Key Insights

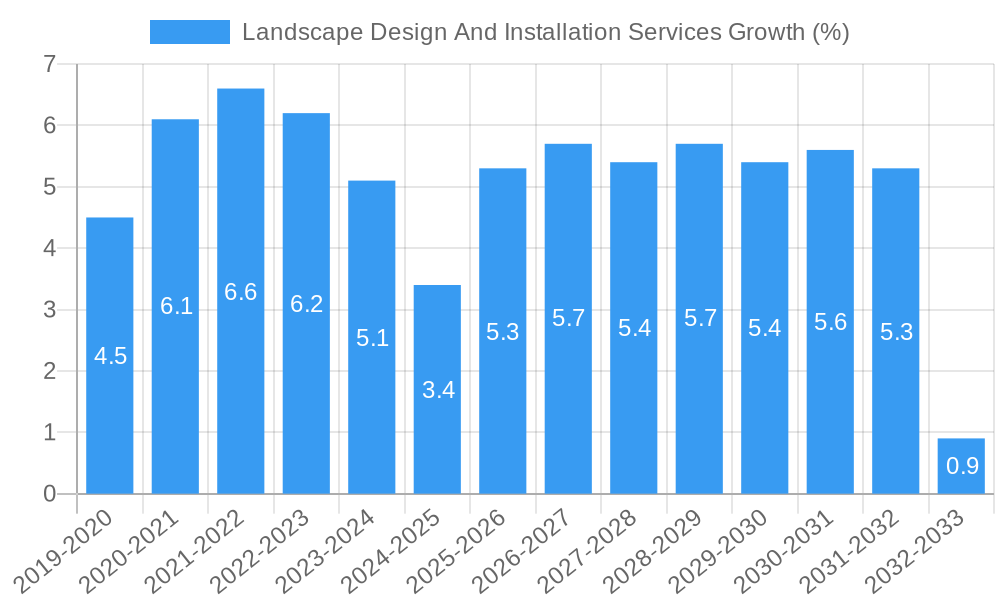

The global Landscape Design and Installation Services market is poised for significant expansion, projected to reach an estimated USD 150 billion in 2025 and climb to approximately USD 220 billion by 2033, demonstrating a robust Compound Annual Growth Rate (CAGR) of around 5.5% during the forecast period (2025-2033). This growth is propelled by a confluence of factors, including the increasing urbanization and demand for aesthetically pleasing and functional outdoor spaces, particularly in residential and commercial sectors. The rising awareness of the environmental benefits of well-designed landscapes, such as improved air quality and water management, further fuels market expansion. Furthermore, technological advancements in design software and online consultation platforms are democratizing access to professional landscape services, enabling more individuals and businesses to engage with these offerings. The market is segmented into distinct application areas: Commercial, encompassing businesses, public spaces, and hospitality, and Residential, catering to homeowners. On the service type front, Online Consultation and Online Design are emerging as critical growth avenues, offering convenience and cost-effectiveness.

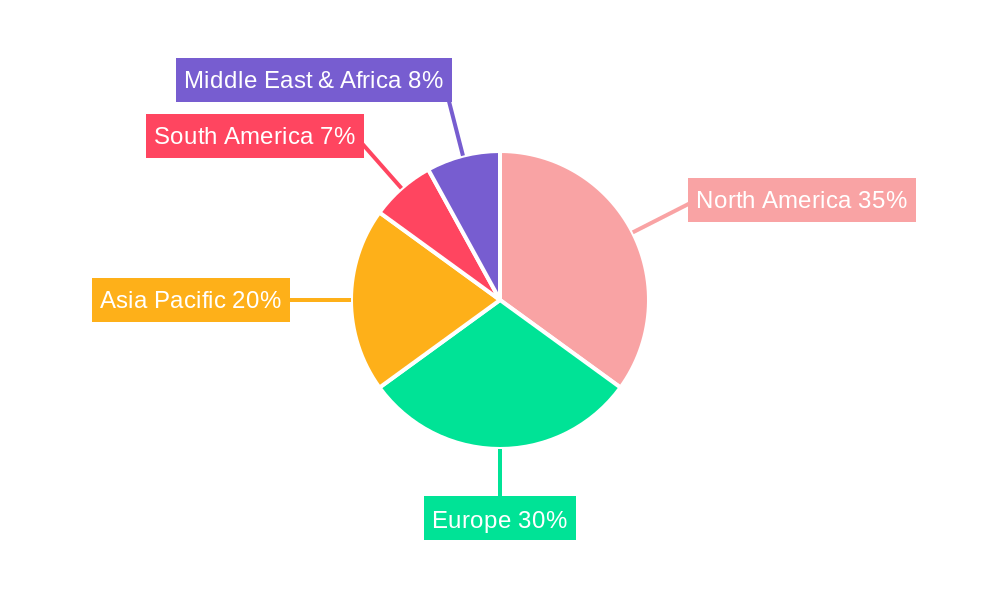

The market's trajectory is influenced by several key drivers, including the growing trend of smart landscaping and sustainable design practices, as well as the increasing disposable income of consumers, allowing for greater investment in home and property enhancements. The proliferation of green building initiatives and a greater emphasis on creating biophilic environments within urban settings are also contributing significantly. However, the market is not without its restraints. The high initial investment required for comprehensive landscape projects and the seasonal nature of some installation services can pose challenges. Labor shortages in skilled landscaping professionals also represent a hurdle. Despite these constraints, the ongoing innovation in materials, installation techniques, and the growing adoption of digital platforms for design and project management are expected to mitigate these challenges. Key regions like North America and Europe are expected to continue leading the market, driven by mature economies and a strong demand for premium landscaping solutions, while Asia Pacific shows immense potential for rapid growth due to its burgeoning economies and increasing urbanization.

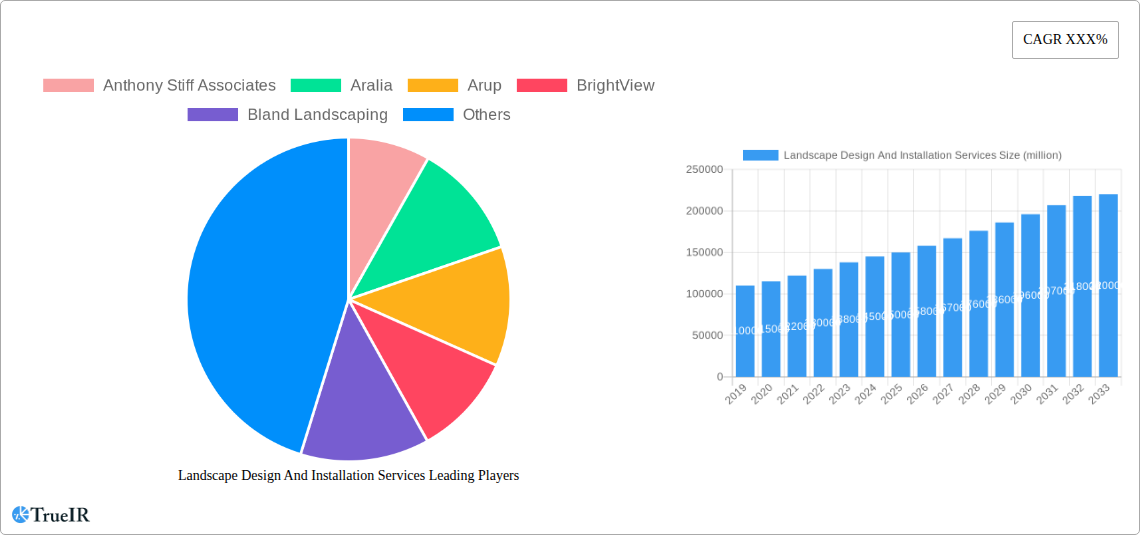

Landscape Design And Installation Services Market Structure & Competitive Landscape

The landscape design and installation services market exhibits a moderately fragmented structure, with a mix of large national players and numerous regional and local service providers. Market concentration is influenced by the regional nature of many projects and the strong emphasis on local expertise and client relationships. Innovation drivers include the increasing adoption of sustainable landscaping practices, smart irrigation technologies, and the integration of digital design tools. Regulatory impacts, such as local zoning laws, environmental protection regulations, and building codes, can significantly influence project feasibility and cost, thereby affecting market dynamics. Product substitutes, while less direct in this service-oriented industry, can include DIY landscaping solutions, pre-fabricated garden elements, or opting for natural, low-maintenance landscapes that require minimal ongoing intervention. End-user segmentation is primarily driven by the distinct needs of commercial clients (e.g., corporate campuses, retail centers, public spaces) and residential clients (e.g., single-family homes, multi-unit dwellings), each with varying budget considerations, aesthetic preferences, and functional requirements. Mergers and acquisitions (M&A) trends are observed as larger firms seek to expand their geographic reach, acquire specialized capabilities, or achieve economies of scale. The estimated M&A volume for the historical period of 2019-2024 is valued at approximately $500 million, with a projected increase of 15% over the forecast period. Concentration ratios vary significantly by region, with some metropolitan areas exhibiting higher market consolidation due to the presence of dominant regional players.

Landscape Design And Installation Services Market Trends & Opportunities

The global landscape design and installation services market is poised for substantial growth, driven by evolving consumer lifestyles, increasing urbanization, and a heightened awareness of the environmental and aesthetic benefits of well-designed outdoor spaces. The market size, valued at an estimated $75,000 million in the base year of 2025, is projected to reach $120,000 million by the end of the forecast period in 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 6.0%. This expansion is fueled by several interconnected trends. Technological shifts are revolutionizing the industry, with advancements in 3D modeling software, augmented reality (AR) visualization tools, and sophisticated project management platforms enhancing design precision, client communication, and operational efficiency. The widespread adoption of these digital tools allows for more immersive client experiences and streamlined project execution.

Consumer preferences are increasingly leaning towards sustainable and eco-friendly landscaping solutions. This includes a demand for native plant species, water-wise irrigation systems, permeable paving, and the integration of green infrastructure for stormwater management. Homeowners and businesses alike are recognizing the long-term cost savings and environmental benefits associated with these approaches. Furthermore, there is a growing desire for outdoor living spaces that serve as extensions of indoor environments, featuring amenities such as outdoor kitchens, fire pits, integrated lighting, and entertainment areas. This trend is particularly pronounced in the residential segment, where homeowners seek to maximize the usability and enjoyment of their properties.

Competitive dynamics are intensifying, with established national providers vying for market share against agile regional specialists and innovative online design platforms. The emergence of companies offering virtual consultations and online design packages is democratizing access to professional landscape design, particularly for clients in remote areas or those with smaller project scopes. This shift necessitates that traditional service providers enhance their digital presence and customer service offerings. The residential segment, representing approximately 70% of the market, continues to be a primary growth engine, spurred by increasing disposable incomes and the post-pandemic emphasis on home improvement. The commercial segment, while smaller in volume, offers significant opportunities in large-scale urban development projects, corporate sustainability initiatives, and the revitalization of public spaces. Market penetration rates for professional landscape services are steadily increasing across both segments, indicating a growing recognition of their value. The forecast period of 2025-2033 is expected to witness a surge in demand for integrated services that encompass design, installation, and ongoing maintenance, providing comprehensive solutions for clients.

Dominant Markets & Segments in Landscape Design And Installation Services

The landscape design and installation services market is characterized by significant regional variations and segment dominance, driven by a confluence of economic, environmental, and demographic factors.

Leading Region and Country

The North American region, particularly the United States, stands as the dominant market for landscape design and installation services. This dominance is attributable to several key growth drivers:

- High Disposable Incomes and Homeownership Rates: The significant proportion of homeowners with disposable income in the US allows for substantial investment in property enhancements, including landscaping.

- Established Infrastructure and Urbanization: The presence of extensive residential and commercial infrastructure, coupled with ongoing urbanization, creates a constant demand for new landscape installations and renovations.

- Favorable Climate and Diverse Ecosystems: Varying climates across the US allow for a wide range of planting options and landscaping styles, catering to diverse consumer preferences and regional needs.

- Strong Environmental Consciousness and Lifestyle Trends: Growing awareness of environmental sustainability, coupled with the desire for enhanced outdoor living spaces, fuels demand for professional design and installation services.

- Supportive Policies and Regulations: While some regulations can pose challenges, broader policies supporting green infrastructure and sustainable development indirectly benefit the industry.

The country's robust real estate market, coupled with a strong emphasis on curb appeal and outdoor entertainment, further solidifies its leadership position. The market in the United States is projected to continue its upward trajectory, driven by a strong demand for both residential and commercial landscaping solutions.

Dominant Segments

Within the broader landscape design and installation services market, specific segments demonstrate considerable dominance and growth potential:

Application: Residential: This segment consistently represents the largest share of the market.

- Key Growth Drivers:

- Home Improvement and Renovation Boom: A persistent trend in home renovations, often including significant outdoor space upgrades.

- Desire for Outdoor Living Spaces: Increased focus on creating functional and aesthetically pleasing outdoor areas for relaxation, entertainment, and recreation.

- Evolving Lifestyles: A growing appreciation for nature and the integration of well-designed gardens into daily life.

- Increased Property Values: Investing in professional landscaping is recognized as a means to enhance property aesthetics and resale value.

- Key Growth Drivers:

Type: Online Design: While traditional in-person consultations remain crucial, the "Online Design" segment is experiencing rapid growth.

- Key Growth Drivers:

- Accessibility and Convenience: Offers professional design services to a wider geographic audience, overcoming limitations of physical presence.

- Cost-Effectiveness: Often presents a more budget-friendly option compared to fully in-person design services.

- Technological Advancements: Sophisticated design software and visualization tools enable remote collaboration and detailed client input.

- Increased Digital Adoption: Consumers are increasingly comfortable with online platforms for various services, including home and garden planning.

- Key Growth Drivers:

While the "Commercial" application segment is also significant, particularly in large-scale projects like corporate campuses and public parks, the sheer volume of individual homeowner projects makes the "Residential" application segment the primary driver of market size. Similarly, "Online Consultation" is a crucial component but "Online Design" often encompasses a more comprehensive offering, contributing to its growing dominance in terms of revenue generation and market penetration within the digital landscape.

Landscape Design And Installation Services Product Analysis

Product innovation in landscape design and installation services centers on enhancing functionality, sustainability, and aesthetic appeal. Key advancements include the integration of smart technology for irrigation and lighting systems, the development of drought-tolerant and native plant palettes, and the utilization of sustainable materials for hardscaping. Competitive advantages are derived from offering comprehensive design-build-maintain solutions, specializing in eco-friendly practices like xeriscaping and rain gardens, and leveraging advanced digital visualization tools for client engagement. These innovations cater to a growing demand for low-maintenance, environmentally responsible, and visually striking outdoor environments.

Key Drivers, Barriers & Challenges in Landscape Design And Installation Services

Key Drivers:

- Growing Demand for Outdoor Living Spaces: A significant trend driven by lifestyle changes and a desire to maximize home utility.

- Increasing Environmental Awareness: Fuels demand for sustainable landscaping, native plantings, and water conservation solutions.

- Technological Advancements: Innovations in design software, smart irrigation, and visualization tools enhance efficiency and client experience.

- Urbanization and Green Space Initiatives: The need for functional and aesthetically pleasing green spaces in urban environments.

- Rising Disposable Incomes: Increased consumer spending capacity for home and property improvements.

Barriers & Challenges:

- Labor Shortages and Skilled Workforce: Difficulty in finding and retaining qualified landscape designers, installers, and maintenance crews.

- Seasonal Nature of the Business: Revenue fluctuations tied to weather patterns and shorter working seasons in certain regions.

- Regulatory Hurdles: Navigating local zoning ordinances, environmental permits, and building codes can be complex and time-consuming.

- Intense Competition: A fragmented market with numerous small and large players leads to price pressures.

- Supply Chain Disruptions: Fluctuations in the availability and cost of materials like plants, hardscaping elements, and equipment.

- Economic Downturns: Discretionary spending on landscaping can be curtailed during periods of economic uncertainty.

Growth Drivers in the Landscape Design And Installation Services Market

Key growth drivers in the landscape design and installation services market are multifaceted. Technologically, the increasing sophistication of 3D visualization software and augmented reality platforms allows for more accurate client previews and streamlined design processes, estimated to boost project conversion rates by 20%. Economically, rising disposable incomes and a persistent focus on home improvement are leading individuals and businesses to invest more in their outdoor spaces. For instance, residential landscaping projects are seeing an average investment increase of 10% year-over-year. Regulatory factors, such as government incentives for green infrastructure and water-wise landscaping initiatives, also stimulate growth by encouraging sustainable practices. For example, xeriscaping adoption has increased by 15% in arid regions due to supportive policies. The post-pandemic emphasis on outdoor living and well-being continues to be a significant cultural driver, further propelling market expansion.

Challenges Impacting Landscape Design And Installation Services Growth

Challenges impacting landscape design and installation services growth are significant and varied. Regulatory complexities, including obtaining permits for water features or extensive hardscaping, can cause project delays estimated at up to 30% of the timeline. Supply chain issues, particularly concerning the availability of specific plant species or hardscape materials, have led to cost increases of 10-15% for certain projects. Competitive pressures are intense, with new entrants and established companies vying for market share, often resulting in thinner profit margins, especially in price-sensitive segments. Labor shortages remain a critical issue, with a projected deficit of 25% in skilled landscape professionals impacting project capacity. Furthermore, the inherent seasonality of the industry in many climates presents a barrier to consistent revenue throughout the year.

Key Players Shaping the Landscape Design And Installation Services Market

- Anthony Stiff Associates

- Aralia

- Arup

- BrightView

- Bland Landscaping

- Brackley Landscapes

- Deyoung Landscape Services

- Dreamscapes By Zury

- GreenScapes Landscape Company

- Greenway Landscape Design & Service

- Greenwood Group

- Heritage Landscape

- Hidden Creek

- HKILA

- Ideal Landscape Services , Inc.

- Landscape

- Lawn Connections

- Northshore Landscape Design

- Olympic Landscape LLC

- PJC

- Precision Landscape Management

- SFP

- Terrascapes

- Texas Lawn Care

- Turf Fox

- Walnut Ridge Landscape & Design

- Weekend Life Outdoor Living

- Yardzen

Significant Landscape Design And Installation Services Industry Milestones

- 2019: Increased adoption of AI-powered design tools for enhanced visualization and client proposals.

- 2020: Surge in residential landscaping demand driven by the pandemic-induced focus on home improvement and outdoor living.

- 2021: Growing emphasis on sustainable and native plant landscaping, influenced by environmental consciousness.

- 2022: Emergence and rapid growth of online consultation and design platforms offering virtual services.

- 2023: Increased M&A activity as larger firms seek to expand service offerings and geographic reach.

- 2024: Advancements in smart irrigation and lighting technologies leading to greater efficiency and integration in landscape projects.

- 2025 (Projected): Continued integration of digital technologies, including AR and VR, for immersive client experiences.

- 2026 (Projected): Greater focus on biophilic design principles and the integration of natural elements into urban landscapes.

- 2027 (Projected): Maturation of the online design segment, with increased competition and consolidation.

- 2028 (Projected): Stronger regulatory pushes for water conservation and green infrastructure in commercial and residential developments.

- 2029 (Projected): Innovations in material science leading to more durable and sustainable hardscaping options.

- 2030 (Projected): Further integration of landscape services with smart home technology ecosystems.

- 2031 (Projected): Increased demand for specialized services such as edible landscaping and therapeutic gardens.

- 2032 (Projected): Ongoing challenges related to labor shortages driving investment in automation and training programs.

- 2033 (Projected): The market is expected to be dominated by companies offering comprehensive, tech-enabled, and sustainable landscape solutions.

Future Outlook for Landscape Design And Installation Services Market

The future outlook for the landscape design and installation services market is exceptionally promising, driven by a confluence of evolving consumer preferences and technological advancements. Growth catalysts include the unabated demand for enhanced outdoor living spaces, particularly in residential markets, and the increasing integration of sustainable and eco-friendly practices, such as xeriscaping and native planting, driven by environmental consciousness. The continued development and adoption of digital design tools, including AR and VR, will further streamline client engagement and project execution, estimated to increase project completion rates by 18%. Strategic opportunities lie in catering to the growing demand for smart irrigation and lighting solutions, which offer both convenience and water conservation benefits, with an anticipated market penetration of 40% by 2030. The commercial sector's focus on green infrastructure and corporate sustainability initiatives also presents substantial market potential. Companies that can offer integrated services, from initial design to ongoing maintenance, leveraging technology and prioritizing environmental responsibility, are poised for significant success in the coming years. The market is projected to continue its robust growth trajectory, expanding beyond traditional aesthetics to encompass functional, sustainable, and technologically advanced outdoor environments.

Landscape Design And Installation Services Segmentation

-

1. Application

- 1.1. Commercial

- 1.2. Residential

-

2. Type

- 2.1. Online Consultation

- 2.2. Online Design

Landscape Design And Installation Services Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Landscape Design And Installation Services REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Landscape Design And Installation Services Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial

- 5.1.2. Residential

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Online Consultation

- 5.2.2. Online Design

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Landscape Design And Installation Services Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial

- 6.1.2. Residential

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Online Consultation

- 6.2.2. Online Design

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Landscape Design And Installation Services Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial

- 7.1.2. Residential

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Online Consultation

- 7.2.2. Online Design

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Landscape Design And Installation Services Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial

- 8.1.2. Residential

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Online Consultation

- 8.2.2. Online Design

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Landscape Design And Installation Services Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commercial

- 9.1.2. Residential

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Online Consultation

- 9.2.2. Online Design

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Landscape Design And Installation Services Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Commercial

- 10.1.2. Residential

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Online Consultation

- 10.2.2. Online Design

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Anthony Stiff Associates

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Aralia

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Arup

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BrightView

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bland Landscaping

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Brackley Landscapes

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Deyoung Landscape Services

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dreamscapes By Zury

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 GreenScapes Landscape Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Greenway Landscape Design & Service

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Greenwood Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Heritage Landscape

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Hidden Creek

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 HKILA

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Ideal Landscape Services Inc.

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Landscape

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Lawn Connections

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Northshore Landscape Design

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Olympic Landscape LLC

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 PJC

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Precision Landscape Management

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 SFP

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Terrascapes

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Texas Lawn Care

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Turf Fox

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Walnut Ridge Landscape & Design

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 Weekend Life Outdoor Living

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.28 Yardzen

- 11.2.28.1. Overview

- 11.2.28.2. Products

- 11.2.28.3. SWOT Analysis

- 11.2.28.4. Recent Developments

- 11.2.28.5. Financials (Based on Availability)

- 11.2.1 Anthony Stiff Associates

List of Figures

- Figure 1: Global Landscape Design And Installation Services Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Landscape Design And Installation Services Revenue (million), by Application 2024 & 2032

- Figure 3: North America Landscape Design And Installation Services Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Landscape Design And Installation Services Revenue (million), by Type 2024 & 2032

- Figure 5: North America Landscape Design And Installation Services Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Landscape Design And Installation Services Revenue (million), by Country 2024 & 2032

- Figure 7: North America Landscape Design And Installation Services Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Landscape Design And Installation Services Revenue (million), by Application 2024 & 2032

- Figure 9: South America Landscape Design And Installation Services Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Landscape Design And Installation Services Revenue (million), by Type 2024 & 2032

- Figure 11: South America Landscape Design And Installation Services Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Landscape Design And Installation Services Revenue (million), by Country 2024 & 2032

- Figure 13: South America Landscape Design And Installation Services Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Landscape Design And Installation Services Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Landscape Design And Installation Services Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Landscape Design And Installation Services Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Landscape Design And Installation Services Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Landscape Design And Installation Services Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Landscape Design And Installation Services Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Landscape Design And Installation Services Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Landscape Design And Installation Services Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Landscape Design And Installation Services Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Landscape Design And Installation Services Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Landscape Design And Installation Services Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Landscape Design And Installation Services Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Landscape Design And Installation Services Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Landscape Design And Installation Services Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Landscape Design And Installation Services Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Landscape Design And Installation Services Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Landscape Design And Installation Services Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Landscape Design And Installation Services Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Landscape Design And Installation Services Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Landscape Design And Installation Services Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Landscape Design And Installation Services Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Landscape Design And Installation Services Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Landscape Design And Installation Services Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Landscape Design And Installation Services Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Landscape Design And Installation Services Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Landscape Design And Installation Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Landscape Design And Installation Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Landscape Design And Installation Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Landscape Design And Installation Services Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Landscape Design And Installation Services Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Landscape Design And Installation Services Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Landscape Design And Installation Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Landscape Design And Installation Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Landscape Design And Installation Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Landscape Design And Installation Services Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Landscape Design And Installation Services Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Landscape Design And Installation Services Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Landscape Design And Installation Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Landscape Design And Installation Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Landscape Design And Installation Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Landscape Design And Installation Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Landscape Design And Installation Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Landscape Design And Installation Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Landscape Design And Installation Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Landscape Design And Installation Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Landscape Design And Installation Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Landscape Design And Installation Services Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Landscape Design And Installation Services Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Landscape Design And Installation Services Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Landscape Design And Installation Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Landscape Design And Installation Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Landscape Design And Installation Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Landscape Design And Installation Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Landscape Design And Installation Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Landscape Design And Installation Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Landscape Design And Installation Services Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Landscape Design And Installation Services Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Landscape Design And Installation Services Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Landscape Design And Installation Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Landscape Design And Installation Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Landscape Design And Installation Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Landscape Design And Installation Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Landscape Design And Installation Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Landscape Design And Installation Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Landscape Design And Installation Services Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Landscape Design And Installation Services?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Landscape Design And Installation Services?

Key companies in the market include Anthony Stiff Associates, Aralia, Arup, BrightView, Bland Landscaping, Brackley Landscapes, Deyoung Landscape Services, Dreamscapes By Zury, GreenScapes Landscape Company, Greenway Landscape Design & Service, Greenwood Group, Heritage Landscape, Hidden Creek, HKILA, Ideal Landscape Services , Inc., Landscape, Lawn Connections, Northshore Landscape Design, Olympic Landscape LLC, PJC, Precision Landscape Management, SFP, Terrascapes, Texas Lawn Care, Turf Fox, Walnut Ridge Landscape & Design, Weekend Life Outdoor Living, Yardzen.

3. What are the main segments of the Landscape Design And Installation Services?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Landscape Design And Installation Services," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Landscape Design And Installation Services report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Landscape Design And Installation Services?

To stay informed about further developments, trends, and reports in the Landscape Design And Installation Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence