Key Insights

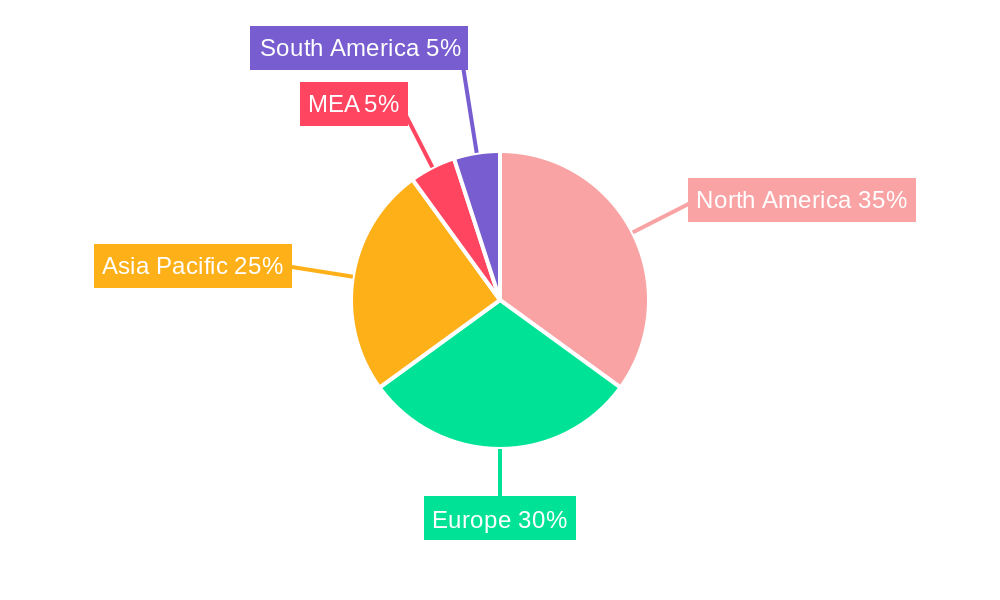

The Middle East and Africa (MEA) Solid State Drive (SSD) caching market is experiencing robust growth, driven by the increasing adoption of cloud computing, big data analytics, and the proliferation of data centers across the region. The 7.89% Compound Annual Growth Rate (CAGR) observed globally suggests a similarly strong, albeit potentially slightly lower, growth trajectory within the MEA region, considering the varying levels of technological adoption across different countries. Key drivers include the need for faster data access speeds in enterprise storage solutions, the rising demand for high-performance computing in various sectors like finance and telecommunications, and the growing preference for personal storage devices with enhanced speed and reliability. The market segmentation is primarily driven by the application, with enterprise storage currently holding a larger market share due to the higher investment capacity and technological infrastructure in this segment. However, the personal storage segment is experiencing significant growth, fueled by increasing smartphone usage and the rising demand for faster data transfer speeds on personal devices. Factors such as high initial investment costs, lack of awareness about SSD caching technology in certain regions, and the presence of alternative storage technologies might act as restraints. However, ongoing technological advancements, decreasing prices, and government initiatives promoting digital transformation are expected to mitigate these limitations. Leading players like Seagate, Micron, Samsung, and Western Digital are actively competing in this market, expanding their product portfolios and strengthening their distribution networks to capitalize on the burgeoning opportunities. The focus on strategic partnerships and the development of customized solutions for specific industry verticals will further shape the competitive landscape in the coming years.

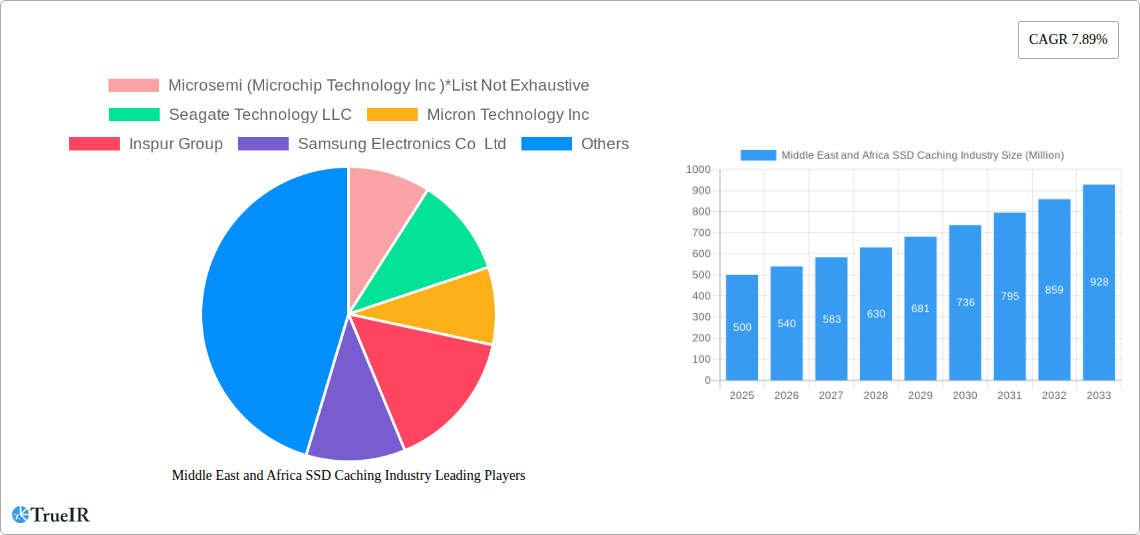

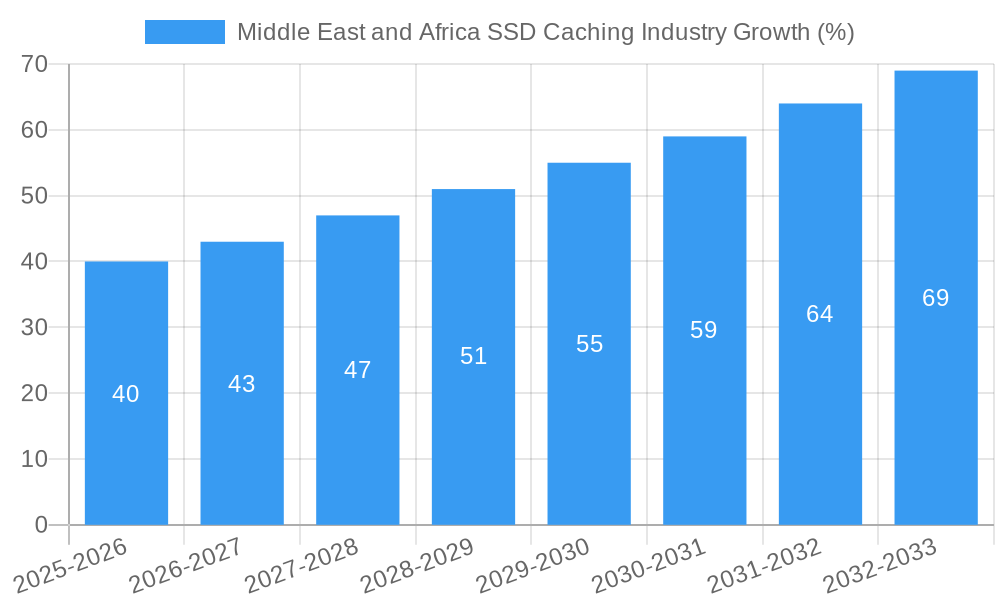

The forecast period (2025-2033) is expected to witness significant expansion of the MEA SSD caching market, particularly in countries experiencing rapid economic growth and digital transformation. While specific market size figures for MEA are not provided, a reasonable estimate based on global trends and regional growth dynamics can be made. Considering the global market's size and the projected CAGR, a conservative estimate for the MEA market size in 2025 could be around $500 million, potentially reaching $1 billion by 2033. This estimation takes into account the proportionally lower penetration of SSD caching in MEA compared to more developed regions but acknowledges the rapid expansion of data centers and cloud infrastructure. Further growth will be influenced by factors such as increasing investment in digital infrastructure, the adoption of advanced technologies by businesses, and the growth of e-commerce and related digital services within the MEA region.

Middle East and Africa SSD Caching Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Middle East and Africa SSD caching industry, offering valuable insights into market trends, competitive dynamics, and future growth prospects. With a focus on the period 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report is an essential resource for industry stakeholders, investors, and strategic decision-makers. The market is expected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period.

Middle East and Africa SSD Caching Industry Market Structure & Competitive Landscape

The Middle East and Africa SSD caching market exhibits a moderately consolidated structure, with several key players vying for market share. The market concentration ratio (CR4) is estimated at xx%, indicating the presence of both large multinational corporations and regional players. Innovation is a key driver, with continuous advancements in SSD technology leading to higher performance, lower latency, and improved energy efficiency. Regulatory frameworks, while still evolving in some regions, are increasingly focused on data security and privacy, impacting the adoption of SSD caching solutions. Product substitution primarily comes from alternative storage technologies like HDDs and cloud storage, but the performance advantage of SSDs remains a significant barrier to substitution. The market is segmented by application into Enterprise Storage and Personal Storage, with distinct needs and growth trajectories. M&A activity in the sector has been moderate, with approximately xx deals recorded between 2019 and 2024, largely driven by the consolidation of smaller players and expansion into new markets.

- Market Concentration: CR4 estimated at xx%

- Innovation Drivers: NVMe, 3D NAND, improved controllers

- Regulatory Impacts: Data privacy regulations, cybersecurity standards

- Product Substitutes: HDDs, cloud storage

- End-User Segmentation: Enterprise Storage, Personal Storage

- M&A Trends: xx deals between 2019 and 2024

Middle East and Africa SSD Caching Industry Market Trends & Opportunities

The Middle East and Africa SSD caching market is experiencing significant growth, driven by the increasing demand for high-performance storage solutions across various sectors. The market size is projected to reach xx Million by 2025 and xx Million by 2033. This growth is fueled by technological advancements, such as the rise of NVMe SSDs, which offer significantly faster speeds compared to traditional SATA SSDs. The increasing adoption of cloud computing and big data analytics further contributes to the demand for robust and efficient storage solutions. Consumer preferences are shifting towards faster, more reliable storage, driving the adoption of SSD caching in both enterprise and personal applications. Competitive dynamics are intense, with major players investing heavily in R&D to maintain a competitive edge. The market penetration rate for SSD caching in enterprise storage is currently estimated at xx%, while in the personal storage segment it stands at xx%, leaving considerable room for growth.

Dominant Markets & Segments in Middle East and Africa SSD Caching Industry

While the entire Middle East and Africa region shows considerable potential, [Specific Country/Region with highest market share e.g., South Africa] currently holds the dominant position in the SSD caching market. This dominance is driven by several factors:

- Enterprise Storage: Rapid growth of data centers and cloud infrastructure

- Personal Storage: Increasing adoption of high-performance computing devices

- Government Initiatives: Investments in digital infrastructure and technology adoption

- Economic Growth: Increasing disposable incomes and higher IT spending

Further analysis reveals that the [Enterprise/Personal - Specify dominant segment] segment exhibits faster growth, driven by [Explain the reason behind faster growth e.g., the increasing demand for high-performance storage in the financial services sector or the growing popularity of gaming and media consumption].

Middle East and Africa SSD Caching Industry Product Analysis

The market offers a wide range of SSD caching products, from consumer-grade solutions for personal use to high-end enterprise-level systems for data centers. Key technological advancements include NVMe technology, 3D NAND flash memory, and advanced controller architectures, all contributing to improved performance, capacity, and reliability. The competitive advantage often lies in offering a balance of performance, cost-effectiveness, and features tailored to specific application requirements. The market is witnessing a move towards specialized SSDs optimized for specific workloads and applications, further enhancing efficiency and performance.

Key Drivers, Barriers & Challenges in Middle East and Africa SSD Caching Industry

Key Drivers: The increasing adoption of cloud computing, big data analytics, and high-performance computing applications is driving demand for high-speed storage solutions. Technological advancements, such as NVMe, are pushing performance boundaries. Government initiatives promoting digital transformation in various sectors are also contributing to market growth.

Challenges: High initial investment costs can be a barrier to adoption, especially for smaller businesses. Supply chain disruptions and the volatility of raw material prices pose risks. Competition from established storage vendors and the emergence of new technologies requires ongoing innovation. The lack of skilled workforce also presents a challenge to implementation and maintenance.

Growth Drivers in the Middle East and Africa SSD Caching Industry Market

The rising adoption of cloud computing and big data analytics in various industries, along with the growing demand for high-performance computing and faster data processing speeds, are major drivers. Government initiatives promoting digital transformation and increased investment in IT infrastructure are bolstering market growth. Technological advancements like NVMe and 3D NAND are further pushing the adoption of SSD caching technology.

Challenges Impacting Middle East and Africa SSD Caching Industry Growth

High initial investment costs can hinder widespread adoption, especially among smaller businesses. Supply chain vulnerabilities and volatile raw material prices create uncertainty. Intense competition among established players can put downward pressure on prices and margins. Moreover, the lack of awareness about the benefits of SSD caching among potential users is a barrier to market penetration.

Key Players Shaping the Middle East and Africa SSD Caching Industry Market

- Microsemi (Microchip Technology Inc)

- Seagate Technology LLC

- Micron Technology Inc

- Inspur Group

- Samsung Electronics Co Ltd

- Transcend Information Inc

- Kioxia (Toshiba Memory Corporation)

- ADATA Technology Co Ltd

- Western Digital Corporation

- SK Hynix Inc

- NetApp Inc

- Intel Corporation

- QNAP Systems Inc

Significant Middle East and Africa SSD Caching Industry Industry Milestones

- October 2022: Lenovo launched ThinkSystem DM5000H, a unified hybrid storage system leveraging NVMe SSD caching for accelerated read-centric workloads, targeting midsize companies. This signifies a push towards more accessible enterprise-grade solutions.

- September 2022: Amazon's enhanced Relational Database Service for Oracle integrated Database Smart Flash Cache (flash cache) into M5d and R5d instances, boosting performance for applications requiring high-speed temporary data storage. This demonstrates the increasing integration of SSD caching into cloud infrastructure.

Future Outlook for Middle East and Africa SSD Caching Industry Market

The Middle East and Africa SSD caching market is poised for continued strong growth, driven by ongoing technological advancements, expanding digital infrastructure, and increasing data demands across various sectors. Strategic opportunities exist in developing cost-effective solutions for smaller businesses and expanding into underserved regions. The market's potential remains significant, with substantial room for growth in both enterprise and personal storage segments. Further innovation in SSD technology and its integration with cloud platforms will be key to unlocking future market potential.

Middle East and Africa SSD Caching Industry Segmentation

-

1. Application

- 1.1. Enterprise Storage

- 1.2. Personal Storage

Middle East and Africa SSD Caching Industry Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa SSD Caching Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.89% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Improvements Offered by SSDs Over Conventional HDDs; Demand for the Cloud Storage Driving the Market Growth

- 3.3. Market Restrains

- 3.3.1. Slow Pace in Development of Applications Despite Heavy investments in R&D; Commplexities in Hardware Designing

- 3.4. Market Trends

- 3.4.1. Enterprise Storage Expected to Hold Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa SSD Caching Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Enterprise Storage

- 5.1.2. Personal Storage

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. South Africa Middle East and Africa SSD Caching Industry Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Middle East and Africa SSD Caching Industry Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Middle East and Africa SSD Caching Industry Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Middle East and Africa SSD Caching Industry Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Middle East and Africa SSD Caching Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Middle East and Africa SSD Caching Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Microsemi (Microchip Technology Inc )*List Not Exhaustive

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Seagate Technology LLC

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Micron Technology Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Inspur Group

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Samsung Electronics Co Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Transcend Information Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Kioxia (Toshiba Memory Corporation)

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 ADATA Technology Co Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Western Digital Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 SK Hynix Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 NetApp Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Intel Corporation

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 QNAP Systems Inc

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.1 Microsemi (Microchip Technology Inc )*List Not Exhaustive

List of Figures

- Figure 1: Middle East and Africa SSD Caching Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East and Africa SSD Caching Industry Share (%) by Company 2024

List of Tables

- Table 1: Middle East and Africa SSD Caching Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East and Africa SSD Caching Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Middle East and Africa SSD Caching Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Middle East and Africa SSD Caching Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: South Africa Middle East and Africa SSD Caching Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Sudan Middle East and Africa SSD Caching Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Uganda Middle East and Africa SSD Caching Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Tanzania Middle East and Africa SSD Caching Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Kenya Middle East and Africa SSD Caching Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of Africa Middle East and Africa SSD Caching Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Middle East and Africa SSD Caching Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 12: Middle East and Africa SSD Caching Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Saudi Arabia Middle East and Africa SSD Caching Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United Arab Emirates Middle East and Africa SSD Caching Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Israel Middle East and Africa SSD Caching Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Qatar Middle East and Africa SSD Caching Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Kuwait Middle East and Africa SSD Caching Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Oman Middle East and Africa SSD Caching Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Bahrain Middle East and Africa SSD Caching Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Jordan Middle East and Africa SSD Caching Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Lebanon Middle East and Africa SSD Caching Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa SSD Caching Industry?

The projected CAGR is approximately 7.89%.

2. Which companies are prominent players in the Middle East and Africa SSD Caching Industry?

Key companies in the market include Microsemi (Microchip Technology Inc )*List Not Exhaustive, Seagate Technology LLC, Micron Technology Inc, Inspur Group, Samsung Electronics Co Ltd, Transcend Information Inc, Kioxia (Toshiba Memory Corporation), ADATA Technology Co Ltd, Western Digital Corporation, SK Hynix Inc, NetApp Inc, Intel Corporation, QNAP Systems Inc.

3. What are the main segments of the Middle East and Africa SSD Caching Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Improvements Offered by SSDs Over Conventional HDDs; Demand for the Cloud Storage Driving the Market Growth.

6. What are the notable trends driving market growth?

Enterprise Storage Expected to Hold Major Share.

7. Are there any restraints impacting market growth?

Slow Pace in Development of Applications Despite Heavy investments in R&D; Commplexities in Hardware Designing.

8. Can you provide examples of recent developments in the market?

October 2022: Lenovo launched ThinkSystem DM5000H a unified, hybrid storage system developed for midsize companies to deliver performance, simplicity, capacity, security, and high availability. ThinkSystem DM5000H, powered by ONTAP software, provides enterprise-class storage management capabilities with a wide range of host connectivity choices, customizable drive configurations, increased data management tools, and acceleration of read-centric workloads with onboard NVMe SSD caching.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa SSD Caching Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa SSD Caching Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa SSD Caching Industry?

To stay informed about further developments, trends, and reports in the Middle East and Africa SSD Caching Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence