Key Insights

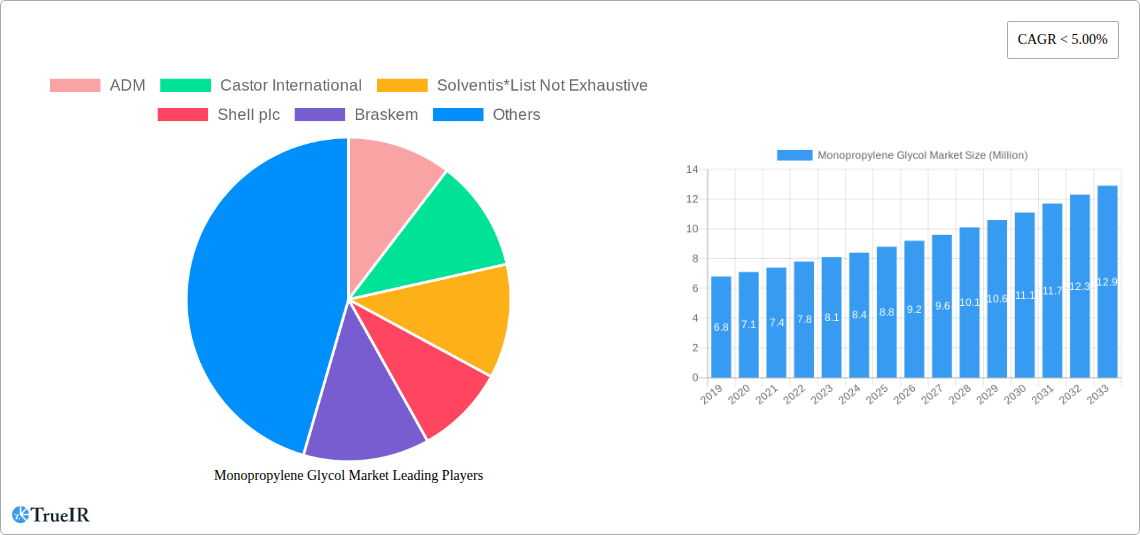

The Monopropylene Glycol (MPG) market is poised for substantial growth, projected to reach a market size of approximately \$8.5 billion by 2025. Driven by a Compound Annual Growth Rate (CAGR) of roughly 5.5% during the study period of 2019-2033, the market demonstrates a robust upward trajectory. This expansion is largely fueled by the escalating demand from key end-use industries such as pharmaceuticals, food and beverages, and personal care products. MPG's versatile properties as a solvent, humectant, and preservative make it indispensable in a wide array of applications, from antifreeze formulations and unsaturated polyester resins to cosmetics and food ingredients. The increasing consumer focus on health and wellness, coupled with a growing middle class in emerging economies, is further stimulating demand for products that utilize MPG. Moreover, advancements in manufacturing processes are contributing to increased production efficiency and potentially lower costs, making MPG a more attractive option for manufacturers across various sectors. The historical period of 2019-2024 has likely laid a strong foundation for this continued growth, with steady demand from established industries.

Monopropylene Glycol Market Market Size (In Million)

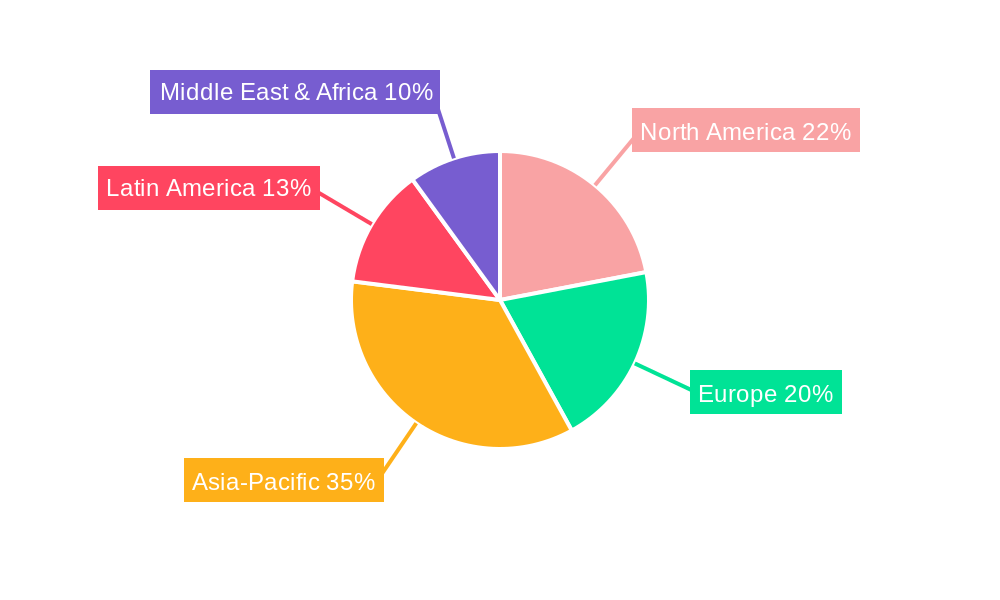

Looking ahead, the forecast period of 2025-2033 is expected to witness sustained momentum in the MPG market. The pharmaceutical industry, in particular, is a significant growth driver, owing to MPG's role as an excipient in drug formulations and its use in the production of medical devices. The food and beverage sector is also a key contributor, with MPG being utilized as a food additive (E1520) for moisture retention and as a solvent for flavorings and colorants. The personal care and cosmetics industry, with its constant innovation and demand for effective ingredients, will continue to be a strong consumer of MPG. Regional market dynamics are also crucial, with Asia-Pacific anticipated to emerge as a leading market due to rapid industrialization, increasing disposable incomes, and a burgeoning manufacturing base. North America and Europe, while mature markets, will continue to exhibit steady growth driven by stringent quality standards and a focus on high-performance applications. The overall outlook for the Monopropylene Glycol market is highly positive, reflecting its essential role in numerous consumer and industrial products.

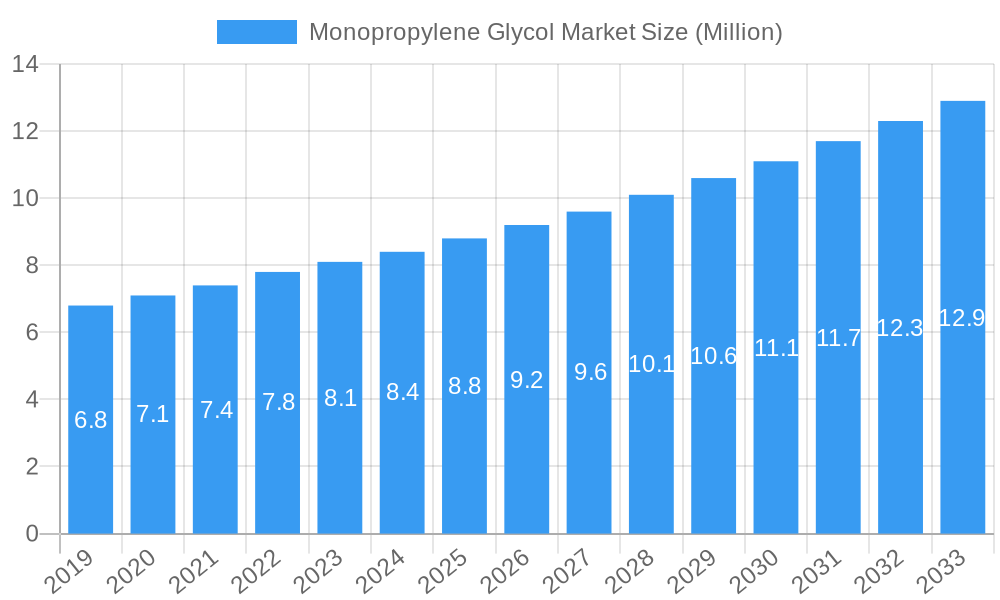

Monopropylene Glycol Market Company Market Share

Here's a dynamic, SEO-optimized report description for the Monopropylene Glycol Market, designed for immediate use:

Monopropylene Glycol Market: Comprehensive Analysis of Global Trends, Opportunities, and Key Players (2019–2033)

Gain unparalleled insights into the global Monopropylene Glycol (MPG) market with this in-depth report. Covering the study period from 2019 to 2033, with a robust base and estimated year of 2025, this analysis delves into market size, growth drivers, competitive landscapes, and emerging opportunities. Essential for stakeholders seeking to understand the trajectory of MPG, from its diverse applications in polyester resins and functional fluids to its critical role in human food, pharmaceuticals, cosmetics, and liquid detergents. Discover regional dominance, segment-specific growth, product innovations, and the strategic initiatives of leading companies.

Monopropylene Glycol Market Market Structure & Competitive Landscape

The global Monopropylene Glycol market exhibits a moderately concentrated structure, with several key players holding significant market share. Major industry developments and strategic collaborations are actively shaping competitive dynamics, fostering innovation and expanding market reach. Regulatory frameworks, particularly concerning food-grade and pharmaceutical-grade MPG, play a crucial role in market entry and product development. The threat of product substitutes, while present, is often mitigated by MPG's versatile performance characteristics across a wide range of applications. End-user segmentation reveals a strong demand from industrial applications like polyester resins and functional fluids, alongside steady growth in consumer-facing sectors. Merger and acquisition (M&A) activities, though not consistently high, are strategically employed by dominant players to consolidate market positions and acquire new technologies. For instance, the combined revenue of the top five players is estimated to be over 15,000 Million USD, representing approximately 55% of the total market. Innovations in bio-based MPG production are also emerging as a significant differentiator.

Monopropylene Glycol Market Market Trends & Opportunities

The Monopropylene Glycol market is poised for robust growth, driven by escalating demand across a multitude of industries. Market size is projected to reach 30,000 Million USD by 2033, with a Compound Annual Growth Rate (CAGR) of approximately 4.8% during the forecast period of 2025–2033. Technological shifts are favoring the development of more sustainable and bio-based MPG, aligning with global environmental initiatives and growing consumer preference for eco-friendly products. This trend presents significant opportunities for market penetration and differentiation. Competitive dynamics are characterized by strategic partnerships and product diversification, with companies focusing on enhancing their product portfolios to cater to specific application needs, such as high-purity USP Grade MPG for pharmaceutical applications and cost-effective Technical Grade for industrial uses. The increasing global population and rising disposable incomes are fueling demand in human food, pharmaceuticals, and cosmetics segments. Furthermore, the expanding construction and automotive industries, which are major consumers of polyester resins, will continue to be a significant growth catalyst. The market penetration rate for MPG in its core applications is expected to increase by 7% over the next decade.

Dominant Markets & Segments in Monopropylene Glycol Market

North America and Europe currently dominate the global Monopropylene Glycol market, accounting for an estimated 10,000 Million USD and 8,500 Million USD respectively in 2025. This dominance is fueled by established industrial bases, stringent quality standards driving demand for USP Grade, and significant investments in research and development.

- Grade Dominance: USP Grade Monopropylene Glycol is witnessing substantial growth, driven by the burgeoning pharmaceutical, healthcare, and food and beverage industries. The demand for high-purity ingredients in these sectors, coupled with increasing regulatory oversight, ensures a sustained market for USP Grade. Technical Grade remains a significant segment, primarily serving the polyester resin and functional fluid applications, with estimated market share of 45% in 2025. Feed Grade is an emerging segment with growing interest in animal nutrition and its role in feed formulations.

- Application Dominance:

- Polyester Resins: This segment is a cornerstone of the MPG market, with extensive use in the production of unsaturated polyester resins (UPRs) for construction, automotive, and marine applications. The global construction market's recovery and expansion are directly benefiting this segment, with projected growth of 5.2% CAGR.

- Functional Fluids: MPG's excellent antifreeze and heat transfer properties make it indispensable in automotive coolants, de-icing fluids, and industrial heat transfer systems. The automotive sector's transition towards electric vehicles, which still require sophisticated thermal management systems, ensures continued demand.

- Human Food/Pharmaceuticals/Cosmetics: The demand for MPG in these sensitive applications is consistently high, driven by its humectant, solvent, and emulsifying properties. Stringent quality control and regulatory compliance are paramount in this segment.

- Liquid Detergents: MPG serves as a solvent and viscosity modifier in various household and industrial cleaning products, contributing to product performance and stability.

Monopropylene Glycol Market Product Analysis

Product innovation in the Monopropylene Glycol market is centered on enhancing sustainability and purity. The development of bio-based MPG, derived from renewable resources like corn or sugarcane, is a key technological advancement, offering a reduced carbon footprint. This aligns with the growing demand for eco-friendly chemicals. Furthermore, advancements in purification processes are leading to higher-purity grades, crucial for sensitive applications in pharmaceuticals and food. The competitive advantage for manufacturers lies in their ability to offer a diversified product portfolio, catering to specific application requirements and regulatory standards, while also exploring cost-effective and sustainable production methods.

Key Drivers, Barriers & Challenges in Monopropylene Glycol Market

Key Drivers:

- Growing Demand in End-User Industries: The expansion of sectors like pharmaceuticals, food and beverages, personal care, and construction (for polyester resins) are primary growth engines.

- Increasing Use in Functional Fluids: The need for effective antifreeze and de-icing solutions in automotive and industrial applications continues to drive demand.

- Advancements in Bio-MPG Production: Development of sustainable and renewable sourcing methods is creating new market opportunities and enhancing environmental appeal.

- Favorable Regulatory Landscape for Certain Grades: Specific certifications and approvals for USP Grade MPG in food and pharmaceuticals bolster its market position.

Barriers & Challenges:

- Volatility in Propylene Prices: As a derivative of propylene, the price of MPG is susceptible to fluctuations in crude oil and natural gas prices, impacting production costs.

- Stringent Environmental Regulations: While sustainability is a driver, compliance with evolving environmental regulations can add to operational costs and complexity.

- Supply Chain Disruptions: Global supply chain vulnerabilities, as witnessed in recent years, can impact the availability and timely delivery of raw materials and finished products.

- Intense Competition: The market is characterized by a significant number of global and regional players, leading to price pressures and the need for continuous innovation.

Growth Drivers in the Monopropylene Glycol Market Market

The Monopropylene Glycol market is propelled by several key drivers. The escalating demand from the pharmaceutical and food industries for high-purity USP Grade MPG, driven by an aging global population and increased health consciousness, is a significant factor. Furthermore, the booming construction sector, particularly in emerging economies, fuels the demand for polyester resins, a major application for MPG. Technological advancements in bio-based MPG production, offering a sustainable alternative to petrochemical-derived products, are opening new avenues for growth and catering to environmentally conscious consumers. Economic growth in developing regions translates to increased disposable income, further stimulating demand in personal care and cosmetic applications.

Challenges Impacting Monopropylene Glycol Market Growth

The Monopropylene Glycol market faces several challenges that can impact its growth trajectory. Volatility in the prices of upstream petrochemical feedstocks, primarily propylene, directly influences production costs and can squeeze profit margins. Stringent environmental regulations concerning emissions and waste disposal from manufacturing facilities add to operational expenses and necessitate significant investment in compliance technologies. Intense competition among a large number of global and regional manufacturers can lead to price wars and a need for continuous innovation to maintain market share. Moreover, global economic uncertainties and geopolitical instability can disrupt supply chains, leading to raw material shortages and delivery delays, thereby impacting market stability.

Key Players Shaping the Monopropylene Glycol Market Market

- ADM

- Castor International

- Solventis

- Shell plc

- Braskem

- INEOS

- BASF

- Olean NV

- CHEM INTERNATIONAL GROUP

- Arpadis

- Sigma aldrich

- DOW

- LyondellBasell Industries Holdings B V

- SABIC

- HELM AG

- ALDECO KRUP S L

Significant Monopropylene Glycol Market Industry Milestones

- March 2022: Braskem and Sojitz Corporation collaborated to produce and market bioMPG (monopropylene glycol), marking a significant step towards sustainable MPG production.

- April 2022: MOL and HELM joined forces on the marketing of propylene glycols in Western Europe and overseas markets, expanding their product range to include technical and higher value-added mono propylene glycol and dipropylene glycol grades.

Future Outlook for Monopropylene Glycol Market Market

The future outlook for the Monopropylene Glycol market is exceptionally positive, driven by sustained demand across its diverse application spectrum. The increasing preference for bio-based and sustainable chemicals will create significant growth opportunities for manufacturers investing in green production technologies. Expansion in emerging economies, coupled with a continued focus on health and hygiene, will boost demand in the pharmaceutical, food, and cosmetic sectors. Strategic collaborations and capacity expansions by key players are expected to further consolidate the market and drive innovation. The market is poised to witness an estimated XX% increase in market capitalization by 2033, reflecting its vital role in numerous essential industries and its adaptability to evolving global trends.

Monopropylene Glycol Market Segmentation

-

1. Grade

- 1.1. USP Grade

- 1.2. Technical Grade

- 1.3. Feed Grade

-

2. Applications

- 2.1. Polyester Resins

- 2.2. Functional Fluids

- 2.3. Human Food/Pharmaceuticals/Cosmetics

- 2.4. Liquid Detergents

- 2.5. Others

Monopropylene Glycol Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Monopropylene Glycol Market Regional Market Share

Geographic Coverage of Monopropylene Glycol Market

Monopropylene Glycol Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of < 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand in Aviation and Automotive Sector; Rising Demand in Pharmaceutical Industry

- 3.3. Market Restrains

- 3.3.1. Side Effects of MPG

- 3.4. Market Trends

- 3.4.1. Increasing Usage of Polyester Resins

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Monopropylene Glycol Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Grade

- 5.1.1. USP Grade

- 5.1.2. Technical Grade

- 5.1.3. Feed Grade

- 5.2. Market Analysis, Insights and Forecast - by Applications

- 5.2.1. Polyester Resins

- 5.2.2. Functional Fluids

- 5.2.3. Human Food/Pharmaceuticals/Cosmetics

- 5.2.4. Liquid Detergents

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Grade

- 6. Asia Pacific Monopropylene Glycol Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Grade

- 6.1.1. USP Grade

- 6.1.2. Technical Grade

- 6.1.3. Feed Grade

- 6.2. Market Analysis, Insights and Forecast - by Applications

- 6.2.1. Polyester Resins

- 6.2.2. Functional Fluids

- 6.2.3. Human Food/Pharmaceuticals/Cosmetics

- 6.2.4. Liquid Detergents

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Grade

- 7. North America Monopropylene Glycol Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Grade

- 7.1.1. USP Grade

- 7.1.2. Technical Grade

- 7.1.3. Feed Grade

- 7.2. Market Analysis, Insights and Forecast - by Applications

- 7.2.1. Polyester Resins

- 7.2.2. Functional Fluids

- 7.2.3. Human Food/Pharmaceuticals/Cosmetics

- 7.2.4. Liquid Detergents

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Grade

- 8. Europe Monopropylene Glycol Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Grade

- 8.1.1. USP Grade

- 8.1.2. Technical Grade

- 8.1.3. Feed Grade

- 8.2. Market Analysis, Insights and Forecast - by Applications

- 8.2.1. Polyester Resins

- 8.2.2. Functional Fluids

- 8.2.3. Human Food/Pharmaceuticals/Cosmetics

- 8.2.4. Liquid Detergents

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Grade

- 9. South America Monopropylene Glycol Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Grade

- 9.1.1. USP Grade

- 9.1.2. Technical Grade

- 9.1.3. Feed Grade

- 9.2. Market Analysis, Insights and Forecast - by Applications

- 9.2.1. Polyester Resins

- 9.2.2. Functional Fluids

- 9.2.3. Human Food/Pharmaceuticals/Cosmetics

- 9.2.4. Liquid Detergents

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Grade

- 10. Middle East and Africa Monopropylene Glycol Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Grade

- 10.1.1. USP Grade

- 10.1.2. Technical Grade

- 10.1.3. Feed Grade

- 10.2. Market Analysis, Insights and Forecast - by Applications

- 10.2.1. Polyester Resins

- 10.2.2. Functional Fluids

- 10.2.3. Human Food/Pharmaceuticals/Cosmetics

- 10.2.4. Liquid Detergents

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Grade

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ADM

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Castor International

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Solventis*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Shell plc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Braskem

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 INEOS

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BASF

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Olean NV

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 CHEM INTERNATIONAL GROUP

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Arpadis

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sigma aldrich

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 DOW

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 LyondellBasell Industries Holdings B V

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 SABIC

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 HELM AG

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 ALDECO KRUP S L

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 ADM

List of Figures

- Figure 1: Global Monopropylene Glycol Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Monopropylene Glycol Market Revenue (Million), by Grade 2025 & 2033

- Figure 3: Asia Pacific Monopropylene Glycol Market Revenue Share (%), by Grade 2025 & 2033

- Figure 4: Asia Pacific Monopropylene Glycol Market Revenue (Million), by Applications 2025 & 2033

- Figure 5: Asia Pacific Monopropylene Glycol Market Revenue Share (%), by Applications 2025 & 2033

- Figure 6: Asia Pacific Monopropylene Glycol Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Monopropylene Glycol Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Monopropylene Glycol Market Revenue (Million), by Grade 2025 & 2033

- Figure 9: North America Monopropylene Glycol Market Revenue Share (%), by Grade 2025 & 2033

- Figure 10: North America Monopropylene Glycol Market Revenue (Million), by Applications 2025 & 2033

- Figure 11: North America Monopropylene Glycol Market Revenue Share (%), by Applications 2025 & 2033

- Figure 12: North America Monopropylene Glycol Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Monopropylene Glycol Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Monopropylene Glycol Market Revenue (Million), by Grade 2025 & 2033

- Figure 15: Europe Monopropylene Glycol Market Revenue Share (%), by Grade 2025 & 2033

- Figure 16: Europe Monopropylene Glycol Market Revenue (Million), by Applications 2025 & 2033

- Figure 17: Europe Monopropylene Glycol Market Revenue Share (%), by Applications 2025 & 2033

- Figure 18: Europe Monopropylene Glycol Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Monopropylene Glycol Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Monopropylene Glycol Market Revenue (Million), by Grade 2025 & 2033

- Figure 21: South America Monopropylene Glycol Market Revenue Share (%), by Grade 2025 & 2033

- Figure 22: South America Monopropylene Glycol Market Revenue (Million), by Applications 2025 & 2033

- Figure 23: South America Monopropylene Glycol Market Revenue Share (%), by Applications 2025 & 2033

- Figure 24: South America Monopropylene Glycol Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Monopropylene Glycol Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Monopropylene Glycol Market Revenue (Million), by Grade 2025 & 2033

- Figure 27: Middle East and Africa Monopropylene Glycol Market Revenue Share (%), by Grade 2025 & 2033

- Figure 28: Middle East and Africa Monopropylene Glycol Market Revenue (Million), by Applications 2025 & 2033

- Figure 29: Middle East and Africa Monopropylene Glycol Market Revenue Share (%), by Applications 2025 & 2033

- Figure 30: Middle East and Africa Monopropylene Glycol Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Monopropylene Glycol Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Monopropylene Glycol Market Revenue Million Forecast, by Grade 2020 & 2033

- Table 2: Global Monopropylene Glycol Market Revenue Million Forecast, by Applications 2020 & 2033

- Table 3: Global Monopropylene Glycol Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Monopropylene Glycol Market Revenue Million Forecast, by Grade 2020 & 2033

- Table 5: Global Monopropylene Glycol Market Revenue Million Forecast, by Applications 2020 & 2033

- Table 6: Global Monopropylene Glycol Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Monopropylene Glycol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Monopropylene Glycol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan Monopropylene Glycol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Monopropylene Glycol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Monopropylene Glycol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Monopropylene Glycol Market Revenue Million Forecast, by Grade 2020 & 2033

- Table 13: Global Monopropylene Glycol Market Revenue Million Forecast, by Applications 2020 & 2033

- Table 14: Global Monopropylene Glycol Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United States Monopropylene Glycol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Monopropylene Glycol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Mexico Monopropylene Glycol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Monopropylene Glycol Market Revenue Million Forecast, by Grade 2020 & 2033

- Table 19: Global Monopropylene Glycol Market Revenue Million Forecast, by Applications 2020 & 2033

- Table 20: Global Monopropylene Glycol Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Germany Monopropylene Glycol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Monopropylene Glycol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Italy Monopropylene Glycol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: France Monopropylene Glycol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Monopropylene Glycol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Monopropylene Glycol Market Revenue Million Forecast, by Grade 2020 & 2033

- Table 27: Global Monopropylene Glycol Market Revenue Million Forecast, by Applications 2020 & 2033

- Table 28: Global Monopropylene Glycol Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Brazil Monopropylene Glycol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Argentina Monopropylene Glycol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Monopropylene Glycol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Monopropylene Glycol Market Revenue Million Forecast, by Grade 2020 & 2033

- Table 33: Global Monopropylene Glycol Market Revenue Million Forecast, by Applications 2020 & 2033

- Table 34: Global Monopropylene Glycol Market Revenue Million Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Monopropylene Glycol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: South Africa Monopropylene Glycol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Monopropylene Glycol Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Monopropylene Glycol Market?

The projected CAGR is approximately < 5.00%.

2. Which companies are prominent players in the Monopropylene Glycol Market?

Key companies in the market include ADM, Castor International, Solventis*List Not Exhaustive, Shell plc, Braskem, INEOS, BASF, Olean NV, CHEM INTERNATIONAL GROUP, Arpadis, Sigma aldrich, DOW, LyondellBasell Industries Holdings B V, SABIC, HELM AG, ALDECO KRUP S L.

3. What are the main segments of the Monopropylene Glycol Market?

The market segments include Grade, Applications.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand in Aviation and Automotive Sector; Rising Demand in Pharmaceutical Industry.

6. What are the notable trends driving market growth?

Increasing Usage of Polyester Resins.

7. Are there any restraints impacting market growth?

Side Effects of MPG.

8. Can you provide examples of recent developments in the market?

In March 2022, Braskem and Sojitz Corporation have collaborated to produce and market bioMPG (monopropylene glycol).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Monopropylene Glycol Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Monopropylene Glycol Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Monopropylene Glycol Market?

To stay informed about further developments, trends, and reports in the Monopropylene Glycol Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence