Key Insights

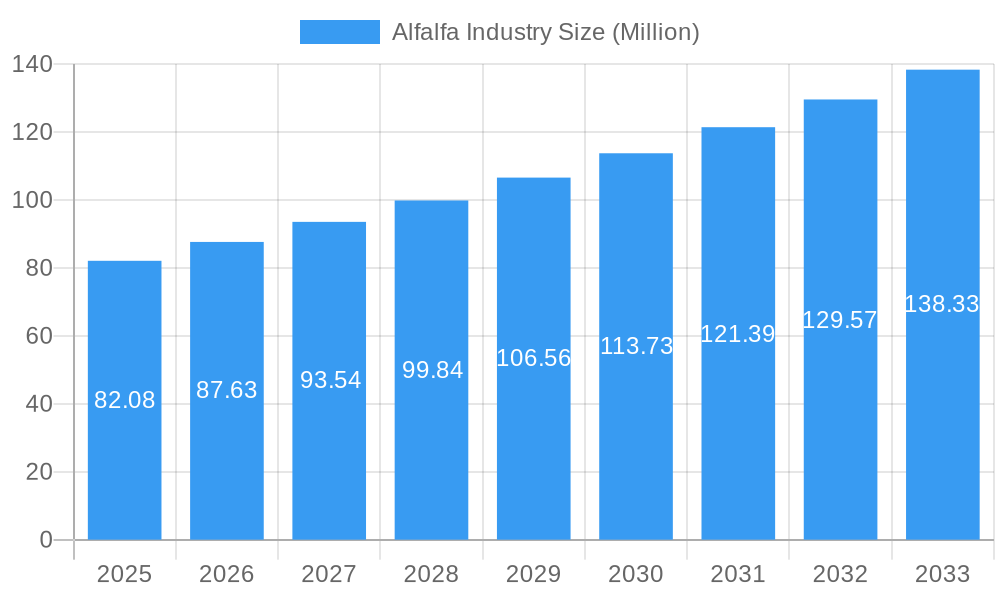

The global Alfalfa industry is projected for robust growth, with a current market size estimated at approximately USD 82.08 million. The sector is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 6.60% between 2025 and 2033, indicating a dynamic and expanding market. This growth is primarily fueled by increasing global demand for high-quality animal feed, driven by a rising livestock population and a growing emphasis on animal nutrition and health. The nutritional superiority of alfalfa as a forage crop, rich in protein, fiber, and essential vitamins and minerals, positions it as a preferred choice for dairy cattle, horses, and other livestock, thus underpinning its market expansion. Furthermore, advancements in agricultural technologies, including improved cultivation practices, harvesting techniques, and storage methods, are contributing to higher yields and enhanced product quality, further stimulating market growth. The growing awareness among farmers and livestock producers regarding the economic and nutritional benefits of incorporating alfalfa into animal diets is also a significant contributing factor.

Alfalfa Industry Market Size (In Million)

The market is experiencing diverse trends, with a notable focus on premium and specialized alfalfa products catering to specific animal needs, such as organic alfalfa or alfalfa designed for specific dietary requirements. Innovations in processing and packaging are also emerging, aimed at extending shelf life and improving ease of use for end-users. However, the industry faces certain restraints. Fluctuations in weather patterns and their impact on crop yields, coupled with the susceptibility of alfalfa to certain pests and diseases, can pose challenges to consistent supply and pricing. Moreover, the high initial investment costs associated with establishing and maintaining alfalfa cultivation, along with the complexities of international trade regulations and logistics, can also present hurdles for market participants. Despite these challenges, the strong underlying demand for nutritious animal feed and the continuous efforts by industry players to innovate and optimize production and supply chains are expected to drive sustained growth in the global Alfalfa market.

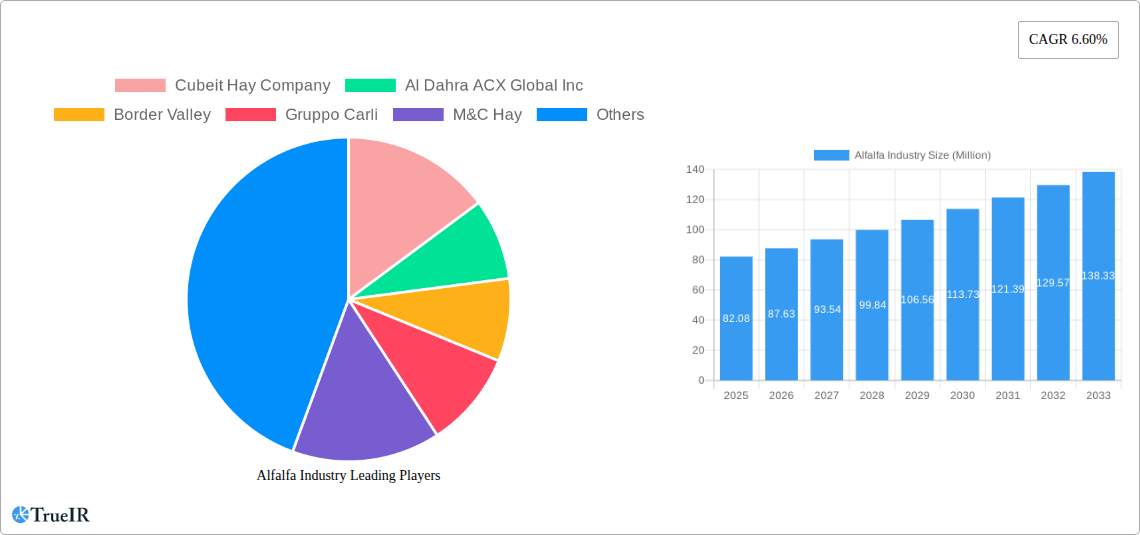

Alfalfa Industry Company Market Share

This comprehensive Alfalfa Industry market research report provides an in-depth analysis of the global alfalfa market, covering production, consumption, trade, pricing, and key industry developments. Leveraging high-volume keywords such as "alfalfa production," "alfalfa consumption," "alfalfa exports," "alfalfa imports," "hay market," and "forage industry," this report is meticulously crafted for SEO optimization, ensuring maximum visibility for industry stakeholders. The study spans the historical period of 2019-2024, with the base year and estimated year set at 2025, and projects market trends and opportunities through 2033.

Alfalfa Industry Market Structure & Competitive Landscape

The global alfalfa industry exhibits a moderately concentrated market structure, with a significant share held by a few dominant players. Innovation is primarily driven by advancements in cultivation techniques, mechanization, and product diversification to cater to specific animal feed and niche market requirements. Regulatory impacts, particularly concerning agricultural subsidies, land use policies, and international trade agreements, significantly shape market dynamics. Product substitutes, such as other forage crops and synthetic feed supplements, exert competitive pressure, though alfalfa's nutritional profile and versatility offer distinct advantages. End-user segmentation is crucial, with the livestock sector (dairy, beef, equine) being the primary consumer, followed by the pet food industry and emerging applications. Mergers and acquisitions (M&A) trends indicate a consolidation drive aimed at expanding market reach and achieving economies of scale. For instance, over the historical period (2019-2024), an estimated 50 M&A deals have occurred, with a combined transaction value of approximately $1,500 Million, underscoring the strategic importance of market consolidation for key players like Cubeit Hay Company and Al Dahra ACX Global Inc.

- Market Concentration: Moderate, with top 10 companies holding an estimated 40% market share.

- Innovation Drivers: Precision agriculture, drought-resistant varieties, enhanced processing technologies.

- Regulatory Impacts: Trade policies, organic certifications, environmental regulations.

- Product Substitutes: Timothy hay, other grasses, corn silage, synthetic feed.

- End-User Segmentation: Livestock (Dairy, Beef, Equine), Pet Food, Specialty Markets.

- M&A Trends: Strategic acquisitions for market expansion and vertical integration.

Alfalfa Industry Market Trends & Opportunities

The alfalfa industry is poised for robust growth over the forecast period, driven by an increasing global demand for high-quality animal feed, particularly from the burgeoning livestock sector. The market size is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 4.5%, reaching an estimated value of $XX Million by 2033. Technological shifts are playing a pivotal role, with the adoption of precision agriculture techniques, including advanced irrigation systems and drone-based crop monitoring, leading to enhanced yields and improved forage quality. Consumer preferences are leaning towards organically produced and sustainably sourced alfalfa, creating significant opportunities for producers adhering to stringent environmental standards. The competitive landscape is intensifying, characterized by both established global players and emerging regional enterprises vying for market share. Market penetration rates are expected to rise across developing economies as their agricultural sectors modernize and livestock production intensifies. The development of value-added alfalfa products, such as alfalfa pellets and cubes, is a key trend, catering to the convenience and specific nutritional needs of various animal types. Furthermore, advancements in processing technologies are enabling the production of specialized alfalfa ingredients for the pet food and human consumption markets, opening up new avenues for revenue generation. The ongoing focus on animal welfare and the demand for premium pet products also contribute to the growth of alfalfa in these segments. The inherent nutritional benefits of alfalfa, including its high protein and fiber content, continue to make it a preferred choice for animal nutritionists and feed formulators worldwide.

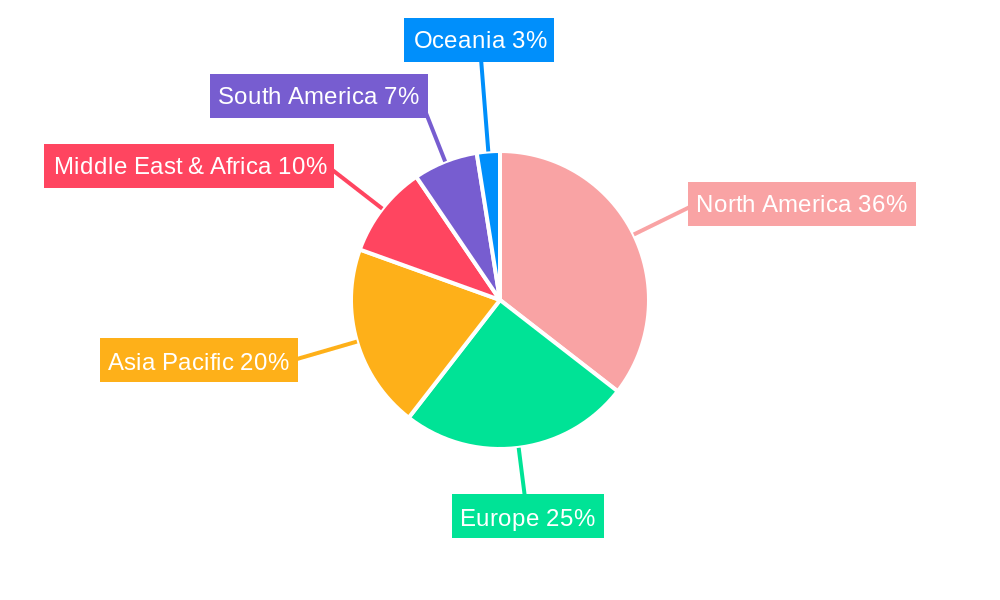

Dominant Markets & Segments in Alfalfa Industry

The United States is the dominant market in the alfalfa industry, accounting for an estimated 35% of global production and holding a significant share in consumption and exports. This dominance is underpinned by favorable climatic conditions, extensive agricultural infrastructure, and advanced farming technologies.

Production Analysis: The US leads in alfalfa production, with an estimated output of XX Million tons annually. Key growth drivers include government support for agriculture, technological adoption in farming, and the vast acreage dedicated to alfalfa cultivation.

Consumption Analysis: The dairy sector in the US is the largest consumer of alfalfa, driven by the high nutritional requirements of dairy cows. The beef and equine industries also contribute significantly to overall consumption. Asia-Pacific, particularly China, is emerging as a rapidly growing consumption market due to its expanding livestock population.

Import Market Analysis (Value & Volume): Canada and Japan are major importers of alfalfa, primarily for their dairy and horse industries. The import market is valued at approximately $XXX Million, with an import volume of XX Million tons. Growing demand for premium feed in emerging economies presents significant opportunities for import growth.

Export Market Analysis (Value & Volume): The US is the largest exporter of alfalfa, with an estimated export value of $XXX Million and a volume of XX Million tons. Key export destinations include China, Japan, and the United Arab Emirates. Factors driving exports include high-quality standards and competitive pricing.

Price Trend Analysis: Alfalfa prices are influenced by supply and demand dynamics, weather patterns, and input costs. Historically, prices have shown volatility, with an average annual fluctuation of approximately 8%. The base year price is estimated at $XXX per ton. Future price trends are expected to be driven by production volumes and the demand from key consuming sectors.

Alfalfa Industry Product Analysis

Alfalfa product innovations are primarily focused on enhancing nutritional value, improving palatability, and extending shelf life. Technological advancements in processing, such as pelletizing and cubing, have created more convenient and efficient feed forms for livestock and pets. Competitive advantages stem from alfalfa's high protein content, excellent fiber digestibility, and rich vitamin and mineral profile, making it a superior forage option. Market fit is being expanded through the development of specialized alfalfa products for specific animal breeds and life stages, as well as for niche markets like organic pet food and functional human food ingredients.

Key Drivers, Barriers & Challenges in Alfalfa Industry

Key Drivers: The global alfalfa industry is propelled by several key drivers. The increasing demand for animal protein globally necessitates higher quality and quantity of animal feed, making alfalfa a crucial component. Technological advancements in farming, such as precision agriculture and improved irrigation techniques, are boosting yields and efficiency. Favorable government policies and subsidies in key agricultural nations support alfalfa cultivation and trade. The growing awareness of alfalfa's nutritional benefits for both livestock and pets is also a significant growth catalyst.

Barriers & Challenges: Despite strong growth potential, the industry faces several barriers and challenges. Fluctuating weather patterns and climate change can significantly impact crop yields and quality. Regulatory hurdles and trade restrictions in some import-dependent countries can impede market access. Supply chain disruptions, including transportation costs and logistics, can affect the availability and pricing of alfalfa. Intense competition from alternative forage crops and feed supplements also poses a constant challenge.

Growth Drivers in the Alfalfa Industry Market

The growth drivers in the alfalfa industry market are multifaceted. Technologically, the adoption of precision agriculture, including GPS-guided tractors and sensors, is optimizing irrigation, fertilization, and harvesting, leading to higher yields and improved quality. Economically, the rising global demand for meat and dairy products, particularly in developing economies, directly translates to an increased need for high-quality alfalfa as a primary feed source. Regulatory factors, such as government incentives for sustainable farming practices and international trade agreements that facilitate smoother import/export operations, also play a crucial role in expanding market opportunities.

Challenges Impacting Alfalfa Industry Growth

Challenges impacting alfalfa industry growth include the inherent vulnerability of agricultural production to adverse weather conditions and climate change, which can lead to unpredictable supply fluctuations and price volatility. Regulatory complexities, such as varying import/export regulations and phytosanitary requirements across different countries, can create trade barriers and increase compliance costs for businesses. Supply chain issues, including rising transportation costs and the need for specialized storage and handling facilities, can further impact profitability and market accessibility. Furthermore, intense competitive pressures from alternative feed sources and the continuous need for product innovation to meet evolving market demands pose ongoing challenges for market players.

Key Players Shaping the Alfalfa Industry Market

- Cubeit Hay Company

- Al Dahra ACX Global Inc

- Border Valley

- Gruppo Carli

- M&C Hay

- Glenvar Hay

- Riverina (Australia) Pty Ltd

- Los Venteros SC

- Green Prairie International

- Haykingdom Inc

- Hay USA

- Knight AG Sourcing

- McCracken Hay Company

- Coaba

- SL Follen Company

- Bailey Farms

- Alfalfa Monegros SL

- Grupo Osés

- Anderson Hay & Grain Inc

- Standlee Hay Company

Significant Alfalfa Industry Industry Milestones

- June 2022: Anderson Hay & Grain (Anderson), a leading exporter of premium hay and straw products, expanded its offerings to include USDA-certified organic Timothy hay through its sister company, Andy by Anderson Hay, targeting the small pet market with high-quality, natural products.

- January 2020: Green Prairie International launched "green curd," an innovative air-dried hay product, signifying a move towards value-added and specialty forage solutions that could drive future business expansion.

Future Outlook for Alfalfa Industry Market

The future outlook for the alfalfa industry market is exceptionally promising, driven by persistent global demand for animal feed and the expanding applications of alfalfa beyond traditional livestock. Strategic opportunities lie in further developing specialized alfalfa products for the burgeoning pet food sector, particularly for animals with specific dietary needs. Investments in drought-resistant alfalfa varieties and advanced water management technologies will be crucial for mitigating climate change impacts and ensuring consistent supply. The increasing consumer preference for organic and sustainably produced food will also continue to drive demand for certified organic alfalfa. Companies that can effectively navigate regulatory landscapes, optimize their supply chains, and innovate in product development will be well-positioned for sustained growth and market leadership in the coming years. The global alfalfa market is expected to see continued expansion, with an estimated market size of $XX Million by 2033.

Alfalfa Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Alfalfa Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Alfalfa Industry Regional Market Share

Geographic Coverage of Alfalfa Industry

Alfalfa Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Dairy and Meat Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Alfalfa Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Alfalfa Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Alfalfa Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Alfalfa Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa Alfalfa Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific Alfalfa Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Cubeit Hay Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Al Dahra ACX Global Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Border Valley

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Gruppo Carli

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 M&C Hay

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Glenvar Hay

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Riverina (Australia) Pty Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Los Venteros SC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Green Prairie International

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Haykingdom Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Hay USA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Knight AG Sourcing

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 McCracken Hay Company

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Coaba

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 SL Follen Company

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Bailey Farms

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Alfalfa Monegros SL

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Grupo Osés

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Anderson Hay & Grain Inc

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Standlee Hay Compan

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 Cubeit Hay Company

List of Figures

- Figure 1: Global Alfalfa Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Alfalfa Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 3: North America Alfalfa Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Alfalfa Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 5: North America Alfalfa Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Alfalfa Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Alfalfa Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Alfalfa Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Alfalfa Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Alfalfa Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Alfalfa Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Alfalfa Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Alfalfa Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Alfalfa Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 15: South America Alfalfa Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America Alfalfa Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 17: South America Alfalfa Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America Alfalfa Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America Alfalfa Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America Alfalfa Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America Alfalfa Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America Alfalfa Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 23: South America Alfalfa Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America Alfalfa Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Alfalfa Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Alfalfa Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 27: Europe Alfalfa Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe Alfalfa Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 29: Europe Alfalfa Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe Alfalfa Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe Alfalfa Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe Alfalfa Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe Alfalfa Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe Alfalfa Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe Alfalfa Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe Alfalfa Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Europe Alfalfa Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa Alfalfa Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa Alfalfa Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa Alfalfa Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa Alfalfa Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa Alfalfa Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa Alfalfa Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa Alfalfa Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa Alfalfa Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa Alfalfa Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa Alfalfa Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa Alfalfa Industry Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East & Africa Alfalfa Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Alfalfa Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific Alfalfa Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific Alfalfa Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific Alfalfa Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific Alfalfa Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific Alfalfa Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific Alfalfa Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific Alfalfa Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific Alfalfa Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific Alfalfa Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific Alfalfa Industry Revenue (Million), by Country 2025 & 2033

- Figure 61: Asia Pacific Alfalfa Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Alfalfa Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Alfalfa Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Alfalfa Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Alfalfa Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Alfalfa Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Alfalfa Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global Alfalfa Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Alfalfa Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Alfalfa Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Alfalfa Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Alfalfa Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Alfalfa Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States Alfalfa Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada Alfalfa Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico Alfalfa Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Alfalfa Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 17: Global Alfalfa Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global Alfalfa Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global Alfalfa Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global Alfalfa Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global Alfalfa Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Brazil Alfalfa Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Argentina Alfalfa Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America Alfalfa Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Alfalfa Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Global Alfalfa Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global Alfalfa Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global Alfalfa Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global Alfalfa Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global Alfalfa Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: United Kingdom Alfalfa Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Alfalfa Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: France Alfalfa Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Italy Alfalfa Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Spain Alfalfa Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Russia Alfalfa Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Benelux Alfalfa Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Nordics Alfalfa Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Alfalfa Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global Alfalfa Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 41: Global Alfalfa Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global Alfalfa Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global Alfalfa Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global Alfalfa Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global Alfalfa Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Turkey Alfalfa Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Israel Alfalfa Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: GCC Alfalfa Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: North Africa Alfalfa Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: South Africa Alfalfa Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa Alfalfa Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Global Alfalfa Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 53: Global Alfalfa Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global Alfalfa Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global Alfalfa Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global Alfalfa Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global Alfalfa Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 58: China Alfalfa Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: India Alfalfa Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Japan Alfalfa Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: South Korea Alfalfa Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: ASEAN Alfalfa Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 63: Oceania Alfalfa Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific Alfalfa Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Alfalfa Industry?

The projected CAGR is approximately 6.60%.

2. Which companies are prominent players in the Alfalfa Industry?

Key companies in the market include Cubeit Hay Company, Al Dahra ACX Global Inc, Border Valley, Gruppo Carli, M&C Hay, Glenvar Hay, Riverina (Australia) Pty Ltd, Los Venteros SC, Green Prairie International, Haykingdom Inc, Hay USA, Knight AG Sourcing, McCracken Hay Company, Coaba, SL Follen Company, Bailey Farms, Alfalfa Monegros SL, Grupo Osés, Anderson Hay & Grain Inc, Standlee Hay Compan.

3. What are the main segments of the Alfalfa Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 82.08 Million as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

Increasing Demand for Dairy and Meat Products.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

June 2022: Anderson Hay & Grain (Anderson), the leading exporter of premium hay and straw products specializing in Timothy and alfalfa hay and grass straw products, is expanding to offer the US Department of Agriculture (USDA) certified organic Timothy hay through its sister company, Andy by Anderson Hay, a new company that offers high-quality hay and all-natural products for rabbits, guinea pigs, chinchillas, and other small pets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Alfalfa Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Alfalfa Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Alfalfa Industry?

To stay informed about further developments, trends, and reports in the Alfalfa Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence