Key Insights

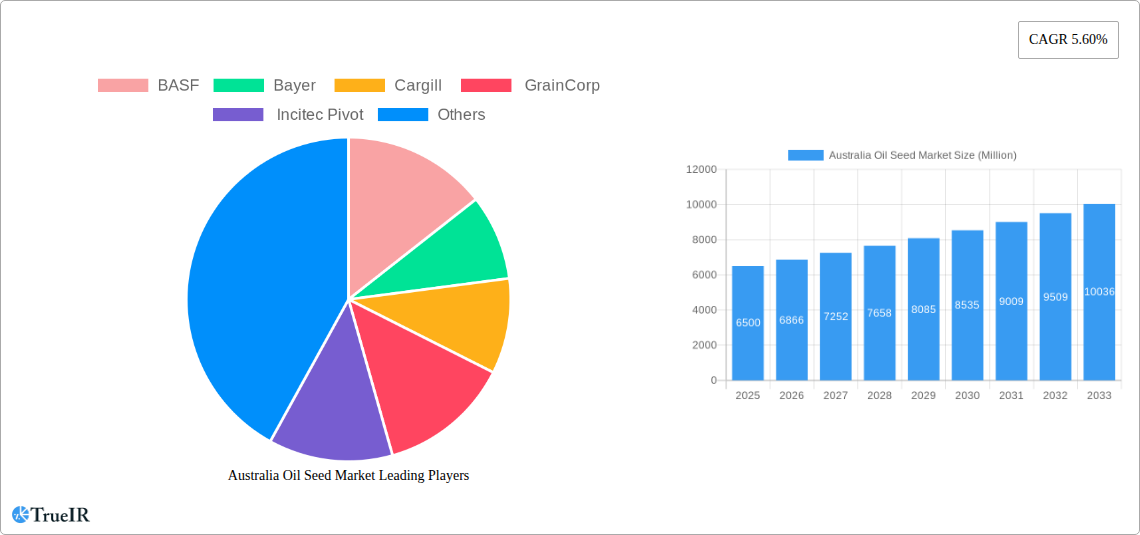

The Australian oilseed market is poised for robust growth, driven by increasing demand for edible oils, animal feed, and biofuels. With a projected market size of approximately AUD 6,500 million in 2025, the industry is expected to expand at a Compound Annual Growth Rate (CAGR) of 5.60% over the forecast period of 2025-2033. This expansion is significantly influenced by key drivers such as the growing adoption of healthier diets, the rising popularity of plant-based protein sources, and supportive government policies promoting renewable energy. Rapeseed is anticipated to be a dominant segment, owing to its versatility in both food and industrial applications, coupled with advancements in cultivation techniques that enhance yield and quality. The increasing focus on sustainable agriculture and the demand for domestically produced oilseeds to reduce reliance on imports are further bolstering market prospects.

Australia Oil Seed Market Market Size (In Billion)

While the overall outlook is positive, the Australian oilseed market faces certain restraints, including volatile commodity prices, the impact of adverse weather conditions on crop yields, and competition from established global players. However, the market is also characterized by evolving trends, such as the growing interest in niche oilseeds like sunflower and safflower for their unique nutritional profiles and functional properties. Technological innovations in oilseed processing, extraction, and product development are also shaping the market landscape, leading to the creation of value-added products. Key companies like Cargill, Wilmar, and BASF are actively investing in research and development, expanding their production capacities, and forging strategic partnerships to capitalize on these evolving market dynamics and maintain a competitive edge within Australia and beyond.

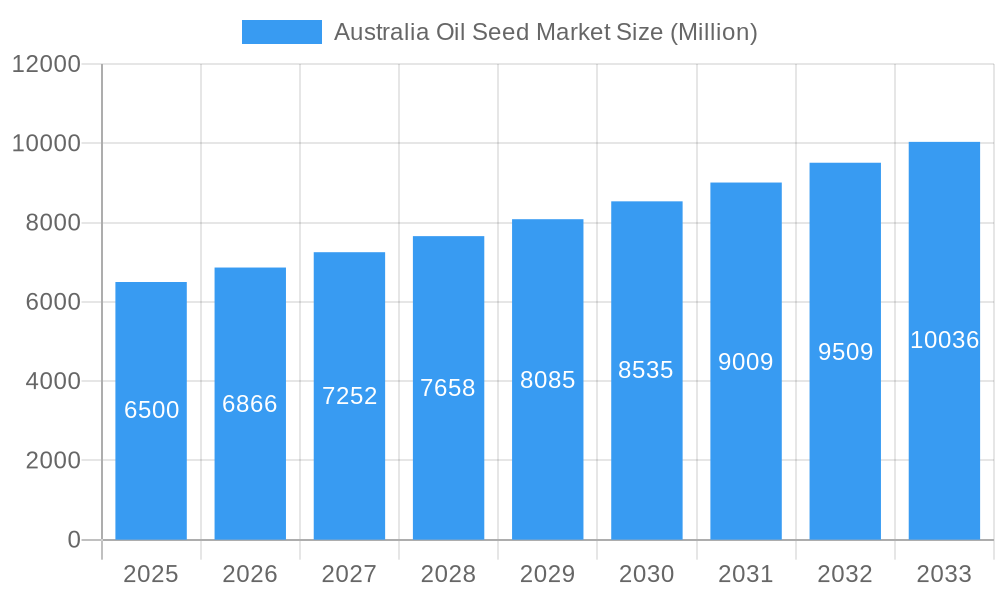

Australia Oil Seed Market Company Market Share

Here's a dynamic, SEO-optimized report description for the Australia Oil Seed Market:

This comprehensive report provides an in-depth analysis of the Australia Oil Seed Market, offering critical insights into production, consumption, import/export dynamics, price trends, and future growth prospects. With a focus on high-volume keywords such as "Australian oilseeds," "rapeseed market Australia," "soybean Australia," "sunflower seed market," and "cottonseed production," this report is designed to be an indispensable resource for industry stakeholders, investors, and policymakers navigating the Australian agricultural landscape. We cover the Study Period: 2019–2033, with a Base Year: 2025 and Forecast Period: 2025–2033, encompassing a detailed Historical Period: 2019–2024.

Australia Oil Seed Market Market Structure & Competitive Landscape

The Australia Oil Seed Market exhibits a moderately concentrated structure, with key players like Cargill, GrainCorp, Bayer, and Wilmar holding significant market shares. Innovation is primarily driven by advancements in agricultural technology, including improved crop genetics, precision farming techniques, and sustainable cultivation practices. Regulatory impacts, such as government subsidies, trade agreements, and environmental standards, play a crucial role in shaping market dynamics. While direct product substitutes are limited within the oilseed category, alternative edible oils and animal feed sources present indirect competition. End-user segmentation reveals strong demand from the food processing, animal feed, and biofuel sectors. Mergers and acquisitions (M&A) have been a notable trend, with an estimated volume of $150 Million in M&A deals during the historical period, indicating a consolidation drive among major entities aiming to enhance market reach and operational efficiencies. The market concentration ratio for the top three players stands at approximately 45%, highlighting the influence of dominant companies in setting market trends and pricing.

Australia Oil Seed Market Market Trends & Opportunities

The Australia Oil Seed Market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.2% from 2025 to 2033. This expansion is fueled by escalating global demand for vegetable oils and protein meals, coupled with Australia's strategic position as a key agricultural producer. Technological shifts are profoundly impacting the sector, with the adoption of genetically modified (GM) seeds and advanced irrigation systems increasing yields and resilience against climate variability. Consumer preferences are leaning towards healthier, plant-based food options, boosting demand for oils derived from soybeans, sunflowers, and rapeseed. The competitive dynamics are intensifying, characterized by strategic partnerships and product differentiation. Market penetration rates for high-oleic sunflower oil and specialty rapeseed varieties are on the rise, indicating a growing niche market. The increasing focus on sustainability and traceability within the food supply chain presents significant opportunities for oilseed producers who can meet stringent environmental and ethical standards. Furthermore, government initiatives promoting agricultural innovation and export diversification are expected to provide a conducive environment for market expansion. The biofuel sector's growing reliance on domestically sourced oilseeds also represents a substantial growth avenue. Emerging opportunities lie in the development of value-added oilseed products and the exploration of new export markets beyond traditional partners. The market size is estimated to reach $12,500 Million by 2033.

Dominant Markets & Segments in Australia Oil Seed Market

The Rapeseed market stands out as a dominant segment within the Australia Oil Seed Market. Its significant market share is attributed to strong production capabilities, consistent consumption demand, and favorable export opportunities.

Rapeseed:

- Production Analysis: Australia's rapeseed production has shown a steady upward trend, driven by advancements in agricultural practices and favorable climatic conditions in key growing regions like Western Australia and New South Wales. Production volumes are estimated to reach 3.8 Million tonnes by 2025, with further growth anticipated.

- Consumption Analysis & Market Size: Domestic consumption is robust, primarily for edible oil production and animal feed. The domestic market size for rapeseed oil is estimated at $2,200 Million in 2025.

- Import Market Analysis (Volume & Value): While Australia is a net exporter of rapeseed, imports may occur for specific varietal needs or to supplement domestic supply, though volumes are typically modest, valued at approximately $50 Million annually.

- Export Market Analysis (Volume & Value): Rapeseed exports are a cornerstone of the Australian oilseed industry, with major destinations including Asia and Europe. Export volumes are projected to reach 3.1 Million tonnes by 2025, valued at $2,800 Million.

- Price Trend Analysis: Rapeseed prices are influenced by global commodity markets, weather patterns, and demand from international buyers, with an average price of $900 per tonne anticipated for 2025.

Cottonseed:

- Production Analysis: Cottonseed production is intrinsically linked to Australia's cotton output, with volumes fluctuating based on crop yields. Estimated production is around 1.2 Million tonnes in 2025.

- Consumption Analysis & Market Size: Primarily used for animal feed and cottonseed oil extraction. The cottonseed oil market is valued at $600 Million.

- Import Market Analysis (Volume & Value): Limited imports, with a value of around $10 Million.

- Export Market Analysis (Volume & Value): Significant export potential, particularly for the meal component. Estimated exports at 0.7 Million tonnes, valued at $400 Million.

- Price Trend Analysis: Prices are influenced by cotton production and demand for animal feed, averaging $300 per tonne in 2025.

Soybean:

- Production Analysis: Soybean cultivation is concentrated in Queensland and New South Wales. Production is projected to be 0.6 Million tonnes in 2025.

- Consumption Analysis & Market Size: Growing demand for food products and animal feed. The soybean oil market is valued at $1,000 Million.

- Import Market Analysis (Volume & Value): Australia relies on imports for a portion of its soybean needs, valued at $200 Million.

- Export Market Analysis (Volume & Value): Export potential exists, though domestic consumption is a priority. Estimated exports at 0.1 Million tonnes, valued at $100 Million.

- Price Trend Analysis: Influenced by global soybean prices and domestic demand, with an average price of $550 per tonne for 2025.

Sunflower Seed:

- Production Analysis: Production is expanding, particularly in New South Wales and Queensland, driven by demand for high-oleic sunflower oil. Estimated production of 0.3 Million tonnes in 2025.

- Consumption Analysis & Market Size: Growing demand for edible oils and functional food ingredients. The sunflower oil market is valued at $700 Million.

- Import Market Analysis (Volume & Value): Minimal imports, valued at $5 Million.

- Export Market Analysis (Volume & Value): Export potential for specialty sunflower oils. Estimated exports at 0.1 Million tonnes, valued at $90 Million.

- Price Trend Analysis: Higher prices for high-oleic varieties, averaging $800 per tonne in 2025.

Safflower Seed:

- Production Analysis: Niche crop with fluctuating production, estimated at 0.05 Million tonnes in 2025.

- Consumption Analysis & Market Size: Primarily for edible oil and industrial applications. The safflower oil market is valued at $150 Million.

- Import Market Analysis (Volume & Value): Minimal imports, valued at $2 Million.

- Export Market Analysis (Volume & Value): Limited export volumes.

- Price Trend Analysis: Variable pricing based on demand and supply, averaging $700 per tonne in 2025.

Australia Oil Seed Market Product Analysis

Product innovation in the Australia Oil Seed Market centers on enhancing nutritional profiles, improving sustainability, and developing novel applications. Advancements in breeding technologies are yielding oilseed varieties with higher oil content, improved fatty acid compositions (e.g., high-oleic sunflower oil), and increased resistance to pests and diseases. These innovations cater to growing consumer demand for healthier food ingredients and reduce reliance on chemical inputs. Applications are expanding beyond traditional uses in cooking oils and animal feed to include biofuels, bioplastics, and specialized industrial lubricants. Competitive advantages are gained through superior product quality, consistent supply chains, and the ability to meet stringent food safety and traceability standards. Technological advancements in processing and refining are also enabling the creation of premium oilseed-derived products with distinct market appeal.

Key Drivers, Barriers & Challenges in Australia Oil Seed Market

Key Drivers, Barriers & Challenges in Australia Oil Seed Market

Key Drivers:

- Growing Global Demand: Increasing worldwide need for edible oils and protein meals for food and feed.

- Technological Advancements: Innovations in seed genetics, precision agriculture, and sustainable farming practices enhance yields and efficiency.

- Government Support & Policies: Favorable agricultural policies, research grants, and export incentives bolster the sector.

- Health and Sustainability Trends: Rising consumer preference for plant-based diets and sustainable agricultural products.

- Biofuel Production: Growing demand for oilseeds as feedstocks for renewable energy.

Key Barriers & Challenges:

- Climate Variability: Susceptibility to drought, extreme weather events, and changing rainfall patterns impacts yields.

- Market Price Volatility: Fluctuations in global commodity prices can affect producer profitability.

- Supply Chain Logistics: Infrastructure limitations and transportation costs, particularly in remote regions, pose challenges.

- Competition from Imports: Lower-cost imported oils and meals can pressure domestic markets.

- Regulatory Compliance: Adhering to evolving environmental regulations and international trade standards.

- Pest and Disease Outbreaks: The risk of crop damage from pests and diseases requires ongoing management strategies.

Growth Drivers in the Australia Oil Seed Market Market

The Australia Oil Seed Market is propelled by a confluence of technological, economic, and regulatory factors. Technological advancements, such as the development of drought-resistant seed varieties and the adoption of smart farming techniques, are crucial in mitigating climate-related risks and boosting productivity. Economically, the increasing global appetite for vegetable oils and protein meals, particularly from Asia, provides a strong export impetus. Government support, including research and development grants and trade promotion initiatives, plays a vital role in fostering innovation and market expansion. For instance, investments in agricultural research institutions are leading to the development of higher-yielding and more resilient oilseed crops. The growing demand for plant-based proteins in food products also contributes significantly to the market's growth trajectory.

Challenges Impacting Australia Oil Seed Market Growth

The Australia Oil Seed Market faces several significant challenges that could impede its growth. Regulatory complexities, including evolving environmental standards and biosecurity measures, can increase compliance costs and operational hurdles for producers. Supply chain issues, such as bottlenecks in logistics and storage infrastructure, especially in remote agricultural areas, can impact the timely delivery of products and increase transportation expenses. Competitive pressures from international markets, where producers may benefit from lower production costs or more favorable subsidies, also pose a threat. Furthermore, the inherent vulnerability of agriculture to unpredictable weather patterns, such as extended droughts or unseasonal floods, directly impacts production volumes and can lead to price volatility. For example, a significant drought could reduce yields by up to 30%, impacting both domestic supply and export capabilities.

Key Players Shaping the Australia Oil Seed Market Market

- BASF

- Bayer

- Cargill

- GrainCorp

- Incitec Pivot

- Nufarm

- Richardson International

- Wilmar

Significant Australia Oil Seed Market Industry Milestones

- 2019: Increased government investment in agricultural innovation funding for oilseed research.

- 2020: Launch of new high-oleic sunflower varieties with enhanced disease resistance.

- 2021: Expansion of canola processing facilities to meet growing domestic demand for edible oils.

- 2022: Signification of new trade agreements boosting oilseed exports to Asian markets.

- 2023: Introduction of precision agriculture technologies, including drone-based crop monitoring, becoming more widespread.

- 2024: Growing focus on sustainable farming certifications for oilseed production.

Future Outlook for Australia Oil Seed Market Market

The Australia Oil Seed Market is projected for sustained growth, driven by a combination of increasing global demand for food and feed, and the sector's capacity for innovation and adaptation. Strategic opportunities lie in expanding value-added product lines, such as specialized edible oils and protein isolates, and in further developing export markets, particularly in Southeast Asia and beyond. The ongoing adoption of advanced agricultural technologies and a continued focus on sustainable practices will be critical in enhancing competitiveness and meeting evolving consumer and regulatory expectations. Furthermore, exploring new applications for oilseeds in bio-based industries presents a significant avenue for long-term market expansion and diversification, solidifying Australia's position as a key global supplier.

Australia Oil Seed Market Segmentation

-

1. Oilseed Type

-

1.1. Rapeseed

- 1.1.1. Production Analysis

- 1.1.2. Consumption Analysis & Market Size

- 1.1.3. Import Market Analysis (Volume & Value)

- 1.1.4. Export Market Analysis (Volume & Value)

- 1.1.5. Price Trend Analysis

- 1.2. Cotton seed

- 1.3. Soybean

- 1.4. Sunflower Seed

- 1.5. Safflower Seed

-

1.1. Rapeseed

-

2. Oilseed Type

-

2.1. Rapeseed

- 2.1.1. Production Analysis

- 2.1.2. Consumption Analysis & Market Size

- 2.1.3. Import Market Analysis (Volume & Value)

- 2.1.4. Export Market Analysis (Volume & Value)

- 2.1.5. Price Trend Analysis

- 2.2. Cotton seed

- 2.3. Soybean

- 2.4. Sunflower Seed

- 2.5. Safflower Seed

-

2.1. Rapeseed

Australia Oil Seed Market Segmentation By Geography

- 1. Australia

Australia Oil Seed Market Regional Market Share

Geographic Coverage of Australia Oil Seed Market

Australia Oil Seed Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Awareness About Health Benefits Associated With Pecan Consumption; Wide Application of Pecan

- 3.3. Market Restrains

- 3.3.1. ; Volatility in the Prices; Adverse Weather Conditions Affecting Yield

- 3.4. Market Trends

- 3.4.1. Increasing Global Consumption of Canola Oil

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Oil Seed Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Oilseed Type

- 5.1.1. Rapeseed

- 5.1.1.1. Production Analysis

- 5.1.1.2. Consumption Analysis & Market Size

- 5.1.1.3. Import Market Analysis (Volume & Value)

- 5.1.1.4. Export Market Analysis (Volume & Value)

- 5.1.1.5. Price Trend Analysis

- 5.1.2. Cotton seed

- 5.1.3. Soybean

- 5.1.4. Sunflower Seed

- 5.1.5. Safflower Seed

- 5.1.1. Rapeseed

- 5.2. Market Analysis, Insights and Forecast - by Oilseed Type

- 5.2.1. Rapeseed

- 5.2.1.1. Production Analysis

- 5.2.1.2. Consumption Analysis & Market Size

- 5.2.1.3. Import Market Analysis (Volume & Value)

- 5.2.1.4. Export Market Analysis (Volume & Value)

- 5.2.1.5. Price Trend Analysis

- 5.2.2. Cotton seed

- 5.2.3. Soybean

- 5.2.4. Sunflower Seed

- 5.2.5. Safflower Seed

- 5.2.1. Rapeseed

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Oilseed Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BASF

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bayer

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cargill

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 GrainCorp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Incitec Pivot

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nufarm

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Richardson International

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Wilmar

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 BASF

List of Figures

- Figure 1: Australia Oil Seed Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Oil Seed Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Oil Seed Market Revenue Million Forecast, by Oilseed Type 2020 & 2033

- Table 2: Australia Oil Seed Market Volume Kiloton Forecast, by Oilseed Type 2020 & 2033

- Table 3: Australia Oil Seed Market Revenue Million Forecast, by Oilseed Type 2020 & 2033

- Table 4: Australia Oil Seed Market Volume Kiloton Forecast, by Oilseed Type 2020 & 2033

- Table 5: Australia Oil Seed Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Australia Oil Seed Market Volume Kiloton Forecast, by Region 2020 & 2033

- Table 7: Australia Oil Seed Market Revenue Million Forecast, by Oilseed Type 2020 & 2033

- Table 8: Australia Oil Seed Market Volume Kiloton Forecast, by Oilseed Type 2020 & 2033

- Table 9: Australia Oil Seed Market Revenue Million Forecast, by Oilseed Type 2020 & 2033

- Table 10: Australia Oil Seed Market Volume Kiloton Forecast, by Oilseed Type 2020 & 2033

- Table 11: Australia Oil Seed Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Australia Oil Seed Market Volume Kiloton Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Oil Seed Market?

The projected CAGR is approximately 5.60%.

2. Which companies are prominent players in the Australia Oil Seed Market?

Key companies in the market include BASF, Bayer , Cargill , GrainCorp, Incitec Pivot, Nufarm , Richardson International , Wilmar.

3. What are the main segments of the Australia Oil Seed Market?

The market segments include Oilseed Type, Oilseed Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX Million as of 2022.

5. What are some drivers contributing to market growth?

; Awareness About Health Benefits Associated With Pecan Consumption; Wide Application of Pecan.

6. What are the notable trends driving market growth?

Increasing Global Consumption of Canola Oil.

7. Are there any restraints impacting market growth?

; Volatility in the Prices; Adverse Weather Conditions Affecting Yield.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Oil Seed Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Oil Seed Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Oil Seed Market?

To stay informed about further developments, trends, and reports in the Australia Oil Seed Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence