Key Insights

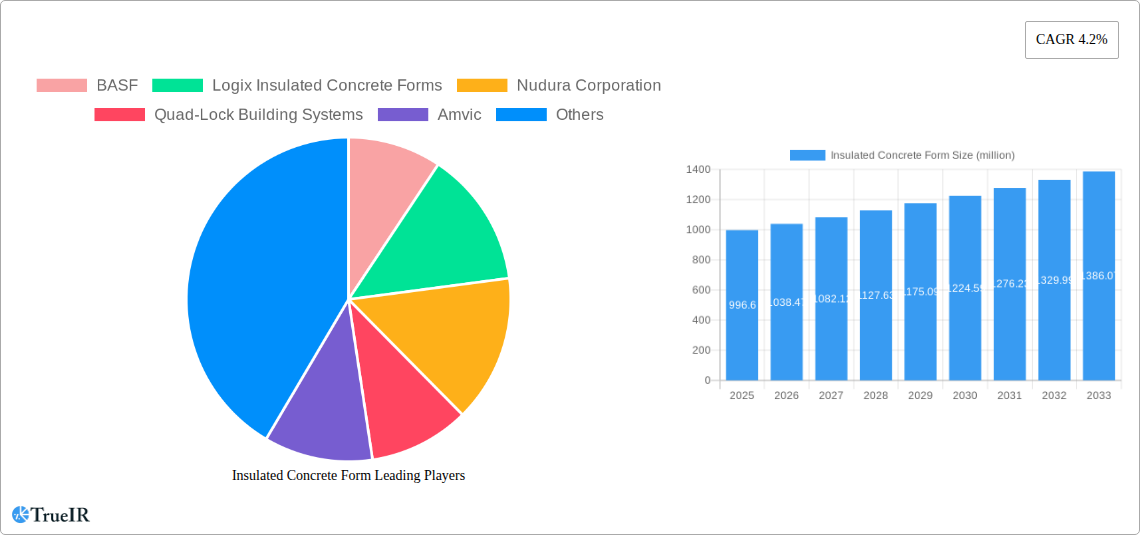

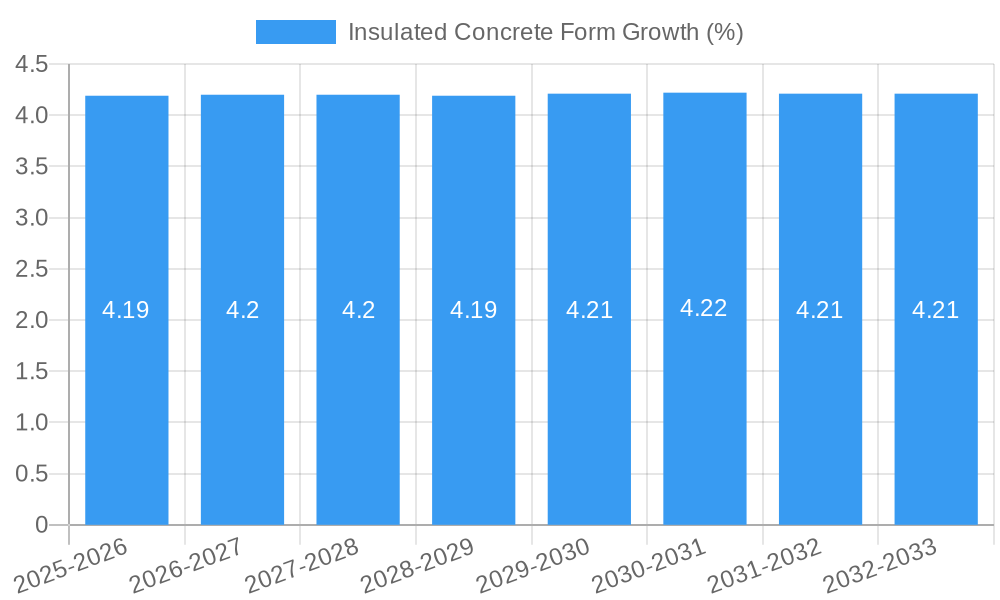

The global Insulated Concrete Forms (ICF) market is poised for significant expansion, with a current market size of approximately $996.6 million. This growth is driven by a projected Compound Annual Growth Rate (CAGR) of 4.2% from the base year 2025 through to 2033, indicating a robust and sustained upward trajectory. The increasing demand for energy-efficient and sustainable building solutions is a primary catalyst. ICFs offer superior thermal insulation, reducing energy consumption for heating and cooling, which directly appeals to environmentally conscious consumers and stringent building codes worldwide. Furthermore, the inherent strength, durability, and fire resistance of ICF construction contribute to enhanced safety and reduced long-term maintenance costs, making them an attractive alternative to traditional building materials in both residential and non-residential sectors. The market is segmented into applications such as Residential and Non-residential, with types including Expanded Polystyrene Foam, Polyurethane Foam, and Others, each catering to diverse construction needs and preferences.

The market's momentum is further bolstered by technological advancements in ICF systems, improving ease of installation and cost-effectiveness, thereby addressing historical adoption barriers. Trends such as the growing emphasis on green building certifications and government incentives for energy-efficient construction are expected to accelerate market penetration. While the market enjoys strong growth drivers, certain restraints, such as the initial perception of higher upfront costs compared to conventional methods and the need for specialized training for installers, could moderate the pace of adoption in some regions. However, the long-term cost savings and performance benefits of ICFs are increasingly outweighing these initial challenges. Key industry players like BASF, Logix Insulated Concrete Forms, and Nudura Corporation are actively innovating and expanding their product portfolios to meet the evolving demands of the construction industry, further solidifying the market's growth outlook.

Insulated Concrete Form Market: Comprehensive Analysis and Future Projections (2019-2033)

This in-depth report provides a detailed analysis of the global Insulated Concrete Form (ICF) market, covering historical trends, current market dynamics, and future growth projections. Leveraging high-volume SEO keywords, this report is designed to inform industry professionals, investors, and stakeholders about the evolving ICF landscape. The study encompasses a comprehensive forecast period from 2025–2033, with a base year of 2025 and historical data spanning 2019–2024.

Insulated Concrete Form Market Structure & Competitive Landscape

The global Insulated Concrete Form (ICF) market exhibits a moderately concentrated structure, with several key players dominating a significant portion of the market share, estimated to be around 60% by leading entities. Innovation is a paramount driver, fueled by ongoing research and development into enhanced insulation properties, improved structural integrity, and more efficient installation methods. Regulatory impacts are substantial, with building codes increasingly favoring energy-efficient and sustainable construction materials, thereby boosting ICF adoption. Product substitutes, while present in the form of traditional concrete, wood framing, and other insulation systems, are facing increasing competition from the superior performance attributes of ICFs, particularly in terms of energy savings and durability.

End-user segmentation reveals a strong demand from both Residential and Non-residential applications. The residential sector is driven by homeowners seeking reduced energy bills and increased comfort, while the non-residential sector is influenced by the need for robust, energy-efficient structures for commercial, institutional, and industrial purposes. Mergers and Acquisitions (M&A) trends, while not at extremely high volumes, indicate strategic consolidation by larger players to expand their market reach and product portfolios. For instance, an estimated 5-7 significant M&A activities have been observed throughout the historical period, indicating a gradual consolidation phase. The presence of established manufacturers and emerging innovators ensures a dynamic competitive environment focused on product differentiation and market penetration.

Insulated Concrete Form Market Trends & Opportunities

The global Insulated Concrete Form (ICF) market is projected to experience robust growth, with an estimated market size exceeding $5 million in the base year 2025 and poised for significant expansion throughout the forecast period. This impressive trajectory is underpinned by a confluence of favorable market trends and emerging opportunities. A key trend is the escalating global emphasis on sustainable construction and energy efficiency. As governments worldwide implement stricter building codes and offer incentives for green building practices, the demand for ICFs, known for their superior thermal performance and reduced energy consumption, is set to surge. The average energy savings attributed to ICF construction can range from 20% to 50% compared to traditional building methods, a compelling proposition for both residential and commercial property owners.

Technological shifts are also playing a pivotal role. Manufacturers are continuously innovating to develop lighter, stronger, and easier-to-install ICF systems. This includes advancements in the types of foam used, such as improved Expanded Polystyrene (EPS) Foam and Polyurethane Foam formulations, leading to enhanced R-values and structural capabilities. Furthermore, the integration of digital technologies in the manufacturing and installation process, including pre-fabrication and modular design, is streamlining construction timelines and reducing labor costs. Consumer preferences are increasingly aligning with these advancements. End-users are becoming more educated about the long-term benefits of ICFs, including enhanced durability, superior soundproofing, improved indoor air quality, and resistance to extreme weather events and natural disasters like hurricanes and earthquakes.

The competitive landscape, while featuring established players, is also ripe with opportunities for market penetration. Companies that can offer cost-effective solutions, demonstrate superior product performance, and provide comprehensive installation support are likely to capture significant market share. The projected Compound Annual Growth Rate (CAGR) for the ICF market is estimated to be around 7.5% to 8.5% during the forecast period, indicating a substantial market expansion. Market penetration rates, currently estimated to be around 15% to 20% in developed regions, are expected to rise as awareness and adoption increase in both established and emerging construction markets. The increasing demand for resilient and eco-friendly building materials presents a vast opportunity for ICF manufacturers and suppliers to capitalize on this growing market. The development of specialized ICF systems for specific applications, such as high-rise buildings or infrastructure projects, also represents a significant untapped market potential. The growing awareness of climate change and the need for a reduced carbon footprint in the construction industry further solidifies the long-term positive outlook for ICFs.

Dominant Markets & Segments in Insulated Concrete Form

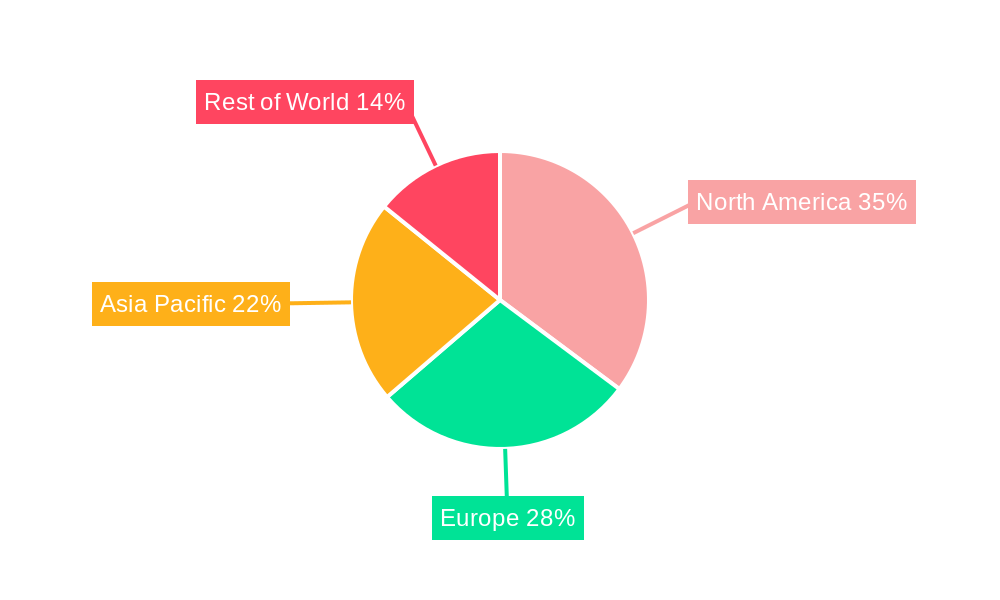

The Insulated Concrete Form (ICF) market is characterized by strong performance across its various segments, with certain regions and applications exhibiting particular dominance.

Dominant Markets:

- North America: This region consistently leads the global ICF market, driven by a combination of stringent energy efficiency regulations, a mature construction industry, and widespread consumer awareness regarding the benefits of sustainable building. The United States, in particular, represents a significant market share due to its extensive residential construction and a growing demand for resilient building solutions in disaster-prone areas.

- Europe: With a strong focus on environmental sustainability and energy conservation, European countries are increasingly adopting ICFs for both residential and non-residential projects. Policies promoting low-carbon construction and the renovation of existing building stock are major catalysts.

Dominant Segments:

- Application: Residential

- Key Growth Drivers: Growing demand for energy-efficient homes, increased disposable incomes allowing for investment in sustainable housing, and rising awareness of the comfort and durability benefits of ICFs. The long-term cost savings on energy bills are a major selling point for homeowners.

- Detailed Analysis: The residential segment benefits from its direct impact on household energy consumption and comfort. The ease of installation for typical residential structures, coupled with the inherent safety and thermal performance of ICFs, makes them an attractive choice for custom homes, multi-family dwellings, and single-family residences. The ability of ICF walls to significantly reduce noise pollution is also a growing factor in urban and suburban residential development.

- Types: Expanded Polystyrene (EPS) Foam

- Key Growth Drivers: Cost-effectiveness, widespread availability, excellent insulation properties, and proven performance. EPS remains the most popular choice due to its balance of performance and affordability.

- Detailed Analysis: EPS foam ICFs offer a robust combination of thermal resistance (R-values typically ranging from R-20 to R-25 for wall systems) and structural integrity when filled with concrete. Their lightweight nature simplifies transportation and handling on job sites. The manufacturing process for EPS is well-established, contributing to competitive pricing. Furthermore, advancements in EPS formulations are continually enhancing its fire resistance and moisture control properties, making it a more compelling option.

- Types: Polyurethane Foam

- Key Growth Drivers: Superior insulation R-values per inch, lightweight properties, and excellent moisture resistance. Polyurethane offers a premium insulation solution.

- Detailed Analysis: While often more expensive than EPS, polyurethane foam ICFs provide higher R-values within a thinner profile, making them ideal for projects with space constraints or where maximum energy efficiency is paramount. Their inherent resistance to moisture and mold growth further enhances their appeal, particularly in humid climates or basement applications. The innovation in spray foam technology is also influencing the development of polyurethane-based ICFs.

- Application: Residential

- Key Growth Drivers: Growing demand for energy-efficient homes, increased disposable incomes allowing for investment in sustainable housing, and rising awareness of the comfort and durability benefits of ICFs. The long-term cost savings on energy bills are a major selling point for homeowners.

- Detailed Analysis: The residential segment benefits from its direct impact on household energy consumption and comfort. The ease of installation for typical residential structures, coupled with the inherent safety and thermal performance of ICFs, makes them an attractive choice for custom homes, multi-family dwellings, and single-family residences. The ability of ICF walls to significantly reduce noise pollution is also a growing factor in urban and suburban residential development.

- Types: Expanded Polystyrene (EPS) Foam

- Key Growth Drivers: Cost-effectiveness, widespread availability, excellent insulation properties, and proven performance. EPS remains the most popular choice due to its balance of performance and affordability.

- Detailed Analysis: EPS foam ICFs offer a robust combination of thermal resistance (R-values typically ranging from R-20 to R-25 for wall systems) and structural integrity when filled with concrete. Their lightweight nature simplifies transportation and handling on job sites. The manufacturing process for EPS is well-established, contributing to competitive pricing. Furthermore, advancements in EPS formulations are continually enhancing its fire resistance and moisture control properties, making it a more compelling option.

- Types: Polyurethane Foam

- Key Growth Drivers: Superior insulation R-values per inch, lightweight properties, and excellent moisture resistance. Polyurethane offers a premium insulation solution.

- Detailed Analysis: While often more expensive than EPS, polyurethane foam ICFs provide higher R-values within a thinner profile, making them ideal for projects with space constraints or where maximum energy efficiency is paramount. Their inherent resistance to moisture and mold growth further enhances their appeal, particularly in humid climates or basement applications. The innovation in spray foam technology is also influencing the development of polyurethane-based ICFs.

The continued emphasis on energy-efficient building practices, coupled with growing awareness of the long-term economic and environmental benefits, will ensure sustained growth for ICFs across these dominant markets and segments. The Non-residential segment is also witnessing significant traction, driven by the need for durable, fire-resistant, and energy-efficient structures in commercial, institutional, and industrial sectors. The growth in this segment is directly linked to infrastructure development and the construction of schools, hospitals, and office buildings that prioritize lifecycle cost savings and occupant comfort.

Insulated Concrete Form Product Analysis

Insulated Concrete Form (ICF) products are characterized by continuous technological advancements aimed at enhancing their performance, ease of use, and sustainability. Innovations include improved foam formulations for higher R-values and better fire resistance, integrated vapor barriers, and refined interlocking mechanisms for quicker assembly. Competitive advantages stem from their inherent strength, superior thermal insulation leading to substantial energy savings, excellent soundproofing, and resilience against extreme weather. Applications range from single-family homes and multi-unit residential buildings to commercial structures, schools, and hospitals, demonstrating their versatility. The market fit is increasingly strong as building codes and consumer demand gravitate towards energy-efficient, durable, and environmentally conscious construction methods.

Key Drivers, Barriers & Challenges in Insulated Concrete Form

Key Drivers:

- Increasing Demand for Energy-Efficient Buildings: Growing awareness of climate change and rising energy costs are compelling builders and homeowners to opt for materials that reduce energy consumption, a core strength of ICFs. Government regulations and incentives promoting energy conservation further bolster this driver.

- Durability and Resilience: ICF structures offer superior strength and resistance to natural disasters like hurricanes, earthquakes, and fires, leading to lower maintenance costs and enhanced safety.

- Technological Advancements: Continuous improvements in ICF design, materials (e.g., advanced foam technologies), and installation techniques are making them more cost-effective and easier to implement.

- Health and Comfort Benefits: ICFs provide superior sound insulation, better indoor air quality by minimizing drafts and air infiltration, and more consistent indoor temperatures, contributing to occupant comfort.

Barriers & Challenges:

- Initial Cost Perception: While offering long-term savings, the upfront cost of ICF construction can be higher than traditional methods, posing a barrier for some developers and homeowners.

- Skilled Labor Shortage: The installation of ICFs requires specific training and expertise. A lack of readily available skilled labor can lead to project delays and increased labor costs.

- Lack of Widespread Awareness and Education: Despite growing adoption, a significant portion of the construction industry and the general public remains unfamiliar with the full benefits and proper installation of ICFs.

- Regulatory Hurdles and Local Building Codes: While many codes are becoming more accommodating, some regions may still have outdated building codes or require specific approvals for ICF construction, leading to administrative delays. Supply chain disruptions, while a general construction challenge, can also impact the timely availability of ICF components.

Growth Drivers in the Insulated Concrete Form Market

- Initial Cost Perception: While offering long-term savings, the upfront cost of ICF construction can be higher than traditional methods, posing a barrier for some developers and homeowners.

- Skilled Labor Shortage: The installation of ICFs requires specific training and expertise. A lack of readily available skilled labor can lead to project delays and increased labor costs.

- Lack of Widespread Awareness and Education: Despite growing adoption, a significant portion of the construction industry and the general public remains unfamiliar with the full benefits and proper installation of ICFs.

- Regulatory Hurdles and Local Building Codes: While many codes are becoming more accommodating, some regions may still have outdated building codes or require specific approvals for ICF construction, leading to administrative delays. Supply chain disruptions, while a general construction challenge, can also impact the timely availability of ICF components.

Growth Drivers in the Insulated Concrete Form Market

The Insulated Concrete Form (ICF) market is propelled by several key drivers. Technological advancements in foam composition and system design offer superior insulation and structural integrity, leading to enhanced energy efficiency. Economic factors, such as rising energy prices and growing demand for sustainable and durable buildings, make ICFs a compelling long-term investment. Governmental policies and regulations mandating energy-efficient construction and providing incentives for green building further accelerate adoption. For instance, building code updates favoring higher R-values directly translate to increased ICF utilization. The emphasis on creating resilient structures capable of withstanding extreme weather events is also a significant growth catalyst.

Challenges Impacting Insulated Concrete Form Growth

Despite the positive outlook, the Insulated Concrete Form (ICF) market faces several challenges. Regulatory complexities and the need for specialized approvals in some jurisdictions can slow down adoption. Supply chain issues, impacting the timely availability of raw materials and finished products, can lead to project delays and increased costs. Competitive pressures from traditional building materials and other innovative insulation systems require continuous product development and effective marketing to highlight ICF advantages. Furthermore, a shortage of skilled labor trained in ICF installation can be a significant constraint, leading to higher labor costs and potential installation errors. Overcoming the perception of higher initial costs compared to conventional methods remains an ongoing challenge, necessitating better education on long-term lifecycle savings.

Key Players Shaping the Insulated Concrete Form Market

- BASF

- Logix Insulated Concrete Forms

- Nudura Corporation

- Quad-Lock Building Systems

- Amvic

- Airlite Plastics

- ConForm Global

- Kore

- Polycrete International

- LiteForm Technologies

- Sunbloc

- SuperForm Products

- IntegraSpec

- BuildBlock Building Systems

- PolySteel Warmerwall

Significant Insulated Concrete Form Industry Milestones

- 2019: Increased adoption of fire-resistant foam technologies in EPS ICFs.

- 2020: Growing focus on integrating smart home technologies with ICF construction.

- 2021: Major manufacturers invest in expanding production capacity to meet rising demand.

- 2022: Introduction of new ICF systems with higher R-values and improved structural load capacities.

- 2023: Greater emphasis on recycled content in ICF foam production.

- 2024: Significant research and development into bio-based foam alternatives for ICFs.

Future Outlook for Insulated Concrete Form Market

The future outlook for the Insulated Concrete Form (ICF) market is exceptionally bright, driven by an escalating global commitment to sustainable and resilient construction. Growth catalysts include increasingly stringent energy efficiency regulations, rising consumer demand for durable and comfortable living spaces, and ongoing technological innovations that enhance product performance and installation efficiency. Strategic opportunities lie in expanding into emerging markets, developing specialized ICF solutions for diverse applications (e.g., high-rise construction, infrastructure projects), and further educating the market on the long-term economic and environmental advantages. The market potential is substantial as ICFs are well-positioned to become a cornerstone of future building practices.

Insulated Concrete Form Segmentation

-

1. Application

- 1.1. Residential

- 1.2. Non-residential

-

2. Types

- 2.1. Expanded polystyrene Foam

- 2.2. Polyurethane Foam

- 2.3. Others

Insulated Concrete Form Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Insulated Concrete Form REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.2% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Insulated Concrete Form Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Residential

- 5.1.2. Non-residential

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Expanded polystyrene Foam

- 5.2.2. Polyurethane Foam

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Insulated Concrete Form Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Residential

- 6.1.2. Non-residential

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Expanded polystyrene Foam

- 6.2.2. Polyurethane Foam

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Insulated Concrete Form Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Residential

- 7.1.2. Non-residential

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Expanded polystyrene Foam

- 7.2.2. Polyurethane Foam

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Insulated Concrete Form Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Residential

- 8.1.2. Non-residential

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Expanded polystyrene Foam

- 8.2.2. Polyurethane Foam

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Insulated Concrete Form Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Residential

- 9.1.2. Non-residential

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Expanded polystyrene Foam

- 9.2.2. Polyurethane Foam

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Insulated Concrete Form Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Residential

- 10.1.2. Non-residential

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Expanded polystyrene Foam

- 10.2.2. Polyurethane Foam

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 BASF

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Logix Insulated Concrete Forms

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nudura Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Quad-Lock Building Systems

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Amvic

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Airlite Plastics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ConForm Global

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kore

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Polycrete International

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 LiteForm Technologies

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sunbloc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 SuperForm Products

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 IntegraSpec

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 BuildBlock Building Systems

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 PolySteel Warmerwall

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 BASF

List of Figures

- Figure 1: Global Insulated Concrete Form Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Insulated Concrete Form Revenue (million), by Application 2024 & 2032

- Figure 3: North America Insulated Concrete Form Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Insulated Concrete Form Revenue (million), by Types 2024 & 2032

- Figure 5: North America Insulated Concrete Form Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Insulated Concrete Form Revenue (million), by Country 2024 & 2032

- Figure 7: North America Insulated Concrete Form Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Insulated Concrete Form Revenue (million), by Application 2024 & 2032

- Figure 9: South America Insulated Concrete Form Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Insulated Concrete Form Revenue (million), by Types 2024 & 2032

- Figure 11: South America Insulated Concrete Form Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Insulated Concrete Form Revenue (million), by Country 2024 & 2032

- Figure 13: South America Insulated Concrete Form Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Insulated Concrete Form Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Insulated Concrete Form Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Insulated Concrete Form Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Insulated Concrete Form Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Insulated Concrete Form Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Insulated Concrete Form Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Insulated Concrete Form Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Insulated Concrete Form Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Insulated Concrete Form Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Insulated Concrete Form Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Insulated Concrete Form Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Insulated Concrete Form Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Insulated Concrete Form Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Insulated Concrete Form Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Insulated Concrete Form Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Insulated Concrete Form Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Insulated Concrete Form Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Insulated Concrete Form Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Insulated Concrete Form Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Insulated Concrete Form Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Insulated Concrete Form Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Insulated Concrete Form Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Insulated Concrete Form Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Insulated Concrete Form Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Insulated Concrete Form Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Insulated Concrete Form Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Insulated Concrete Form Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Insulated Concrete Form Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Insulated Concrete Form Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Insulated Concrete Form Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Insulated Concrete Form Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Insulated Concrete Form Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Insulated Concrete Form Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Insulated Concrete Form Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Insulated Concrete Form Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Insulated Concrete Form Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Insulated Concrete Form Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Insulated Concrete Form Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Insulated Concrete Form Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Insulated Concrete Form Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Insulated Concrete Form Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Insulated Concrete Form Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Insulated Concrete Form Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Insulated Concrete Form Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Insulated Concrete Form Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Insulated Concrete Form Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Insulated Concrete Form Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Insulated Concrete Form Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Insulated Concrete Form Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Insulated Concrete Form Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Insulated Concrete Form Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Insulated Concrete Form Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Insulated Concrete Form Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Insulated Concrete Form Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Insulated Concrete Form Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Insulated Concrete Form Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Insulated Concrete Form Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Insulated Concrete Form Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Insulated Concrete Form Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Insulated Concrete Form Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Insulated Concrete Form Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Insulated Concrete Form Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Insulated Concrete Form Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Insulated Concrete Form Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Insulated Concrete Form Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Insulated Concrete Form?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the Insulated Concrete Form?

Key companies in the market include BASF, Logix Insulated Concrete Forms, Nudura Corporation, Quad-Lock Building Systems, Amvic, Airlite Plastics, ConForm Global, Kore, Polycrete International, LiteForm Technologies, Sunbloc, SuperForm Products, IntegraSpec, BuildBlock Building Systems, PolySteel Warmerwall.

3. What are the main segments of the Insulated Concrete Form?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 996.6 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Insulated Concrete Form," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Insulated Concrete Form report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Insulated Concrete Form?

To stay informed about further developments, trends, and reports in the Insulated Concrete Form, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence