Key Insights

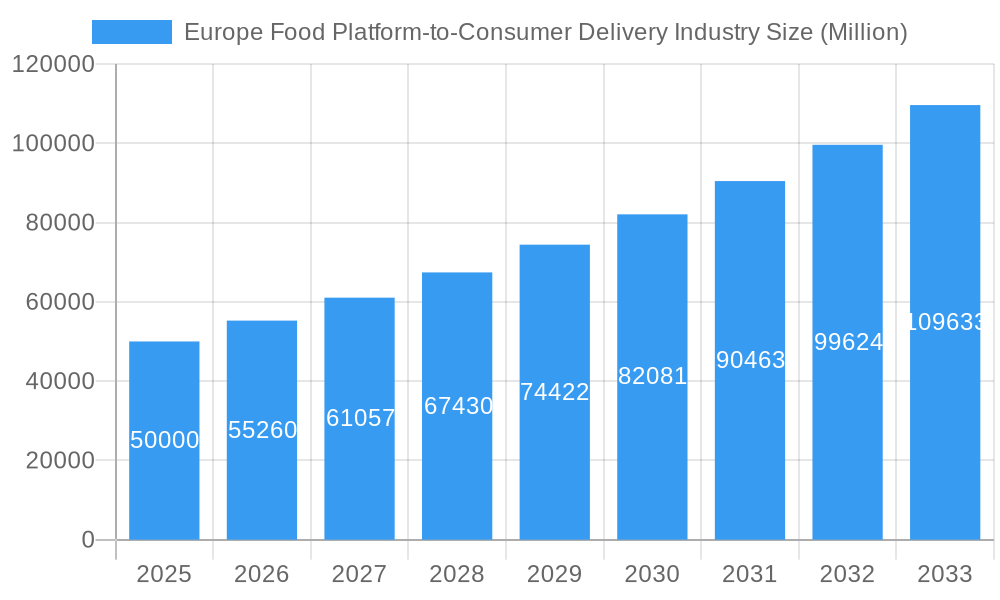

The European food delivery platform market is experiencing significant growth, fueled by increasing smartphone adoption, evolving consumer lifestyles prioritizing convenience, and a widening array of culinary options. With a projected Compound Annual Growth Rate (CAGR) of 7.7%, the market size is estimated at 73798.4 million in the base year of 2024. This expansion is particularly pronounced in key European economies, including the UK, Germany, France, and Italy. The emergence of ghost kitchens and the implementation of AI for delivery optimization further accelerate market development. Intense competition among established players like Deliveroo, Uber Eats, and Just Eat, alongside emerging local providers, is driving innovation in pricing, customer loyalty initiatives, and service expansion into smaller urban areas. Understanding country-specific consumer preferences and competitive landscapes is crucial. Future growth is anticipated from sustainable delivery practices and deeper integration with grocery delivery services.

Europe Food Platform-to-Consumer Delivery Industry Market Size (In Billion)

Market challenges include fluctuating fuel costs, stringent food safety regulations, and maintaining consistent delivery quality and timeliness across diverse regions. To mitigate these, platforms are investing in efficient logistics, strategic restaurant partnerships, and advanced order management systems. Expanding into less densely populated areas presents unique logistical and economic hurdles requiring strategic planning. Despite these restraints, the long-term outlook for the European food platform-to-consumer delivery market remains positive, driven by evolving consumer habits and ongoing technological advancements.

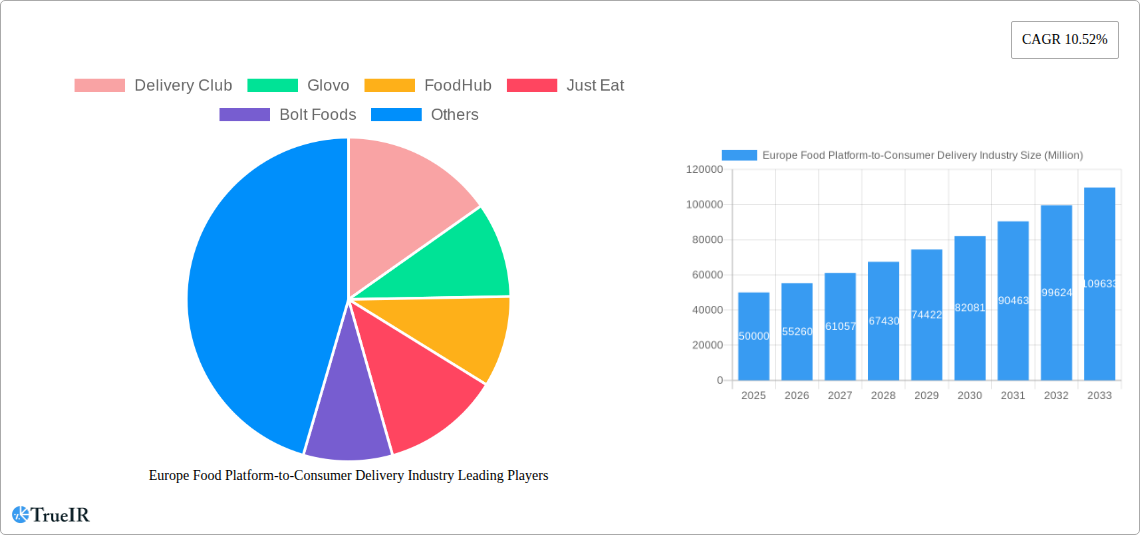

Europe Food Platform-to-Consumer Delivery Industry Company Market Share

Europe Food Platform-to-Consumer Delivery Industry Market Report: 2024-2033

This comprehensive report analyzes the Europe food platform-to-consumer delivery industry from 2024 to 2033. It provides critical insights into market structure, competitive dynamics, growth drivers, challenges, and future projections, serving as an essential resource for industry professionals, investors, and strategists. The report utilizes extensive data analysis and forecasts to deliver actionable intelligence, supported by key performance indicators and strategic recommendations. The market size for 2025 is estimated at 73798.4 million, with a projected CAGR of 7.7% from 2025 to 2033.

Europe Food Platform-to-Consumer Delivery Industry Market Structure & Competitive Landscape

The European food platform-to-consumer delivery market exhibits a moderately concentrated structure, with several major players vying for market share. The top five companies—Delivery Hero, Just Eat, Deliveroo, Uber Eats, and Glovo—hold an estimated XX% of the market, reflecting significant consolidation and a high barrier to entry for new entrants. This concentration is further analyzed by the Herfindahl-Hirschman Index (HHI), which shows a score of XX, indicating a moderately consolidated market.

- Innovation Drivers: Technological advancements like AI-powered order routing, improved delivery logistics, and personalized recommendation engines are key innovation drivers.

- Regulatory Impacts: Varying regulations across European nations regarding food safety, data privacy, and worker classification pose challenges to consistent operations and market expansion.

- Product Substitutes: Traditional restaurant dining, grocery delivery services, and meal kit subscriptions are key substitutes for online food delivery.

- End-User Segmentation: Market segmentation focuses primarily on demographics (age, income), location (urban vs. rural), and lifestyle preferences. The younger demographic (18-35) represents the largest user segment.

- M&A Trends: Consolidation continues to be a prominent trend, with an estimated XX number of M&A transactions in the past five years, mostly involving smaller players being absorbed by larger corporations.

Europe Food Platform-to-Consumer Delivery Industry Market Trends & Opportunities

The European food platform-to-consumer delivery market is experiencing robust growth, driven by several factors. Market size expanded from €XX Million in 2019 to an estimated €XX Million in 2024. Technological advancements like mobile apps and improved delivery infrastructure have significantly increased market penetration. Consumer preferences are shifting towards convenience, with a growing reliance on online platforms for ordering food. This trend is further amplified by urbanization, increased disposable incomes in many countries, and the adoption of on-demand services. The market is expected to continue its growth trajectory, with various opportunities for existing players to expand their services and for new entrants to find a niche. This includes personalized offerings, expansion into adjacent markets such as grocery delivery, and enhancing user experience through innovative technologies.

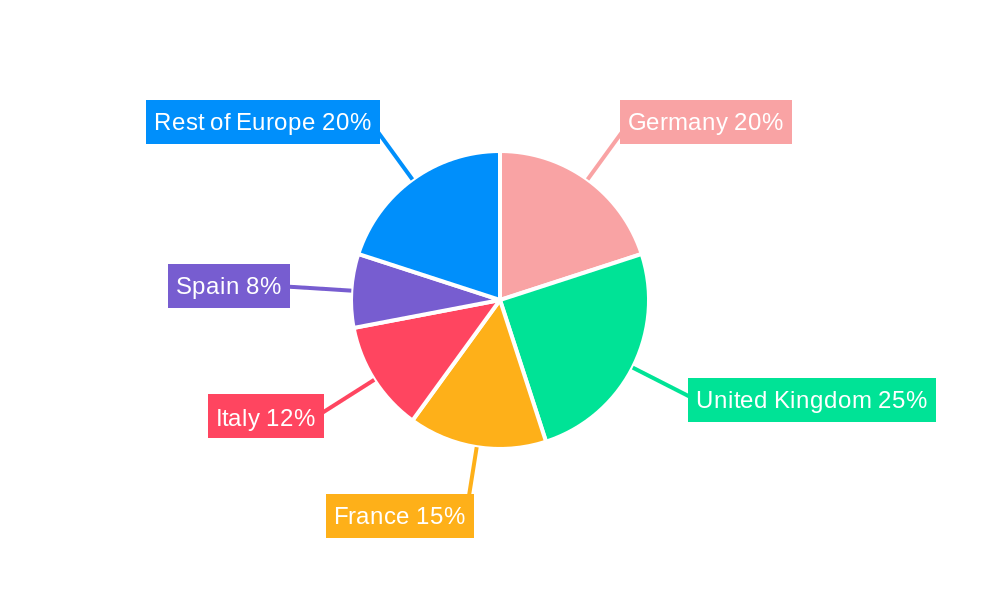

Dominant Markets & Segments in Europe Food Platform-to-Consumer Delivery Industry

The United Kingdom, Germany, and France represent the most significant markets within Europe, accounting for over XX% of the total market revenue.

United Kingdom:

- Key Growth Drivers: High smartphone penetration, well-developed delivery infrastructure, and a strong culture of online ordering.

Germany:

- Key Growth Drivers: Increasing urban population, rising disposable incomes, and a growing adoption of online services.

France:

- Key Growth Drivers: Growing preference for convenience food and a rising number of online food delivery platform users.

Other significant markets include Spain and Italy, exhibiting steady growth albeit at a slower pace compared to the top three. The Rest of Europe segment also presents opportunities with potential for expansion as these markets mature and adopt similar trends. The dominance of the UK, Germany, and France is primarily attributed to their higher levels of internet penetration, sophisticated logistical infrastructure, and established online ordering cultures.

Europe Food Platform-to-Consumer Delivery Industry Product Analysis

The industry is witnessing significant product innovation with the introduction of features such as AI-driven recommendation systems, enhanced customer support channels, and loyalty programs designed to increase user retention. Delivery optimization through route planning algorithms and delivery-only kitchens contribute to operational efficiency and competitive advantage. These innovations directly impact market fit, ensuring timely delivery and meeting consumer demand for a seamless ordering experience. The focus is on improving the speed, accuracy, and convenience of the delivery service to enhance customer satisfaction.

Key Drivers, Barriers & Challenges in Europe Food Platform-to-Consumer Delivery Industry

Key Drivers:

- Increasing urbanization and busy lifestyles.

- Rising disposable incomes and spending power in key European countries.

- Technological advancements and improved delivery infrastructure.

- Growing adoption of smartphones and mobile applications.

Challenges:

- Intense competition among established players and new entrants.

- Stringent food safety and hygiene regulations.

- Concerns over worker classification and labor rights.

- Fluctuating fuel prices impacting delivery costs. A rise in fuel prices by XX% in 2024 resulted in a YY% increase in delivery costs for some operators.

Growth Drivers in the Europe Food Platform-to-Consumer Delivery Industry Market

The market's growth is primarily fueled by escalating consumer demand for convenience, increasing smartphone penetration, and advancements in food delivery technology. Urbanization, expanding middle classes in several European nations, and the ever-increasing adoption of online services all contribute to market expansion. Furthermore, government initiatives promoting digital infrastructure and e-commerce further bolster the industry's trajectory.

Challenges Impacting Europe Food Platform-to-Consumer Delivery Industry Growth

Significant barriers to market growth include intense competition, fluctuating fuel prices, and the complexities of navigating diverse regulatory frameworks across Europe. Maintaining profitability in a price-sensitive market is a major challenge. Concerns regarding labor relations, food safety regulations, and the environmental impact of deliveries also add to the complexity of the operating environment.

Key Players Shaping the Europe Food Platform-to-Consumer Delivery Industry Market

- Delivery Hero

- Glovo

- FoodHub

- Just Eat

- Bolt Foods

- Deliveroo

- Uber Eats

- GrubHub

- Doordash Inc

- FoodPanda

- Delivery Club

Significant Europe Food Platform-to-Consumer Delivery Industry Industry Milestones

- June 2022: Just Eat increased its restaurant commission charges by 1% due to rising inflation and operational costs.

- March 2022: Deliveroo launched an engineering center in Hyderabad, India, marking its expansion into the Indian market.

Future Outlook for Europe Food Platform-to-Consumer Delivery Industry Market

The European food platform-to-consumer delivery market is poised for continued growth, driven by ongoing technological advancements, increasing consumer adoption, and expansion into new markets. Opportunities exist in personalized services, strategic partnerships, and the integration of new technologies to enhance efficiency and customer satisfaction. This positive outlook is tempered by the need to address challenges related to sustainability, labor regulations, and intense competition. The market is expected to reach €XX Million by 2033, representing substantial growth potential for market players.

Europe Food Platform-to-Consumer Delivery Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Food Platform-to-Consumer Delivery Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Food Platform-to-Consumer Delivery Industry Regional Market Share

Geographic Coverage of Europe Food Platform-to-Consumer Delivery Industry

Europe Food Platform-to-Consumer Delivery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. New delivery platforms (Aggregator platforms) are driving the growth towards the market; Increasing the number of takeaway services

- 3.3. Market Restrains

- 3.3.1. Increased Competition in the Market

- 3.4. Market Trends

- 3.4.1. Increasing Demand of Online Food Delivery Platforms

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Food Platform-to-Consumer Delivery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Delivery Club

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Glovo

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 FoodHub

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Just Eat

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bolt Foods

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Delivery Hero

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Deliveroo

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Uber Eat

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GrubHub

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Doordash Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 FoodPanda

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Delivery Club

List of Figures

- Figure 1: Europe Food Platform-to-Consumer Delivery Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Food Platform-to-Consumer Delivery Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Food Platform-to-Consumer Delivery Industry Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 2: Europe Food Platform-to-Consumer Delivery Industry Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Europe Food Platform-to-Consumer Delivery Industry Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Europe Food Platform-to-Consumer Delivery Industry Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Europe Food Platform-to-Consumer Delivery Industry Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Europe Food Platform-to-Consumer Delivery Industry Revenue million Forecast, by Region 2020 & 2033

- Table 7: Europe Food Platform-to-Consumer Delivery Industry Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 8: Europe Food Platform-to-Consumer Delivery Industry Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Europe Food Platform-to-Consumer Delivery Industry Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Europe Food Platform-to-Consumer Delivery Industry Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Europe Food Platform-to-Consumer Delivery Industry Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Europe Food Platform-to-Consumer Delivery Industry Revenue million Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Food Platform-to-Consumer Delivery Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Germany Europe Food Platform-to-Consumer Delivery Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: France Europe Food Platform-to-Consumer Delivery Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Food Platform-to-Consumer Delivery Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Food Platform-to-Consumer Delivery Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Netherlands Europe Food Platform-to-Consumer Delivery Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Belgium Europe Food Platform-to-Consumer Delivery Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Sweden Europe Food Platform-to-Consumer Delivery Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Norway Europe Food Platform-to-Consumer Delivery Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Poland Europe Food Platform-to-Consumer Delivery Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Denmark Europe Food Platform-to-Consumer Delivery Industry Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Food Platform-to-Consumer Delivery Industry?

The projected CAGR is approximately 7.7%.

2. Which companies are prominent players in the Europe Food Platform-to-Consumer Delivery Industry?

Key companies in the market include Delivery Club, Glovo, FoodHub, Just Eat, Bolt Foods, Delivery Hero, Deliveroo, Uber Eat, GrubHub, Doordash Inc, FoodPanda.

3. What are the main segments of the Europe Food Platform-to-Consumer Delivery Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 73798.4 million as of 2022.

5. What are some drivers contributing to market growth?

New delivery platforms (Aggregator platforms) are driving the growth towards the market; Increasing the number of takeaway services.

6. What are the notable trends driving market growth?

Increasing Demand of Online Food Delivery Platforms.

7. Are there any restraints impacting market growth?

Increased Competition in the Market.

8. Can you provide examples of recent developments in the market?

June 2022 - Just Eat, one of the prominent players in the online meals delivery market in Europe, increased its restaurant commission charges by 1%. With rising inflation and higher operational costs, the company has increased its commission charges.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Food Platform-to-Consumer Delivery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Food Platform-to-Consumer Delivery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Food Platform-to-Consumer Delivery Industry?

To stay informed about further developments, trends, and reports in the Europe Food Platform-to-Consumer Delivery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence