Key Insights

The Egyptian commercial vehicles lubricants market is projected for steady expansion, with an estimated market size of USD 1.5 billion by 2024. The market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 2.3% through 2033. Key growth drivers include significant government investment in infrastructure, such as road network expansion and logistics hubs, which boosts demand for commercial vehicles and their associated lubrication needs. The increasing fleet size of heavy-duty trucks and buses for transportation further supports this market growth. Additionally, advancements in engine technologies and stringent emission standards are compelling fleet operators to adopt high-performance lubricants that enhance fuel efficiency and extend drain intervals. The burgeoning e-commerce sector and the resulting rise in last-mile delivery services are also significantly contributing to increased commercial vehicle utilization and lubricant consumption. Engine oils and hydraulic fluids are expected to lead key product segments due to their widespread application.

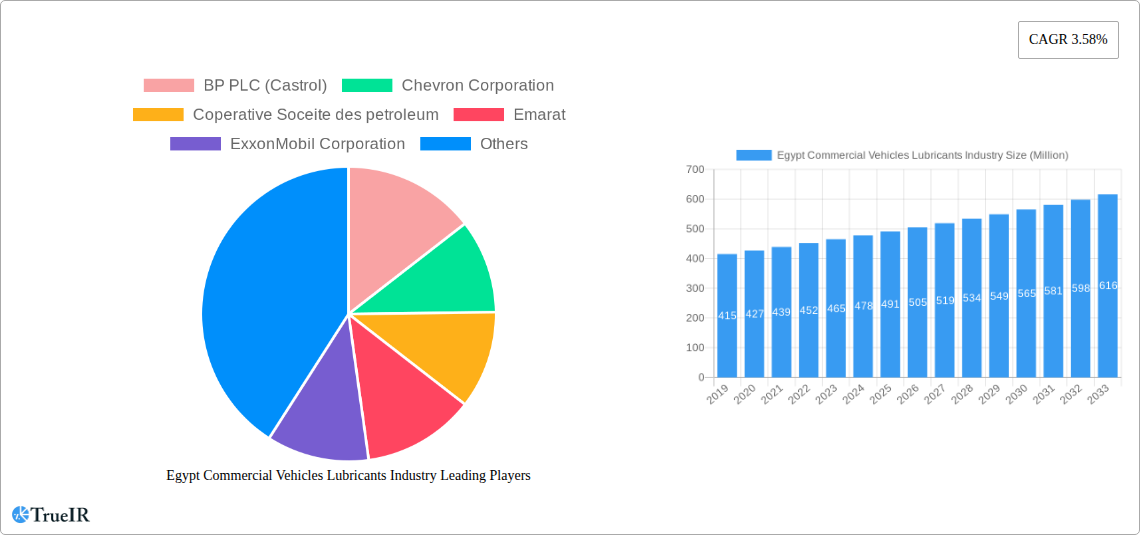

Egypt Commercial Vehicles Lubricants Industry Market Size (In Billion)

Despite the positive growth, the market faces challenges. Fluctuations in crude oil prices, a primary input for lubricant production, can impact manufacturing costs and lubricant pricing, potentially affecting demand in price-sensitive segments. The growing adoption of electric vehicles (EVs) in the commercial sector, while currently nascent in Egypt, presents a long-term challenge as EVs require distinct lubrication solutions, diminishing the role of traditional lubricants. However, the substantial existing fleet of internal combustion engine (ICE) vehicles and the gradual EV transition indicate that conventional lubricants will remain a significant market component for the foreseeable future. The market features major global players, including BP PLC (Castrol), Chevron Corporation, ExxonMobil Corporation, and Royal Dutch Shell PLC, alongside prominent local entities such as Misr Petroleum and Petromin Corporation, fostering a competitive environment focused on product innovation and strategic alliances.

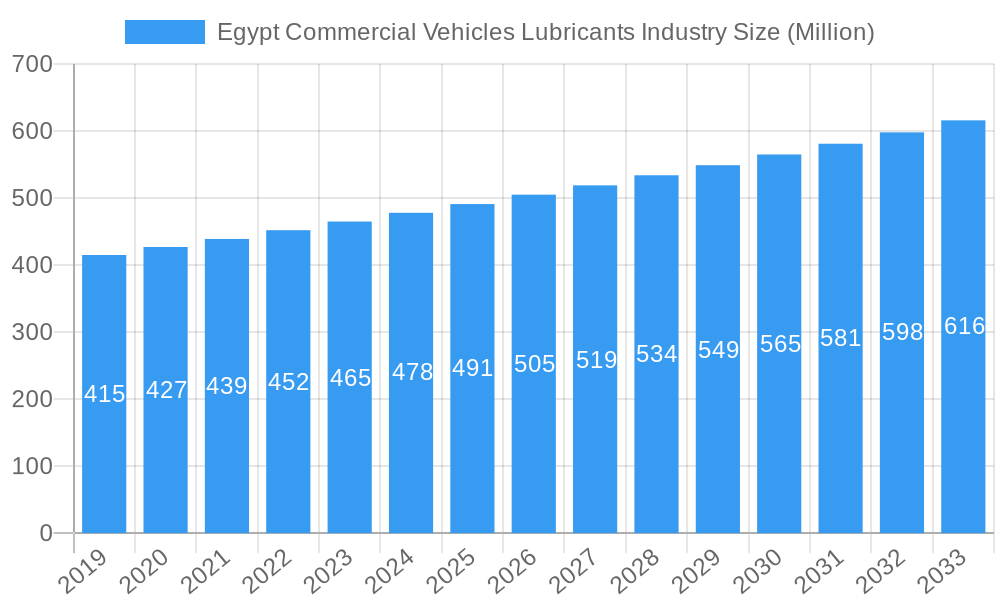

Egypt Commercial Vehicles Lubricants Industry Company Market Share

This report offers an in-depth analysis of the Egyptian Commercial Vehicles Lubricants Market, providing critical insights into its structure, trends, opportunities, and competitive landscape. With a base year of 2024 and a forecast period extending to 2033, this study utilizes extensive historical data from 2019–2024 to deliver robust market projections. Understand the driving forces behind the Egypt commercial lubricants market, key product segments, dominant players, and future outlook. This research is essential for stakeholders seeking to comprehend the Egyptian automotive lubricants market, heavy-duty engine oil market Egypt, and fleet lubricant solutions Egypt.

Egypt Commercial Vehicles Lubricants Industry Market Structure & Competitive Landscape

The Egypt Commercial Vehicles Lubricants Industry exhibits a moderately concentrated market structure, driven by established multinational corporations and key local players. Innovation is primarily fueled by the demand for enhanced fuel efficiency, extended drain intervals, and emission reduction technologies. Regulatory impacts, particularly those concerning environmental standards and vehicle emission norms, significantly shape product development and market entry. Product substitutes, while present in the form of lower-grade lubricants or alternative lubrication technologies in niche applications, do not pose a substantial threat to the core market. End-user segmentation is crucial, with distinct needs arising from the transportation, construction, and industrial sectors. Mergers & Acquisitions (M&A) trends indicate strategic consolidation, aimed at expanding market reach and portfolio diversification. Concentration ratios are estimated at approximately 65% for the top five players, indicating significant market control. M&A volumes have seen a steady increase, with an estimated 15% year-on-year growth in deal value within the broader MENA region, reflecting confidence in the Egyptian market.

Egypt Commercial Vehicles Lubricants Industry Market Trends & Opportunities

The Egypt Commercial Vehicles Lubricants Industry is poised for significant growth, with market size projected to reach $XXX Million by 2033, expanding at a Compound Annual Growth Rate (CAGR) of XX% during the forecast period. This expansion is propelled by a burgeoning logistics and transportation sector, fueled by government investments in infrastructure development and trade facilitation. Technological shifts are increasingly influencing the market, with a growing demand for synthetic and semi-synthetic lubricants that offer superior performance, reduced wear, and improved fuel economy. The transition towards more stringent emission standards also necessitates the adoption of advanced lubricant formulations capable of meeting Euro VI and equivalent regulations. Consumer preferences are evolving, with fleet operators prioritizing cost-effectiveness through extended drain intervals and reduced maintenance downtime. This trend favors high-performance lubricants that can deliver long-term savings despite a higher initial investment. Competitive dynamics are intensifying, with global players leveraging their brand reputation and technological expertise, while local manufacturers focus on price competitiveness and localized distribution networks. Opportunities abound in the development of specialized lubricants for emerging commercial vehicle segments, such as electric and hybrid trucks, and in catering to the specific needs of the rapidly growing construction and mining sectors. Furthermore, the increasing adoption of advanced additive technologies and the focus on sustainable and biodegradable lubricant options present significant market penetration potential. The market penetration rate for high-performance lubricants is currently estimated at around 40%, with substantial room for growth as awareness and demand for superior lubrication solutions increase.

Dominant Markets & Segments in Egypt Commercial Vehicles Lubricants Industry

The Egypt Commercial Vehicles Lubricants Industry is dominated by Engine Oils, which represent the largest segment by volume and value, accounting for an estimated 60% of the total market share. This dominance is attributed to the fundamental requirement of engine protection and performance in all commercial vehicles. The ongoing modernization of Egypt's commercial fleet, coupled with stringent emission regulations, is driving demand for advanced, high-performance engine oils.

Engine Oils:

- Key Growth Drivers: Increasing number of commercial vehicles on the road, stringent emission standards (Euro V, Euro VI), and the growing adoption of advanced engine technologies requiring specialized formulations. The expansion of the logistics sector and increased inter-city transportation further bolsters demand.

- Market Dominance Analysis: Engine oils are the lifeblood of commercial vehicles. The Egyptian market sees strong demand for both heavy-duty diesel engine oils (HDDEO) and gasoline engine oils (HDEO) for trucks, buses, and light commercial vehicles. The forecast period anticipates continued dominance, driven by the sheer volume of vehicles and the need for reliable engine protection against wear and tear, sludge formation, and oxidation, thereby extending engine life and reducing maintenance costs.

Transmission & Gear Oils:

- Key Growth Drivers: Robust growth in the construction and mining sectors requiring heavy-duty equipment, and the increasing complexity of transmission systems in modern commercial vehicles.

- Market Dominance Analysis: Transmission and gear oils are critical for efficient power transfer and component longevity. The expanding infrastructure projects and the constant movement of goods necessitate reliable gear performance. The market is witnessing a shift towards synthetic and semi-synthetic formulations for enhanced thermal stability and load-carrying capacity.

Hydraulic Fluids:

- Key Growth Drivers: Significant government investment in infrastructure projects, including roads, bridges, and new urban developments, which rely heavily on hydraulic-powered machinery.

- Market Dominance Analysis: Hydraulic fluids are essential for the operation of construction equipment, agricultural machinery, and material handling vehicles. The ongoing development boom in Egypt directly translates into sustained demand for high-quality hydraulic fluids that can withstand extreme pressures and operating conditions.

Greases:

- Key Growth Drivers: The maintenance needs of various moving parts in commercial vehicles, including wheel bearings, chassis components, and fifth wheels.

- Market Dominance Analysis: While a smaller segment compared to engine oils, greases play a vital role in preventing friction and wear in numerous critical components. Demand is driven by the need for durable and effective lubrication in a variety of operating environments.

Egypt Commercial Vehicles Lubricants Industry Product Analysis

The Egypt Commercial Vehicles Lubricants Industry is characterized by continuous product innovation focused on enhancing performance and sustainability. Advanced synthetic and semi-synthetic formulations are gaining traction, offering superior protection, extended drain intervals, and improved fuel efficiency. Key applications range from protecting heavy-duty diesel engines from extreme wear and deposits to ensuring smooth operation of complex transmission and hydraulic systems. Competitive advantages are being built on technological superiority, compliance with international standards, and the ability to cater to specific end-user needs, such as lubricants formulated for electric vehicles or those designed to reduce environmental impact.

Key Drivers, Barriers & Challenges in Egypt Commercial Vehicles Lubricants Industry

Key Drivers, Barriers & Challenges in Egypt Commercial Vehicles Lubricants Industry

Key Drivers:

- Growing Logistics and Transportation Sector: Increased demand for efficient goods movement fuels the need for reliable commercial vehicle lubricants.

- Infrastructure Development Projects: Massive government investments in roads, construction, and urban development necessitate extensive use of heavy machinery and commercial vehicles.

- Fleet Modernization and Expansion: The ongoing replacement and expansion of commercial vehicle fleets with newer, more efficient models require advanced lubricant solutions.

- Technological Advancements: The introduction of high-performance synthetic and semi-synthetic lubricants offering extended drain intervals and superior protection.

- Regulatory Push for Emission Control: Stricter emission standards drive the adoption of lubricants that support cleaner combustion and reduce engine wear.

Key Barriers and Challenges:

- Price Sensitivity: A significant portion of the market remains price-sensitive, leading to a demand for lower-cost options, potentially impacting the adoption of premium lubricants.

- Counterfeit Products: The prevalence of counterfeit lubricants poses a risk to vehicle performance and brand reputation, eroding trust and market share for genuine products.

- Supply Chain Disruptions: Geopolitical factors and global supply chain complexities can lead to fluctuations in raw material availability and increased logistics costs.

- Limited Awareness of Premium Lubricant Benefits: A segment of fleet operators may still lack complete understanding of the long-term cost savings and performance benefits associated with high-performance lubricants.

- Economic Volatility: Fluctuations in the Egyptian economy can impact fleet operating budgets, influencing purchasing decisions for lubricants.

Growth Drivers in the Egypt Commercial Vehicles Lubricants Industry Market

Growth in the Egypt Commercial Vehicles Lubricants Industry Market is primarily propelled by the nation's ambitious infrastructure development initiatives, leading to a significant increase in the construction and logistics sectors. The ongoing fleet modernization programs, coupled with government incentives for adopting Euro VI emission standards, are creating a substantial demand for advanced, high-performance engine oils and specialized lubricants. Technological advancements, such as the wider adoption of synthetic and semi-synthetic formulations, are driving improved fuel efficiency and extended drain intervals, appealing to cost-conscious fleet operators. Furthermore, increasing foreign investment in the automotive and logistics sectors is injecting dynamism into the market, fostering competition and innovation.

Challenges Impacting Egypt Commercial Vehicles Lubricants Industry Growth

Despite the positive growth trajectory, the Egypt Commercial Vehicles Lubricants Industry faces several challenges. The persistent issue of counterfeit lubricants continues to undermine market integrity and brand reputation, posing significant operational risks to fleets. Economic volatility and currency fluctuations can impact the affordability of imported base oils and additives, leading to price increases for premium products. Supply chain complexities, exacerbated by global events, can disrupt the consistent availability of essential raw materials, impacting production schedules and delivery timelines. Moreover, a segment of the market still exhibits resistance to adopting premium lubricants due to a perceived higher upfront cost, despite demonstrable long-term savings.

Key Players Shaping the Egypt Commercial Vehicles Lubricants Industry Market

- BP PLC (Castrol)

- Chevron Corporation

- Coperative Soceite des petroleum

- Emarat

- ExxonMobil Corporation

- FUCHS

- Misr Petroleum

- Petromin Corporation

- Royal Dutch Shell PLC

- TotalEnergie

Significant Egypt Commercial Vehicles Lubricants Industry Industry Milestones

- January 2022: Effective April 1, ExxonMobil Corporation was organized along three business lines - ExxonMobil Upstream Company, ExxonMobil Product Solutions and ExxonMobil Low Carbon Solutions. This strategic restructuring is expected to streamline operations and enhance focus on diverse market needs within the lubricants sector.

- July 2021: ExxonMobil and Trella signed a partnership that will allow Trella to improve trucking productivity and efficiency while also empowering drivers and fleets through the usage of Mobil Delvac. This collaboration signifies a commitment to leveraging advanced lubricant technology to enhance fleet operations.

- March 2021: Castrol announced the launch of Castrol ON (a Castrol e-fluid range that includes e-gear oils, e-coolants, and e-greases) to its product portfolio. This range is specially designed for electric vehicles, marking a significant step towards catering to the evolving needs of the automotive industry and anticipating future market demands.

Future Outlook for Egypt Commercial Vehicles Lubricants Industry Market

The future outlook for the Egypt Commercial Vehicles Lubricants Industry is highly promising, driven by sustained economic growth, ongoing infrastructure development, and an increasing focus on fleet efficiency and environmental compliance. The shift towards higher-performance synthetic lubricants is expected to accelerate, driven by a desire for extended drain intervals and reduced operational costs. Opportunities will emerge in the development and supply of specialized lubricants for the nascent electric commercial vehicle market, as well as in addressing the unique lubrication needs of emerging industries. Strategic partnerships and technological innovation will be crucial for players aiming to capture market share and navigate the evolving landscape of the Egyptian commercial lubricants sector.

Egypt Commercial Vehicles Lubricants Industry Segmentation

-

1. Product Type

- 1.1. Engine Oils

- 1.2. Greases

- 1.3. Hydraulic Fluids

- 1.4. Transmission & Gear Oils

Egypt Commercial Vehicles Lubricants Industry Segmentation By Geography

- 1. Egypt

Egypt Commercial Vehicles Lubricants Industry Regional Market Share

Geographic Coverage of Egypt Commercial Vehicles Lubricants Industry

Egypt Commercial Vehicles Lubricants Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Largest Segment By Product Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Egypt Commercial Vehicles Lubricants Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oils

- 5.1.2. Greases

- 5.1.3. Hydraulic Fluids

- 5.1.4. Transmission & Gear Oils

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Egypt

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BP PLC (Castrol)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chevron Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Coperative Soceite des petroleum

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Emarat

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ExxonMobil Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FUCHS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Misr Petroleum

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Petromin Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Royal Dutch Shell PLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TotalEnergie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 BP PLC (Castrol)

List of Figures

- Figure 1: Egypt Commercial Vehicles Lubricants Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Egypt Commercial Vehicles Lubricants Industry Share (%) by Company 2025

List of Tables

- Table 1: Egypt Commercial Vehicles Lubricants Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Egypt Commercial Vehicles Lubricants Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Egypt Commercial Vehicles Lubricants Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 4: Egypt Commercial Vehicles Lubricants Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Egypt Commercial Vehicles Lubricants Industry?

The projected CAGR is approximately 2.3%.

2. Which companies are prominent players in the Egypt Commercial Vehicles Lubricants Industry?

Key companies in the market include BP PLC (Castrol), Chevron Corporation, Coperative Soceite des petroleum, Emarat, ExxonMobil Corporation, FUCHS, Misr Petroleum, Petromin Corporation, Royal Dutch Shell PLC, TotalEnergie.

3. What are the main segments of the Egypt Commercial Vehicles Lubricants Industry?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.5 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Largest Segment By Product Type : Engine Oils.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2022: Effective April 1, ExxonMobil Corporation was organized along three business lines - ExxonMobil Upstream Company, ExxonMobil Product Solutions and ExxonMobil Low Carbon Solutions.July 2021: ExxonMobil and Trella signed a partnership that will allow Trella to improve trucking productivity and efficiency while also empowering drivers and fleets through the usage of Mobil Delvac.March 2021: Castrol announced the launch of Castrol ON (a Castrol e-fluid range that includes e-gear oils, e-coolants, and e-greases) to its product portfolio. This range is specially designed for electric vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Egypt Commercial Vehicles Lubricants Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Egypt Commercial Vehicles Lubricants Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Egypt Commercial Vehicles Lubricants Industry?

To stay informed about further developments, trends, and reports in the Egypt Commercial Vehicles Lubricants Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence