Key Insights

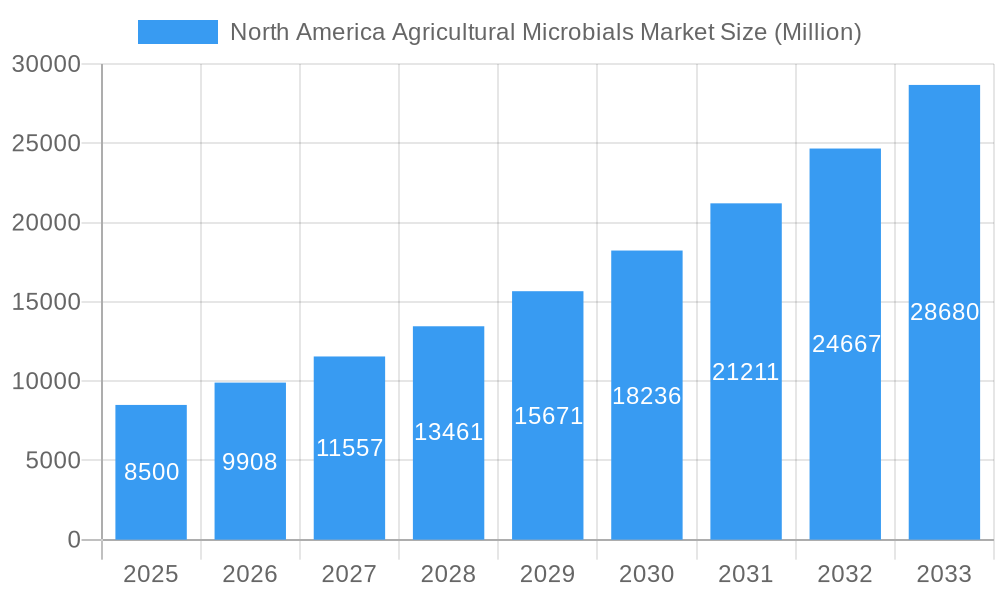

The North American agricultural microbials market is poised for remarkable expansion, projected to reach a significant market size of approximately $8,500 million by 2025. Fueled by a robust Compound Annual Growth Rate (CAGR) of 16.50%, the market is set to demonstrate sustained momentum through 2033. This impressive growth is primarily driven by a confluence of factors including the escalating demand for sustainable agricultural practices, increasing consumer preference for organic and residue-free produce, and a growing awareness of the detrimental effects of synthetic pesticides and fertilizers on the environment and human health. Governments across North America are also actively promoting the adoption of bio-based solutions through favorable policies and subsidies, further bolstering market penetration. The market's trajectory indicates a substantial shift towards eco-friendly alternatives, with agricultural microbials emerging as a cornerstone of modern, responsible farming.

North America Agricultural Microbials Market Market Size (In Billion)

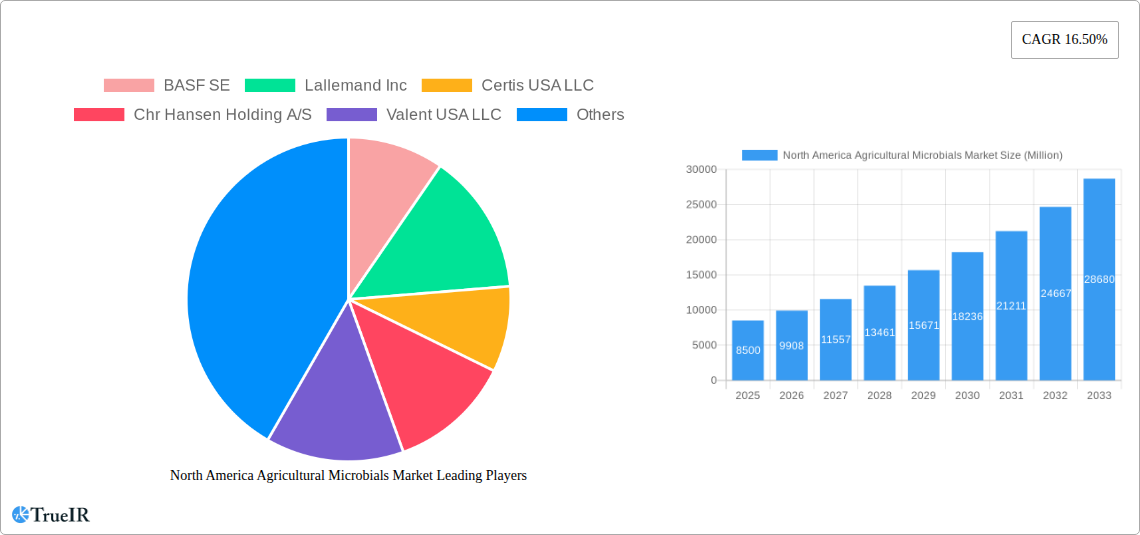

The market is segmented into key areas of production analysis, consumption analysis, import and export dynamics (both value and volume), and price trend analysis, offering a comprehensive view of its intricate workings. Leading companies such as BASF SE, Lallemand Inc., Certis USA LLC, and Bayer CropScience AG are at the forefront, investing heavily in research and development to introduce innovative microbial products. These products encompass a wide range of applications, including biopesticides, biofertilizers, and biostimulants, catering to diverse crop types and agricultural challenges. Key restraints include the initial cost of some microbial products, the need for greater farmer education on their application and benefits, and potential challenges in standardization and regulation. However, the persistent upward trend in adoption and the continuous innovation pipeline suggest that these restraints will be progressively overcome, solidifying the vital role of agricultural microbials in ensuring food security and environmental sustainability across North America.

North America Agricultural Microbials Market Company Market Share

North America Agricultural Microbials Market Market Structure & Competitive Landscape

The North America agricultural microbials market is characterized by a moderately concentrated landscape, with a mix of large multinational corporations and specialized biologicals companies. Major players such as BASF SE, Bayer CropScience AG, Syngenta AG, and Corteva Agriscience exert significant influence due to their extensive R&D capabilities, global distribution networks, and established agricultural portfolios. However, the market also features dynamic smaller companies and innovators like Lallemand Inc., Certis USA LLC, Chr Hansen Holding A/S, Valent USA LLC, Precision Laboratories, Isagro USA, Verdesian Life Sciences LLC, Marrone Bio Innovations, and Koppert Biological Systems, which are often at the forefront of novel microbial product development and niche applications.

Innovation is a key driver, fueled by increasing demand for sustainable agriculture, reduced reliance on synthetic chemicals, and the need for improved crop yields and soil health. The regulatory environment plays a crucial role, with differing approval processes across the US and Canada impacting market entry and product adoption rates. Product substitutes, primarily synthetic fertilizers and pesticides, remain a significant competitive factor, though growing awareness of the environmental and health benefits of microbials is gradually shifting preferences.

End-user segmentation, encompassing row crops, fruits and vegetables, turf and ornamentals, and specialty crops, dictates tailored product development and marketing strategies. Mergers and acquisitions (M&A) are an active trend, as larger companies seek to bolster their biologicals portfolios and gain access to innovative technologies and market share. For instance, the period between 2019-2024 has seen several strategic acquisitions aimed at consolidating market positions and expanding product offerings. Estimated M&A volumes are projected to reach over $2,000 million in this period, signaling robust investor confidence and industry consolidation.

North America Agricultural Microbials Market Market Trends & Opportunities

The North America agricultural microbials market is poised for substantial growth, driven by an escalating global demand for sustainable agricultural practices and a growing imperative to reduce the environmental footprint of farming. Over the forecast period of 2025-2033, the market is projected to expand at a robust Compound Annual Growth Rate (CAGR) of approximately 15.5%. This expansion is fueled by a confluence of technological advancements, evolving consumer preferences, and supportive policy frameworks aimed at promoting eco-friendly agricultural inputs.

Technological shifts are at the core of this market's dynamism. Advancements in microbial identification, fermentation techniques, and formulation technologies are leading to the development of more potent, stable, and user-friendly microbial products. These innovations enable better efficacy in diverse environmental conditions and crop types, broadening the application spectrum of agricultural microbials. Precision agriculture, with its emphasis on data-driven decision-making and targeted input application, presents a significant opportunity for microbials, allowing for optimized delivery and enhanced performance. The integration of AI and machine learning in microbial research is accelerating the discovery of novel microbial strains with specific beneficial traits, such as enhanced nutrient uptake, disease resistance, and stress tolerance.

Consumer preferences are increasingly leaning towards food produced with minimal chemical intervention. This trend is translating into higher demand for organically grown produce and food products with a reduced pesticide residue profile, directly benefiting the agricultural microbials market. Farmers, recognizing the market advantage and the long-term benefits of soil health, are actively seeking biological alternatives to conventional chemical inputs. This shift in perception is supported by a growing body of scientific evidence showcasing the efficacy of microbials in improving crop yields, enhancing soil fertility, and contributing to a more resilient agricultural ecosystem.

Competitive dynamics are evolving rapidly. While established players like BASF SE, Bayer CropScience AG, Syngenta AG, and Corteva Agriscience are investing heavily in their biologicals divisions, a vibrant ecosystem of specialized companies, including Lallemand Inc., Certis USA LLC, Chr Hansen Holding A/S, Valent USA LLC, and Koppert Biological Systems, are driving innovation and catering to specific market needs. Strategic partnerships, collaborations, and acquisitions are becoming common as companies aim to broaden their product portfolios, expand their geographic reach, and leverage complementary technologies. The market penetration rate for agricultural microbials, though still lower than conventional inputs, is steadily increasing, indicating a significant untapped potential. The estimated market size is expected to reach over $4,500 million by 2025, further underscoring the substantial growth trajectory.

Dominant Markets & Segments in North America Agricultural Microbials Market

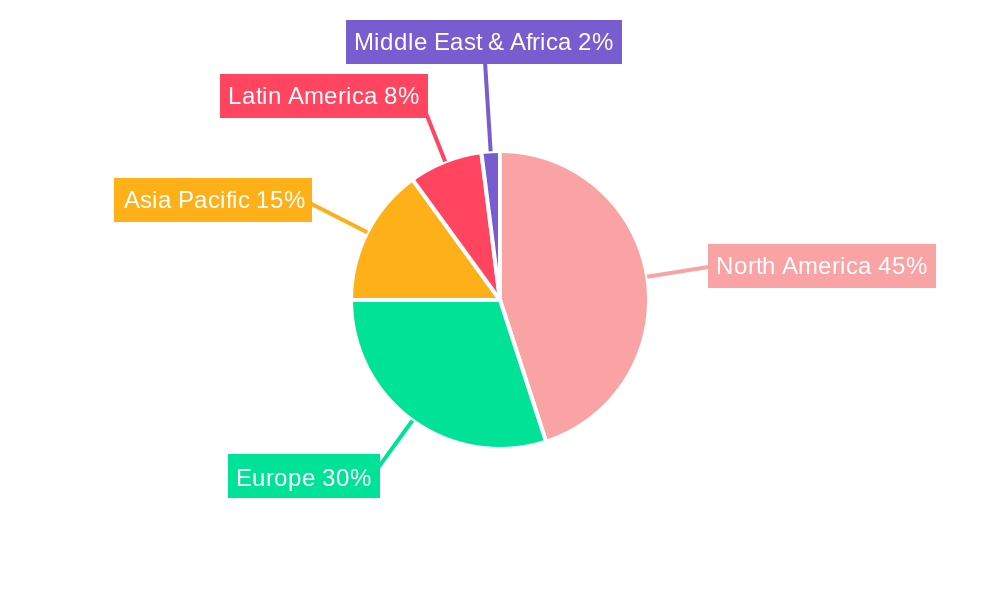

The North America agricultural microbials market exhibits distinct regional and segment dominance, driven by a complex interplay of agricultural practices, environmental regulations, and economic factors.

Production Analysis: The United States remains the dominant force in the production of agricultural microbials, accounting for over 80% of the North American output. This leadership is attributed to its vast agricultural land, advanced research infrastructure, and a significant number of key microbial product manufacturers. Canada, while a smaller producer, is steadily increasing its production capacity, focusing on niche biological solutions for its specific climatic and crop requirements. The dominance in production is underpinned by a strong foundation in biotechnological research and development.

Consumption Analysis: The United States also leads in consumption, driven by its large-scale row crop agriculture, including corn, soybeans, and wheat, where microbial inoculants and biopesticides are increasingly adopted to enhance yields and improve soil health. The fruit and vegetable sector in California and other major agricultural states also represents a significant consumption hub, demanding biological solutions for pest and disease management. The market penetration of microbials in these high-value crops is relatively higher due to the premium placed on organic and sustainably produced goods. Canada’s consumption is growing, particularly in Western Canada's grain production and Eastern Canada's horticultural sectors.

Import Market Analysis (Value & Volume): The import market in North America is primarily driven by specialized microbial products and strains that may not be readily available domestically. While the US is a net exporter of many biologicals, it imports specific high-value or technologically advanced microbial formulations, particularly from European countries renowned for their biologicals research. The import value is estimated to be around $350 million in 2025, with volume fluctuating based on demand for specific solutions. Canada, with a smaller domestic production base, relies more heavily on imports, especially for niche biologicals for its diverse agricultural landscape.

Export Market Analysis (Value & Volume): The United States is a major exporter of agricultural microbials to other regions, leveraging its scale and technological advancements. Exports are projected to reach a value of approximately $700 million in 2025. Key export markets include Latin America, Asia, and increasingly, parts of Europe, as global demand for sustainable agriculture grows. Canadian exports, though smaller, are also on an upward trend, particularly for specific inoculants and biopesticides. The export dominance is propelled by competitive pricing and the efficacy of American-developed microbial solutions.

Price Trend Analysis: Price trends in the North American agricultural microbials market are influenced by production costs, R&D investment, formulation complexity, and market competition. Generally, microbial products command a premium over conventional chemical inputs due to their specialized nature and the perceived value in terms of sustainability and reduced environmental impact. However, increasing competition and economies of scale in production are leading to a gradual stabilization and, in some cases, a reduction in price per unit volume. The estimated average price for microbial inoculants is around $15 per acre, while biopesticides can range from $20 to $50 per acre depending on the target pest and application method. Price trends are expected to remain stable with minor increases driven by innovation and regulatory compliance costs.

North America Agricultural Microbials Market Product Analysis

Product innovation in the North America agricultural microbials market is a continuous cycle driven by the pursuit of enhanced efficacy, broader application ranges, and improved sustainability profiles. Key innovations focus on developing microbial inoculants that boost nutrient availability and plant growth, such as nitrogen-fixing bacteria and phosphorus-solubilizing microbes. Biopesticides, utilizing bacteria, fungi, viruses, and natural compounds, are gaining traction for their targeted pest and disease control capabilities with minimal environmental impact. Advancements in formulation technologies, including encapsulation and liquid suspensions, ensure better shelf life, easier application, and increased microbial viability in diverse field conditions. These innovations provide competitive advantages by offering farmers more sustainable, effective, and often cost-competitive alternatives to synthetic chemical inputs, directly addressing the growing demand for eco-friendly agricultural practices and improved crop health.

Key Drivers, Barriers & Challenges in North America Agricultural Microbials Market

Key Drivers: The North America agricultural microbials market is propelled by several key drivers. A primary driver is the escalating global demand for sustainable agriculture and organic food production, pushing farmers to adopt eco-friendly inputs. Technological advancements in microbial research and development, including genetic engineering and advanced fermentation, are creating more effective and diverse microbial products. Supportive government policies and initiatives promoting biologicals, such as subsidies and favorable regulations, further incentivize adoption. The increasing awareness among farmers about the long-term benefits of improved soil health and reduced chemical residues in crops also plays a crucial role. Furthermore, the rising incidence of pest resistance to conventional pesticides necessitates innovative control methods, opening doors for microbials.

Barriers & Challenges: Despite the growth, the market faces significant barriers and challenges. A major challenge is the perception of lower efficacy compared to conventional chemicals, often stemming from inconsistent performance in varied environmental conditions or improper application. Regulatory hurdles and lengthy approval processes for new microbial products can delay market entry and increase development costs. Supply chain complexities, including maintaining microbial viability during storage and transportation, pose another significant challenge. Price sensitivity among some farmers, especially for bulk commodity crops, can limit the adoption of microbials, which may have a higher upfront cost. Educating farmers and agronomists about the correct use and benefits of microbial products is also an ongoing challenge. The market is also subject to competitive pressures from established chemical manufacturers, who often have larger marketing budgets and existing farmer relationships.

Growth Drivers in the North America Agricultural Microbials Market Market

The growth of the North America agricultural microbials market is significantly driven by a burgeoning demand for sustainable agricultural practices and the increasing consumer preference for organically produced food. Technological advancements are at the forefront, with breakthroughs in microbial strain identification, genetic engineering, and sophisticated formulation techniques leading to more potent and reliable bio-based solutions. Government policies and incentives that promote the use of biologicals, coupled with stricter regulations on synthetic chemical pesticides, are creating a more favorable market environment. Furthermore, the imperative to enhance soil health and biodiversity, essential for long-term agricultural productivity and climate resilience, is pushing farmers towards microbial inputs. Economic factors, such as the rising cost of synthetic fertilizers and pesticides, also make microbials an increasingly attractive alternative for farmers looking to optimize their input expenditures.

Challenges Impacting North America Agricultural Microbials Market Growth

Several challenges are impacting the growth of the North America agricultural microbials market. Regulatory complexities and the time-consuming approval processes for new microbial products in both the US and Canada can hinder market entry and innovation. Supply chain issues, including ensuring the stability and viability of live microbial products from production to application, remain a significant concern, impacting product efficacy and farmer confidence. Competitive pressures from well-established chemical agrochemical companies, who possess extensive distribution networks and significant marketing budgets, create a challenging landscape for newer biological companies. Farmer education and adoption rates are also a hurdle, as many growers remain accustomed to conventional practices and may require more convincing evidence of the cost-effectiveness and consistent performance of microbial solutions across diverse agricultural environments.

Key Players Shaping the North America Agricultural Microbials Market Market

BASF SE Lallemand Inc. Certis USA LLC Chr Hansen Holding A/S Valent USA LLC Precision Laboratories Isagro USA Bayer CropScience AG Verdesian Life Sciences LLC Marrone Bio Innovations Syngenta AG Corteva Agriscience Koppert Biological Systems

Significant North America Agricultural Microbials Market Industry Milestones

- 2019: Marrone Bio Innovations acquires the assets of St. Gabriel Enterprise, expanding its biopesticide portfolio.

- 2020: Bayer CropScience AG launches new microbial-based seed treatments to enhance early plant growth and nutrient uptake.

- 2021: Certis USA LLC announces the acquisition of Tribe to expand its biological fungicide offerings.

- 2022: Syngenta AG invests in new research facilities dedicated to developing advanced microbial solutions for disease and pest management.

- 2023: Corteva Agriscience partners with a leading microbial research institute to accelerate the discovery of novel biologicals for crop protection.

- January 2024: Lallemand Inc. introduces a new line of plant growth-promoting rhizobacteria for a wider range of crops.

- March 2024: Verdesian Life Sciences LLC expands its distribution network across the Midwestern United States for its nutrient use efficiency products.

Future Outlook for North America Agricultural Microbials Market Market

The future outlook for the North America agricultural microbials market is exceptionally bright, driven by the unwavering global shift towards sustainable agriculture. Continued investment in R&D will unlock more potent and specialized microbial products, addressing specific crop needs and environmental challenges. The integration of digital technologies, such as AI-powered diagnostics and precision application systems, will further optimize microbial performance and farmer adoption. Regulatory frameworks are expected to become more supportive of biologicals, streamlining approval processes and encouraging innovation. Strategic collaborations and acquisitions will continue to shape the competitive landscape, consolidating market players and fostering synergy in product development. The market is projected to witness sustained double-digit growth, with microbials playing an increasingly integral role in enhancing crop yields, improving soil health, and contributing to a more resilient and environmentally sound agricultural future, reaching an estimated market size exceeding $7,500 million by 2033.

North America Agricultural Microbials Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North America Agricultural Microbials Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Agricultural Microbials Market Regional Market Share

Geographic Coverage of North America Agricultural Microbials Market

North America Agricultural Microbials Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs

- 3.3. Market Restrains

- 3.3.1. Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers

- 3.4. Market Trends

- 3.4.1. Popularity of Organic Farming

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Agricultural Microbials Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BASF SE

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lallemand Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Certis USA LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Chr Hansen Holding A/S

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Valent USA LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Precision Laboratories

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Isagro USA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bayer CropSCience AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Verdesian Life Sciences LL

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Marrone Bio Innovations

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Syngenta AG

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Corteva Agriscience

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Koppert Biological Systems

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 BASF SE

List of Figures

- Figure 1: North America Agricultural Microbials Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Agricultural Microbials Market Share (%) by Company 2025

List of Tables

- Table 1: North America Agricultural Microbials Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: North America Agricultural Microbials Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: North America Agricultural Microbials Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: North America Agricultural Microbials Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: North America Agricultural Microbials Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: North America Agricultural Microbials Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: North America Agricultural Microbials Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: North America Agricultural Microbials Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: North America Agricultural Microbials Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: North America Agricultural Microbials Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: North America Agricultural Microbials Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: North America Agricultural Microbials Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States North America Agricultural Microbials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada North America Agricultural Microbials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico North America Agricultural Microbials Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Agricultural Microbials Market?

The projected CAGR is approximately 16.50%.

2. Which companies are prominent players in the North America Agricultural Microbials Market?

Key companies in the market include BASF SE, Lallemand Inc, Certis USA LLC, Chr Hansen Holding A/S, Valent USA LLC, Precision Laboratories, Isagro USA, Bayer CropSCience AG, Verdesian Life Sciences LL, Marrone Bio Innovations, Syngenta AG, Corteva Agriscience, Koppert Biological Systems.

3. What are the main segments of the North America Agricultural Microbials Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs.

6. What are the notable trends driving market growth?

Popularity of Organic Farming.

7. Are there any restraints impacting market growth?

Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Agricultural Microbials Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Agricultural Microbials Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Agricultural Microbials Market?

To stay informed about further developments, trends, and reports in the North America Agricultural Microbials Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence