Key Insights

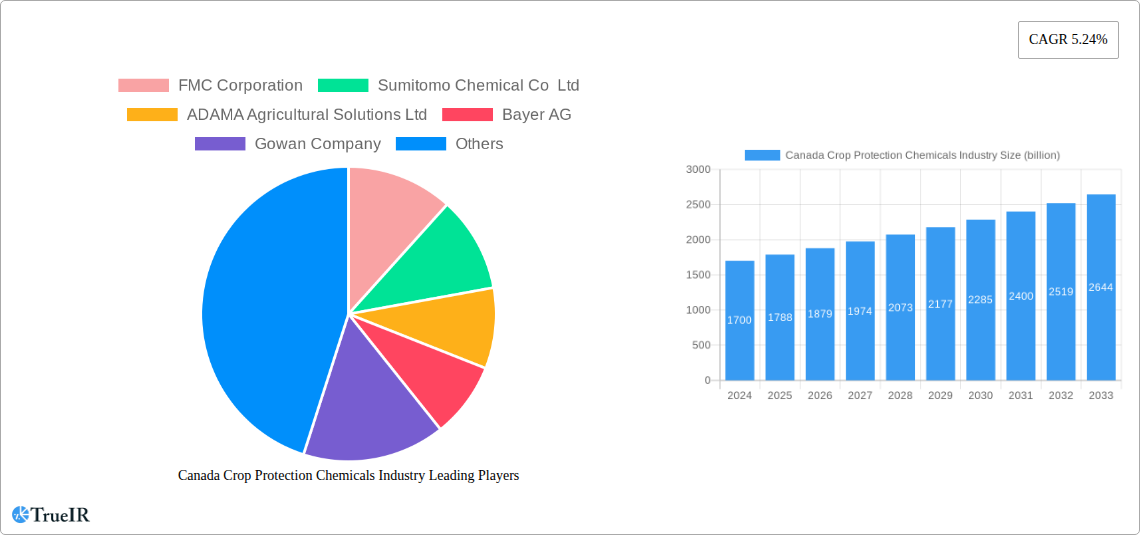

The Canadian crop protection chemicals market is projected to witness robust growth, driven by the increasing demand for higher agricultural yields to meet the food security needs of a growing population and rising export demands. The market size for crop protection chemicals in Canada was an estimated $1.7 billion in 2024. This growth is fueled by several key factors, including the escalating need to combat evolving pest resistance, the adoption of advanced agricultural practices, and government initiatives promoting sustainable farming. The CAGR of 5.24% is expected to persist through the forecast period, indicating a steady and significant expansion of the market. Fungicides, herbicides, and insecticides represent the dominant segments within the crop protection chemicals market due to their widespread application across various crops. Chemigation and foliar application methods are gaining traction, reflecting a shift towards more efficient and targeted delivery systems.

Canada Crop Protection Chemicals Industry Market Size (In Billion)

The market is segmented across diverse crop types, including grains & cereals, fruits & vegetables, and commercial crops, each presenting unique opportunities and challenges for crop protection solutions. While the market exhibits strong growth potential, certain restraints such as stringent environmental regulations and the increasing adoption of organic farming practices could pose challenges. However, ongoing research and development in creating eco-friendlier and more targeted crop protection solutions, coupled with advancements in precision agriculture, are expected to mitigate these restraints. Key players like Bayer AG, Syngenta Group, and BASF SE are actively investing in innovation and strategic collaborations to enhance their market presence and cater to the evolving needs of Canadian agriculture.

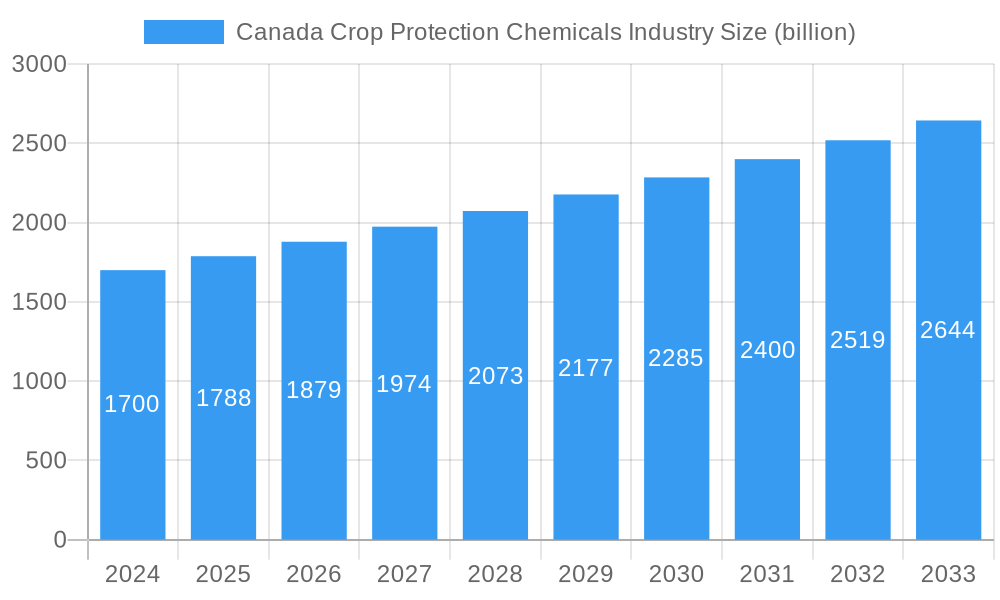

Canada Crop Protection Chemicals Industry Company Market Share

This in-depth report provides an unparalleled analysis of the Canada Crop Protection Chemicals Industry, a critical sector projected to reach a market value of over USD 1.5 billion by 2033. Delving into the intricate dynamics from 2019 to 2033, with a base and estimated year of 2025, this study is an indispensable resource for stakeholders seeking to understand market structure, emerging trends, dominant segments, and the strategic landscape of Canadian agriculture chemicals. We dissect the industry from its foundational components, including the fungicide, herbicide, insecticide, molluscicide, and nematicide markets, to sophisticated application modes like chemigation, foliar, fumigation, seed treatment, and soil treatment. Furthermore, we examine the impact across diverse crop types, from commercial crops and fruits & vegetables to grains & cereals, pulses & oilseeds, and turf & ornamental applications.

Canada Crop Protection Chemicals Industry Market Structure & Competitive Landscape

The Canada Crop Protection Chemicals industry exhibits a moderately concentrated market structure, with key players like FMC Corporation, Sumitomo Chemical Co Ltd, ADAMA Agricultural Solutions Ltd, Bayer AG, Gowan Company, UPL Limited, Syngenta Group, Corteva Agriscience, Nufarm Ltd, and BASF SE dominating a significant market share. Innovation is a primary driver, fueled by ongoing research and development in advanced formulations and bio-pesticides, aiming to address evolving pest resistance and environmental concerns. Regulatory impacts, particularly from Health Canada's Pest Management Regulatory Agency (PMRA), play a crucial role in market entry and product approvals, shaping competitive advantages. Product substitutes, such as integrated pest management (IPM) strategies and genetically modified (GM) crops with inherent resistance, are increasingly influencing market dynamics. End-user segmentation reveals a strong demand from large-scale commercial farming operations for grains & cereals and pulses & oilseeds, alongside a growing niche for specialized products in fruits & vegetables and turf & ornamental sectors. Merger and acquisition (M&A) trends, evidenced by strategic partnerships and consolidations, aim to enhance R&D capabilities and expand market reach. While precise concentration ratios are subject to ongoing market shifts, the top five players are estimated to hold a combined market share exceeding 60% in 2025. The volume of M&A activities is predicted to remain robust, with an estimated 5-10 significant transactions annually over the forecast period, driven by the need for portfolio diversification and economies of scale.

Canada Crop Protection Chemicals Industry Market Trends & Opportunities

The Canada Crop Protection Chemicals industry is on a robust growth trajectory, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 6.2% during the forecast period (2025-2033). This expansion is underpinned by a confluence of factors including the increasing need for enhanced food production to meet a growing global population, the persistent challenge of pest and disease outbreaks affecting crop yields, and the continuous development of novel, more effective, and environmentally responsible crop protection solutions. Technological advancements are a significant trend, with a pronounced shift towards precision agriculture, smart farming technologies, and the integration of digital tools for optimized application and monitoring of crop protection chemicals. This includes the development of drone-based application systems, sensor technologies for early pest detection, and AI-driven predictive analytics for disease management. Consumer preferences are increasingly leaning towards sustainably produced food, driving demand for crop protection chemicals that are perceived as safer for human health and the environment. This has spurred innovation in bio-pesticides, reduced-risk formulations, and integrated pest management (IPM) programs, creating opportunities for companies that can align with these evolving demands.

Competitive dynamics are intensifying, with established global players like Syngenta Group, Bayer AG, and Corteva Agriscience facing competition from agile domestic companies and emerging bio-tech firms. The market penetration rate for advanced crop protection solutions is steadily increasing across all crop segments, reflecting a greater adoption of sophisticated agricultural practices by Canadian farmers. Opportunities abound for companies offering specialized fungicide, herbicide, and insecticide solutions tailored to specific regional challenges and crop types. The demand for seed treatment solutions, enhancing early plant vigor and protection, is particularly strong. Furthermore, the growing emphasis on organic and sustainable farming practices presents a significant opportunity for the development and market penetration of bio-rational and bio-pesticide products, expected to capture an increasing share of the market by 2033. The expansion of export markets for Canadian agricultural produce also necessitates advanced crop protection strategies to meet international quality and safety standards, thereby supporting the growth of the Canadian crop protection chemicals industry.

Dominant Markets & Segments in Canada Crop Protection Chemicals Industry

The herbicide segment is poised to remain the dominant force within the Canada Crop Protection Chemicals industry throughout the forecast period (2025-2033). This dominance is attributed to the widespread cultivation of grains & cereals and pulses & oilseeds across vast agricultural lands in Canada, where weed management is paramount for maximizing yield and quality. The application mode of foliar application is expected to continue its stronghold, offering efficient delivery and rapid absorption of active ingredients for both broad-spectrum and targeted weed control. Key growth drivers in this segment include the persistent challenge of herbicide-resistant weeds, necessitating the development and adoption of new active ingredients and combination products. Government policies supporting sustainable agriculture and promoting efficient land use also indirectly bolster the demand for effective weed control solutions.

Beyond herbicides, fungicides represent another critical segment, particularly for fruits & vegetables and grains & cereals, where fungal diseases can cause significant crop losses. The seed treatment application mode is experiencing substantial growth within the fungicide and insecticide segments, as it provides crucial early-stage protection to seedlings, enhancing their survival and vigor. This is particularly relevant for pulses & oilseeds, where germination and early development are vulnerable. The commercial crops sector, encompassing a wide array of agricultural produce, also exhibits consistent demand across all functional segments.

While chemigation, fumigation, and soil treatment applications hold significant importance for specific crops and pest challenges, their market share is comparatively smaller than foliar applications. However, there are emerging opportunities in precision soil treatment for targeted nutrient delivery and pest control, driven by advancements in soil science and application technology. The turf & ornamental segment, while smaller in overall volume, represents a high-value niche with consistent demand for specialized fungicides, herbicides, and insecticides for maintaining aesthetic appeal and plant health in landscaping and public spaces. The increasing adoption of integrated pest management (IPM) strategies is expected to foster a balanced approach, driving demand for a diverse range of crop protection solutions that minimize environmental impact while maximizing efficacy.

Canada Crop Protection Chemicals Industry Product Analysis

The Canada Crop Protection Chemicals industry is witnessing a surge in product innovation, driven by the imperative to develop more targeted, efficient, and environmentally conscious solutions. Companies are focusing on novel active ingredients with reduced environmental persistence and lower toxicity profiles, alongside advanced formulation technologies that enhance efficacy and minimize off-target drift. The development of bio-pesticides and bio-stimulants, leveraging natural processes and biological agents, is a significant trend, offering sustainable alternatives or complements to conventional chemical treatments. These innovations cater to a growing demand for eco-friendly crop protection, particularly in the fruits & vegetables and turf & ornamental segments, while also meeting the stringent regulatory requirements for grains & cereals and pulses & oilseeds. The competitive advantage lies in products that offer broad-spectrum control with minimal resistance development, improved application efficiency through advanced delivery systems like microencapsulation, and demonstrable benefits in terms of yield enhancement and crop quality.

Key Drivers, Barriers & Challenges in Canada Crop Protection Chemicals Industry

Key Drivers:

- Technological Advancements: Continuous innovation in chemical formulations, biological controls, and precision application technologies.

- Growing Demand for Food Security: Increasing global and domestic demand for agricultural produce, necessitating yield enhancement and crop loss prevention.

- Supportive Government Policies: Initiatives promoting agricultural productivity and sustainable farming practices.

- R&D Investment: Significant investment by major players in developing next-generation crop protection solutions.

Key Barriers & Challenges:

- Stringent Regulatory Landscape: Complex and evolving regulations from Health Canada's PMRA regarding product registration, residue limits, and environmental impact.

- Pest Resistance: The development of resistance in pests, weeds, and diseases to existing active ingredients, requiring constant innovation.

- Supply Chain Disruptions: Global and domestic logistics challenges, impacting the availability and cost of raw materials and finished products.

- Public Perception and Environmental Concerns: Growing public awareness and demand for reduced chemical inputs in agriculture.

- High Cost of R&D and Registration: The significant financial and time investment required for bringing new products to market.

Growth Drivers in the Canada Crop Protection Chemicals Industry Market

The growth of the Canada Crop Protection Chemicals industry is propelled by several interconnected factors. Technological innovation remains a primary catalyst, with ongoing research into novel active ingredients, advanced formulations, and biological control agents that offer enhanced efficacy and improved environmental profiles. The increasing adoption of precision agriculture techniques, enabled by digital technologies like sensors and drones, allows for more targeted and efficient application of crop protection chemicals, minimizing waste and environmental impact. Economic drivers include the persistent need to maximize crop yields to meet global food demand and ensure agricultural profitability for Canadian farmers. Supportive government policies, aimed at enhancing agricultural productivity and promoting sustainable farming practices, also play a crucial role. Furthermore, the growing awareness and demand for sustainably produced food are creating opportunities for the development and market penetration of bio-pesticides and reduced-risk chemical solutions.

Challenges Impacting Canada Crop Protection Chemicals Industry Growth

Despite robust growth prospects, the Canada Crop Protection Chemicals industry faces significant hurdles. The regulatory environment, governed by Health Canada's Pest Management Regulatory Agency (PMRA), presents a substantial challenge due to stringent approval processes, evolving risk assessments, and potential restrictions on certain active ingredients. This can lead to increased R&D costs and extended market entry timelines. Supply chain vulnerabilities, exacerbated by global events and logistical complexities, can lead to shortages of critical raw materials and finished products, impacting availability and price stability. Competitive pressures from both established multinational corporations and emerging players, particularly in the bio-pesticide space, necessitate continuous innovation and strategic market positioning. Furthermore, public perception regarding the use of chemical pesticides and the increasing demand for organic produce can create market access challenges and influence consumer purchasing decisions, requiring a greater emphasis on transparent communication and sustainable solutions.

Key Players Shaping the Canada Crop Protection Chemicals Industry Market

- FMC Corporation

- Sumitomo Chemical Co Ltd

- ADAMA Agricultural Solutions Ltd

- Bayer AG

- Gowan Company

- UPL Limited

- Syngenta Group

- Corteva Agriscience

- Nufarm Ltd

- BASF SE

Significant Canada Crop Protection Chemicals Industry Industry Milestones

- July 2023: ADAMA introduced new products, Davai A Plus and Clearfield Broad-Spectrum Herbicide Solutions, for imidazolinone-tolerant legumes like lentils, peas, and soybeans, expanding their herbicide portfolio and addressing specific crop needs.

- January 2023: For the Canadian horticulture market, Gowan Canada Inc. introduced Magister SC Miticide. This product offers rapid action against specific species of mites in both Eriophyidae and Tetranychidae families, as well as pear psylla, enhancing pest management options for fruit growers.

- January 2023: Bayer formed a new partnership with Oerth Bio to enhance crop protection technology and create more eco-friendly crop protection solutions, signaling a commitment to sustainable innovation and integrated pest management strategies.

Future Outlook for Canada Crop Protection Chemicals Industry Market

The future outlook for the Canada Crop Protection Chemicals industry is overwhelmingly positive, driven by sustained demand for efficient and sustainable agricultural practices. The ongoing evolution of pest resistance and the increasing need for enhanced crop yields will continue to fuel innovation in both conventional and biological crop protection solutions. Strategic opportunities lie in the development of precision agriculture technologies that optimize chemical application, reduce environmental impact, and improve cost-effectiveness for farmers. The growing consumer preference for sustainably produced food will further accelerate the adoption of bio-pesticides and integrated pest management (IPM) strategies, creating a dynamic market for companies that can offer holistic crop protection solutions. Market penetration of advanced seed treatment technologies is expected to rise, providing crucial early-season protection for a wide range of crops. Overall, the industry is poised for continued growth, characterized by a focus on innovation, sustainability, and tailored solutions to meet the evolving needs of Canadian agriculture.

Canada Crop Protection Chemicals Industry Segmentation

-

1. Function

- 1.1. Fungicide

- 1.2. Herbicide

- 1.3. Insecticide

- 1.4. Molluscicide

- 1.5. Nematicide

-

2. Application Mode

- 2.1. Chemigation

- 2.2. Foliar

- 2.3. Fumigation

- 2.4. Seed Treatment

- 2.5. Soil Treatment

-

3. Crop Type

- 3.1. Commercial Crops

- 3.2. Fruits & Vegetables

- 3.3. Grains & Cereals

- 3.4. Pulses & Oilseeds

- 3.5. Turf & Ornamental

-

4. Function

- 4.1. Fungicide

- 4.2. Herbicide

- 4.3. Insecticide

- 4.4. Molluscicide

- 4.5. Nematicide

-

5. Application Mode

- 5.1. Chemigation

- 5.2. Foliar

- 5.3. Fumigation

- 5.4. Seed Treatment

- 5.5. Soil Treatment

-

6. Crop Type

- 6.1. Commercial Crops

- 6.2. Fruits & Vegetables

- 6.3. Grains & Cereals

- 6.4. Pulses & Oilseeds

- 6.5. Turf & Ornamental

Canada Crop Protection Chemicals Industry Segmentation By Geography

- 1. Canada

Canada Crop Protection Chemicals Industry Regional Market Share

Geographic Coverage of Canada Crop Protection Chemicals Industry

Canada Crop Protection Chemicals Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. The market is driven by the growing pressure of pests and diseases

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Crop Protection Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Fungicide

- 5.1.2. Herbicide

- 5.1.3. Insecticide

- 5.1.4. Molluscicide

- 5.1.5. Nematicide

- 5.2. Market Analysis, Insights and Forecast - by Application Mode

- 5.2.1. Chemigation

- 5.2.2. Foliar

- 5.2.3. Fumigation

- 5.2.4. Seed Treatment

- 5.2.5. Soil Treatment

- 5.3. Market Analysis, Insights and Forecast - by Crop Type

- 5.3.1. Commercial Crops

- 5.3.2. Fruits & Vegetables

- 5.3.3. Grains & Cereals

- 5.3.4. Pulses & Oilseeds

- 5.3.5. Turf & Ornamental

- 5.4. Market Analysis, Insights and Forecast - by Function

- 5.4.1. Fungicide

- 5.4.2. Herbicide

- 5.4.3. Insecticide

- 5.4.4. Molluscicide

- 5.4.5. Nematicide

- 5.5. Market Analysis, Insights and Forecast - by Application Mode

- 5.5.1. Chemigation

- 5.5.2. Foliar

- 5.5.3. Fumigation

- 5.5.4. Seed Treatment

- 5.5.5. Soil Treatment

- 5.6. Market Analysis, Insights and Forecast - by Crop Type

- 5.6.1. Commercial Crops

- 5.6.2. Fruits & Vegetables

- 5.6.3. Grains & Cereals

- 5.6.4. Pulses & Oilseeds

- 5.6.5. Turf & Ornamental

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 FMC Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sumitomo Chemical Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ADAMA Agricultural Solutions Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bayer AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Gowan Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 UPL Limite

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Syngenta Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Corteva Agriscience

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nufarm Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BASF SE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 FMC Corporation

List of Figures

- Figure 1: Canada Crop Protection Chemicals Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Crop Protection Chemicals Industry Share (%) by Company 2025

List of Tables

- Table 1: Canada Crop Protection Chemicals Industry Revenue billion Forecast, by Function 2020 & 2033

- Table 2: Canada Crop Protection Chemicals Industry Revenue billion Forecast, by Application Mode 2020 & 2033

- Table 3: Canada Crop Protection Chemicals Industry Revenue billion Forecast, by Crop Type 2020 & 2033

- Table 4: Canada Crop Protection Chemicals Industry Revenue billion Forecast, by Function 2020 & 2033

- Table 5: Canada Crop Protection Chemicals Industry Revenue billion Forecast, by Application Mode 2020 & 2033

- Table 6: Canada Crop Protection Chemicals Industry Revenue billion Forecast, by Crop Type 2020 & 2033

- Table 7: Canada Crop Protection Chemicals Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Canada Crop Protection Chemicals Industry Revenue billion Forecast, by Function 2020 & 2033

- Table 9: Canada Crop Protection Chemicals Industry Revenue billion Forecast, by Application Mode 2020 & 2033

- Table 10: Canada Crop Protection Chemicals Industry Revenue billion Forecast, by Crop Type 2020 & 2033

- Table 11: Canada Crop Protection Chemicals Industry Revenue billion Forecast, by Function 2020 & 2033

- Table 12: Canada Crop Protection Chemicals Industry Revenue billion Forecast, by Application Mode 2020 & 2033

- Table 13: Canada Crop Protection Chemicals Industry Revenue billion Forecast, by Crop Type 2020 & 2033

- Table 14: Canada Crop Protection Chemicals Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Crop Protection Chemicals Industry?

The projected CAGR is approximately 5.24%.

2. Which companies are prominent players in the Canada Crop Protection Chemicals Industry?

Key companies in the market include FMC Corporation, Sumitomo Chemical Co Ltd, ADAMA Agricultural Solutions Ltd, Bayer AG, Gowan Company, UPL Limite, Syngenta Group, Corteva Agriscience, Nufarm Ltd, BASF SE.

3. What are the main segments of the Canada Crop Protection Chemicals Industry?

The market segments include Function, Application Mode, Crop Type, Function, Application Mode, Crop Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

The market is driven by the growing pressure of pests and diseases.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

July 2023: ADAMA introduced new products, Davai A Plus and Clearfield Broad-Spectrum Herbicide Solutions, for imidazolinone-tolerant legumes like lentils, peas, and soybeans.January 2023: For the Canadian horticulture market, Gowan Canada Inc. introduced Magister SC Miticide. The product provides rapid action against certain species of mites in both Eriophyidae and Tetranychidae families and pear psylla.January 2023: Bayer formed a new partnership with Oerth Bio to enhance crop protection technology and create more eco-friendly crop protection solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Crop Protection Chemicals Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Crop Protection Chemicals Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Crop Protection Chemicals Industry?

To stay informed about further developments, trends, and reports in the Canada Crop Protection Chemicals Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence