Key Insights

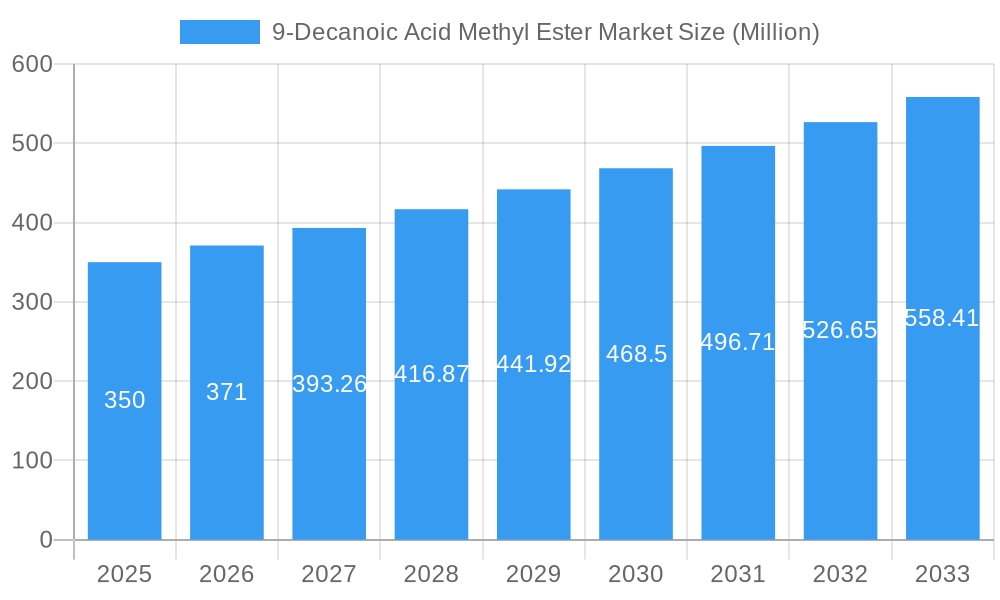

The 9-Decanoic Acid Methyl Ester market is projected for substantial expansion, estimated to reach $89.6 million by 2025, driven by a CAGR of 6% through 2033. Key growth drivers include surging demand from the personal care sector for its emollient properties in cosmetics and skincare, and from the pharmaceutical industry as a versatile solvent and intermediate. Its unique aroma also fuels demand in the flavors and fragrances sector. A significant trend is the increasing preference for natural and sustainably sourced 9-Decanoic Acid Methyl Ester, prompting manufacturers to adopt bio-based production methods. The Asia Pacific region, led by China and India, is a key growth area due to expanding consumer markets and manufacturing capabilities.

9-Decanoic Acid Methyl Ester Market Market Size (In Million)

Potential market restraints include raw material price volatility for fatty acids and methanol, and stringent regulatory compliance for chemical compounds in personal care and pharmaceuticals. However, ongoing research and development focused on optimizing production efficiency, reducing environmental impact, and discovering new applications are expected to offset these challenges. Innovations in synthetic pathways will be crucial for sustained growth. As demand for high-performance ingredients in consumer goods and pharmaceuticals escalates, the 9-Decanoic Acid Methyl Ester market, with North America and Europe as established markets alongside the rapidly growing Asia Pacific, is poised for continued success.

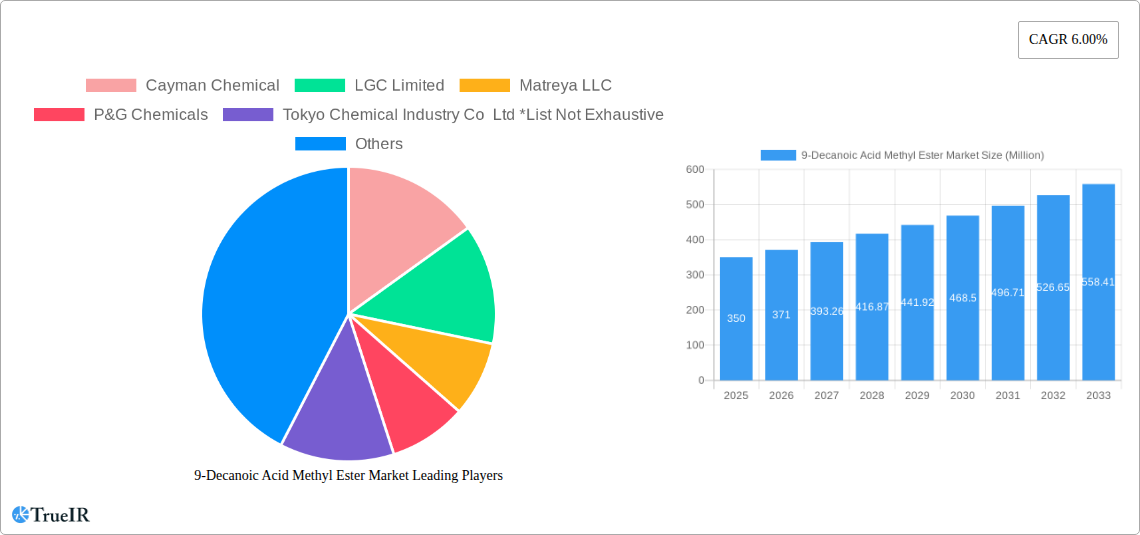

9-Decanoic Acid Methyl Ester Market Company Market Share

9-Decanoic Acid Methyl Ester Market Market Structure & Competitive Landscape

The 9-Decanoic Acid Methyl Ester market exhibits a moderately concentrated structure, with a blend of established chemical manufacturers and specialized ingredient suppliers. Key players like Cayman Chemical, LGC Limited, Matreya LLC, P&G Chemicals, and Tokyo Chemical Industry Co Ltd, though not an exhaustive list, significantly influence market dynamics through their robust product portfolios and established distribution networks. Innovation drivers revolve around enhancing product purity, developing sustainable production methods, and catering to specific application requirements, particularly in the high-growth personal care and pharmaceutical sectors. Regulatory impacts, while generally favorable for high-purity chemical intermediates, necessitate stringent quality control and adherence to international standards. Product substitutes, primarily other medium-chain fatty acid methyl esters or naturally derived emollients, present a moderate competitive threat, with the choice often dictated by cost, performance, and desired product attributes. End-user segmentation reveals a strong reliance on the personal care industry for emollients and fragrance components, followed by the pharmaceutical sector for excipients and intermediates. The Flavors and Fragrances segment also contributes significantly. Merger and acquisition (M&A) trends are nascent but indicate potential consolidation among smaller players seeking scale or access to advanced manufacturing technologies. Over the study period (2019-2033), we anticipate an increase in strategic partnerships and targeted acquisitions aimed at expanding geographical reach and technological capabilities. The concentration ratio for the top 5 players is estimated to be around 45% in 2025, with potential for slight shifts due to M&A activity.

9-Decanoic Acid Methyl Ester Market Market Trends & Opportunities

The global 9-Decanoic Acid Methyl Ester market is poised for robust growth, driven by an escalating demand for high-performance ingredients across various consumer and industrial applications. Market size is projected to expand from approximately $150 Million in 2019 to an estimated $290 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of around 4.5% from 2025 to 2033. This growth is underpinned by significant technological shifts, including advancements in enzymatic synthesis and green chemistry processes, leading to more sustainable and cost-effective production of methyl decanoate. Consumer preferences are increasingly leaning towards natural and bio-based ingredients, creating opportunities for manufacturers of naturally derived 9-decanoic acid methyl ester. This trend is particularly evident in the personal care sector, where consumers actively seek products with transparent ingredient lists and environmentally friendly sourcing.

The pharmaceutical industry continues to be a stable driver, utilizing 9-decanoic acid methyl ester as an excipient and an intermediate in the synthesis of various active pharmaceutical ingredients (APIs). The demand here is often characterized by stringent quality requirements and regulatory compliance. In the Flavors and Fragrances segment, its characteristic fruity and waxy notes make it a valuable component in a wide array of formulations, contributing to its consistent demand. Competitive dynamics are characterized by price sensitivity, product quality, and the ability to offer customized solutions. Companies are investing in research and development to enhance product purity, explore novel applications, and optimize production yields. The market penetration rate for 9-decanoic acid methyl ester, while already substantial in developed economies, is expected to witness considerable growth in emerging markets as disposable incomes rise and consumer awareness regarding product ingredients increases. Opportunities lie in developing specialized grades for niche applications, such as biodegradable lubricants or advanced material science, further diversifying the market's revenue streams. The anticipated market size in the base year of 2025 is projected to be around $210 Million.

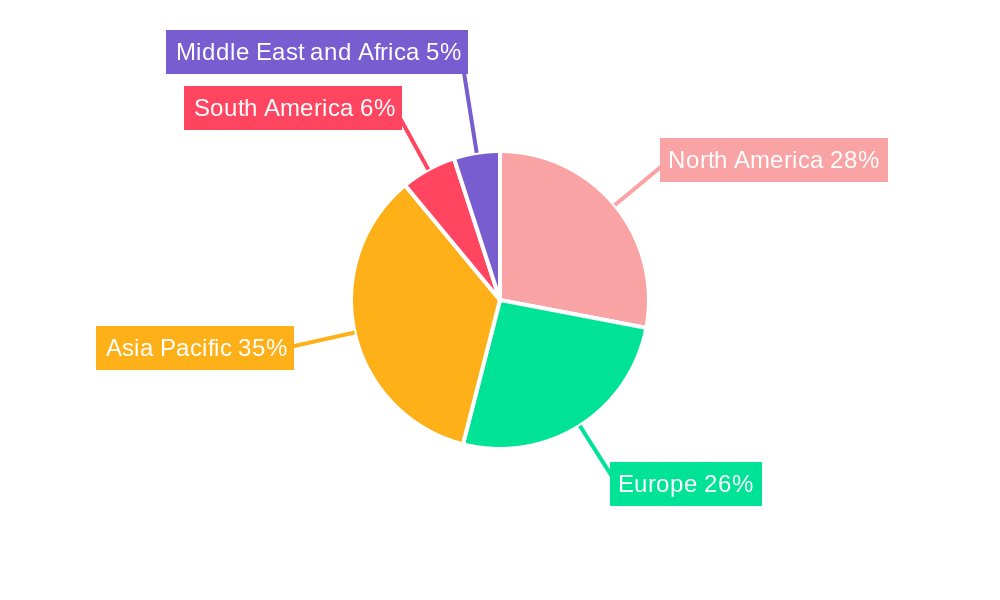

Dominant Markets & Segments in 9-Decanoic Acid Methyl Ester Market

The 9-Decanoic Acid Methyl Ester market is characterized by distinct regional dominance and segment leadership, driven by specific application needs and market maturity. Geographically, North America and Europe currently represent the largest markets due to their advanced industrial infrastructure, strong presence of key end-user industries like personal care and pharmaceuticals, and high consumer spending power. Within these regions, countries like the United States, Germany, and the United Kingdom are significant contributors. However, the Asia-Pacific region, particularly China and India, is emerging as a high-growth market, propelled by rapidly industrializing economies, a burgeoning middle class, and increasing domestic demand for cosmetics and pharmaceuticals.

In terms of Product Type, the Synthetic 9-Decanoic Acid Methyl Ester segment holds a dominant position. This is primarily due to its cost-effectiveness in large-scale production, consistent purity, and broader availability to meet the high-volume demands of industrial applications. While Natural 9-Decanoic Acid Methyl Ester is gaining traction due to the ‘green’ trend, its production scalability and cost remain comparative limitations for mass market penetration.

Analyzing by Application, the Personal Care segment is the most dominant. This is attributed to the extensive use of methyl decanoate as an emollient, solvent, and fragrance ingredient in a wide range of cosmetic and personal hygiene products, including creams, lotions, soaps, and hair care formulations. Its skin-conditioning properties and mild nature make it highly desirable. The Flavors and Fragrances segment also plays a crucial role, contributing significantly to the market's value by providing characteristic scent and flavor profiles in food products and perfumes. The Pharmaceuticals segment, while representing a smaller volume, is a high-value segment due to the stringent quality requirements and higher pricing for pharmaceutical-grade ingredients used as excipients or intermediates in drug formulations. Key growth drivers for dominance in these segments include supportive government policies promoting domestic manufacturing, increasing investments in R&D for product enhancement, and evolving consumer preferences for high-quality, performance-driven ingredients. The market size for the Personal Care segment is estimated to be approximately 40% of the total market in 2025.

9-Decanoic Acid Methyl Ester Market Product Analysis

9-Decanoic Acid Methyl Ester, also known as methyl decanoate, is a key ester of decanoic acid. Its primary appeal lies in its excellent emollient properties, low viscosity, and mild, fruity aroma, making it a versatile ingredient. Technological advancements have focused on improving its purity levels, particularly for pharmaceutical applications, and developing sustainable synthesis routes. The competitive advantage of 9-decanoic acid methyl ester stems from its balanced performance profile: it effectively conditions the skin without feeling greasy, acts as an efficient solvent for other ingredients, and imparts desirable olfactory notes. Its compatibility with a wide range of cosmetic and pharmaceutical formulations further enhances its market fit.

Key Drivers, Barriers & Challenges in 9-Decanoic Acid Methyl Ester Market

Key Drivers:

- Growing Demand in Personal Care: The rising global demand for cosmetic and skincare products, driven by increasing disposable incomes and evolving beauty trends, is a primary growth catalyst.

- Pharmaceutical Applications: Its use as an excipient and intermediate in drug formulations provides a steady and high-value demand.

- Technological Advancements: Innovations in sustainable production methods and enhanced purity are improving its market appeal.

- Expanding Emerging Markets: Increasing consumer awareness and industrialization in regions like Asia-Pacific are opening new avenues for growth.

Key Barriers & Challenges:

- Raw Material Price Volatility: Fluctuations in the prices of feedstock, particularly coconut oil or palm kernel oil derivatives, can impact production costs and profit margins.

- Regulatory Scrutiny: Stringent quality control and regulatory compliance, especially for pharmaceutical-grade products, can increase operational expenses.

- Competition from Substitutes: The availability of other natural oils, synthetic emollients, and alternative esters presents a competitive challenge.

- Supply Chain Disruptions: Geopolitical factors, natural disasters, or logistical challenges can disrupt the steady supply of raw materials and finished products. The impact of raw material volatility on production costs can be as high as 15% depending on market conditions.

Growth Drivers in the 9-Decanoic Acid Methyl Ester Market Market

The 9-Decanoic Acid Methyl Ester market is propelled by several key growth drivers. Technologically, advancements in green chemistry and enzymatic esterification processes are enabling more sustainable and cost-efficient production, appealing to environmentally conscious consumers and manufacturers. Economically, the rising global disposable income, particularly in emerging economies, fuels the demand for premium personal care products, where methyl decanoate is a valued ingredient for its emollient and sensory properties. Regulatory factors, such as increasing approval of fatty acid esters in cosmetic and pharmaceutical formulations, also contribute positively. Furthermore, the growing trend of "clean beauty" and the preference for natural or naturally derived ingredients present a significant opportunity for sustainably sourced 9-decanoic acid methyl ester.

Challenges Impacting 9-Decanoic Acid Methyl Ester Market Growth

Several challenges can impact the growth of the 9-Decanoic Acid Methyl Ester market. Regulatory complexities, particularly concerning ingredient safety, labeling, and environmental impact assessments in different regions, can pose hurdles for market entry and product expansion. Supply chain issues, including the availability and price volatility of key raw materials like palm or coconut derivatives, can lead to unpredictable production costs and affect profit margins. Competitive pressures from alternative emollients, natural oils, and other ester derivatives necessitate continuous innovation and cost optimization. The estimated impact of supply chain disruptions on project timelines can be up to 10-15%.

Key Players Shaping the 9-Decanoic Acid Methyl Ester Market Market

- Cayman Chemical

- LGC Limited

- Matreya LLC

- P&G Chemicals

- Tokyo Chemical Industry Co Ltd

Significant 9-Decanoic Acid Methyl Ester Market Industry Milestones

- 2020: Increased focus on sustainable sourcing and production methods for 9-Decanoic Acid Methyl Ester by major manufacturers.

- 2021: Introduction of enhanced purity grades of methyl decanoate for advanced pharmaceutical applications.

- 2022: Growing consumer demand for "clean label" personal care products driving the market for naturally derived 9-Decanoic Acid Methyl Ester.

- 2023: Exploration of new applications in biodegradable lubricants and specialty chemicals.

Future Outlook for 9-Decanoic Acid Methyl Ester Market Market

The future outlook for the 9-Decanoic Acid Methyl Ester market is highly promising, driven by sustained demand from its core application sectors and emerging opportunities. Continued innovation in sustainable production technologies, coupled with the increasing consumer preference for natural and high-performance ingredients, will further solidify its market position. Strategic collaborations and potential consolidation among key players are anticipated to shape the competitive landscape. Growth catalysts include the expanding personal care and pharmaceutical industries in developing economies and the potential for novel applications in bio-based materials. The market is projected to witness steady growth, with a strong emphasis on product quality, regulatory compliance, and environmental responsibility. The estimated market size in 2033 is projected to reach $290 Million.

9-Decanoic Acid Methyl Ester Market Segmentation

-

1. Product Type

- 1.1. Natural 9-Decanoic Acid Methyl Ester

- 1.2. Synthetic 9-Decanoic Acid Methyl Ester

-

2. Application

- 2.1. Personal Care

- 2.2. Pharmaceuticals

- 2.3. Flavors and Fragnances

9-Decanoic Acid Methyl Ester Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

9-Decanoic Acid Methyl Ester Market Regional Market Share

Geographic Coverage of 9-Decanoic Acid Methyl Ester Market

9-Decanoic Acid Methyl Ester Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Significant Demand from Personal Care Segment; Increased Demand for Flavors and Fragnances

- 3.3. Market Restrains

- 3.3.1. ; Significant Demand from Personal Care Segment; Increased Demand for Flavors and Fragnances

- 3.4. Market Trends

- 3.4.1. Significant Demand from Personal Care Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global 9-Decanoic Acid Methyl Ester Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Natural 9-Decanoic Acid Methyl Ester

- 5.1.2. Synthetic 9-Decanoic Acid Methyl Ester

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Personal Care

- 5.2.2. Pharmaceuticals

- 5.2.3. Flavors and Fragnances

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Asia Pacific 9-Decanoic Acid Methyl Ester Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Natural 9-Decanoic Acid Methyl Ester

- 6.1.2. Synthetic 9-Decanoic Acid Methyl Ester

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Personal Care

- 6.2.2. Pharmaceuticals

- 6.2.3. Flavors and Fragnances

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. North America 9-Decanoic Acid Methyl Ester Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Natural 9-Decanoic Acid Methyl Ester

- 7.1.2. Synthetic 9-Decanoic Acid Methyl Ester

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Personal Care

- 7.2.2. Pharmaceuticals

- 7.2.3. Flavors and Fragnances

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe 9-Decanoic Acid Methyl Ester Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Natural 9-Decanoic Acid Methyl Ester

- 8.1.2. Synthetic 9-Decanoic Acid Methyl Ester

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Personal Care

- 8.2.2. Pharmaceuticals

- 8.2.3. Flavors and Fragnances

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America 9-Decanoic Acid Methyl Ester Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Natural 9-Decanoic Acid Methyl Ester

- 9.1.2. Synthetic 9-Decanoic Acid Methyl Ester

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Personal Care

- 9.2.2. Pharmaceuticals

- 9.2.3. Flavors and Fragnances

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa 9-Decanoic Acid Methyl Ester Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Natural 9-Decanoic Acid Methyl Ester

- 10.1.2. Synthetic 9-Decanoic Acid Methyl Ester

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Personal Care

- 10.2.2. Pharmaceuticals

- 10.2.3. Flavors and Fragnances

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Cayman Chemical

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 LGC Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Matreya LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 P&G Chemicals

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Tokyo Chemical Industry Co Ltd *List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 Cayman Chemical

List of Figures

- Figure 1: Global 9-Decanoic Acid Methyl Ester Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific 9-Decanoic Acid Methyl Ester Market Revenue (million), by Product Type 2025 & 2033

- Figure 3: Asia Pacific 9-Decanoic Acid Methyl Ester Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Asia Pacific 9-Decanoic Acid Methyl Ester Market Revenue (million), by Application 2025 & 2033

- Figure 5: Asia Pacific 9-Decanoic Acid Methyl Ester Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific 9-Decanoic Acid Methyl Ester Market Revenue (million), by Country 2025 & 2033

- Figure 7: Asia Pacific 9-Decanoic Acid Methyl Ester Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America 9-Decanoic Acid Methyl Ester Market Revenue (million), by Product Type 2025 & 2033

- Figure 9: North America 9-Decanoic Acid Methyl Ester Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: North America 9-Decanoic Acid Methyl Ester Market Revenue (million), by Application 2025 & 2033

- Figure 11: North America 9-Decanoic Acid Methyl Ester Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America 9-Decanoic Acid Methyl Ester Market Revenue (million), by Country 2025 & 2033

- Figure 13: North America 9-Decanoic Acid Methyl Ester Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe 9-Decanoic Acid Methyl Ester Market Revenue (million), by Product Type 2025 & 2033

- Figure 15: Europe 9-Decanoic Acid Methyl Ester Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Europe 9-Decanoic Acid Methyl Ester Market Revenue (million), by Application 2025 & 2033

- Figure 17: Europe 9-Decanoic Acid Methyl Ester Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe 9-Decanoic Acid Methyl Ester Market Revenue (million), by Country 2025 & 2033

- Figure 19: Europe 9-Decanoic Acid Methyl Ester Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America 9-Decanoic Acid Methyl Ester Market Revenue (million), by Product Type 2025 & 2033

- Figure 21: South America 9-Decanoic Acid Methyl Ester Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America 9-Decanoic Acid Methyl Ester Market Revenue (million), by Application 2025 & 2033

- Figure 23: South America 9-Decanoic Acid Methyl Ester Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America 9-Decanoic Acid Methyl Ester Market Revenue (million), by Country 2025 & 2033

- Figure 25: South America 9-Decanoic Acid Methyl Ester Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa 9-Decanoic Acid Methyl Ester Market Revenue (million), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa 9-Decanoic Acid Methyl Ester Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa 9-Decanoic Acid Methyl Ester Market Revenue (million), by Application 2025 & 2033

- Figure 29: Middle East and Africa 9-Decanoic Acid Methyl Ester Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa 9-Decanoic Acid Methyl Ester Market Revenue (million), by Country 2025 & 2033

- Figure 31: Middle East and Africa 9-Decanoic Acid Methyl Ester Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global 9-Decanoic Acid Methyl Ester Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Global 9-Decanoic Acid Methyl Ester Market Revenue million Forecast, by Application 2020 & 2033

- Table 3: Global 9-Decanoic Acid Methyl Ester Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global 9-Decanoic Acid Methyl Ester Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 5: Global 9-Decanoic Acid Methyl Ester Market Revenue million Forecast, by Application 2020 & 2033

- Table 6: Global 9-Decanoic Acid Methyl Ester Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: China 9-Decanoic Acid Methyl Ester Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: India 9-Decanoic Acid Methyl Ester Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Japan 9-Decanoic Acid Methyl Ester Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: South Korea 9-Decanoic Acid Methyl Ester Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific 9-Decanoic Acid Methyl Ester Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global 9-Decanoic Acid Methyl Ester Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 13: Global 9-Decanoic Acid Methyl Ester Market Revenue million Forecast, by Application 2020 & 2033

- Table 14: Global 9-Decanoic Acid Methyl Ester Market Revenue million Forecast, by Country 2020 & 2033

- Table 15: United States 9-Decanoic Acid Methyl Ester Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Canada 9-Decanoic Acid Methyl Ester Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Mexico 9-Decanoic Acid Methyl Ester Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Global 9-Decanoic Acid Methyl Ester Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 19: Global 9-Decanoic Acid Methyl Ester Market Revenue million Forecast, by Application 2020 & 2033

- Table 20: Global 9-Decanoic Acid Methyl Ester Market Revenue million Forecast, by Country 2020 & 2033

- Table 21: Germany 9-Decanoic Acid Methyl Ester Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom 9-Decanoic Acid Methyl Ester Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: France 9-Decanoic Acid Methyl Ester Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Italy 9-Decanoic Acid Methyl Ester Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe 9-Decanoic Acid Methyl Ester Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Global 9-Decanoic Acid Methyl Ester Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 27: Global 9-Decanoic Acid Methyl Ester Market Revenue million Forecast, by Application 2020 & 2033

- Table 28: Global 9-Decanoic Acid Methyl Ester Market Revenue million Forecast, by Country 2020 & 2033

- Table 29: Brazil 9-Decanoic Acid Methyl Ester Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Argentina 9-Decanoic Acid Methyl Ester Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America 9-Decanoic Acid Methyl Ester Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Global 9-Decanoic Acid Methyl Ester Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 33: Global 9-Decanoic Acid Methyl Ester Market Revenue million Forecast, by Application 2020 & 2033

- Table 34: Global 9-Decanoic Acid Methyl Ester Market Revenue million Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia 9-Decanoic Acid Methyl Ester Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: South Africa 9-Decanoic Acid Methyl Ester Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa 9-Decanoic Acid Methyl Ester Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the 9-Decanoic Acid Methyl Ester Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the 9-Decanoic Acid Methyl Ester Market?

Key companies in the market include Cayman Chemical, LGC Limited, Matreya LLC, P&G Chemicals, Tokyo Chemical Industry Co Ltd *List Not Exhaustive.

3. What are the main segments of the 9-Decanoic Acid Methyl Ester Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 89.6 million as of 2022.

5. What are some drivers contributing to market growth?

; Significant Demand from Personal Care Segment; Increased Demand for Flavors and Fragnances.

6. What are the notable trends driving market growth?

Significant Demand from Personal Care Segment.

7. Are there any restraints impacting market growth?

; Significant Demand from Personal Care Segment; Increased Demand for Flavors and Fragnances.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "9-Decanoic Acid Methyl Ester Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the 9-Decanoic Acid Methyl Ester Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the 9-Decanoic Acid Methyl Ester Market?

To stay informed about further developments, trends, and reports in the 9-Decanoic Acid Methyl Ester Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence