Key Insights

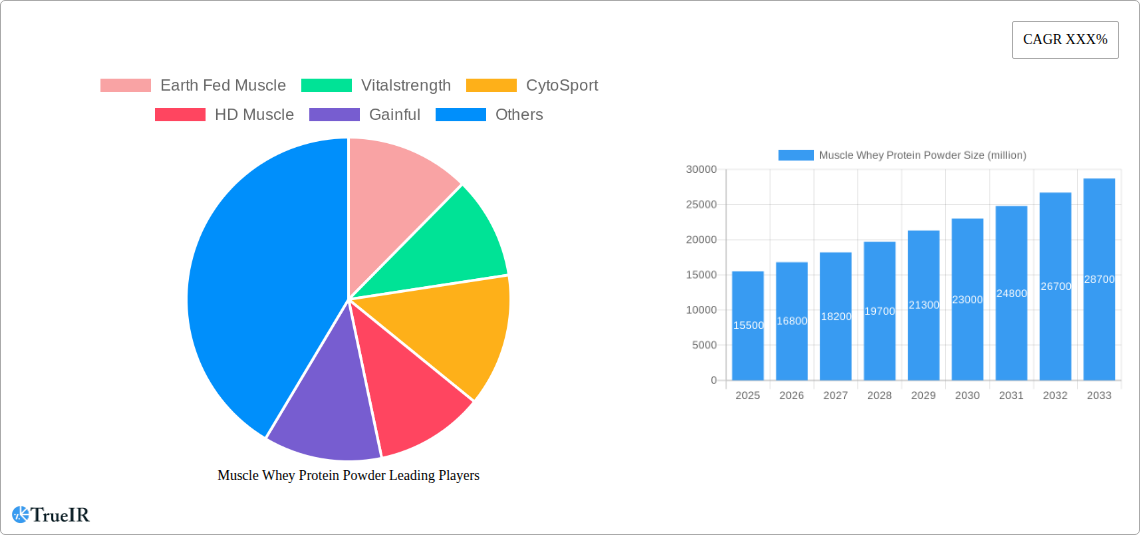

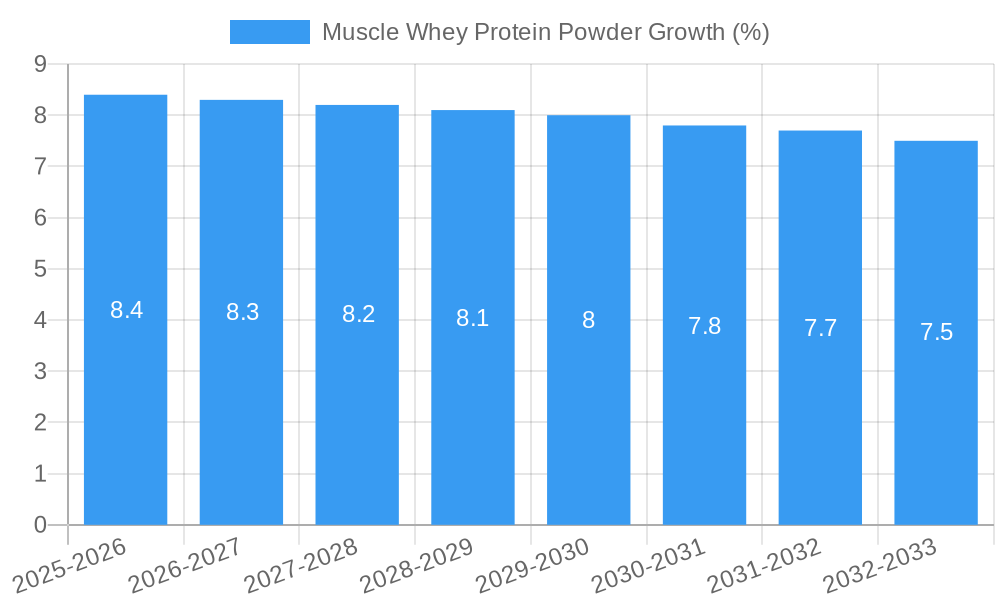

The global Muscle Whey Protein Powder market is projected to witness substantial growth, estimated to reach approximately USD 15,500 million by 2025 and expand significantly by 2033. This robust expansion is fueled by a confluence of factors, including an increasing global emphasis on health and fitness, a rising awareness of protein's role in muscle building and recovery, and the growing popularity of sports nutrition. The market is characterized by a dynamic landscape where manufacturers are continuously innovating to cater to diverse consumer preferences, leading to the introduction of various product types like concentrated, isolated, and hydrolyzed whey protein. The convenience and efficacy of whey protein powders in supporting active lifestyles and post-workout recovery are key drivers behind their widespread adoption across different demographics, from professional athletes to fitness enthusiasts.

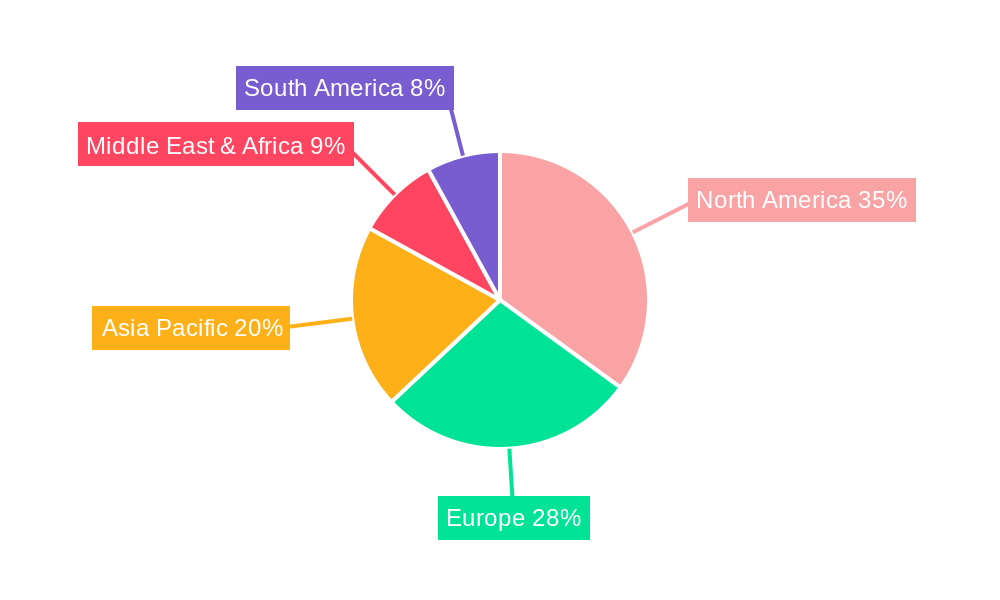

The market's trajectory is further bolstered by emerging trends such as the demand for plant-based alternatives and the increasing integration of whey protein into everyday food and beverage products, moving beyond traditional supplement use. Online sales channels are playing an increasingly vital role, offering accessibility and a wide product selection, while offline sales through retail stores and specialized nutrition outlets continue to hold significant sway. Despite its promising outlook, the market faces certain restraints, including fluctuating raw material prices and growing competition from alternative protein sources. Geographically, North America and Europe are anticipated to maintain a dominant market share due to established fitness cultures and higher disposable incomes, with the Asia Pacific region presenting considerable growth opportunities driven by a burgeoning middle class and increasing health consciousness.

The global Muscle Whey Protein Powder market, valued at over $7,500 million in 2025, exhibits a moderately concentrated structure with a few dominant players alongside numerous smaller, specialized brands. Innovation drivers such as advanced processing technologies to enhance bioavailability and taste, alongside growing consumer demand for plant-based and allergen-free alternatives, are shaping product development. Regulatory impacts, including stringent food safety standards and labeling requirements, influence market entry and operational costs. Product substitutes, such as other protein sources like casein, soy, and plant-based proteins, present a constant competitive pressure, forcing manufacturers to differentiate through quality, efficacy, and branding. End-user segmentation reveals a significant reliance on the sports nutrition and fitness enthusiast demographic, but a burgeoning segment of health-conscious individuals seeking convenient protein supplementation is also emerging. Mergers and acquisitions (M&A) trends are notable, with larger entities acquiring smaller, innovative companies to expand their product portfolios and market reach. For instance, over the historical period (2019-2024), approximately 30 M&A deals valued at over $50 million each have been recorded. The concentration ratio for the top five players is estimated to be around 55% in 2025.

Muscle Whey Protein Powder Market Trends & Opportunities

The Muscle Whey Protein Powder market is poised for substantial expansion, projected to grow from over $7,500 million in 2025 to an estimated over $12,000 million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately 5.9% during the forecast period (2025–2033). This growth is fueled by an escalating global consciousness regarding health, fitness, and the critical role of protein in muscle repair, growth, and overall well-being. Technological shifts are playing a pivotal role, with advancements in ultra-filtration and ion-exchange processes leading to higher purity whey protein isolates and concentrates, offering improved amino acid profiles and faster absorption rates. The demand for specialized formulations, such as slow-digesting blends and those catering to specific dietary needs like lactose intolerance or veganism, is also on the rise. Consumer preferences are increasingly leaning towards natural ingredients, transparent sourcing, and sustainable production methods. This has spurred a wave of product innovations, including organic certifications and the exclusion of artificial sweeteners and colors. The competitive dynamics are intensifying, with established giants like Optimum Nutrition and Vitalstrength facing increasing competition from agile, direct-to-consumer brands like Gainful and HD Muscle, who leverage personalization and subscription models to capture market share. Online sales channels are experiencing exponential growth, driven by the convenience and wider product selection available, now accounting for over 45% of total market revenue in 2025, up from approximately 30% in 2019. Offline sales, primarily through specialty nutrition stores and pharmacies, remain significant, particularly in emerging markets, but are seeing slower growth compared to their online counterparts. The market penetration rate for whey protein supplements is estimated to be around 25% in developed economies, with considerable room for growth in developing regions. Opportunities abound for companies that can effectively address the demand for clean-label products, offer personalized solutions, and build strong community engagement around fitness and nutrition. The integration of smart packaging and traceability technologies further enhances consumer trust and brand loyalty.

Dominant Markets & Segments in Muscle Whey Protein Powder

The global Muscle Whey Protein Powder market showcases distinct dominance across various applications, types, and geographical regions, driven by a confluence of economic, social, and infrastructural factors.

Application: Online Sales are emerging as the dominant and fastest-growing application segment. In 2025, online sales are projected to account for over $3,375 million in revenue, representing approximately 45% of the total market. This dominance is fueled by:

- Unparalleled Convenience: Consumers can access a vast array of products, compare prices, and have them delivered directly to their doorstep, fitting seamlessly into busy lifestyles.

- Extensive Product Variety: Online platforms offer a wider selection of brands, flavors, and specialized formulations than typically found in brick-and-mortar stores.

- Digital Marketing Reach: Brands effectively leverage social media, influencer marketing, and targeted advertising to reach a global audience, driving online purchases.

- Direct-to-Consumer (DTC) Models: Companies like Gainful and HD Muscle have successfully implemented DTC strategies online, fostering direct relationships with consumers and offering personalized products.

Type: Concentrated Whey Protein continues to hold a significant market share, projected to generate over $3,000 million in 2025. Its dominance is attributed to:

- Cost-Effectiveness: Whey protein concentrate (WPC) is generally more affordable than isolate or hydrolysate, making it an accessible entry point for many consumers.

- Versatility: WPC contains a good balance of protein, carbohydrates, and fats, making it suitable for general muscle support and recovery.

- Widely Available: It remains the most common form of whey protein found in the market, readily available from major manufacturers.

However, Isolated Whey Protein is exhibiting rapid growth, projected to reach over $2,500 million in 2025. Key growth drivers include:

- Higher Protein Purity: With less lactose and fat, isolated whey protein (WPI) is ideal for individuals with lactose intolerance or those seeking a purer protein source.

- Faster Absorption: The refined processing leads to quicker absorption, making it a popular choice for post-workout recovery.

- Growing Health Consciousness: Consumers are increasingly seeking products with specific nutritional profiles, driving demand for WPI.

Hydrolyzed Whey Protein, while a smaller segment at over $1,625 million in 2025, is also experiencing steady growth due to its:

- Pre-digested Nature: Hydrolyzed whey is broken down into smaller peptides, leading to the fastest absorption rates, beneficial for intensive training regimes.

- Hypoallergenic Properties: It is often favored by individuals with digestive sensitivities.

Geographically, North America and Europe remain dominant markets, but Asia-Pacific is emerging as a key growth engine due to rising disposable incomes and increasing awareness of health and fitness trends.

Muscle Whey Protein Powder Product Analysis

The Muscle Whey Protein Powder market is characterized by a constant stream of product innovations aimed at enhancing efficacy, appeal, and market fit. Companies are focusing on producing ultra-pure whey isolates and concentrates with superior amino acid profiles and improved digestibility, leveraging advanced filtration techniques. Innovations include the development of flavored powders with natural sweeteners and the incorporation of additional performance-enhancing ingredients like BCAAs, creatine, and digestive enzymes. Competitive advantages are being built through transparent sourcing, organic certifications, and sustainable packaging solutions, appealing to the growing segment of health-conscious and environmentally aware consumers.

Key Drivers, Barriers & Challenges in Muscle Whey Protein Powder

Key Drivers:

- Rising Health and Fitness Consciousness: A global surge in interest in fitness, athletic performance, and overall well-being significantly fuels the demand for muscle-building supplements.

- Growing Millennial and Gen Z Population: These demographics are highly engaged with fitness trends and actively seek protein supplements for their health goals.

- Advancements in Protein Processing Technology: Improved methods lead to higher quality, better-tasting, and more easily digestible whey protein powders.

- Increasing Availability of Online Sales Channels: E-commerce platforms provide wider accessibility and convenience for consumers globally.

- Demand for Convenient Nutritional Solutions: Whey protein offers a quick and easy way to supplement dietary protein intake.

Barriers & Challenges:

- Intense Market Competition: A crowded marketplace with numerous brands leads to price pressures and the need for significant marketing investment.

- Fluctuating Raw Material Prices: The cost of milk and its derivatives can be volatile, impacting production costs and profit margins.

- Regulatory Hurdles and Quality Control: Stringent regulations regarding food safety, labeling, and health claims can be costly and complex to navigate.

- Consumer Skepticism and Misinformation: Negative perceptions or misunderstandings surrounding protein supplements can hinder adoption.

- Allergen Concerns: Lactose intolerance and dairy allergies necessitate the development of specialized, often more expensive, alternative formulations.

Growth Drivers in the Muscle Whey Protein Powder Market

Key growth drivers for the Muscle Whey Protein Powder market are multi-faceted, encompassing technological, economic, and policy-driven factors. Technologically, advancements in filtration and processing techniques continue to yield higher purity whey isolates and concentrates with improved solubility and taste profiles. Economically, rising disposable incomes in emerging markets are expanding the consumer base for health and fitness supplements. Furthermore, the increasing awareness among consumers about the benefits of protein for muscle growth, recovery, and overall health is a powerful economic catalyst. Policy-wise, while regulations can be a challenge, supportive government initiatives promoting sports and fitness can indirectly benefit the market by fostering a culture of health-consciousness.

Challenges Impacting Muscle Whey Protein Powder Growth

Several challenges significantly impact the growth of the Muscle Whey Protein Powder market. Regulatory complexities, including evolving food safety standards and advertising guidelines across different regions, can create compliance burdens and hinder market expansion. Supply chain issues, such as the volatility of milk prices and potential disruptions in dairy production, directly affect manufacturing costs and product availability. Competitive pressures are immense, with both established players and emerging brands vying for market share, leading to price wars and a constant need for product differentiation and innovation. The presence of numerous product substitutes, including plant-based proteins and other protein supplements, also exerts pressure on market growth.

Key Players Shaping the Muscle Whey Protein Powder Market

- Earth Fed Muscle

- Vitalstrength

- CytoSport

- HD Muscle

- Gainful

- Optimum Nutrition

- Ascent

- BigMuscles Nutrition

- NOW Foods

- Orgain

- Vega

- Team Muscles Nutrition

Significant Muscle Whey Protein Powder Industry Milestones

- 2019: Increased focus on plant-based protein alternatives gains momentum, prompting whey protein brands to diversify.

- 2020 (Q2): COVID-19 pandemic leads to a surge in at-home fitness, boosting demand for protein supplements.

- 2021: Major brands invest heavily in sustainable sourcing and eco-friendly packaging.

- 2022: Advancements in hydrolysis technology improve digestibility and reduce allergenicity of whey protein.

- 2023: Growth of direct-to-consumer (DTC) online sales channels accelerates significantly.

- 2024: Introduction of personalized protein formulations based on individual dietary needs and fitness goals.

Future Outlook for Muscle Whey Protein Powder Market

- 2019: Increased focus on plant-based protein alternatives gains momentum, prompting whey protein brands to diversify.

- 2020 (Q2): COVID-19 pandemic leads to a surge in at-home fitness, boosting demand for protein supplements.

- 2021: Major brands invest heavily in sustainable sourcing and eco-friendly packaging.

- 2022: Advancements in hydrolysis technology improve digestibility and reduce allergenicity of whey protein.

- 2023: Growth of direct-to-consumer (DTC) online sales channels accelerates significantly.

- 2024: Introduction of personalized protein formulations based on individual dietary needs and fitness goals.

Future Outlook for Muscle Whey Protein Powder Market

The future outlook for the Muscle Whey Protein Powder market is exceptionally bright, driven by an enduring global commitment to health, fitness, and performance optimization. Strategic opportunities lie in the continued development of specialized formulations catering to niche markets, such as vegan-friendly whey alternatives and products enhanced with nootropics or adaptogens. The market potential is further amplified by the increasing adoption of smart packaging with blockchain integration for enhanced traceability and transparency. As consumer education around the benefits of protein supplementation grows, particularly in developing economies, the market is poised for sustained and robust expansion. Companies focusing on innovation, sustainability, and personalized consumer experiences will be best positioned to capitalize on this promising future.

Muscle Whey Protein Powder Segmentation

-

1. Application

- 1.1. Online Sales

- 1.2. Offline Sales

-

2. Type

- 2.1. Concentrated Whey Protein

- 2.2. Isolated Whey Protein

- 2.3. Hydrolyzed Whey Protein

Muscle Whey Protein Powder Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Muscle Whey Protein Powder REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Muscle Whey Protein Powder Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online Sales

- 5.1.2. Offline Sales

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Concentrated Whey Protein

- 5.2.2. Isolated Whey Protein

- 5.2.3. Hydrolyzed Whey Protein

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Muscle Whey Protein Powder Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online Sales

- 6.1.2. Offline Sales

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Concentrated Whey Protein

- 6.2.2. Isolated Whey Protein

- 6.2.3. Hydrolyzed Whey Protein

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Muscle Whey Protein Powder Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online Sales

- 7.1.2. Offline Sales

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Concentrated Whey Protein

- 7.2.2. Isolated Whey Protein

- 7.2.3. Hydrolyzed Whey Protein

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Muscle Whey Protein Powder Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online Sales

- 8.1.2. Offline Sales

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Concentrated Whey Protein

- 8.2.2. Isolated Whey Protein

- 8.2.3. Hydrolyzed Whey Protein

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Muscle Whey Protein Powder Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online Sales

- 9.1.2. Offline Sales

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Concentrated Whey Protein

- 9.2.2. Isolated Whey Protein

- 9.2.3. Hydrolyzed Whey Protein

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Muscle Whey Protein Powder Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online Sales

- 10.1.2. Offline Sales

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Concentrated Whey Protein

- 10.2.2. Isolated Whey Protein

- 10.2.3. Hydrolyzed Whey Protein

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Earth Fed Muscle

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Vitalstrength

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CytoSport

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 HD Muscle

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Gainful

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Optimum Nutrition

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ascent

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BigMuscles Nutrition

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 NOW Foods

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Orgain

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Vega

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Team Muscles Nutrition

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Earth Fed Muscle

List of Figures

- Figure 1: Global Muscle Whey Protein Powder Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Muscle Whey Protein Powder Revenue (million), by Application 2024 & 2032

- Figure 3: North America Muscle Whey Protein Powder Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Muscle Whey Protein Powder Revenue (million), by Type 2024 & 2032

- Figure 5: North America Muscle Whey Protein Powder Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Muscle Whey Protein Powder Revenue (million), by Country 2024 & 2032

- Figure 7: North America Muscle Whey Protein Powder Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Muscle Whey Protein Powder Revenue (million), by Application 2024 & 2032

- Figure 9: South America Muscle Whey Protein Powder Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Muscle Whey Protein Powder Revenue (million), by Type 2024 & 2032

- Figure 11: South America Muscle Whey Protein Powder Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Muscle Whey Protein Powder Revenue (million), by Country 2024 & 2032

- Figure 13: South America Muscle Whey Protein Powder Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Muscle Whey Protein Powder Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Muscle Whey Protein Powder Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Muscle Whey Protein Powder Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Muscle Whey Protein Powder Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Muscle Whey Protein Powder Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Muscle Whey Protein Powder Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Muscle Whey Protein Powder Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Muscle Whey Protein Powder Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Muscle Whey Protein Powder Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Muscle Whey Protein Powder Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Muscle Whey Protein Powder Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Muscle Whey Protein Powder Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Muscle Whey Protein Powder Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Muscle Whey Protein Powder Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Muscle Whey Protein Powder Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Muscle Whey Protein Powder Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Muscle Whey Protein Powder Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Muscle Whey Protein Powder Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Muscle Whey Protein Powder Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Muscle Whey Protein Powder Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Muscle Whey Protein Powder Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Muscle Whey Protein Powder Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Muscle Whey Protein Powder Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Muscle Whey Protein Powder Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Muscle Whey Protein Powder Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Muscle Whey Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Muscle Whey Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Muscle Whey Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Muscle Whey Protein Powder Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Muscle Whey Protein Powder Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Muscle Whey Protein Powder Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Muscle Whey Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Muscle Whey Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Muscle Whey Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Muscle Whey Protein Powder Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Muscle Whey Protein Powder Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Muscle Whey Protein Powder Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Muscle Whey Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Muscle Whey Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Muscle Whey Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Muscle Whey Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Muscle Whey Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Muscle Whey Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Muscle Whey Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Muscle Whey Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Muscle Whey Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Muscle Whey Protein Powder Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Muscle Whey Protein Powder Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Muscle Whey Protein Powder Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Muscle Whey Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Muscle Whey Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Muscle Whey Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Muscle Whey Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Muscle Whey Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Muscle Whey Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Muscle Whey Protein Powder Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Muscle Whey Protein Powder Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Muscle Whey Protein Powder Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Muscle Whey Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Muscle Whey Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Muscle Whey Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Muscle Whey Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Muscle Whey Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Muscle Whey Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Muscle Whey Protein Powder Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Muscle Whey Protein Powder?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Muscle Whey Protein Powder?

Key companies in the market include Earth Fed Muscle, Vitalstrength, CytoSport, HD Muscle, Gainful, Optimum Nutrition, Ascent, BigMuscles Nutrition, NOW Foods, Orgain, Vega, Team Muscles Nutrition.

3. What are the main segments of the Muscle Whey Protein Powder?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Muscle Whey Protein Powder," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Muscle Whey Protein Powder report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Muscle Whey Protein Powder?

To stay informed about further developments, trends, and reports in the Muscle Whey Protein Powder, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence