Key Insights

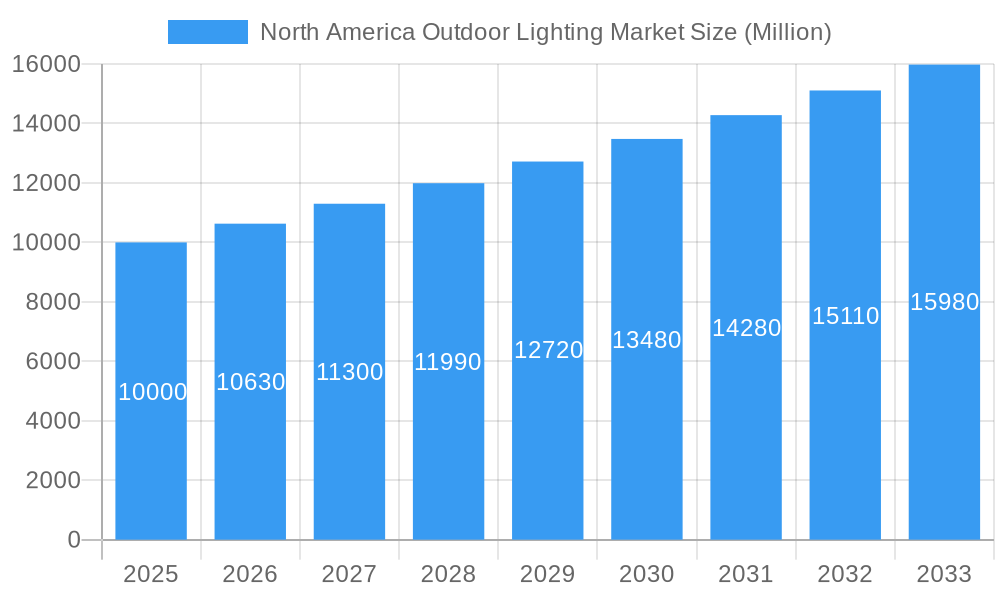

The North American outdoor lighting market is projected for substantial expansion, fueled by urbanization, the escalating demand for energy-efficient LED solutions, and the proliferation of smart city initiatives. The market, valued at approximately 26.06 billion in the base year 2025, is anticipated to grow at a compound annual growth rate (CAGR) of 8.6% from 2025 to 2033. Key growth drivers include the widespread adoption of LED technology across residential, architectural, and commercial sectors, owing to its superior energy efficiency, longevity, and performance. Smart city programs are further stimulating the integration of connected outdoor lighting systems for enhanced monitoring, control, and energy management. Significant infrastructure investments across the United States and Canada are also contributing to market buoyancy. The market segments show strong performance in residential and architectural outdoor lighting applications. LED lighting dominates the technology landscape, with direct sales and wholesale/retail channels being the primary distribution methods.

North America Outdoor Lighting Market Market Size (In Billion)

Despite a favorable outlook, the market faces challenges including raw material price volatility and supply chain disruptions, which can affect production costs. Stringent energy efficiency and light pollution regulations may also necessitate greater investment in compliant technologies. Intense competition from established and emerging players adds complexity. Nevertheless, the increasing adoption of smart lighting and ongoing advancements in LED technology are expected to overcome these obstacles and maintain positive market momentum. The persistent focus on sustainable and energy-efficient solutions, particularly in the United States and Canada, positions the North American outdoor lighting market for significant growth. The expansion of smart city applications and innovations in connected lighting will be pivotal for future market development.

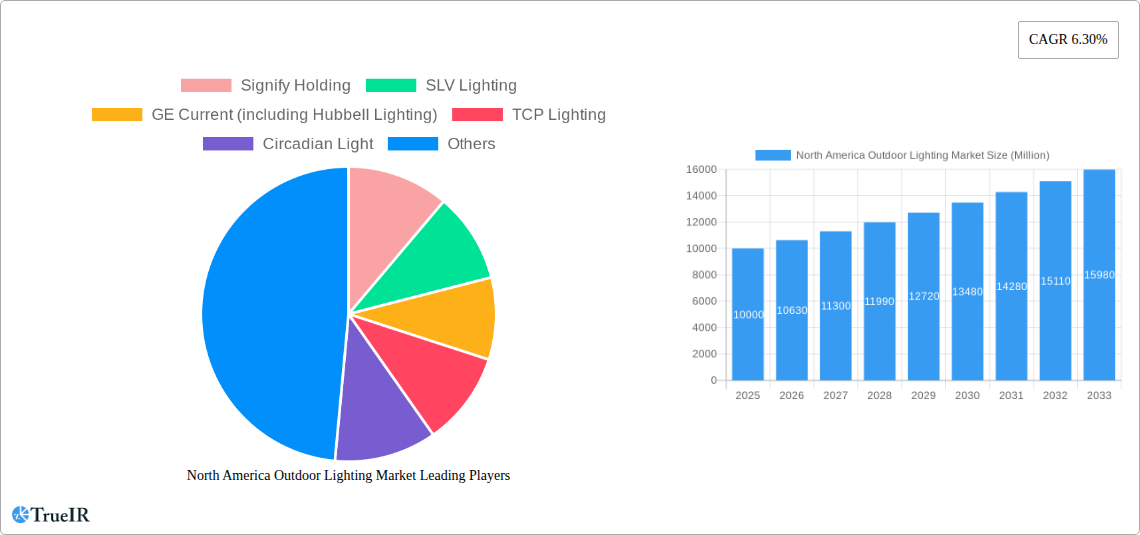

North America Outdoor Lighting Market Company Market Share

North America Outdoor Lighting Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America outdoor lighting market, offering invaluable insights for industry stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report illuminates market dynamics, growth drivers, challenges, and future prospects. The analysis encompasses key segments, including residential, architectural, sports arenas, and other applications, across various distribution channels and lighting types. Leading players like Signify Holding, SLV Lighting, GE Current (including Hubbell Lighting), TCP Lighting, Circadian Light, Cree Lighting, Ideal Industries, and Acuity Brands are profiled, providing a complete understanding of the competitive landscape.

North America Outdoor Lighting Market Structure & Competitive Landscape

The North America outdoor lighting market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx, suggesting a competitive but not overly fragmented landscape. Innovation is a key driver, with continuous advancements in LED technology, smart lighting solutions, and energy-efficient designs shaping market dynamics. Stringent environmental regulations and energy efficiency standards play a significant role, prompting the adoption of energy-saving LED lighting and pushing companies to develop more sustainable solutions. Product substitution is evident with the gradual shift from traditional lighting to LED, driven by lower operating costs and longer lifespans.

End-user segmentation is crucial, with residential, commercial, and public sectors driving distinct demand patterns. Mergers and acquisitions (M&A) activity has been moderate in recent years, with xx major transactions recorded between 2019 and 2024, primarily focused on expanding product portfolios and geographical reach. Smaller companies are increasingly seeking partnerships with larger players to gain access to resources and distribution networks. These activities are further consolidating the market and shaping its competitive dynamics.

North America Outdoor Lighting Market Market Trends & Opportunities

The North America outdoor lighting market is experiencing robust growth, driven by several key trends. The market size is projected to reach USD xx Million by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by the widespread adoption of energy-efficient LED lighting, increasing urbanization, and rising demand for smart lighting solutions offering improved safety, security, and energy management capabilities.

Technological advancements, including the integration of IoT (Internet of Things) technologies, are transforming the market, leading to the emergence of smart streetlights with features such as remote monitoring, data analytics, and integrated communication networks. Consumer preferences are shifting towards energy-efficient, aesthetically pleasing, and technologically advanced lighting solutions. Competitive dynamics are characterized by intense competition among established players and the emergence of innovative startups offering specialized solutions. Market penetration rates for LED lighting are increasing steadily, exceeding xx% in 2024 and anticipated to reach xx% by 2033, replacing traditional lighting systems.

Dominant Markets & Segments in North America Outdoor Lighting Market

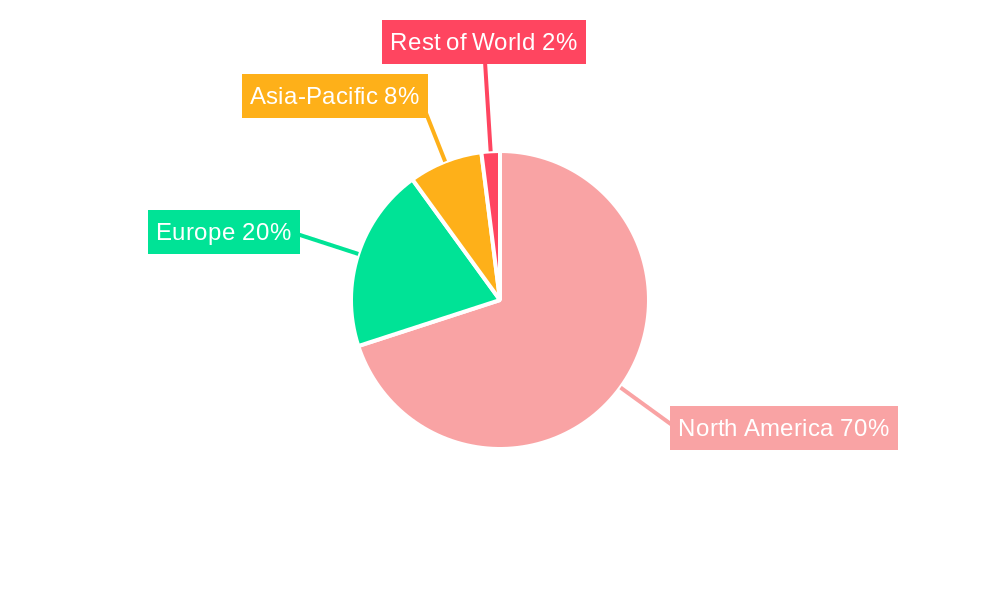

The United States dominates the North America outdoor lighting market, accounting for a larger share of the overall market revenue compared to Canada due to its larger population, extensive infrastructure, and higher levels of disposable income.

Key Growth Drivers:

- Significant Infrastructure Development: Large-scale projects involving the modernization of street lighting and expansion of outdoor infrastructure fuel substantial demand.

- Government Initiatives and Subsidies: Favorable policies encouraging the adoption of energy-efficient lighting solutions incentivize market growth.

- Rising Energy Costs: The increasing cost of traditional lighting encourages the shift to energy-efficient alternatives.

- Growing Emphasis on Public Safety and Security: The installation of smart lighting solutions for enhanced visibility and security boosts market expansion.

Market Dominance Analysis:

The LED lighting segment is experiencing exponential growth due to its energy efficiency, longer lifespan, and cost-effectiveness in comparison to traditional lighting. The residential segment holds a considerable market share as a significant portion of the population upgrades or replaces outdoor lighting in their homes. The architectural and sports/large area segments also contribute significantly to market growth, driven by construction activities and the adoption of advanced lighting systems. Wholesale/retail distribution channels still dominate, though direct sales are increasing as companies offer comprehensive smart lighting solutions directly to clients.

North America Outdoor Lighting Market Product Analysis

Technological advancements are driving innovation in outdoor lighting products, featuring advanced LED technologies offering improved energy efficiency, enhanced color rendering, and smart functionalities. These products find applications across various segments including street lighting, landscape lighting, and architectural lighting. Smart lighting solutions, enabled by IoT and remote monitoring capabilities, offer increased control, reduced energy consumption, and improved maintenance schedules.

Key Drivers, Barriers & Challenges in North America Outdoor Lighting Market

Key Drivers: The increasing adoption of LED lighting, driven by energy efficiency and cost savings, is a primary driver. Government initiatives promoting energy conservation and smart city development fuel growth. The rising demand for improved safety and security in public spaces also drives demand for innovative lighting solutions.

Key Challenges: High upfront costs associated with smart lighting systems and infrastructure upgrades can be a barrier. Supply chain disruptions, particularly in sourcing components for LED lights and smart systems, can negatively impact market growth. Competition from a wide range of established and new players makes maintaining market share a considerable challenge. The impact of supply chain constraints has led to increased prices and project delays for xx% of projects in 2024.

Growth Drivers in the North America Outdoor Lighting Market Market

Technological innovation in LED technology and smart lighting, along with government support for energy efficiency and smart city initiatives, significantly contribute to market growth. Increased construction activity and urban expansion, along with rising safety and security concerns, are also driving factors.

Challenges Impacting North America Outdoor Lighting Market Growth

High initial investment costs for LED lighting and smart systems, combined with potential supply chain disruptions and intense competition, pose significant challenges. Regulatory complexities and varying standards across regions add further hurdles.

Key Players Shaping the North America Outdoor Lighting Market Market

- Signify Holding

- SLV Lighting

- GE Current (including Hubbell Lighting)

- TCP Lighting

- Circadian Light

- Cree Lighting

- Ideal Industries

- Acuity Brands

Significant North America Outdoor Lighting Market Industry Milestones

- February 2022: The District of Columbia Council approved USD 309 Million for LED streetlight upgrades, impacting the market significantly.

- May 2022: The District of Columbia partnered with PIDC for a USD 309 Million streetlight modernization project, demonstrating large-scale adoption of smart solutions.

- May 2022: Ubicquia and RealTerm Energy completed 25 smart street lighting projects across the US and Canada, showcasing the market trend towards smart city initiatives.

Future Outlook for North America Outdoor Lighting Market Market

The North America outdoor lighting market is poised for continued growth, driven by technological advancements, favorable government policies, and rising demand for smart and energy-efficient solutions. Strategic opportunities lie in developing innovative smart lighting systems, expanding into niche segments, and focusing on sustainable and eco-friendly product offerings. The market's potential is substantial, with significant opportunities for growth across various segments and applications.

North America Outdoor Lighting Market Segmentation

-

1. Type of Application

- 1.1. Residential Outdoor

- 1.2. Architectural

- 1.3. Sport Arenas/Large Areas/Campus

- 1.4. Other Ap

-

2. Distribution Channel

- 2.1. Direct Sales

- 2.2. Wholesale/Retail

-

3. Type of Lighting

- 3.1. Traditional

- 3.2. LED

North America Outdoor Lighting Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Outdoor Lighting Market Regional Market Share

Geographic Coverage of North America Outdoor Lighting Market

North America Outdoor Lighting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Need for Energy-efficient Lighting Systems and Favorable Government Regulations; Declining Prices of LED Products

- 3.3. Market Restrains

- 3.3.1. ; Lack of Awareness and Higher Initial Cost

- 3.4. Market Trends

- 3.4.1. LED Lighting is Expected to Hold Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Outdoor Lighting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Application

- 5.1.1. Residential Outdoor

- 5.1.2. Architectural

- 5.1.3. Sport Arenas/Large Areas/Campus

- 5.1.4. Other Ap

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct Sales

- 5.2.2. Wholesale/Retail

- 5.3. Market Analysis, Insights and Forecast - by Type of Lighting

- 5.3.1. Traditional

- 5.3.2. LED

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type of Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Signify Holding

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SLV Lighting

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GE Current (including Hubbell Lighting)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 TCP Lighting

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Circadian Light

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cree Lighting*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ideal Industries

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Acuity Brands

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Signify Holding

List of Figures

- Figure 1: North America Outdoor Lighting Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Outdoor Lighting Market Share (%) by Company 2025

List of Tables

- Table 1: North America Outdoor Lighting Market Revenue billion Forecast, by Type of Application 2020 & 2033

- Table 2: North America Outdoor Lighting Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: North America Outdoor Lighting Market Revenue billion Forecast, by Type of Lighting 2020 & 2033

- Table 4: North America Outdoor Lighting Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Outdoor Lighting Market Revenue billion Forecast, by Type of Application 2020 & 2033

- Table 6: North America Outdoor Lighting Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: North America Outdoor Lighting Market Revenue billion Forecast, by Type of Lighting 2020 & 2033

- Table 8: North America Outdoor Lighting Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States North America Outdoor Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Outdoor Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Outdoor Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Outdoor Lighting Market?

The projected CAGR is approximately 8.6%.

2. Which companies are prominent players in the North America Outdoor Lighting Market?

Key companies in the market include Signify Holding, SLV Lighting, GE Current (including Hubbell Lighting), TCP Lighting, Circadian Light, Cree Lighting*List Not Exhaustive, Ideal Industries, Acuity Brands.

3. What are the main segments of the North America Outdoor Lighting Market?

The market segments include Type of Application, Distribution Channel, Type of Lighting.

4. Can you provide details about the market size?

The market size is estimated to be USD 26.06 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in Need for Energy-efficient Lighting Systems and Favorable Government Regulations; Declining Prices of LED Products.

6. What are the notable trends driving market growth?

LED Lighting is Expected to Hold Major Share.

7. Are there any restraints impacting market growth?

; Lack of Awareness and Higher Initial Cost.

8. Can you provide examples of recent developments in the market?

May 2022 - The District of Columbia's Department of Transportation and the Office of Public-Private Partnerships (OP3) announced a long-term public-private partnership with the Plenary Infrastructure DC (PIDC) consortium to modernize more than 75,000 lights throughout the District. The USD 309 million projects are expected to modernize over 75,000 streetlights, reduce energy consumption by more than 50%, improve service equity, and expand Wi-Fi coverage in underserved neighborhoods.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Outdoor Lighting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Outdoor Lighting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Outdoor Lighting Market?

To stay informed about further developments, trends, and reports in the North America Outdoor Lighting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence