Key Insights

The North America Snack Bar Market is projected to experience significant growth, reaching an estimated $70.8 billion by 2025, driven by a CAGR of 4.27% through 2033. This expansion is fueled by evolving consumer lifestyles and a growing emphasis on health and wellness. The convenience and diverse nutritious formulations of snack bars align with on-the-go consumption habits. Demand for protein bars is surging as consumers seek convenient protein sources, while cereal and fruit & nut bars are increasingly favored as healthier alternatives to processed snacks.

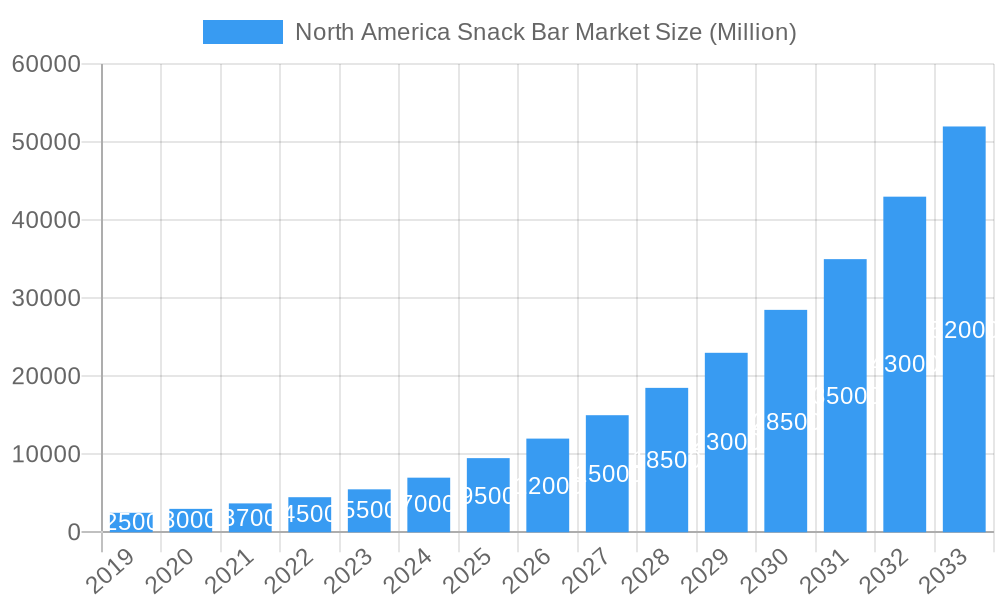

North America Snack Bar Market Market Size (In Billion)

The market's growth is further accelerated by robust distribution strategies, with online retail offering extensive product selection and accessibility. Convenience stores and supermarkets/hypermarkets remain key distribution channels. Leading companies are investing in product innovation, introducing bars with varied ingredients catering to specific dietary needs such as gluten-free, vegan, and low-sugar options. Potential challenges include consumer price sensitivity during economic downturns and competition from alternative healthy snacks. Nevertheless, the inherent convenience, portability, and evolving nutritional benefits of snack bars ensure their sustained market dominance.

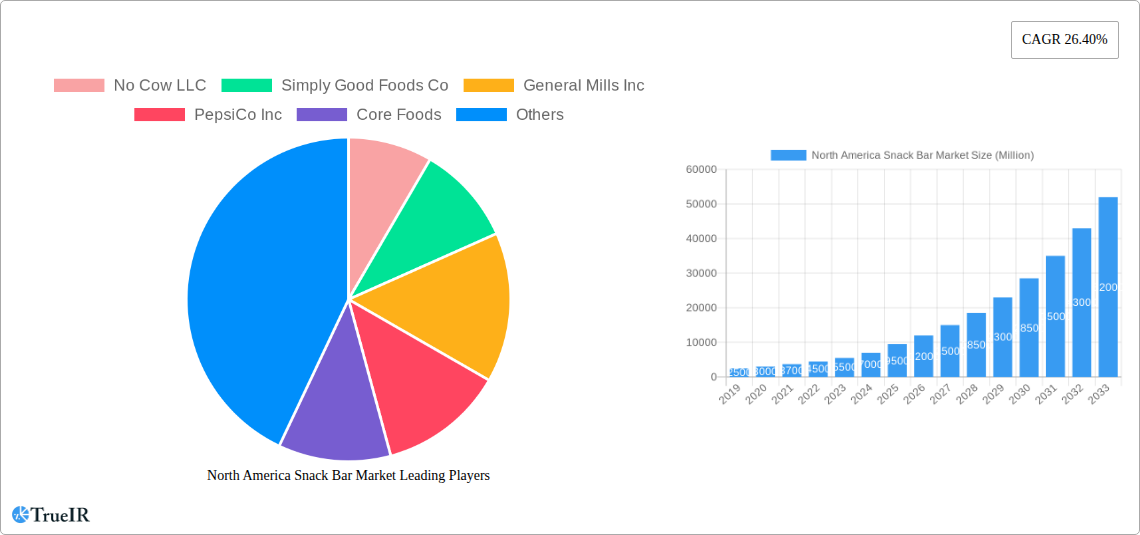

North America Snack Bar Market Company Market Share

Gain critical insights into the North America Snack Bar Market with this comprehensive report. Covering the period from 2019 to 2033, with a base year of 2025, this analysis provides detailed market size, trends, opportunities, and competitive strategies. Optimized with high-volume keywords like "North America snack bar market," "protein bar market," "granola bar growth," and "healthy snack bars," this report is essential for industry professionals navigating market shifts.

The North America snack bar market is a dynamic sector propelled by increasing health consciousness, demand for convenient food options, and a widening array of product offerings. This report examines the market structure, competitive landscape, dominant segments, and future outlook.

North America Snack Bar Market Market Structure & Competitive Landscape

The North America snack bar market exhibits a moderately concentrated structure, with a blend of large multinational corporations and agile niche players driving innovation. Key innovation drivers include the demand for plant-based ingredients, functional benefits (e.g., energy, gut health), and reduced sugar content. Regulatory impacts, primarily concerning labeling and nutritional claims, also shape product development and marketing strategies. Product substitutes, such as fresh fruits, yogurt, and other convenience snacks, pose a constant challenge, necessitating continuous product differentiation. End-user segmentation is diverse, encompassing health-conscious consumers, athletes, busy professionals, and families seeking on-the-go nutrition. Mergers and acquisitions (M&A) trends are evident, as larger companies seek to expand their portfolios and acquire innovative brands. For instance, the acquisition of smaller, specialized snack bar companies by major food conglomerates aims to capture emerging consumer preferences and diversify market presence. Concentration ratios are influenced by the market share held by top players, currently estimated to be around 55% held by the top five companies, underscoring both competition and the significant presence of established brands. M&A volumes have seen a steady increase, with an average of 10-15 significant deals annually in the past three years, reflecting a dynamic consolidation phase.

North America Snack Bar Market Market Trends & Opportunities

The North America snack bar market is experiencing robust growth, projected to reach a market size of $15,000 Million by 2025, with a compound annual growth rate (CAGR) of approximately 6.5% from 2019 to 2033. This expansion is fueled by a confluence of evolving consumer preferences and technological advancements. A significant trend is the escalating demand for health and wellness-oriented snack bars. Consumers are increasingly scrutinizing ingredient lists, prioritizing natural, organic, and non-GMO options. This has spurred a surge in the popularity of protein bars and fruit & nut bars, catering to individuals seeking sustained energy and muscle recovery, as well as those looking for wholesome, less processed alternatives. The "free-from" movement also plays a pivotal role, with growing markets for gluten-free, dairy-free, and allergen-free snack bars, addressing a wider spectrum of dietary needs and sensitivities.

Technological shifts in food processing and ingredient sourcing are enabling manufacturers to create more innovative and functional snack bars. For example, advancements in plant-based protein extraction have led to a wider array of vegan protein bar options that rival traditional whey-based products in efficacy and taste. Furthermore, the integration of superfoods like chia seeds, flaxseeds, and adaptogens is becoming a common strategy to enhance the nutritional profile and perceived health benefits of snack bars.

Competitive dynamics are intensifying, with established brands facing pressure from agile startups that are quick to identify and capitalize on niche market opportunities. This often involves direct-to-consumer (DTC) models and strong social media marketing strategies. Opportunities abound for brands that can effectively communicate their unique value proposition, whether it's through superior taste, functional ingredients, sustainable sourcing, or ethical production practices. The demand for personalized nutrition is also emerging, suggesting future opportunities for customizable snack bar formulations. Online retail stores and subscription box services are becoming increasingly important distribution channels, offering convenience and accessibility to a wider consumer base. The market penetration rate for snack bars in North America is estimated to be around 70% of households, indicating substantial room for further growth as new product categories and dietary trends emerge. The increasing adoption of e-commerce platforms for grocery shopping further bolsters the online retail channel's significance, making it a critical avenue for market expansion and consumer engagement.

Dominant Markets & Segments in North America Snack Bar Market

The United States stands as the dominant market within the North America snack bar landscape, driven by its large population, high disposable income, and a deeply ingrained culture of convenience and health-consciousness. Within the US, urban and suburban regions exhibit higher consumption rates due to accessibility and a faster-paced lifestyle. Canada follows as a significant, albeit smaller, market, with similar consumer trends towards healthier eating and on-the-go options. Mexico, while growing, currently holds a smaller market share but presents considerable future potential as economic development and health awareness increase.

Among the variants, Protein Bars have emerged as a leading segment, projected to account for over 35% of the total market revenue by 2025. This dominance is attributed to the rising popularity of fitness and active lifestyles, coupled with the increasing awareness of protein's role in muscle repair, satiety, and overall well-being. Athletes, fitness enthusiasts, and even a growing number of general consumers are incorporating protein bars into their daily routines as convenient meal replacements or post-workout recovery tools. The innovation within this segment is rapid, with a continuous introduction of diverse protein sources (whey, soy, pea, rice) and sophisticated flavor profiles.

The Fruit & Nut Bar segment is another substantial contributor, expected to capture approximately 25% of the market share by 2025. These bars appeal to a broad consumer base seeking natural ingredients, fiber, and sustained energy without the high protein content often associated with dedicated protein bars. They are often positioned as healthier alternatives to traditional confectionery snacks and are popular among families and individuals looking for a quick, wholesome energy boost.

Cereal Bars represent a more traditional segment, still holding a significant market presence, particularly among children and budget-conscious consumers. While facing increased competition from more health-focused options, their convenience and familiarity ensure continued demand.

In terms of distribution channels, Supermarkets/Hypermarkets remain the primary avenue for snack bar sales, accounting for an estimated 40% of the market. Their extensive reach and product variety make them a one-stop shop for consumers. However, the Online Retail Store segment is experiencing the most rapid growth, with an estimated CAGR of over 10% over the forecast period. The convenience of online shopping, coupled with wider product selection and competitive pricing, is driving this surge. Convenience Stores are also crucial, offering immediate accessibility for impulse purchases and on-the-go consumption, representing approximately 25% of sales. The "Others" category, including gyms, health clubs, and specialty stores, caters to niche markets and contributes to the overall market penetration.

North America Snack Bar Market Product Analysis

Product innovation in the North America snack bar market is characterized by a dual focus on health and indulgence. Manufacturers are increasingly emphasizing natural ingredients, plant-based proteins, and functional benefits like added vitamins, probiotics, and adaptogens. Competitive advantages are being carved out through unique flavor combinations, allergen-free formulations, and sustainable packaging solutions. For instance, brands are offering low-sugar, high-fiber cereal bars that appeal to health-conscious parents, while simultaneously developing indulgent, gourmet-flavored protein bars targeting the premium segment. Technological advancements in extrusion and bar formation allow for novel textures and ingredient inclusions, enhancing both palatability and market appeal. The market fit is optimized by aligning product development with prevailing consumer trends, such as the demand for vegan, keto-friendly, or gluten-free options.

Key Drivers, Barriers & Challenges in North America Snack Bar Market

The North America snack bar market is propelled by several key drivers. The escalating health and wellness trend is paramount, with consumers actively seeking nutritious and functional food options. The demand for convenience, driven by busy lifestyles, ensures a consistent need for on-the-go snacking solutions. Product innovation, including the development of plant-based, organic, and allergen-free bars, expands the market appeal to a wider consumer base. The growing influence of e-commerce platforms also facilitates accessibility and expands market reach.

Conversely, the market faces significant barriers and challenges. Intense competition from established brands and emerging startups leads to price pressures and necessitates continuous product differentiation. Supply chain disruptions, particularly concerning ingredient sourcing and logistics, can impact production costs and availability. Regulatory complexities surrounding nutritional labeling and health claims require careful navigation. Furthermore, the perception of some snack bars as processed or unhealthy can act as a restraint, particularly among highly health-conscious consumers. The potential for market saturation in certain categories also presents a challenge for new entrants.

Growth Drivers in the North America Snack Bar Market Market

Key growth drivers in the North America snack bar market are multifaceted. Technologically, advancements in ingredient processing and formulation allow for the creation of more diverse and functional snack bars, catering to specific dietary needs like keto or paleo. Economically, rising disposable incomes in developed North American countries enable consumers to spend more on premium and health-focused food products. Policy-driven factors, such as government initiatives promoting healthy eating and physical activity, indirectly boost the demand for nutritious snack options. The increasing popularity of fitness and sports activities directly fuels the demand for protein-rich snack bars for recovery and performance. Furthermore, a growing consumer awareness regarding the benefits of plant-based diets is significantly contributing to the expansion of vegan and vegetarian snack bar options.

Challenges Impacting North America Snack Bar Market Growth

Several challenges can impact the growth of the North America snack bar market. Regulatory complexities, particularly around health claims and labeling standards across different jurisdictions, can create compliance burdens and limit marketing flexibility. Supply chain issues, including volatility in raw material prices for ingredients like nuts, seeds, and proteins, and logistical bottlenecks, can affect profitability and product availability. Competitive pressures are intense, with a crowded market requiring significant investment in marketing and product development to maintain market share. The negative perception of "processed foods" among some consumer segments can also act as a restraint, necessitating clear communication about ingredient sourcing and nutritional value. Moreover, the ever-evolving consumer preferences demand constant adaptation, posing a challenge for manufacturers to stay ahead of trends.

Key Players Shaping the North America Snack Bar Market Market

- No Cow LLC

- Simply Good Foods Co

- General Mills Inc

- PepsiCo Inc

- Core Foods

- Abbott Laboratories

- Probar Inc

- Power Crunch Pty Ltd

- 1440 Foods Company

- Mars Incorporated

- The Hershey Company

- Go Macro LLC

- Mondelēz International Inc

- Jamieson Wellness Inc

- Kellogg Company

Significant North America Snack Bar Market Industry Milestones

- March 2023: CORE® Foods announced its partnership with American Professional Snowboarder and two-time Olympic Gold Medalist Chloe Kim. This news strengthened the cooperation between CORE® and the Alterra Mountain Company, serving the company's various mountain destinations across the United States.

- March 2023: General Mills brand Cascadian Farm launched granola bars that are made in a peanut-free facility. The bars are also USDA-certified organic and made with 35% less sugar compared to the original Annie’s Dipped Granola Bars.

- March 2023: General Mills has added two buildings to the site in Geneva: a one-story 65,600-square-foot asset and a 48,600-square-foot warehouse expansion. The Geneva factory will produce snack brands such as Fiber One, Nature Valley, and Fruit by the Foot, which will be sold across North America.

Future Outlook for North America Snack Bar Market Market

The future outlook for the North America snack bar market is exceptionally promising, with continued robust growth anticipated. Strategic opportunities lie in further product diversification, particularly in the realms of personalized nutrition, functional ingredients catering to specific health concerns (e.g., gut health, cognitive function), and sustainable product development. The increasing adoption of e-commerce and direct-to-consumer channels will continue to shape distribution strategies, offering direct engagement with consumers. The market potential is further amplified by ongoing innovation in plant-based alternatives and allergen-free options, broadening the appeal to an ever-wider consumer base. As health consciousness deepens and the demand for convenient, nutritious, and ethically produced food options escalates, the North America snack bar market is poised for sustained expansion and evolution.

North America Snack Bar Market Segmentation

-

1. Confectionery Variant

- 1.1. Cereal Bar

- 1.2. Fruit & Nut Bar

- 1.3. Protein Bar

-

2. Distribution Channel

- 2.1. Convenience Store

- 2.2. Online Retail Store

- 2.3. Supermarket/Hypermarket

- 2.4. Others

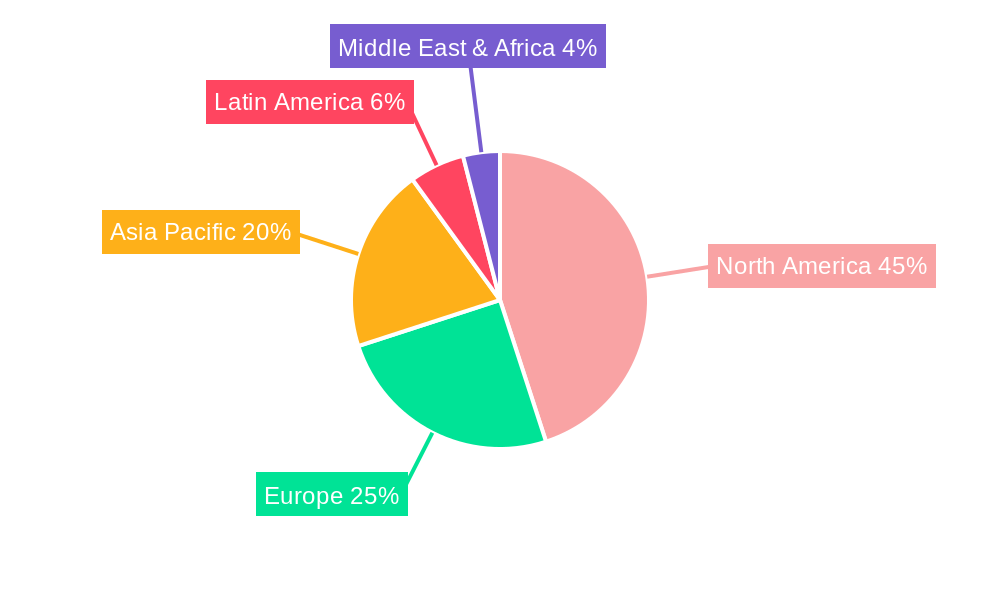

North America Snack Bar Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Snack Bar Market Regional Market Share

Geographic Coverage of North America Snack Bar Market

North America Snack Bar Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.27% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Urbanization; Growing Disposable Income

- 3.3. Market Restrains

- 3.3.1. High-price and additional delivery charges

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Snack Bar Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 5.1.1. Cereal Bar

- 5.1.2. Fruit & Nut Bar

- 5.1.3. Protein Bar

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Convenience Store

- 5.2.2. Online Retail Store

- 5.2.3. Supermarket/Hypermarket

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 No Cow LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Simply Good Foods Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 General Mills Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PepsiCo Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Core Foods

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Abbott Laboratories

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Probar Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Power Crunch Pty Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 1440 Foods Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mars Incorporated

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 The Hershey Compan

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Go Macro LLC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Mondelēz International Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Jamieson Wellness Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Kellogg Company

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 No Cow LLC

List of Figures

- Figure 1: North America Snack Bar Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Snack Bar Market Share (%) by Company 2025

List of Tables

- Table 1: North America Snack Bar Market Revenue billion Forecast, by Confectionery Variant 2020 & 2033

- Table 2: North America Snack Bar Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: North America Snack Bar Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America Snack Bar Market Revenue billion Forecast, by Confectionery Variant 2020 & 2033

- Table 5: North America Snack Bar Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: North America Snack Bar Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States North America Snack Bar Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Snack Bar Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Snack Bar Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Snack Bar Market?

The projected CAGR is approximately 4.27%.

2. Which companies are prominent players in the North America Snack Bar Market?

Key companies in the market include No Cow LLC, Simply Good Foods Co, General Mills Inc, PepsiCo Inc, Core Foods, Abbott Laboratories, Probar Inc, Power Crunch Pty Ltd, 1440 Foods Company, Mars Incorporated, The Hershey Compan, Go Macro LLC, Mondelēz International Inc, Jamieson Wellness Inc, Kellogg Company.

3. What are the main segments of the North America Snack Bar Market?

The market segments include Confectionery Variant, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 70.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Urbanization; Growing Disposable Income.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High-price and additional delivery charges.

8. Can you provide examples of recent developments in the market?

March 2023: CORE® Foods announced its partnership with American Professional Snowboarder and two-time Olympic Gold Medalist Chloe Kim. This news strengthened the cooperation between CORE® and the Alterra Mountain Company, serving the company's various mountain destinations across the United States.March 2023: General Mills brand Cascadian Farm launched granola bars that are made in a peanut-free facility. The bars are also USDA-certified organic and made with 35% less sugar compared to the original Annie’s Dipped Granola Bars.March 2023: General Mills has added two buildings to the site in Geneva: a one-story 65,600-square-foot asset and a 48,600-square-foot warehouse expansion. The Geneva factory will produce snack brands such as Fiber One, Nature Valley, and Fruit by the Foot, which will be sold across North America.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Snack Bar Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Snack Bar Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Snack Bar Market?

To stay informed about further developments, trends, and reports in the North America Snack Bar Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence