Key Insights

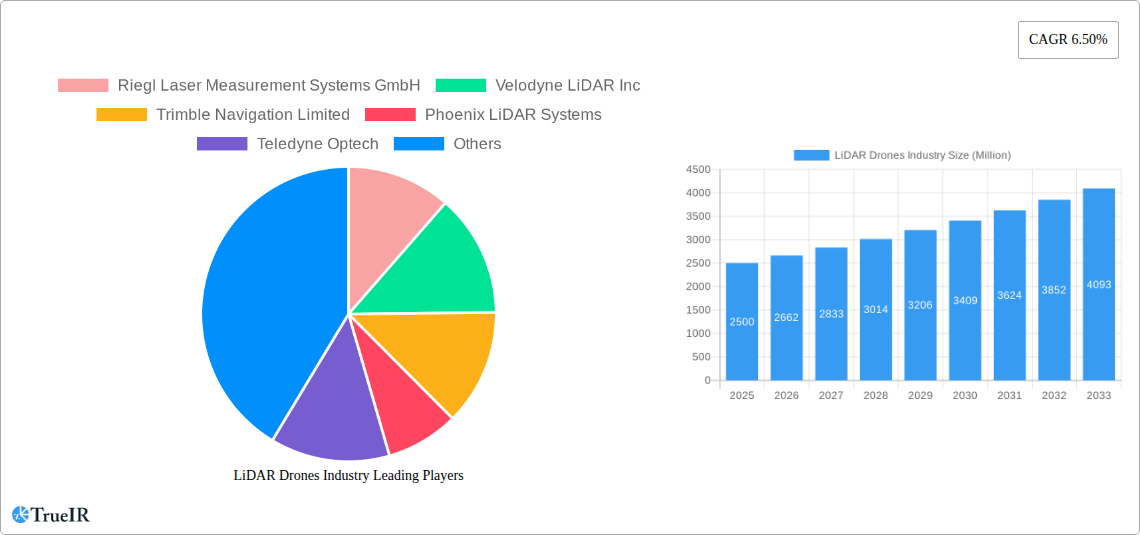

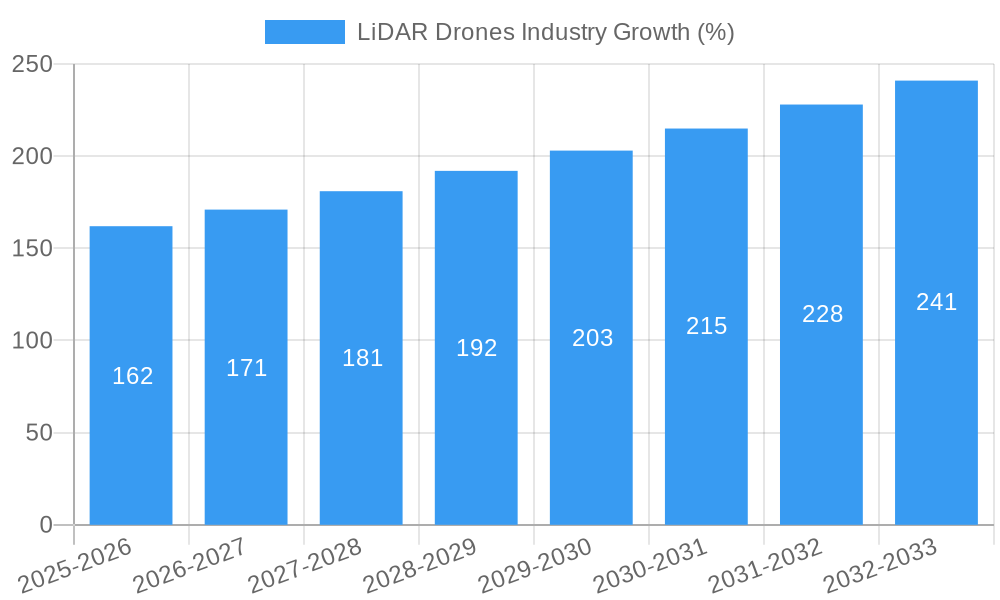

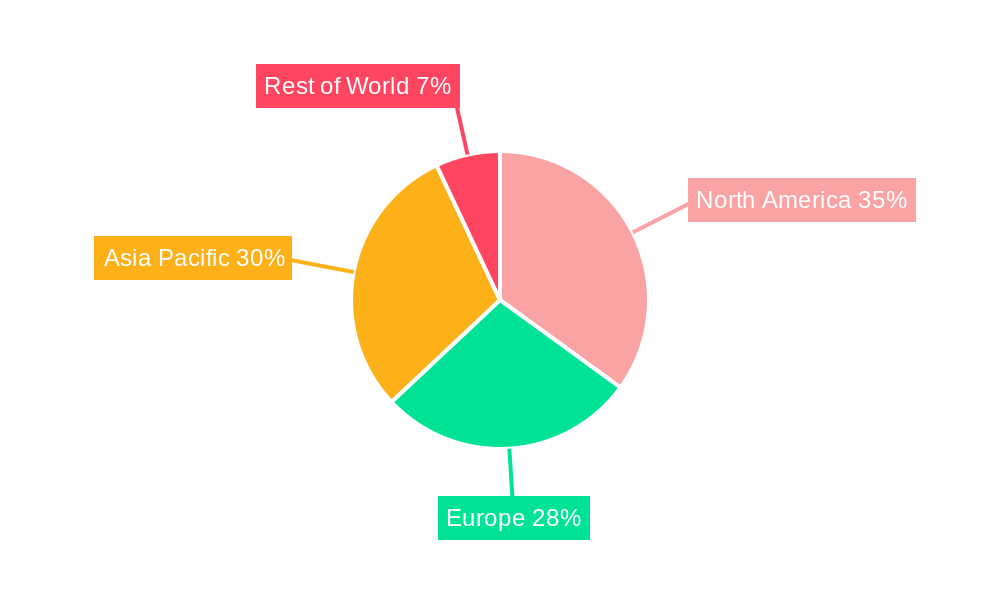

The LiDAR drone market is experiencing robust growth, driven by increasing demand across diverse sectors. The market's Compound Annual Growth Rate (CAGR) of 6.50% from 2019 to 2024 suggests a significant expansion, projected to continue throughout the forecast period (2025-2033). Key drivers include the rising need for precise data in applications like construction (site surveying, 3D modeling), environmental monitoring (vegetation mapping, deforestation analysis), precision agriculture (crop yield optimization), and corridor mapping (pipeline inspections, power line surveys). Technological advancements, such as improved sensor accuracy, miniaturization of LiDAR systems, and enhanced drone flight autonomy, further fuel market expansion. The market is segmented by component (laser scanners, navigation systems, cameras), product type (rotary and fixed-wing drones), and application, with construction and environmental monitoring currently dominating. While regulatory hurdles and the relatively high cost of LiDAR drones pose some restraints, the overall market outlook remains positive, especially considering the increasing adoption of LiDAR technology across various industries for its ability to provide highly accurate and detailed 3D data. The competitive landscape is marked by established players like Riegl, Velodyne, and Trimble, alongside emerging technology companies, fostering innovation and driving price competition. The Asia-Pacific region, particularly China and India, is expected to show strong growth due to increasing infrastructure development and government initiatives promoting technological advancements in surveying and mapping. North America, however, is likely to remain a significant market due to established adoption in advanced surveying and mapping applications.

The continued growth trajectory is predicated on several factors. Firstly, the increasing affordability of LiDAR drones, combined with advancements in data processing and analysis software, is making the technology accessible to a wider range of users. Secondly, the development of new applications, such as autonomous drone operations and the integration of LiDAR with other sensor technologies (e.g., multispectral cameras), will further expand market potential. Finally, the growing emphasis on data-driven decision-making across sectors, including urban planning and disaster response, underscores the continued importance of accurate and comprehensive spatial data provided by LiDAR drones. Competition will likely intensify, with companies focusing on developing differentiated offerings—in terms of sensor technology, drone platform integration, data analytics capabilities—to gain market share.

This comprehensive report provides a detailed analysis of the LiDAR Drones industry, covering market size, growth trends, competitive landscape, and future outlook from 2019 to 2033. With a focus on key segments and leading players, this report is an essential resource for businesses, investors, and researchers seeking to understand and navigate this rapidly evolving market. The report leverages extensive data analysis to offer actionable insights and forecasts, enabling informed decision-making in this dynamic sector. The market is projected to reach xx Million by 2033.

LiDAR Drones Industry Market Structure & Competitive Landscape

The LiDAR Drones industry exhibits a moderately concentrated market structure, with several key players holding significant market share. However, the market is also characterized by a high degree of innovation, particularly in sensor technology and data processing capabilities. This drives continuous product improvements and the emergence of new entrants. Regulatory frameworks concerning drone operation and data privacy vary across regions, influencing market dynamics. Product substitutes, such as traditional surveying methods, remain relevant in certain niche applications, though LiDAR's superior accuracy and speed are increasingly favored. The end-user segmentation is diverse, encompassing construction, environmental monitoring, agriculture, and defense sectors. M&A activity has been relatively moderate in recent years, though strategic acquisitions by established players to expand their technology portfolios or market reach are expected to increase.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately concentrated market.

- Innovation Drivers: Advancements in sensor technology, data processing algorithms, and autonomous flight capabilities are key drivers.

- Regulatory Impacts: Varying drone regulations across regions impact market accessibility and operational costs.

- Product Substitutes: Traditional surveying and mapping methods offer lower-cost alternatives but lack the precision of LiDAR.

- End-User Segmentation: Construction, environment, precision agriculture, and defense are major end-user sectors.

- M&A Trends: Moderate M&A activity observed in recent years, with potential for increased strategic acquisitions.

LiDAR Drones Industry Market Trends & Opportunities

The LiDAR Drones market is experiencing robust growth, driven by increasing demand across diverse applications. The market size is projected to reach xx Million in 2025, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth reflects the growing adoption of LiDAR technology for various applications, its ability to generate highly precise 3D point cloud data, and advances in drone technology. Key factors driving market expansion include: increasing infrastructure development, particularly in developing economies, growing need for precise mapping and surveying in various industries, and increased government investments in infrastructure projects. Technological advancements in sensor technology, processing power, and data analytics also fuel the industry's progress. Consumer preferences are shifting towards higher-accuracy data and faster data acquisition capabilities, prompting innovation. The competitive landscape is dynamic, with both established players and new entrants vying for market share, leading to price competition and product differentiation strategies. Market penetration rates are expected to rise significantly, especially in emerging economies with rapidly growing infrastructure needs.

Dominant Markets & Segments in LiDAR Drones Industry

The North American market currently holds a dominant position in the LiDAR drones industry, fueled by strong demand from the construction and defense sectors. However, the Asia-Pacific region is projected to experience the highest growth rate due to rapid urbanization and infrastructure development.

Key Growth Drivers by Segment:

- By Component:

- Laser Scanners: High demand for high-resolution data drives growth.

- Navigation and Positioning Systems: Precise positioning is crucial for accurate data acquisition, driving this segment.

- Cameras: Integration of cameras with LiDAR enhances data utility, driving market growth.

- Other Components: Supporting hardware and software components are vital for system functionality.

- By Product:

- Rotary Wing LiDAR Drone: Versatility and maneuverability make this a preferred option in diverse applications.

- Fixed Wing LiDAR Drone: Covers larger areas quickly and efficiently, making it ideal for large-scale projects.

- By Application:

- Construction: Precise 3D modeling for design and construction management is a major driver.

- Environment: Monitoring environmental changes, deforestation, and natural disaster assessment.

- Precision Agriculture: Optimizing farming practices and resource management.

- Corridor Mapping: Efficiently surveying linear infrastructure such as roads, pipelines, and power lines.

- Defense: Military surveillance and reconnaissance applications.

- Other Applications: Expanding applications in mining, archaeology, and urban planning.

LiDAR Drones Industry Product Analysis

Recent product innovations focus on miniaturization, improved accuracy, increased range, and enhanced data processing capabilities. These advancements are making LiDAR drone technology more accessible and affordable, expanding its applications. The competitive advantage lies in offering higher resolution data, faster processing speeds, and user-friendly software solutions. The market fits the needs of various industries seeking efficient and precise data acquisition for diverse applications, further fueling market growth.

Key Drivers, Barriers & Challenges in LiDAR Drones Industry

Key Drivers:

- Technological advancements in sensor technology, data processing, and drone autonomy.

- Increasing demand for accurate spatial data across multiple industries.

- Growing government investments in infrastructure projects.

- Favorable regulatory environments in certain regions.

Key Challenges and Restraints:

- High initial investment costs for LiDAR systems and associated software.

- Varying regulatory frameworks across regions pose operational challenges.

- Data processing demands high computational power, increasing costs.

- Intense competition amongst manufacturers and service providers. Price pressures are significant. This has reduced profit margins for some companies by xx%.

Growth Drivers in the LiDAR Drones Industry Market

The key drivers of growth in the LiDAR Drones industry include the increasing demand for precise 3D mapping and modeling across various industries, technological advancements in LiDAR sensor technology and drone autonomy, expanding applications in sectors such as infrastructure development, environmental monitoring, and precision agriculture, and supportive government policies in some regions promoting the adoption of drone technology.

Challenges Impacting LiDAR Drones Industry Growth

Challenges facing the industry include the high cost of LiDAR systems, the complexity of data processing, stringent regulatory frameworks governing drone operations, competition from other surveying technologies, and potential supply chain disruptions impacting the availability of essential components.

Key Players Shaping the LiDAR Drones Industry Market

- Riegl Laser Measurement Systems GmbH

- Velodyne LiDAR Inc

- Trimble Navigation Limited

- Phoenix LiDAR Systems

- Teledyne Optech

- TDK-Lambda Corporation

- Leica Geosystems AG

- SZ DJI Technology Co Ltd

- Sick AG

- FARO Technologies Inc

Significant LiDAR Drones Industry Industry Milestones

- June 2022: Draganfly introduces a new long-range LiDAR drone system capable of producing 0.5-centimeter point clouds with 2-centimeter global accuracy and a scanning range of 750 meters at two million points per second. This significantly improves data resolution and accuracy compared to traditional photogrammetry.

- August 2022: Aerial Precision secures EUR 760,000 (USD 810,395.60) in funding to develop intelligent LiDAR solutions for commercial drones and mobility vehicles, addressing the limited utilization of 3D map production.

Future Outlook for LiDAR Drones Industry Market

The LiDAR Drones market is poised for continued strong growth, driven by technological advancements, expanding applications, and increasing investments in infrastructure. Strategic opportunities exist for companies that can offer innovative solutions, such as integrating AI and machine learning for enhanced data processing and analysis, developing more compact and cost-effective systems, and expanding into new and emerging markets. The market presents significant potential for growth and innovation in the coming years.

LiDAR Drones Industry Segmentation

-

1. Component

- 1.1. Laser Scanners

- 1.2. Navigation and Positioning Systems

- 1.3. Cameras

- 1.4. Other Components

-

2. Product

- 2.1. Rotary Wing LiDAR Drone

- 2.2. Fixed Wing LiDAR Drone

-

3. Application

- 3.1. Construction

- 3.2. Environment

- 3.3. Precision Agriculture

- 3.4. Corridor Mapping

- 3.5. Defense

- 3.6. Other Applications

LiDAR Drones Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

- 4. Rest of the World

LiDAR Drones Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Advancements in Drone Technology; Cost Effective and Accurate Geo Mapping; Increasing Need for Robust Surveillance Systems across Various Industries

- 3.3. Market Restrains

- 3.3.1. Increase in the Cost of Equipment

- 3.4. Market Trends

- 3.4.1. Construction is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global LiDAR Drones Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Laser Scanners

- 5.1.2. Navigation and Positioning Systems

- 5.1.3. Cameras

- 5.1.4. Other Components

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Rotary Wing LiDAR Drone

- 5.2.2. Fixed Wing LiDAR Drone

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Construction

- 5.3.2. Environment

- 5.3.3. Precision Agriculture

- 5.3.4. Corridor Mapping

- 5.3.5. Defense

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America LiDAR Drones Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Laser Scanners

- 6.1.2. Navigation and Positioning Systems

- 6.1.3. Cameras

- 6.1.4. Other Components

- 6.2. Market Analysis, Insights and Forecast - by Product

- 6.2.1. Rotary Wing LiDAR Drone

- 6.2.2. Fixed Wing LiDAR Drone

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Construction

- 6.3.2. Environment

- 6.3.3. Precision Agriculture

- 6.3.4. Corridor Mapping

- 6.3.5. Defense

- 6.3.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe LiDAR Drones Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Laser Scanners

- 7.1.2. Navigation and Positioning Systems

- 7.1.3. Cameras

- 7.1.4. Other Components

- 7.2. Market Analysis, Insights and Forecast - by Product

- 7.2.1. Rotary Wing LiDAR Drone

- 7.2.2. Fixed Wing LiDAR Drone

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Construction

- 7.3.2. Environment

- 7.3.3. Precision Agriculture

- 7.3.4. Corridor Mapping

- 7.3.5. Defense

- 7.3.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific LiDAR Drones Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Laser Scanners

- 8.1.2. Navigation and Positioning Systems

- 8.1.3. Cameras

- 8.1.4. Other Components

- 8.2. Market Analysis, Insights and Forecast - by Product

- 8.2.1. Rotary Wing LiDAR Drone

- 8.2.2. Fixed Wing LiDAR Drone

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Construction

- 8.3.2. Environment

- 8.3.3. Precision Agriculture

- 8.3.4. Corridor Mapping

- 8.3.5. Defense

- 8.3.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Rest of the World LiDAR Drones Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Laser Scanners

- 9.1.2. Navigation and Positioning Systems

- 9.1.3. Cameras

- 9.1.4. Other Components

- 9.2. Market Analysis, Insights and Forecast - by Product

- 9.2.1. Rotary Wing LiDAR Drone

- 9.2.2. Fixed Wing LiDAR Drone

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Construction

- 9.3.2. Environment

- 9.3.3. Precision Agriculture

- 9.3.4. Corridor Mapping

- 9.3.5. Defense

- 9.3.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. North America LiDAR Drones Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 11. Europe LiDAR Drones Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United Kingdom

- 11.1.2 Germany

- 11.1.3 France

- 11.1.4 Rest of Europe

- 12. Asia Pacific LiDAR Drones Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 China

- 12.1.2 Japan

- 12.1.3 India

- 12.1.4 Rest of Asia Pacific

- 13. Rest of the World LiDAR Drones Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Riegl Laser Measurement Systems GmbH

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Velodyne LiDAR Inc

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Trimble Navigation Limited

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Phoenix LiDAR Systems

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Teledyne Optech

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 TDK-Lambda Corporation

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Leica Geosystems AG

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 SZ DJI Technology Co Ltd *List Not Exhaustive

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Sick AG

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 FARO Technologies Inc

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Riegl Laser Measurement Systems GmbH

List of Figures

- Figure 1: Global LiDAR Drones Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America LiDAR Drones Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America LiDAR Drones Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe LiDAR Drones Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe LiDAR Drones Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific LiDAR Drones Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific LiDAR Drones Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World LiDAR Drones Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World LiDAR Drones Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America LiDAR Drones Industry Revenue (Million), by Component 2024 & 2032

- Figure 11: North America LiDAR Drones Industry Revenue Share (%), by Component 2024 & 2032

- Figure 12: North America LiDAR Drones Industry Revenue (Million), by Product 2024 & 2032

- Figure 13: North America LiDAR Drones Industry Revenue Share (%), by Product 2024 & 2032

- Figure 14: North America LiDAR Drones Industry Revenue (Million), by Application 2024 & 2032

- Figure 15: North America LiDAR Drones Industry Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America LiDAR Drones Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America LiDAR Drones Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe LiDAR Drones Industry Revenue (Million), by Component 2024 & 2032

- Figure 19: Europe LiDAR Drones Industry Revenue Share (%), by Component 2024 & 2032

- Figure 20: Europe LiDAR Drones Industry Revenue (Million), by Product 2024 & 2032

- Figure 21: Europe LiDAR Drones Industry Revenue Share (%), by Product 2024 & 2032

- Figure 22: Europe LiDAR Drones Industry Revenue (Million), by Application 2024 & 2032

- Figure 23: Europe LiDAR Drones Industry Revenue Share (%), by Application 2024 & 2032

- Figure 24: Europe LiDAR Drones Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe LiDAR Drones Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific LiDAR Drones Industry Revenue (Million), by Component 2024 & 2032

- Figure 27: Asia Pacific LiDAR Drones Industry Revenue Share (%), by Component 2024 & 2032

- Figure 28: Asia Pacific LiDAR Drones Industry Revenue (Million), by Product 2024 & 2032

- Figure 29: Asia Pacific LiDAR Drones Industry Revenue Share (%), by Product 2024 & 2032

- Figure 30: Asia Pacific LiDAR Drones Industry Revenue (Million), by Application 2024 & 2032

- Figure 31: Asia Pacific LiDAR Drones Industry Revenue Share (%), by Application 2024 & 2032

- Figure 32: Asia Pacific LiDAR Drones Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific LiDAR Drones Industry Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of the World LiDAR Drones Industry Revenue (Million), by Component 2024 & 2032

- Figure 35: Rest of the World LiDAR Drones Industry Revenue Share (%), by Component 2024 & 2032

- Figure 36: Rest of the World LiDAR Drones Industry Revenue (Million), by Product 2024 & 2032

- Figure 37: Rest of the World LiDAR Drones Industry Revenue Share (%), by Product 2024 & 2032

- Figure 38: Rest of the World LiDAR Drones Industry Revenue (Million), by Application 2024 & 2032

- Figure 39: Rest of the World LiDAR Drones Industry Revenue Share (%), by Application 2024 & 2032

- Figure 40: Rest of the World LiDAR Drones Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of the World LiDAR Drones Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global LiDAR Drones Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global LiDAR Drones Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 3: Global LiDAR Drones Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 4: Global LiDAR Drones Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global LiDAR Drones Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global LiDAR Drones Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States LiDAR Drones Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada LiDAR Drones Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global LiDAR Drones Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United Kingdom LiDAR Drones Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Germany LiDAR Drones Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France LiDAR Drones Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe LiDAR Drones Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global LiDAR Drones Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: China LiDAR Drones Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan LiDAR Drones Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: India LiDAR Drones Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Asia Pacific LiDAR Drones Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global LiDAR Drones Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: LiDAR Drones Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global LiDAR Drones Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 22: Global LiDAR Drones Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 23: Global LiDAR Drones Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Global LiDAR Drones Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: United States LiDAR Drones Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Canada LiDAR Drones Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global LiDAR Drones Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 28: Global LiDAR Drones Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 29: Global LiDAR Drones Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 30: Global LiDAR Drones Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 31: United Kingdom LiDAR Drones Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Germany LiDAR Drones Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: France LiDAR Drones Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of Europe LiDAR Drones Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global LiDAR Drones Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 36: Global LiDAR Drones Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 37: Global LiDAR Drones Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 38: Global LiDAR Drones Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 39: China LiDAR Drones Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Japan LiDAR Drones Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: India LiDAR Drones Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Asia Pacific LiDAR Drones Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global LiDAR Drones Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 44: Global LiDAR Drones Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 45: Global LiDAR Drones Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 46: Global LiDAR Drones Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the LiDAR Drones Industry?

The projected CAGR is approximately 6.50%.

2. Which companies are prominent players in the LiDAR Drones Industry?

Key companies in the market include Riegl Laser Measurement Systems GmbH, Velodyne LiDAR Inc, Trimble Navigation Limited, Phoenix LiDAR Systems, Teledyne Optech, TDK-Lambda Corporation, Leica Geosystems AG, SZ DJI Technology Co Ltd *List Not Exhaustive, Sick AG, FARO Technologies Inc.

3. What are the main segments of the LiDAR Drones Industry?

The market segments include Component, Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Advancements in Drone Technology; Cost Effective and Accurate Geo Mapping; Increasing Need for Robust Surveillance Systems across Various Industries.

6. What are the notable trends driving market growth?

Construction is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Increase in the Cost of Equipment.

8. Can you provide examples of recent developments in the market?

June 2022: A new lidar drone was introduced by Dragonfly. In comparison to traditional photogrammetry techniques, Draganfly's long-range LiDAR system is able to deliver precise distance readings and enhanced resolution. The company's system can produce 0.5-centimeter point clouds with 2-centimeter global accuracy and a scanning range of 750 meters, ensuring high-resolution data at two million points per second. Unmanned aerial vehicles ("UAVs''), helicopters, and other types of aircraft can all use the system. If it is put on a car or backpack, it can also be utilized as a mobile scanning solution.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "LiDAR Drones Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the LiDAR Drones Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the LiDAR Drones Industry?

To stay informed about further developments, trends, and reports in the LiDAR Drones Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence