Key Insights

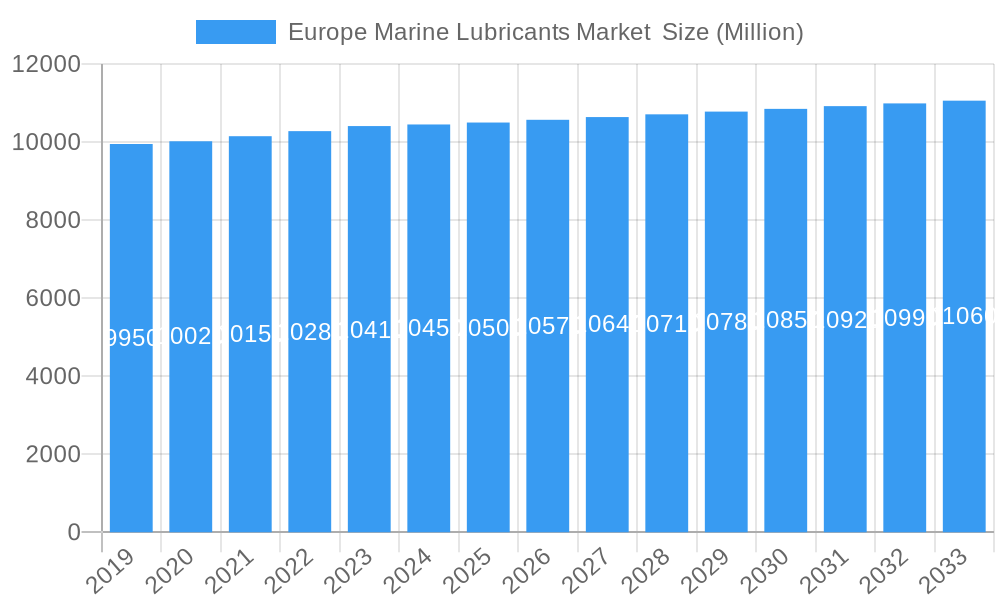

The Europe Marine Lubricants Market is projected to reach a significant size of 14.07 billion by 2033, driven by a Compound Annual Growth Rate (CAGR) of 10.7% from the base year 2025. Key growth drivers include the escalating demand for high-performance lubricants that enhance fuel efficiency and extend equipment life in modern marine vessels. Stricter environmental regulations from bodies like the International Maritime Organization (IMO), mandating lower-sulfur fuels, are accelerating the adoption of advanced marine lubricants to manage combustion byproducts. Continuous advancements in marine engine technology necessitate specialized lubrication solutions, further fueling market expansion. Europe's robust shipping infrastructure and substantial maritime trade also reinforce demand.

Europe Marine Lubricants Market Market Size (In Billion)

Despite positive growth prospects, the market faces challenges. Crude oil price volatility impacts manufacturing costs for mineral oil-based lubricants. The increasing adoption of alternative fuels such as LNG, methanol, and ammonia poses a long-term threat, as these require distinct lubrication formulations and may reduce demand for traditional lubricants. The initial investment in synthetic and bio-based lubricants, though offering superior performance and environmental advantages, can be a barrier. The market is segmented by product type, including system oil, marine cylinder lubricants, trunk piston engine oil, gear oil, greases, and hydraulic fluids. System oil and marine cylinder lubricants typically dominate market share due to their critical role in engine protection. Leading companies like Shell Plc, Exxon Mobil Corporation, and BP p.l.c. are actively innovating to meet evolving industry needs and regulatory requirements.

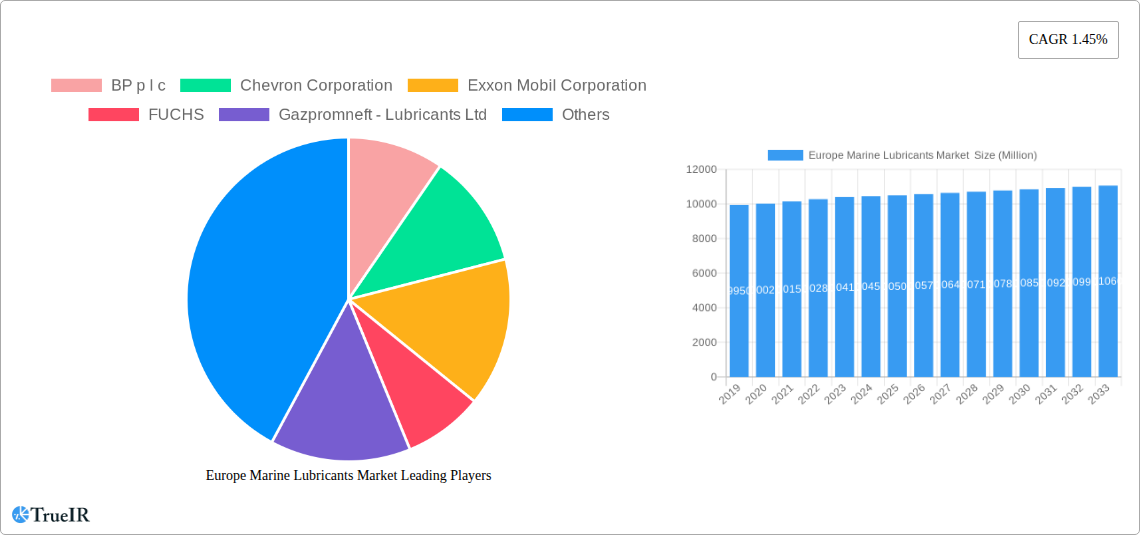

Europe Marine Lubricants Market Company Market Share

This comprehensive report provides an in-depth analysis of the Europe Marine Lubricants Market for the period 2025–2033, with 2025 as the base year. It offers crucial insights into market size, growth, competitive strategies, and emerging opportunities within this vital maritime sector.

Europe Marine Lubricants Market Market Structure & Competitive Landscape

The Europe Marine Lubricants Market exhibits a moderately concentrated structure, with leading global players dominating a significant share of the market. Key innovation drivers revolve around the development of environmentally friendly lubricants that meet stringent regulatory requirements, such as the IMO 2020 sulfur cap and EU emission standards. Regulatory impacts are profound, influencing product formulations and demanding greater sustainability. Product substitutes, while present in niche applications, have limited widespread adoption due to performance requirements. End-user segmentation is primarily driven by vessel type and operational needs, including container ships, tankers, bulk carriers, and offshore support vessels. Mergers and acquisitions (M&A) trends are evident as major companies seek to consolidate market presence, expand product portfolios, and enhance their geographical reach. For instance, M&A activity volume in the European marine lubricants sector has seen an estimated increase of 10-15% annually over the historical period, reflecting strategic consolidations. Concentration ratios for the top five players are estimated to be around 65-70%, indicating a competitive yet consolidated market.

Europe Marine Lubricants Market Market Trends & Opportunities

The Europe Marine Lubricants Market is poised for significant expansion, driven by a confluence of robust economic activity, increasing global trade volumes, and a sustained focus on environmental compliance. The market size is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 4.5% from 2025 to 2033. Technological shifts are paramount, with a pronounced trend towards the adoption of advanced synthetic and bio-based marine lubricants designed to enhance engine efficiency, extend service intervals, and minimize environmental impact. Consumer preferences are increasingly leaning towards sustainable and low-sulfur lubricant solutions, directly influenced by evolving environmental regulations and corporate sustainability goals. Competitive dynamics are intensifying, with companies investing heavily in research and development to introduce next-generation lubricants that offer superior performance under challenging marine conditions, including extreme temperatures and pressures. The penetration rate of advanced lubricant technologies, such as biodegradable options, is expected to rise from an estimated 15% in 2024 to over 30% by 2033. Opportunities abound in developing specialized lubricants for emerging vessel technologies like LNG-powered ships and hybrid-electric propulsion systems. Furthermore, the digitalization of supply chains and lubricant management services presents a significant avenue for differentiation and value creation for market participants. The ongoing expansion of port infrastructure across Europe also fuels demand for a consistent and reliable supply of high-performance marine lubricants, supporting increased maritime traffic and operational efficiency. The growing awareness of total cost of ownership, beyond just the initial purchase price, is pushing ship owners towards lubricants that offer long-term benefits in terms of reduced maintenance and operational downtime.

Dominant Markets & Segments in Europe Marine Lubricants Market

The Mineral Oil base stock segment continues to hold a dominant position within the Europe Marine Lubricants Market, primarily due to its established cost-effectiveness and widespread availability across various marine applications. However, the Synthetic Oil segment is experiencing rapid growth, driven by its superior performance characteristics, including enhanced thermal stability, oxidation resistance, and extended drain intervals, crucial for modern, high-efficiency marine engines. Bio-Based Oils represent a nascent but rapidly expanding segment, propelled by stringent environmental regulations and a growing demand for sustainable maritime operations.

Product Type Dominance:

- Trunk Piston Engine Oil (TPEO): This segment is a significant revenue generator, essential for the operation of medium-speed diesel engines found in a wide range of vessels. Growth is fueled by the ongoing operation and new builds of these engine types.

- Marine Cylinder Lubricants (MCLs): Crucial for the lubrication of large two-stroke engines in large commercial vessels, MCLs are directly impacted by the shift towards lower sulfur fuels and the adoption of exhaust gas cleaning systems (scrubbers).

- System Oil: Essential for the lubrication of various onboard systems, including pumps and steering gear, this segment benefits from overall maritime activity growth.

- Gear Oil & Hydraulic Fluids: These segments are vital for the mechanical and operational integrity of vessels, experiencing steady demand tied to vessel maintenance and operational requirements.

Geographical Dominance: While the overall Europe market is the focus, countries with extensive port infrastructure and significant maritime traffic, such as Germany, the Netherlands, and the United Kingdom, are key consumption hubs. The increasing focus on emission control zones (ECZs) within European waters further stimulates demand for compliant lubricant solutions.

Europe Marine Lubricants Market Product Analysis

The Europe Marine Lubricants Market is characterized by continuous product innovation aimed at meeting evolving performance and environmental demands. Manufacturers are actively developing advanced lubricant formulations that offer superior protection against wear and corrosion, enhance fuel efficiency, and are compatible with new engine technologies and fuel types, including LNG and methanol. The competitive advantage lies in products that provide extended drain intervals, reduce operational costs, and comply with stringent environmental regulations such as those concerning biodegradability and sulfur content.

Key Drivers, Barriers & Challenges in Europe Marine Lubricants Market

Key Drivers: The primary forces propelling the Europe Marine Lubricants Market include stringent environmental regulations, such as the IMO 2020 sulfur cap and upcoming EU emission targets, which necessitate the use of advanced lubricants. Technological advancements in marine engine design, leading to higher operating pressures and temperatures, also drive demand for higher-performance lubricants. Economic recovery and growth in global trade are fundamental drivers, increasing maritime activity and thus lubricant consumption.

Barriers & Challenges: Key challenges include the fluctuating price of crude oil, which impacts base oil costs and thus lubricant pricing. Regulatory complexities and the need for continuous product reformulation to meet new standards present significant R&D hurdles. Supply chain disruptions, as seen in recent global events, can affect the availability and cost of raw materials. Intense competition among established players and the threat of generic product offerings also pose challenges, with estimated impacts on profit margins of 5-10% during periods of price volatility.

Growth Drivers in the Europe Marine Lubricants Market Market

The Europe Marine Lubricants Market is driven by several interconnected factors. Increasingly stringent environmental regulations, particularly those related to sulfur emissions and the push for greener maritime operations, are compelling the adoption of advanced, eco-friendly lubricant solutions. Technological advancements in marine engine design, leading to more efficient yet demanding operating conditions, necessitate higher-performance lubricants that can withstand extreme temperatures and pressures. Furthermore, a projected recovery and sustained growth in global trade volumes directly translate to increased maritime traffic and, consequently, higher demand for essential marine lubricants.

Challenges Impacting Europe Marine Lubricants Market Growth

Regulatory complexities and the ever-evolving landscape of environmental mandates present a significant hurdle, requiring continuous investment in R&D and product reformulation for compliance. Supply chain vulnerabilities, exacerbated by geopolitical events and logistical challenges, can lead to material shortages and price volatility, impacting both production costs and product availability. Intense competitive pressures from both global majors and regional players can lead to price erosion and pressure on profit margins. The cost of transitioning to and adopting newer, more sustainable lubricant technologies can also be a barrier for some operators.

Key Players Shaping the Europe Marine Lubricants Market Market

- BP p l c

- Chevron Corporation

- Exxon Mobil Corporation

- FUCHS

- Gazpromneft - Lubricants Ltd

- Gulf Oil International Ltd

- LUKOIL

- Repsol

- Shell Plc

- TotalEnergies

Significant Europe Marine Lubricants Market Industry Milestones

- 2020: Implementation of IMO 2020 sulfur cap, driving demand for low-sulfur and compatible marine lubricants.

- 2021: Increased focus on the development and adoption of biodegradable lubricants for sensitive marine environments.

- 2022: Major players announce strategic partnerships to enhance their sustainable lubricant offerings and expand service networks across Europe.

- 2023: Introduction of new lubricant formulations designed for LNG-powered vessels and other alternative fuel technologies.

- Ongoing: Continuous investment in R&D by key players to meet evolving EU emission standards and eco-labeling requirements.

Future Outlook for Europe Marine Lubricants Market Market

The future outlook for the Europe Marine Lubricants Market is characterized by robust growth and an accelerating shift towards sustainability. Key growth catalysts include the continued tightening of environmental regulations, the increasing adoption of cleaner marine fuels and propulsion technologies, and the overall expansion of global trade. Strategic opportunities lie in developing and marketing specialized lubricants for niche applications, such as offshore wind farm support vessels and the growing cruise ship sector. The market is expected to witness further consolidation and innovation, with companies that prioritize eco-friendly solutions and technological advancements poised for success. The estimated market value is projected to reach approximately €5,000 Million by 2033.

Europe Marine Lubricants Market Segmentation

-

1. Base Stock

- 1.1. Mineral Oil

- 1.2. Synthetic Oil

- 1.3. Bio-Based Oils

-

2. Product Type

- 2.1. System Oil

- 2.2. Marine Cylinder Lubricants

- 2.3. Trunk Piston Engine Oil

- 2.4. Gear Oil

- 2.5. Greases

- 2.6. Hydraulic Fluids

- 2.7. Other Pr

Europe Marine Lubricants Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. Italy

- 4. France

- 5. Spain

- 6. Rest of Europe

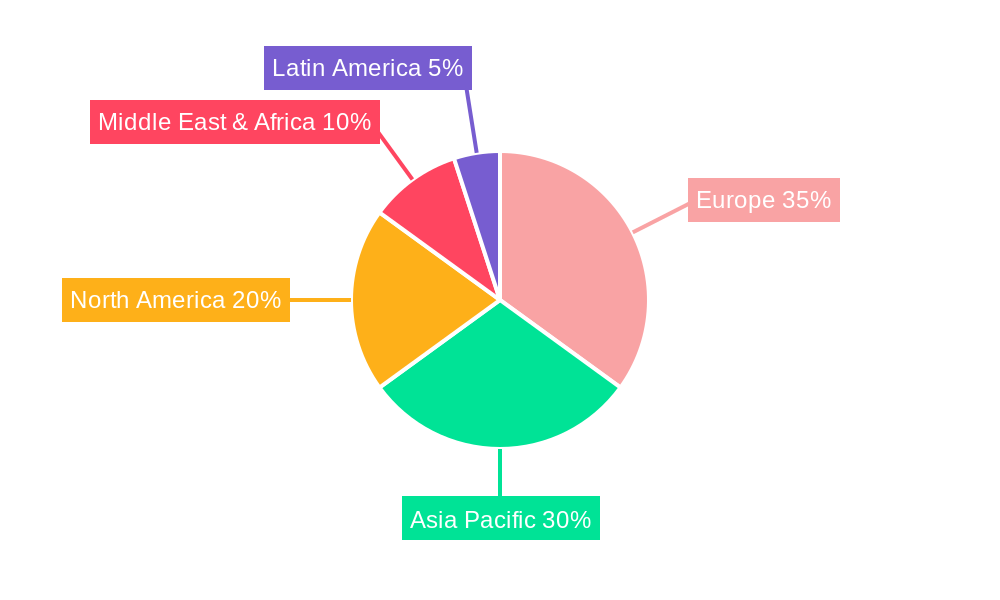

Europe Marine Lubricants Market Regional Market Share

Geographic Coverage of Europe Marine Lubricants Market

Europe Marine Lubricants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Marine Transportation; Rise in Emission Control Technologies; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Growing Demand for Marine Transportation; Rise in Emission Control Technologies; Other Drivers

- 3.4. Market Trends

- 3.4.1. Increasing Maritime Trade in Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Europe Marine Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Base Stock

- 5.1.1. Mineral Oil

- 5.1.2. Synthetic Oil

- 5.1.3. Bio-Based Oils

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. System Oil

- 5.2.2. Marine Cylinder Lubricants

- 5.2.3. Trunk Piston Engine Oil

- 5.2.4. Gear Oil

- 5.2.5. Greases

- 5.2.6. Hydraulic Fluids

- 5.2.7. Other Pr

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. Italy

- 5.3.4. France

- 5.3.5. Spain

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Base Stock

- 6. Germany Europe Marine Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Base Stock

- 6.1.1. Mineral Oil

- 6.1.2. Synthetic Oil

- 6.1.3. Bio-Based Oils

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. System Oil

- 6.2.2. Marine Cylinder Lubricants

- 6.2.3. Trunk Piston Engine Oil

- 6.2.4. Gear Oil

- 6.2.5. Greases

- 6.2.6. Hydraulic Fluids

- 6.2.7. Other Pr

- 6.1. Market Analysis, Insights and Forecast - by Base Stock

- 7. United Kingdom Europe Marine Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Base Stock

- 7.1.1. Mineral Oil

- 7.1.2. Synthetic Oil

- 7.1.3. Bio-Based Oils

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. System Oil

- 7.2.2. Marine Cylinder Lubricants

- 7.2.3. Trunk Piston Engine Oil

- 7.2.4. Gear Oil

- 7.2.5. Greases

- 7.2.6. Hydraulic Fluids

- 7.2.7. Other Pr

- 7.1. Market Analysis, Insights and Forecast - by Base Stock

- 8. Italy Europe Marine Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Base Stock

- 8.1.1. Mineral Oil

- 8.1.2. Synthetic Oil

- 8.1.3. Bio-Based Oils

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. System Oil

- 8.2.2. Marine Cylinder Lubricants

- 8.2.3. Trunk Piston Engine Oil

- 8.2.4. Gear Oil

- 8.2.5. Greases

- 8.2.6. Hydraulic Fluids

- 8.2.7. Other Pr

- 8.1. Market Analysis, Insights and Forecast - by Base Stock

- 9. France Europe Marine Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Base Stock

- 9.1.1. Mineral Oil

- 9.1.2. Synthetic Oil

- 9.1.3. Bio-Based Oils

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. System Oil

- 9.2.2. Marine Cylinder Lubricants

- 9.2.3. Trunk Piston Engine Oil

- 9.2.4. Gear Oil

- 9.2.5. Greases

- 9.2.6. Hydraulic Fluids

- 9.2.7. Other Pr

- 9.1. Market Analysis, Insights and Forecast - by Base Stock

- 10. Spain Europe Marine Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Base Stock

- 10.1.1. Mineral Oil

- 10.1.2. Synthetic Oil

- 10.1.3. Bio-Based Oils

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. System Oil

- 10.2.2. Marine Cylinder Lubricants

- 10.2.3. Trunk Piston Engine Oil

- 10.2.4. Gear Oil

- 10.2.5. Greases

- 10.2.6. Hydraulic Fluids

- 10.2.7. Other Pr

- 10.1. Market Analysis, Insights and Forecast - by Base Stock

- 11. Rest of Europe Europe Marine Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Base Stock

- 11.1.1. Mineral Oil

- 11.1.2. Synthetic Oil

- 11.1.3. Bio-Based Oils

- 11.2. Market Analysis, Insights and Forecast - by Product Type

- 11.2.1. System Oil

- 11.2.2. Marine Cylinder Lubricants

- 11.2.3. Trunk Piston Engine Oil

- 11.2.4. Gear Oil

- 11.2.5. Greases

- 11.2.6. Hydraulic Fluids

- 11.2.7. Other Pr

- 11.1. Market Analysis, Insights and Forecast - by Base Stock

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 BP p l c

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Chevron Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Exxon Mobil Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 FUCHS

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Gazpromneft - Lubricants Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Gulf Oil International Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 LUKOIL

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Repsol

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Shell Plc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 TotalEnergies*List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 BP p l c

List of Figures

- Figure 1: Global Europe Marine Lubricants Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Germany Europe Marine Lubricants Market Revenue (billion), by Base Stock 2025 & 2033

- Figure 3: Germany Europe Marine Lubricants Market Revenue Share (%), by Base Stock 2025 & 2033

- Figure 4: Germany Europe Marine Lubricants Market Revenue (billion), by Product Type 2025 & 2033

- Figure 5: Germany Europe Marine Lubricants Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: Germany Europe Marine Lubricants Market Revenue (billion), by Country 2025 & 2033

- Figure 7: Germany Europe Marine Lubricants Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: United Kingdom Europe Marine Lubricants Market Revenue (billion), by Base Stock 2025 & 2033

- Figure 9: United Kingdom Europe Marine Lubricants Market Revenue Share (%), by Base Stock 2025 & 2033

- Figure 10: United Kingdom Europe Marine Lubricants Market Revenue (billion), by Product Type 2025 & 2033

- Figure 11: United Kingdom Europe Marine Lubricants Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: United Kingdom Europe Marine Lubricants Market Revenue (billion), by Country 2025 & 2033

- Figure 13: United Kingdom Europe Marine Lubricants Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Italy Europe Marine Lubricants Market Revenue (billion), by Base Stock 2025 & 2033

- Figure 15: Italy Europe Marine Lubricants Market Revenue Share (%), by Base Stock 2025 & 2033

- Figure 16: Italy Europe Marine Lubricants Market Revenue (billion), by Product Type 2025 & 2033

- Figure 17: Italy Europe Marine Lubricants Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Italy Europe Marine Lubricants Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Italy Europe Marine Lubricants Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: France Europe Marine Lubricants Market Revenue (billion), by Base Stock 2025 & 2033

- Figure 21: France Europe Marine Lubricants Market Revenue Share (%), by Base Stock 2025 & 2033

- Figure 22: France Europe Marine Lubricants Market Revenue (billion), by Product Type 2025 & 2033

- Figure 23: France Europe Marine Lubricants Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 24: France Europe Marine Lubricants Market Revenue (billion), by Country 2025 & 2033

- Figure 25: France Europe Marine Lubricants Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Spain Europe Marine Lubricants Market Revenue (billion), by Base Stock 2025 & 2033

- Figure 27: Spain Europe Marine Lubricants Market Revenue Share (%), by Base Stock 2025 & 2033

- Figure 28: Spain Europe Marine Lubricants Market Revenue (billion), by Product Type 2025 & 2033

- Figure 29: Spain Europe Marine Lubricants Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Spain Europe Marine Lubricants Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Spain Europe Marine Lubricants Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Rest of Europe Europe Marine Lubricants Market Revenue (billion), by Base Stock 2025 & 2033

- Figure 33: Rest of Europe Europe Marine Lubricants Market Revenue Share (%), by Base Stock 2025 & 2033

- Figure 34: Rest of Europe Europe Marine Lubricants Market Revenue (billion), by Product Type 2025 & 2033

- Figure 35: Rest of Europe Europe Marine Lubricants Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Rest of Europe Europe Marine Lubricants Market Revenue (billion), by Country 2025 & 2033

- Figure 37: Rest of Europe Europe Marine Lubricants Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Europe Marine Lubricants Market Revenue billion Forecast, by Base Stock 2020 & 2033

- Table 2: Global Europe Marine Lubricants Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Global Europe Marine Lubricants Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Europe Marine Lubricants Market Revenue billion Forecast, by Base Stock 2020 & 2033

- Table 5: Global Europe Marine Lubricants Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global Europe Marine Lubricants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Europe Marine Lubricants Market Revenue billion Forecast, by Base Stock 2020 & 2033

- Table 8: Global Europe Marine Lubricants Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 9: Global Europe Marine Lubricants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Europe Marine Lubricants Market Revenue billion Forecast, by Base Stock 2020 & 2033

- Table 11: Global Europe Marine Lubricants Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: Global Europe Marine Lubricants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Europe Marine Lubricants Market Revenue billion Forecast, by Base Stock 2020 & 2033

- Table 14: Global Europe Marine Lubricants Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 15: Global Europe Marine Lubricants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Europe Marine Lubricants Market Revenue billion Forecast, by Base Stock 2020 & 2033

- Table 17: Global Europe Marine Lubricants Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: Global Europe Marine Lubricants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Global Europe Marine Lubricants Market Revenue billion Forecast, by Base Stock 2020 & 2033

- Table 20: Global Europe Marine Lubricants Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 21: Global Europe Marine Lubricants Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Marine Lubricants Market ?

The projected CAGR is approximately 10.7%.

2. Which companies are prominent players in the Europe Marine Lubricants Market ?

Key companies in the market include BP p l c, Chevron Corporation, Exxon Mobil Corporation, FUCHS, Gazpromneft - Lubricants Ltd, Gulf Oil International Ltd, LUKOIL, Repsol, Shell Plc, TotalEnergies*List Not Exhaustive.

3. What are the main segments of the Europe Marine Lubricants Market ?

The market segments include Base Stock, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.07 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Marine Transportation; Rise in Emission Control Technologies; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Maritime Trade in Europe.

7. Are there any restraints impacting market growth?

Growing Demand for Marine Transportation; Rise in Emission Control Technologies; Other Drivers.

8. Can you provide examples of recent developments in the market?

Recent developments pertaining to the major players in the market are covered in the complete study.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Marine Lubricants Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Marine Lubricants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Marine Lubricants Market ?

To stay informed about further developments, trends, and reports in the Europe Marine Lubricants Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence