Key Insights

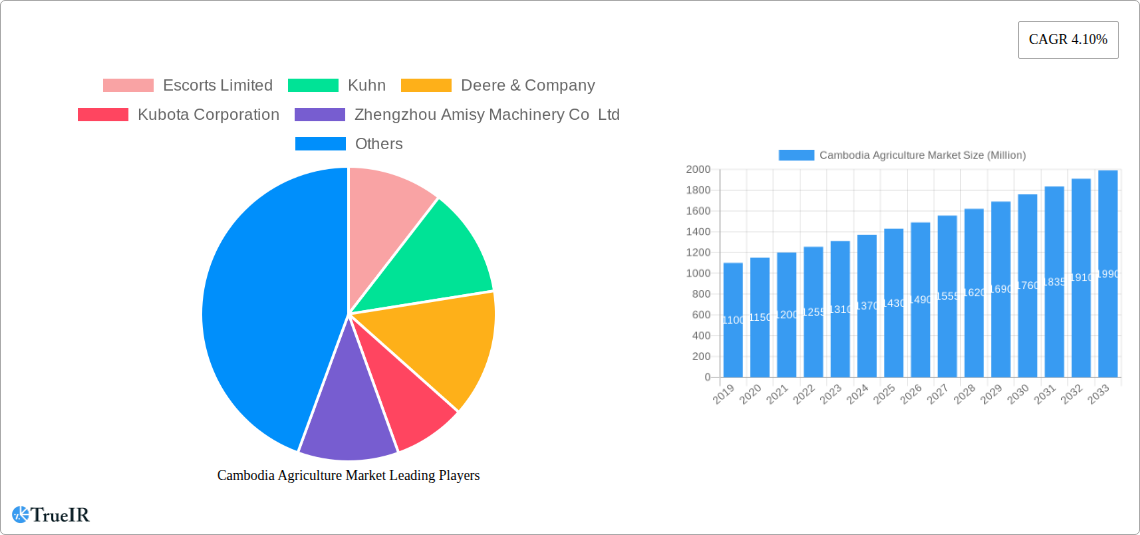

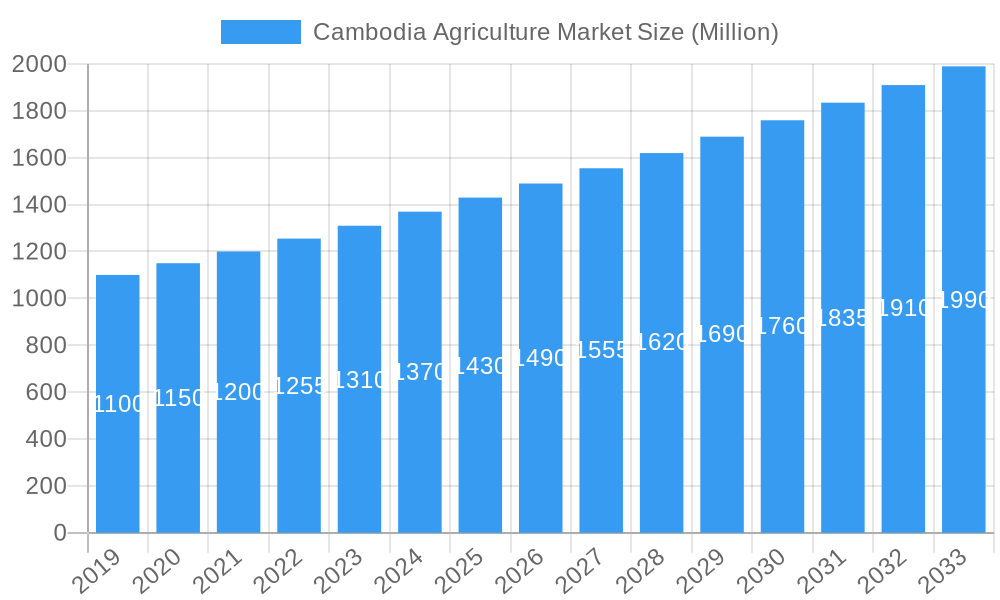

The Cambodia agriculture market is poised for robust growth, projected to reach a substantial market size of approximately USD 1,500 million by 2025, with a Compound Annual Growth Rate (CAGR) of 4.10% expected to continue through 2033. This expansion is primarily fueled by increasing domestic food demand driven by a growing population and a rising middle class, as well as supportive government initiatives aimed at modernizing the agricultural sector and enhancing food security. Key drivers include the adoption of advanced farming techniques, improved irrigation systems, and greater access to quality agricultural machinery. The market's evolution is further shaped by a growing emphasis on sustainable farming practices and the adoption of technologies that boost yield and efficiency, moving away from traditional methods.

Cambodia Agriculture Market Market Size (In Billion)

The market is segmented into crucial areas including production analysis, consumption analysis, import and export market dynamics, and price trend analysis, all of which are critical indicators of the sector's health and trajectory. While the nation actively works towards increasing its agricultural output and self-sufficiency, import analysis reveals a demand for specific technologies and inputs that enhance productivity. Conversely, export potential is also on the rise, particularly for commodities that Cambodia has a comparative advantage in producing. Restraints, such as limited access to finance for smallholder farmers and the impact of climate change on crop yields, are being addressed through policy interventions and technological solutions. The competitive landscape features both domestic players and international agricultural machinery giants, all vying to capture market share by offering innovative and efficient solutions to Cambodian farmers.

Cambodia Agriculture Market Company Market Share

Cambodia Agriculture Market: Market Insights, Trends, and Future Outlook (2019-2033)

This comprehensive report delves into the dynamic Cambodia Agriculture Market, providing in-depth analysis from 2019 to 2033, with a base and estimated year of 2025. We explore production, consumption, import/export dynamics, price trends, and key industry developments to offer actionable insights for stakeholders. Leverage high-volume keywords such as "Cambodia agriculture," "agricultural machinery," "crop production Cambodia," "farm equipment market," and "ASEAN agriculture" to enhance your strategic decision-making.

Cambodia Agriculture Market Market Structure & Competitive Landscape

The Cambodia agriculture market exhibits a moderately consolidated structure, with a few dominant players in machinery and a fragmented landscape in primary production. Innovation drivers are largely centered around mechanization, precision agriculture adoption, and improved irrigation techniques, aiming to boost yields and reduce labor dependency. Regulatory impacts, while evolving, focus on promoting sustainable farming practices and facilitating foreign investment in the sector. Product substitutes are primarily traditional farming methods and imported, lower-cost machinery. End-user segmentation is heavily skewed towards smallholder farmers, with increasing adoption among medium-to-large scale agribusinesses. Mergers and acquisitions (M&A) activity is nascent but expected to grow as larger corporations seek to expand their presence and optimize supply chains. For instance, the market concentration ratio for agricultural machinery is estimated to be around 0.6, indicating a moderate level of dominance by top firms. M&A volumes have seen a steady increase, averaging 2-3 significant deals annually over the historical period, signaling growing investor confidence.

Cambodia Agriculture Market Market Trends & Opportunities

The Cambodia agriculture market is poised for significant growth, driven by a burgeoning population, increasing demand for food security, and government initiatives aimed at modernizing the sector. The market size is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 6.5% over the forecast period. Technological shifts are paramount, with a growing emphasis on the adoption of advanced agricultural machinery, including tractors, harvesters, and irrigation systems, contributing to enhanced efficiency and productivity. Consumer preferences are leaning towards higher quality, safer, and more consistently produced agricultural products, necessitating investments in improved farming techniques and post-harvest management. Competitive dynamics are intensifying, with both domestic and international players vying for market share. Opportunities abound in the adoption of smart farming technologies, the development of value-added agricultural processing, and the expansion of export markets for key Cambodian commodities. Market penetration rates for modern agricultural equipment are still relatively low, estimated at around 30%, presenting substantial room for growth and innovation. The integration of digital solutions for farm management and market access will be crucial for competitive advantage.

Dominant Markets & Segments in Cambodia Agriculture Market

Within the Cambodia Agriculture Market, Rice Production stands out as the dominant segment, forming the backbone of the nation's agricultural output and contributing an estimated 40% to the agricultural GDP. Key growth drivers in this segment include ongoing government support for rice cultivation, favorable export policies, and the continuous development of high-yield rice varieties. The Import Market Analysis (Value & Volume) reveals a strong demand for agricultural machinery and inputs, with tractors and fertilizers being major categories. Infrastructure development, including improvements in rural roads and storage facilities, plays a critical role in facilitating the efficient movement of agricultural produce and inputs, thereby supporting market dominance.

- Production Analysis: Cambodia's production is heavily reliant on traditional crops, with rice leading the way. The country's arable land and favorable climate for rice cultivation contribute significantly to its production volumes, estimated to reach over 10 million metric tons annually. Efforts to diversify crop production, including fruits and vegetables, are gaining traction, supported by initiatives to improve farming techniques and access to modern agricultural equipment.

- Consumption Analysis: Domestic consumption is driven by a growing population and changing dietary habits. The demand for staple foods like rice remains high, while the consumption of fruits, vegetables, and processed agricultural products is steadily increasing, indicating a shift towards a more diverse diet. Per capita consumption of rice is estimated at 150 kg per year.

- Import Market Analysis (Value & Volume): The import market is characterized by a significant inflow of agricultural machinery, ranging from small-scale farming tools to larger tractors and processing equipment. Imports are crucial for modernizing farming practices and increasing efficiency. The total value of agricultural machinery imports is estimated at USD 80 Million annually.

- Export Market Analysis (Value & Volume): Rice remains Cambodia's primary agricultural export, with significant volumes shipped to international markets. The export value of agricultural products is projected to reach USD 2,000 Million by 2025, driven by increasing global demand. Emerging export opportunities lie in rubber, cashew nuts, and processed fruits.

- Price Trend Analysis: Price trends for agricultural commodities are influenced by global market dynamics, weather patterns, and government policies. Fluctuations in input costs, such as fertilizers and fuel, also impact farmer profitability and market prices. The average wholesale price of unmilled rice is estimated to be around USD 300 per metric ton.

Cambodia Agriculture Market Product Analysis

Product innovation in the Cambodia Agriculture Market is increasingly focused on enhancing efficiency, sustainability, and mechanization. Tractors, particularly those suitable for small to medium-sized farms and varied terrains, are seeing continuous development. Advancements in irrigation technologies, such as drip irrigation and smart sprinklers, offer competitive advantages by conserving water and optimizing crop yields. The application of precision agriculture tools, including GPS-guided machinery and sensor-based monitoring systems, is gaining traction, enabling farmers to make data-driven decisions and improve resource management. These technological advancements are crucial for addressing labor shortages and increasing overall farm productivity.

Key Drivers, Barriers & Challenges in Cambodia Agriculture Market

Key Drivers:

- Government Support and Policies: Initiatives promoting agricultural modernization, investment incentives, and trade agreements are significant drivers. For example, the government's commitment to developing the agricultural sector through research and development, as highlighted in October 2022, fuels growth.

- Technological Advancements: The adoption of modern agricultural machinery, improved seeds, and innovative farming techniques are boosting productivity.

- Increasing Food Demand: A growing population and rising incomes are driving domestic and regional demand for agricultural products.

- Foreign Investment: Increasing interest from international investors in Cambodia's agricultural potential is contributing to capital inflow and technological transfer.

Barriers & Challenges:

- Limited Access to Finance: Smallholder farmers often face challenges in accessing affordable credit for purchasing modern equipment and inputs. This can restrict the pace of mechanization.

- Infrastructure Deficiencies: Inadequate rural infrastructure, including poor road networks and limited cold storage facilities, can lead to post-harvest losses and logistical challenges, impacting the value chain.

- Climate Change Vulnerability: Cambodia's agriculture sector is susceptible to the impacts of climate change, including droughts and floods, which can disrupt production and income.

- Skilled Labor Shortage: A lack of adequately trained personnel for operating and maintaining advanced agricultural machinery can hinder adoption.

Growth Drivers in the Cambodia Agriculture Market Market

The Cambodia Agriculture Market is propelled by a confluence of factors. Government initiatives aimed at boosting agricultural productivity and modernizing farming practices serve as a significant catalyst. The increasing adoption of advanced agricultural machinery, driven by the need for greater efficiency and labor cost reduction, is another key growth driver. Furthermore, the rising global and domestic demand for food products, coupled with Cambodia's strategic location within the ASEAN economic bloc, creates substantial market opportunities. The government's focus on research and development and the adoption of new technologies, as emphasized in October 2022, is crucial for long-term sustainable growth.

Challenges Impacting Cambodia Agriculture Market Growth

Despite positive growth prospects, the Cambodia Agriculture Market faces several hurdles. Regulatory complexities and the need for streamlined agricultural policies can sometimes impede investment and operational efficiency. Supply chain inefficiencies, including underdeveloped logistics and limited access to markets for smallholder farmers, contribute to losses and reduced profitability. Intense competition, both from domestic producers and imported goods, necessitates continuous improvement in product quality and cost-effectiveness. Addressing these challenges requires a concerted effort from government, private sector stakeholders, and farmers to foster a more resilient and competitive agricultural landscape.

Key Players Shaping the Cambodia Agriculture Market Market

- Escorts Limited

- Kuhn

- Deere & Company

- Kubota Corporation

- Zhengzhou Amisy Machinery Co Ltd

- New Holland Agriculture

- AGCO Corporation

- Yanmar Co Ltd

- Iseki & Co Ltd

- Mahindra & Mahindra Ltd

- Tractors and Farm Equipment Limited (TAFE)

- Claas KGaA mbH

Significant Cambodia Agriculture Market Industry Milestones

- November 2022: John Deere introduced tractors designed for work in narrow orchards and vineyards with the addition of the new 5EN and 5ML Series, ideal for fruit handling and hauling, spraying, mowing, and any application that takes place within the narrow confines of an orchard or vineyard. This development enhances the availability of specialized machinery for niche agricultural applications, potentially increasing productivity in fruit cultivation.

- October 2022: The newly appointed Minister of Agriculture, Forestry, and Fisheries planned to focus on measures to promote research and development in the agricultural sector and to adopt practical approaches and new technologies beneficial for Cambodian agriculture, empowering farmers and industry workers for effective production. This initiative signifies a strategic shift towards innovation and knowledge transfer, aiming to uplift the overall efficiency and sustainability of the sector.

Future Outlook for Cambodia Agriculture Market Market

The future outlook for the Cambodia Agriculture Market is highly promising, driven by sustained government support, increasing adoption of advanced technologies, and a growing demand for agricultural products. Strategic opportunities lie in the expansion of value-added processing, the development of sustainable farming practices, and the leveraging of e-commerce platforms for market access. The market has the potential to not only ensure food security but also to become a significant contributor to Cambodia's economic growth through enhanced exports and diversified agricultural output. Investments in research, infrastructure, and farmer training will be critical for realizing this potential.

Cambodia Agriculture Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Cambodia Agriculture Market Segmentation By Geography

- 1. Cambodia

Cambodia Agriculture Market Regional Market Share

Geographic Coverage of Cambodia Agriculture Market

Cambodia Agriculture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Legalization of Cannabis; Growing Focus on Health Benefits of Cannabis

- 3.3. Market Restrains

- 3.3.1. Lack of Data on Dosages and Results; Lack of Access to Financial Assistance

- 3.4. Market Trends

- 3.4.1. Decline in Agriculture Labor Drives the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Cambodia Agriculture Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Cambodia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Escorts Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kuhn

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Deere & Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kubota Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Zhengzhou Amisy Machinery Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 New Holland Agricultur

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AGCO Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Yanmar Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Iseki & Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mahindra & Mahindra Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Tractors and Farm Equipment Limited (TAFE)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Claas KGaA mbH

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Escorts Limited

List of Figures

- Figure 1: Cambodia Agriculture Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Cambodia Agriculture Market Share (%) by Company 2025

List of Tables

- Table 1: Cambodia Agriculture Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Cambodia Agriculture Market Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 3: Cambodia Agriculture Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 4: Cambodia Agriculture Market Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 5: Cambodia Agriculture Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: Cambodia Agriculture Market Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: Cambodia Agriculture Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: Cambodia Agriculture Market Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: Cambodia Agriculture Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: Cambodia Agriculture Market Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: Cambodia Agriculture Market Revenue Million Forecast, by Region 2020 & 2033

- Table 12: Cambodia Agriculture Market Volume Kiloton Forecast, by Region 2020 & 2033

- Table 13: Cambodia Agriculture Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 14: Cambodia Agriculture Market Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 15: Cambodia Agriculture Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 16: Cambodia Agriculture Market Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 17: Cambodia Agriculture Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: Cambodia Agriculture Market Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Cambodia Agriculture Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Cambodia Agriculture Market Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: Cambodia Agriculture Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: Cambodia Agriculture Market Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: Cambodia Agriculture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Cambodia Agriculture Market Volume Kiloton Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cambodia Agriculture Market?

The projected CAGR is approximately 4.10%.

2. Which companies are prominent players in the Cambodia Agriculture Market?

Key companies in the market include Escorts Limited, Kuhn, Deere & Company, Kubota Corporation, Zhengzhou Amisy Machinery Co Ltd, New Holland Agricultur, AGCO Corporation, Yanmar Co Ltd, Iseki & Co Ltd, Mahindra & Mahindra Ltd, Tractors and Farm Equipment Limited (TAFE), Claas KGaA mbH.

3. What are the main segments of the Cambodia Agriculture Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Legalization of Cannabis; Growing Focus on Health Benefits of Cannabis.

6. What are the notable trends driving market growth?

Decline in Agriculture Labor Drives the market.

7. Are there any restraints impacting market growth?

Lack of Data on Dosages and Results; Lack of Access to Financial Assistance.

8. Can you provide examples of recent developments in the market?

November 2022: John Deere has introduced tractors designed for work in narrow orchards and vineyards with the addition of the new 5EN and 5ML Series and it is ideal for fruit handling and hauling, spraying, mowing, and any application that takes place within the narrow confines of an orchard or vineyard.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cambodia Agriculture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cambodia Agriculture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cambodia Agriculture Market?

To stay informed about further developments, trends, and reports in the Cambodia Agriculture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence