Key Insights

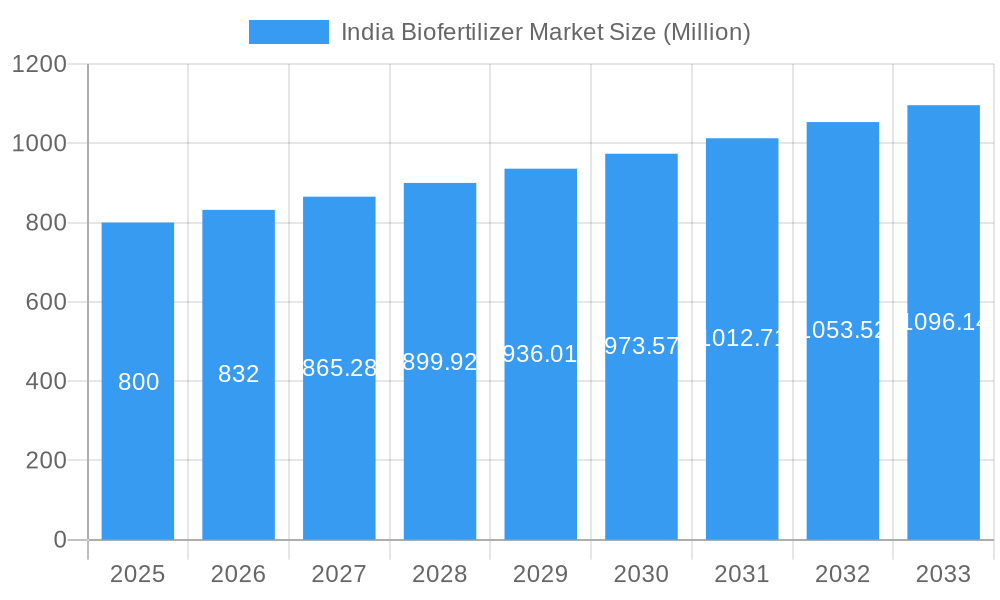

The Indian biofertilizer market is set for robust expansion, fueled by increasing adoption of sustainable agriculture and supportive government initiatives for organic farming. The market, valued at 152.5 million in the 2025 base year, is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% through 2033. Key growth drivers include heightened farmer awareness of biofertilizers' environmental advantages and long-term soil health benefits compared to conventional chemical alternatives. Favorable government policies, including subsidies and organic farming promotion programs, are creating an conducive environment. The shift away from chemical pesticides and fertilizers, coupled with rising consumer demand for organic produce, further strengthens market prospects.

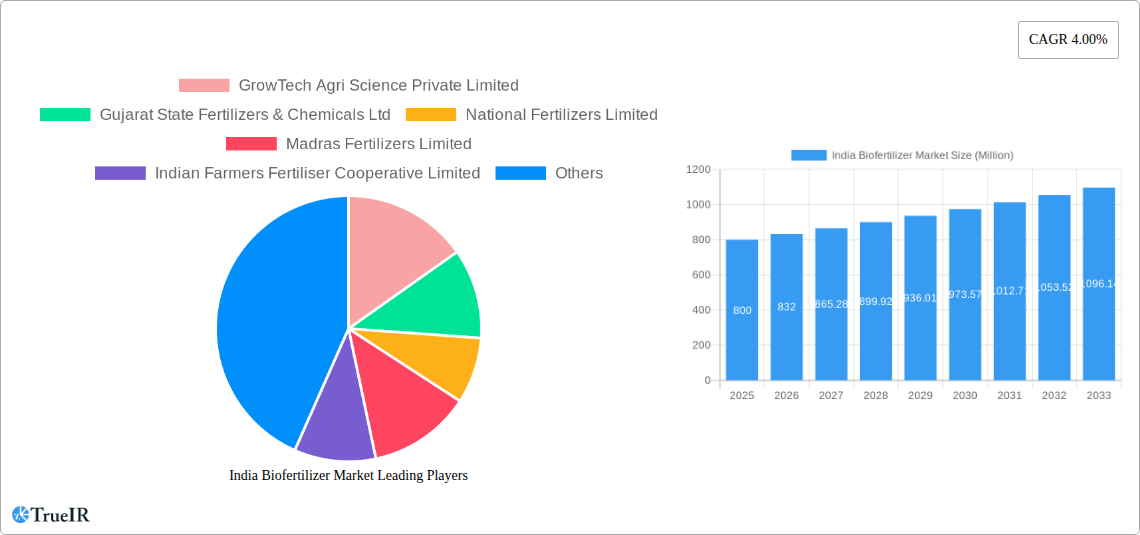

India Biofertilizer Market Market Size (In Million)

Challenges include farmer education on effective application and benefits, and the perceived higher initial cost versus chemical fertilizers. Ensuring consistent product quality and shelf life also presents hurdles. Despite these, the market is segmented by production, consumption, imports, exports, and price trends, with major players like IFFCO, National Fertilizers Limited, and Gujarat State Fertilizers & Chemicals Ltd. leading the sector. Innovations in biofertilizer formulations and expanding distribution networks are expected to mitigate barriers and drive sustained market growth.

India Biofertilizer Market Company Market Share

This comprehensive report delivers an optimized analysis of the India Biofertilizer Market, covering production, consumption, trade, pricing, and industry advancements from 2019 to 2033. Utilizing high-volume keywords and extensive quantitative data, this report provides critical insights for stakeholders, investors, and policymakers navigating India's dynamic biofertilizer landscape.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

India Biofertilizer Market Market Structure & Competitive Landscape

The India Biofertilizer Market is characterized by a moderately concentrated structure, with a mix of large established players and emerging regional enterprises. Innovation drivers are primarily fueled by the growing demand for sustainable agriculture, government initiatives promoting organic farming, and advancements in microbial research. Regulatory impacts, while generally supportive of biofertilizer adoption through subsidies and quality standards, can also pose challenges in terms of product registration and standardization across different states. Product substitutes, mainly conventional chemical fertilizers, are gradually being displaced by biofertilizers due to their eco-friendly nature and long-term soil health benefits. End-user segmentation is diverse, encompassing smallholder farmers, large agricultural corporations, horticulturalists, and organic food producers. Mergers & Acquisitions (M&A) trends are emerging as companies seek to consolidate market share, expand their product portfolios, and leverage synergistic technologies. While specific M&A volumes are subject to market dynamics, the trend indicates a growing interest in strategic partnerships and consolidations to achieve scale and competitive advantage. The market concentration ratio for the top 5 players is estimated to be around 45%, with significant growth potential for innovative smaller players.

India Biofertilizer Market Market Trends & Opportunities

The India Biofertilizer Market is experiencing robust growth, driven by a confluence of factors including increasing environmental consciousness, the imperative to improve soil health, and supportive government policies. The market size is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 15.8% over the forecast period of 2025-2033. Technological shifts are central to this expansion, with ongoing research and development leading to the discovery and application of novel microbial strains with enhanced efficacy and broader applications. These advancements include the development of multi-strain biofertilizers, bio-stimulants, and bio-pesticides that offer integrated nutrient management solutions. Consumer preferences are increasingly leaning towards organic and sustainably produced food, creating a strong pull for biofertilizer-based agricultural practices. Farmers are becoming more aware of the detrimental effects of excessive chemical fertilizer use, including soil degradation and water pollution, and are actively seeking alternatives. Competitive dynamics are intensifying as both domestic and international players vie for market share. Opportunities abound in the development of customized biofertilizer solutions tailored to specific soil types and crop requirements, as well as in expanding the reach of these products to remote agricultural regions through improved distribution networks and farmer education programs. The market penetration rate for biofertilizers, while still lower than chemical fertilizers, is on a steady upward trajectory, indicating significant room for future growth.

Dominant Markets & Segments in India Biofertilizer Market

The Consumption Analysis segment holds significant dominance within the India Biofertilizer Market, reflecting the country's vast agricultural base and growing adoption of sustainable farming practices. India's immense agricultural land, coupled with the government's push towards reducing chemical fertilizer dependency, has made it a crucial market for biofertilizers. Key growth drivers in this segment include extensive government subsidies and promotional schemes like the Paramparagat Krishi Vikas Yojana (PKVY) and the National Mission for Sustainable Agriculture (NMSA), which actively encourage the use of organic inputs. The sheer volume of farmers, from smallholders to large-scale agricultural enterprises, represents a massive potential user base.

In terms of Production Analysis, India is also a significant producer, with a growing number of manufacturing facilities catering to domestic demand and, increasingly, export markets. The government's focus on promoting indigenous manufacturing and the availability of raw materials, such as microbial cultures and organic carriers, contribute to this dominance.

The Import Market Analysis for India Biofertilizers is relatively smaller compared to domestic production, but it is growing as specialized and novel biofertilizer formulations become available from international markets. The value of imports is expected to reach approximately $80 Million by 2025, with a projected volume of 55 Million Kilograms. Key growth drivers here include the demand for advanced biofertilizer technologies and specific microbial strains that may not be readily available domestically.

Conversely, the Export Market Analysis is an emerging but promising segment. India is gradually increasing its export of biofertilizers, driven by cost-effectiveness and the growing global demand for organic agricultural inputs. The value of exports is estimated to reach $60 Million by 2025, with a volume of 45 Million Kilograms. Countries in Southeast Asia, Africa, and the Middle East are becoming key destinations for Indian biofertilizers.

The Price Trend Analysis indicates a steady but moderate increase in biofertilizer prices, primarily driven by rising raw material costs, advancements in R&D, and increasing demand. However, the price differential between biofertilizers and chemical fertilizers is gradually narrowing, making biofertilizers more competitive. The average price per kilogram is projected to be around $1.20 in 2025.

India Biofertilizer Market Product Analysis

Product innovations in the India Biofertilizer Market are central to its growth. Companies are focusing on developing multi-strain biofertilizers that offer synergistic effects, enhancing nutrient availability and improving plant growth across a wider range of conditions. Advancements in encapsulation and formulation technologies are also improving the shelf-life and efficacy of biofertilizers. Applications are expanding beyond traditional nitrogen and phosphorus fixation to include biofertilizers that promote micronutrient uptake, enhance stress tolerance in plants, and improve soil structure. Competitive advantages are being gained through superior microbial strains, enhanced formulation stability, and targeted solutions for specific crops and soil types.

Key Drivers, Barriers & Challenges in India Biofertilizer Market

Key Drivers:

- Government Initiatives & Subsidies: Policies promoting organic farming and providing financial incentives significantly boost adoption.

- Environmental Concerns: Growing awareness of the negative impacts of chemical fertilizers on soil and water health.

- Soil Health Improvement: Increasing recognition of biofertilizers' role in long-term soil fertility and sustainability.

- Technological Advancements: Development of more effective and diverse biofertilizer formulations.

Key Barriers & Challenges:

- Farmer Awareness & Education: Lack of widespread knowledge about the benefits and proper application of biofertilizers.

- Supply Chain & Distribution: Inadequate reach of biofertilizer products to remote agricultural areas.

- Quality Control & Standardization: Inconsistent product quality and lack of uniform standards across the market.

- Perception & Trust: Historical reliance on chemical fertilizers creates a trust deficit for some farmers.

- Shelf-Life & Storage: Biofertilizers often have shorter shelf-lives and require specific storage conditions.

Growth Drivers in the India Biofertilizer Market Market

Key drivers propelling the India Biofertilizer Market include robust government support through various agricultural missions and subsidies, coupled with a growing societal and farmer-driven emphasis on sustainable agriculture and environmental protection. Technological advancements in microbial research are continuously yielding more effective and specialized biofertilizer products. Economic factors, such as the increasing cost of chemical fertilizers and the long-term benefits of improved soil health and reduced input costs, are also significant motivators. Policy frameworks promoting organic farming and mandating reduced chemical fertilizer use further enhance the market's growth trajectory.

Challenges Impacting India Biofertilizer Market Growth

Challenges impacting India Biofertilizer Market growth are multifaceted. Regulatory complexities and the slow pace of product registration can hinder market entry for new products. Inconsistent quality control and a lack of standardized efficacy testing can lead to farmer skepticism and reluctance to adopt. Supply chain issues, particularly in reaching remote rural areas effectively, limit the widespread availability of these products. Intense competition from established chemical fertilizer markets and a general lack of farmer awareness regarding optimal application techniques and benefits also present significant hurdles. Quantifiable impacts include potential yield losses if biofertilizers are not applied correctly or if the product quality is sub-optimal.

Key Players Shaping the India Biofertilizer Market Market

- GrowTech Agri Science Private Limited

- Gujarat State Fertilizers & Chemicals Ltd

- National Fertilizers Limited

- Madras Fertilizers Limited

- Indian Farmers Fertiliser Cooperative Limited

- Samriddhi Crops India Pvt Ltd

- IPL Biologicals Limited

- Biostadt India Limited

- T Stanes and Company Limited

- Fertilizers and Chemicals Travancore Limited

Significant India Biofertilizer Market Industry Milestones

- November 2019: IPL Biologicals Limited launched four new biofertilizer products, including Nitrogcea, Phosphacea, Potacea, and Zinkaacea, in Maharashtra, India. This product expansion aimed to cater to the specific nutrient needs of crops in the region and contributed to the growing portfolio of indigenous biofertilizer solutions.

- 2020: Government of India increased budgetary allocation for schemes promoting organic farming and biofertilizer use, signaling a stronger commitment to sustainable agriculture.

- 2021: Several Indian agricultural universities and research institutions reported significant breakthroughs in identifying novel microbial consortia for enhanced nutrient use efficiency and soil remediation.

- 2022: Increased adoption of biofertilizers by large-scale farming cooperatives and agribusinesses, indicating a shift in perception and growing market acceptance.

- 2023: Emergence of several start-ups focusing on customized biofertilizer solutions and digital platforms for farmer advisory services related to organic inputs.

Future Outlook for India Biofertilizer Market Market

The future outlook for the India Biofertilizer Market is exceptionally promising. Growth catalysts include continued government support, rising farmer awareness, and advancements in biotechnology leading to more potent and diversified product offerings. Strategic opportunities lie in expanding into untapped rural markets, developing climate-resilient biofertilizers, and fostering greater collaboration between research institutions and industry players. The market is poised for sustained high growth, driven by the increasing demand for sustainable food production and the imperative to restore soil health across India. The estimated market size is expected to reach $1.8 Billion by 2033, with a projected CAGR of 15.8%.

India Biofertilizer Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

India Biofertilizer Market Segmentation By Geography

- 1. India

India Biofertilizer Market Regional Market Share

Geographic Coverage of India Biofertilizer Market

India Biofertilizer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns

- 3.3. Market Restrains

- 3.3.1. High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants

- 3.4. Market Trends

- 3.4.1. Increased Food Demand and Need for Increased Agricultural Food Productivity

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Biofertilizer Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. India

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 GrowTech Agri Science Private Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Gujarat State Fertilizers & Chemicals Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 National Fertilizers Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Madras Fertilizers Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Indian Farmers Fertiliser Cooperative Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Samriddhi Crops India Pvt Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 IPL Biologicals Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Biostadt India Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 T Stanes and Company Limite

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fertilizers and Chemicals Travancore Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 GrowTech Agri Science Private Limited

List of Figures

- Figure 1: India Biofertilizer Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Biofertilizer Market Share (%) by Company 2025

List of Tables

- Table 1: India Biofertilizer Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 2: India Biofertilizer Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: India Biofertilizer Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: India Biofertilizer Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: India Biofertilizer Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: India Biofertilizer Market Revenue million Forecast, by Region 2020 & 2033

- Table 7: India Biofertilizer Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 8: India Biofertilizer Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: India Biofertilizer Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: India Biofertilizer Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: India Biofertilizer Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: India Biofertilizer Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Biofertilizer Market?

The projected CAGR is approximately 8.9%.

2. Which companies are prominent players in the India Biofertilizer Market?

Key companies in the market include GrowTech Agri Science Private Limited, Gujarat State Fertilizers & Chemicals Ltd, National Fertilizers Limited, Madras Fertilizers Limited, Indian Farmers Fertiliser Cooperative Limited, Samriddhi Crops India Pvt Ltd, IPL Biologicals Limited, Biostadt India Limited, T Stanes and Company Limite, Fertilizers and Chemicals Travancore Limited.

3. What are the main segments of the India Biofertilizer Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 152.5 million as of 2022.

5. What are some drivers contributing to market growth?

Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns.

6. What are the notable trends driving market growth?

Increased Food Demand and Need for Increased Agricultural Food Productivity.

7. Are there any restraints impacting market growth?

High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants.

8. Can you provide examples of recent developments in the market?

November 2019: IPL Biologicals Limited launched four new biofertilizer products, including Nitrogcea, Phosphacea, Potacea, and Zinkaacea, in Maharashtra, India.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Biofertilizer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Biofertilizer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Biofertilizer Market?

To stay informed about further developments, trends, and reports in the India Biofertilizer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence