Key Insights

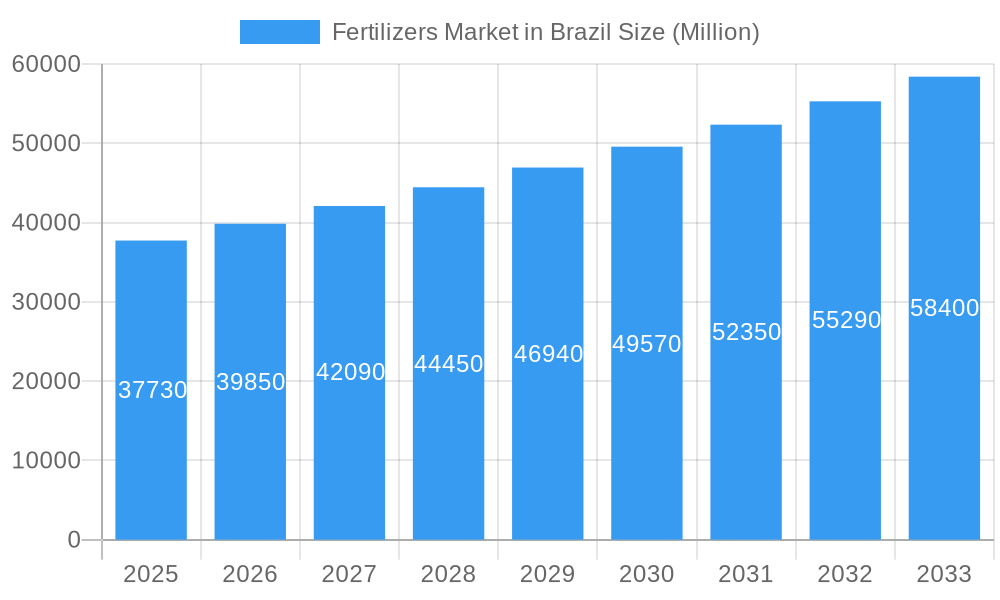

The Brazilian fertilizer market is poised for significant expansion, projecting a market size of USD 37.73 billion in 2025, driven by a Compound Annual Growth Rate (CAGR) of 5.66% through 2033. This robust growth is underpinned by Brazil's status as a global agricultural powerhouse, with a continuous demand for enhanced crop yields to feed a growing world population and capitalize on international export opportunities. Key drivers include the increasing adoption of advanced farming techniques, a rising need for nutrient-rich soils to combat degradation, and government initiatives aimed at boosting agricultural productivity. The market is witnessing a surge in demand for specialized fertilizers, including micronutrients and slow-release formulations, to optimize nutrient uptake and minimize environmental impact. Furthermore, the expansion of cultivated land, particularly for high-value crops, and the ongoing modernization of agricultural practices across diverse regions of Brazil are contributing to this upward trajectory.

Fertilizers Market in Brazil Market Size (In Billion)

The Brazilian fertilizer market's dynamism is also shaped by several emerging trends. A prominent trend is the increasing focus on sustainable agriculture, leading to a greater demand for organic and bio-fertilizers that enhance soil health and reduce reliance on synthetic inputs. Technological advancements in precision agriculture are also playing a crucial role, enabling farmers to apply fertilizers more efficiently based on real-time soil analysis and crop needs. Conversely, challenges such as fluctuating raw material prices, logistical complexities in distribution across Brazil's vast geography, and stringent environmental regulations present potential restraints. Despite these hurdles, the inherent strength of Brazil's agricultural sector, coupled with ongoing innovation and strategic investments by leading fertilizer companies, positions the market for sustained and substantial growth, making it a highly attractive landscape for stakeholders.

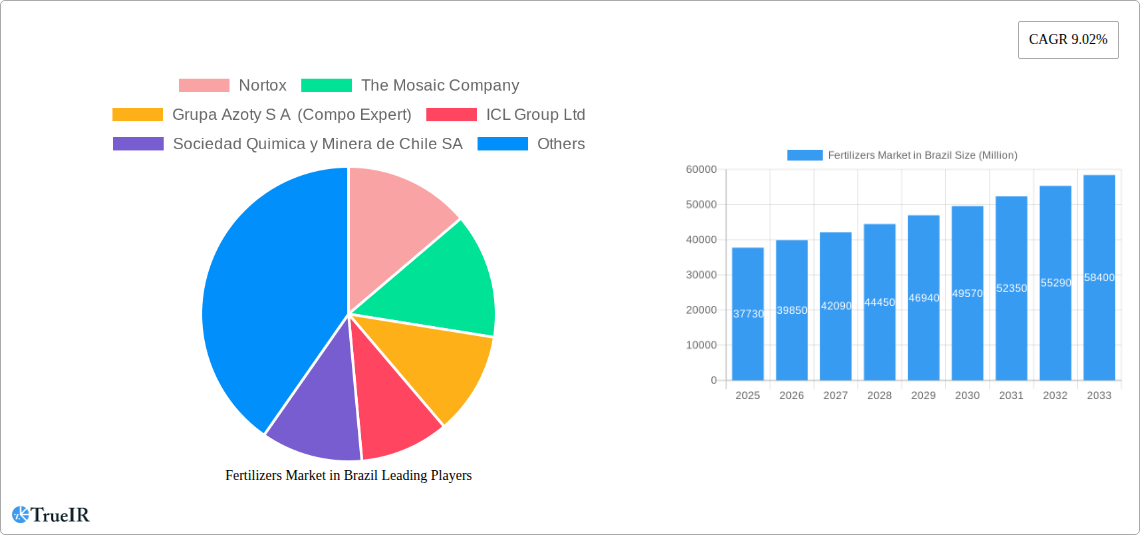

Fertilizers Market in Brazil Company Market Share

Unlock unparalleled insights into Brazil's burgeoning fertilizers market. This definitive report, covering the study period 2019–2033 with a base year and estimated year of 2025, delivers a granular forecast period of 2025–2033 and an in-depth look at the historical period of 2019–2024. Dive deep into fertilizer production, fertilizer consumption, fertilizer imports, fertilizer exports, and fertilizer price trends within the Brazilian agribusiness sector. Our analysis is powered by high-volume keywords such as NPK fertilizers, phosphate fertilizers, potash fertilizers, nitrogen fertilizers, specialty fertilizers, organic fertilizers, and biofertilizers, crucial for understanding the agricultural inputs market and crop nutrition solutions.

Fertilizers Market in Brazil Market Structure & Competitive Landscape

The Brazilian fertilizers market is characterized by a moderate to high concentration, with key global players and significant domestic producers vying for market share. Innovation drivers are primarily focused on enhancing crop yields, improving nutrient use efficiency, and developing environmentally sustainable fertilizer solutions. Regulatory frameworks play a crucial role, influencing import policies, product registration, and environmental standards, which in turn shape competitive dynamics.

- Market Concentration: Dominated by a few major players, but with growing presence of specialized and regional suppliers.

- Innovation Drivers:

- Development of slow-release and controlled-release fertilizers.

- Introduction of micronutrient-enriched fertilizers.

- Focus on bio-fertilizers and organic nutrient solutions.

- Digital agriculture integration for precision farming and nutrient management.

- Regulatory Impacts: Strict adherence to environmental regulations, import tariffs, and product quality standards. Government policies promoting sustainable agriculture significantly influence product development and market entry.

- Product Substitutes: While conventional fertilizers remain dominant, the market is witnessing a gradual increase in the adoption of organic manures, compost, and bio-fertilizers as viable alternatives.

- End-User Segmentation: Primarily agricultural producers across various crop segments like soybeans, corn, sugarcane, and coffee, with a growing segment for horticulture and urban farming.

- M&A Trends: Strategic acquisitions and partnerships are prevalent as companies seek to expand their geographical reach, product portfolios, and technological capabilities. For instance, K+S's acquisition in South Africa signifies a broader strategy to strengthen its footprint in key agricultural regions.

Fertilizers Market in Brazil Market Trends & Opportunities

The fertilizers market in Brazil is poised for robust growth, driven by the nation's status as a global agricultural powerhouse. The increasing demand for food security, coupled with the expansion of arable land and advancements in agricultural technology, fuels the need for efficient crop nutrition. Market size is projected to reach several tens of billions of dollars by 2033, with a consistent Compound Annual Growth Rate (CAGR) estimated at approximately 5.8%.

Technological shifts are profoundly reshaping the Brazilian fertilizer industry. Precision agriculture, utilizing data analytics and GPS technology, is enabling farmers to apply fertilizers more efficiently, reducing waste and environmental impact while maximizing crop yields. The adoption of specialty fertilizers, including water-soluble, liquid, and slow-release formulations, is gaining traction as farmers seek tailored solutions for specific crop needs and soil conditions. This trend is supported by a growing awareness among Brazilian farmers about the benefits of optimized nutrient management for long-term soil health and productivity.

Consumer preferences, influenced by global demand for sustainably produced food, are indirectly driving the demand for more efficient and eco-friendly fertilizers. The emphasis on sustainable agriculture and reducing the environmental footprint of farming practices is creating significant opportunities for organic fertilizers, biofertilizers, and enhanced efficiency fertilizers that minimize nutrient runoff.

Competitive dynamics are intensifying, with both established global players and emerging local companies striving to capture market share. Companies are investing heavily in research and development to introduce innovative products and enhance their distribution networks across Brazil's vast agricultural landscape. Strategic partnerships and mergers, such as ICL's agreement with General Mills, highlight the industry's move towards integrated solutions and broader market access.

Opportunities abound for companies that can offer:

- High-efficiency fertilizers: Products that maximize nutrient uptake and minimize losses.

- Customized nutrient solutions: Tailored formulations for specific crops, soil types, and climate conditions.

- Sustainable and organic alternatives: Meeting the growing demand for eco-friendly agricultural inputs.

- Digital integration: Providing data-driven insights and precision application technologies.

- Robust distribution networks: Ensuring timely and cost-effective delivery across Brazil's diverse agricultural regions.

The continued expansion of Brazil's agricultural sector, coupled with government support for modernization and sustainability, presents a fertile ground for innovation and growth in the fertilizers market.

Dominant Markets & Segments in Fertilizers Market in Brazil

The Brazilian fertilizers market exhibits distinct dominance across various segments, driven by agricultural output, import/export dynamics, and evolving consumption patterns.

Production Analysis: Brazil's production capacity is significant, particularly for nitrogenous and phosphatic fertilizers, though it relies heavily on imports for potash. The Southeast and Center-West regions are major production hubs, benefiting from proximity to key agricultural zones and established industrial infrastructure.

- Key Growth Drivers: Government incentives for domestic production, investment in port infrastructure to facilitate raw material imports, and technological advancements in manufacturing processes.

- Detailed Analysis: Production is concentrated around major industrial centers and port cities, leveraging access to raw materials and efficient logistics for distribution to vast agricultural frontiers. The push for self-sufficiency in fertilizer production is a recurring theme in government policy, encouraging investment in local manufacturing facilities.

Consumption Analysis: Brazil stands as one of the world's largest consumers of fertilizers, driven by its expansive agricultural sector, particularly for soybeans, corn, sugarcane, and coffee. The Center-West region, with its massive soybean and corn cultivation, represents the largest consumption market.

- Key Growth Drivers: Expanding planted area, increasing demand for higher crop yields, adoption of advanced farming techniques, and the need to replenish soil nutrients in intensive farming systems.

- Detailed Analysis: Consumption is directly correlated with the performance of Brazil's major commodity crops. The transition from basic fertilizers to more sophisticated specialty fertilizers and controlled-release fertilizers is a significant trend, aimed at improving nutrient use efficiency and reducing environmental impact.

Import Market Analysis (Value & Volume): Brazil is a net importer of fertilizers, especially potash and phosphate rock, due to limited domestic reserves. The value of fertilizer imports is substantial, reaching tens of billions of dollars annually.

- Key Growth Drivers: Global price fluctuations of raw materials, currency exchange rates, trade agreements, and the demand-supply gap for certain fertilizer types.

- Detailed Analysis: Major import sources include Canada, Russia, China, and the United States. Port infrastructure and logistics efficiency play a critical role in the cost and volume of fertilizer imports. Phosphate fertilizers and potash fertilizers constitute the largest share of imports.

Export Market Analysis (Value & Volume): Brazil exports a relatively smaller volume of finished fertilizers, primarily to neighboring South American countries. The value of fertilizer exports is a fraction of the import value.

- Key Growth Drivers: Regional demand for specific fertilizer types, competitive pricing, and strategic trade partnerships.

- Detailed Analysis: Exports are often driven by surplus production of certain types of fertilizers or by companies seeking to balance their regional supply chains. The focus remains primarily on serving the vast domestic market.

Price Trend Analysis: Fertilizer prices in Brazil are highly susceptible to global commodity prices (e.g., natural gas for nitrogenous fertilizers, phosphate rock, and potash), exchange rates, and domestic demand-supply dynamics. Prices have historically shown volatility.

- Key Growth Drivers: Global energy costs, international shipping rates, geopolitical factors impacting supply chains, and government subsidies or taxes.

- Detailed Analysis: The trend over the historical period indicated a generally upward trajectory with significant fluctuations, influenced by global supply disruptions and increased agricultural commodity prices. The base year and forecast period are expected to see continued price sensitivity to global market conditions.

Fertilizers Market in Brazil Product Analysis

The Brazilian fertilizers market is witnessing significant product innovation, driven by the need for enhanced crop performance and sustainable agricultural practices. Key product segments include nitrogenous fertilizers, phosphate fertilizers, potash fertilizers, and a rapidly growing category of specialty fertilizers. Innovations focus on improving nutrient delivery mechanisms, such as slow-release and controlled-release formulations, which optimize nutrient availability to plants while minimizing losses to the environment. The integration of micronutrients and biostimulants into fertilizer products is also a key trend, offering comprehensive crop nutrition solutions. Companies like ICL are actively launching NPK formulations with increased trace elements, demonstrating a commitment to advanced product development. The competitive advantage lies in providing scientifically backed, yield-enhancing, and environmentally responsible products that meet the diverse needs of Brazil's agricultural sector.

Key Drivers, Barriers & Challenges in Fertilizers Market in Brazil

The fertilizers market in Brazil is propelled by powerful growth drivers, including the nation's status as a global agricultural leader, continuous expansion of arable land, and increasing adoption of modern farming techniques. Technological advancements in precision agriculture and the development of high-efficiency fertilizers are critical. Economic factors, such as favorable commodity prices and government support for agribusiness, also play a significant role. Policy-driven initiatives promoting sustainable farming practices are creating opportunities for organic fertilizers and biofertilizers.

However, significant barriers and challenges impact growth. Supply chain disruptions, both domestic and international, can lead to price volatility and availability issues. Regulatory complexities in product registration and import/export procedures can create hurdles. Competitive pressures from global players and the need for significant capital investment in production and distribution infrastructure are also considerable. Fluctuations in currency exchange rates significantly impact the cost of imported raw materials and finished products. The vast geographical expanse of Brazil presents logistical challenges for efficient distribution across diverse agricultural regions.

Growth Drivers in the Fertilizers Market in Brazil Market

The fertilizers market in Brazil is experiencing robust growth, primarily driven by the country's pivotal role in global food production. The ever-increasing global demand for agricultural commodities, such as soybeans, corn, and sugarcane, necessitates higher crop yields, which directly translates into greater fertilizer consumption. Technological advancements are a significant catalyst; the widespread adoption of precision agriculture techniques allows for more targeted and efficient fertilizer application, maximizing nutrient uptake and minimizing waste. Government policies aimed at boosting agricultural productivity and supporting sustainable farming practices further fuel this growth. Economic factors, including favorable commodity prices and access to credit for farmers, also empower them to invest more in essential agricultural inputs like fertilizers.

Challenges Impacting Fertilizers Market in Brazil Growth

Despite its immense potential, the fertilizers market in Brazil faces several significant challenges that can impede growth. The country's heavy reliance on imports for key fertilizer components, particularly potash and phosphate, makes it vulnerable to global supply chain disruptions and price volatility stemming from geopolitical events or trade disputes. Regulatory complexities, including lengthy product registration processes and varying state-level regulations, can create hurdles for market entry and product diversification. Furthermore, the vast geographical size of Brazil poses significant logistical challenges and elevated transportation costs, impacting the affordability and timely availability of fertilizers across its diverse agricultural regions. Intense competition from both domestic and international players also necessitates continuous innovation and cost management.

Key Players Shaping the Fertilizers Market in Brazil Market

- Nortox

- The Mosaic Company

- Grupa Azoty S A (Compo Expert)

- ICL Group Ltd

- Sociedad Quimica y Minera de Chile SA

- Haifa Group

- K+S Aktiengesellschaft

- Yara International AS

- Nutrien Ltd

- Fertgrow

Significant Fertilizers Market in Brazil Industry Milestones

- April 2023: K+S acquired a 75% share of the fertilizer business of a South African trading company, Industrial Commodities Holdings (Pty) Ltd (ICH). This acquisition aims to expand the core business and strengthen K+S's operations in southern and eastern Africa, with the newly acquired business to be operated as Fertiv Pty Ltd.

- January 2023: ICL entered into a strategic partnership agreement with General Mills, becoming a supplier of strategic specialty phosphate solutions and focusing on international expansion.

- May 2022: ICL launched three new NPK formulations of Solinure, a product enhanced with increased trace elements designed to optimize crop yields.

Future Outlook for Fertilizers Market in Brazil Market

The future outlook for the fertilizers market in Brazil is exceptionally bright, driven by the convergence of sustainable agriculture mandates and the unwavering demand for food security. Brazil's continued expansion as a global agricultural leader will ensure a sustained demand for high-quality fertilizers. The market is expected to witness a significant surge in the adoption of specialty fertilizers, including water-soluble, liquid, and micronutrient-enriched formulations, catering to the increasing sophistication of Brazilian farming practices. Furthermore, the growing emphasis on environmental stewardship will propel the market for organic fertilizers and biofertilizers, aligning with global trends towards greener agricultural inputs. Investments in domestic production capabilities and improvements in logistical infrastructure are anticipated to mitigate some of the current import-related challenges. Strategic partnerships and mergers will continue to shape the competitive landscape, fostering innovation and market consolidation. Overall, the Brazilian fertilizer industry is on a trajectory of strong, sustainable growth, presenting substantial opportunities for all stakeholders involved in the agricultural value chain.

Fertilizers Market in Brazil Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Fertilizers Market in Brazil Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

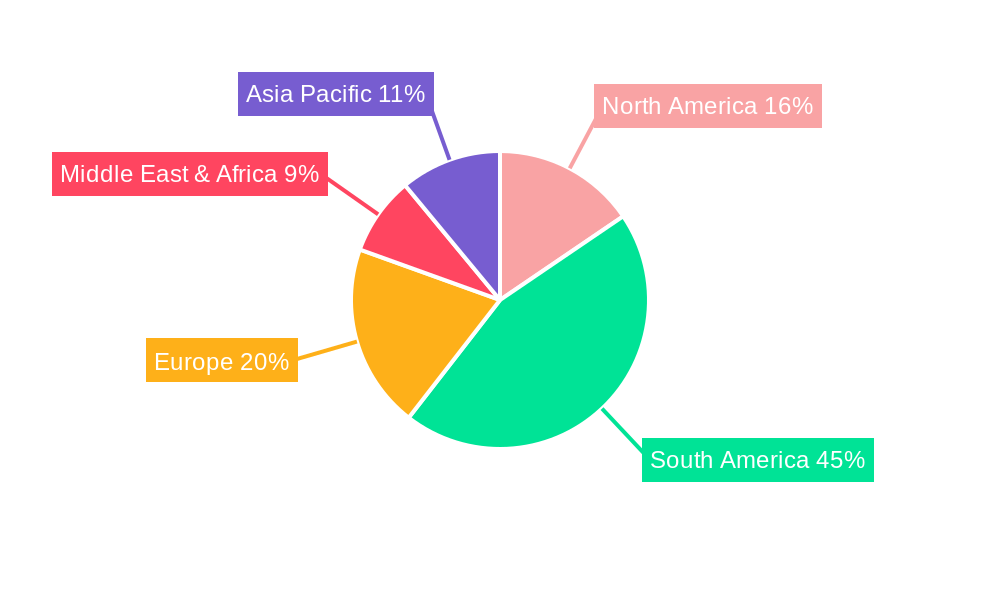

Fertilizers Market in Brazil Regional Market Share

Geographic Coverage of Fertilizers Market in Brazil

Fertilizers Market in Brazil REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Need for Custom Product Development; Use of CROs for Regulatory Services

- 3.3. Market Restrains

- 3.3.1. Data and Cyber Security Concerns; Lack of Experts and Professionals in this Industry

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fertilizers Market in Brazil Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Fertilizers Market in Brazil Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Fertilizers Market in Brazil Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Fertilizers Market in Brazil Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa Fertilizers Market in Brazil Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific Fertilizers Market in Brazil Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Nortox

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The Mosaic Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Grupa Azoty S A (Compo Expert)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ICL Group Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sociedad Quimica y Minera de Chile SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Haifa Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 K+S Aktiengesellschaft

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Yara International AS

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nutrien Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Fertgrow

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Nortox

List of Figures

- Figure 1: Global Fertilizers Market in Brazil Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Fertilizers Market in Brazil Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 3: North America Fertilizers Market in Brazil Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Fertilizers Market in Brazil Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 5: North America Fertilizers Market in Brazil Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Fertilizers Market in Brazil Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Fertilizers Market in Brazil Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Fertilizers Market in Brazil Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Fertilizers Market in Brazil Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Fertilizers Market in Brazil Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Fertilizers Market in Brazil Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Fertilizers Market in Brazil Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America Fertilizers Market in Brazil Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Fertilizers Market in Brazil Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 15: South America Fertilizers Market in Brazil Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America Fertilizers Market in Brazil Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 17: South America Fertilizers Market in Brazil Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America Fertilizers Market in Brazil Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America Fertilizers Market in Brazil Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America Fertilizers Market in Brazil Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America Fertilizers Market in Brazil Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America Fertilizers Market in Brazil Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 23: South America Fertilizers Market in Brazil Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America Fertilizers Market in Brazil Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Fertilizers Market in Brazil Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Fertilizers Market in Brazil Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 27: Europe Fertilizers Market in Brazil Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe Fertilizers Market in Brazil Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 29: Europe Fertilizers Market in Brazil Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe Fertilizers Market in Brazil Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe Fertilizers Market in Brazil Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe Fertilizers Market in Brazil Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe Fertilizers Market in Brazil Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe Fertilizers Market in Brazil Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe Fertilizers Market in Brazil Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe Fertilizers Market in Brazil Revenue (undefined), by Country 2025 & 2033

- Figure 37: Europe Fertilizers Market in Brazil Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa Fertilizers Market in Brazil Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa Fertilizers Market in Brazil Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa Fertilizers Market in Brazil Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa Fertilizers Market in Brazil Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa Fertilizers Market in Brazil Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa Fertilizers Market in Brazil Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa Fertilizers Market in Brazil Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa Fertilizers Market in Brazil Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa Fertilizers Market in Brazil Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa Fertilizers Market in Brazil Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa Fertilizers Market in Brazil Revenue (undefined), by Country 2025 & 2033

- Figure 49: Middle East & Africa Fertilizers Market in Brazil Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Fertilizers Market in Brazil Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific Fertilizers Market in Brazil Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific Fertilizers Market in Brazil Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific Fertilizers Market in Brazil Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific Fertilizers Market in Brazil Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific Fertilizers Market in Brazil Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific Fertilizers Market in Brazil Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific Fertilizers Market in Brazil Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific Fertilizers Market in Brazil Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific Fertilizers Market in Brazil Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific Fertilizers Market in Brazil Revenue (undefined), by Country 2025 & 2033

- Figure 61: Asia Pacific Fertilizers Market in Brazil Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Fertilizers Market in Brazil Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Fertilizers Market in Brazil Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Fertilizers Market in Brazil Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Fertilizers Market in Brazil Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Fertilizers Market in Brazil Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Fertilizers Market in Brazil Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: Global Fertilizers Market in Brazil Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Fertilizers Market in Brazil Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Fertilizers Market in Brazil Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Fertilizers Market in Brazil Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Fertilizers Market in Brazil Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Fertilizers Market in Brazil Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: United States Fertilizers Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Canada Fertilizers Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Mexico Fertilizers Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Fertilizers Market in Brazil Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 17: Global Fertilizers Market in Brazil Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global Fertilizers Market in Brazil Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global Fertilizers Market in Brazil Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global Fertilizers Market in Brazil Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global Fertilizers Market in Brazil Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: Brazil Fertilizers Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Argentina Fertilizers Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America Fertilizers Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Global Fertilizers Market in Brazil Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 26: Global Fertilizers Market in Brazil Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global Fertilizers Market in Brazil Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global Fertilizers Market in Brazil Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global Fertilizers Market in Brazil Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global Fertilizers Market in Brazil Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: United Kingdom Fertilizers Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Germany Fertilizers Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: France Fertilizers Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Italy Fertilizers Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Spain Fertilizers Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Russia Fertilizers Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Benelux Fertilizers Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Nordics Fertilizers Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Fertilizers Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Global Fertilizers Market in Brazil Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 41: Global Fertilizers Market in Brazil Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global Fertilizers Market in Brazil Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global Fertilizers Market in Brazil Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global Fertilizers Market in Brazil Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global Fertilizers Market in Brazil Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: Turkey Fertilizers Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: Israel Fertilizers Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: GCC Fertilizers Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: North Africa Fertilizers Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: South Africa Fertilizers Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa Fertilizers Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Global Fertilizers Market in Brazil Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 53: Global Fertilizers Market in Brazil Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global Fertilizers Market in Brazil Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global Fertilizers Market in Brazil Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global Fertilizers Market in Brazil Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global Fertilizers Market in Brazil Revenue undefined Forecast, by Country 2020 & 2033

- Table 58: China Fertilizers Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 59: India Fertilizers Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 60: Japan Fertilizers Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 61: South Korea Fertilizers Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: ASEAN Fertilizers Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 63: Oceania Fertilizers Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific Fertilizers Market in Brazil Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fertilizers Market in Brazil?

The projected CAGR is approximately 5.66%.

2. Which companies are prominent players in the Fertilizers Market in Brazil?

Key companies in the market include Nortox, The Mosaic Company, Grupa Azoty S A (Compo Expert), ICL Group Ltd, Sociedad Quimica y Minera de Chile SA, Haifa Group, K+S Aktiengesellschaft, Yara International AS, Nutrien Ltd, Fertgrow.

3. What are the main segments of the Fertilizers Market in Brazil?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Need for Custom Product Development; Use of CROs for Regulatory Services.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Data and Cyber Security Concerns; Lack of Experts and Professionals in this Industry.

8. Can you provide examples of recent developments in the market?

April 2023: K+S acquired a 75% share of the fertilizer business of a South African trading company, Industrial Commodities Holdings (Pty) Ltd (ICH). In addition to expanding the core business, K+S is strengthening its operations in southern and eastern Africa as a result of this acquisition. The newly acquired fertilizer business in the future is to be operated in a joint venture under the name of FertivPty Ltd.January 2023: ICL has entered into a strategic partnership agreement with General Mills, in which it will be the supplier of strategic specialty phosphate solutions to General Mills. The long-term agreement will also focus on international expansion.May 2022: ICL launched three new NPK formulations of Solinure, a product with increased trace elements to optimize yields.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fertilizers Market in Brazil," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fertilizers Market in Brazil report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fertilizers Market in Brazil?

To stay informed about further developments, trends, and reports in the Fertilizers Market in Brazil, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence