Key Insights

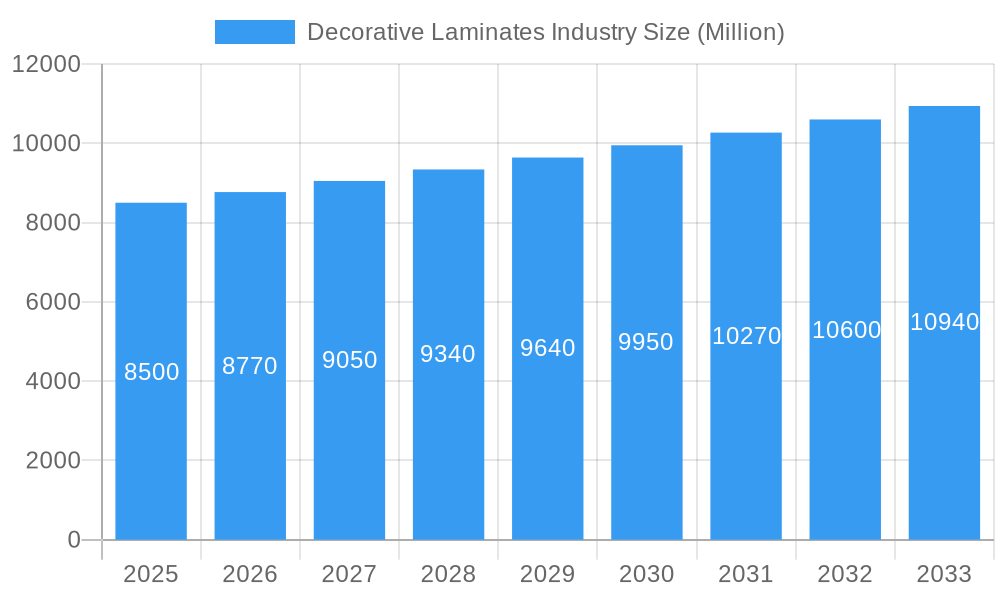

The global Decorative Laminates market is poised for robust growth, projected to reach an estimated XX million by 2025, with a Compound Annual Growth Rate (CAGR) exceeding 3.00% throughout the forecast period of 2025-2033. This expansion is fueled by a confluence of powerful drivers, primarily the escalating demand for aesthetically pleasing and durable interior design solutions across residential and non-residential sectors. Increasing urbanization and a growing middle class in emerging economies are significantly boosting construction activities, consequently driving the adoption of decorative laminates for furniture, cabinets, flooring, and wall panels. Furthermore, continuous innovation in product design, offering a wide array of textures, finishes, and patterns, alongside advancements in material technology that enhance scratch resistance, heat resistance, and ease of maintenance, are key factors propelling market growth. The versatility and cost-effectiveness of decorative laminates compared to traditional materials like natural wood and stone also contribute to their widespread appeal.

Decorative Laminates Industry Market Size (In Billion)

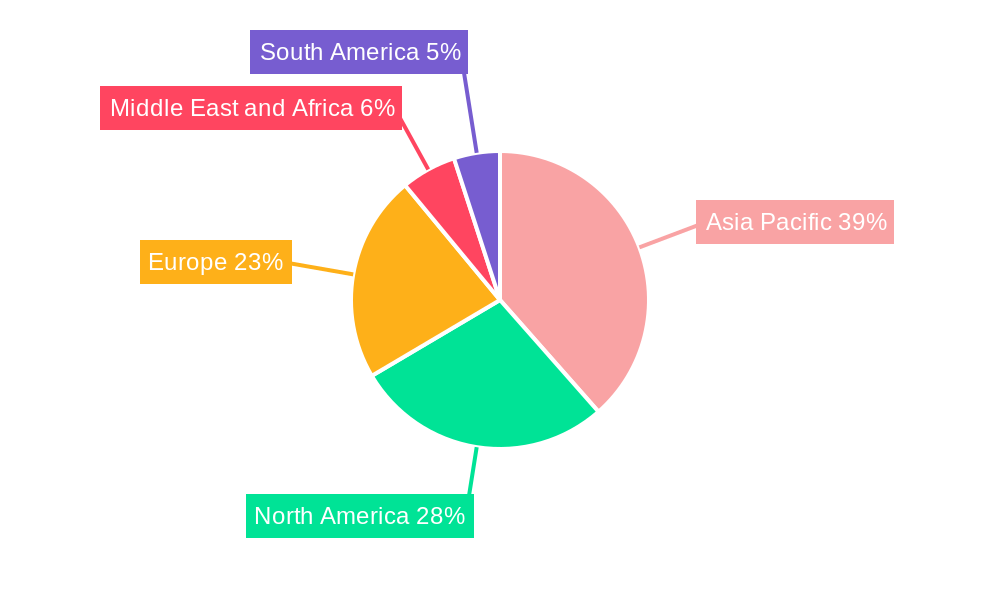

However, the market is not without its challenges. Fluctuations in the prices of key raw materials, particularly plastic resins and wood substrates, can impact manufacturing costs and subsequently affect market pricing. Intense competition among established players and the emergence of new entrants, coupled with the need for substantial capital investment in manufacturing and R&D, also present some restraints. Despite these factors, the market is witnessing significant trends such as the rising popularity of sustainable and eco-friendly laminate options, driven by growing environmental consciousness among consumers and regulatory pressures. The integration of digital printing technologies for customized designs and the increasing use of laminates in the transportation sector for interior finishing are further shaping the market landscape. Key regions like Asia Pacific, led by China and India, are expected to remain dominant due to rapid industrialization and infrastructure development, while North America and Europe will continue to be significant markets driven by renovation and remodeling activities.

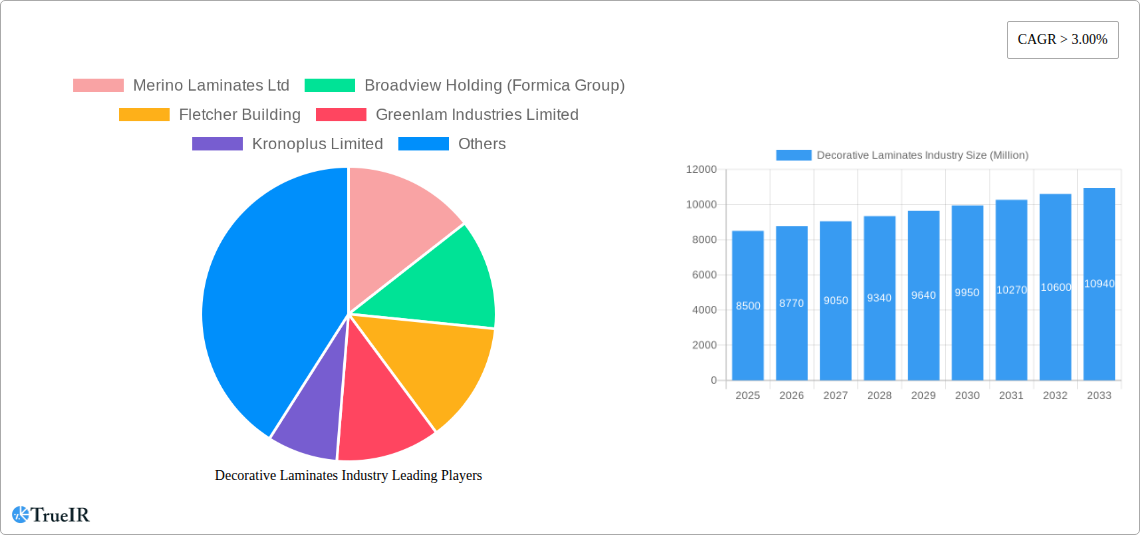

Decorative Laminates Industry Company Market Share

Decorative Laminates Industry: Comprehensive Market Analysis and Future Outlook (2019-2033)

This in-depth report provides a dynamic, SEO-optimized analysis of the global Decorative Laminates industry, leveraging high-volume keywords to enhance search rankings and engage industry stakeholders. The study spans the historical period of 2019–2024, with a base year of 2025 and an extensive forecast period extending to 2033. We delve into market structure, trends, opportunities, dominant segments, product innovations, key drivers, barriers, and the competitive landscape, offering invaluable insights for strategic decision-making.

Decorative Laminates Industry Market Structure & Competitive Landscape

The global Decorative Laminates market exhibits a moderately concentrated structure, with leading players like Merino Laminates Ltd, Broadview Holding (Formica Group), Fletcher Building, and Greenlam Industries Limited holding significant market shares. Innovation is a key driver, fueled by advancements in digital printing technologies, sustainable material development, and enhanced durability features. Regulatory impacts, particularly concerning environmental standards and fire safety, are shaping manufacturing processes and product offerings. Product substitutes, such as engineered wood, natural veneers, and tile, present ongoing competitive pressure, necessitating continuous product differentiation and value enhancement.

The end-user segmentation is dominated by the Furniture and Cabinets applications, reflecting robust demand in residential and non-residential construction. Mergers and acquisitions (M&A) activity plays a crucial role in market consolidation and expansion. For instance, recent M&A volumes are estimated at over $500 million, indicating a trend towards strategic acquisitions to enhance product portfolios and geographical reach. Competitive advantages are derived from factors such as cost leadership, product quality, design innovation, and strong distribution networks. The industry concentration ratio for the top 5 players is approximately 45% in 2025.

Decorative Laminates Industry Market Trends & Opportunities

The Decorative Laminates market is poised for significant growth, projected to reach a valuation of over $25,000 million by 2033, with a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period (2025–2033). This expansion is driven by a confluence of evolving consumer preferences, rapid technological advancements, and burgeoning opportunities in emerging economies. The increasing demand for aesthetically pleasing and durable interior design solutions in both residential and commercial spaces is a primary catalyst. Consumers are increasingly seeking laminates that mimic natural materials like wood and stone, or offer unique abstract designs, driving innovation in printing and surface technologies.

Technological shifts are paramount, with the adoption of digital printing allowing for greater design flexibility, faster turnaround times, and on-demand customization. This not only caters to niche market demands but also reduces manufacturing waste. The development of eco-friendly and sustainable laminates, utilizing recycled materials and low-VOC adhesives, is gaining traction as environmental consciousness rises among consumers and regulatory bodies. Opportunities abound in the development of high-performance laminates with enhanced scratch resistance, heat resistance, and antimicrobial properties, particularly for high-traffic areas and specialized applications.

Competitive dynamics are intensifying, with both established players and new entrants vying for market share. Companies are investing heavily in research and development (R&D) to introduce innovative product lines and expand their geographical footprint. The rise of e-commerce platforms is also creating new distribution channels, enabling manufacturers to reach a wider customer base directly. Market penetration rates for decorative laminates in emerging economies are still relatively low, presenting substantial untapped potential for growth. Strategic partnerships and collaborations are becoming more prevalent, allowing companies to leverage each other's strengths in technology, distribution, and market access. The emphasis on interior aesthetics and functional durability in spaces like hotels, offices, and retail environments further fuels demand. The market is also seeing a rise in demand for laminates with antibacterial properties, especially in healthcare and hospitality sectors, creating specialized market segments.

Dominant Markets & Segments in Decorative Laminates Industry

The Residential end-user industry stands as the dominant segment within the Decorative Laminates market, driven by sustained global urbanization, rising disposable incomes, and a persistent demand for home renovation and interior décor upgrades. This segment is projected to contribute over 60% of the total market revenue by 2033. The application segment of Furniture is the largest contributor, accounting for an estimated 45% of the market in 2025, followed closely by Cabinets at approximately 30%. This dominance is underpinned by the widespread use of decorative laminates in the manufacturing of modular kitchens, wardrobes, office furniture, and various household furnishings due to their cost-effectiveness, durability, and wide range of aesthetic options.

Geographically, Asia Pacific is emerging as the most significant market, driven by rapid infrastructure development, a burgeoning middle class, and increasing construction activities in countries like China, India, and Southeast Asian nations. The region's market share is expected to exceed 35% by 2033. This growth is further propelled by favorable government policies promoting manufacturing and urbanization, leading to a surge in demand for interior finishing materials. The Non-residential sector, encompassing commercial spaces like offices, retail outlets, hotels, and educational institutions, is also a substantial and growing market. Its growth is tied to commercial real estate development and the increasing emphasis on creating attractive and functional work and public environments.

Key growth drivers within these dominant segments include:

- Infrastructure Development: Massive government investments in public infrastructure projects, including housing, transportation hubs, and commercial complexes, directly stimulate demand for interior finishing materials like decorative laminates.

- Urbanization and Disposable Income: The ongoing shift of populations to urban centers and the rise in per capita disposable income in developing economies translate into increased consumer spending on home improvement and furniture.

- Design Trends and Customization: Evolving interior design trends that favor diverse textures, colors, and patterns necessitate manufacturers to offer a wide spectrum of decorative laminate options, driving demand for sophisticated printing and finishing technologies.

- Technological Advancements: Innovations in laminate production, such as digital printing and the development of eco-friendly alternatives, are expanding application possibilities and appealing to environmentally conscious consumers.

- Durability and Cost-Effectiveness: Decorative laminates offer a compelling combination of durability, ease of maintenance, and affordability compared to traditional materials like natural wood or stone, making them a preferred choice for a broad consumer base.

The Wood Substrate remains the predominant raw material in the decorative laminates industry, forming the base for the vast majority of products. However, there is a growing emphasis on sustainable sourcing and the development of composite substrates.

Decorative Laminates Industry Product Analysis

Product innovation in the Decorative Laminates industry is characterized by advancements in aesthetics, functionality, and sustainability. Manufacturers are leveraging digital printing technologies to create hyper-realistic imitations of natural materials like wood grains, marbles, and stones, as well as offering entirely novel abstract and artistic designs. Competitive advantages are being gained through the development of laminates with enhanced properties such as superior scratch, stain, and heat resistance, making them ideal for high-traffic areas and demanding applications like kitchen countertops and commercial flooring. Furthermore, the introduction of anti-microbial and flame-retardant laminates caters to specific industry needs in healthcare, hospitality, and public spaces. The growing consumer and regulatory demand for eco-friendly solutions is driving the development of laminates made from recycled materials and those with low volatile organic compound (VOC) emissions, positioning these products favorably in a sustainability-conscious market.

Key Drivers, Barriers & Challenges in Decorative Laminates Industry

Key drivers propelling the Decorative Laminates industry include robust global construction and renovation activities, the increasing demand for aesthetically versatile and durable interior design solutions, and technological advancements in printing and manufacturing processes that enable greater design customization and cost efficiencies. Economic growth and rising disposable incomes, particularly in emerging markets, further fuel consumer spending on home improvement and furniture, directly boosting laminate demand.

Challenges impacting the Decorative Laminates industry growth are multifaceted. Fluctuations in raw material prices, particularly for plastic resins and wood pulp, can significantly impact production costs and profit margins. Stringent environmental regulations and the growing consumer preference for sustainable products necessitate investment in eco-friendly manufacturing processes and materials, which can increase operational expenses. Intense competition from both established players and emerging manufacturers, coupled with the availability of substitute materials like engineered wood and tiles, creates pressure on pricing and market share. Supply chain disruptions, as witnessed in recent global events, can lead to material shortages and increased lead times, impacting production schedules and customer delivery. The need for continuous innovation to keep pace with evolving design trends also presents a significant challenge.

Growth Drivers in the Decorative Laminates Industry Market

Growth in the Decorative Laminates industry is primarily driven by the burgeoning real estate and construction sectors, especially in developing economies, coupled with escalating consumer demand for aesthetically appealing and durable interior finishes. Technological advancements in digital printing are enabling unparalleled design customization and faster production cycles, meeting evolving market preferences. The growing awareness and preference for eco-friendly and sustainable building materials are also creating significant growth opportunities for manufacturers offering green laminate solutions. Furthermore, government initiatives promoting affordable housing and infrastructure development in various regions are directly translating into increased demand for cost-effective and versatile interior finishing materials like decorative laminates.

Challenges Impacting Decorative Laminates Industry Growth

Challenges impacting Decorative Laminates industry growth are substantial. Volatility in raw material prices, particularly for petrochemicals used in plastic resins and wood-based products, can lead to unpredictable cost structures and affect profitability. Stricter environmental regulations concerning emissions and waste management require significant investment in cleaner production technologies and sustainable sourcing. Intense competition from both domestic and international players, alongside the threat of substitute materials such as natural wood veneers and vinyl flooring, necessitates constant innovation and competitive pricing strategies. Global supply chain disruptions can lead to material shortages and delays, impacting manufacturing output and timely delivery to customers. Furthermore, the evolving nature of design trends demands continuous R&D efforts and adaptation, which can be resource-intensive.

Key Players Shaping the Decorative Laminates Industry Market

- Merino Laminates Ltd

- Broadview Holding (Formica Group)

- Fletcher Building

- Greenlam Industries Limited

- Kronoplus Limited

- Panolam Industries International Inc

- Archidply

- FunderMax

- Stylam Pvt Ltd

- Abet Laminati S p A

- Bell Laminates

- Wilsonart LLC

- OMNOVA Solutions Inc

- Airolam decorative laminates

- AICA Laminates India Pvt Ltd

Significant Decorative Laminates Industry Industry Milestones

- 2019: Introduction of advanced digital printing technologies enabling hyper-realistic wood grain and stone patterns.

- 2020: Increased focus on developing and marketing eco-friendly laminates with low VOC emissions and recycled content in response to growing environmental concerns.

- 2021: Significant surge in demand for home renovation products driven by increased time spent at home during the pandemic, boosting laminate sales.

- 2022: Expansion of product portfolios to include laminates with enhanced anti-microbial properties for healthcare and hospitality sectors.

- 2023: Strategic partnerships and acquisitions aimed at consolidating market share and expanding global distribution networks.

- 2024: Enhanced focus on sustainable manufacturing practices and circular economy principles within the industry.

Future Outlook for Decorative Laminates Industry Market

The future outlook for the Decorative Laminates industry is exceptionally bright, with sustained growth projected due to continued global construction and renovation activities, particularly in emerging economies. The increasing consumer demand for personalized and aesthetically diverse interior design solutions will continue to drive innovation in digital printing and specialized finishes. Furthermore, the growing emphasis on sustainability will create significant market opportunities for manufacturers that prioritize eco-friendly materials and production processes. Strategic investments in R&D for high-performance laminates, coupled with expansion into untapped geographical markets and the development of smart/interactive laminate technologies, will be key to capitalizing on the evolving market dynamics and securing long-term competitive advantage. The market is expected to witness a growing trend towards circular economy models.

Decorative Laminates Industry Segmentation

-

1. Raw Material

- 1.1. Plastic Resin

- 1.2. Overlays

- 1.3. Adhesives

- 1.4. Wood Substrate

- 1.5. Others

-

2. Application

- 2.1. Furniture

- 2.2. Cabinets

- 2.3. Flooring

- 2.4. Wall Panels

- 2.5. Others

-

3. End-user Industry

- 3.1. Residential

- 3.2. Non-residential

- 3.3. Transportation

Decorative Laminates Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Decorative Laminates Industry Regional Market Share

Geographic Coverage of Decorative Laminates Industry

Decorative Laminates Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Construction Industry in the Asia-Pacific Region; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Unfavorable Conditions Arising Due to COVID-19 Outbreak; Other Restraints

- 3.4. Market Trends

- 3.4.1. Furniture Application to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Decorative Laminates Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 5.1.1. Plastic Resin

- 5.1.2. Overlays

- 5.1.3. Adhesives

- 5.1.4. Wood Substrate

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Furniture

- 5.2.2. Cabinets

- 5.2.3. Flooring

- 5.2.4. Wall Panels

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Residential

- 5.3.2. Non-residential

- 5.3.3. Transportation

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 6. Asia Pacific Decorative Laminates Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Raw Material

- 6.1.1. Plastic Resin

- 6.1.2. Overlays

- 6.1.3. Adhesives

- 6.1.4. Wood Substrate

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Furniture

- 6.2.2. Cabinets

- 6.2.3. Flooring

- 6.2.4. Wall Panels

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Residential

- 6.3.2. Non-residential

- 6.3.3. Transportation

- 6.1. Market Analysis, Insights and Forecast - by Raw Material

- 7. North America Decorative Laminates Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Raw Material

- 7.1.1. Plastic Resin

- 7.1.2. Overlays

- 7.1.3. Adhesives

- 7.1.4. Wood Substrate

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Furniture

- 7.2.2. Cabinets

- 7.2.3. Flooring

- 7.2.4. Wall Panels

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Residential

- 7.3.2. Non-residential

- 7.3.3. Transportation

- 7.1. Market Analysis, Insights and Forecast - by Raw Material

- 8. Europe Decorative Laminates Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Raw Material

- 8.1.1. Plastic Resin

- 8.1.2. Overlays

- 8.1.3. Adhesives

- 8.1.4. Wood Substrate

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Furniture

- 8.2.2. Cabinets

- 8.2.3. Flooring

- 8.2.4. Wall Panels

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Residential

- 8.3.2. Non-residential

- 8.3.3. Transportation

- 8.1. Market Analysis, Insights and Forecast - by Raw Material

- 9. South America Decorative Laminates Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Raw Material

- 9.1.1. Plastic Resin

- 9.1.2. Overlays

- 9.1.3. Adhesives

- 9.1.4. Wood Substrate

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Furniture

- 9.2.2. Cabinets

- 9.2.3. Flooring

- 9.2.4. Wall Panels

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Residential

- 9.3.2. Non-residential

- 9.3.3. Transportation

- 9.1. Market Analysis, Insights and Forecast - by Raw Material

- 10. Middle East and Africa Decorative Laminates Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Raw Material

- 10.1.1. Plastic Resin

- 10.1.2. Overlays

- 10.1.3. Adhesives

- 10.1.4. Wood Substrate

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Furniture

- 10.2.2. Cabinets

- 10.2.3. Flooring

- 10.2.4. Wall Panels

- 10.2.5. Others

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Residential

- 10.3.2. Non-residential

- 10.3.3. Transportation

- 10.1. Market Analysis, Insights and Forecast - by Raw Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Merino Laminates Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Broadview Holding (Formica Group)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fletcher Building

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Greenlam Industries Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kronoplus Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Panolam Industries International Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Archidply

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 FunderMax

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Stylam Pvt Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Abet Laminati S p A

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Bell Laminates

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Wilsonart LLC *List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 OMNOVA Solutions Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Airolam decorative laminates

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 AICA Laminates India Pvt Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Merino Laminates Ltd

List of Figures

- Figure 1: Global Decorative Laminates Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Decorative Laminates Industry Revenue (Million), by Raw Material 2025 & 2033

- Figure 3: Asia Pacific Decorative Laminates Industry Revenue Share (%), by Raw Material 2025 & 2033

- Figure 4: Asia Pacific Decorative Laminates Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: Asia Pacific Decorative Laminates Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Decorative Laminates Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: Asia Pacific Decorative Laminates Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: Asia Pacific Decorative Laminates Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Asia Pacific Decorative Laminates Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Decorative Laminates Industry Revenue (Million), by Raw Material 2025 & 2033

- Figure 11: North America Decorative Laminates Industry Revenue Share (%), by Raw Material 2025 & 2033

- Figure 12: North America Decorative Laminates Industry Revenue (Million), by Application 2025 & 2033

- Figure 13: North America Decorative Laminates Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: North America Decorative Laminates Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: North America Decorative Laminates Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: North America Decorative Laminates Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: North America Decorative Laminates Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Decorative Laminates Industry Revenue (Million), by Raw Material 2025 & 2033

- Figure 19: Europe Decorative Laminates Industry Revenue Share (%), by Raw Material 2025 & 2033

- Figure 20: Europe Decorative Laminates Industry Revenue (Million), by Application 2025 & 2033

- Figure 21: Europe Decorative Laminates Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Decorative Laminates Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Europe Decorative Laminates Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Europe Decorative Laminates Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Decorative Laminates Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Decorative Laminates Industry Revenue (Million), by Raw Material 2025 & 2033

- Figure 27: South America Decorative Laminates Industry Revenue Share (%), by Raw Material 2025 & 2033

- Figure 28: South America Decorative Laminates Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: South America Decorative Laminates Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: South America Decorative Laminates Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: South America Decorative Laminates Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: South America Decorative Laminates Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Decorative Laminates Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Decorative Laminates Industry Revenue (Million), by Raw Material 2025 & 2033

- Figure 35: Middle East and Africa Decorative Laminates Industry Revenue Share (%), by Raw Material 2025 & 2033

- Figure 36: Middle East and Africa Decorative Laminates Industry Revenue (Million), by Application 2025 & 2033

- Figure 37: Middle East and Africa Decorative Laminates Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: Middle East and Africa Decorative Laminates Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Middle East and Africa Decorative Laminates Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Middle East and Africa Decorative Laminates Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Decorative Laminates Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Decorative Laminates Industry Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 2: Global Decorative Laminates Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Decorative Laminates Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Decorative Laminates Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Decorative Laminates Industry Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 6: Global Decorative Laminates Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global Decorative Laminates Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Decorative Laminates Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Japan Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: South Korea Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Decorative Laminates Industry Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 15: Global Decorative Laminates Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 16: Global Decorative Laminates Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 17: Global Decorative Laminates Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: United States Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Canada Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Mexico Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Decorative Laminates Industry Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 22: Global Decorative Laminates Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Global Decorative Laminates Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Decorative Laminates Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Germany Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Italy Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: France Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Decorative Laminates Industry Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 31: Global Decorative Laminates Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 32: Global Decorative Laminates Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 33: Global Decorative Laminates Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Brazil Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Argentina Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Decorative Laminates Industry Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 38: Global Decorative Laminates Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 39: Global Decorative Laminates Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 40: Global Decorative Laminates Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Saudi Arabia Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: South Africa Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Rest of Middle East and Africa Decorative Laminates Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Decorative Laminates Industry?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Decorative Laminates Industry?

Key companies in the market include Merino Laminates Ltd, Broadview Holding (Formica Group), Fletcher Building, Greenlam Industries Limited, Kronoplus Limited, Panolam Industries International Inc, Archidply, FunderMax, Stylam Pvt Ltd, Abet Laminati S p A, Bell Laminates, Wilsonart LLC *List Not Exhaustive, OMNOVA Solutions Inc, Airolam decorative laminates, AICA Laminates India Pvt Ltd.

3. What are the main segments of the Decorative Laminates Industry?

The market segments include Raw Material, Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Construction Industry in the Asia-Pacific Region; Other Drivers.

6. What are the notable trends driving market growth?

Furniture Application to Dominate the Market.

7. Are there any restraints impacting market growth?

; Unfavorable Conditions Arising Due to COVID-19 Outbreak; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Decorative Laminates Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Decorative Laminates Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Decorative Laminates Industry?

To stay informed about further developments, trends, and reports in the Decorative Laminates Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence