed sector and the expanding brewing industry are primary growth catalysts.

- Technological Advancements: Innovations in crop breeding and cultivation techniques are improving yields and resilience.

- Government Support and Policies: Agricultural policies, such as the EU's CAP, provide crucial support for farmers and production.

Barriers & Challenges:

- Climate Change and Weather Volatility: Extreme weather events can lead to crop failures and supply chain disruptions.

- Input Cost Volatility: Fluctuations in the prices of fertilizers, energy, and labor impact profitability.

- Regulatory Hurdles: Stringent regulations on trade, food safety, and environmental practices can create compliance challenges.

- Competition from Substitute Grains: Other grains like corn and wheat compete in the animal feed market.

Growth Drivers in the Barley Industry Market

The barley industry is propelled by a confluence of technological, economic, and regulatory factors. Technologically, advancements in plant breeding are yielding barley varieties with enhanced resilience to climate change and diseases, ensuring more stable yields. Economically, the escalating global demand for animal protein fuels the need for cost-effective feed grains, with barley playing a vital role. Furthermore, the burgeoning craft beer and spirits market creates a consistent demand for high-quality malting barley. Regulatory support, such as the European Commission's Common Agricultural Policy, plays a significant role by incentivizing sustainable farming practices and providing financial assistance to farmers, thereby bolstering production. These interwoven drivers collectively contribute to the sustained growth trajectory of the barley market.

Challenges Impacting Barley Industry Growth

The barley industry faces several significant challenges that can hinder its growth trajectory. Regulatory complexities, including varying trade policies and evolving food safety standards across different regions, can create barriers to market access and increase compliance costs. Supply chain disruptions, often exacerbated by extreme weather events, geopolitical instability, or logistical bottlenecks, pose a constant threat to the timely and cost-effective delivery of barley. Competitive pressures from substitute grains, such as corn and wheat, in the animal feed sector, can impact market share and pricing power. Additionally, the increasing cost of agricultural inputs, including fertilizers and energy, directly affects farmers' profitability and can deter investment in increased production.

Key Players Shaping the Barley Industry Market

- Malteurop

- Rahr Malting

- Soufflet Group

- Cargill

- Boortmalt

Significant Barley Industry Industry Milestones

- January 2023: The European Commission's new Common Agricultural Policy aims to support European farmers in transitioning to a more sustainable and resilient agricultural industry and preserving the diversity of rural communities, impacting production practices and market incentives across the EU.

- April 2021: Intergrain, a leading Australian barley breeding company, teamed up with two major Australian universities to improve barley yield stability in the face of climate variability and provide innovative breeding solutions that enable the development of more productive crops, signifying a commitment to climate-resilient agriculture and enhanced crop output.

Future Outlook for Barley Industry Market

The future outlook for the barley industry is characterized by sustained growth, driven by increasing global demand and ongoing innovation. Strategic opportunities lie in developing and adopting climate-resilient barley varieties to mitigate the impacts of weather volatility, thereby ensuring supply stability. The expanding demand from the animal feed sector, coupled with the premiumization of the brewing and distilling industries, will continue to be significant growth catalysts. Furthermore, the increasing consumer focus on health and wellness presents an avenue for growth in the human food applications of barley. Investments in research and development for novel uses and improved cultivation techniques will be crucial for market players to capitalize on the projected market expansion, ensuring the industry remains robust and responsive to global needs.

Barley Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Barley Industry Segmentation By Geography

-

1. North America

- 1.1. United States

-

2. Europe

- 2.1. Germany

-

3. Asia Pacific

- 3.1. China

-

4. South America

- 4.1. Argentina

- 5. Middle East

- 6. Saudi Arabia

Barley Industry Regional Market Share

Geographic Coverage of Barley Industry

Barley Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.73% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Berry Consumption for Health Benefits; Increasing Adoption of High-Technology Farm Practices; Growing Usage of Berries in the Food and Beverage Industries

- 3.3. Market Restrains

- 3.3.1. High Production Cost Involved in Berry Production; Increasing Disease and Pest Infestations

- 3.4. Market Trends

- 3.4.1. Emerging Applications is Various Industries Led to Growth in Exports

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Barley Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia Pacific

- 5.6.4. South America

- 5.6.5. Middle East

- 5.6.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Barley Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. Europe Barley Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Asia Pacific Barley Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. South America Barley Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Middle East Barley Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Saudi Arabia Barley Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 11.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 11.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 11.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 11.1. Market Analysis, Insights and Forecast - by Production Analysis

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Malteurop

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Rahr Malting

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Soufflet Group

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Cargill

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Boortmalt

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.1 Malteurop

List of Figures

- Figure 1: Global Barley Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Barley Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 3: North America Barley Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Barley Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 5: North America Barley Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Barley Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Barley Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Barley Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Barley Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Barley Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Barley Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Barley Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Barley Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Barley Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 15: Europe Barley Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: Europe Barley Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 17: Europe Barley Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: Europe Barley Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: Europe Barley Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: Europe Barley Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: Europe Barley Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: Europe Barley Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 23: Europe Barley Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: Europe Barley Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Barley Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Barley Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 27: Asia Pacific Barley Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Asia Pacific Barley Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 29: Asia Pacific Barley Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Asia Pacific Barley Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Asia Pacific Barley Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Asia Pacific Barley Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Asia Pacific Barley Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Asia Pacific Barley Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 35: Asia Pacific Barley Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Asia Pacific Barley Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Asia Pacific Barley Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: South America Barley Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 39: South America Barley Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: South America Barley Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 41: South America Barley Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: South America Barley Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: South America Barley Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: South America Barley Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: South America Barley Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: South America Barley Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 47: South America Barley Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: South America Barley Industry Revenue (Million), by Country 2025 & 2033

- Figure 49: South America Barley Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East Barley Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 51: Middle East Barley Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Middle East Barley Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 53: Middle East Barley Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Middle East Barley Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Middle East Barley Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Middle East Barley Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Middle East Barley Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Middle East Barley Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 59: Middle East Barley Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Middle East Barley Industry Revenue (Million), by Country 2025 & 2033

- Figure 61: Middle East Barley Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Saudi Arabia Barley Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 63: Saudi Arabia Barley Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 64: Saudi Arabia Barley Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 65: Saudi Arabia Barley Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 66: Saudi Arabia Barley Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 67: Saudi Arabia Barley Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 68: Saudi Arabia Barley Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 69: Saudi Arabia Barley Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 70: Saudi Arabia Barley Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 71: Saudi Arabia Barley Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 72: Saudi Arabia Barley Industry Revenue (Million), by Country 2025 & 2033

- Figure 73: Saudi Arabia Barley Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Barley Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Barley Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Barley Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Barley Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Barley Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Barley Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global Barley Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Barley Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Barley Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Barley Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Barley Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Barley Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States Barley Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Barley Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 15: Global Barley Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 16: Global Barley Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 17: Global Barley Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 18: Global Barley Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 19: Global Barley Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Germany Barley Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Barley Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 22: Global Barley Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 23: Global Barley Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 24: Global Barley Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 25: Global Barley Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 26: Global Barley Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 27: China Barley Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Barley Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 29: Global Barley Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 30: Global Barley Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 31: Global Barley Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 32: Global Barley Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 33: Global Barley Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Argentina Barley Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Barley Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 36: Global Barley Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 37: Global Barley Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 38: Global Barley Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 39: Global Barley Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 40: Global Barley Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Global Barley Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 42: Global Barley Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 43: Global Barley Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global Barley Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 45: Global Barley Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 46: Global Barley Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Barley Industry?

The projected CAGR is approximately 4.73%.

2. Which companies are prominent players in the Barley Industry?

Key companies in the market include Malteurop , Rahr Malting , Soufflet Group , Cargill, Boortmalt .

3. What are the main segments of the Barley Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Berry Consumption for Health Benefits; Increasing Adoption of High-Technology Farm Practices; Growing Usage of Berries in the Food and Beverage Industries.

6. What are the notable trends driving market growth?

Emerging Applications is Various Industries Led to Growth in Exports.

7. Are there any restraints impacting market growth?

High Production Cost Involved in Berry Production; Increasing Disease and Pest Infestations.

8. Can you provide examples of recent developments in the market?

January 2023: The European Commission's new Common Agricultural Policy aims to support European farmers in transitioning to a more sustainable and resilient agricultural industry and preserving the diversity of rural communities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Barley Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Barley Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Barley Industry?

To stay informed about further developments, trends, and reports in the Barley Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence