Key Insights

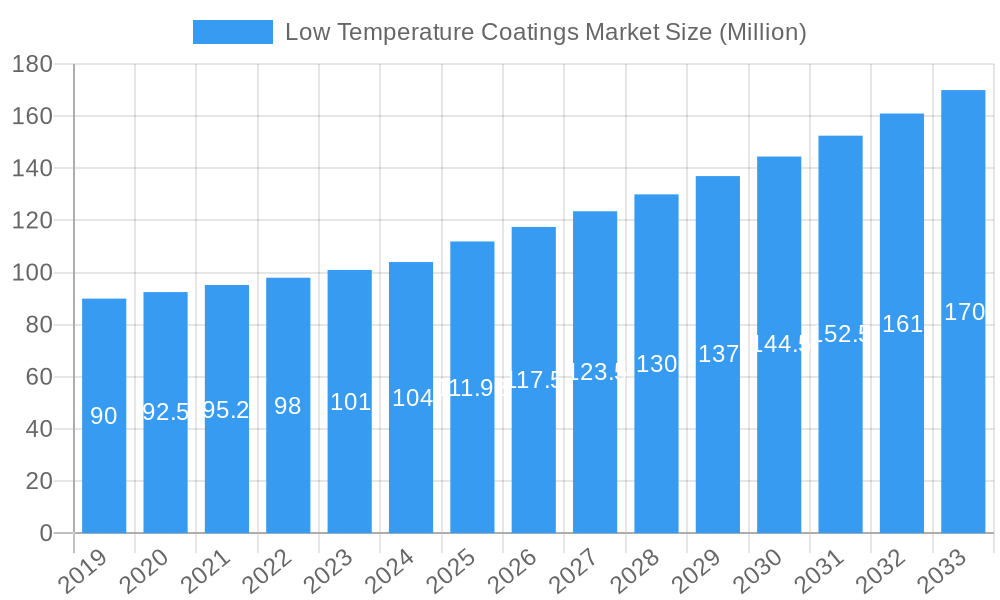

The global Low Temperature Coatings Market is poised for robust expansion, projected to reach USD 111.92 million in 2025, and is expected to witness a Compound Annual Growth Rate (CAGR) exceeding 5.00% during the forecast period of 2025-2033. This significant market valuation underscores the growing demand for specialized coatings designed to perform optimally in cold environments. The primary drivers fueling this growth are the increasing industrialization and infrastructure development in regions experiencing colder climates, coupled with advancements in coating technology that enhance durability and performance under extreme temperatures. Furthermore, the automotive sector's continuous innovation in vehicle design and the demand for protective coatings that withstand harsh weather conditions are contributing substantially to market expansion. The architectural segment also plays a crucial role, with a rising need for weather-resistant paints and coatings for buildings in colder regions.

Low Temperature Coatings Market Market Size (In Million)

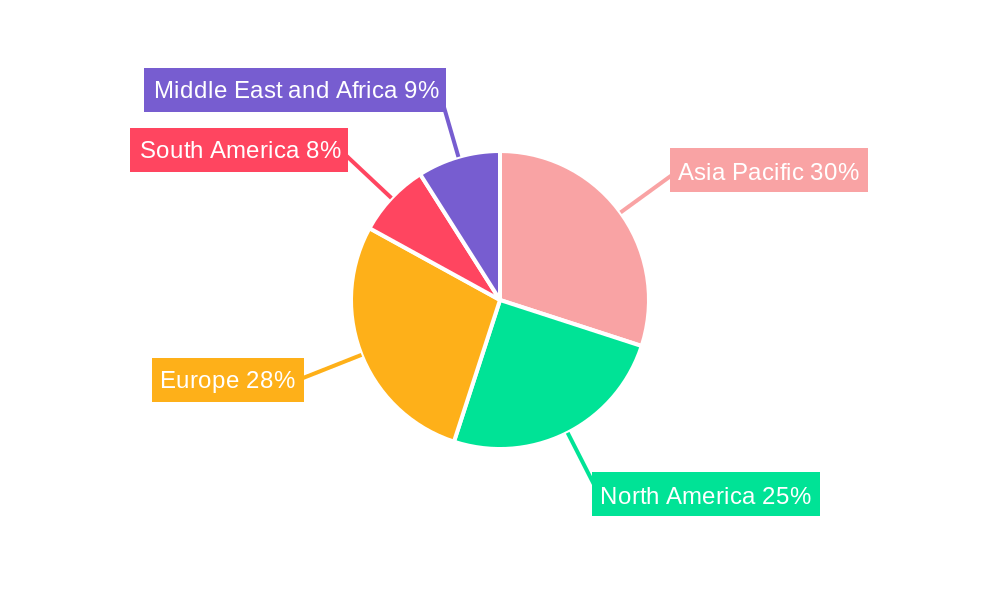

The market segmentation by resin type highlights the dominance of Polyester and Epoxy resins, owing to their superior chemical resistance and mechanical properties, making them ideal for low-temperature applications. Polyurethane and Acrylics also hold significant shares, offering a balance of flexibility and protection. End-user industries like Architectural and Industrial are expected to lead the demand, driven by construction projects and the need for protective layers in manufacturing and infrastructure. The automotive industry's adoption of advanced coatings for both aesthetic appeal and functional benefits in colder climates further bolsters market growth. Geographically, Asia Pacific, particularly China and India, is anticipated to emerge as a key growth engine due to rapid industrialization and increasing disposable incomes, leading to higher adoption rates of low-temperature coatings. North America and Europe, with their established cold climates and stringent performance requirements, will continue to be significant markets.

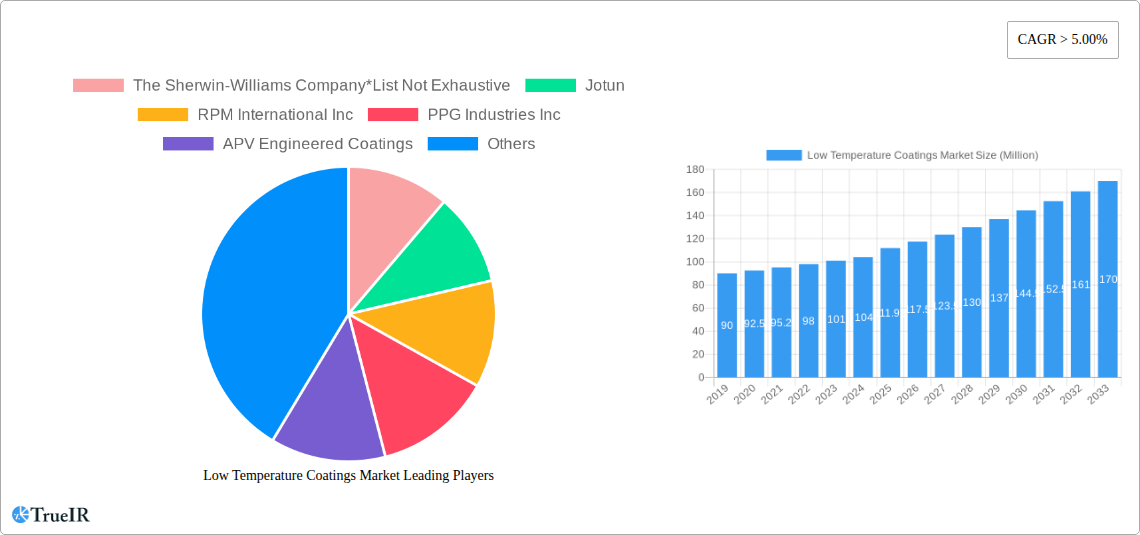

Low Temperature Coatings Market Company Market Share

Here is a dynamic, SEO-optimized report description for the Low Temperature Coatings Market, structured as requested and incorporating high-volume keywords:

This in-depth report provides a strategic analysis of the global Low Temperature Coatings Market, offering critical insights into its growth trajectory, market dynamics, and competitive landscape. Covering the study period from 2019 to 2033, with a base and estimated year of 2025 and a detailed forecast period from 2025 to 2033, this report is an essential resource for stakeholders seeking to understand and capitalize on emerging opportunities within this evolving sector. We delve into key segments including Polyester, Epoxy, Polyurethane, and Acrylics resins, and analyze their application across Architectural, Industrial, Automotive, and Wood end-user segments. The report meticulously examines industry developments such as the rise of low-VOC and VOC-free coatings, the proliferation of waterborne coatings, the adoption of automated coating systems, and the growing influence of nanotechnology. With an estimated market size projected to reach xx Million by 2033, driven by a robust CAGR, this report is indispensable for informed decision-making.

Low Temperature Coatings Market Market Structure & Competitive Landscape

The Low Temperature Coatings Market exhibits a moderately concentrated structure, with key players like The Sherwin-Williams Company, Jotun, RPM International Inc, PPG Industries Inc, Axalta Coating Systems, and Akzo Nobel N V holding significant market share. Innovation serves as a primary driver, fueled by continuous research and development into advanced formulations that offer enhanced performance, sustainability, and application efficiency. Regulatory impacts, particularly stringent environmental standards concerning VOC emissions, are shaping product development and market entry strategies. The threat of product substitutes is present, though specialized performance requirements of low-temperature applications often limit their widespread adoption. End-user segmentation is critical, with the Industrial and Architectural sectors demonstrating strong demand. Mergers and acquisitions (M&A) are also a notable trend, with companies consolidating to expand their product portfolios and geographical reach. For instance, Valspar's acquisition by Sherwin-Williams highlights this strategic consolidation. The market concentration ratio is estimated to be around xx% for the top five players in 2025. M&A volumes in the past five years are estimated at xx Million.

Low Temperature Coatings Market Market Trends & Opportunities

The Low Temperature Coatings Market is poised for substantial growth, driven by a confluence of technological advancements, evolving consumer preferences, and expanding industrial applications. The global market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately xx% from 2025 to 2033, reaching an estimated value of xx Million by the end of the forecast period. This expansion is largely attributable to the increasing demand for coatings that can be applied and cure effectively in sub-optimal temperature conditions, thereby extending the application window for construction and manufacturing projects.

Technological shifts are a major catalyst, with a significant trend towards developing low-VOC and VOC-free coatings. This is directly influenced by rising environmental consciousness and stricter regulatory frameworks across major economies, pushing manufacturers to innovate with more sustainable and healthier coating solutions. The introduction and widespread adoption of waterborne coatings further align with these sustainability goals, offering reduced environmental impact and improved worker safety.

Consumer preferences are also evolving. End-users are increasingly prioritizing coatings that offer superior durability, enhanced aesthetic appeal, and extended service life, even in challenging climatic environments. This demand is particularly pronounced in sectors like architectural coatings, where long-term performance and resistance to weathering are paramount.

The competitive dynamics within the Low Temperature Coatings Market are intensifying. Established players are investing heavily in R&D to differentiate their offerings, while new entrants are emerging with niche solutions. The growing adoption of automated coating systems presents a significant opportunity for manufacturers to develop specialized coatings that are optimized for robotic application, leading to increased precision, reduced waste, and improved efficiency. Furthermore, the increasing use of nanotechnology in coatings is unlocking new performance characteristics, such as enhanced scratch resistance, self-cleaning properties, and improved thermal insulation, thereby creating premium product segments.

The market penetration rate for advanced low-temperature coatings in emerging economies is still relatively low, indicating significant untapped potential for growth. Strategic partnerships and collaborations between raw material suppliers, coating manufacturers, and end-users are expected to accelerate innovation and market penetration. The demand for coatings in sectors like renewable energy infrastructure (e.g., wind turbines operating in cold climates) and specialized industrial applications further bolsters the market's growth prospects. The overall market size in 2025 is estimated to be xx Million.

Dominant Markets & Segments in Low Temperature Coatings Market

The Low Temperature Coatings Market is characterized by distinct regional dominance and segment-specific growth drivers.

Regional Dominance: North America and Europe currently lead the global market due to their mature industrial bases, stringent environmental regulations that favor advanced coating technologies, and high disposable incomes driving demand in architectural and automotive sectors. However, the Asia-Pacific region is emerging as a high-growth frontier, propelled by rapid industrialization, significant infrastructure development projects, and increasing urbanization. Emerging economies within this region are witnessing substantial investments in construction and manufacturing, thereby creating a burgeoning demand for specialized coatings.

Resin Segment Dominance:

- Epoxy resins are expected to dominate the market, owing to their excellent adhesion, chemical resistance, and durability, making them ideal for industrial protective coatings, marine applications, and flooring, even in low-temperature environments.

- Polyurethane resins are also witnessing significant growth, driven by their flexibility, abrasion resistance, and aesthetic versatility, finding widespread use in automotive refinishes and architectural finishes.

- Polyester resins are crucial for applications requiring good weatherability and corrosion resistance, particularly in industrial maintenance and coil coatings.

- Acrylics offer a balance of performance and cost-effectiveness, finding applications in both architectural and industrial coatings where moderate protection is required.

- Other Resins, including hybrid formulations and specialized polymers, are gaining traction as manufacturers seek to tailor properties for specific niche applications.

End-user Segment Dominance:

- The Industrial segment is a primary driver, encompassing a wide range of applications from heavy machinery and infrastructure to oil & gas facilities, where protective coatings are essential for longevity and performance in harsh conditions.

- The Architectural segment is also a significant contributor, with increasing demand for paints and coatings that can be applied year-round in diverse climatic conditions for both interior and exterior applications, particularly in regions experiencing prolonged cold seasons.

- The Automotive sector relies on low-temperature coatings for vehicle manufacturing and repair, where consistent application and curing are critical for quality and efficiency.

- The Wood segment, including furniture and building materials, benefits from coatings that protect against moisture and temperature fluctuations, enhancing product lifespan.

Key growth drivers for market dominance include government initiatives promoting sustainable construction, investments in infrastructure upgrades, and the need for durable protective coatings in sectors exposed to extreme temperatures. For instance, the substantial infrastructure spending in countries like China and India is directly fueling demand for industrial and architectural coatings. The market size for epoxy resins is projected to reach xx Million by 2033. The industrial end-user segment is estimated to hold a market share of xx% in 2025.

Low Temperature Coatings Market Product Analysis

Product innovation in the Low Temperature Coatings Market is intensely focused on enhancing performance under challenging conditions. Advancements include the development of rapid-curing formulations that cure effectively at temperatures below 0°C, offering significant application flexibility. These coatings often leverage novel binder technologies, such as specialized epoxies and polyurethanes, that maintain flexibility and adhesion at low temperatures. Nanotechnology integration is also leading to products with improved scratch resistance, UV stability, and anti-corrosive properties. Competitive advantages are derived from formulations that offer extended pot life, reduced application time, and superior adhesion to various substrates, including metals, concrete, and composites. The market fit for these products is increasingly driven by sustainability mandates, leading to a surge in low-VOC and waterborne options.

Key Drivers, Barriers & Challenges in Low Temperature Coatings Market

The Low Temperature Coatings Market is propelled by several key drivers. Technological advancements in resin chemistry, particularly the development of low-temperature curing agents and binder systems, are paramount. Economic factors, such as increased construction activity in colder regions and the need for durable coatings in industrial maintenance, also play a significant role. Policy-driven factors, including stringent environmental regulations encouraging sustainable coatings, further boost demand. For example, the push for energy-efficient buildings necessitates coatings that maintain integrity in varying temperatures.

However, the market faces several challenges and restraints. Supply chain complexities, particularly for specialized raw materials, can lead to price volatility and availability issues. Regulatory hurdles, while driving innovation, also impose compliance costs on manufacturers. Competitive pressures from established players and emerging technologies require continuous investment in R&D. The initial cost of advanced low-temperature coatings can also be a barrier for some end-users. For instance, the volatile pricing of key raw materials like epoxy resins can impact the overall cost of finished products. The estimated impact of raw material price fluctuations on the market is xx%.

Growth Drivers in the Low Temperature Coatings Market Market

Key growth drivers in the Low Temperature Coatings Market are predominantly rooted in technological innovation and increasing demand for year-round application capabilities. The development of advanced resin technologies, enabling coatings to cure and perform optimally at sub-zero temperatures, is a primary catalyst. Economically, the global expansion of construction and infrastructure projects, especially in regions with harsh winters, fuels the need for coatings that can be applied irrespective of ambient temperature. Policy-driven initiatives, such as the emphasis on reducing project delays caused by weather conditions and promoting sustainable building practices, further stimulate the adoption of low-temperature coatings. The growing awareness and demand for durable, long-lasting protective solutions across industrial, architectural, and automotive sectors also contribute significantly to market expansion. The market for low-temperature coatings in the construction sector is estimated to grow by xx% annually.

Challenges Impacting Low Temperature Coatings Market Growth

Challenges impacting Low Temperature Coatings Market growth are multifaceted. Regulatory complexities surrounding environmental standards, while driving innovation, can also lead to increased compliance costs and longer product development cycles. Supply chain issues, including the availability and price volatility of key raw materials required for specialized formulations, pose a significant restraint. Furthermore, competitive pressures from both established global manufacturers and agile local players necessitate continuous investment in research and development and marketing efforts. The perception of higher upfront costs for advanced low-temperature coatings compared to standard alternatives can also be a barrier to adoption for some market segments, particularly in price-sensitive regions. The impact of supply chain disruptions on market growth is estimated to be around xx%.

Key Players Shaping the Low Temperature Coatings Market Market

- The Sherwin-Williams Company

- Jotun

- RPM International Inc

- PPG Industries Inc

- APV Engineered Coatings

- Axalta Coating Systems

- Hempel A/S

- Akzo Nobel N V

- BASF

- Valspar (part of Sherwin-Williams)

- 3M

Significant Low Temperature Coatings Market Industry Milestones

- 2019: Introduction of advanced, low-VOC epoxy formulations for industrial applications, enhancing worker safety and environmental compliance.

- 2020: Significant market penetration of waterborne polyurethane coatings for architectural use, offering improved sustainability and performance.

- 2021: Increased adoption of automated coating systems in automotive manufacturing, necessitating specialized low-temperature curing paints.

- 2022: Breakthroughs in nanotechnology leading to the development of self-healing and superhydrophobic coatings for demanding industrial environments.

- 2023: Further advancements in ultra-low temperature curing technologies, enabling application and performance down to -20°C.

- 2024: Increased focus on bio-based resins for low-temperature coatings, aligning with global sustainability goals.

Future Outlook for Low Temperature Coatings Market Market

The Low Temperature Coatings Market is projected for sustained growth, driven by an intensified focus on sustainable solutions and the need for robust performance in diverse climatic conditions. Strategic opportunities lie in the expansion of low-VOC and VOC-free product portfolios, catering to stringent environmental regulations and growing consumer demand for eco-friendly options. The continued development of waterborne technologies will further solidify market share. The integration of advanced materials, including nanotechnology, will unlock new performance attributes, creating premium market segments. Furthermore, the growing adoption of automated application systems presents a significant opportunity for specialized, high-performance coatings. Emerging economies, with their expanding industrial and construction sectors, represent a vast untapped market potential. The market outlook indicates a strong CAGR of xx% from 2025 to 2033, driven by these critical growth catalysts.

Low Temperature Coatings Market Segmentation

-

1. Resin

- 1.1. Polyester

- 1.2. Epoxy

- 1.3. Polyurethane

- 1.4. Acrylics

- 1.5. Other Resins

-

2. End-user

- 2.1. Architectural

- 2.2. Industrial

- 2.3. Automotive

- 2.4. Wood

- 2.5. Other End-users

Low Temperature Coatings Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Low Temperature Coatings Market Regional Market Share

Geographic Coverage of Low Temperature Coatings Market

Low Temperature Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increase in Energy Savings due to Reduction in Cure Temperatures; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Unsuitability in Thin Coating Applications; Impact of COVID-19 Pandemic

- 3.4. Market Trends

- 3.4.1. Increasing Usage in the Automotive Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Low Temperature Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 5.1.1. Polyester

- 5.1.2. Epoxy

- 5.1.3. Polyurethane

- 5.1.4. Acrylics

- 5.1.5. Other Resins

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Architectural

- 5.2.2. Industrial

- 5.2.3. Automotive

- 5.2.4. Wood

- 5.2.5. Other End-users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 6. Asia Pacific Low Temperature Coatings Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Resin

- 6.1.1. Polyester

- 6.1.2. Epoxy

- 6.1.3. Polyurethane

- 6.1.4. Acrylics

- 6.1.5. Other Resins

- 6.2. Market Analysis, Insights and Forecast - by End-user

- 6.2.1. Architectural

- 6.2.2. Industrial

- 6.2.3. Automotive

- 6.2.4. Wood

- 6.2.5. Other End-users

- 6.1. Market Analysis, Insights and Forecast - by Resin

- 7. North America Low Temperature Coatings Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Resin

- 7.1.1. Polyester

- 7.1.2. Epoxy

- 7.1.3. Polyurethane

- 7.1.4. Acrylics

- 7.1.5. Other Resins

- 7.2. Market Analysis, Insights and Forecast - by End-user

- 7.2.1. Architectural

- 7.2.2. Industrial

- 7.2.3. Automotive

- 7.2.4. Wood

- 7.2.5. Other End-users

- 7.1. Market Analysis, Insights and Forecast - by Resin

- 8. Europe Low Temperature Coatings Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Resin

- 8.1.1. Polyester

- 8.1.2. Epoxy

- 8.1.3. Polyurethane

- 8.1.4. Acrylics

- 8.1.5. Other Resins

- 8.2. Market Analysis, Insights and Forecast - by End-user

- 8.2.1. Architectural

- 8.2.2. Industrial

- 8.2.3. Automotive

- 8.2.4. Wood

- 8.2.5. Other End-users

- 8.1. Market Analysis, Insights and Forecast - by Resin

- 9. South America Low Temperature Coatings Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Resin

- 9.1.1. Polyester

- 9.1.2. Epoxy

- 9.1.3. Polyurethane

- 9.1.4. Acrylics

- 9.1.5. Other Resins

- 9.2. Market Analysis, Insights and Forecast - by End-user

- 9.2.1. Architectural

- 9.2.2. Industrial

- 9.2.3. Automotive

- 9.2.4. Wood

- 9.2.5. Other End-users

- 9.1. Market Analysis, Insights and Forecast - by Resin

- 10. Middle East and Africa Low Temperature Coatings Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Resin

- 10.1.1. Polyester

- 10.1.2. Epoxy

- 10.1.3. Polyurethane

- 10.1.4. Acrylics

- 10.1.5. Other Resins

- 10.2. Market Analysis, Insights and Forecast - by End-user

- 10.2.1. Architectural

- 10.2.2. Industrial

- 10.2.3. Automotive

- 10.2.4. Wood

- 10.2.5. Other End-users

- 10.1. Market Analysis, Insights and Forecast - by Resin

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 The Sherwin-Williams Company*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Jotun

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 RPM International Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 PPG Industries Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 APV Engineered Coatings

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Axalta Coating Systems

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hempel A/S

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Akzo Nobel N V

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BASF

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Valspar (part of Sherwin-Williams)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 3M

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 The Sherwin-Williams Company*List Not Exhaustive

List of Figures

- Figure 1: Global Low Temperature Coatings Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Low Temperature Coatings Market Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Low Temperature Coatings Market Revenue (Million), by Resin 2025 & 2033

- Figure 4: Asia Pacific Low Temperature Coatings Market Volume (K Tons), by Resin 2025 & 2033

- Figure 5: Asia Pacific Low Temperature Coatings Market Revenue Share (%), by Resin 2025 & 2033

- Figure 6: Asia Pacific Low Temperature Coatings Market Volume Share (%), by Resin 2025 & 2033

- Figure 7: Asia Pacific Low Temperature Coatings Market Revenue (Million), by End-user 2025 & 2033

- Figure 8: Asia Pacific Low Temperature Coatings Market Volume (K Tons), by End-user 2025 & 2033

- Figure 9: Asia Pacific Low Temperature Coatings Market Revenue Share (%), by End-user 2025 & 2033

- Figure 10: Asia Pacific Low Temperature Coatings Market Volume Share (%), by End-user 2025 & 2033

- Figure 11: Asia Pacific Low Temperature Coatings Market Revenue (Million), by Country 2025 & 2033

- Figure 12: Asia Pacific Low Temperature Coatings Market Volume (K Tons), by Country 2025 & 2033

- Figure 13: Asia Pacific Low Temperature Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Low Temperature Coatings Market Volume Share (%), by Country 2025 & 2033

- Figure 15: North America Low Temperature Coatings Market Revenue (Million), by Resin 2025 & 2033

- Figure 16: North America Low Temperature Coatings Market Volume (K Tons), by Resin 2025 & 2033

- Figure 17: North America Low Temperature Coatings Market Revenue Share (%), by Resin 2025 & 2033

- Figure 18: North America Low Temperature Coatings Market Volume Share (%), by Resin 2025 & 2033

- Figure 19: North America Low Temperature Coatings Market Revenue (Million), by End-user 2025 & 2033

- Figure 20: North America Low Temperature Coatings Market Volume (K Tons), by End-user 2025 & 2033

- Figure 21: North America Low Temperature Coatings Market Revenue Share (%), by End-user 2025 & 2033

- Figure 22: North America Low Temperature Coatings Market Volume Share (%), by End-user 2025 & 2033

- Figure 23: North America Low Temperature Coatings Market Revenue (Million), by Country 2025 & 2033

- Figure 24: North America Low Temperature Coatings Market Volume (K Tons), by Country 2025 & 2033

- Figure 25: North America Low Temperature Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: North America Low Temperature Coatings Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Low Temperature Coatings Market Revenue (Million), by Resin 2025 & 2033

- Figure 28: Europe Low Temperature Coatings Market Volume (K Tons), by Resin 2025 & 2033

- Figure 29: Europe Low Temperature Coatings Market Revenue Share (%), by Resin 2025 & 2033

- Figure 30: Europe Low Temperature Coatings Market Volume Share (%), by Resin 2025 & 2033

- Figure 31: Europe Low Temperature Coatings Market Revenue (Million), by End-user 2025 & 2033

- Figure 32: Europe Low Temperature Coatings Market Volume (K Tons), by End-user 2025 & 2033

- Figure 33: Europe Low Temperature Coatings Market Revenue Share (%), by End-user 2025 & 2033

- Figure 34: Europe Low Temperature Coatings Market Volume Share (%), by End-user 2025 & 2033

- Figure 35: Europe Low Temperature Coatings Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe Low Temperature Coatings Market Volume (K Tons), by Country 2025 & 2033

- Figure 37: Europe Low Temperature Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Low Temperature Coatings Market Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Low Temperature Coatings Market Revenue (Million), by Resin 2025 & 2033

- Figure 40: South America Low Temperature Coatings Market Volume (K Tons), by Resin 2025 & 2033

- Figure 41: South America Low Temperature Coatings Market Revenue Share (%), by Resin 2025 & 2033

- Figure 42: South America Low Temperature Coatings Market Volume Share (%), by Resin 2025 & 2033

- Figure 43: South America Low Temperature Coatings Market Revenue (Million), by End-user 2025 & 2033

- Figure 44: South America Low Temperature Coatings Market Volume (K Tons), by End-user 2025 & 2033

- Figure 45: South America Low Temperature Coatings Market Revenue Share (%), by End-user 2025 & 2033

- Figure 46: South America Low Temperature Coatings Market Volume Share (%), by End-user 2025 & 2033

- Figure 47: South America Low Temperature Coatings Market Revenue (Million), by Country 2025 & 2033

- Figure 48: South America Low Temperature Coatings Market Volume (K Tons), by Country 2025 & 2033

- Figure 49: South America Low Temperature Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Low Temperature Coatings Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Low Temperature Coatings Market Revenue (Million), by Resin 2025 & 2033

- Figure 52: Middle East and Africa Low Temperature Coatings Market Volume (K Tons), by Resin 2025 & 2033

- Figure 53: Middle East and Africa Low Temperature Coatings Market Revenue Share (%), by Resin 2025 & 2033

- Figure 54: Middle East and Africa Low Temperature Coatings Market Volume Share (%), by Resin 2025 & 2033

- Figure 55: Middle East and Africa Low Temperature Coatings Market Revenue (Million), by End-user 2025 & 2033

- Figure 56: Middle East and Africa Low Temperature Coatings Market Volume (K Tons), by End-user 2025 & 2033

- Figure 57: Middle East and Africa Low Temperature Coatings Market Revenue Share (%), by End-user 2025 & 2033

- Figure 58: Middle East and Africa Low Temperature Coatings Market Volume Share (%), by End-user 2025 & 2033

- Figure 59: Middle East and Africa Low Temperature Coatings Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East and Africa Low Temperature Coatings Market Volume (K Tons), by Country 2025 & 2033

- Figure 61: Middle East and Africa Low Temperature Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Low Temperature Coatings Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Low Temperature Coatings Market Revenue Million Forecast, by Resin 2020 & 2033

- Table 2: Global Low Temperature Coatings Market Volume K Tons Forecast, by Resin 2020 & 2033

- Table 3: Global Low Temperature Coatings Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 4: Global Low Temperature Coatings Market Volume K Tons Forecast, by End-user 2020 & 2033

- Table 5: Global Low Temperature Coatings Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Low Temperature Coatings Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Global Low Temperature Coatings Market Revenue Million Forecast, by Resin 2020 & 2033

- Table 8: Global Low Temperature Coatings Market Volume K Tons Forecast, by Resin 2020 & 2033

- Table 9: Global Low Temperature Coatings Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 10: Global Low Temperature Coatings Market Volume K Tons Forecast, by End-user 2020 & 2033

- Table 11: Global Low Temperature Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Low Temperature Coatings Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: China Low Temperature Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: China Low Temperature Coatings Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: India Low Temperature Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: India Low Temperature Coatings Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Japan Low Temperature Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Japan Low Temperature Coatings Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: South Korea Low Temperature Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: South Korea Low Temperature Coatings Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Rest of Asia Pacific Low Temperature Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Low Temperature Coatings Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Global Low Temperature Coatings Market Revenue Million Forecast, by Resin 2020 & 2033

- Table 24: Global Low Temperature Coatings Market Volume K Tons Forecast, by Resin 2020 & 2033

- Table 25: Global Low Temperature Coatings Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 26: Global Low Temperature Coatings Market Volume K Tons Forecast, by End-user 2020 & 2033

- Table 27: Global Low Temperature Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global Low Temperature Coatings Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 29: United States Low Temperature Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United States Low Temperature Coatings Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Canada Low Temperature Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Canada Low Temperature Coatings Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 33: Mexico Low Temperature Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Mexico Low Temperature Coatings Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 35: Global Low Temperature Coatings Market Revenue Million Forecast, by Resin 2020 & 2033

- Table 36: Global Low Temperature Coatings Market Volume K Tons Forecast, by Resin 2020 & 2033

- Table 37: Global Low Temperature Coatings Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 38: Global Low Temperature Coatings Market Volume K Tons Forecast, by End-user 2020 & 2033

- Table 39: Global Low Temperature Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global Low Temperature Coatings Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 41: Germany Low Temperature Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Germany Low Temperature Coatings Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 43: United Kingdom Low Temperature Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: United Kingdom Low Temperature Coatings Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 45: Italy Low Temperature Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Italy Low Temperature Coatings Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 47: France Low Temperature Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: France Low Temperature Coatings Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 49: Rest of Europe Low Temperature Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Rest of Europe Low Temperature Coatings Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 51: Global Low Temperature Coatings Market Revenue Million Forecast, by Resin 2020 & 2033

- Table 52: Global Low Temperature Coatings Market Volume K Tons Forecast, by Resin 2020 & 2033

- Table 53: Global Low Temperature Coatings Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 54: Global Low Temperature Coatings Market Volume K Tons Forecast, by End-user 2020 & 2033

- Table 55: Global Low Temperature Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Global Low Temperature Coatings Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 57: Brazil Low Temperature Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Brazil Low Temperature Coatings Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 59: Argentina Low Temperature Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Argentina Low Temperature Coatings Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 61: Rest of South America Low Temperature Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of South America Low Temperature Coatings Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 63: Global Low Temperature Coatings Market Revenue Million Forecast, by Resin 2020 & 2033

- Table 64: Global Low Temperature Coatings Market Volume K Tons Forecast, by Resin 2020 & 2033

- Table 65: Global Low Temperature Coatings Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 66: Global Low Temperature Coatings Market Volume K Tons Forecast, by End-user 2020 & 2033

- Table 67: Global Low Temperature Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 68: Global Low Temperature Coatings Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 69: Saudi Arabia Low Temperature Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: Saudi Arabia Low Temperature Coatings Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 71: South Africa Low Temperature Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: South Africa Low Temperature Coatings Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 73: Rest of Middle East and Africa Low Temperature Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Rest of Middle East and Africa Low Temperature Coatings Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Low Temperature Coatings Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Low Temperature Coatings Market?

Key companies in the market include The Sherwin-Williams Company*List Not Exhaustive, Jotun, RPM International Inc, PPG Industries Inc, APV Engineered Coatings, Axalta Coating Systems, Hempel A/S, Akzo Nobel N V, BASF , Valspar (part of Sherwin-Williams), 3M.

3. What are the main segments of the Low Temperature Coatings Market?

The market segments include Resin, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 111.92 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increase in Energy Savings due to Reduction in Cure Temperatures; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Usage in the Automotive Industry.

7. Are there any restraints impacting market growth?

; Unsuitability in Thin Coating Applications; Impact of COVID-19 Pandemic.

8. Can you provide examples of recent developments in the market?

The development of new low-VOC and VOC-free coatings

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Low Temperature Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Low Temperature Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Low Temperature Coatings Market?

To stay informed about further developments, trends, and reports in the Low Temperature Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence