Key Insights

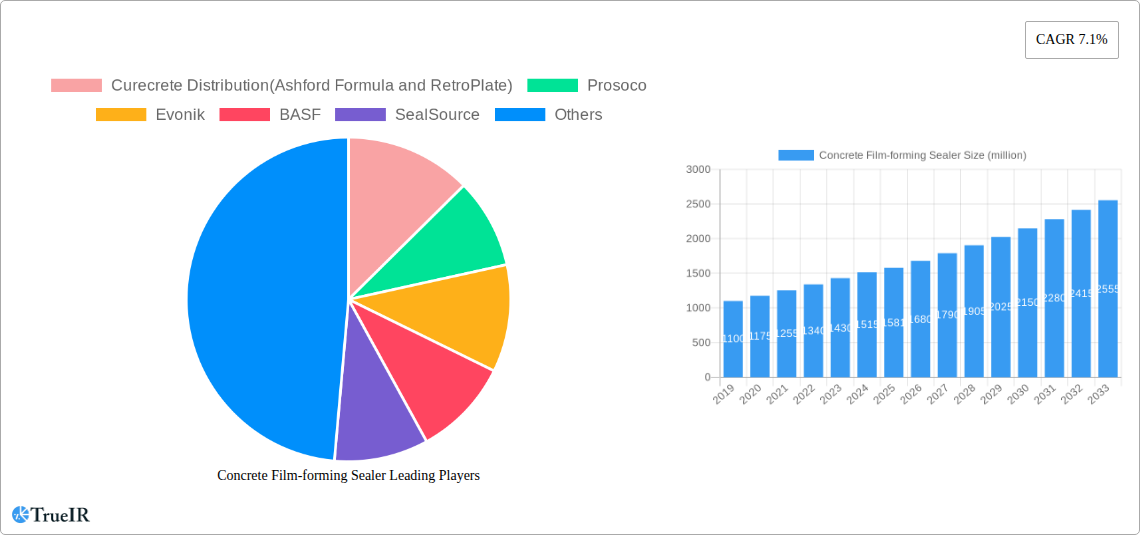

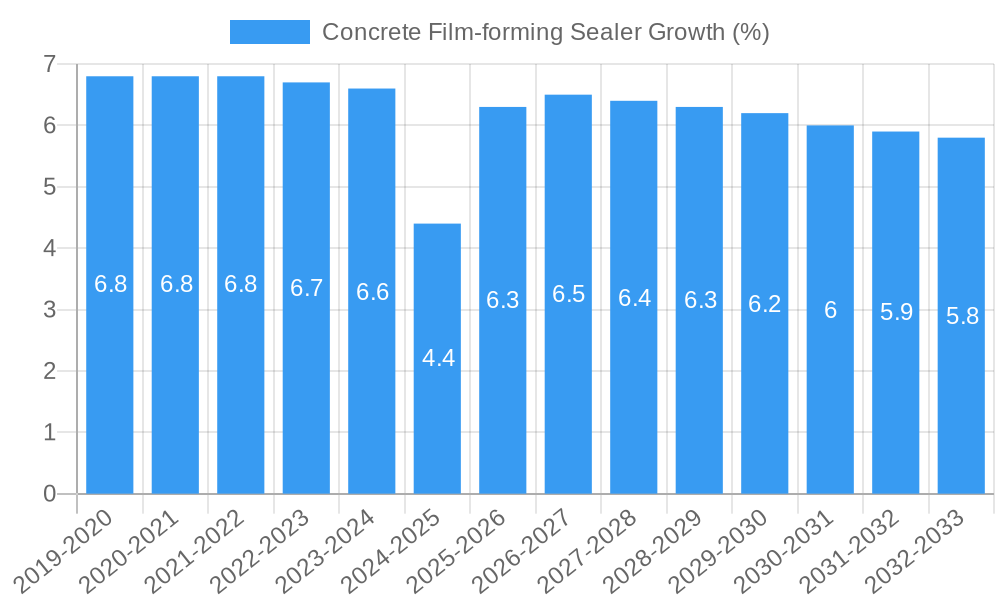

The global Concrete Film-forming Sealer market is poised for robust growth, projected to reach approximately $1581 million by 2025 with a Compound Annual Growth Rate (CAGR) of 7.1% through 2033. This expansion is significantly driven by the escalating demand from the construction sector, where these sealers play a crucial role in enhancing the durability, aesthetics, and protective qualities of concrete surfaces. The industrial application segment is also a major contributor, with businesses increasingly recognizing the value of concrete sealers in protecting infrastructure and machinery from chemical spills, abrasion, and environmental degradation. Key trends shaping the market include the growing adoption of advanced sealer technologies, such as those offering superior stain resistance and breathability, and a rising preference for sustainable and eco-friendly formulations that minimize volatile organic compounds (VOCs). Innovation in acrylics and epoxies is particularly noteworthy, offering versatile solutions for a wide range of applications.

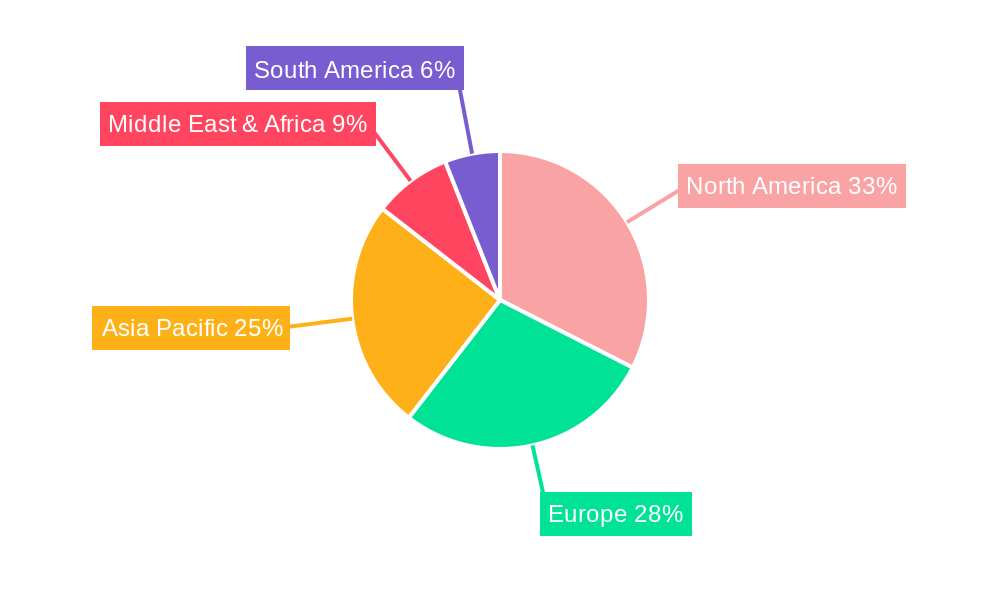

Despite the positive outlook, certain restraints may influence market dynamics. The initial cost of high-performance sealers can be a deterrent for some end-users, particularly in price-sensitive markets. Furthermore, the availability of lower-cost alternatives, albeit with potentially inferior performance, poses a competitive challenge. However, the long-term benefits of concrete film-forming sealers, including reduced maintenance costs and extended service life of concrete structures, are increasingly outweighing these upfront considerations. The market is characterized by a diverse range of players, from established chemical giants to specialized solution providers, all vying to capture market share through product innovation, strategic partnerships, and expanding distribution networks across key regions like North America, Europe, and Asia Pacific. The continuous development of novel formulations and application techniques will be critical for sustained growth in this dynamic market.

Dynamic SEO-Optimized Report Description: Concrete Film-forming Sealer Market Analysis (2019-2033)

This comprehensive market research report provides an in-depth analysis of the global Concrete Film-forming Sealer market, projected to reach $3.5 million by 2033. Spanning a study period from 2019 to 2033, with a base year of 2025 and an estimated year also of 2025, this report meticulously examines historical trends, current market dynamics, and future projections across diverse applications, product types, and industry segments. Leveraging high-volume SEO keywords such as "concrete sealer," "film-forming sealer," "industrial concrete coatings," "construction sealants," "acrylic sealers," "epoxy concrete coatings," and "urethane sealers," this report is designed to enhance search rankings and attract a global audience of industry professionals, investors, and researchers.

Concrete Film-forming Sealer Market Structure & Competitive Landscape

The Concrete Film-forming Sealer market, projected to be valued at $3.5 million by 2033, exhibits a moderate to highly concentrated structure, with several key players dominating significant market shares. Innovation drivers are primarily focused on enhanced durability, aesthetic appeal, and eco-friendly formulations, responding to evolving construction standards and consumer preferences. Regulatory impacts, particularly concerning VOC emissions and environmental sustainability, are increasingly shaping product development and market entry strategies. Product substitutes, while present in the form of penetrating sealers and waxes, are largely outcompeted by the superior protection and aesthetic finishes offered by film-forming sealers in key applications. End-user segmentation reveals a strong reliance on the constructional and industrial sectors, with niche applications emerging in other areas. Mergers and acquisitions (M&A) activity, valued at approximately $5 million in the historical period, are anticipated to continue as companies seek to expand their product portfolios and geographical reach. Key trends include the consolidation of smaller players and strategic partnerships to gain a competitive edge.

- Market Concentration: Dominated by a mix of large multinational corporations and specialized regional manufacturers.

- Innovation Drivers: Focus on UV resistance, chemical resistance, ease of application, and low-VOC formulations.

- Regulatory Impacts: Stringent environmental regulations in developed economies are pushing for sustainable and compliant product offerings.

- Product Substitutes: Penetrating sealers, densifiers, and surface treatments offer alternative protection but often lack the aesthetic and filmic properties of film-forming sealers.

- End-User Segmentation: Constructional (e.g., residential, commercial, infrastructure) and Industrial (e.g., manufacturing plants, warehouses, parking structures) are dominant.

- M&A Trends: Companies are actively acquiring smaller innovative firms and expanding production capacities to meet growing demand.

Concrete Film-forming Sealer Market Trends & Opportunities

The global Concrete Film-forming Sealer market is poised for substantial growth, with an estimated compound annual growth rate (CAGR) of 6.8% during the forecast period (2025-2033), reaching a projected market size of $3.5 million by the end of the period. This expansion is fueled by a confluence of factors, including increasing global construction activities, a heightened awareness of the importance of concrete protection and longevity, and technological advancements that are continuously improving product performance and sustainability. The constructional segment, encompassing residential, commercial, and public infrastructure projects, represents the largest market share, driven by urbanization, government investments in infrastructure development, and the demand for durable and aesthetically pleasing architectural finishes. Industrial applications, such as manufacturing facilities, warehouses, and transportation hubs, are also significant contributors, demanding sealers that offer robust chemical resistance, abrasion protection, and ease of maintenance.

Technological shifts are playing a pivotal role in shaping market trends. The development of advanced formulations, including nano-technology-enhanced sealers and low-VOC (Volatile Organic Compound) products, is gaining traction as environmental regulations become more stringent worldwide. These innovations not only offer superior performance characteristics like enhanced hydrophobicity, oleophobicity, and stain resistance but also align with the growing demand for sustainable building materials. Furthermore, the increasing use of decorative concrete techniques, such as stamping, staining, and polishing, necessitates high-performance film-forming sealers that can preserve and enhance these finishes, driving demand in the residential and commercial sectors.

Consumer preferences are evolving towards sealers that offer a combination of protection, aesthetics, and ease of application. The demand for sealers that provide a non-yellowing finish, excellent UV stability, and long-term durability is particularly strong. The competitive landscape is characterized by a blend of established global players and emerging regional manufacturers, all striving to differentiate themselves through product innovation, pricing strategies, and channel partnerships. Opportunities for market penetration are ripe in developing economies where infrastructure development is rapidly accelerating, and there is a growing adoption of modern construction practices and materials. The increasing focus on extending the lifespan of existing concrete structures, both industrially and commercially, also presents a significant opportunity for the replacement and maintenance market for film-forming sealers. The integration of smart technologies in building materials, although nascent, could also pave the way for future developments in self-healing or color-changing concrete sealers.

Dominant Markets & Segments in Concrete Film-forming Sealer

The global Concrete Film-forming Sealer market is experiencing robust growth, with several regions and segments demonstrating significant dominance and high growth potential. The Constructional application segment stands out as the largest and most influential, driven by continuous infrastructure development, urbanization, and the increasing adoption of protective and decorative concrete finishes across residential, commercial, and public sectors worldwide. Within this segment, countries with heavy infrastructure investment and rapidly expanding construction industries, such as China, India, and the United States, represent key markets. The industrial application segment is also a major contributor, propelled by the need for durable, chemical-resistant, and low-maintenance surfaces in manufacturing plants, warehouses, and transportation facilities.

Among the product types, Acrylics currently hold a substantial market share due to their cost-effectiveness, ease of application, and good performance characteristics, including UV resistance and gloss retention, making them a popular choice for a wide range of applications. However, Epoxies are gaining significant traction, particularly in industrial settings, due to their superior hardness, chemical resistance, and abrasion protection capabilities. Urethanes are also witnessing steady growth, offering excellent flexibility, abrasion resistance, and UV stability, making them suitable for high-traffic areas and demanding environments. The growth in the urethane segment is particularly notable in applications requiring enhanced crack bridging and weathering resistance.

Key Growth Drivers in Dominant Markets and Segments:

Constructional Application:

- Infrastructure Development: Government initiatives and private sector investments in roads, bridges, airports, and public buildings globally, especially in emerging economies.

- Urbanization: The increasing need for new residential and commercial spaces in growing urban centers.

- Decorative Concrete Trends: The rising popularity of stamped, stained, and polished concrete for aesthetic appeal in both residential and commercial projects.

- Demand for Durability and Longevity: Increasing awareness of the benefits of protecting concrete structures from environmental degradation, freeze-thaw cycles, and chemical attack.

Industrial Application:

- Manufacturing and Warehousing Growth: Expansion of industrial facilities to meet global demand for goods.

- Chemical and Abrasion Resistance Requirements: Critical need for sealers that can withstand harsh chemicals, heavy machinery, and constant wear and tear.

- Food and Beverage Industry Standards: Stringent hygiene and safety requirements necessitate easy-to-clean and non-porous surfaces.

- Transportation Infrastructure: Demand for durable sealers in parking garages, ports, and logistics centers.

Product Types (Acrylics, Epoxies, Urethanes):

- Acrylics: Cost-effectiveness, ease of application, and good general-purpose protection for a broad range of applications.

- Epoxies: Superior performance in demanding industrial environments requiring high chemical and abrasion resistance.

- Urethanes: Excellent flexibility, UV stability, and abrasion resistance for high-traffic and exposed areas.

Concrete Film-forming Sealer Product Analysis

Concrete film-forming sealers are evolving with significant product innovations focused on enhanced durability, environmental sustainability, and advanced protective capabilities. Manufacturers are investing heavily in research and development to create formulations with superior UV resistance, chemical inertness, and abrasion resilience. For instance, the incorporation of nanotechnology is leading to sealers with significantly improved hydrophobicity and oleophobicity, repelling water and oil-based stains more effectively. Low-VOC and water-based formulations are also gaining prominence, addressing growing environmental concerns and regulatory mandates. These advancements not only extend the lifespan of concrete surfaces but also contribute to their aesthetic appeal by providing high-gloss finishes, color enhancement, and protection against efflorescence. The competitive advantage lies in offering tailored solutions that meet specific performance requirements for diverse applications, from residential driveways to heavy industrial flooring.

Key Drivers, Barriers & Challenges in Concrete Film-forming Sealer

The Concrete Film-forming Sealer market is propelled by several key drivers. Technological advancements in material science are enabling the development of high-performance sealers with superior durability, chemical resistance, and aesthetic qualities. Growing global construction activity, particularly in emerging economies, directly translates to increased demand for concrete protection. Furthermore, a rising awareness of the importance of concrete longevity and maintenance, driven by the desire to reduce lifecycle costs and environmental impact, is a significant catalyst. Government initiatives promoting durable infrastructure and stricter building codes also play a crucial role.

However, the market faces notable barriers and challenges. The fluctuating prices of raw materials, such as acrylic polymers and epoxy resins, can impact manufacturing costs and profit margins. Stringent environmental regulations, while driving innovation, can also increase compliance costs and limit the use of certain traditional formulations. Intense competition among manufacturers, leading to price pressures, is another significant challenge. Furthermore, a lack of awareness or understanding of the benefits of high-quality sealers among some end-users can hinder market penetration. Supply chain disruptions and logistical complexities can also affect product availability and cost.

Growth Drivers in the Concrete Film-forming Sealer Market

The Concrete Film-forming Sealer market's growth is primarily fueled by escalating global construction activities, particularly in infrastructure development and the burgeoning real estate sector. Technological advancements in formulations, leading to enhanced durability, UV resistance, and chemical resilience, are creating new market opportunities. The increasing emphasis on extending the lifespan of concrete structures, thereby reducing maintenance costs and environmental impact, is a significant driver. Regulatory mandates promoting the use of sustainable and low-VOC building materials are also pushing the adoption of advanced film-forming sealers. Economic growth in developing nations, coupled with rising disposable incomes, is contributing to demand in both residential and commercial construction.

Challenges Impacting Concrete Film-forming Sealer Growth

The growth of the Concrete Film-forming Sealer market is impacted by several challenges. Fluctuations in raw material prices, particularly petrochemical derivatives, can lead to cost volatility for manufacturers. Stringent environmental regulations, while encouraging innovation, also impose compliance costs and can restrict the market for certain traditional, high-performance formulations. Intense competition among a large number of players, including global giants and regional specialists, often results in significant price pressures, impacting profitability. Furthermore, a lack of widespread awareness regarding the long-term benefits and proper application techniques of advanced sealers among a segment of end-users can impede market penetration, especially in emerging markets. Supply chain disruptions and logistical complexities can also affect the timely availability and cost-effectiveness of products.

Key Players Shaping the Concrete Film-forming Sealer Market

- Curecrete Distribution (Ashford Formula and RetroPlate)

- Prosoco

- Evonik

- BASF

- SealSource

- AmeriPolish

- LYTHIC

- W. R. MEADOWS

- Larsen

- KreteTek Industries

- Kimbol Sealer

- Stone Technologies

- LATICRETE International

- Nutech Paint

- NewLook

- Euclid Chemical

- Henry Company

- Chem Tec

- Mapei

- Nanofront

- Suzhou Jinrun

- Guangzhou Ontop Building Material

Significant Concrete Film-forming Sealer Industry Milestones

- 2019: Increased focus on eco-friendly, low-VOC formulations gains momentum in North America and Europe.

- 2020: Global supply chain disruptions due to the pandemic lead to temporary material shortages and price volatility.

- 2021: Nanotechnology integration in sealers begins to show tangible benefits in enhanced stain and water repellency.

- 2022: Prosoco launches a new line of high-performance, breathable concrete sealers catering to sustainable construction.

- 2023: BASF expands its concrete admixture and protection portfolio, including advanced film-forming sealers, in emerging markets.

- 2024: Market sees an increase in strategic partnerships for distribution and technological co-development among key players.

Future Outlook for Concrete Film-forming Sealer Market

The future outlook for the Concrete Film-forming Sealer market is exceptionally bright, with continued robust growth projected through 2033. Key growth catalysts include sustained global infrastructure spending, particularly in developing economies, and the increasing demand for aesthetically pleasing and durable architectural finishes in residential and commercial construction. The drive towards sustainable building practices will further propel the adoption of eco-friendly, low-VOC, and water-based sealer technologies. Opportunities lie in the development of "smart" sealers with self-healing properties, enhanced functionality through nanotechnology, and integration with building management systems. Strategic investments in emerging markets, coupled with continuous innovation in product performance and application ease, will be crucial for market leaders to capitalize on the substantial market potential.

Concrete Film-forming Sealer Segmentation

-

1. Application

- 1.1. Constructional

- 1.2. Industrial

- 1.3. Other

-

2. Types

- 2.1. Acrylics

- 2.2. Epoxies

- 2.3. Urethanes

Concrete Film-forming Sealer Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Concrete Film-forming Sealer REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.1% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Concrete Film-forming Sealer Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Constructional

- 5.1.2. Industrial

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Acrylics

- 5.2.2. Epoxies

- 5.2.3. Urethanes

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Concrete Film-forming Sealer Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Constructional

- 6.1.2. Industrial

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Acrylics

- 6.2.2. Epoxies

- 6.2.3. Urethanes

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Concrete Film-forming Sealer Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Constructional

- 7.1.2. Industrial

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Acrylics

- 7.2.2. Epoxies

- 7.2.3. Urethanes

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Concrete Film-forming Sealer Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Constructional

- 8.1.2. Industrial

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Acrylics

- 8.2.2. Epoxies

- 8.2.3. Urethanes

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Concrete Film-forming Sealer Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Constructional

- 9.1.2. Industrial

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Acrylics

- 9.2.2. Epoxies

- 9.2.3. Urethanes

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Concrete Film-forming Sealer Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Constructional

- 10.1.2. Industrial

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Acrylics

- 10.2.2. Epoxies

- 10.2.3. Urethanes

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Curecrete Distribution(Ashford Formula and RetroPlate)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Prosoco

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Evonik

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BASF

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SealSource

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AmeriPolish

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 LYTHIC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 W. R. MEADOWS

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Larsen

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 KreteTek Industries

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Kimbol Sealer

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Stone Technologies

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 LATICRETE International

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Nutech Paint

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 NewLook

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Euclid Chemical

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Henry Company

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Chem Tec

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Mapei

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Nanofront

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Suzhou Jinrun

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Guangzhou Ontop Building Material

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.1 Curecrete Distribution(Ashford Formula and RetroPlate)

List of Figures

- Figure 1: Global Concrete Film-forming Sealer Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Concrete Film-forming Sealer Revenue (million), by Application 2024 & 2032

- Figure 3: North America Concrete Film-forming Sealer Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Concrete Film-forming Sealer Revenue (million), by Types 2024 & 2032

- Figure 5: North America Concrete Film-forming Sealer Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Concrete Film-forming Sealer Revenue (million), by Country 2024 & 2032

- Figure 7: North America Concrete Film-forming Sealer Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Concrete Film-forming Sealer Revenue (million), by Application 2024 & 2032

- Figure 9: South America Concrete Film-forming Sealer Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Concrete Film-forming Sealer Revenue (million), by Types 2024 & 2032

- Figure 11: South America Concrete Film-forming Sealer Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Concrete Film-forming Sealer Revenue (million), by Country 2024 & 2032

- Figure 13: South America Concrete Film-forming Sealer Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Concrete Film-forming Sealer Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Concrete Film-forming Sealer Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Concrete Film-forming Sealer Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Concrete Film-forming Sealer Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Concrete Film-forming Sealer Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Concrete Film-forming Sealer Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Concrete Film-forming Sealer Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Concrete Film-forming Sealer Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Concrete Film-forming Sealer Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Concrete Film-forming Sealer Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Concrete Film-forming Sealer Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Concrete Film-forming Sealer Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Concrete Film-forming Sealer Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Concrete Film-forming Sealer Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Concrete Film-forming Sealer Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Concrete Film-forming Sealer Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Concrete Film-forming Sealer Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Concrete Film-forming Sealer Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Concrete Film-forming Sealer Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Concrete Film-forming Sealer Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Concrete Film-forming Sealer Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Concrete Film-forming Sealer Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Concrete Film-forming Sealer Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Concrete Film-forming Sealer Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Concrete Film-forming Sealer Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Concrete Film-forming Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Concrete Film-forming Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Concrete Film-forming Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Concrete Film-forming Sealer Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Concrete Film-forming Sealer Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Concrete Film-forming Sealer Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Concrete Film-forming Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Concrete Film-forming Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Concrete Film-forming Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Concrete Film-forming Sealer Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Concrete Film-forming Sealer Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Concrete Film-forming Sealer Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Concrete Film-forming Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Concrete Film-forming Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Concrete Film-forming Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Concrete Film-forming Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Concrete Film-forming Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Concrete Film-forming Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Concrete Film-forming Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Concrete Film-forming Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Concrete Film-forming Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Concrete Film-forming Sealer Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Concrete Film-forming Sealer Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Concrete Film-forming Sealer Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Concrete Film-forming Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Concrete Film-forming Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Concrete Film-forming Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Concrete Film-forming Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Concrete Film-forming Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Concrete Film-forming Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Concrete Film-forming Sealer Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Concrete Film-forming Sealer Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Concrete Film-forming Sealer Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Concrete Film-forming Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Concrete Film-forming Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Concrete Film-forming Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Concrete Film-forming Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Concrete Film-forming Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Concrete Film-forming Sealer Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Concrete Film-forming Sealer Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Concrete Film-forming Sealer?

The projected CAGR is approximately 7.1%.

2. Which companies are prominent players in the Concrete Film-forming Sealer?

Key companies in the market include Curecrete Distribution(Ashford Formula and RetroPlate), Prosoco, Evonik, BASF, SealSource, AmeriPolish, LYTHIC, W. R. MEADOWS, Larsen, KreteTek Industries, Kimbol Sealer, Stone Technologies, LATICRETE International, Nutech Paint, NewLook, Euclid Chemical, Henry Company, Chem Tec, Mapei, Nanofront, Suzhou Jinrun, Guangzhou Ontop Building Material.

3. What are the main segments of the Concrete Film-forming Sealer?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 1581 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Concrete Film-forming Sealer," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Concrete Film-forming Sealer report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Concrete Film-forming Sealer?

To stay informed about further developments, trends, and reports in the Concrete Film-forming Sealer, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence