Key Insights

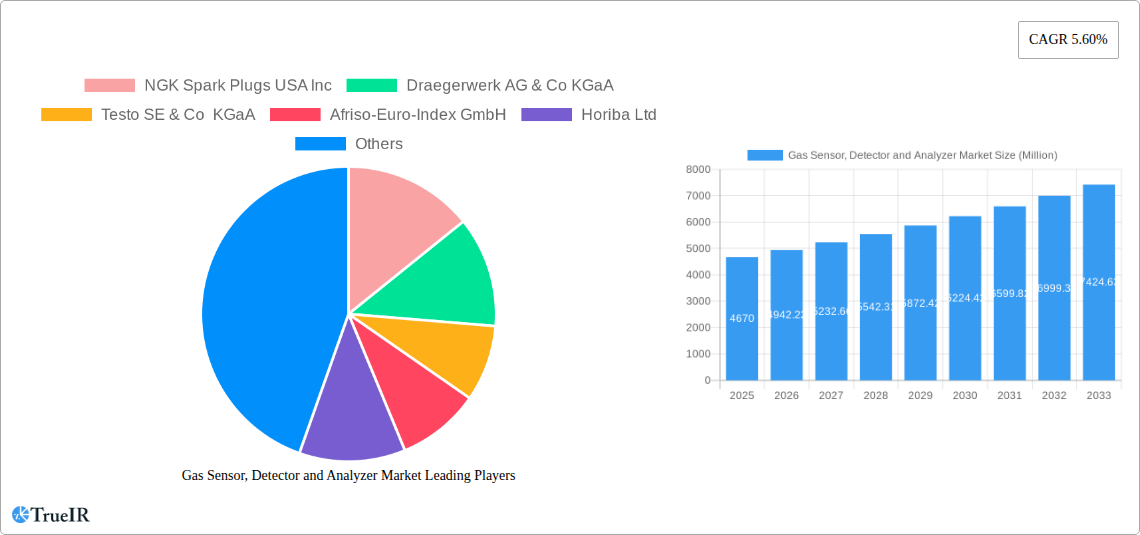

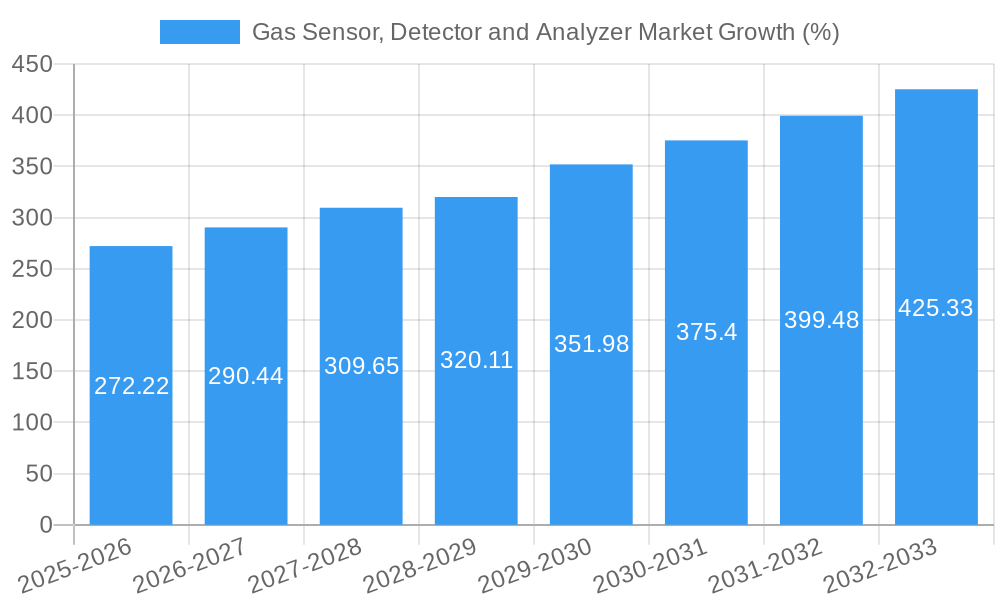

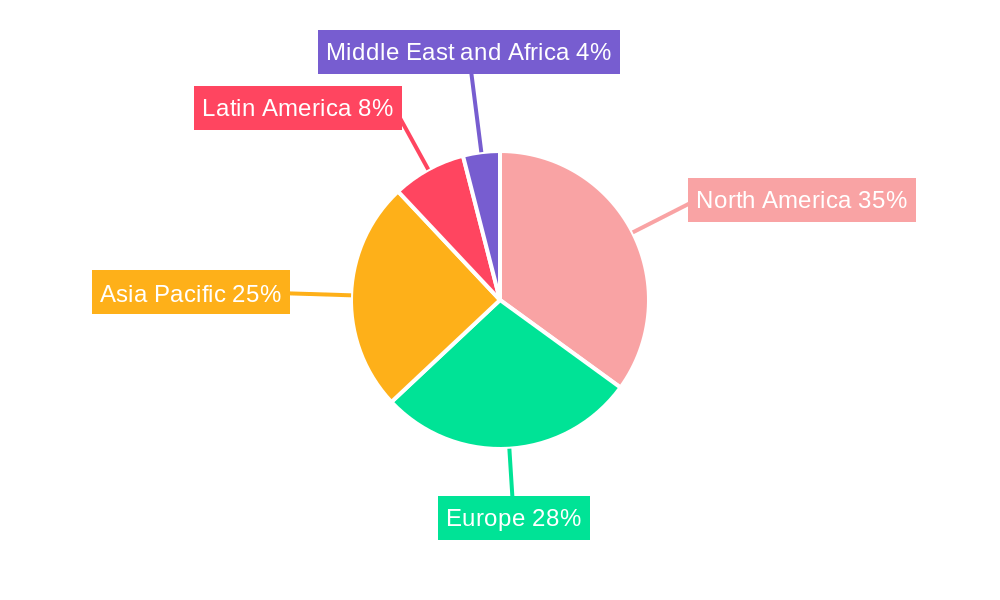

The global Gas Sensor, Detector, and Analyzer Market is experiencing robust growth, projected to reach \$4.67 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 5.60% from 2025 to 2033. This expansion is driven by several key factors. Increasing industrial automation necessitates precise and reliable gas detection for safety and process optimization across diverse sectors, including manufacturing, oil & gas, and environmental monitoring. Stringent environmental regulations globally are further propelling demand for advanced gas analyzers to comply with emission standards and ensure worker safety. Technological advancements in sensor technology, such as the development of miniaturized, more sensitive, and cost-effective sensors, are contributing to market growth. The shift towards non-disruptive infrared (NDIR) technology offers enhanced accuracy and reliability, further boosting market adoption. Growing awareness of gas leakages and their potential health hazards are fueling demand, particularly in residential and commercial applications. The market is segmented by technology (e.g., electrochemical, NDIR, photoionization) and end-user industry (e.g., automotive, healthcare, environmental monitoring). North America currently holds a significant market share due to the presence of major players and a strong focus on safety regulations. However, rapidly developing economies in Asia-Pacific are expected to witness significant growth in the coming years due to increasing industrialization and rising infrastructure investments.

The competitive landscape is characterized by a mix of established players and emerging companies, each focusing on specific technologies and end-user segments. Major industry participants such as NGK Spark Plugs, Draegerwerk, and Honeywell Analytics are leveraging their established market presence and R&D capabilities to expand their product portfolios and geographic reach. Meanwhile, smaller companies specializing in niche technologies are emerging as key players in certain market segments. While potential restraints include high initial investment costs for advanced analyzers and the complexity of integrating these systems into existing infrastructure, the long-term growth outlook remains positive, driven by continuous advancements in sensor technology, increasing regulatory pressures, and rising awareness of gas safety. Future growth will likely be shaped by the ongoing development of Internet of Things (IoT)-enabled gas detection systems allowing for remote monitoring and data analysis, enhancing efficiency and safety further.

Gas Sensor, Detector, and Analyzer Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the Gas Sensor, Detector, and Analyzer market, offering invaluable insights for industry stakeholders. Leveraging extensive market research and data analysis spanning the period 2019-2033 (historical period: 2019-2024, base year: 2025, forecast period: 2025-2033), this report offers a 360° view of market dynamics, competitive landscapes, and future growth potential. The market is estimated to be worth xx Million in 2025 and is projected to experience significant growth over the forecast period.

Gas Sensor, Detector and Analyzer Market Market Structure & Competitive Landscape

The Gas Sensor, Detector, and Analyzer market exhibits a moderately concentrated structure, with several large multinational corporations and a significant number of specialized niche players. The Herfindahl-Hirschman Index (HHI) for the market is estimated to be xx, indicating a moderately consolidated landscape. Innovation is a key driver, with continuous advancements in sensor technology, miniaturization, and connectivity pushing market growth. Stringent environmental regulations globally are also significantly impacting market dynamics, mandating the use of gas detection and analysis equipment in various industries. The market experiences competition from alternative technologies in specific applications, particularly in cost-sensitive segments. End-user segmentation is diverse, encompassing industrial, environmental monitoring, healthcare, and automotive sectors. The past five years have seen a moderate level of M&A activity, with approximately xx deals valued at xx Million. This activity mainly focuses on expanding product portfolios and geographic reach.

- Market Concentration: Moderately concentrated, HHI estimated at xx.

- Innovation Drivers: Miniaturization, improved sensitivity, connectivity, AI integration.

- Regulatory Impacts: Stringent emission standards, workplace safety regulations.

- Product Substitutes: Limited direct substitutes, but alternative technologies exist in niche applications.

- End-user Segmentation: Industrial (largest segment), environmental monitoring, healthcare, automotive.

- M&A Trends: Moderate activity (xx deals over the past 5 years) with a focus on portfolio expansion and geographical reach.

Gas Sensor, Detector and Analyzer Market Market Trends & Opportunities

The Gas Sensor, Detector, and Analyzer market is experiencing robust growth, driven by increasing industrial automation, stricter environmental regulations, and rising safety concerns across diverse industries. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. Technological advancements, such as the development of highly sensitive, selective, and miniaturized sensors, are enhancing market penetration rates in various applications. Consumer preference for reliable and user-friendly equipment is driving demand for advanced features like remote monitoring and data analytics capabilities. Intense competition among key players fosters continuous innovation and cost optimization, benefiting end-users. Emerging applications in areas like smart cities and environmental monitoring present significant growth opportunities. The market penetration rate for advanced gas sensors in industrial settings is expected to reach xx% by 2033.

Dominant Markets & Segments in Gas Sensor, Detector and Analyzer Market

The industrial sector represents the largest end-user segment for gas analyzers, driven by the high demand for process monitoring and safety systems in manufacturing plants. Within gas analyzer technologies, non-disruptive infrared (NDIR) spectroscopy dominates, due to its accuracy, reliability, and relatively lower cost compared to other methods. The Asia-Pacific region is the leading market for gas sensors, detectors, and analyzers, fueled by robust industrial growth, especially in China and India. North America and Europe also maintain substantial market shares, driven by strong regulatory environments and technological advancements.

- Key Growth Drivers in Asia-Pacific: Rapid industrialization, increasing infrastructure investments, stringent environmental regulations.

- Key Growth Drivers in North America: Stringent workplace safety regulations, advancements in sensor technology, demand for advanced monitoring systems.

- Key Growth Drivers in Europe: Focus on environmental sustainability, growing adoption of advanced monitoring systems in various industries.

Gas Sensor, Detector and Analyzer Market Product Analysis

Recent product innovations focus on enhanced sensitivity, improved selectivity, miniaturization, and wireless connectivity. Applications range from industrial process monitoring and environmental monitoring to personal safety and healthcare. Key competitive advantages lie in technological superiority, such as higher accuracy, faster response times, and greater durability. The market is seeing the increasing integration of AI and machine learning for predictive maintenance and improved data analytics.

Key Drivers, Barriers & Challenges in Gas Sensor, Detector and Analyzer Market

Key Drivers: Stringent environmental regulations, growing industrial automation, increasing awareness of workplace safety, advancements in sensor technology (e.g., miniaturization, improved sensitivity, lower power consumption), and rising demand for portable and connected devices.

Challenges: Supply chain disruptions impacting component availability and costs (estimated impact: xx% increase in production costs in 2023), fluctuating raw material prices, intense competition leading to pricing pressure, and complex regulatory frameworks varying across different regions. These challenges contribute to market volatility and can hinder growth.

Growth Drivers in the Gas Sensor, Detector and Analyzer Market Market

Technological advancements, specifically the development of highly sensitive and selective sensors, along with miniaturization and wireless connectivity, are significant growth drivers. Increasing industrial automation, stringent environmental regulations enforcing emissions monitoring, and heightened focus on workplace safety are further accelerating market expansion. Government initiatives promoting the adoption of advanced gas detection systems also contribute to growth.

Challenges Impacting Gas Sensor, Detector and Analyzer Market Growth

Significant challenges include supply chain vulnerabilities leading to component shortages and price volatility, intense competition, which leads to pricing pressure, and the complexity of complying with diverse and evolving regulatory frameworks in different geographical locations. These factors can significantly impact profitability and hinder the overall market growth.

Key Players Shaping the Gas Sensor, Detector and Analyzer Market Market

- NGK Spark Plugs USA Inc

- Draegerwerk AG & Co KGaA

- Testo SE & Co KGaA

- Afriso-Euro-Index GmbH

- Horiba Ltd

- Figaro Engineering Inc

- MSA Safety Incorporated

- Servomex Group Limited (Spectris PLC)

- Honeywell Analytics Inc

- Bacharach Inc

- Delphi Technologies (BorgWarner Inc)

- GfG Gas Detection UK Ltd

- Detector Electronics Corporation

- Alphasense Limited

- Siemens AG

- Trolex Ltd

- Senseir AB

- Eaton Corporation PLC

- SGX Sensortech Limited (Amphenol Limited)

- California Analytical Instruments

- MKS Instruments Inc

- RKI Instruments Inc

- Robert Bosch GmbH

- Control Instruments Corporation

- Crowncon Detection Instruments Limited

- Yokogawa Electric Corporation

- Thermofisher Scientific Inc

- General Electric Company

- Industrial Scientific Corporation

- Teledyne API

- Denso Corporation

- Membrapor AG

- Emerson Electric Company

Significant Gas Sensor, Detector and Analyzer Market Industry Milestones

- September 2022: Industrial Scientific Corporation launched a new Photo-Ionization Detector sensor for the Ventis Pro5 Multi-gas monitor, enhancing its capabilities for VOC detection and situational awareness. This improved the market offering of compact, versatile personal gas monitors.

- June 2022: Servomex Group Ltd introduced a new, advanced photometric gas analysis solution on an easier-to-use digital platform. This broadened the application range of rugged, reliable analyzers to diverse industrial processes.

Future Outlook for Gas Sensor, Detector and Analyzer Market Market

The Gas Sensor, Detector, and Analyzer market is poised for continued growth, fueled by ongoing technological innovations, strengthening environmental regulations, and the increasing adoption of smart technologies across various industries. Strategic opportunities exist in developing highly integrated systems, utilizing advanced data analytics, and expanding into emerging applications, particularly in the environmental monitoring and smart city sectors. The market holds significant potential for expansion, driven by the growing demand for safe and efficient industrial processes and a heightened focus on environmental sustainability.

Gas Sensor, Detector and Analyzer Market Segmentation

-

1. Type

- 1.1. Sensor

- 1.2. Detector

- 1.3. Analyzer

-

2. End-Use

- 2.1. Industrial

- 2.2. Environmental Monitoring

- 2.3. Safety

- 2.4. Research & Development

Gas Sensor, Detector and Analyzer Market Segmentation By Geography

-

1. North America

- 1.1. Europe

- 1.2. Asia Pacific

- 1.3. Latin America

- 1.4. Middle East and Africa

-

2. North America

- 2.1. Europe

- 2.2. Asia Pacific

- 2.3. Latin America

- 2.4. Middle East and Africa

-

3. North America

- 3.1. Europe

- 3.2. Asia Pacific

- 3.3. Latin America

- 3.4. Middle East and Africa

Gas Sensor, Detector and Analyzer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Safety Awareness Regarding Occupational Hazards; Proliferation of Handheld Devices

- 3.3. Market Restrains

- 3.3.1. High Costs and Lack of Product Differentiation

- 3.4. Market Trends

- 3.4.1. Oil and Gas Industry Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gas Sensor, Detector and Analyzer Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Sensor

- 5.1.2. Detector

- 5.1.3. Analyzer

- 5.2. Market Analysis, Insights and Forecast - by End-Use

- 5.2.1. Industrial

- 5.2.2. Environmental Monitoring

- 5.2.3. Safety

- 5.2.4. Research & Development

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. North America

- 5.3.3. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Gas Sensor, Detector and Analyzer Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Sensor

- 6.1.2. Detector

- 6.1.3. Analyzer

- 6.2. Market Analysis, Insights and Forecast - by End-Use

- 6.2.1. Industrial

- 6.2.2. Environmental Monitoring

- 6.2.3. Safety

- 6.2.4. Research & Development

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Gas Sensor, Detector and Analyzer Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Sensor

- 7.1.2. Detector

- 7.1.3. Analyzer

- 7.2. Market Analysis, Insights and Forecast - by End-Use

- 7.2.1. Industrial

- 7.2.2. Environmental Monitoring

- 7.2.3. Safety

- 7.2.4. Research & Development

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. North America Gas Sensor, Detector and Analyzer Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Sensor

- 8.1.2. Detector

- 8.1.3. Analyzer

- 8.2. Market Analysis, Insights and Forecast - by End-Use

- 8.2.1. Industrial

- 8.2.2. Environmental Monitoring

- 8.2.3. Safety

- 8.2.4. Research & Development

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Europe Gas Sensor, Detector and Analyzer Market Analysis, Insights and Forecast, 2019-2031

- 10. Asia Pacific Gas Sensor, Detector and Analyzer Market Analysis, Insights and Forecast, 2019-2031

- 11. Latin America Gas Sensor, Detector and Analyzer Market Analysis, Insights and Forecast, 2019-2031

- 12. Middle East and Africa Gas Sensor, Detector and Analyzer Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 NGK Spark Plugs USA Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Draegerwerk AG & Co KGaA

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Testo SE & Co KGaA

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Afriso-Euro-Index GmbH

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Horiba Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Figaro Engineering Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 MSA Safety Incorporated

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Servomex Group Limited (Spectris PLC)

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Honeywell Analytics Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Bacharach Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Delphi Technologies (BorgWarner Inc )

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 GfG Gas Detection UK Ltd

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Detector Electronics Corporation

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Alphasense Limited

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Siemens AG

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 Trolex Ltd

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.17 Senseir AB

- 13.2.17.1. Overview

- 13.2.17.2. Products

- 13.2.17.3. SWOT Analysis

- 13.2.17.4. Recent Developments

- 13.2.17.5. Financials (Based on Availability)

- 13.2.18 Eaton Corporation PLC

- 13.2.18.1. Overview

- 13.2.18.2. Products

- 13.2.18.3. SWOT Analysis

- 13.2.18.4. Recent Developments

- 13.2.18.5. Financials (Based on Availability)

- 13.2.19 SGX Sensortech Limited (Amphenol Limited)

- 13.2.19.1. Overview

- 13.2.19.2. Products

- 13.2.19.3. SWOT Analysis

- 13.2.19.4. Recent Developments

- 13.2.19.5. Financials (Based on Availability)

- 13.2.20 California Analytical Instruments

- 13.2.20.1. Overview

- 13.2.20.2. Products

- 13.2.20.3. SWOT Analysis

- 13.2.20.4. Recent Developments

- 13.2.20.5. Financials (Based on Availability)

- 13.2.21 MKS Instruments Inc

- 13.2.21.1. Overview

- 13.2.21.2. Products

- 13.2.21.3. SWOT Analysis

- 13.2.21.4. Recent Developments

- 13.2.21.5. Financials (Based on Availability)

- 13.2.22 RKI Instruments Inc

- 13.2.22.1. Overview

- 13.2.22.2. Products

- 13.2.22.3. SWOT Analysis

- 13.2.22.4. Recent Developments

- 13.2.22.5. Financials (Based on Availability)

- 13.2.23 Robert Bosch GmbH

- 13.2.23.1. Overview

- 13.2.23.2. Products

- 13.2.23.3. SWOT Analysis

- 13.2.23.4. Recent Developments

- 13.2.23.5. Financials (Based on Availability)

- 13.2.24 Control Instruments Corporation

- 13.2.24.1. Overview

- 13.2.24.2. Products

- 13.2.24.3. SWOT Analysis

- 13.2.24.4. Recent Developments

- 13.2.24.5. Financials (Based on Availability)

- 13.2.25 Crowncon Detection Instruments Limited

- 13.2.25.1. Overview

- 13.2.25.2. Products

- 13.2.25.3. SWOT Analysis

- 13.2.25.4. Recent Developments

- 13.2.25.5. Financials (Based on Availability)

- 13.2.26 Yokogawa Electric Corporation

- 13.2.26.1. Overview

- 13.2.26.2. Products

- 13.2.26.3. SWOT Analysis

- 13.2.26.4. Recent Developments

- 13.2.26.5. Financials (Based on Availability)

- 13.2.27 Thermofisher Scientific Inc

- 13.2.27.1. Overview

- 13.2.27.2. Products

- 13.2.27.3. SWOT Analysis

- 13.2.27.4. Recent Developments

- 13.2.27.5. Financials (Based on Availability)

- 13.2.28 General Electric Company

- 13.2.28.1. Overview

- 13.2.28.2. Products

- 13.2.28.3. SWOT Analysis

- 13.2.28.4. Recent Developments

- 13.2.28.5. Financials (Based on Availability)

- 13.2.29 Industrial Scientific Corporation

- 13.2.29.1. Overview

- 13.2.29.2. Products

- 13.2.29.3. SWOT Analysis

- 13.2.29.4. Recent Developments

- 13.2.29.5. Financials (Based on Availability)

- 13.2.30 Teledyne API

- 13.2.30.1. Overview

- 13.2.30.2. Products

- 13.2.30.3. SWOT Analysis

- 13.2.30.4. Recent Developments

- 13.2.30.5. Financials (Based on Availability)

- 13.2.31 Denso Corporation

- 13.2.31.1. Overview

- 13.2.31.2. Products

- 13.2.31.3. SWOT Analysis

- 13.2.31.4. Recent Developments

- 13.2.31.5. Financials (Based on Availability)

- 13.2.32 Membrapor AG

- 13.2.32.1. Overview

- 13.2.32.2. Products

- 13.2.32.3. SWOT Analysis

- 13.2.32.4. Recent Developments

- 13.2.32.5. Financials (Based on Availability)

- 13.2.33 Emerson Electric Company

- 13.2.33.1. Overview

- 13.2.33.2. Products

- 13.2.33.3. SWOT Analysis

- 13.2.33.4. Recent Developments

- 13.2.33.5. Financials (Based on Availability)

- 13.2.1 NGK Spark Plugs USA Inc

List of Figures

- Figure 1: Global Gas Sensor, Detector and Analyzer Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Gas Sensor, Detector and Analyzer Market Volume Breakdown (K Unit, %) by Region 2024 & 2032

- Figure 3: North America Gas Sensor, Detector and Analyzer Market Revenue (Million), by Country 2024 & 2032

- Figure 4: North America Gas Sensor, Detector and Analyzer Market Volume (K Unit), by Country 2024 & 2032

- Figure 5: North America Gas Sensor, Detector and Analyzer Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: North America Gas Sensor, Detector and Analyzer Market Volume Share (%), by Country 2024 & 2032

- Figure 7: North America Gas Sensor, Detector and Analyzer Market Revenue (Million), by Type 2024 & 2032

- Figure 8: North America Gas Sensor, Detector and Analyzer Market Volume (K Unit), by Type 2024 & 2032

- Figure 9: North America Gas Sensor, Detector and Analyzer Market Revenue Share (%), by Type 2024 & 2032

- Figure 10: North America Gas Sensor, Detector and Analyzer Market Volume Share (%), by Type 2024 & 2032

- Figure 11: North America Gas Sensor, Detector and Analyzer Market Revenue (Million), by End-Use 2024 & 2032

- Figure 12: North America Gas Sensor, Detector and Analyzer Market Volume (K Unit), by End-Use 2024 & 2032

- Figure 13: North America Gas Sensor, Detector and Analyzer Market Revenue Share (%), by End-Use 2024 & 2032

- Figure 14: North America Gas Sensor, Detector and Analyzer Market Volume Share (%), by End-Use 2024 & 2032

- Figure 15: North America Gas Sensor, Detector and Analyzer Market Revenue (Million), by Country 2024 & 2032

- Figure 16: North America Gas Sensor, Detector and Analyzer Market Volume (K Unit), by Country 2024 & 2032

- Figure 17: North America Gas Sensor, Detector and Analyzer Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: North America Gas Sensor, Detector and Analyzer Market Volume Share (%), by Country 2024 & 2032

- Figure 19: North America Gas Sensor, Detector and Analyzer Market Revenue (Million), by Type 2024 & 2032

- Figure 20: North America Gas Sensor, Detector and Analyzer Market Volume (K Unit), by Type 2024 & 2032

- Figure 21: North America Gas Sensor, Detector and Analyzer Market Revenue Share (%), by Type 2024 & 2032

- Figure 22: North America Gas Sensor, Detector and Analyzer Market Volume Share (%), by Type 2024 & 2032

- Figure 23: North America Gas Sensor, Detector and Analyzer Market Revenue (Million), by End-Use 2024 & 2032

- Figure 24: North America Gas Sensor, Detector and Analyzer Market Volume (K Unit), by End-Use 2024 & 2032

- Figure 25: North America Gas Sensor, Detector and Analyzer Market Revenue Share (%), by End-Use 2024 & 2032

- Figure 26: North America Gas Sensor, Detector and Analyzer Market Volume Share (%), by End-Use 2024 & 2032

- Figure 27: North America Gas Sensor, Detector and Analyzer Market Revenue (Million), by Country 2024 & 2032

- Figure 28: North America Gas Sensor, Detector and Analyzer Market Volume (K Unit), by Country 2024 & 2032

- Figure 29: North America Gas Sensor, Detector and Analyzer Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: North America Gas Sensor, Detector and Analyzer Market Volume Share (%), by Country 2024 & 2032

- Figure 31: North America Gas Sensor, Detector and Analyzer Market Revenue (Million), by Type 2024 & 2032

- Figure 32: North America Gas Sensor, Detector and Analyzer Market Volume (K Unit), by Type 2024 & 2032

- Figure 33: North America Gas Sensor, Detector and Analyzer Market Revenue Share (%), by Type 2024 & 2032

- Figure 34: North America Gas Sensor, Detector and Analyzer Market Volume Share (%), by Type 2024 & 2032

- Figure 35: North America Gas Sensor, Detector and Analyzer Market Revenue (Million), by End-Use 2024 & 2032

- Figure 36: North America Gas Sensor, Detector and Analyzer Market Volume (K Unit), by End-Use 2024 & 2032

- Figure 37: North America Gas Sensor, Detector and Analyzer Market Revenue Share (%), by End-Use 2024 & 2032

- Figure 38: North America Gas Sensor, Detector and Analyzer Market Volume Share (%), by End-Use 2024 & 2032

- Figure 39: North America Gas Sensor, Detector and Analyzer Market Revenue (Million), by Country 2024 & 2032

- Figure 40: North America Gas Sensor, Detector and Analyzer Market Volume (K Unit), by Country 2024 & 2032

- Figure 41: North America Gas Sensor, Detector and Analyzer Market Revenue Share (%), by Country 2024 & 2032

- Figure 42: North America Gas Sensor, Detector and Analyzer Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Gas Sensor, Detector and Analyzer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Gas Sensor, Detector and Analyzer Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Global Gas Sensor, Detector and Analyzer Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Gas Sensor, Detector and Analyzer Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: Global Gas Sensor, Detector and Analyzer Market Revenue Million Forecast, by End-Use 2019 & 2032

- Table 6: Global Gas Sensor, Detector and Analyzer Market Volume K Unit Forecast, by End-Use 2019 & 2032

- Table 7: Global Gas Sensor, Detector and Analyzer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Gas Sensor, Detector and Analyzer Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Global Gas Sensor, Detector and Analyzer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global Gas Sensor, Detector and Analyzer Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Europe Gas Sensor, Detector and Analyzer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Europe Gas Sensor, Detector and Analyzer Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Asia Pacific Gas Sensor, Detector and Analyzer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Asia Pacific Gas Sensor, Detector and Analyzer Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Latin America Gas Sensor, Detector and Analyzer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Latin America Gas Sensor, Detector and Analyzer Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Middle East and Africa Gas Sensor, Detector and Analyzer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Middle East and Africa Gas Sensor, Detector and Analyzer Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Global Gas Sensor, Detector and Analyzer Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Global Gas Sensor, Detector and Analyzer Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 21: Global Gas Sensor, Detector and Analyzer Market Revenue Million Forecast, by End-Use 2019 & 2032

- Table 22: Global Gas Sensor, Detector and Analyzer Market Volume K Unit Forecast, by End-Use 2019 & 2032

- Table 23: Global Gas Sensor, Detector and Analyzer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Gas Sensor, Detector and Analyzer Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 25: Europe Gas Sensor, Detector and Analyzer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Europe Gas Sensor, Detector and Analyzer Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Asia Pacific Gas Sensor, Detector and Analyzer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Asia Pacific Gas Sensor, Detector and Analyzer Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Latin America Gas Sensor, Detector and Analyzer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Latin America Gas Sensor, Detector and Analyzer Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: Middle East and Africa Gas Sensor, Detector and Analyzer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Middle East and Africa Gas Sensor, Detector and Analyzer Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 33: Global Gas Sensor, Detector and Analyzer Market Revenue Million Forecast, by Type 2019 & 2032

- Table 34: Global Gas Sensor, Detector and Analyzer Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 35: Global Gas Sensor, Detector and Analyzer Market Revenue Million Forecast, by End-Use 2019 & 2032

- Table 36: Global Gas Sensor, Detector and Analyzer Market Volume K Unit Forecast, by End-Use 2019 & 2032

- Table 37: Global Gas Sensor, Detector and Analyzer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Global Gas Sensor, Detector and Analyzer Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 39: Europe Gas Sensor, Detector and Analyzer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Europe Gas Sensor, Detector and Analyzer Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 41: Asia Pacific Gas Sensor, Detector and Analyzer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Asia Pacific Gas Sensor, Detector and Analyzer Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Latin America Gas Sensor, Detector and Analyzer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Latin America Gas Sensor, Detector and Analyzer Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: Middle East and Africa Gas Sensor, Detector and Analyzer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Middle East and Africa Gas Sensor, Detector and Analyzer Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: Global Gas Sensor, Detector and Analyzer Market Revenue Million Forecast, by Type 2019 & 2032

- Table 48: Global Gas Sensor, Detector and Analyzer Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 49: Global Gas Sensor, Detector and Analyzer Market Revenue Million Forecast, by End-Use 2019 & 2032

- Table 50: Global Gas Sensor, Detector and Analyzer Market Volume K Unit Forecast, by End-Use 2019 & 2032

- Table 51: Global Gas Sensor, Detector and Analyzer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: Global Gas Sensor, Detector and Analyzer Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 53: Europe Gas Sensor, Detector and Analyzer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Europe Gas Sensor, Detector and Analyzer Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 55: Asia Pacific Gas Sensor, Detector and Analyzer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Asia Pacific Gas Sensor, Detector and Analyzer Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 57: Latin America Gas Sensor, Detector and Analyzer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Latin America Gas Sensor, Detector and Analyzer Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 59: Middle East and Africa Gas Sensor, Detector and Analyzer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Middle East and Africa Gas Sensor, Detector and Analyzer Market Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gas Sensor, Detector and Analyzer Market?

The projected CAGR is approximately 5.60%.

2. Which companies are prominent players in the Gas Sensor, Detector and Analyzer Market?

Key companies in the market include NGK Spark Plugs USA Inc, Draegerwerk AG & Co KGaA, Testo SE & Co KGaA, Afriso-Euro-Index GmbH, Horiba Ltd, Figaro Engineering Inc, MSA Safety Incorporated, Servomex Group Limited (Spectris PLC), Honeywell Analytics Inc, Bacharach Inc, Delphi Technologies (BorgWarner Inc ), GfG Gas Detection UK Ltd, Detector Electronics Corporation, Alphasense Limited, Siemens AG, Trolex Ltd, Senseir AB, Eaton Corporation PLC, SGX Sensortech Limited (Amphenol Limited), California Analytical Instruments, MKS Instruments Inc, RKI Instruments Inc, Robert Bosch GmbH, Control Instruments Corporation, Crowncon Detection Instruments Limited, Yokogawa Electric Corporation, Thermofisher Scientific Inc, General Electric Company, Industrial Scientific Corporation, Teledyne API, Denso Corporation, Membrapor AG, Emerson Electric Company.

3. What are the main segments of the Gas Sensor, Detector and Analyzer Market?

The market segments include Type , End-Use .

4. Can you provide details about the market size?

The market size is estimated to be USD 4.67 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Safety Awareness Regarding Occupational Hazards; Proliferation of Handheld Devices.

6. What are the notable trends driving market growth?

Oil and Gas Industry Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

High Costs and Lack of Product Differentiation.

8. Can you provide examples of recent developments in the market?

September 2022 - Industrial Scientific Corporation introduced a new Photo-Ionization Detector sensor for the Ventis Pro5 Multi-gas monitor, making it the most compact, versatile, and connected five-gas personal monitor that allows users to detect VOCs while improving situational awareness reliably.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gas Sensor, Detector and Analyzer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gas Sensor, Detector and Analyzer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gas Sensor, Detector and Analyzer Market?

To stay informed about further developments, trends, and reports in the Gas Sensor, Detector and Analyzer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence