Key Insights

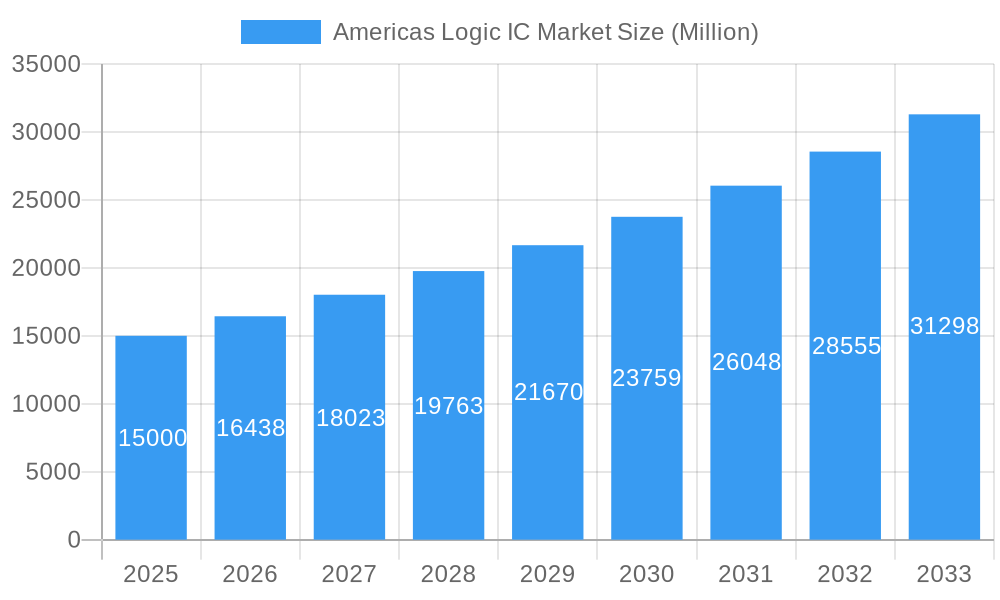

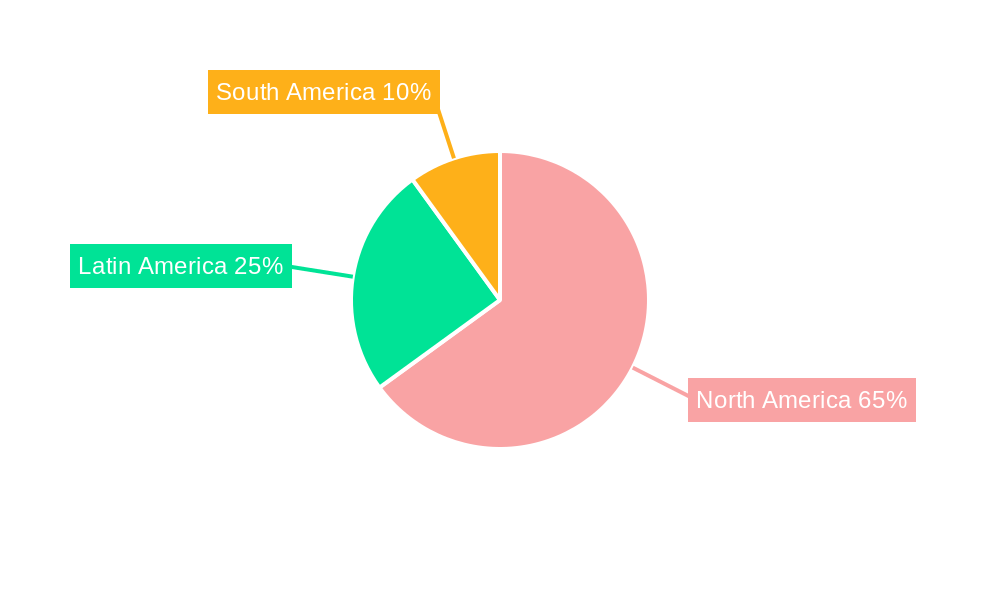

The Americas logic IC market, encompassing key economies like the United States, Canada, Mexico, and Brazil, is poised for significant expansion. Driven by escalating demand for advanced electronics across a spectrum of industries, this market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% from its 2025 market size of 151.4 billion. Key growth catalysts include the widespread adoption of consumer electronics, rapid advancements in automotive technologies (such as autonomous driving and electric vehicles), and the continuous expansion of IT and telecommunications infrastructure. The burgeoning influence of Industry 4.0 and automation further accelerates demand for logic ICs in manufacturing and related sectors. Market segmentation reveals opportunities across various product types (ASICs, ASSPs, PLDs) and applications, with consumer electronics leading, followed by automotive and IT/telecom. MOS special-purpose logic is anticipated to show strong growth due to its application in specialized automotive and industrial solutions. While supply chain disruptions and economic uncertainties present potential restraints, the market outlook remains robust, underpinned by long-term trends like the Internet of Things (IoT), artificial intelligence (AI), and ongoing semiconductor miniaturization. Intense competition among leading players like Analog Devices, Microchip Technology, and Texas Instruments fosters innovation and market development. North America, led by the United States, holds a substantial market share, with Brazil and Mexico emerging as significant Latin American contributors. The forecast period from 2025 to 2033 indicates sustained growth opportunities in emerging healthcare, aerospace, and defense applications.

Americas Logic IC Market Market Size (In Billion)

Continued integration of logic ICs into diverse applications will drive market expansion. The automotive sector's transition towards advanced driver-assistance systems (ADAS) and electric vehicles is a primary growth contributor. Furthermore, the increasing demand for high-performance computing and data centers within the IT and telecommunications sectors is a significant driver. Ongoing innovation in semiconductor technology, focusing on energy-efficient and high-performance logic ICs, will continue to shape the market landscape. While potential economic slowdowns may offer temporary challenges, the long-term trajectory points to sustained market growth, propelled by continuous technological advancements and widespread adoption across end-user industries. Geographical expansion into other South American nations presents substantial potential for future market penetration.

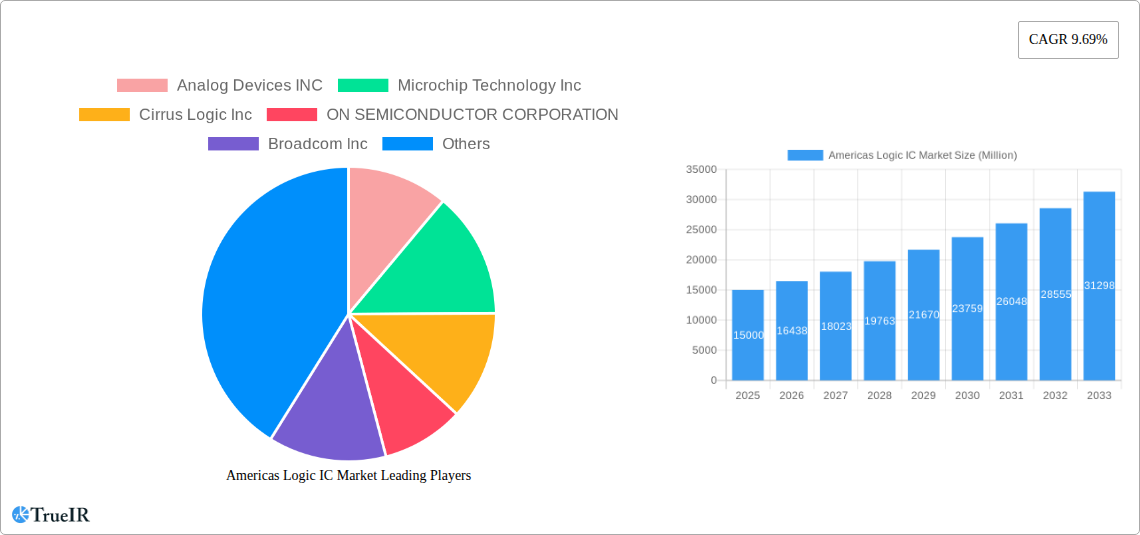

Americas Logic IC Market Company Market Share

Americas Logic IC Market: A Comprehensive Market Report (2019-2033)

This dynamic report provides a comprehensive analysis of the Americas Logic IC market, offering invaluable insights for stakeholders across the semiconductor industry. Leveraging extensive market research and data analysis covering the period 2019-2033 (base year 2025), this report illuminates current market trends, future projections, and key players shaping the landscape. We delve into market segmentation, competitive dynamics, and regulatory influences, providing actionable intelligence to inform strategic decision-making. The report projects a xx Million USD market value in 2025, with a CAGR of xx% projected from 2025 to 2033.

Americas Logic IC Market Structure & Competitive Landscape

The Americas Logic IC market exhibits a moderately concentrated structure, with a Herfindahl-Hirschman Index (HHI) of xx in 2024. Key players, including Analog Devices INC, Microchip Technology Inc, Cirrus Logic Inc, ON SEMICONDUCTOR CORPORATION, Broadcom Inc, Integrated Silicon Solution Inc ( ISSI), Advanced Micro Devices Inc, Texas Instruments Incorporated, Bourns Inc, and Intel Corporation, hold significant market share. Innovation in areas such as low-power consumption, higher integration, and advanced packaging technologies are crucial drivers. Stringent regulatory frameworks, particularly concerning export controls and data privacy, significantly influence market dynamics. Product substitution is limited due to the specialized nature of Logic ICs; however, increasing competition from Asian manufacturers poses a challenge. M&A activity in the sector has been moderate in recent years, with xx recorded mergers and acquisitions totaling xx Million USD in the historical period. This activity is anticipated to increase due to the consolidation strategies of leading players aiming to enhance their market positions.

Americas Logic IC Market Market Trends & Opportunities

The Americas Logic IC market is experiencing robust growth, fueled by increasing demand across diverse end-user industries. The market size expanded from xx Million USD in 2019 to xx Million USD in 2024, demonstrating substantial expansion. Several factors contribute to this positive outlook: the proliferation of smart devices in the consumer electronics sector, the rapid growth of the automotive industry (particularly electric vehicles), the expansion of 5G networks, increasing automation across manufacturing and industrial sectors, and the adoption of advanced technologies within the healthcare sector. Technological advancements in miniaturization, higher processing speeds, and improved energy efficiency are driving demand for more sophisticated Logic ICs. However, fluctuations in global economic conditions and supply chain disruptions pose potential challenges. The market penetration rate for Logic ICs in key applications like automotive and consumer electronics remains high and is expected to increase further as these sectors show continued growth.

Dominant Markets & Segments in Americas Logic IC Market

- Leading Region: The United States dominates the Americas Logic IC market, accounting for approximately xx% of the total market value in 2024. Strong domestic demand, robust R&D investments, and the presence of major semiconductor manufacturers contribute significantly. Canada and Mexico also show substantial growth but at a lower rate.

- Dominant Product Type: ASSPs (Application-Specific Standard Products) hold the largest market share within the product type segment, followed by ASICs (Application-Specific Integrated Circuits) and PLDs (Programmable Logic Devices).

- Key Application Segments: Consumer electronics and automotive sectors are the largest end-users of Logic ICs in the Americas region, driven by increasing demand for smartphones, wearables, and advanced driver-assistance systems (ADAS). IT & Telecommunications segment shows consistent growth owing to the expansion of 5G infrastructure and cloud computing. Manufacturing and Automation is also a rapidly growing market segment due to the increasing automation trend. Healthcare and Aerospace and defense sectors are relatively smaller but are demonstrating impressive growth.

- Dominant Logic Type: Logic Standard chips currently dominate this segment, though there is a growing shift towards MOS Special Purpose Logic chips due to their enhanced capabilities.

- Key Growth Drivers:

- Government initiatives such as the CHIPS Act are stimulating domestic production.

- Rising adoption of IoT devices and automation in various industries.

- Increasing demand for high-performance computing and data centers.

Americas Logic IC Market Product Analysis

The Americas Logic IC market features ongoing innovation in power efficiency, miniaturization, and integration. New products incorporating advanced features such as AI capabilities and improved security are gaining traction. The competitive advantage lies in offering superior performance, lower power consumption, and cost-effectiveness, coupled with robust supply chain management to mitigate potential disruptions.

Key Drivers, Barriers & Challenges in Americas Logic IC Market

Key Drivers: The increasing demand across diverse end-user industries, technological advancements leading to higher performance and efficiency, and supportive government policies like the CHIPS Act are propelling the market's growth. The expansion of 5G networks and the rise of the Internet of Things (IoT) are also significant factors.

Key Challenges: The global semiconductor shortage, rising geopolitical tensions impacting supply chains, and increased competition from Asian manufacturers are significant challenges. Regulatory hurdles and stringent environmental regulations add complexity. The estimated impact of these challenges on market growth is a reduction of xx% in 2025 compared to the forecasted value without these challenges.

Growth Drivers in the Americas Logic IC Market Market

Technological advancements, robust demand from various sectors, and government support are major drivers. The CHIPS Act and other similar initiatives incentivize domestic manufacturing and bolster innovation.

Challenges Impacting Americas Logic IC Market Growth

Supply chain disruptions, geopolitical uncertainties, and intense competition from established and emerging players hinder growth. Regulatory complexities also increase the difficulty for smaller market players.

Key Players Shaping the Americas Logic IC Market Market

- Analog Devices INC

- Microchip Technology Inc

- Cirrus Logic Inc

- ON SEMICONDUCTOR CORPORATION

- Broadcom Inc

- Integrated Silicon Solution Inc ( ISSI)

- Advanced Micro Devices Inc

- Texas Instruments Incorporated

- Bourns Inc

- Intel Corporation

Significant Americas Logic IC Market Industry Milestones

- September 2022: The US Department of Commerce unveiled its plan to allocate USD 50 Billion from the CHIPS Act, aiming to revitalize the domestic semiconductor industry and reduce reliance on Asian manufacturers. This initiative is expected to significantly boost domestic Logic IC production and innovation.

- October 2022: The Biden administration implemented new export controls, restricting the sale of certain semiconductor chips to China. This move is likely to reshape global supply chains and increase demand for Logic ICs produced in the Americas.

Future Outlook for Americas Logic IC Market Market

The Americas Logic IC market is poised for continued growth driven by technological advancements, increasing demand across various sectors, and supportive government policies. Strategic investments in R&D, capacity expansion, and supply chain diversification will be crucial for companies to capitalize on the market's potential. The expected growth trajectory suggests a substantial increase in market value in the coming years.

Americas Logic IC Market Segmentation

-

1. Type

- 1.1. Logic Standard

- 1.2. MOS Special Purpose Logic

-

2. Product Type

- 2.1. ASIC

- 2.2. ASSP

- 2.3. PLD

-

3. Application

- 3.1. Consumer Electronics

- 3.2. Automotive

- 3.3. IT & Telecommunications

- 3.4. Manufacturing and Automation

- 3.5. Other En

Americas Logic IC Market Segmentation By Geography

-

1. Americas

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Brazil

- 1.5. Argentina

- 1.6. Chile

- 1.7. Colombia

- 1.8. Peru

Americas Logic IC Market Regional Market Share

Geographic Coverage of Americas Logic IC Market

Americas Logic IC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Focus on Integration of Devices; Rising Capital Spending by Fabs to Increase Production Capacities

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations; Lack of Skilled Radiation Professionals

- 3.4. Market Trends

- 3.4.1. Growing Adoption of Logic IC in Automotive Industries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Americas Logic IC Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Logic Standard

- 5.1.2. MOS Special Purpose Logic

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. ASIC

- 5.2.2. ASSP

- 5.2.3. PLD

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Consumer Electronics

- 5.3.2. Automotive

- 5.3.3. IT & Telecommunications

- 5.3.4. Manufacturing and Automation

- 5.3.5. Other En

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Americas

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Analog Devices INC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Microchip Technology Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cirrus Logic Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ON SEMICONDUCTOR CORPORATION

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Broadcom Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Integrated Silicon Solution Inc ( ISSI)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Advanced Micro Devices Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Texas Instruments Incorporated

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bourns Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Intel Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Analog Devices INC

List of Figures

- Figure 1: Americas Logic IC Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Americas Logic IC Market Share (%) by Company 2025

List of Tables

- Table 1: Americas Logic IC Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Americas Logic IC Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Americas Logic IC Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Americas Logic IC Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Americas Logic IC Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Americas Logic IC Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Americas Logic IC Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Americas Logic IC Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Americas Logic IC Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Americas Logic IC Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Americas Logic IC Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Brazil Americas Logic IC Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Argentina Americas Logic IC Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Chile Americas Logic IC Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Colombia Americas Logic IC Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Peru Americas Logic IC Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Americas Logic IC Market?

The projected CAGR is approximately 7.5%.

2. Which companies are prominent players in the Americas Logic IC Market?

Key companies in the market include Analog Devices INC, Microchip Technology Inc, Cirrus Logic Inc, ON SEMICONDUCTOR CORPORATION, Broadcom Inc, Integrated Silicon Solution Inc ( ISSI), Advanced Micro Devices Inc, Texas Instruments Incorporated, Bourns Inc, Intel Corporation.

3. What are the main segments of the Americas Logic IC Market?

The market segments include Type, Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 151.4 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Focus on Integration of Devices; Rising Capital Spending by Fabs to Increase Production Capacities.

6. What are the notable trends driving market growth?

Growing Adoption of Logic IC in Automotive Industries.

7. Are there any restraints impacting market growth?

Stringent Government Regulations; Lack of Skilled Radiation Professionals.

8. Can you provide examples of recent developments in the market?

October 2022: The Biden administration issued a new set of export controls. As per the new set of regulations, the US would be cutting China off from certain semiconductor chips made anywhere in the world with US equipment to slow down Beijing's technological and military advances. Such regulations are expected to further influence the demand for Logic ICs in the market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Americas Logic IC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Americas Logic IC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Americas Logic IC Market?

To stay informed about further developments, trends, and reports in the Americas Logic IC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence