Key Insights

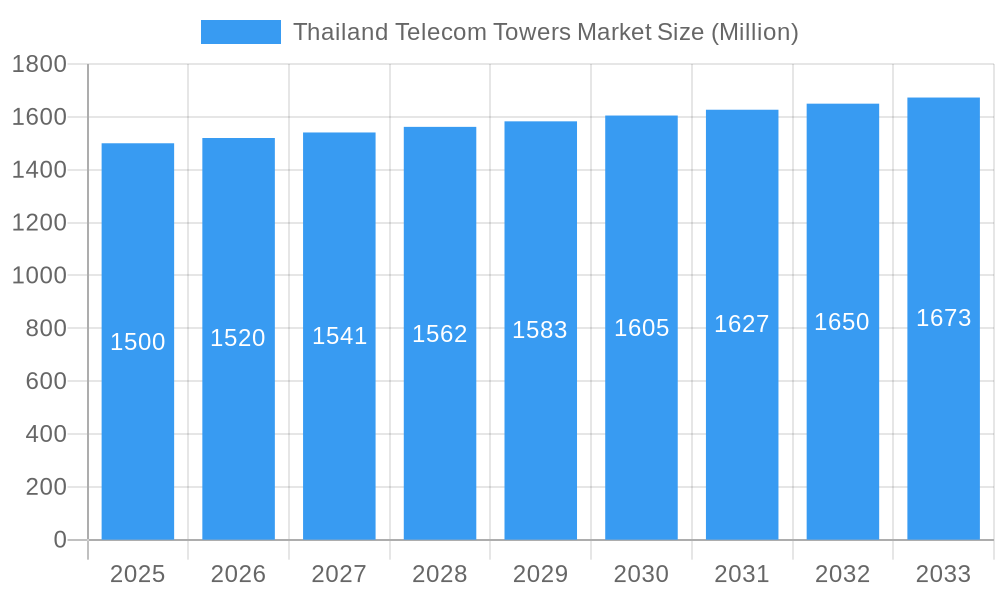

The Thailand Telecom Towers market, exhibiting a Compound Annual Growth Rate (CAGR) of 1.35%, presents a steady growth trajectory from 2019 to 2033. The market's expansion is fueled by several key drivers. Increasing mobile data consumption, driven by the rising adoption of smartphones and the proliferation of data-intensive applications like video streaming and online gaming, is a significant factor. Furthermore, the government's initiatives to improve digital infrastructure and expand 5G network coverage are creating substantial demand for new telecom towers. The deployment of advanced technologies like IoT (Internet of Things) and smart city initiatives further contribute to market growth. However, the market faces certain restraints, including regulatory hurdles, high initial investment costs for infrastructure development, and competition among existing telecom tower companies. The market is segmented based on tower type (macrocells, microcells, etc.), geographic location, and operator type (independent tower companies, MNOs). Key players in the market include Advanced Info Service, Total Access Communication, True Corporation, Samart Corporation, and Jasmine Technology Solution, alongside international players like Ericsson. These companies are strategically investing in tower infrastructure, tower sharing agreements, and technological upgrades to maintain competitiveness.

Thailand Telecom Towers Market Market Size (In Billion)

Considering the provided CAGR of 1.35% and a study period of 2019-2033, with a base year of 2025, we can project future market size. While the exact market size (XX million) for 2025 is not provided, assuming a reasonably sized market in 2025, the steady growth indicates a robust and expanding sector, attractive to both domestic and international investment. The competitive landscape suggests a focus on strategic partnerships, technological advancements, and efficient operations to capture market share and maximize profitability within the context of the identified growth drivers and restraints. The market’s overall trajectory suggests sustained expansion over the forecast period, aligning with broader trends in Southeast Asia's increasing digitalization.

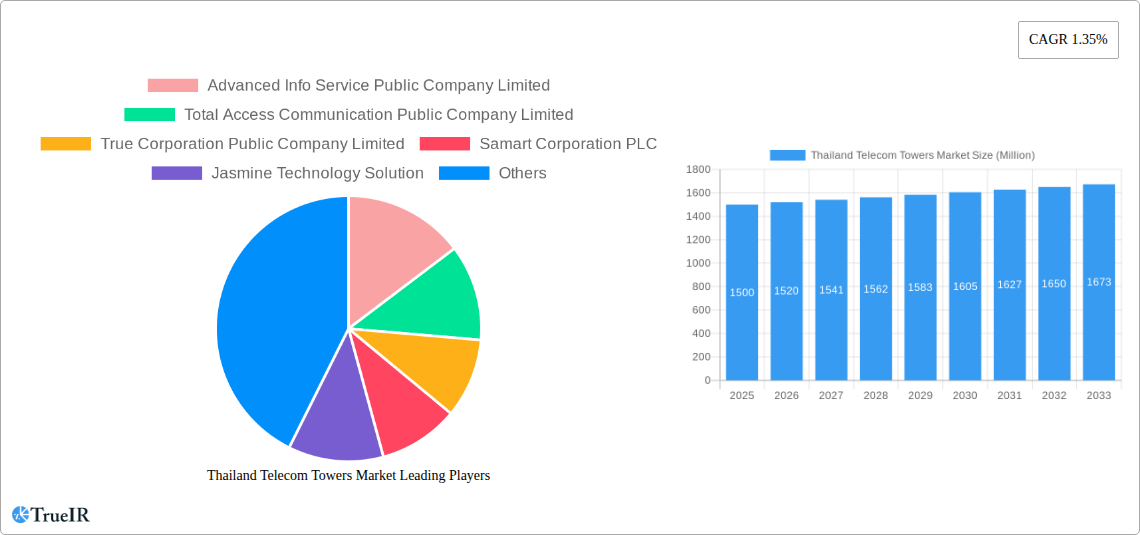

Thailand Telecom Towers Market Company Market Share

Thailand Telecom Towers Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Thailand Telecom Towers Market, offering invaluable insights for investors, industry professionals, and strategic decision-makers. With a focus on the period 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report delivers a data-driven perspective on market trends, competitive dynamics, and future growth potential. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Thailand Telecom Towers Market Market Structure & Competitive Landscape

The Thailand telecom towers market exhibits a moderately concentrated structure, with a few dominant players and a growing number of smaller, specialized firms. Key players include Advanced Info Service Public Company Limited, Total Access Communication Public Company Limited, True Corporation Public Company Limited, Samart Corporation PLC, Jasmine Technology Solution, Ericsson, Interlink Telecom Public Company Limited, and Sky Tower PLC. However, the list is not exhaustive. The market's competitive landscape is shaped by several factors:

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the market is estimated to be around xx, indicating a moderately concentrated market.

- Innovation Drivers: The increasing demand for 5G infrastructure, the adoption of innovative technologies like small cells and fiber connectivity, and the development of smart city initiatives are driving innovation in the sector.

- Regulatory Impacts: Government regulations regarding spectrum allocation, licensing, and infrastructure development significantly influence market dynamics. Changes in these regulations can create both opportunities and challenges.

- Product Substitutes: While traditional macro towers remain dominant, the emergence of alternative solutions like distributed antenna systems (DAS) and small cells is creating competitive pressure.

- End-User Segmentation: The market caters to a diverse range of end-users, including mobile network operators (MNOs), internet service providers (ISPs), and government agencies. The relative contribution of each segment to overall market growth varies and is detailed within the report.

- M&A Trends: The market has witnessed a moderate level of mergers and acquisitions (M&A) activity in recent years, with xx Million in M&A volume recorded in 2024. These activities are expected to continue, driven by consolidation efforts and expansion strategies among key players.

Thailand Telecom Towers Market Market Trends & Opportunities

The Thailand telecom towers market is experiencing robust growth, driven by several key factors. Market size expansion is significantly influenced by the rising demand for mobile data, increased 4G/5G network deployments, and government initiatives to enhance digital infrastructure. Technological advancements, including the deployment of 5G technology, the adoption of IoT devices and the increasing demand for high-speed internet access are fueling market expansion. Furthermore, consumer preferences are shifting toward higher data consumption, which is directly impacting the demand for improved network coverage and capacity. This heightened demand, in turn, creates opportunities for new entrants and drives further innovation within the sector. The market penetration rate for 4G/5G networks is currently estimated at xx% and is projected to reach xx% by 2033. The market exhibits a compound annual growth rate (CAGR) of xx% during the forecast period. The competitive landscape is dynamic, with existing players constantly vying for market share and new entrants exploring various market niches.

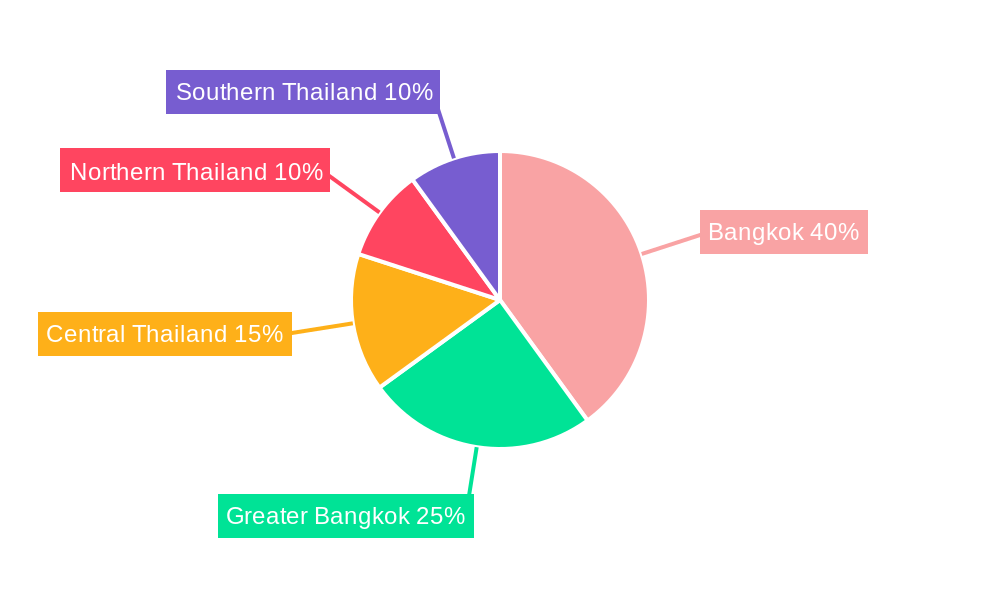

Dominant Markets & Segments in Thailand Telecom Towers Market

The Bangkok Metropolitan Region (BMR) is currently the dominant market segment, representing xx% of the overall market share in 2025. The report further identifies other high-growth regions and segments. Key factors contributing to the dominance of the BMR include:

- High Population Density: The BMR boasts a high concentration of population, translating into a larger demand for telecom services.

- Advanced Infrastructure: The region has a relatively well-developed telecommunications infrastructure, facilitating rapid network deployment.

- Government Support: Government initiatives promoting digital infrastructure development within the BMR have further accelerated market growth.

Other key growth drivers across various segments include:

- Increasing urbanization: This leads to higher demand for telecommunications services in urban centers.

- Government initiatives: Government investment in digital infrastructure and support for 5G rollouts significantly contributes to market growth.

- Rising disposable incomes: Increased spending power among consumers results in higher demand for mobile data and other telecom services.

Thailand Telecom Towers Market Product Analysis

The Thailand telecom towers market offers a range of products, from traditional macro towers to more advanced solutions like small cells and distributed antenna systems (DAS). Recent technological advancements have focused on improving efficiency, increasing capacity, and enhancing network coverage. The market is witnessing a growing adoption of smart towers, integrated with energy-efficient technologies and advanced monitoring systems. This focus on technological advancements aims to meet the demands of evolving network requirements, while ensuring cost-effectiveness and long-term sustainability.

Key Drivers, Barriers & Challenges in Thailand Telecom Towers Market

Key Drivers:

The Thai telecom towers market is propelled by the rapid expansion of 4G and 5G networks, growing mobile data consumption, and substantial government investments in digital infrastructure. Furthermore, the increasing adoption of IoT devices and the rising demand for high-speed internet access are key driving forces.

Key Barriers and Challenges:

The market faces challenges such as securing regulatory approvals for tower deployments, navigating complex land acquisition processes, and managing supply chain disruptions. Furthermore, intense competition among existing and emerging players, coupled with potential economic downturns, can impact market growth. The cost of infrastructure development remains a significant barrier, particularly in geographically challenging regions.

Growth Drivers in the Thailand Telecom Towers Market Market

Several factors fuel the growth of the Thailand telecom towers market, including the increasing demand for mobile data, government support for infrastructure development, and the expanding adoption of 5G technology. The rise of IoT devices, smart cities initiatives, and private sector investments further accelerate market growth. The regulatory environment, although sometimes challenging, is generally supportive of the telecom industry's expansion.

Challenges Impacting Thailand Telecom Towers Market Growth

Significant challenges constrain growth in the Thailand telecom towers market. These include the high initial investment costs associated with infrastructure development, securing necessary permits and approvals, and the complexities of land acquisition. Competition for spectrum allocation and the potential impact of economic fluctuations also pose threats to market growth. Supply chain disruptions can also impact the availability and cost of critical components for tower construction and maintenance.

Key Players Shaping the Thailand Telecom Towers Market Market

- Advanced Info Service Public Company Limited

- Total Access Communication Public Company Limited

- True Corporation Public Company Limited

- Samart Corporation PLC

- Jasmine Technology Solution

- Ericsson

- Interlink Telecom Public Company Limited

- Sky Tower PLC

- List Not Exhaustive

Significant Thailand Telecom Towers Market Industry Milestones

- July 2024: Ericsson Thailand unveils its vision to drive Thailand's digital transformation using its robust 5G infrastructure, showcasing its commitment to the nation’s digital economy development.

- June 2024: mu Space and Advanced Technology Co. Ltd and Interlink Telecom Public Company Limited sign a MOU to explore new opportunities in satellite and telecommunications networks, indicating collaboration and potential market expansion.

- June 2024: Advanced Info Service (AIS) partners with Gulf Energy Development to create solar-powered telecommunication infrastructure in remote areas, highlighting a commitment to sustainable infrastructure development.

- January 2024: National Telecoms Public Company Limited (NT) collaborates with Evolution DC Thailand Company Limited (EDC) to enhance Thailand's digital infrastructure, signaling a significant push towards becoming a regional digital hub.

Future Outlook for Thailand Telecom Towers Market Market

The future of the Thailand telecom towers market looks bright, driven by continued government investment in infrastructure, expanding 5G deployment, and sustained growth in mobile data consumption. Opportunities exist for companies to capitalize on the demand for innovative solutions such as small cells and private 5G networks. Strategic partnerships and collaborations will be crucial for companies to navigate the challenges and maximize growth potential in this dynamic market.

Thailand Telecom Towers Market Segmentation

-

1. Ownership

- 1.1. Operator-owned

- 1.2. Private-owned

- 1.3. MNO Captive sites

-

2. Installation

- 2.1. Rooftop

- 2.2. Ground-based

-

3. Fuel Type

- 3.1. Renewable

- 3.2. Non-renewable

Thailand Telecom Towers Market Segmentation By Geography

- 1. Thailand

Thailand Telecom Towers Market Regional Market Share

Geographic Coverage of Thailand Telecom Towers Market

Thailand Telecom Towers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.62% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Connecting/Improving Connectivity to Rural Areas; Improving and Catering to Increasing Data Needs

- 3.3. Market Restrains

- 3.3.1. Connecting/Improving Connectivity to Rural Areas; Improving and Catering to Increasing Data Needs

- 3.4. Market Trends

- 3.4.1. High Rooftop Installation Augment's the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Telecom Towers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 5.1.1. Operator-owned

- 5.1.2. Private-owned

- 5.1.3. MNO Captive sites

- 5.2. Market Analysis, Insights and Forecast - by Installation

- 5.2.1. Rooftop

- 5.2.2. Ground-based

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Renewable

- 5.3.2. Non-renewable

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Advanced Info Service Public Company Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Total Access Communication Public Company Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 True Corporation Public Company Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Samart Corporation PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Jasmine Technology Solution

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ericsson

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Interlink Telecom Public Company Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sky Tower PLC*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Advanced Info Service Public Company Limited

List of Figures

- Figure 1: Thailand Telecom Towers Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Thailand Telecom Towers Market Share (%) by Company 2025

List of Tables

- Table 1: Thailand Telecom Towers Market Revenue undefined Forecast, by Ownership 2020 & 2033

- Table 2: Thailand Telecom Towers Market Revenue undefined Forecast, by Installation 2020 & 2033

- Table 3: Thailand Telecom Towers Market Revenue undefined Forecast, by Fuel Type 2020 & 2033

- Table 4: Thailand Telecom Towers Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Thailand Telecom Towers Market Revenue undefined Forecast, by Ownership 2020 & 2033

- Table 6: Thailand Telecom Towers Market Revenue undefined Forecast, by Installation 2020 & 2033

- Table 7: Thailand Telecom Towers Market Revenue undefined Forecast, by Fuel Type 2020 & 2033

- Table 8: Thailand Telecom Towers Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Telecom Towers Market?

The projected CAGR is approximately 2.62%.

2. Which companies are prominent players in the Thailand Telecom Towers Market?

Key companies in the market include Advanced Info Service Public Company Limited, Total Access Communication Public Company Limited, True Corporation Public Company Limited, Samart Corporation PLC, Jasmine Technology Solution, Ericsson, Interlink Telecom Public Company Limited, Sky Tower PLC*List Not Exhaustive.

3. What are the main segments of the Thailand Telecom Towers Market?

The market segments include Ownership, Installation, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Connecting/Improving Connectivity to Rural Areas; Improving and Catering to Increasing Data Needs.

6. What are the notable trends driving market growth?

High Rooftop Installation Augment's the Market Growth.

7. Are there any restraints impacting market growth?

Connecting/Improving Connectivity to Rural Areas; Improving and Catering to Increasing Data Needs.

8. Can you provide examples of recent developments in the market?

July 2024: Ericsson Thailand introduced its ambitious vision to drive the digital transformation of Thailand based on the strong 5G infrastructure it is creating in the country. Leveraging its state-of-the-art 5G network solutions together with its extensive experience and expertise in establishing efficient, reliable, and sustainable 5G networks worldwide, Ericsson is well poised to play a pivotal role in accelerating Thailand’s journey toward becoming a digital economy.June 2024: In a collaboration, mu Space and Advanced Technology Co. Ltd (“mu Space”) and Interlink Telecom Public Company Limited (“ITEL”) signed a Memorandum of Understanding (MOU) to explore new opportunities in satellite and telecommunications networks and services. This MOU sets the stage for combining the expertise and resources of both industry leaders to drive innovation and expand service offerings in Thailand and beyond.June 2024: Advanced Info Service (AIS), Thailand's key digital network provider, teamed up with Gulf Energy Development, a key player in sustainable energy and infrastructure in the region. Together, they aim to set up solar-powered telecommunication infrastructure in the country's remote areas.January 2024: National Telecoms Public Company Limited (NT) partnered with Evolution DC Thailand Company Limited (EDC), a joint venture formed by Central Pattana (CPN) and Evolution Data Centres. Together, they aim to enhance Thailand's digital infrastructure, steering the nation closer to its goal of becoming a central digital hub in ASEAN.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Telecom Towers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Telecom Towers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Telecom Towers Market?

To stay informed about further developments, trends, and reports in the Thailand Telecom Towers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence