Key Insights

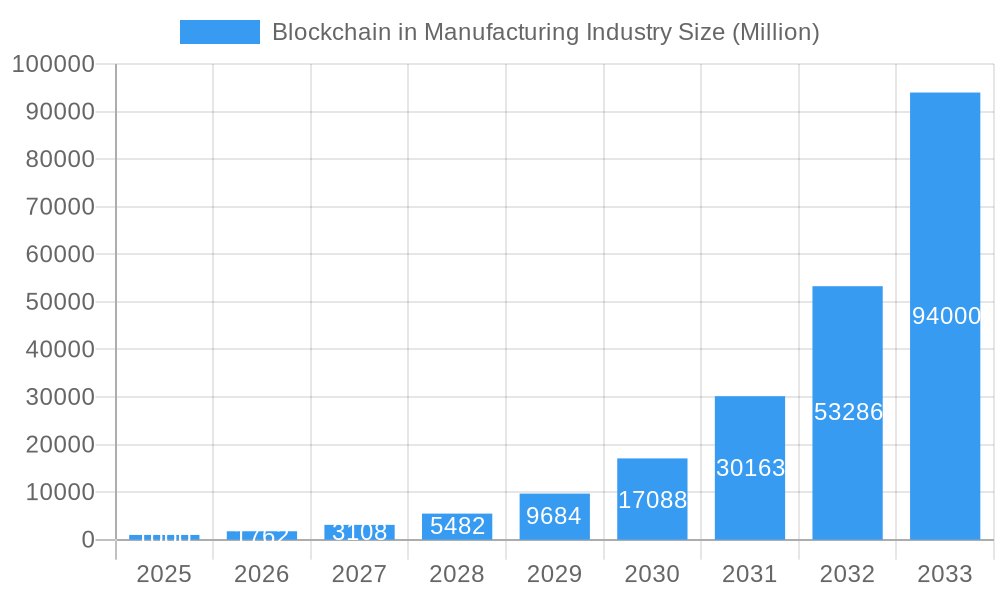

The Blockchain in Manufacturing market is poised for significant expansion, projected to reach $427.99 billion by 2033, driven by a robust CAGR of 66.6% from 2025. This growth is primarily attributed to the escalating demand for enhanced supply chain transparency, counterfeit prevention, and improved quality control and regulatory compliance. Leading sectors such as automotive, aerospace & defense, and pharmaceuticals are actively adopting blockchain to bolster operational security, efficiency, and trust. Core applications encompass supply chain management, product authentication, and compliance assurance, leading to streamlined operations and cost reductions.

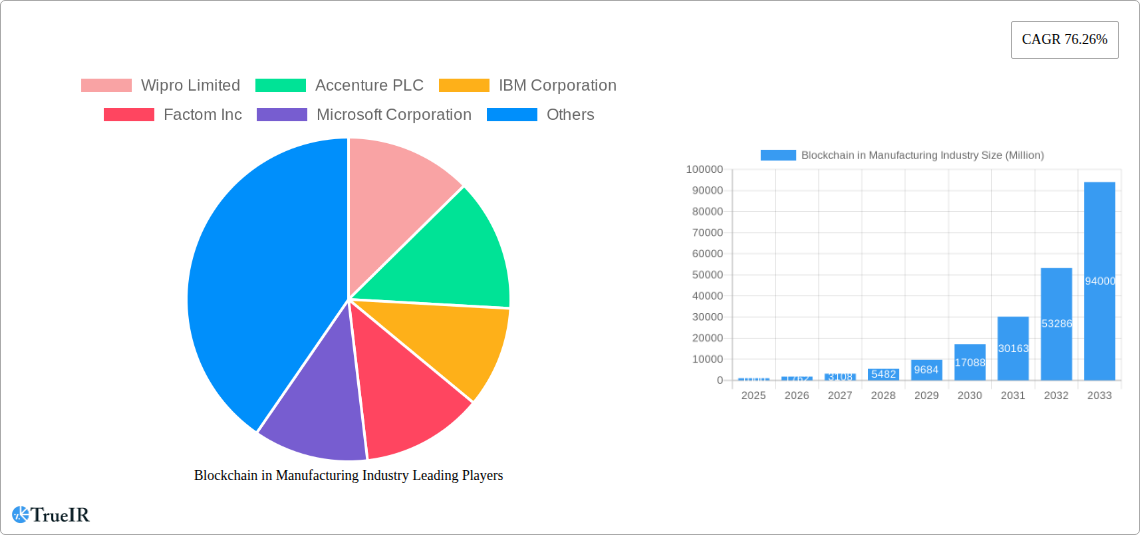

Blockchain in Manufacturing Industry Market Size (In Billion)

While challenges such as high initial investment, platform standardization issues, and data privacy concerns persist, technological advancements, evolving regulatory frameworks, and heightened industry awareness are expected to facilitate widespread adoption. Future growth will be further propelled by emerging applications like digital twins and predictive maintenance, alongside the increasing involvement of both established technology providers and innovative startups, indicating a dynamic and promising market trajectory.

Blockchain in Manufacturing Industry Company Market Share

Blockchain in Manufacturing Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a comprehensive analysis of the Blockchain in Manufacturing Industry market, projecting a market value exceeding $XX Million by 2033. Leveraging a robust methodology and incorporating data from the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this report is an indispensable resource for industry stakeholders seeking to navigate the rapidly evolving landscape of blockchain technology in manufacturing. The report delves into key market segments, competitive dynamics, and future growth potential, offering invaluable insights for strategic decision-making. This report is essential for CEOs, CTOs, CIOs, VPs, Business Development Managers, Marketing Managers, and Investors involved in the manufacturing and blockchain technology sectors.

Blockchain in Manufacturing Industry Market Structure & Competitive Landscape

The Blockchain in Manufacturing Industry market exhibits a moderately concentrated structure, with key players like Wipro Limited, Accenture PLC, IBM Corporation, Factom Inc, Microsoft Corporation, Advanced Micro Devices Inc, Amazon Web Services Inc, Oracle Corporation, Infosys Ltd, SAP SE, and Intel Corporation holding significant market share. However, the market is also witnessing the emergence of numerous startups and smaller players, leading to increased competition. The concentration ratio (CR4) is estimated at xx%, indicating a moderately competitive landscape. Innovation in blockchain algorithms, consensus mechanisms, and data security protocols are key drivers. Regulatory frameworks, particularly around data privacy and security, are significantly impacting market growth. Product substitutes, including traditional database management systems and centralized supply chain solutions, pose a competitive threat. The market experiences moderate M&A activity, with an estimated xx number of deals annually over the past five years, primarily focused on technology acquisition and market expansion. End-user segmentation is driven by the diverse application of blockchain across various manufacturing sectors.

Blockchain in Manufacturing Industry Market Trends & Opportunities

The Blockchain in Manufacturing Industry market is poised for robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This expansion is fueled by several key factors. Technological advancements, particularly in scalability and interoperability solutions, are enabling wider adoption. The increasing need for enhanced supply chain transparency and traceability is driving demand for blockchain-based solutions across various industry segments, such as automotive and pharmaceuticals. The growing adoption of Industry 4.0 and the Internet of Things (IoT) is creating synergy with blockchain technology, further boosting market growth. The market penetration rate for blockchain solutions in manufacturing is currently estimated at xx%, with significant potential for future expansion, especially in developing economies. Consumer preference for sustainable and ethically sourced products is indirectly impacting market growth, driving the adoption of blockchain for traceability and counterfeit management. The competitive dynamics are characterized by a blend of established technology vendors and emerging blockchain-focused startups, fostering innovation and driving down costs. Market size is projected to reach $XX Million by 2033.

Dominant Markets & Segments in Blockchain in Manufacturing Industry

While the global market is expanding rapidly, specific segments and regions are experiencing faster growth than others. The Logistics and Supply Chain Management application segment currently holds the largest market share, driven by the need for enhanced transparency and efficiency in the movement of goods and materials. Counterfeit management is gaining traction, particularly in the pharmaceutical and consumer electronics sectors, as businesses seek to protect their brand reputation and prevent the sale of counterfeit goods. The Automotive and Aerospace and Defense end-user verticals exhibit high growth potential due to the stringent quality control and compliance requirements of these industries.

- Key Growth Drivers (Logistics and Supply Chain Management):

- Increasing adoption of IoT devices in supply chains.

- Growing demand for enhanced supply chain visibility and traceability.

- Stringent regulations regarding supply chain transparency.

- Key Growth Drivers (Automotive):

- Rising demand for secure and transparent supply chains within the automotive industry.

- Stringent regulations regarding vehicle authenticity and parts traceability.

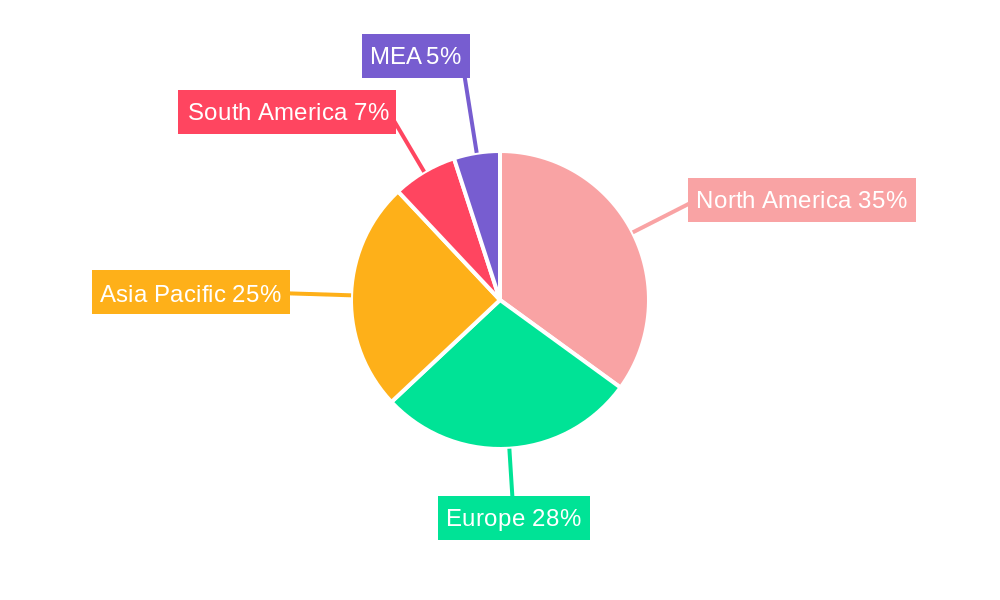

The North American region currently holds a significant market share, driven by early adoption of blockchain technology and the presence of many leading technology providers. However, the Asia-Pacific region is expected to witness the fastest growth in the coming years, owing to rapid industrialization, increasing digitalization, and government initiatives promoting technological innovation. Detailed regional breakdowns are available within the full report.

Blockchain in Manufacturing Industry Product Analysis

The market offers a diverse range of blockchain-based solutions tailored to the specific needs of the manufacturing industry. These solutions encompass platforms for supply chain management, track-and-trace systems for counterfeit prevention, and tools for enhancing quality control and compliance. Technological advancements focus on improving scalability, security, and interoperability, addressing challenges associated with blockchain implementation. The competitive advantage lies in the ability to offer robust, user-friendly solutions that integrate seamlessly into existing manufacturing processes. Furthermore, cost-effective solutions and strong customer support are crucial factors for market success.

Key Drivers, Barriers & Challenges in Blockchain in Manufacturing Industry

Key Drivers:

- Enhanced Supply Chain Transparency and Traceability: Blockchain's immutable ledger allows for real-time tracking of goods, improving efficiency and reducing fraud.

- Improved Data Security: Blockchain enhances data security and prevents unauthorized access or modification.

- Increased Efficiency and Reduced Costs: By automating processes, blockchain can streamline operations and reduce administrative costs.

- Regulatory Initiatives: Governments are actively promoting blockchain adoption, creating incentives for businesses to implement these solutions.

Challenges & Restraints:

- Scalability and Interoperability Issues: Currently, blockchain solutions face limitations in scalability and interoperability, hindering mass adoption.

- Lack of Standardization: Absence of uniform standards for blockchain implementation creates interoperability challenges.

- High Initial Investment Costs: The initial investment costs associated with implementing blockchain technology can deter some businesses.

- Regulatory Uncertainty: The evolving regulatory landscape surrounding blockchain technology poses challenges for businesses. Estimated impact of these challenges on market growth is estimated at a reduction of xx% over the next decade.

Growth Drivers in the Blockchain in Manufacturing Industry Market

The growth of the Blockchain in Manufacturing Industry market is propelled by several factors. Technological advancements continue to improve the scalability, security, and interoperability of blockchain solutions. The increasing demand for secure and transparent supply chains drives adoption across various industries. Favorable regulatory initiatives from governments worldwide encourage businesses to adopt blockchain technology. Furthermore, the rise of Industry 4.0 and the integration of IoT devices create synergistic opportunities for blockchain implementation. These factors collectively accelerate market growth.

Challenges Impacting Blockchain in Manufacturing Industry Growth

Several challenges hinder the widespread adoption of blockchain in manufacturing. Regulatory complexities related to data privacy and security create uncertainty for businesses. Supply chain complexities and integration challenges increase implementation costs and complexity. The relatively high initial investment costs associated with blockchain implementation can deter smaller companies. Competitive pressures from traditional solutions and the emergence of new technologies create a dynamic environment.

Key Players Shaping the Blockchain in Manufacturing Industry Market

- Wipro Limited

- Accenture PLC

- IBM Corporation

- Factom Inc

- Microsoft Corporation

- Advanced Micro Devices Inc

- Amazon Web Services Inc

- Oracle Corporation

- Infosys Ltd

- SAP SE

- Intel Corporation

Significant Blockchain in Manufacturing Industry Industry Milestones

- June 2022: Shell, Accenture, and American Express Global Business Travel launched Avelia, a blockchain-based platform for sustainable aviation fuel (SAF) traceability. This highlights the growing adoption of blockchain for environmental sustainability initiatives.

- April 2022: Intel Corporation launched the Intel Blockscale ASIC, a specialized chip designed to enhance the energy efficiency of bitcoin mining operations. This development impacts blockchain technology infrastructure and its sustainability.

Future Outlook for Blockchain in Manufacturing Industry Market

The Blockchain in Manufacturing Industry market is expected to continue its strong growth trajectory, driven by ongoing technological advancements, increasing regulatory support, and growing demand for supply chain transparency and security. Strategic partnerships between technology providers and manufacturers will further accelerate market penetration. The convergence of blockchain with other emerging technologies, such as IoT and AI, will unlock new opportunities for innovation and create a more resilient and efficient manufacturing ecosystem. The market's potential is immense, with significant opportunities for growth across various industry verticals and geographical regions.

Blockchain in Manufacturing Industry Segmentation

-

1. Application

- 1.1. Logistics and Supply Chain Management

- 1.2. Counterfeit Management

- 1.3. Quality Control and Compliance

- 1.4. Other Applications

-

2. End-user Vertical

- 2.1. Automotive

- 2.2. Aerospace and Defense

- 2.3. Pharmaceutical

- 2.4. Consumer Electronics

- 2.5. Other End-user Verticals

Blockchain in Manufacturing Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Blockchain in Manufacturing Industry Regional Market Share

Geographic Coverage of Blockchain in Manufacturing Industry

Blockchain in Manufacturing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 66.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Blockchain-as-a-Service Solutions for Enterprises; Simplifies Business Processes and Reduces Cost of Production

- 3.3. Market Restrains

- 3.3.1. Absence of Common Set of Standards and Regulatory Bodies

- 3.4. Market Trends

- 3.4.1. Automotive Vertical is to Witness the Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Blockchain in Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Logistics and Supply Chain Management

- 5.1.2. Counterfeit Management

- 5.1.3. Quality Control and Compliance

- 5.1.4. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Automotive

- 5.2.2. Aerospace and Defense

- 5.2.3. Pharmaceutical

- 5.2.4. Consumer Electronics

- 5.2.5. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Blockchain in Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Logistics and Supply Chain Management

- 6.1.2. Counterfeit Management

- 6.1.3. Quality Control and Compliance

- 6.1.4. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. Automotive

- 6.2.2. Aerospace and Defense

- 6.2.3. Pharmaceutical

- 6.2.4. Consumer Electronics

- 6.2.5. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Blockchain in Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Logistics and Supply Chain Management

- 7.1.2. Counterfeit Management

- 7.1.3. Quality Control and Compliance

- 7.1.4. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. Automotive

- 7.2.2. Aerospace and Defense

- 7.2.3. Pharmaceutical

- 7.2.4. Consumer Electronics

- 7.2.5. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Blockchain in Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Logistics and Supply Chain Management

- 8.1.2. Counterfeit Management

- 8.1.3. Quality Control and Compliance

- 8.1.4. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.2.1. Automotive

- 8.2.2. Aerospace and Defense

- 8.2.3. Pharmaceutical

- 8.2.4. Consumer Electronics

- 8.2.5. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of the World Blockchain in Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Logistics and Supply Chain Management

- 9.1.2. Counterfeit Management

- 9.1.3. Quality Control and Compliance

- 9.1.4. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.2.1. Automotive

- 9.2.2. Aerospace and Defense

- 9.2.3. Pharmaceutical

- 9.2.4. Consumer Electronics

- 9.2.5. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Wipro Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Accenture PLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 IBM Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Factom Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Microsoft Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Advanced Micro Devices Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Amazon Web Services Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Oracle Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Infosys Ltd*List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 SAP SE

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Intel Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Wipro Limited

List of Figures

- Figure 1: Global Blockchain in Manufacturing Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Blockchain in Manufacturing Industry Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Blockchain in Manufacturing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Blockchain in Manufacturing Industry Revenue (billion), by End-user Vertical 2025 & 2033

- Figure 5: North America Blockchain in Manufacturing Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 6: North America Blockchain in Manufacturing Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Blockchain in Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Blockchain in Manufacturing Industry Revenue (billion), by Application 2025 & 2033

- Figure 9: Europe Blockchain in Manufacturing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: Europe Blockchain in Manufacturing Industry Revenue (billion), by End-user Vertical 2025 & 2033

- Figure 11: Europe Blockchain in Manufacturing Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 12: Europe Blockchain in Manufacturing Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Blockchain in Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Blockchain in Manufacturing Industry Revenue (billion), by Application 2025 & 2033

- Figure 15: Asia Pacific Blockchain in Manufacturing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Asia Pacific Blockchain in Manufacturing Industry Revenue (billion), by End-user Vertical 2025 & 2033

- Figure 17: Asia Pacific Blockchain in Manufacturing Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 18: Asia Pacific Blockchain in Manufacturing Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Blockchain in Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Blockchain in Manufacturing Industry Revenue (billion), by Application 2025 & 2033

- Figure 21: Rest of the World Blockchain in Manufacturing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Rest of the World Blockchain in Manufacturing Industry Revenue (billion), by End-user Vertical 2025 & 2033

- Figure 23: Rest of the World Blockchain in Manufacturing Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 24: Rest of the World Blockchain in Manufacturing Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the World Blockchain in Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Blockchain in Manufacturing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Blockchain in Manufacturing Industry Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 3: Global Blockchain in Manufacturing Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Blockchain in Manufacturing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Global Blockchain in Manufacturing Industry Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 6: Global Blockchain in Manufacturing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Blockchain in Manufacturing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Global Blockchain in Manufacturing Industry Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 9: Global Blockchain in Manufacturing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Blockchain in Manufacturing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global Blockchain in Manufacturing Industry Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 12: Global Blockchain in Manufacturing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Blockchain in Manufacturing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Blockchain in Manufacturing Industry Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 15: Global Blockchain in Manufacturing Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Blockchain in Manufacturing Industry?

The projected CAGR is approximately 66.6%.

2. Which companies are prominent players in the Blockchain in Manufacturing Industry?

Key companies in the market include Wipro Limited, Accenture PLC, IBM Corporation, Factom Inc, Microsoft Corporation, Advanced Micro Devices Inc, Amazon Web Services Inc, Oracle Corporation, Infosys Ltd*List Not Exhaustive, SAP SE, Intel Corporation.

3. What are the main segments of the Blockchain in Manufacturing Industry?

The market segments include Application, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 427.99 billion as of 2022.

5. What are some drivers contributing to market growth?

Blockchain-as-a-Service Solutions for Enterprises; Simplifies Business Processes and Reduces Cost of Production.

6. What are the notable trends driving market growth?

Automotive Vertical is to Witness the Significant Growth.

7. Are there any restraints impacting market growth?

Absence of Common Set of Standards and Regulatory Bodies.

8. Can you provide examples of recent developments in the market?

June 2022: Shell, Accenture, and American Express Global Business Travel collaborated to launch Avelia, one of the first digital book-and-claim services for sustainable aviation fuel (SAF) backed by blockchain for business travel. The program's pilot phase intends to show the validity of the book-and-claim concept by securing the distribution of SAF's environmental qualities to businesses and airlines after the fuel has been supplied into the fuel network using blockchain technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Blockchain in Manufacturing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Blockchain in Manufacturing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Blockchain in Manufacturing Industry?

To stay informed about further developments, trends, and reports in the Blockchain in Manufacturing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence