Key Insights

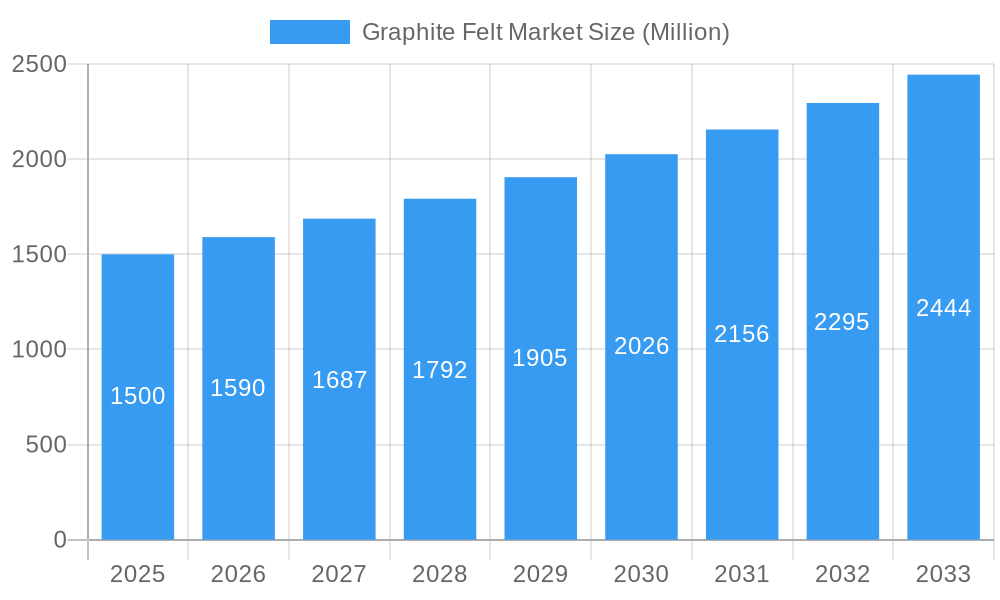

The global Graphite Felt Market is projected for substantial expansion, driven by escalating demand across key industries. Analysis indicates a robust Compound Annual Growth Rate (CAGR) of 5.2% from a market size of 172 million in the base year 2025. This growth is primarily attributed to the increasing utilization of graphite felt in high-temperature industrial applications, notably within metallurgical and chemical processing. Its superior thermal conductivity, chemical resistance, and flexibility render it essential for numerous industrial processes. Emerging technological advancements promising enhanced material properties and expanded application scope are expected to further propel market growth.

Graphite Felt Market Market Size (In Million)

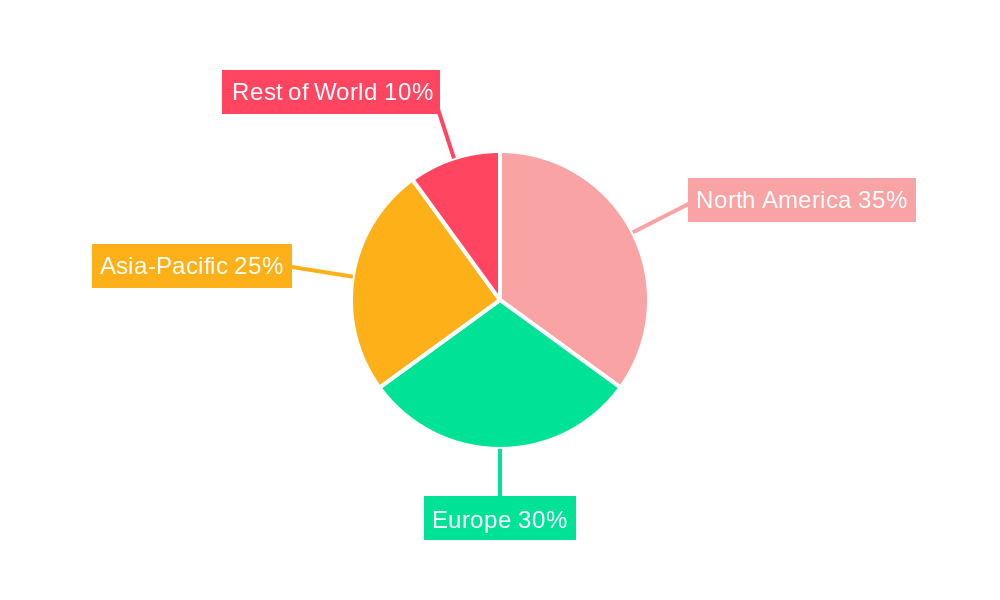

The historical period (2019-2024) likely demonstrated steady market progression, paving the way for accelerated expansion during the forecast period (2025-2033). North America and Europe are anticipated to be significant contributors, owing to established industrial infrastructures and stringent environmental mandates favoring advanced materials. However, the Asia-Pacific region is forecast to exhibit the most rapid growth, propelled by rapid industrialization and increased manufacturing sector investments. The market landscape is characterized by a mix of established and emerging players, competing through material innovation and application-tailored solutions. Continuous research and development efforts aimed at improving performance and cost-efficiency are further supporting market expansion. The Graphite Felt Market is therefore positioned for sustained growth, influenced by technological progress, expanding industrial applications, and growing environmental consciousness.

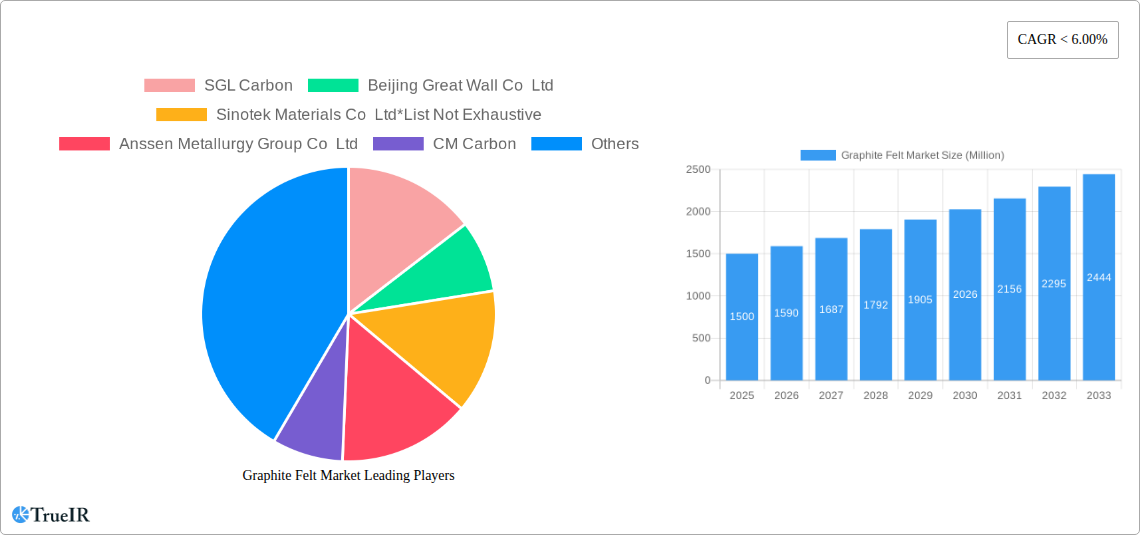

Graphite Felt Market Company Market Share

Graphite Felt Market: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the Graphite Felt market, offering invaluable insights for industry stakeholders, investors, and researchers. With a comprehensive study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's current state, future trajectory, and key players. The report leverages high-impact keywords to ensure optimal search engine visibility and provides actionable intelligence for informed decision-making.

Graphite Felt Market Structure & Competitive Landscape

The Graphite Felt market exhibits a moderately concentrated landscape, with several key players vying for market share. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately concentrated market. Innovation is a critical driver, with companies continuously striving to enhance product performance, particularly in terms of thermal conductivity and durability. Stringent environmental regulations concerning carbon emissions impact manufacturing processes and material sourcing, prompting companies to adopt sustainable practices. Product substitutes, such as ceramic fibers, pose a competitive challenge, especially in specific applications. End-user segmentation is diverse, spanning heat insulation, batteries, semiconductors, and other specialized applications. The market witnessed xx M&A transactions between 2019 and 2024, signifying a dynamic competitive landscape with companies pursuing strategic acquisitions to expand their market reach and product portfolios.

- Market Concentration: Moderately Concentrated (HHI xx in 2024)

- Innovation Drivers: Enhanced thermal conductivity, improved durability, sustainable manufacturing

- Regulatory Impacts: Stringent environmental regulations on carbon emissions

- Product Substitutes: Ceramic fibers

- End-User Segmentation: Heat insulation, batteries, semiconductors, other applications (absorptive materials, automotive exhaust linings)

- M&A Trends: xx transactions between 2019 and 2024

Graphite Felt Market Trends & Opportunities

The Graphite Felt market is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, reaching a market value of xx Million by 2033. This growth is fueled by increasing demand from the burgeoning electric vehicle (EV) battery sector, where graphite felt is crucial for thermal management. The expanding semiconductor industry, particularly in advanced packaging technologies, further contributes to market expansion. Technological advancements, such as the development of high-performance graphite felt with enhanced thermal conductivity and improved chemical resistance, are driving market penetration. Consumer preferences are shifting towards energy-efficient and eco-friendly solutions, aligning well with the sustainability profile of graphite felt in certain applications. Competitive dynamics are shaped by continuous product innovation, strategic partnerships, and acquisitions, leading to a dynamic and evolving market landscape. Market penetration rates for graphite felt in key application segments, such as batteries and semiconductors, are projected to increase significantly during the forecast period.

Dominant Markets & Segments in Graphite Felt Market

The Asia-Pacific region currently dominates the Graphite Felt market, driven by robust growth in the electronics and automotive industries within countries like China and South Korea. The significant expansion of the electric vehicle sector in this region fuels demand for high-performance graphite felt for battery thermal management systems. Within the raw material type segment, Polyacrylonitrile (PAN)-based graphite felt holds the largest market share due to its superior properties in terms of strength and thermal conductivity. Similarly, the batteries application segment is the leading application area, experiencing rapid growth propelled by the surging demand for electric vehicle batteries and energy storage systems.

Key Growth Drivers in Asia-Pacific:

- Rapid growth in the electronics and automotive industries.

- Significant expansion of the electric vehicle sector.

- Government initiatives promoting renewable energy and sustainable technologies.

Leading Raw Material Type: Polyacrylonitrile (PAN) - Superior properties (strength, thermal conductivity)

Leading Application Segment: Batteries - Driven by EV and energy storage system demand

Graphite Felt Market Product Analysis

Technological advancements in graphite felt manufacturing focus on enhancing thermal conductivity, improving chemical resistance, and optimizing mechanical properties for specific applications. Innovations include the development of specialized graphite felts with tailored porosity and fiber orientation to meet the rigorous demands of high-temperature applications, such as semiconductor manufacturing and advanced battery systems. The competitive advantages are primarily based on superior product performance, cost-effectiveness, and tailored solutions for specific end-user needs.

Key Drivers, Barriers & Challenges in Graphite Felt Market

Key Drivers:

- Growing demand from the electric vehicle industry for battery thermal management systems.

- Increasing adoption of graphite felt in semiconductor manufacturing for heat dissipation.

- Technological advancements leading to improved product performance and cost-effectiveness.

Challenges:

- Fluctuations in raw material prices (Petroleum pitch, PAN, Rayon) impacting production costs.

- Stringent environmental regulations requiring sustainable manufacturing practices.

- Intense competition from alternative materials, such as ceramic fibers.

- Supply chain disruptions impacting availability and timely delivery.

Growth Drivers in the Graphite Felt Market

The Graphite Felt market is propelled by technological advancements leading to superior product performance, the escalating demand from the electric vehicle industry and semiconductor sectors, and government support for renewable energy and sustainable technologies. These drivers fuel market expansion and drive innovation within the industry.

Challenges Impacting Graphite Felt Market Growth

Significant challenges include fluctuating raw material costs and supply chain vulnerabilities. Stringent environmental regulations increase manufacturing costs, while competition from substitute materials puts pressure on market share.

Key Players Shaping the Graphite Felt Market

- SGL Carbon

- Beijing Great Wall Co Ltd

- Sinotek Materials Co Ltd

- Anssen Metallurgy Group Co Ltd

- CM Carbon

- Nippon Carbon Co Ltd

- Carbon Composites Inc

- CGT Carbon GmbH

- Morgan Advanced Materials

- Schunk Carbon Technology

- Mersen Graphite

- CeraMaterials

- Av Carb LLC

- Liaoning Jingu carbon material Co Ltd

- Chemshine Carbon Co Ltd

- CFCCARBON Co Ltd

- HPMS Graphite

Significant Graphite Felt Market Industry Milestones

- July 2021: CGT Carbon GmbH partially acquired Thermic Edge Coatings Ltd. and established Thermic Edge Europe GmbH as a joint venture. This expanded CGT Carbon's reach into specialized coatings for high-temperature applications, enhancing its product portfolio and market position.

Future Outlook for Graphite Felt Market

The Graphite Felt market is poised for continued growth, driven by the sustained expansion of the EV and semiconductor industries. Strategic investments in research and development, focusing on enhanced product performance and sustainable manufacturing processes, will further shape the market's trajectory. The emergence of innovative applications, such as advanced thermal management solutions for next-generation electronics and aerospace, presents significant growth opportunities. The market anticipates a positive outlook with substantial growth potential in the coming years.

Graphite Felt Market Segmentation

-

1. Raw Material Type

- 1.1. Polyacrylonitrile (PAN)

- 1.2. Rayon

- 1.3. Petroleum Pitch

-

2. Application

- 2.1. Heat Insulation

- 2.2. Batteries

- 2.3. Semiconductors

- 2.4. Other Ap

Graphite Felt Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Graphite Felt Market Regional Market Share

Geographic Coverage of Graphite Felt Market

Graphite Felt Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from Industrial Applications and Energy Efficiency; Growing Industrialization in the Asia-Pacific Region

- 3.3. Market Restrains

- 3.3.1. High Cost Associated With Carbon Felt Manufacturing; Other Restraints

- 3.4. Market Trends

- 3.4.1. Increasing Applications from Heat Insulation Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Graphite Felt Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 5.1.1. Polyacrylonitrile (PAN)

- 5.1.2. Rayon

- 5.1.3. Petroleum Pitch

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Heat Insulation

- 5.2.2. Batteries

- 5.2.3. Semiconductors

- 5.2.4. Other Ap

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 6. Asia Pacific Graphite Felt Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 6.1.1. Polyacrylonitrile (PAN)

- 6.1.2. Rayon

- 6.1.3. Petroleum Pitch

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Heat Insulation

- 6.2.2. Batteries

- 6.2.3. Semiconductors

- 6.2.4. Other Ap

- 6.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 7. North America Graphite Felt Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 7.1.1. Polyacrylonitrile (PAN)

- 7.1.2. Rayon

- 7.1.3. Petroleum Pitch

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Heat Insulation

- 7.2.2. Batteries

- 7.2.3. Semiconductors

- 7.2.4. Other Ap

- 7.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 8. Europe Graphite Felt Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 8.1.1. Polyacrylonitrile (PAN)

- 8.1.2. Rayon

- 8.1.3. Petroleum Pitch

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Heat Insulation

- 8.2.2. Batteries

- 8.2.3. Semiconductors

- 8.2.4. Other Ap

- 8.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 9. South America Graphite Felt Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 9.1.1. Polyacrylonitrile (PAN)

- 9.1.2. Rayon

- 9.1.3. Petroleum Pitch

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Heat Insulation

- 9.2.2. Batteries

- 9.2.3. Semiconductors

- 9.2.4. Other Ap

- 9.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 10. Middle East and Africa Graphite Felt Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 10.1.1. Polyacrylonitrile (PAN)

- 10.1.2. Rayon

- 10.1.3. Petroleum Pitch

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Heat Insulation

- 10.2.2. Batteries

- 10.2.3. Semiconductors

- 10.2.4. Other Ap

- 10.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SGL Carbon

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Beijing Great Wall Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sinotek Materials Co Ltd*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Anssen Metallurgy Group Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 CM Carbon

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nippon Carbon Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Carbon Composites Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 CGT Carbon GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Morgan Advanced Materials

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Schunk Carbon Technology

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Mersen Graphite

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 CeraMaterials

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Av Carb LLC

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Liaoning Jingu carbon material Co Ltd

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Chemshine Carbon Co Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 CFCCARBON Co Ltd

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 HPMS Graphite

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 SGL Carbon

List of Figures

- Figure 1: Global Graphite Felt Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Graphite Felt Market Revenue (million), by Raw Material Type 2025 & 2033

- Figure 3: Asia Pacific Graphite Felt Market Revenue Share (%), by Raw Material Type 2025 & 2033

- Figure 4: Asia Pacific Graphite Felt Market Revenue (million), by Application 2025 & 2033

- Figure 5: Asia Pacific Graphite Felt Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Graphite Felt Market Revenue (million), by Country 2025 & 2033

- Figure 7: Asia Pacific Graphite Felt Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Graphite Felt Market Revenue (million), by Raw Material Type 2025 & 2033

- Figure 9: North America Graphite Felt Market Revenue Share (%), by Raw Material Type 2025 & 2033

- Figure 10: North America Graphite Felt Market Revenue (million), by Application 2025 & 2033

- Figure 11: North America Graphite Felt Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Graphite Felt Market Revenue (million), by Country 2025 & 2033

- Figure 13: North America Graphite Felt Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Graphite Felt Market Revenue (million), by Raw Material Type 2025 & 2033

- Figure 15: Europe Graphite Felt Market Revenue Share (%), by Raw Material Type 2025 & 2033

- Figure 16: Europe Graphite Felt Market Revenue (million), by Application 2025 & 2033

- Figure 17: Europe Graphite Felt Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Graphite Felt Market Revenue (million), by Country 2025 & 2033

- Figure 19: Europe Graphite Felt Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Graphite Felt Market Revenue (million), by Raw Material Type 2025 & 2033

- Figure 21: South America Graphite Felt Market Revenue Share (%), by Raw Material Type 2025 & 2033

- Figure 22: South America Graphite Felt Market Revenue (million), by Application 2025 & 2033

- Figure 23: South America Graphite Felt Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Graphite Felt Market Revenue (million), by Country 2025 & 2033

- Figure 25: South America Graphite Felt Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Graphite Felt Market Revenue (million), by Raw Material Type 2025 & 2033

- Figure 27: Middle East and Africa Graphite Felt Market Revenue Share (%), by Raw Material Type 2025 & 2033

- Figure 28: Middle East and Africa Graphite Felt Market Revenue (million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Graphite Felt Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Graphite Felt Market Revenue (million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Graphite Felt Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Graphite Felt Market Revenue million Forecast, by Raw Material Type 2020 & 2033

- Table 2: Global Graphite Felt Market Revenue million Forecast, by Application 2020 & 2033

- Table 3: Global Graphite Felt Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Graphite Felt Market Revenue million Forecast, by Raw Material Type 2020 & 2033

- Table 5: Global Graphite Felt Market Revenue million Forecast, by Application 2020 & 2033

- Table 6: Global Graphite Felt Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: China Graphite Felt Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: India Graphite Felt Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Japan Graphite Felt Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Graphite Felt Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Graphite Felt Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global Graphite Felt Market Revenue million Forecast, by Raw Material Type 2020 & 2033

- Table 13: Global Graphite Felt Market Revenue million Forecast, by Application 2020 & 2033

- Table 14: Global Graphite Felt Market Revenue million Forecast, by Country 2020 & 2033

- Table 15: United States Graphite Felt Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Canada Graphite Felt Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Mexico Graphite Felt Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Global Graphite Felt Market Revenue million Forecast, by Raw Material Type 2020 & 2033

- Table 19: Global Graphite Felt Market Revenue million Forecast, by Application 2020 & 2033

- Table 20: Global Graphite Felt Market Revenue million Forecast, by Country 2020 & 2033

- Table 21: Germany Graphite Felt Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Graphite Felt Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: France Graphite Felt Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Italy Graphite Felt Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Graphite Felt Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Global Graphite Felt Market Revenue million Forecast, by Raw Material Type 2020 & 2033

- Table 27: Global Graphite Felt Market Revenue million Forecast, by Application 2020 & 2033

- Table 28: Global Graphite Felt Market Revenue million Forecast, by Country 2020 & 2033

- Table 29: Brazil Graphite Felt Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Argentina Graphite Felt Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Graphite Felt Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Global Graphite Felt Market Revenue million Forecast, by Raw Material Type 2020 & 2033

- Table 33: Global Graphite Felt Market Revenue million Forecast, by Application 2020 & 2033

- Table 34: Global Graphite Felt Market Revenue million Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Graphite Felt Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: South Africa Graphite Felt Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Graphite Felt Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Graphite Felt Market?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the Graphite Felt Market?

Key companies in the market include SGL Carbon, Beijing Great Wall Co Ltd, Sinotek Materials Co Ltd*List Not Exhaustive, Anssen Metallurgy Group Co Ltd, CM Carbon, Nippon Carbon Co Ltd, Carbon Composites Inc, CGT Carbon GmbH, Morgan Advanced Materials, Schunk Carbon Technology, Mersen Graphite, CeraMaterials, Av Carb LLC, Liaoning Jingu carbon material Co Ltd, Chemshine Carbon Co Ltd, CFCCARBON Co Ltd, HPMS Graphite.

3. What are the main segments of the Graphite Felt Market?

The market segments include Raw Material Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 172 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from Industrial Applications and Energy Efficiency; Growing Industrialization in the Asia-Pacific Region.

6. What are the notable trends driving market growth?

Increasing Applications from Heat Insulation Segment.

7. Are there any restraints impacting market growth?

High Cost Associated With Carbon Felt Manufacturing; Other Restraints.

8. Can you provide examples of recent developments in the market?

In 2021, CGT Carbon GmbH partially acquired the company Thermic Edge Coatings Ltd. and laid the foundation of Thermic Edge Europe GmbH as a joint venture.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Graphite Felt Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Graphite Felt Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Graphite Felt Market?

To stay informed about further developments, trends, and reports in the Graphite Felt Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence